GAINSCO Auto Insurance Review (2025)

GAINSCO, a subsidiary of State Farm, offers non-standard coverage to high-risk drivers in 17 states.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

GAINSCO Auto Insurance

Average Monthly Rate For Good Drivers

$166A.M. Best Rating:

A-Complaint Level:

HighPros

- Coverage for high-risk drivers

- SR-22 form filings

- A website that offers online quotes and allows customers to make payments

- Over 7,000 independent insurance agents

- A helpful mobile app

- Bilingual assistance for Spanish speakers

Cons

- A significant number of customer complaints

- A website that does not offer details on coverage options

- Limited availability

- GAINSCO is a subsidiary of State Farm Insurance Company

- GAINSCO offers non-standard car insurance coverage to high-risk drivers

- The company has received a significant number of customer complaints

There are a lot of options when it comes to car insurance. But if you’re a high-risk driver, you may find it challenging to find proper coverage. While certain companies won’t offer coverage to high-risk drivers, GAINSCO Insurance offers standard coverage options to people with bad driving records.

As you search for the best car insurance companies in your area, GAINSCO could be an excellent option. The company files SR-22 forms and offers online quotes to potential customers.

Unfortunately, GAINSCO is only available in 17 states and does have a significant number of customer complaints.

What You Should Know About Gainsco Auto Insurance

GAINSCO has an A- (Excellent) financial strength rating with A.M. Best. However, according to the National Association of Insurance Commissioners (NAIC), GAINSCO policyholders have filed many complaints against the company.

Based on the GAINSCO insurance reviews, GAINSCO policyholders are unhappy with the company’s customer service, the speed with which the company issues insurance payments, and the overall process for filing claims.

If you’re considering purchasing a policy with GAINSCO, you may want to read a few GAINSCO car insurance reviews ahead of time to hear customer opinions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Gainsco Auto Insurance Coverage Options

GAINSCO offers coverage that meets each state’s minimum requirements. These coverage options include:

- Bodily injury liability

- Property damage liability

- Personal injury protection

- Medical payments

GAINSCO also offers the following add-on coverage options:

- SR-22 form. If your state requires you to show proof of financial responsibility, you may have to file an SR-22 form. Not all insurance companies will do this, but GAINSCO offers this coverage via State Farm’s SR-22 insurance.

- Non-owner insurance. If you regularly drive someone else’s car, non-owner coverage offers liability protection so you don’t have to pay for repairs out of pocket.

While State Farm does offer SR-22 coverage, the company may decline to file a form on your behalf. This is why many people decide to pursue coverage with GAINSCO instead of one of the larger companies.

GAINSCO essentially uses a State Farm SR-22 form, as State Farm is GAINSCO’s parent company. Still, GAINSCO is more likely to offer coverage to individuals with a DUI or another significant violation on their driving record.

Unlike many other auto insurance companies, GAINSCO does not offer many coverage options. Therefore, if you are not a high-risk driver and you don’t need an SR-22 filing, you may want to look elsewhere for coverage.

Gainsco Auto Insurance Rates Breakdown

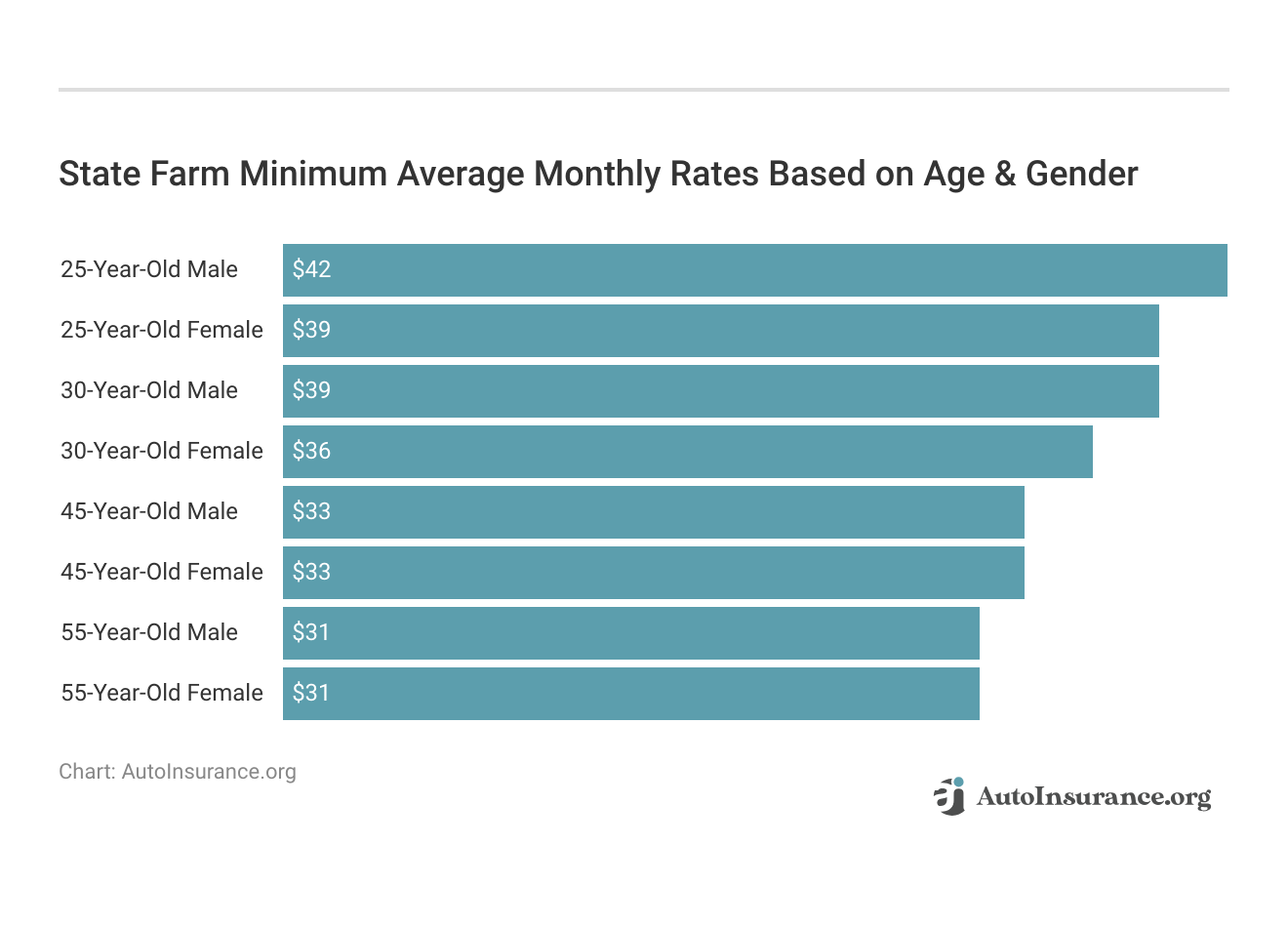

Rates for GAINSCO car insurance vary based on several factors such as age and gender. State Farm, GAINSCO’s parent company, offers some of the cheapest rates for minimum coverage compared to other big names in auto insurance.

The table below shows how GAINSCO (State Farm) stacks up to the competition.

GAINSCO vs. Competitors: Minimum Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $61 |

| American Family | $44 |

| Farmers | $53 |

| GAINSCO | $35 |

| Geico | $30 |

| Liberty Mutual | $67 |

| Nationwide | $44 |

| Progressive | $39 |

| State Farm | $33 |

| Travelers | $38 |

| USAA | $22 |

| U.S. Average | $45 |

And State Farm’s full coverage rates are also one of the cheapest among many of the well-known options in the U.S.

See below how State Farm compares to other top auto insurance companies.

State Farm vs. Competitors: Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $160 |

| American Family | $117 |

| Farmers | $139 |

| GAINSCO | $91 |

| Geico | $80 |

| Liberty Mutual | $174 |

| Nationwide | $115 |

| Progressive | $105 |

| State Farm | $86 |

| Travelers | $99 |

| USAA | $59 |

| U.S. Average | $119 |

Still, GAINSCO rates will likely be more expensive than those with State Farm or many other companies because of the risk associated with non-standard coverage.

How does your driving history affect your GAINSCO rates?

Your driving history plays a vital role in determining your rates with any insurance company. GAINSCO’s offers competitive rates for high-risk drivers with a not-so-stellar driving record.

You can get an idea of how much you might pay after a speeding ticket by comparing the top insurance companies’ rates below.

GAINSCO vs. Competitors: Auto Insurance Monthly Rates for Drivers With a Ticket

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| Allstate | $188 | $160 |

| American Family | $136 | $117 |

| Farmers | $173 | $139 |

| GAINSCO | $163 | $91 |

| Geico | $106 | $80 |

| Liberty Mutual | $212 | $174 |

| Nationwide | $137 | $115 |

| Progressive | $140 | $105 |

| State Farm | $96 | $86 |

| Travelers | $134 | $99 |

| USAA | $67 | $59 |

| U.S. Average | $147 | $119 |

Rates for drivers involved in an accident will also be higher than those with a clean record. See rates from the top insurance companies below to learn what you can expect.

GAINSCO vs. Competitors: Auto Insurance Monthly Rates for Drivers With an Accident

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| Allstate | $225 | $160 |

| American Family | $176 | $117 |

| Farmers | $198 | $139 |

| GAINSCO | $188 | $91 |

| Geico | $132 | $80 |

| Liberty Mutual | $234 | $174 |

| Nationwide | $161 | $115 |

| Progressive | $186 | $105 |

| State Farm | $102 | $86 |

| Travelers | $139 | $99 |

| USAA | $78 | $59 |

| U.S. Average | $173 | $119 |

If you have a DUI on your record, you’ll definitely pay more for insurance and many insurers will refuse to cover you at all. But we’ve put together a list of the top insurance companies that do offer DUI insurance.

GAINSCO vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $160 | $225 | $270 | $188 |

| American Family | $117 | $176 | $194 | $136 |

| Farmers | $139 | $198 | $193 | $173 |

| GAINSCO | $91 | $188 | $228 | $163 |

| Geico | $80 | $132 | $216 | $106 |

| Liberty Mutual | $174 | $234 | $313 | $212 |

| Nationwide | $115 | $161 | $237 | $137 |

| Progressive | $105 | $186 | $140 | $140 |

| State Farm | $86 | $102 | $112 | $96 |

| Travelers | $99 | $139 | $206 | $134 |

| USAA | $59 | $78 | $108 | $67 |

| U.S. Average | $119 | $173 | $209 | $147 |

You can go to the company’s website and get a quote to learn how much you would pay for GAINSCO auto insurance coverage. However, before you make any final decisions, compare your GAINSCO insurance quote to quotes from other companies in your area.

Gainsco Auto Insurance Discounts Available

GAINSCO offers several options for people to save money with auto insurance discounts, including:

- Auto-pay

- Paid-in-full

- Homeowners

- Multi-car

- Loyalty

- Early signing

Discounts can help people save as much as 25% on car insurance. You can ask a GAINSCO representative how much you could save using the company’s discount options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is GAINSCO Auto Insurance?

GAINSCO Auto Insurance is a company that provides auto insurance coverage to individuals and businesses. They offer a range of policies, including liability, comprehensive, collision, and uninsured/underinsured motorist coverage.

What types of vehicles does GAINSCO insure?

GAINSCO provides insurance coverage for a variety of vehicles, including cars, trucks, motorcycles, and recreational vehicles (RVs).

How can I get a quote from GAINSCO Auto Insurance?

You can get a quote from GAINSCO by visiting their website or contacting their customer service directly. They will ask for information about your vehicle, driving history, and other relevant details to provide an accurate quote.

What factors can affect my auto insurance premium with GAINSCO?

Several factors can influence your auto insurance premium with GAINSCO, including your driving record, age, location, type of vehicle, coverage limits, and deductible choices.

Can I customize my coverage with GAINSCO?

Yes, GAINSCO offers customizable coverage options to suit your needs. You can choose different limits and deductibles for various types of coverage.

Does GAINSCO offer any discounts on auto insurance?

GAINSCO provides various discounts to policyholders, such as safe driver discounts, multi-car discounts, and discounts for completing defensive driving courses. It’s best to inquire about specific discounts when obtaining a quote.

How do I file a claim with GAINSCO Auto Insurance?

To file a claim with GAINSCO, you can contact their claims department by phone or through their website. They will guide you through the process and help you gather the necessary information and documentation.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the customer service like with GAINSCO Auto Insurance?

GAINSCO Auto Insurance aims to provide excellent customer service. They have a dedicated customer support team that can assist with policy inquiries, claims, and other concerns.

GAINSCO Auto Insurance is a company that provides auto insurance coverage to individuals and businesses. They offer a range of policies, including liability, comprehensive, collision, and uninsured/underinsured motorist coverage.

GAINSCO provides insurance coverage for a variety of vehicles, including cars, trucks, motorcycles, and recreational vehicles (RVs).

How can I get a quote from GAINSCO Auto Insurance?

You can get a quote from GAINSCO by visiting their website or contacting their customer service directly. They will ask for information about your vehicle, driving history, and other relevant details to provide an accurate quote.

What factors can affect my auto insurance premium with GAINSCO?

Several factors can influence your auto insurance premium with GAINSCO, including your driving record, age, location, type of vehicle, coverage limits, and deductible choices.

Can I customize my coverage with GAINSCO?

Yes, GAINSCO offers customizable coverage options to suit your needs. You can choose different limits and deductibles for various types of coverage.

Does GAINSCO offer any discounts on auto insurance?

GAINSCO provides various discounts to policyholders, such as safe driver discounts, multi-car discounts, and discounts for completing defensive driving courses. It’s best to inquire about specific discounts when obtaining a quote.

How do I file a claim with GAINSCO Auto Insurance?

To file a claim with GAINSCO, you can contact their claims department by phone or through their website. They will guide you through the process and help you gather the necessary information and documentation.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the customer service like with GAINSCO Auto Insurance?

GAINSCO Auto Insurance aims to provide excellent customer service. They have a dedicated customer support team that can assist with policy inquiries, claims, and other concerns.

You can get a quote from GAINSCO by visiting their website or contacting their customer service directly. They will ask for information about your vehicle, driving history, and other relevant details to provide an accurate quote.

Several factors can influence your auto insurance premium with GAINSCO, including your driving record, age, location, type of vehicle, coverage limits, and deductible choices.

Can I customize my coverage with GAINSCO?

Yes, GAINSCO offers customizable coverage options to suit your needs. You can choose different limits and deductibles for various types of coverage.

Does GAINSCO offer any discounts on auto insurance?

GAINSCO provides various discounts to policyholders, such as safe driver discounts, multi-car discounts, and discounts for completing defensive driving courses. It’s best to inquire about specific discounts when obtaining a quote.

How do I file a claim with GAINSCO Auto Insurance?

To file a claim with GAINSCO, you can contact their claims department by phone or through their website. They will guide you through the process and help you gather the necessary information and documentation.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the customer service like with GAINSCO Auto Insurance?

GAINSCO Auto Insurance aims to provide excellent customer service. They have a dedicated customer support team that can assist with policy inquiries, claims, and other concerns.

Yes, GAINSCO offers customizable coverage options to suit your needs. You can choose different limits and deductibles for various types of coverage.

GAINSCO provides various discounts to policyholders, such as safe driver discounts, multi-car discounts, and discounts for completing defensive driving courses. It’s best to inquire about specific discounts when obtaining a quote.

How do I file a claim with GAINSCO Auto Insurance?

To file a claim with GAINSCO, you can contact their claims department by phone or through their website. They will guide you through the process and help you gather the necessary information and documentation.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the customer service like with GAINSCO Auto Insurance?

GAINSCO Auto Insurance aims to provide excellent customer service. They have a dedicated customer support team that can assist with policy inquiries, claims, and other concerns.

To file a claim with GAINSCO, you can contact their claims department by phone or through their website. They will guide you through the process and help you gather the necessary information and documentation.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

GAINSCO Auto Insurance aims to provide excellent customer service. They have a dedicated customer support team that can assist with policy inquiries, claims, and other concerns.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Ex_customer

Worst car insurance company

Chrissy_93

[REDACTED NAME] is the person to talk to if you need insurance

Mark_M

Run Away!

Mad_va

Gainsco doesn't do right by it's customers

Steve32

Poor customer service

Alfredo_J

Very poor Customer Service

Misspakers

Worst CLAIMS SUPPORT EVER

Tsw1981

Insurance lapse without knowing or informed by this company

Lalawter

Worse company ever

Zhanise26

A game toss