Geico vs. State Farm Auto Insurance in 2025 (Find Out Who’s Cheaper)

Geico and State Farm auto insurance are both top providers, offering competitive rates starting at $30/mo. While Geico typically has lower premiums, State Farm provides affordable options for drivers with a DUI or ticket. Since rates vary, compare State Farm vs. Geico prices to find your best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsGeico and State Farm are top auto insurance providers, with both offering competitive rates and coverage options. So, how do you know which is right for you?

We’ll compare Geico vs. State Farm auto insurance rates, discounts, and coverage options based on factors such as driving record, age, and credit score to help you get a better deal. Check out our review of State Farm to find out more.

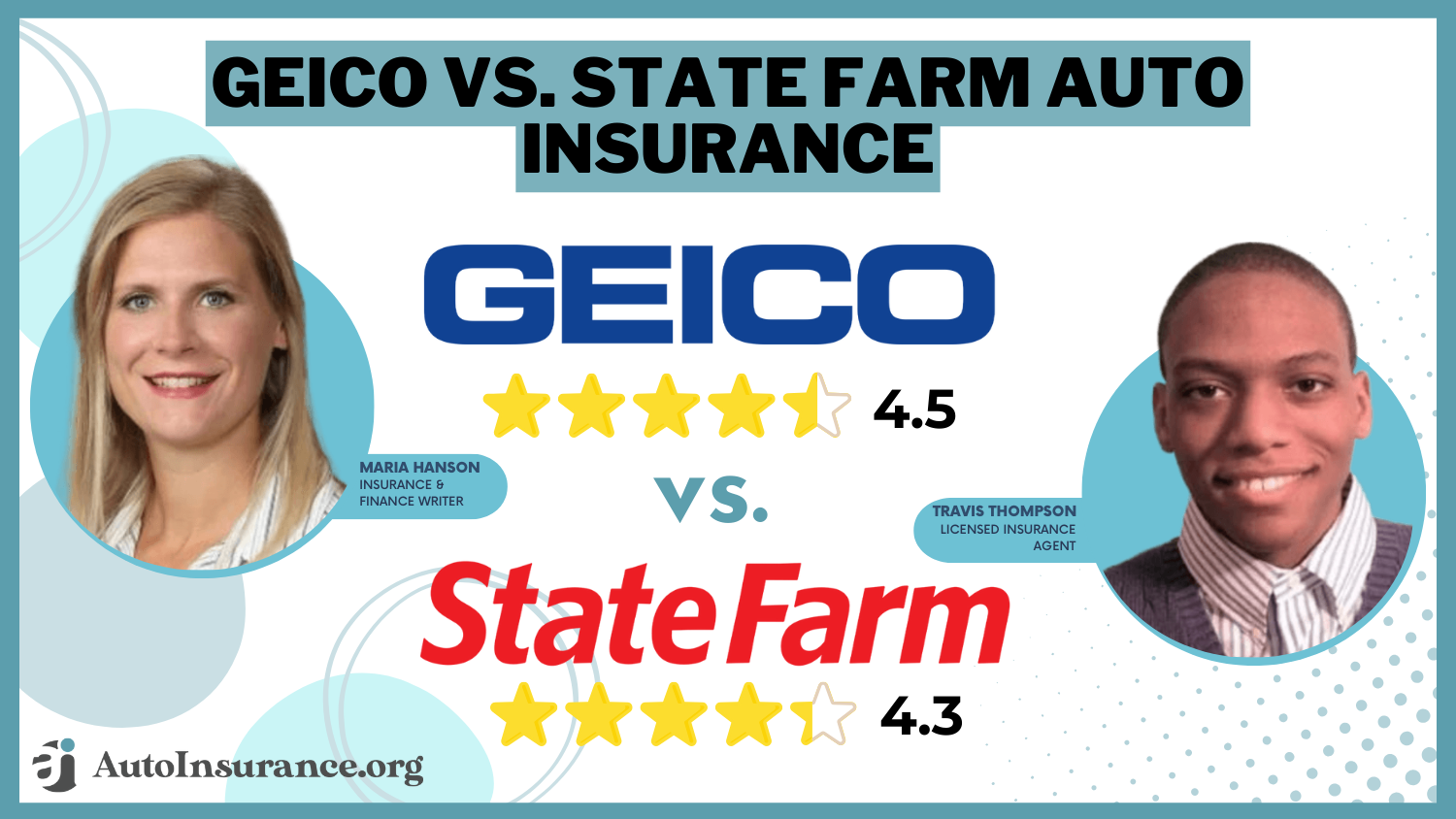

Geico vs. State Farm Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.5 | 4.3 |

| Insurance Cost | 4.4 | 3.9 |

| Discounts Available | 4.7 | 5.0 |

| Claim Processing | 4.8 | 4.3 |

| Customer Satisfaction | 4.5 | 4.1 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.6 | 4.2 |

| Digital Experience | 5.0 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Business Reviews | 4.5 | 5.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 3.8 |

| Savings Potential | 4.5 | 4.3 |

| Geico Review | State Farm Review |

We’ll also compare available discounts and ratings from agencies with a credible and trustworthy view of Geico vs. State Farm auto insurance companies.

Keep reading to learn how to find affordable car insurance rates for Geico and State Farm, and enter your ZIP code to compare quotes from top-rated insurers in your area.

- Usually, Geico car insurance rates are cheaper than State Farm

- State Farm has cheap rates after tickets and DUIs

- Geico and State Farm have similar third-party ratings

State Farm vs. Geico Auto Insurance Rate Comparison

Your State Farm and Geico quotes are shaped by key factors that affect car insurance rates, including age, gender, driving record, and credit score. However, these are only a few of the factors that decide how affordable State Farm vs. Geico car insurance is for you, as rates can vary.

First, let’s see how age, gender, and marital status affect your rates for Geico insurance vs. State Farm:

Geico vs. State Farm Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 17 Female | $220 | $229 |

| Age: 17 Male | $254 | $284 |

| Age: 25 Female | $97 | $101 |

| Age: 25 Male | $93 | $111 |

| Age: 35 Female | $90 | $94 |

| Age: 35 Male | $87 | $103 |

| Age: 60 Female | $76 | $76 |

| Age: 60 Male | $74 | $76 |

As shown, Geico’s rates are cheaper for people of all ages, except for 17-year-old males. Compare auto insurance rates by age here.

Your driving record is a big factor when it comes to calculating your rates. Drivers with accidents, speeding tickets, and DUIs on their record will pay higher rates.

Geico vs. State Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $80 | $86 |

| Not-At-Fault Accident | $92 | $101 |

| Speeding Ticket | $106 | $96 |

| Reckless Driving | $153 | $137 |

| Reckless Driving | $153 | $137 |

| DUI/DWI | $216 | $112 |

Geico auto insurance rates are cheaper for all driving records, with the exception of those with DUIs. State Farm is cheaper if you have a DUI. Find out exactly what you’d pay for coverage in our Geico review.

Your credit score also plays a part in your auto insurance rates in most states. If you have a higher credit score, auto insurance companies believe you will be more likely to pay for damages out of pocket rather than filing a claim.

Geico vs. State Farm Full Coverage Auto Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Excellent (741-850) | $203 | $181 |

| Good (670-740) | $249 | $238 |

| Fair (580-669) | $288 | $275 |

| Poor (300-579) | $355 | $413 |

If you have poor credit, Geico auto insurance quotes are cheaper. Otherwise, State Farm will offer you more affordable rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Geico and State Farm Discounts: Save up to 50% on Your Policy

With State Farm and Geico, you can save up to 50% by taking advantage of car insurance discounts.

Most auto insurance companies offer discounts catered to various drivers' needs. Common discounts include multi-car, bundling, and occupation-based discounts.Ty Stewart Licensed Insurance Agent

Take a look at the table below for a list of discounts that could lead to cheaper Geico versus State Farm quotes:

Geico vs. State Farm Auto Insurance Discounts by Savings Potential

| Discount Name | ||

|---|---|---|

| Anti-Lock Brakes | 5% | 5% |

| Anti-Theft | 25% | 15% |

| Bundling | 10% | 17% |

| Claim Free | 26% | 15% |

| Continuous Coverage | X | X |

| Daytime Running Lights | 1% | X |

| Defensive Driver | X | 5% |

| Distant Student | X | X |

| Driver's Ed | X | 15% |

| Driving Device/App | 25% | 50% |

| Early Signing | X | X |

| Emergency Deployment | 25% | X |

| Family Legacy | X | X |

| Farm Vehicle | X | X |

| Federal Employee | 8% | X |

| Full Payment | X | X |

| Good Student | 15% | 25% |

| Higher Education | X | X |

| Homeowner | X | 3% |

| Low Mileage | X | 30% |

| Loyalty | X | X |

| Married Couple | X | X |

| Membership/Group | X | X |

| Military | 15% | X |

| Multiple Vehicles | 25% | 20% |

| Newer Vehicle | X | 40% |

| Occupation | X | X |

| Paperless/Auto Billing | X | 2% |

| Passive Restraint | 40% | 40% |

| Safe Driver | 15% | 15% |

| Seat Belt Use | 15% | X |

| Students & Alumni | X | X |

| Utility Vehicle | X | X |

| Vehicle Recovery | 15% | 5% |

Both companies offer discounts, but there are some differences. For example, Geico offers an emergency deployment discount and State Farm doesn’t.

Consider how much you’ll pay for coverage after a discount. Just because one company has higher discount percentages doesn’t mean they have the cheapest rates after those discounts.

This may leave you wondering, “Is State Farm cheaper than Geico after discounts?” Check out the table below to compare Geico vs. State Farm prices before and after the most popular discounts:

Price Drops After Discounts: Compare Full Coverage Auto Insurance Monthly Rates

| Discount Name | ||

|---|---|---|

| Anti-Theft | $108 | $121 |

| Bundling | $97 | $120 |

| Claims Free | $114 | $130 |

| Emergency Deployment | $88 | $115 |

| Good Student | $89 | $102 |

| Multi-Vehicle | $109 | $119 |

| New Vehicle | $103 | $117 |

| Passive Restraint | $106 | $121 |

| Safe Driver | $88 | $110 |

| Vehicle Recovery | $117 | $129 |

You should also ask about accident forgiveness before you file a claim with the Geico or State Farm claims department to minimize your rate increase. However, you’ll pay higher rates for this add-on.

If you’re a State Farm customer, use your State Farm login to get into your account and find out which discounts you may qualify for. While some discounts apply automatically, there are many you’ll need to request.

Customer Reviews & Financial Ratings for State Farm vs. Geico

The Better Business Bureau gives Geico an A+ rating. However, State Farm has a C-. J.D. Power, which ranks providers based on customer satisfaction, scores both companies as above average for most regions in the U.S.

Insurance Business Ratings & Consumer Reviews: Geico vs. State Farm

| Agency | ||

|---|---|---|

| Score: 857/1,000 Above Avg. Satisfaction | Score: 877/1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Business Practices | Score: C- Below Avg. Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 0.78 More Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: B Fair Financial Strength |

A.M. Best ranks insurance companies on their financial stability. Geico received an A++ ranking, while State Farm was recently downgraded to a B. However, both companies remain top insurers with some of the most premiums written.

While claims and financial stability is crucial, you may be curious what customers think about costs.

In a discussion of Geico and State Farm on Reddit, one user with a State Farm auto insurance policy in Florida asked whether they should accept a $340 cheaper quote from Geico.

Another user, who claims to be a Geico employee, responded saying online quotes don’t always have everything rated, and that they’ve seen rates change once a policy starts. Geico auto insurance reviews like these help gain insight into customer experiences when comparing top providers.

See our explanation of how to get fast and free auto insurance quotes here.

Side-by-Side Comparison of Coverage Options for Geico vs. State Farm

State Farm vs. Geico car insurance offer a wide range of coverages to meet drivers’ needs, including including essential choices like liability insurance. Check out the table below to see what coverages they offer:

Geico vs. State Farm Auto Insurance Coverage Options

| Coverage Type | ||

|---|---|---|

| Accident Forgiveness | ✅ | ❌ |

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Custom Parts & Equipment (CPE) | ✅ | ✅ |

| Gap Insurance | ❌ | ❌ |

| Glass Coverage | ✅ | ✅ |

| Liability | ✅ | ✅ |

| Mechanical Breakdown (MBI) | ✅ | ❌ |

| Medical Payments (MedPay) | ✅ | ✅ |

| New Car Replacement | ❌ | ❌ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| SR-22 Insurance | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

So while you can find coverages such as accident forgiveness and mechnical breakdown insurance (MBI) with Geico, you can’t buy these policies with State Farm.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

State Farm Pros & Cons

Pros:

- Wide Agent Network: Unlike Geico, State Farm has various agencies across the U.S. ready to provide auto insurance policyholders with personalized support.

- Cheap High-Risk Coverage: DUI insurance coverage with State Farm vs. Geico car insurance is nearly 50% cheaper, costing around $112/mo for State Farm and $216/mo for Geico.

- Top Discount Options: State Farm has more savings opportunities than Geico, with discounts for vehicle safety, safe driving, and more. See our State Farm Drive Safe and Save review to save 50%.

Cons:

- Not Cheaper for Most: While State Farm has the cheapest rates for those with a DUI or ticket, Geico is still more affordable for most drivers. Find the cheapest insurance using our free quote tool.

- Few Digital Tools: State Farm’s strong agency network is ideal for in-person help, but its digital tools are lacking compared to Geico, which excels in online policy management, claims, and quotes.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Geico Pros & Cons

Pros:

- Lower Rates: Geico offers the cheapest rates for most age groups and demographics, starting at $30/mo for minimum coverage.

- Best Online Resources: Operating primarily online, Geico’s website and mobile app offer a smoother experience than State Farm. Find tips to manage your auto insurance policy effectively here.

- Great Ratings: Geico’s NAIC complaint index is 0.55 vs. State Farm’s 0.78, reflecting higher satisfaction. Geico also holds an A++ financial strength rating from A.M. Best, while State Farm’s is a B.

Cons:

- Limited Local Support: Geico has a smaller network of agents vs. State Farm, making it more difficult for drivers who prefer support in person.

- Expensive for High-Risk Drivers: Though Geico has the cheapest insurance premiums overall, high-risk drivers with a DUI, ticket, or poor credit generally see higher rates with Geico.

Geico Car Insurance vs. State Farm: Find Your Best Deal Now

When comparing State Farm insurance vs. Geico, you’ll discover that both are among the best auto insurance companies with some key differences.

Is Geico too good to be true🤔? Low rates🤑 and high customer ratings seem like a good thing, but you’ll want to check out the review📊 at https://t.co/27f1xf1ARb. Read it all here👉: https://t.co/TDX3gZcV2Y pic.twitter.com/q20UpG70UK

— AutoInsurance.org (@AutoInsurance) December 21, 2023

For instance, Geico is the cheapest insurer for most drivers, while State Farm has great service and affordable high-risk insurance rates.

Before you choose to buy Geico or State Farm auto insurance, enter your ZIP code to compare multiple car insurance companies in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Geico or State Farm cheaper?

You may wonder, “Who is more expensive: State Farm or Geico?” While rates vary, Geico generally has cheaper rates than State Farm. Geico’s premiums start at $30/mo to meet minimum insurance requirements, while State Farm costs as low as $33/mo.

However, to find the best auto insurance rates, request quotes from both Geico and State Farm. Then, compare the quotes to determine which option is most cost-effective for your situation. Instantly compare Geico insurance vs. State Farm rates to find the cheapest policy for you with our quote comparison tool.

What factors should I consider when choosing between Geico and State Farm auto insurance?

When comparing Geico vs. State Farm insurance, it’s important to consider factors such as coverage options, pricing, discounts, customer service, financial strength, and the overall reputation of the companies. Receiving State Farm or Geico discounts can help with overall costs.

Assess your specific needs, budget, and preferences to make an informed decision.

What types of coverage options are available with Geico and State Farm auto insurance?

Both Geico and State Farm offer a range of coverage options for auto insurance, including liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP). They may also offer additional options such as roadside assistance and rental car coverage.

Do Geico and State Farm offer any unique features or benefits?

Geico and State Farm have their own unique features and benefits. For example, Geico is known for its online and mobile tools, competitive pricing, and fast claims process. State Farm, on the other hand, has a large network of agents and provides personalized service.

Learn More: How to File an Auto Insurance Claim

Researching these features can help you decide which company aligns better with your preferences.

Is State Farm better than Geico?

A top question readers ask is, “Is Geico or State Farm better?” Determining whether State Farm or Geico is the best depends on your personal needs.

If you prefer personalized service, you may like State Farm’s local agent support and high customer satisfaction. On the other hand, Geico offers cheaper rates than State Farm in most cases, and has more digital resources for managing your policy.

How is the customer service of Geico and State Farm?

Geico and State Farm are top auto insurance companies with the best customer service, though experiences may vary.

When comparing providers, it’s good read reviews about customer support and claims. For instance, search around for reviews of Geico vs. Travelers or Geico vs. Farmers if you’re considering those top companies.

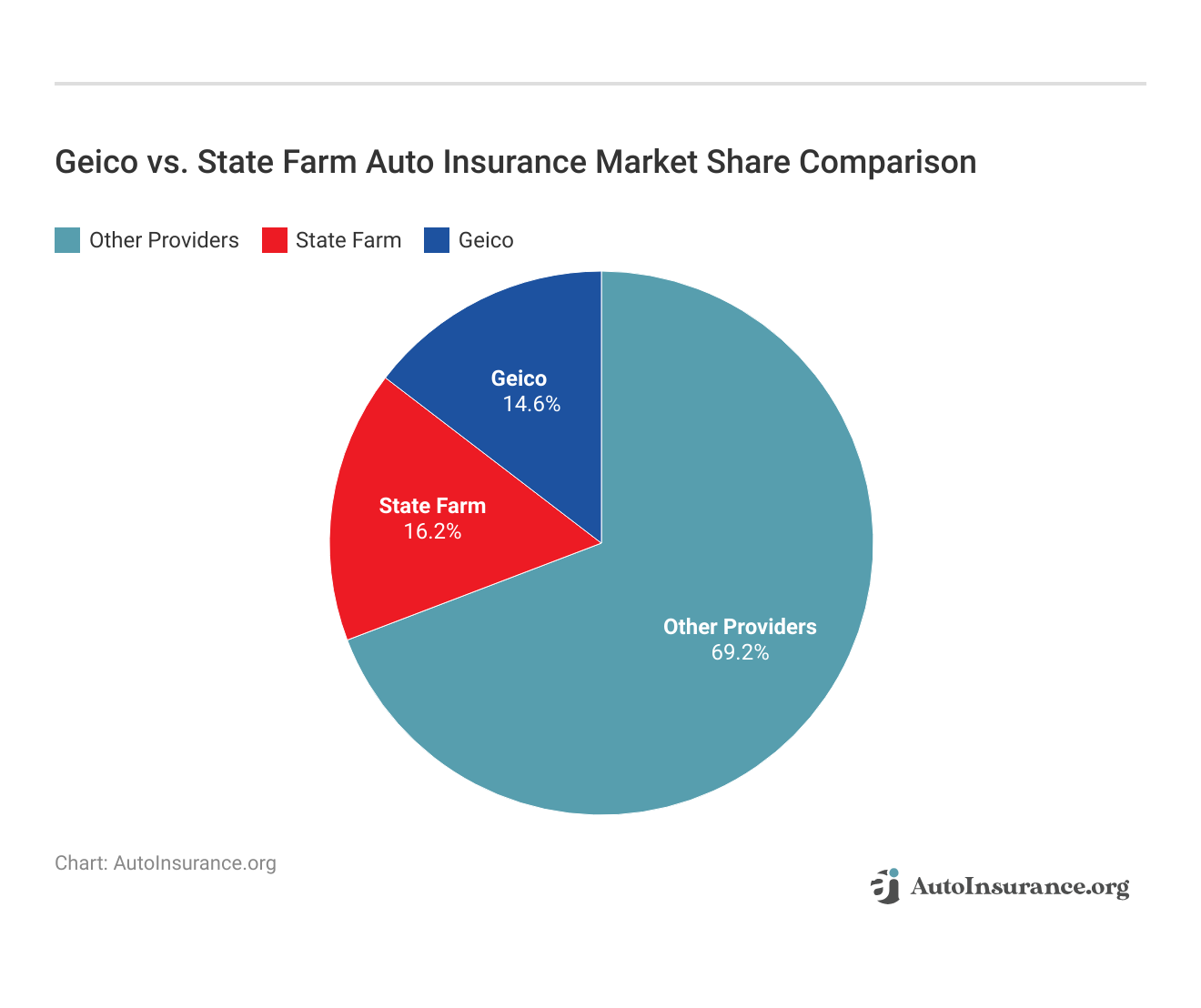

Where do State Farm and Geico rank among insurance providers in the U.S.?

State Farm and Geico rank as two of the top car insurers in America. Both companies have high ratings across the board, making them popular choices for auto insurance. State Farm is actually the largest auto insurance provider in the United States, and Geico is the second largest.

Why is my Geico insurance so cheap?

Geico is the cheapest auto insurance company thanks to its streamlined online operations and various savings opportunities, such as discounts.

Who is State Farm’s biggest competitor?

State Farm and Geico are direct competitors as the two top auto insurers, with Progressive coming in at third. If you’d like to also compare State Farm vs. Geico vs. Progressive, learn more in our review of Progressive insurance.

How is State Farm vs. Geico home insurance?

Like its car insurance, State Farm’s home insurance has more in-person support and coverage add-ons, though you may still see cheaper rates with Geico.

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.