Hugo Auto Insurance Review for 2025 (See if They’re a Good Fit)

Discover Hugo auto insurance, offering pay-as-you-go plans at $82/month tailored for low-mileage drivers. This Hugo auto insurance review showcases its app-based toggle feature, letting users control coverage instantly, making it ideal for those needing affordable, flexible short-term car insurance.

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviews

Hugo Auto Insurance

Monthly Rate For Good Drivers

$82A.M. Best Rating:

NAComplaint Level:

LowPros

- The app allows users to toggle insurance on or off anytime

- Perfect for low-mileage and infrequent drivers’ needs

- No annual premiums or long-term commitments are required

Cons

- Full coverage is limited to Illinois and California only

- Not rated by A.M. Best or J.D. Power currently

This Hugo auto insurance review highlights its innovative pay-as-you-go scheme, created for drivers looking for adaptable and immediate coverage.

Hugo is exceptional because of its application-based switch function. This feature enables users to manage their coverage in actual time.

Hugo Auto Insurance Rating

| Rating Criteria | Score |

|---|---|

| Business Reviews | 4 |

| Claim Processing | 3.3 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.7 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 3.3 |

| Insurance Cost | 4.5 |

| Plan Personalization | 3.5 |

| Policy Options | 5 |

| Savings Potential | 4.1 |

| Insurance Rating | 4.1 |

It’s excellent for those who don’t drive long distances, providing them with options for liability and comprehensive insurance in certain regions.

Hugo makes the process easier by removing usual premiums and focusing on occasional drivers who appreciate the ease and economical price. Compare the best pay-as-you-go auto insurance companies and their unique benefits.

Compare Hugo auto insurance quotes by entering your ZIP code into our free comparison tool.

- Hugo auto insurance earns an $82 rating for flexible plans

- Mobile app allows users to toggle coverage on or off instantly

- Perfect for low-mileage drivers needing short-term insurance

What You Should Know About Hugo Insurance

Hugo Auto Insurance gives a cutting-edge pay-as-you-drive scheme specially designed for drivers who cover fewer miles. The company allows you to switch your coverage on or off using their app. They serve in 13 states, like California and Texas inclusive, offering liability and complete insurance plans at reasonable prices. Even those with driving violations can benefit from their competitive rates.

The system that uses an application makes policy management easier. This is perfect for drivers who drive part-time or temporarily. It doesn’t have extra features such as help on the side of the road and its reach is limited, but Hugo does very well in being affordable, easy to use and offers discounts like saving up to 50% when you don’t drive much.

Hugo Auto Insurance Reviews and Ratings

There are minimal Hugo insurance claims, with most drivers seeking policies that suit their infrequent driving needs. While driving may not be a priority, having adequate coverage is crucial. Hugo offers cheap car insurance every week for those interested in affordable options. The Hugo insurance app download also provides an easy way to manage and access your policy.

Many Hugo car insurance reviews commend its coverage and payment flexibility. These reviews highlight how Hugo effectively addresses drivers’ needs through pay-as-you-go insurance options and a mobile-friendly app with Hugo. The daily pay car insurance feature particularly stands out for its convenience.

Hugo Insurance customer service experiences can vary by region; for example, drivers in California might have a different experience than those in Texas or Tennessee, where coverage options are more limited.

This means that while accessing Hugo Insurance login or contacting Hugo car insurance customer service might differ from state to state, your location can also affect the availability of services and functionality of your Hugo insurance card. Hugo is also a relatively small new company. A.M. Best or J.D. Power does not yet rate it, so it could lack the financial strength and overall customer satisfaction you’re looking for in an insurer.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hugo Insurance Rates Breakdown

Below, we’ve calculated an average of what drivers pay for Hugo auto insurance based on age and where they live. Your driving record will also influence your rates, and Hugo may not insure drivers with multiple accidents or claims. Use the tables below to find affordable Hugo auto insurance near you.

Hugo Auto Insurance Rates by Age And Gender

Despite being cheap usage-based auto insurance, men can still expect to pay more for Hugo than women. Younger drivers will also have higher rates.

Hugo Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $278 | $482 |

| Age: 16 Male | $323 | $529 |

| Age: 18 Female | $247 | $431 |

| Age: 18 Male | $308 | $468 |

| Age: 25 Female | $129 | $206 |

| Age: 25 Male | $154 | $219 |

| Age: 30 Female | $103 | $173 |

| Age: 30 Male | $112 | $184 |

| Age: 45 Female | $86 | $148 |

| Age: 45 Male | $93 | $157 |

| Age: 60 Female | $82 | $139 |

| Age: 60 Male | $88 | $147 |

| Age: 65 Female | $84 | $153 |

| Age: 65 Male | $91 | $161 |

The only states that don’t allow gender to influence insurance rates and also offer Hugo auto insurance are California and Pennsylvania.

Hugo Auto Insurance Rates by State

Hugo auto insurance is only available in 13 states. Find yours in the table below to compare rates:

Hugo Auto Insurance Monthly Rates by State & Coverage Level

State Minimum Coverage Full Coverage

Alabama $60 $120

Arizona $65 $130

California $48 $147

Florida $70 $140

Georgia $75 $150

Illinois $68 $136

Indiana $62 $124

Mississippi $41 $110

Ohio $58 $116

Pennsylvania $72 $144

South Carolina $67 $134

Tennessee $63 $126

Texas $80 $160

Regional claim and auto accident rates will impact your Hugo insurance rates. The cheapest states are Ohio and Alabama, while Georgia and Texas are the most expensive.

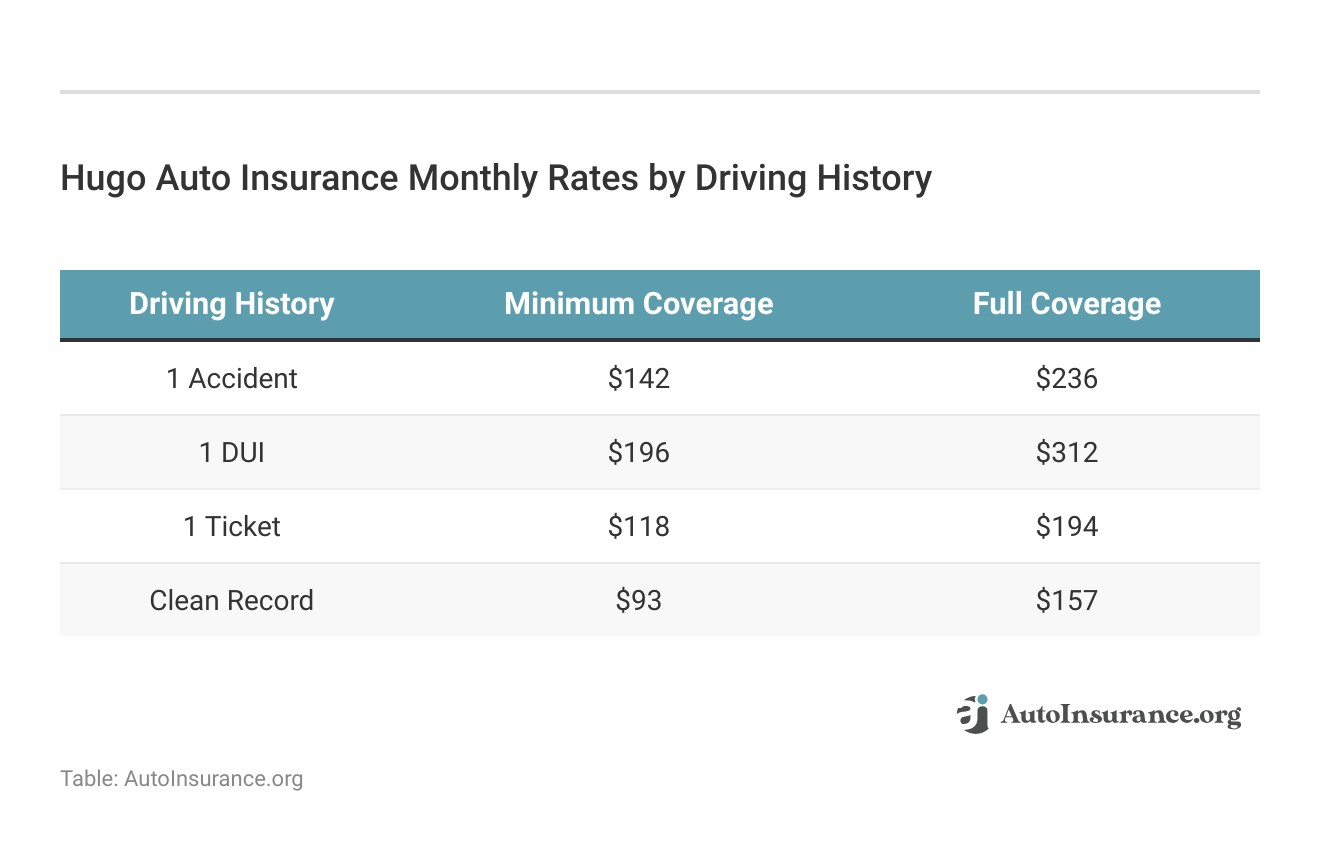

Hugo Auto Insurance Rates by Driving Record

Driving history significantly affects Hugo’s auto insurance rates, and drivers with DUIs pay the most for coverage.

Drivers who have high risk can also obtain cheap coverage based on the plan they select. For example, if you choose a Flex Plan, which is suitable for people driving only several days in one month, it could assist those with DUIs or road accidents to save a lot of money.

This scheme is affordable daily car insurance that can help save significant money. Also, using Hugo’s referral code for no-cost entry or checking out jobs with Hugo Insurance could give even more advantages.

How to Pay For Hugo Auto Insurance

Unlike traditional auto insurance companies, you don’t pay monthly or annual premiums with Hugo. And unlike pay-per-mile insurance programs, you don’t pay a rate based on your monthly mileage.

Hugo only charges for the days you drive, and drivers pay for auto insurance through a refillable account on the Hugo insurance app. You can add funds as needed or set up “Auto Reload” by linking a bank account. The perks of choosing a Flex plan are flat daily rates and the ability to turn coverage off and on as you need it.

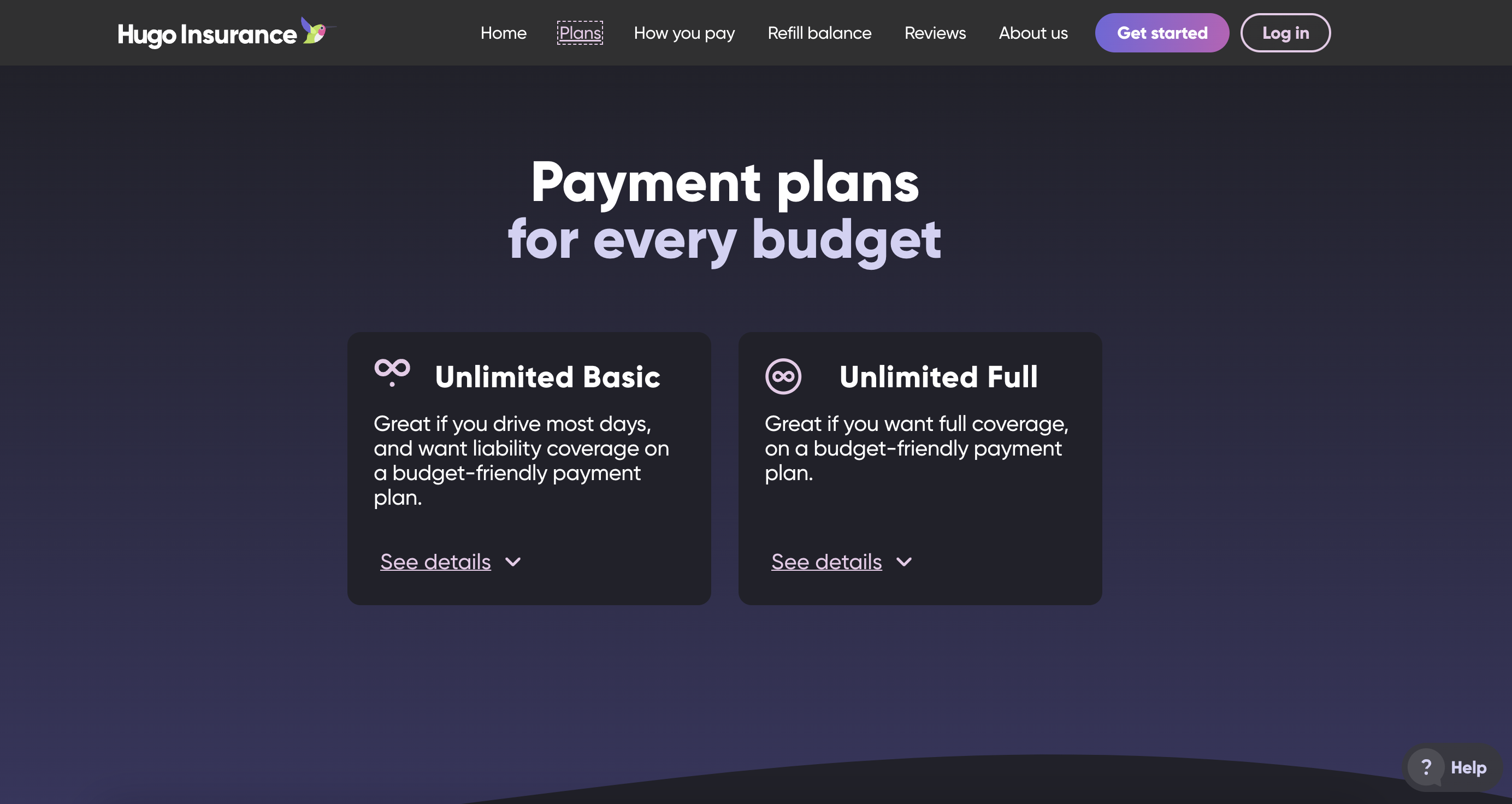

If you need more coverage, Unlimited Basic and Full plans can still reload your Hugo insurance app and extend coverage without payment.

Hugo’s app-based payment model simplifies managing and funding your policy anytime.Ty Stewart Licensed Insurance Agent

Drivers who need 1-day auto insurance or temporary two-week auto insurance enjoy Hugo’s flexible payment options that let you add coverage by the day, week, or month.

Comparing Hugo Auto Insurance Rates to Competitors

Hugo Car Insurance is prominent for its very economical pay-as-per-use system, presenting one of the smallest prices among leading rivals. The given table underscores monthly costs for minimum and complete coverage from big insurance companies, showing Hugo’s unique cost benefit.

Hugo Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $122 | $178 | |

| $95 | $170 | |

| $63 | $147 | |

| $55 | $75 |

| $90 | $165 |

| $75 | $140 |

| $86 | $150 | |

| $68 | $135 | |

| $80 | $155 | |

| $50 | $125 |

The table presents how affordable Hugo’s rates are, especially for those drivers who are looking for options that won’t hurt their wallet. At only $55 for minimal coverage and $75 for full coverage, Hugo consistently provides cheaper prices than competitors. For instance, insurance providers such as Allstate and Farmers ask higher fees at both levels of coverage – with the minimum protection offered by Allstate priced at $122.

Even well-known economical insurance companies such as Geico and State Farm provide rates that are higher than Hugo, highlighting its worth for drivers who don’t drive much or are mindful of their expenses. While USAA slightly surpasses Hugo in terms of minimum coverage at $50, the appeal of Hugo remains due to its flexibility and pricing for full coverage.

Read more: Where to Compare Auto Insurance Rates

Hugo Auto Insurance Rates Across Driving Records

Hugo Car Insurance keeps an advantage over competitors by giving some of the least expensive prices to drivers having different records. The table below contrasts monthly payments among providers, considering driving histories ranging from clean records to instances such as accidents, DUIs or tickets.

Hugo Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $100 | $140 | $180 | $120 | |

| $95 | $135 | $175 | $115 | |

| $78 | $115 | $148 | $95 | |

| $70 | $110 | $150 | $90 |

| $90 | $132 | $170 | $112 |

| $88 | $128 | $160 | $108 |

| $92 | $130 | $165 | $110 | |

| $86 | $123 | $156 | $103 | |

| $85 | $125 | $155 | $105 | |

| $65 | $100 | $140 | $80 |

Hugo’s prices are usually very low, which is good for drivers who need to handle their insurance costs even with some possible issues in their records. Hugo only charges $70 each month if you have a clear record. This price beats most other competitors except USAA that asks for $65.

View this post on Instagram

After an accident, the price for Hugo increases to $110. Yet, this is cheaper than Allstate’s $140 and Farmers’ $135. For drivers with a DUI offense, Hugo charges them at only $150 rate which is quite competitive compared to Geico but definitely less costly than Allstate’s charge of 180 dollars.

People who received one ticket may get insurance coverage from Hugo for just ninety dollars indicating that it continues to be more economical and flexible when we compare it against expensive ones like Liberty Mutual or State Farm.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Unlocking Maximum Savings With Hugo Auto Insurance Discounts

Hugo auto insurance has many discounts to help lower costs for drivers who meet certain criteria. The table below shows the best possible savings in different discount categories, showing how Hugo focuses on providing affordable and flexible choices for policyholders. Learn whether discount auto insurance companies are trustworthy and worth considering for coverage.

Hugo Auto Insurance Discounts by Savings Potential

| Discount Name | Maximum Percentage Saved |

|---|---|

| Pay-As-You-Go Coverage | 50% |

| Usage-Based Savings | 40% |

| Flexible Driving Days Option | 35% |

| Low Mileage Discount | 30% |

| Good Driver Discount | 20% |

| No Continuous Coverage Fees | 15% |

| Safe Parking Discount | 10% |

| No Late Payment Fees | 10% |

| Paperless Billing Discount | 5% |

| Auto-Pay Enrollment Savings | 5% |

The Pay-As-You-Go Coverage discount is notable with a great 50% savings, it gives rewards to drivers who pay only for the days they drive. Close behind at 40% are Usage-Based Savings, this helps those who record less distance each month. For ones with not regular schedules we have Flexible Driving Days Option and it lets drivers save maximum of up to 35%.

You can also get rewards for driving less and safe driving, with up to 30% off for Low Mileage Discounts and 20% off for Good Driver Discounts. Other small discounts like 10% saving on secure parking or going paperless in billing may seem little but they accumulate over time, providing more value especially if you are mindful about your budget.

Hugo Insurance Coverage Options

If you need policy add-ons like roadside assistance or rideshare coverage, Hugo won’t have them. Instead, the provider focuses on affordable temporary auto insurance that drivers can turn on and off as needed. Drivers pick from three different coverage options:

- Unlimited Basic: Immediate liability coverage with no down payment.

- Unlimited Full: Immediate full coverage with no down payment.

All Hugo auto insurance policies come with coverage extensions and no down payments, but only Flex plans can turn coverage off and on instantly. The two plans also differ in other key ways:

Only Unlimited Full plans cover your vehicle, passengers, and personal injuries. What’s more, Hugo’s full coverage insurance like this is only available in Illinois and California. So, if you live in the other states listed above, you can only buy liability insurance from Hugo.

Evaluating Hugo Business Insurance Ratings and Reviews

Hugo’s business insurance work has been recognised for its reliability and the good quality of operations through significant ratings. This table gives a quick view of how Hugo stands in important fields, showing their financial power and focus towards customer service. Find out how auto insurance companies with the best customer service rank today.

Hugo Business Insurance Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: NA |

| Score: A+ Excellent Business Practices |

Hugo has a B+ rating for financial strength from A.M. Best, meaning they have good reserves and a stable ability to pay claims.

Hugo’s focus on efficiency sets it apart in the competitive business insurance market.Justin Wright Licensed Insurance Agent

Their business practices get A+ rating, showing strong working efficiency and commitment to being clear with information. These ratings, even though very good, show that Hugo is becoming a stronger player in the business insurance field.

Consumer reviews say the same things; they praise Hugo’s easy use and new ideas, but some people think there are not enough options. Good ratings for how the company works show it cares about giving reliable and simple service. Discover cheap Hugo auto insurance options by entering your ZIP code in our comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is Hugo Insurance?

Hugo Insurance is a pay-as-you-go auto insurance provider offering flexible daily or weekly coverage for low-mileage drivers seeking affordable policies. Find out if you can pay your auto insurance online and streamline your payments.

What do Hugo Insurance reviews say about their coverage?

Reviews on Hugo insurance highlight its flexible pay-as-you-go plans, affordable rates for low-mileage drivers, and user-friendly mobile app, though some note limited coverage options.

Does Hugo offer full coverage insurance?

Hugo Insurance offers full coverage, but only in Illinois and California. In other states, Hugo primarily provides liability coverage. Save on Hugo auto insurance today by entering your ZIP code into our free comparison tool.

Is Hugo Insurance legit?

Hugo Insurance is a legitimate auto insurance provider operating in 13 states, offering pay-as-you-go coverage and flexible payment options.

Does Hugo Insurance offer SR22 coverage?

No, Hugo Insurance does not provide SR22 auto insurance coverage. Drivers needing SR22 will need to seek other providers.

Is Hugo Insurance available in Georgia?

Hugo Insurance is available in Georgia and 12 other states, though coverage options may vary by state.

What is Hugo Insurance’s phone number?

You can reach Hugo Insurance customer service at 515-303-2410 for assistance with policies and coverage.

Does Hugo Insurance cover rental cars?

Hugo Insurance does not cover rental cars, focusing on short-term and pay-as-you-go auto insurance.

What is Hugo’s prepaid car insurance?

Hugo prepaid car insurance allows drivers to pay for coverage upfront and only for the days they drive, offering flexibility and cost savings for occasional drivers. Check if your auto insurance is usually billed a month in advance and plan accordingly.

Does Hugo Insurance have a grace period for payments?

Hugo Insurance offers a grace period with its Unlimited Basic and Unlimited Full plans, allowing coverage to continue before payment is received.

What states does Hugo Insurance cover?

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

Does Hugo Insurance cover windshield replacement?

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

Hugo Insurance is a pay-as-you-go auto insurance provider offering flexible daily or weekly coverage for low-mileage drivers seeking affordable policies. Find out if you can pay your auto insurance online and streamline your payments.

Reviews on Hugo insurance highlight its flexible pay-as-you-go plans, affordable rates for low-mileage drivers, and user-friendly mobile app, though some note limited coverage options.

Does Hugo offer full coverage insurance?

Hugo Insurance offers full coverage, but only in Illinois and California. In other states, Hugo primarily provides liability coverage. Save on Hugo auto insurance today by entering your ZIP code into our free comparison tool.

Is Hugo Insurance legit?

Hugo Insurance is a legitimate auto insurance provider operating in 13 states, offering pay-as-you-go coverage and flexible payment options.

Does Hugo Insurance offer SR22 coverage?

No, Hugo Insurance does not provide SR22 auto insurance coverage. Drivers needing SR22 will need to seek other providers.

Is Hugo Insurance available in Georgia?

Hugo Insurance is available in Georgia and 12 other states, though coverage options may vary by state.

What is Hugo Insurance’s phone number?

You can reach Hugo Insurance customer service at 515-303-2410 for assistance with policies and coverage.

Does Hugo Insurance cover rental cars?

Hugo Insurance does not cover rental cars, focusing on short-term and pay-as-you-go auto insurance.

What is Hugo’s prepaid car insurance?

Hugo prepaid car insurance allows drivers to pay for coverage upfront and only for the days they drive, offering flexibility and cost savings for occasional drivers. Check if your auto insurance is usually billed a month in advance and plan accordingly.

Does Hugo Insurance have a grace period for payments?

Hugo Insurance offers a grace period with its Unlimited Basic and Unlimited Full plans, allowing coverage to continue before payment is received.

What states does Hugo Insurance cover?

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

Does Hugo Insurance cover windshield replacement?

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

Hugo Insurance offers full coverage, but only in Illinois and California. In other states, Hugo primarily provides liability coverage. Save on Hugo auto insurance today by entering your ZIP code into our free comparison tool.

Hugo Insurance is a legitimate auto insurance provider operating in 13 states, offering pay-as-you-go coverage and flexible payment options.

Does Hugo Insurance offer SR22 coverage?

No, Hugo Insurance does not provide SR22 auto insurance coverage. Drivers needing SR22 will need to seek other providers.

Is Hugo Insurance available in Georgia?

Hugo Insurance is available in Georgia and 12 other states, though coverage options may vary by state.

What is Hugo Insurance’s phone number?

You can reach Hugo Insurance customer service at 515-303-2410 for assistance with policies and coverage.

Does Hugo Insurance cover rental cars?

Hugo Insurance does not cover rental cars, focusing on short-term and pay-as-you-go auto insurance.

What is Hugo’s prepaid car insurance?

Hugo prepaid car insurance allows drivers to pay for coverage upfront and only for the days they drive, offering flexibility and cost savings for occasional drivers. Check if your auto insurance is usually billed a month in advance and plan accordingly.

Does Hugo Insurance have a grace period for payments?

Hugo Insurance offers a grace period with its Unlimited Basic and Unlimited Full plans, allowing coverage to continue before payment is received.

What states does Hugo Insurance cover?

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

Does Hugo Insurance cover windshield replacement?

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

No, Hugo Insurance does not provide SR22 auto insurance coverage. Drivers needing SR22 will need to seek other providers.

Hugo Insurance is available in Georgia and 12 other states, though coverage options may vary by state.

What is Hugo Insurance’s phone number?

You can reach Hugo Insurance customer service at 515-303-2410 for assistance with policies and coverage.

Does Hugo Insurance cover rental cars?

Hugo Insurance does not cover rental cars, focusing on short-term and pay-as-you-go auto insurance.

What is Hugo’s prepaid car insurance?

Hugo prepaid car insurance allows drivers to pay for coverage upfront and only for the days they drive, offering flexibility and cost savings for occasional drivers. Check if your auto insurance is usually billed a month in advance and plan accordingly.

Does Hugo Insurance have a grace period for payments?

Hugo Insurance offers a grace period with its Unlimited Basic and Unlimited Full plans, allowing coverage to continue before payment is received.

What states does Hugo Insurance cover?

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

Does Hugo Insurance cover windshield replacement?

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

You can reach Hugo Insurance customer service at 515-303-2410 for assistance with policies and coverage.

Hugo Insurance does not cover rental cars, focusing on short-term and pay-as-you-go auto insurance.

What is Hugo’s prepaid car insurance?

Hugo prepaid car insurance allows drivers to pay for coverage upfront and only for the days they drive, offering flexibility and cost savings for occasional drivers. Check if your auto insurance is usually billed a month in advance and plan accordingly.

Does Hugo Insurance have a grace period for payments?

Hugo Insurance offers a grace period with its Unlimited Basic and Unlimited Full plans, allowing coverage to continue before payment is received.

What states does Hugo Insurance cover?

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

Does Hugo Insurance cover windshield replacement?

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

Hugo prepaid car insurance allows drivers to pay for coverage upfront and only for the days they drive, offering flexibility and cost savings for occasional drivers. Check if your auto insurance is usually billed a month in advance and plan accordingly.

Hugo Insurance offers a grace period with its Unlimited Basic and Unlimited Full plans, allowing coverage to continue before payment is received.

What states does Hugo Insurance cover?

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

Does Hugo Insurance cover windshield replacement?

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

Hugo Insurance covers 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas. Get personalized Hugo auto insurance quotes by entering your ZIP code now.

A windshield replacement in Hugo is not covered, as its focus is on basic liability and short-term coverage without add-ons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What features does the Hugo car insurance app offer?

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

The Hugo car insurance app allows users to toggle coverage on or off, make payments, and manage their policies conveniently from a mobile device. Explore the features of the best auto insurance apps designed for convenience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.