Inshur Auto Insurance Review for 2025 (Rates & Discounts Analyzed)

Explore this Inshur auto insurance review, highlighting tailored plans for NYC rideshare drivers with rates from $45/m. Understand how driving experience, vehicle type, and operating areas impact premiums. Essential for Uber and Lyft drivers aiming to fine-tune their insurance choices and optimize costs.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviews

Inshur

Average Monthly Rate For Good Drivers

$45A.M. Best Rating:

BComplaint Level:

LowPros

- Affordable for low mileage drivers

- Intuitive mobile app

- Pet injury coverage included

Cons

- Customer complaints

- Higher rates for high mileage

Inshur auto insurance review highlights what sets this provider apart for New York City’s rideshare drivers. Discover how your driving history and the type of vehicle you operate influence your rates, which start as low as $45.

This review is crafted to give you a clear picture of how Inshur tailors insurance specifically for Uber and Lyft drivers, helping you choose a plan that fits your daily needs seamlessly.

Inshur Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.1 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 4.2 |

Inshur auto insurance is a newer insurance company that offers rideshare insurance to drivers in New York City who meet certain requirements, such as age and having an Uber login. Get to know how Inshur simplifies managing your insurance, making it straightforward to stay covered while you’re on the move.

Enter your ZIP code to find nearby Inshur auto insurance options with our free quote tool.

- Inshur auto insurance offers starting rates at $45 for NYC drivers

- Tailored policies meet the specific needs of rideshare drivers

- Inshur provides seamless policy management through its app

How Age and Gender Affect Your Inshur Auto Insurance Rates

The table on Inshur auto insurance’s monthly rates clearly shows how your insurance costs change as you age and what differences there are between genders. For young drivers, like those at 16, the rates are the highest, but the gap between what boys and girls pay is pretty slim.

Inshur Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $128 | $345 |

| Age: 16 Male | $134 | $359 |

| Age: 18 Female | $116 | $296 |

| Age: 18 Male | $122 | $315 |

| Age: 25 Female | $76 | $198 |

| Age: 25 Male | $80 | $210 |

| Age: 30 Female | $64 | $159 |

| Age: 30 Male | $68 | $170 |

| Age: 45 Female | $52 | $123 |

| Age: 45 Male | $54 | $130 |

| Age: 60 Female | $45 | $108 |

| Age: 60 Male | $46 | $115 |

| Age: 65 Female | $50 | $119 |

| Age: 65 Male | $51 | $125 |

Auto insurance rates by age tend to drop as you gain more years behind the wheel. Take a 60-year-old woman, for instance, who might pay just $45 for her basic coverage. It’s pretty cool how insurance companies give a nod to the experience and lower risk that come with age, offering sweeter deals as a little thank you for being a steady, reliable driver.

Inshur's specialized auto insurance effectively meets the unique demands of NYC rideshare drivers, ensuring they have the right coverage for their urban driving needs.Laura Berry Former Licensed Insurance Producer

This insight really brings home how your age can play to your advantage with auto insurance costs. It’s a practical peek into how Inshur car insurance works to the benefit of more experienced drivers. If you’re wondering “Is Inshur legit?” this focus on aiding mature drivers shows their commitment to tailoring policies that genuinely fit your life stage and driving habits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

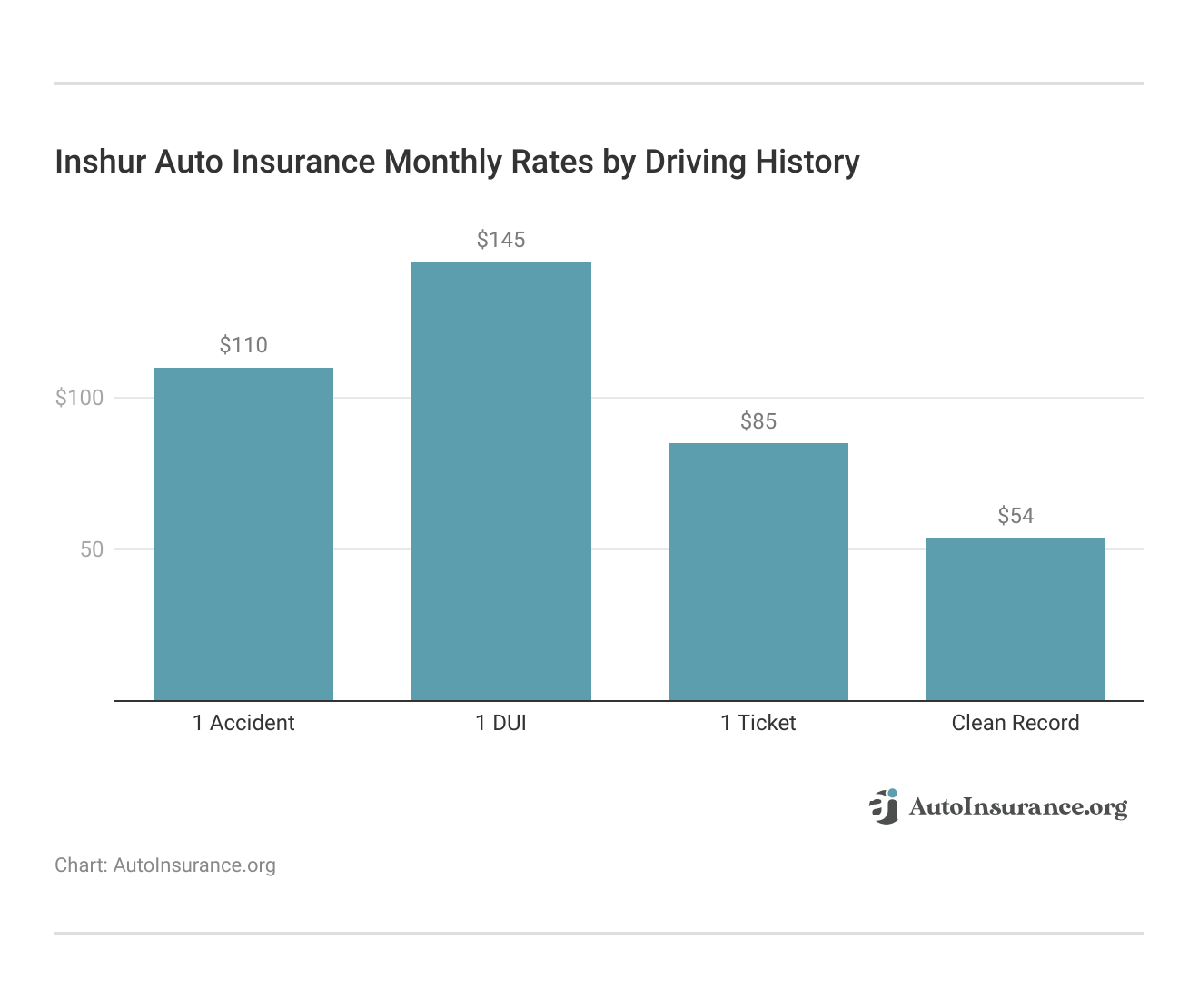

Impact of Driving History on Inshur Auto Insurance Premiums

This chart from Inshur auto insurance lays out monthly rates that vary significantly depending on your driving record. If you’ve managed to keep your driving slate clean, you’re looking at the lowest rate on the graph, just $54 a month. However, if you’ve had a run-in or two, the costs climb.

If you have a clean driving record, your auto insurance premium stays manageable, but getting into an accident could bump it up to $110. A single ticket might raise it to $85 a month, and a DUI could push it all the way to $145. Staying out of trouble isn’t just about safety—it can also keep your wallet from taking a big hit.

Comparing Car Insurance Costs: How Inshur Stacks Up Across Ages and Genders

Inshur auto insurance really finds its stride, offering rates that are just right for New York City’s rideshare drivers. Take, for example, a 17-year-old female driver; Inshur charges her $200, which is less than what Farmers asks but more than State Farm.

Inshur Auto Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $210 | $230 | $160 | $170 | $140 | $150 | $120 | $130 | |

| $220 | $240 | $170 | $180 | $150 | $160 | $125 | $135 | |

| $190 | $210 | $145 | $155 | $120 | $130 | $100 | $110 | |

| $200 | $220 | $150 | $160 | $130 | $140 | $110 | $120 | |

| $205 | $225 | $155 | $165 | $135 | $145 | $115 | $125 |

| $195 | $215 | $150 | $160 | $125 | $135 | $105 | $115 |

| $200 | $220 | $155 | $165 | $130 | $140 | $110 | $120 | |

| $180 | $200 | $140 | $150 | $120 | $130 | $100 | $110 | |

| $210 | $230 | $165 | $175 | $145 | $155 | $125 | $135 |

| $170 | $190 | $135 | $145 | $115 | $125 | $95 | $105 |

Inshur strikes a perfect balance, offering reliable coverage without breaking the bank, which is ideal for young drivers taking the wheel for the first time. If you’re just starting out, it’s a good idea to see where to compare auto insurance rates to really see how Inshur measures up.

Save Big With Inshur Auto Insurance: A Guide to Discounts Available

This table lays out the various discounts Inshur auto insurance offers to help you save on your car insurance. At the top of the list, there’s a hefty 30% savings if you use the Inshur app to monitor your driving habits, promoting safer driving. For those who’ve managed to keep their driving records spotless, a 25% safe driver discount awaits.

Inshur Auto Insurance Discounts

| Discount Type | Percentage Savings | Details |

|---|---|---|

| Telematics Discount | 30% | Use the Inshur app to track and reward safe driving |

| Safe Driver Discount | 25% | Maintain a clean driving record for a set period |

| Multi-Policy Discount | 15% | Bundle auto insurance with other insurance products |

| Good Student Discount | 15% | Available to students with a “B” average or higher |

| Vehicle Safety Features | 15% | For cars equipped with advanced safety technologies |

| Pay-in-Full Discount | 10% | Pay the full policy premium upfront |

| New Customer Discount | 10% | Introductory discount for first-time policyholders |

| Loyalty Discount | 10% | Offered to long-term policyholders renewing coverage |

| Paperless Discount | $10/month | Opt for e-statements and auto-pay enrollment |

| Low-Mileage Discount | Varies | Discounts for drivers who travel below a mileage cap |

Students making the grade can benefit from a 15% good student discount, and bundling your auto insurance discount with other policies can also cut your costs by 15%. If you’re looking to manage expenses upfront, paying your policy in full can shave off another 10%. Each discount aims to reward responsible driving and savvy management of your policy, making it easier and more affordable to stay insured.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Key Factors Influencing Inshur Auto Insurance Rates

There are many factors that affect auto insurance rates, and Inshur uses the same factors to calculate rates for its rideshare drivers. Common factors used to calculate rates include your age, driving record, ZIP code, and even your credit score. Hands down, the greatest factor looked at by auto insurance companies is your driving record.

Inshur Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $180 | $210 | $250 | $300 | |

| $190 | $220 | $260 | $310 | |

| $160 | $190 | $230 | $280 | |

| $170 | $200 | $240 | $290 | |

| $175 | $205 | $245 | $295 |

| $165 | $195 | $235 | $285 |

| $170 | $200 | $240 | $290 | |

| $150 | $180 | $220 | $270 | |

| $185 | $215 | $255 | $305 |

| $140 | $170 | $210 | $260 |

If you happen to get a ticket, Inshur bumps the rate to $200. This is right in line with what companies like Progressive charge and definitely easier on the wallet compared to the higher fees at Farmers or The Hartford. It shows that Inshur is understanding and reasonable, even when you slip up.

And if you’re dealing with the fallout from an accident or a DUI, Inshur’s rates, though higher, are still less daunting than those of some other insurers. With Inshur, a DUI would push your rate to $290, which is quite a bit lower than what you’d face with Farmers or The Hartford. This approach by Inshur helps soften the blow for drivers who are already facing tough situations, making it easier to get back on track.

Filing an Auto Insurance Claim With Inshur

Filing a claim with Inshur is pretty straightforward. While you can’t file a claim directly using the Inshur login in their app, you can easily contact customer service through the app to initiate a claim. If you’ve equipped your vehicle with a Nexar dashcam and registered it with the Inshur Insurance company, you can send the video footage directly to them.

data-media-max-width=”560″>

Annual policies are available for courier and delivery drivers!

Get covered for parcel and food delivery work plus personal use with INSHUR.

Find out more… https://t.co/XtDnur2ALn

·

·#courier #deliverydriver #ubereats #justeat #amazondelivery #insurance pic.twitter.com/FaenW1z4DG— INSHUR (@inshurinsurance) November 25, 2021

For additional support or inquiries, you can reach out using the Inshur Insurance phone number available on their website. This way, you have all the help you need right at your fingertips.

Inshur is enhancing how to file a car insurance claim by speeding up the process; they may even contact you first to get things rolling. Generally, the claims process wraps up in about 7-10 days. Looking ahead, Inshur plans to simplify things even further by enabling drivers to file claims directly through their app.

Inshur Insurance Coverage Options

Inshur exclusively provides auto insurance to rideshare drivers in New York City, with coverages that comply with the Taxi and Limousine Commission (TLC) standards. It’s important to note that the minimum TLC-required insurance does not include collision coverage, meaning damages to your vehicle in an accident won’t be covered unless you opt for additional coverage.

Inshur Auto Insurance Coverage Options

| Coverage Option | Description |

|---|---|

| Collision Coverage | Pays for repairs to your car after an accident, regardless of fault |

| Comprehensive Coverage | Covers non-collision damages like theft, fire, or natural disasters |

| Custom Equipment Coverage | Protects aftermarket modifications or specialized equipment in your car |

| Gap Insurance | Covers the difference between your car's value and the amount owed on a loan |

| Liability Coverage | Covers costs for bodily injury and property damage to others in an accident |

| Medical Payments (MedPay) | Covers medical expenses for you and your passengers, regardless of fault |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers after an accident |

| Rental Reimbursement | Covers the cost of a rental car while your vehicle is being repaired |

| Rideshare Coverage | Extends coverage for drivers working with rideshare services like Uber or Lyft |

| Roadside Assistance | Provides support for emergencies like breakdowns, towing, or flat tires |

| Uninsured/Underinsured Motorist | Protects against damages caused by drivers with insufficient or no insurance |

Adding collision auto insurance coverage might be wise if you lease your vehicle or have a car loan—most lenders will require comprehensive coverage, including collision. It’s also a good idea if you’re unable to afford out-of-pocket expenses for vehicle repairs.

TLC Auto Insurance Coverage

| Coverage | Minimum Coverage Amount | Required? |

|---|---|---|

| Liability coverage per person | $100,000 - $300,000 | Mandatory |

| Personal injury protection | $200,000 | Mandatory |

| Property damage | $10,000 | Mandatory |

| Collision protection | Optional | Optional |

If your car is getting up there in years and isn’t worth much, paying more for something like Inshur TLC insurance might not make sense financially.

But here’s a comforting thought: any policy you pick with Inshur covers you all the time, not just when you’re logged in as a rideshare driver. It’s good to know your insurance is looking out for you, no matter if you’re earning or just running errands.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Inshur Auto Insurance for NYC Rideshare Drivers

Inshur auto insurance review reveals a fully digital approach tailored for New York City rideshare drivers. Only accessible through its app, Inshur streamlines the process of getting quotes and managing your insurance needs with ease.

In select spots like the U.K., Netherlands, and New York City, and backed in the U.S. by Clear Blue, Inshur really steps up for drivers over 21 with Uber credentials—Lyft folks aren’t left out either. They’re getting thumbs up for their Inshur taxi insurance, with riders and drivers sharing great Inshur taxi insurance reviews.

Adhering to the New York Taxi & Limousine Commission’s vehicle standards since 2006, Inshur makes getting insured less of a headache. They keep everything digital, from updating policies to managing details, which is a game changer for securing TLC-compliant coverage efficiently. For those zipping around the city with Uber, the Inshur Uber policies are designed just for you, making sure your rideshare journey is as smooth as your drive.

Overview of Inshur Auto Insurance Ratings

Inshur hasn’t been on the insurance scene in the U.S. for very long, which can affect its ratings. A.M. Best rates companies on financial stability. Since Inshur is relatively new, it does not have an A.M. Best rating. However, its underwriting company Clear Blue has an A- rating with A.M. Best, showing an excellent ability to meet financial obligations.

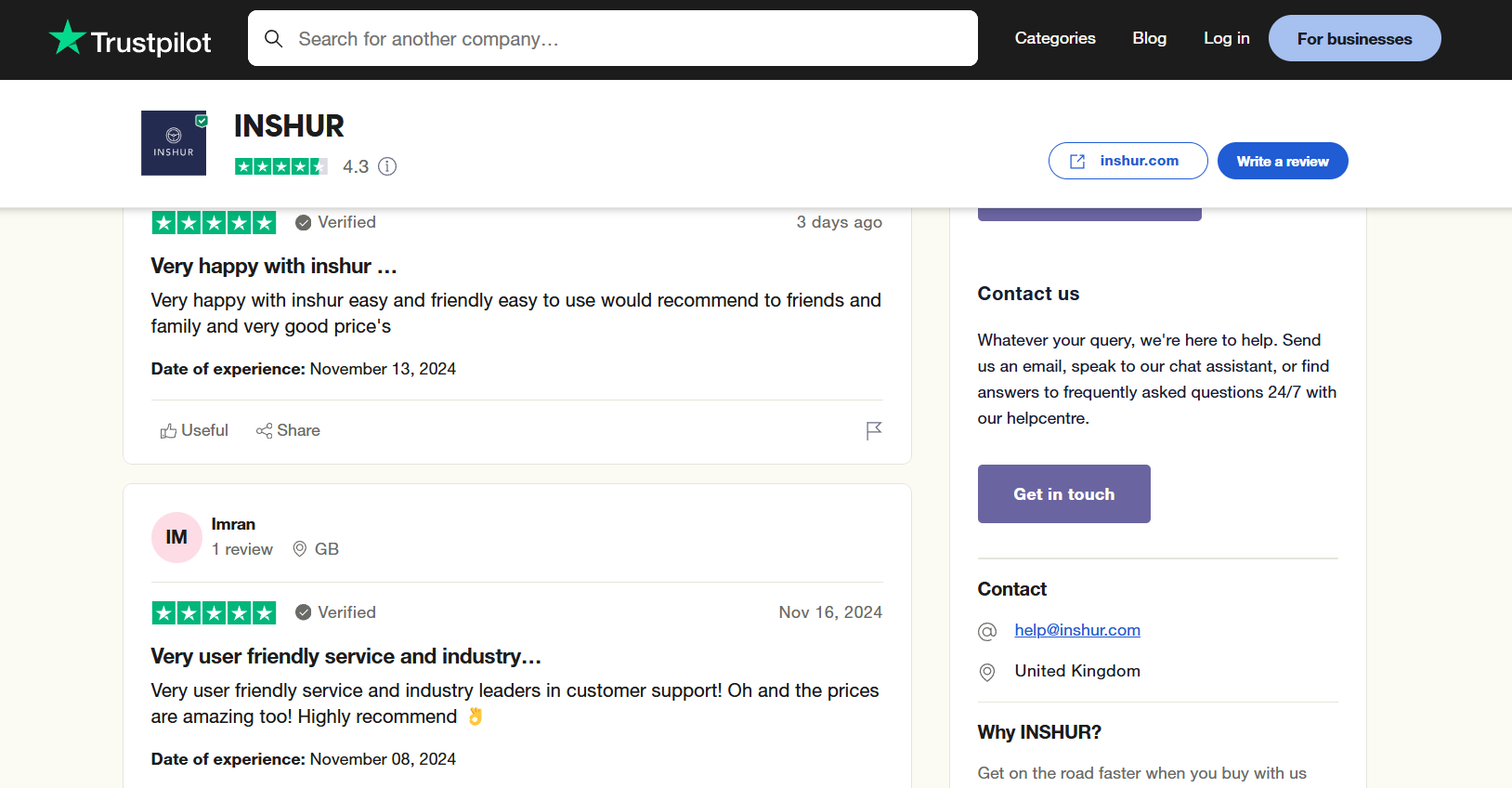

Inshur Business Ratings and Consumer Reviews

| Agency | |

|---|---|

| Score: B Fair Financial Strength |

| Score: A- Good Business Practices |

|

| Score: 65/100 Good Customer Feedback |

|

| Score: 720 / 1,000 Below Avg. Satisfaction |

|

| Score: 1.75 More Complaints Than Avg. |

The Better Business Bureau (BBB) rates companies on their customer interaction quality. Inshur Insurance reviews often mention that it is not BBB accredited and has an F rating, primarily because it does not respond to all customer complaints.

Since everything with Inshur runs through their auto insurance apps, the user feedback becomes crucial. The Inshur app boasts a 3.9 out of 5 rating on Google Play and an even more impressive 4.7 on the Apple App Store, showing that users find it quite reliable.

Inshur Auto Insurance Pros and Cons

Exploring Inshur auto insurance shows strong points in its tech-driven approach and specialized policies.

- Rapid claims processing with mobile app technology

- Tailored policies for rideshare and delivery drivers

- Competitive rates for city-based drivers

While Inshur excels with tech integration and niche coverage, it’s useful to look at a couple of drawbacks.

- Limited availability outside of major urban areas

- Customer support can vary depending on the region

Inshur provides innovative auto insurance solutions for different types of drivers, including urban and gig economy drivers, but it’s worth considering the geographic and support limitations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

A Closer Look at Inshur’s Offerings

In a nutshell of this Inshur auto insurance review, Inshur is an excellent option for NYC rideshare drivers searching for tailored predominantly internet-based items. Inshur stands out for offering various types of auto insurance, primarily focusing on functionality-driven and tech-powered convenience through an app to connect to clients.

This digital approach not only streamlines the insurance management process but also aligns perfectly with the tech-savvy nature of its primary client rideshare drivers. While the company’s relatively short history in the U.S. market may give some pause, its innovative features and competitive pricing make it a worthy consideration for those who value ease and efficiency in managing their auto insurance needs.

If you’re searching for the essentials to stay road-legal, simply enter your ZIP code to compare affordable Inshur auto insurance quotes nearby.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Who are the founders of Inshur?

Inshur was co-founded by Dan Bratshpis and David Daiches, who saw the need for a more streamlined and tech-driven approach to insurance for professional drivers in the gig economy.

Who is the CEO of Inshur?

As of the latest update, the CEO of Inshur is Dan Bratshpis, one of the company’s original co-founders. He brings a wealth of experience in both the technology and insurance industries to his role.

Does Inshur have an app?

Yes, Inshur’s mobile app not only allows you to manage your insurance policies with ease but also provides a straightforward way to check your auto insurance claims history. Through the app, you can quickly view past claims, track their status, and even file new claims—all from the convenience of your smartphone.

What type of coverage options does Inshur provide for Uber drivers?

Inshur specializes in commercial auto insurance tailored for rideshare drivers, including comprehensive and collision coverage that meets or exceeds the requirements set by Uber for their drivers.

Find Inshur auto insurance quotes quickly by entering your ZIP code into our comparison tool.

How does Inshur handle insurance claims?

Inshur emphasizes a hassle-free claims process. Policyholders can submit claims through the mobile app or website, and the Inshur team works diligently to process these claims quickly and efficiently, minimizing downtime for drivers.

What is the name of the lowest car insurance offered by Inshur?

Inshur offers a variety of insurance products tailored to different needs and budgets, including basic liability coverage that meets the minimum auto insurance requirements by state, providing an affordable option for drivers.

How can policyholders renew their insurance with Inshur online?

Inshur makes it easy to renew insurance online via their app or website. Drivers can review their policy, make any necessary changes, and approve the renewal, all with just a few clicks.

How does Inshur’s app enhance the user experience for policy management?

The Inshur app enhances user experience by consolidating all insurance management needs into a single, user-friendly interface. This includes buying insurance, making changes to policies, renewing coverage, and filing claims.

What are the benefits of choosing Inshur for commercial auto insurance?

Choosing Inshur from commercial auto insurance companies means accessing tailored, fast, and flexible coverage. With their digital-first solutions, Inshur provides real-time quotes and instant coverage, crucial for drivers in the on-demand economy who cannot afford delays.

What makes Inshur a preferred insurance partner for Uber?

Uber chooses Inshur because it offers an expert understanding of the specific needs of the Ultralight rideshare industry and it provides comprehensive coverage to ensure that both the driver and the passenger are covered under any circumstance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.