HiRoad Auto Insurance Review for 2025 (Impartial Company Report)

Our HiRoad auto insurance review found it a good option for safe drivers looking to save with usage-based rates. Quotes start at $43 per month, but may change as the HiRoad app tracks driving habits to adjust rates each month. Currently, HiRoad car insurance is only available in Arizona and Rhode Island.

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

HiRoad

Monthly Rate:

$43A.M. Best Rating:

AComplaint Level:

LowPros

- Monthly discount up to 50% for good driving

- Add-ons like roadside assistance

- Strong financial standing according to A.M. Best

Cons

- Only sold in Arizona and Rhode Island

- Not for drivers uncomfortable with data tracking

Our HiRoad auto insurance review found it may be a good option for drivers who want cheap usage-based auto insurance rates.

HiRoad Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 3.0 |

| Claim Processing | 4.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.4 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 5.0 |

| Digital Experience | 4.0 |

| Discounts Available | 3.0 |

| Insurance Cost | 3.5 |

| Plan Personalization | 4.0 |

| Policy Options | 2.2 |

| Savings Potential | 3.4 |

Available in Arizona and Rhode Island, HiRoad Insurance is best for those with clean driving records who want the chance to lower their rates each month through safe driving behaviors.

- HiRoad Insurance earned a 3.2/5 for its good driving discounts

- HiRoad rates start at an average of $43 per month

- HiRoad is only available to buy in Arizona and Rhode Island

While HiRoad offers great coverage choices like roadside assistance, not all drivers may like the telematics-based pricing or data tracking.

When shopping for auto insurance, it’s important to compare quotes from multiple insurers to find the best deal. Compare rates today with our free tool.

Cost of HiRoad Auto Insurance

HiRoad auto insurance rates will be the most expensive for teenagers, which is typical, no matter what company you pick. However, teens who demonstrate good driving behaviors may get lower rates each month. Take a look at the rates below for an idea of the average rates that drivers pay at HiRoad.

HiRoad Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $497 | $497 |

| 16-Year-Old Male | $558 | $558 |

| 18-Year-Old Female | $374 | $374 |

| 18-Year-Old Male | $422 | $422 |

| 25-Year-Old Female | $94 | $168 |

| 25-Year-Old Male | $95 | $168 |

| 30-Year-Old Female | $48 | $139 |

| 30-Year-Old Male | $48 | $141 |

| 45-Year-Old Female | $46 | $132 |

| 45-Year-Old Male | $45 | $133 |

| 60-Year-Old Female | $43 | $118 |

| 60-Year-Old Male | $43 | $119 |

| 65-Year-Old Female | $43 | $130 |

| 65-Year-Old Male | $43 | $130 |

HiRoad also bases quotes on other factors that affect auto insurance rates, like your driving record, and not just your age.

Drivers with clean driving records will naturally have the cheapest rates, as they pose the least risk. However, if you are a high-risk driver with safe driving habits, you could lower your rates with HiRoad car insurance policies since it tracks real-time driving behaviors. Learn how it works below.

How HiRoad Calculates Telematics Rates

HiRoad auto insurance rates are unique. It’s a telematics-based insurance company, meaning it bases rates partly on the driving behaviors tracked in the app every month (Read More: Best Auto Insurance Apps). HiRoad does calculate your base rates based on typical factors, such as your age, location, vehicle, credit score, and driving record.

Customers who maintain safe driving habits, such as minimal braking and low speeds, will benefit the most from telematics-based rates.Dani Best Licensed Insurance Producer

However, your rate will fluctuate each month depending on how you drive, since driving habits and mileage are tracked by the HiRoad insurance app.

You may pay less one month than you do another month with HiRoad insurance. The HiRoad app will track the following:

- Phone Use: HiRoad will give you a better rate if you stay off your phone while driving.

- Time on Road: HiRoad will record how much you drive, where you drive, and when.

- Speeds: HiRoad will track your vehicle’s speed on trips.

- Acceleration and Braking: HiRoad will penalize you for frequent, hard braking and acceleration.

All of these factors will be used to calculate your monthly discount. The better you drive, the more you will save each month on your HiRoad bill. You can track your progress each month in the HiRoad app by using your HiRoad login.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

HiRoad Auto Insurance Rates vs. The Competition

If you want to get an idea of how HiRoad stacks up to other companies’ prices, like Geico, start by comparing average rates for minimum versus full coverage auto insurance.

HiRoad Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $43 | $114 | |

| $110 | $160 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

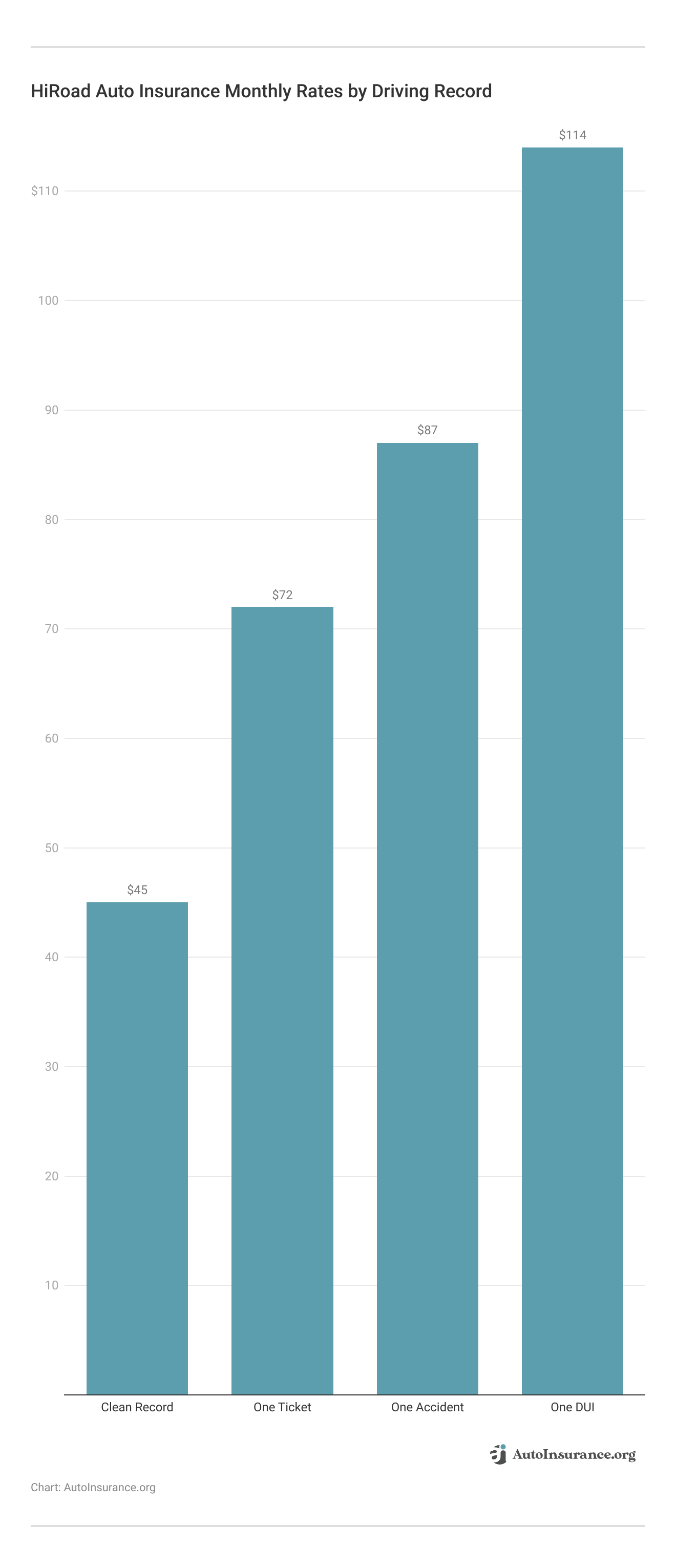

HiRoad is one of the more expensive companies on the list, but bear in mind that this is before the telematics discount is applied. With promised savings of up to 50%, your rate could be lower. Next, let’s compare rates by driving record.

HiRoad Monthly Auto Insurance Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $114 | $151 | $189 | $309 | |

| $160 | $190 | $220 | $260 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

HiRoad falls in the middle for affordability when compared to other companies based on driving record. Drivers with a poor driving record who demonstrate good driving on the HiRoad app may be able to get more affordable rates.

Auto Insurance Coverages Available at HiRoad

You chose to carry minimum or full coverage at HiRoad, as well as add-ons like roadside assistance. See the full list of what HiRoad offers below.

HiRoad Auto Insurance Coverage Options

| Coverage Type | |

|---|---|

| Liability | ✅ |

| Collision | ✅ |

| Comprehensive | ✅ |

| Uninsured/Underinsured Motorist | ✅ |

| Medical Payments (MedPay) | ✅ |

| Personal Injury Protection (PIP) | ✅ |

| Roadside Assistance | ✅ |

| Rental Reimbursement | ✅ |

| Glass Coverage | ✅ |

| Custom Parts & Equipment | ✅ |

Roadside assistance with HiRoad provides help with several breakdown situations, from tows to gas delivery (Learn More: Best Roadside Assistance Plans).

HiRoad Auto Insurance Discounts

Because HiRoad is a usage-based car insurance company, it doesn’t offer many of the best auto insurance discounts beyond savings for good driving. The biggest discount HiRoad offers is up to 50% each month for safe driving scores.

HiRoad also offers a first-month driver discount. This is simply a welcome discount that they give you when you get a quote with HiRoad, and it will be shown in your billing section.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

HiRoad Insurance Customer Service Reviews

Customer feedback for HiRoad can be found on several online rating sites and forums, from Google to Reddit. There are some positive reviews about HiRoad, with customers saying they did get discounted rates and found the customer service helpful.

Learn More: Best Auto Insurance Companies According to Reddit

However, you may find some customer concerns on sites like Reddit, where customers discuss a drop in the discount they earned, as you can see in the post below.

A few other customers agreed on HiRoad insurance reviews on Reddit that while HiRoad was cheap for the first few years they had it, the savings dropped off even with no changes in driving habits or scores.

HiRoad Business Ratings

In addition to customer reviews and ratings of HiRoad, you can check the business ratings of HiRoad to see how financially reliable it is, and HiRoad insurance customer service ratings.

HiRoad Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 770/1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 82/100 High Customer Satisfaction |

|

| Score: 0.75 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

HiRoad ratings are good overall. While it has just average customer claim satisfaction ratings from J.D. Power, it has high customer satisfaction ratings from Consumer Reports (Read More: Best Auto Insurance Companies According to Consumer Reports).

It also has an A rating from A.M. Best, which means it is in good financial standing and able to handle its ongoing financial responsibilities.

Pros and Cons of HiRoad Auto Insurance

HiRoad’s telematics-based insurance may not be right for every driver, and you should carefully consider the pros and cons of the company before signing up. Some of the perks we found include:

- Large Good Driving Discount: HiRoad promises that users with good driving scores in the app can save up to 50% each month.

- Coverage Options: HiRoad offers add-ons like emergency roadside assistance and rental coverage.

- A.M. Best Rating: HiRoad is financially secure with an A rating, meaning it is financially able to handle claims.

Some things to consider before getting a HiRoad insurance policy, however, include its limited availability and data tracking requirements:

- Data Tracking: You must be comfortable with the app tracking your trips, from your speeding to your phone use.

- Availability: HiRoad auto insurance is only sold in Arizona and Rhode Island.

Telematics insurance is not for everyone, so if you aren’t comfortable with your data being tracked, you may want to research other companies and choose a more traditional auto insurance provider (Learn More: How to Research Auto Insurance Companies).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if HiRoad Auto Insurance Meets Your Needs

Our HiRoad auto insurance review discovered that the biggest pro of HiRoad is the potential to save up to 50% each month with good driving behaviors (Learn More: Best Auto Insurance for Good Drivers).

However, drivers with poor driving skills or who aren’t comfortable with the data being tracked may not like or benefit from HiRoad. If you are looking for telematics-based insurance, however, HiRoad might be a good option if you live in Arizona or Rhode Island.

Before choosing an auto insurance company, make sure to compare quotes with our free tool. It will compare car insurance quotes from multiple companies to help you find the best coverage and rates for your needs.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is HiRoad insurance legit?

Yes, HiRoad is a legitimate company with an A rating from A.M. Best.

How does HiRoad insurance work?

The HiRoad app tracks driving behaviors, such as braking, accelerating, speed, and trip duration.

Is HiRoad owned by State Farm?

Yes, State Farm owns HiRoad Assurance Company. Learn more about the company in our State Farm auto insurance review.

Is HiRoad a good insurance?

Yes, HiRoad Assurance Company has an A rating from A.M. Best. However, it is not best for bad drivers or those uncomfortable with their driving data being tracked.

How do I get a HiRoad insurance quote?

You can get a HiRoad Assurance Company quote by visiting their website. If you are interested in comparing multiple quotes from different companies, use our free quote tool to get started.

Does roadside make your insurance go up?

Yes, adding roadside assistance from HiRoad Assurance Company will make rates go up, as it is an optional add-on coverage (Read More: How much car insurance do I need?).

What is the HiRoad auto insurance review on Consumer Reports?

Consumer Reports gave HiRoad a score of 82 out of 100.

How do I contact HiRoad customer care?

The HiRoad insurance phone number for customer care is 888-912-9306.

How do insurance apps know who is driving?

Apps track driving trips, so patterns that emerge are an indicator that the user is driving a common route. HiRoad tracks driving patterns to determine a user’s habits. If you are not driving, even though it’s a common route you take, you can often set yourself as a passenger.

What are the risks of using car insurance tracking apps?

Drivers should be aware of some risks when using telematics insurance. For example, data breaches are a concern, as are denied claims if app data determines they were driving recklessly (Learn More: How to Dispute an Auto Insurance Claim).

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Askowron38

Good inexpensive insurance