Geico vs. USAA Auto Insurance in 2025 (Who Is Better?)

Geico and USAA auto insurance starts at $22/month. Geico offers broad coverage and competitive rates for general drivers, while USAA specializes in military family benefits and lower premiums. Geico vs. USAA auto insurance comparisons help you find the best fit for standard coverage or military-exclusive perks.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

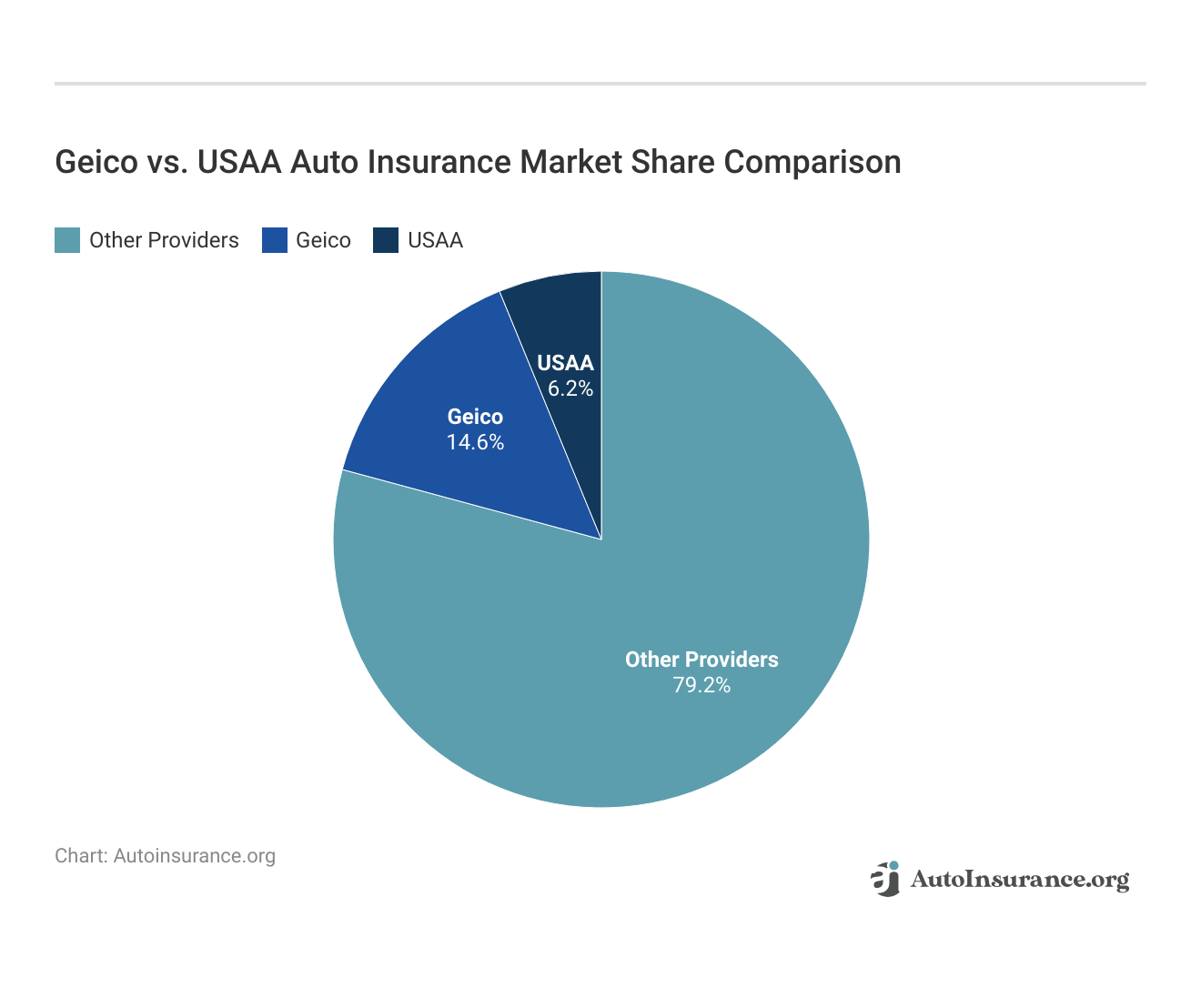

6,589 reviewsThis article compares the auto insurance of Geico vs. USAA. Geico provides rates as low as $30 with widespread availability, while USAA caters to military families with a starting rate of $22 and a highly-rated service.

For affordable options, Geico is ideal, while USAA’s financial strength and military-exclusive benefits make it perfect for service members.

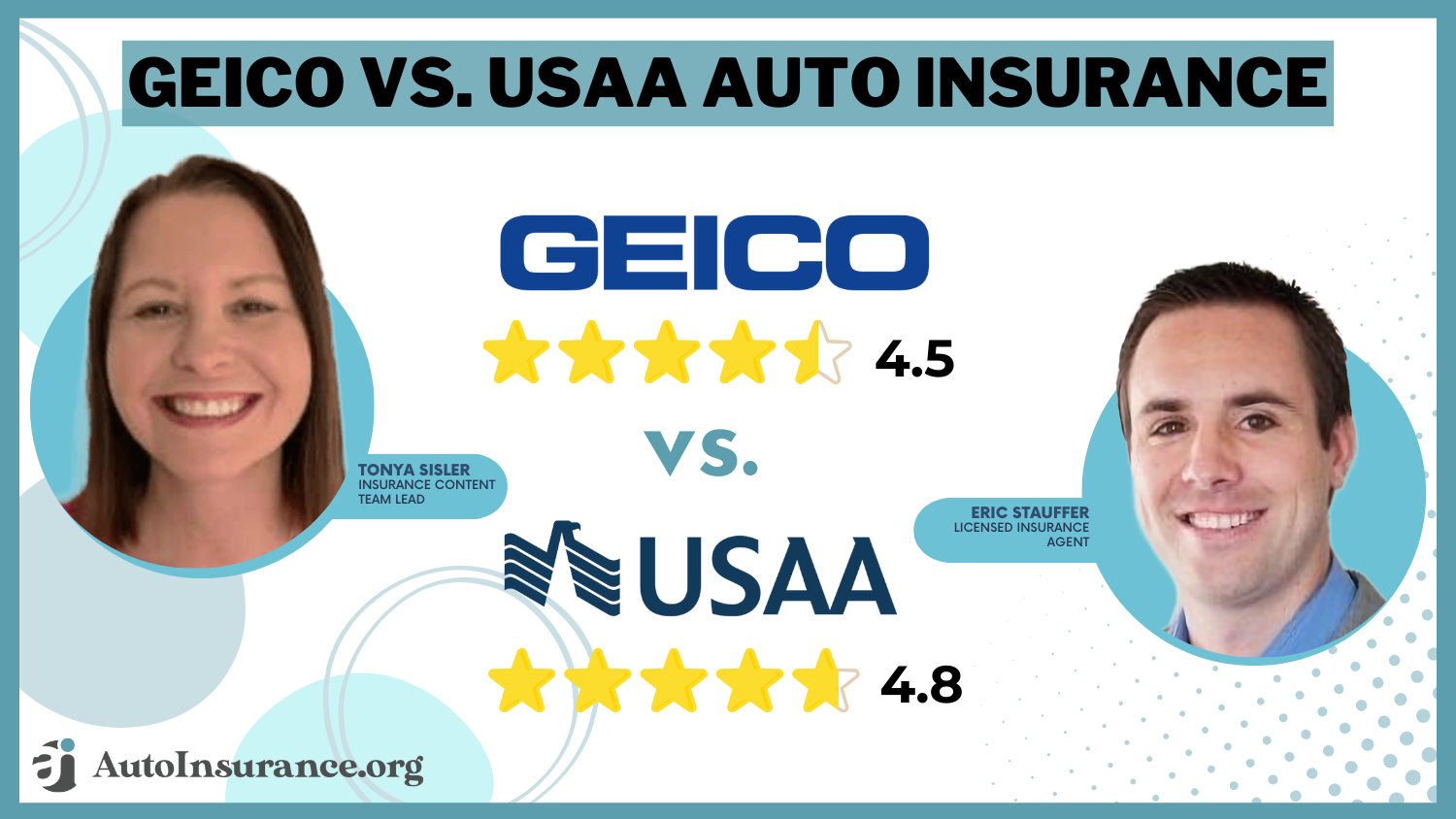

Geico vs. USAA Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.5 | 4.8 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.8 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.4 | 4.7 |

| Customer Satisfaction | 4.5 | 4.7 |

| Digital Experience | 5.0 | 5.0 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.4 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 4.1 | 4.7 |

| Savings Potential | 4.5 | 4.7 |

| Geico Review | USAA Review |

With USAA discounts, members save even more. Find affordable auto insurance rates online by comparing quotes to get the best coverage.

Keep reading to learn how to find affordable Geico vs. USAA auto insurance rates, or enter your ZIP code above to compare car insurance quotes from local providers.

- Geico’s A++ rating reflects its strong financial stability

- USAA offers military-exclusive perks and competitive rates

- Geico provides a 15% discount for the military, while USAA starts at $22

Geico Auto Insurance or USAA Auto Insurance Is Cheaper

What factors go into determining your car insurance rates may surprise you. Companies use your age, gender, marital status, driving record, and credit history to calculate your rates. All of these, and more, will decide how affordable Geico vs. USAA auto insurance is for you.

Geico vs. USAA Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $298 | $245 |

| Age: 16 Male | $312 | $249 |

| Age: 30 Female | $90 | $74 |

| Age: 30 Male | $87 | $79 |

| Age: 45 Female | $80 | $59 |

| Age: 45 Male | $80 | $59 |

| Age: 60 Female | $73 | $53 |

| Age: 60 Male | $74 | $53 |

Keep in mind that rates will be different for every driver. Geico has military discounts for drivers, while USAA only offers them to military members, veterans, and their families. To compare the two, compare auto insurance rates of age, gender, and marital status.

Geico vs. USAA Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $80 | $59 |

| Not-At-Fault Accident | $132 | $78 |

| Speeding Ticket | $106 | $67 |

| DUI/DWI | $216 | $108 |

Everybody already knows that auto insurance rates for young drivers are pretty pricey, but there can be differences in age where you are surprised at rate variations. USAA insurance is cheaper than Geico insurance for all demographics.

One of the most significant factors auto insurance companies consider is your driving record. Accidents, speeding tickets, and DUIs will cause your rates to skyrocket. Geico is more expensive, regardless of your driving record.

Car insurance companies also consider your credit score when calculating auto insurance rates. Insurance providers think that if you have a higher credit score, you’ll be more likely to pay for damages yourself and not file a claim. Once again, USAA is cheaper than Geico, regardless of your credit score.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Geico or USAA Has Better Auto Insurance Discounts

Car insurance discounts are among the best ways to lower your rates significantly. Most auto insurance companies offer many of the same deals, such as good student and multi-car discounts.

The table below shows you the USAA vs. Geico auto insurance discounts offered. The amount of the discount is listed if it is known. Look through this list to see which company will offer you the most deals. The two companies provide many of the same discounts, but some differences exist.

For example, your Geico quotes may include a continuous coverage discount you can’t get from USAA. On the other hand, your USAA quote might list a married discount that Geico doesn’t offer.

That’s why asking for any available discounts when comparing USAA vs. Geico auto insurance quotes is essential. Also, before you file USAA or Geico claims, ask about accident forgiveness.

Comparison of Geico and USAA in Financial Strength and Customer Satisfaction

A.M. Best ranks the financial stability of insurance companies. Both companies received an A++ rating, meaning they have a superior Geico Insurance received an A+ rating from the Better Business Bureau, and USAA received an A- rating.

Insurance Business Ratings & Consumer Reviews: Geico vs. USAA

| Agency | ||

|---|---|---|

| Score: 857 / 1,000 Above Avg. Satisfaction | Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 96/100 High Customer Satisfaction |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 1.74 More Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: A++ Superior Financial Strength |

However, Geico is accredited, and USAA insurance is not. J.D. Power ranks companies on customer satisfaction using factors like prices, billing, claims, and what products are offered. In most regions, both Geico and USAA customer service ranked above average.

Both providers offer mobile apps and websites where you can log in with your USAA or Geico account to see your ID cards and coverage details and pay your bill. Consider this when managing your insurance if you want the best auto insurance apps.

Geico Pros & Cons

Pros

- Affordable Rates: Geico is the cheapest quote, and the policies start from as low as $30. Expand your understanding with our “Geico Auto Insurance Review.”

- Broad Coverage Options: Drivers can choose various coverage options, which are liability, collision, and comprehensive, in varying degrees of their choice.

- Discount Opportunities: Geico permits many coupons, which give more discounts on cost areas such as multi-policy, good driver, and military coupons

cons

- Limited Availability for Military-Specific Benefits: It is less accessible to the particular benefit available for the military forces than other competing organizations.

- Mixed Customer Service Review: Varying customer services, one finds. The better, the less variable, the more reliable overall.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA Pros & Cons

Pros

- Military-Exclusive Benefits: USAA caters to a specific military, its active duties, retired, and families; it provides special discounts, and a set of advantages are received under a unique canopy of perquisite.

- High Customer Satisfaction: USAA is known for its excellent customer service and hence scores on top in all customer satisfaction surveys and reviews.

- Strong Financial Strength: USAA is given an A++ rating by A.M. Best with an outlook of Stable; this means it is financially sound, safe, and can pay claims.

cons

- Eligibility Restrictions: USAA auto insurance can only be applied to military members and their families, limiting its use. Uncover more about our “USAA Auto Insurance Review” by reading further.

- Fewer In-Person Locations: USAA may benefit people who prefer in-person assistance by offering solid digital services while having fewer physical branches.

Choosing Wisely Between Geico and USAA

Geico and USAA represent unique areas for individual needs, coverage, and affordability differentials. Geico rates as low as $30 and provides extensive discounts that fit a broader range of consumers, thus earning a total score of 4.5.

USAA stands out with a $22 monthly rate and exclusive benefits for military families, offering top value and reliability.Jeff Root Licensed Insurance Agent

USAA focuses on military families and offers rates as low as $22. With exclusive discounts for military members and outstanding customer support, they have an impressive aggregate score of 4.8. This makes USAA a strong contender for the best auto insurance for military families and veterans, so it’s essential to read more about why they excel in this market.

Although USAA’s coverage is only reserved for military-affiliated members, both companies have exceptional financial stability ratings, therefore being top picks based on driver eligibility and individual requirements. Before you buy Geico vs. USAA auto insurance, enter your ZIP code to compare multiple car insurance companies in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What are the main differences in coverage and benefits between Geico and USAA?

Geico offers aggressive pricing that starts around $30 and is generally better suited to most drivers. USAA limits itself to military families alone, with starting rates at only $22 and specific military discounts. It’s known for outstanding customer satisfaction and robust financial standing—an attractive trait for those in the military and their families. Each of these USAA vs. Geico car insurance debates offers something different.

What factors affect USAA rates for auto insurance?

USAA auto insurance rates depend on driving history, location, vehicle type, and coverage choices. Moreover, military affiliation might determine whether discount availability is possible, which can add value to the option for qualified members.

How can I find USAA car insurance quotes tailored to my needs?

To receive a personalized USAA car insurance quote that suits your unique needs, try using USAA’s online quote tool or get their consumer service. Compare auto insurance quotes based on essential factors like driving record, military rank, and preferred coverage options for an accurate, tailored rate estimate.

Is USAA cheaper than Geico for typical drivers?

USAA tends to offer more affordable rates for qualifying military members and their families, starting as low as $22. Geico, however, provides competitive pricing and a range of discounts that can make it affordable for many other drivers, especially those without military ties. Start saving on auto insurance byentering your ZIP codebelow and comparing quotes.

How does Geico compare to Liberty Mutual in terms of affordability and coverage?

Geico base rates are often far more affordable, at around $30, while offering various discounts. In contrast, Liberty Mutual has distinct options for its policies and provides much better bundles, particularly for those needing multiple types of insurance.

Which offers better value in coverage and pricing: Geico vs Nationwide?

Geico offers substantial value with lower rates and wide driver accessibility, making it ideal for budget-conscious drivers.A nationwide auto insurance reviewhighlights benefits like vanishing deductibles and loyalty perks, adding value for long-term policyholders seeking extra rewards.

How do customer service and benefits differ in Liberty Mutual vs USAA?

USAA boasts one of the most elevated client satisfaction ratings and offers some military-specific benefits; Liberty Mutual, however, boasts a much broader scope of general policy options. USAA offers exclusive benefits regarding military discounts and financial stability to military families.

Which provider has more favorable rates and discounts: Nationwide vs USAA?

USAA generally offers lower rates and exclusive discounts tailored to military members, making it more affordable for eligible drivers. Nationwide also provides competitive pricing but is more geared toward non-military drivers, with discounts for long-term customers.

Which companies are considered similar to Geico in terms of auto insurance?

Progressive, Allstate, and Liberty Mutual provide similar coverage with competitive rates. They often sell to a wide range of customers because they do. Auto insurance overseeing companies like Geico also offer many discounts, making them an excellent place for affordable coverage. It’s worthwhile reading about these to find the best deal for your needs.

What advantages are there in choosing Nationwide vs Geico for car insurance?

Nationwide offers advantages like accident forgiveness and vanishing deductibles, making it appealing for long-term policyholders. On the other hand, Geico offers low rates starting at $30 and various discounts, making it apt for price-sensitive drivers.

USAA is typically better suited for veterans and military families, with rates as low as $22 and exclusive member benefits. State Farm offers various policies and discounts for non-military drivers and may have broader availability regarding local agents.

What should homeowners consider when comparing USAA vs Geico home insurance?

USAA Home Insurance is well-known for its excellent customer service and the unique advantages it offers to military members, which tie into the best home and auto insurance bundling discounts. Meanwhile, Geico offers competitively priced policies through third-party providers, resulting in less direct management of home insurance. Knowing these differences can help you make the right choice.

Who is eligible for USAA insurance, and what are the membership requirements?

USAA insurance is available to active, retired, or separated military members, spouses, and children. Eligibility extends to family members of existing USAA members, allowing them access to USAA’s comprehensive insurance and financial services.

What are the critical features of Accident Forgiveness from USAA?

USAA’s Accident Forgiveness prevents premium increases after a driver’s first at-fault accident if they have been accident-free for five years. This benefit helps maintain lower rates and rewards safe driving for eligible members. Get fast and affordable car insurance coverage today withour quote comparison tool below.

How can I switch my USAA automobile insurance policies easily?

Contact USAA’s customer service for assistance to switch your auto insurance policy. Suppose you’re considering options like Progressive vs. USAA auto insurance. They will help you adjust coverage or transfer policies to accommodate life or financial changes.

What is the USAA contact number for auto insurance quotes for new customers?

New customers can reach USAA’s auto insurance quote line at 1-800-531-8722. The customer service team can provide personalized quotes and answer specific questions about coverage options.

How can I access Geico’s military customer service for exclusive benefits?

Geico offers a dedicated military customer service line at 1-800-MILITARY. This line is specifically for military members seeking information on Geico’s military discounts and support services.

Does USAA offer a driver’s ed discount for young or new drivers?

USAA offers a discount for young drivers who complete a certified driver’s education course, which can help lower their premiums. Understanding the six reasons auto insurance costs more for young driversis crucial, as this benefit can significantly aid new drivers and their families in managing costs.

How does The General compare to USAA in terms of auto insurance offerings?

The General offers flexible payment plans for high-risk drivers. USAA is more suited for military families, providing added benefits and discounted rates for those in better financial standing.

What are the main differences between American Family and USAA for policyholders?

American Family allows for various coverage options, customizable policies, and much more, while USAA provides affordable quality insurance explicitly designed for the military family with exclusive benefits and discounts.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.