Just Insure Auto Insurance Review for 2025 (See Ratings & Cost Here!)

This Just Insure auto insurance review compares rates starting at $70 per month. Just Insure pay-per-mile insurance sets rates based on your monthly mileage, making it ideal for low-mileage drivers who are retired or work from home. Just Insure auto insurance coverage is only sold in Arizona.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Just Insure

Monthly Rates:

$70A.M. Best Rating:

B+Complaint Level:

LowPros

- Pay-per-mile pricing for low-mileage drivers

- Rates not based on driving behavior

- Encourages safer driving habits

Cons

- Only available to drivers in Arizona

- Not ideal for high-mileage or rideshare drivers

Read this Just Insure auto insurance review to learn how flexible pay-per-mile coverage works, with affordable rates of $70 per month for minimum coverage.

Just Insure tailors pricing based on mileage and driving history, making it ideal for low-mileage drivers. It stands out as a top choice for the best Arizona auto insurance.

Just Insure Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.8 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.4 |

| Coverage Value | 2.7 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 4.0 |

| Discounts Available | 2.0 |

| Insurance Cost | 3.4 |

| Plan Personalization | 4.0 |

| Policy Options | 1.6 |

| Savings Potential | 2.9 |

Available only in Arizona, Just Insure offers state-minimum liability or full coverage with optional uninsured motorist protection. You can find affordable auto insurance, no matter your driving record, by entering your ZIP code into our free quote comparison tool.

- Just Insure pay-per-mile insurance rates average $70 a month

- Flexible policies offer state-minimum liability or full coverage, but only in AZ

- Pricing is based on mileage and driving history, ideal for low-mileage drivers

Just Insure Pay-Per-Mile Auto Insurance Rates

Just Insure auto insurance rates vary by age, gender, and coverage level. Younger drivers, especially 16-year-old males, pay the highest rates at $398 a month for minimum coverage and $611 monthly for full coverage. However, your teen insurance rates will be much lower if you drive less than 600 miles per month.

Just Insure Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $375 | $543 |

| Age: 16 Male | $398 | $611 |

| Age: 18 Female | $283 | $362 |

| Age: 18 Male | $315 | $441 |

| Age: 25 Female | $125 | $178 |

| Age: 25 Male | $137 | $198 |

| Age: 30 Female | $118 | $164 |

| Age: 30 Male | $129 | $172 |

| Age: 45 Female | $109 | $150 |

| Age: 45 Male | $115 | $154 |

| Age: 60 Female | $96 | $139 |

| Age: 60 Male | $105 | $141 |

| Age: 65 Female | $103 | $146 |

| Age: 65 Male | $112 | $148 |

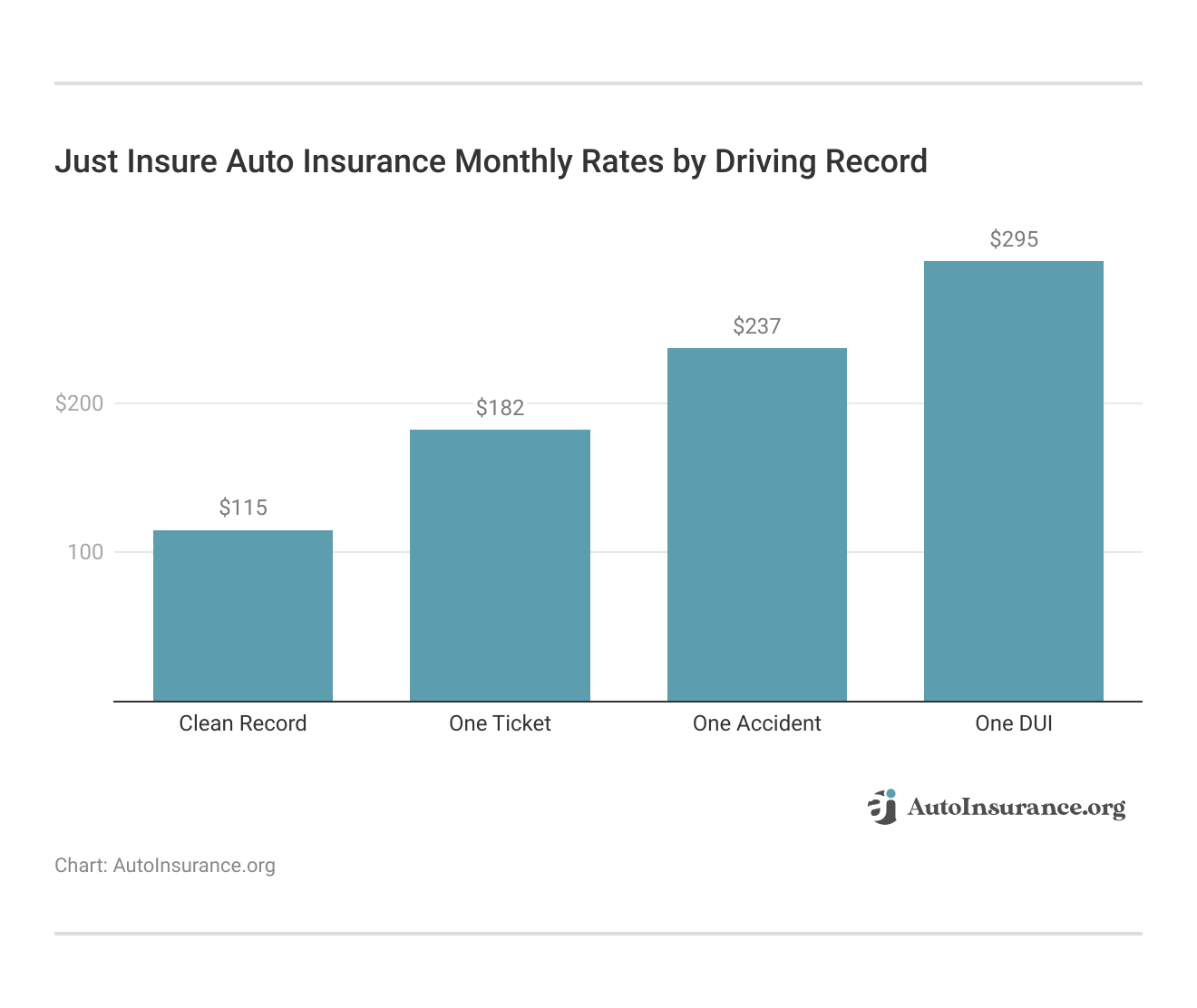

Just Insurance rates also vary based on driving history, with clean-record drivers paying the lowest premiums. For minimum coverage, rates start at $115 a month, increasing to $237 per month for one accident and $295 monthly for a DUI.

Full coverage rates begin at $200 per month for a clean record and rise to $439 monthly for a DUI. Even though Just Insure only charges per mile, the factors that affect auto insurance rates with standard companies still apply.

Your driving record still impacts pay-per-mile insurance rates, with accidents, DUIs, and tickets leading to higher costs.Jeff Root Licensed Insurance Agent

Safe drivers receive the most affordable rates, but high-risk drivers in Arizona will still pay less with Just Insure than they would with standard insurance companies. Keep reading to see how Just Insure compares to the competition.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Just Insure Auto Insurance Rates Compared to Top Providers

With monthly rates starting as low as $70 for minimum coverage and $120 for full coverage, Just Insure is one of the best pay-as-you-go auto insurance companies in Arizona. Its rates undercut those of major providers like Allstate, Liberty Mutual, and State Farm.

Just Insure Auto Insurance Monthly Rates vs. Top Providers by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $80 | $130 | |

| $79 | $129 | |

| $75 | $125 | |

| $70 | $120 |

| $85 | $135 |

| $82 | $132 |

| $78 | $128 | |

| $77 | $127 | |

| $81 | $131 |

| $65 | $110 |

USAA offers the most affordable option at $65 per month for minimum coverage and $110 per month for full coverage. Geico and Farmers also provide competitive pricing, but Just Insure remains one of the best choices for cost-conscious drivers seeking flexible and affordable coverage.

Just Insure continues to offer competitive auto insurance rates based on credit scores compared to the competition. It charges $80 a month for drivers with good credit, compared to $85 monthly with Geico and $90 per month with Allstate.

Just Insure Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $90 | $110 | $140 | |

| $89 | $109 | $139 | |

| $85 | $105 | $135 | |

| $80 | $100 | $130 |

| $95 | $115 | $145 |

| $92 | $112 | $142 |

| $88 | $108 | $138 | |

| $87 | $107 | $137 | |

| $91 | $111 | $141 |

| $75 | $95 | $125 |

Even for poor credit, Just Insure stays affordable at $130 monthly, while other major insurers like Liberty Mutual charge up to $145 a month. USAA offers the lowest rates, starting at $75 for good credit, but is only available to military members.

Just Insure: Flexible Pay-Per-Mile Coverage

Low-mileage drivers in Arizona get the best rates from Just Insure. Just Insure Services offers pay-per-mile insurance, charging a base rate plus a per-mile fee, so drivers only pay for what they drive. This model benefits remote workers, retirees, and those in big cities using alternative transportation.

Unlike usage-based insurance, it calculates premiums solely on miles driven, making it a cost-effective alternative to standard coverage. With the Just Mobile App, drivers can sign up, manage policies, and track mileage easily.

Drivers benefit from real-time updates and auto-renewing coverage. Plus, Just Insure Services offers pay-per-mile insurance with customizable options, making it an ideal choice for cost-conscious drivers.

Learn More: How Annual Mileage Affects Your Auto Insurance Rates

Just Insure Auto Insurance Coverage Options

Just Insure Agency, Inc. sells and markets policies, while Just Insure, Inc. underwrites coverage based on how often you drive. Whether you seek basic liability coverage or full protection, Just Insure offers policies that meet Arizona minimum auto insurance requirements.

Minimum liability auto insurance is legally required and covers third-party bodily injury and property damage if you cause an accident. It pays for medical expenses and property repairs but does not cover your vehicle or medical costs. Coverage limits vary by state, and you may be responsible for costs beyond your policy limits.

Full coverage auto insurance is not a specific type of coverage but rather a package that includes liability plus damages from accidents, theft, vandalism, and weather events with collision and comprehensive coverage.

Uninsured coverage kicks in when the at-fault driver has no liability insurance, while underinsured coverage covers you when their limits are too low. The coverage, available with minimum or entire liability, shields you from out-of-pocket payments after a hit-and-run accident.

Finding the right coverage will depend on your needs and wallet. Full coverage protects the worst, minimum liability protects the law, and uninsured/underinsured gives you the security of knowing you’re not left high and dry. Evaluating your options allows you to find the right mix of affordability and protection.

Just Insure Customer Service & Auto Insurance Ratings

Just Insure’s ratings vary across multiple rating agencies, indicating customer service, business practices, and financial strength. Just Insure’s ratings across various agencies reflect aspects of customer service, business practices, and financial strength. Customer reviews and complaints about Just Insure can be found under the Just Insure reviews complaints section.

Just Insure Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 765/1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 78/100 High Customer Satisfaction |

|

| Score: 0.68 Fewer Complaints Than Avg. |

|

| Score: B+ Strong Financial Strength |

It earned a score of 765/1,000 for overall satisfaction with J.D. Power, an A rating with the BBB, and a score of 78/100 from Consumer Reports, so its customers seem quite satisfied with Just Insure auto insurance claims service.

The NAIC score of 0.68 suggests fewer complaints than average, while A.M. Best’s B+ rating signifies reliable financial strength, albeit not the best. For personalized service or to address specific concerns, customers can contact the company directly using the Just Insure phone number.

Read More: Best Auto Insurance for Seniors in Arizona

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Just Insure Auto Insurance

Just Insure offers flexible, fair auto insurance with customizable coverage and rates based on driving behavior. Safe drivers get competitive pricing, making it an ideal choice for personalized coverage. Below are the key benefits and limitations.

- Customizable Coverage Options: Drivers can select from liability-only policies to full coverage, customizing their plans based on their needs and budget.

- Fair and Transparent Pricing: Just Insure prioritizes fairness by pricing policies based on driving behavior rather than demographic factors like age or ZIP code.

- Comprehensive Protection: This policy offers essential coverage, including uninsured/underinsured motorist protection, ensuring financial security in various accident scenarios.

While Just Insure offers affordable, personalized coverage that focuses on fairness, its availability is currently limited to Arizona and does not cover rideshare or commercial driving.

- Limited Availability: Just Insure is only available in Arizona, restricting driver access in other states.

- No Discounts: Because it’s a pay-per-mile insurance company, Just Insure does not offer any additional discounts on its insurance.

Just Insure could be a great choice if you’re looking for cheap usage-based auto insurance that rewards safe driving and provides essential protection. Prospective clients interested in their services can request a policy estimate through the Just Insure quote feature. Existing customers can manage their policies and access services via the Just Insure login portal.

I’ve seen how pay-per-mile insurance like Just Insure can save low-mileage drivers hundreds per year — opting for pay-per-mile coverage ensures you only pay for what you drive.Aremu Adams Adebisi Feature Writer

Compare your options and see if Just Insure is the right fit for you. Learn where to compare auto insurance rates to find the best coverage.

Just Insure Review: Affordable Pay-Per-Mile Auto Insurance

Our Just Insure auto insurance review found the best pay-as-you-go auto insurance averaging $70 a month for older, low-mileage drivers. Just Insure provides customizable coverage, including liability, collision, and comprehensive auto insurance options in Arizona.

It’s an excellent option for safe, low-mileage drivers seeking flexible, cost-effective insurance, but limited availability in Arizona and no auto insurance discounts are drawbacks.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How do flexible policies with Just Insure benefit drivers?

Just Insure offers flexible policies that allow drivers to choose short-term or long-term coverage without being locked into expensive annual contracts. This flexibility is ideal for those who drive fewer miles or need temporary coverage without long-term commitments.

How are Just Insure rates calculated for drivers?

Just Insure rates are based on mileage and selected coverage levels rather than traditional demographic factors like age or ZIP code. This pricing model benefits safe, low-mileage drivers by offering affordable pay-per-mile rates.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Does full coverage with Just Insure include protection for vehicle damage?

Yes, Just Insure’s full coverage protects you with liability, collision auto insurance, and comprehensive insurance, which protects against damage to your vehicle from accidents, theft, vandalism, and natural disasters. Beyond the state-mandated insurance requirement, this offers financial protection.

Is Just Insure auto insurance a good option for high-mileage drivers?

Just Insure car insurance is best suited for low-mileage drivers who drive fewer than 1,000 miles monthly. High-mileage drivers may find traditional auto insurance more cost-effective since pay-per-mile pricing could increase overall costs.

How do I contact Just Insure customer service?

To reach Just Insure customer service, call the phone number on their official website. Customers can also contact support through the Just Insure app or email their service team for assistance with policy questions, billing, and claims.

How does minimum liability coverage with Just Insure meet state requirements?

Just Insure offers the state-minimum required liability coverage, which will pay for the damage to a third party’s car and their medical bills in an at-fault accident. This coverage fulfills state regulations as well as providing a low-cost insurance option for those on a budget.

How does combined coverage work with Just Insure?

Liability, collision, and comprehensive protection is referred to as combined coverage, which provides financial security in a variety of circumstances. This policy helps protect against third-party damages, as well as covers repairs to your vehicle and non-collision incidents such as theft or weather damage.

How does uninsured/underinsured motorist coverage protect Just Insure policyholders?

Just Insure offers the best uninsured and underinsured motorist (UM/UIM) Coverage as an optional add-on to protect drivers if a driver with no insurance or insufficient coverage hits them. This helps cover medical expenses and damages that might come out of pocket.

Where can I find Just Insure auto insurance reviews on Reddit?

Users frequently mention their experiences with Just Insure’s pay-per-mile rates, claims process, and customer service. Multiple threads allow you to get a sense of what the everyday experience has been with customers and how Just Insure stacks up against other insurers.

Are optional coverages available with Just Insure?

Yes, Just Insure offers optional coverages such as uninsured and underinsured motorist protection. These add-ons provide extra financial security if you’re in an accident with a driver who lacks sufficient insurance, helping you find cheap auto insurance after an accident while maintaining essential coverage.

How does Just Insure compare to traditional car insurance companies?

Unlike traditional car insurance providers, Just Insure determines rates based on driving behavior and mileage instead of demographic factors like age or ZIP code. Low-mileage and safe drivers may find more affordable rates than standard car insurance policies.

What makes Just Insure’s coverage options flexible?

Just Insure allows drivers to choose between minimum liability or full coverage, with the ability to adjust policy limits and add optional protections. The pay-per-mile pricing model also provides flexibility by letting low-mileage drivers save on premiums.

How can I determine the right level of coverage with Just Insure?

The right level of coverage depends on your driving habits, budget, and financial protection needs. The cheapest liability-only auto insurance policies meet state minimums, providing an affordable option, while complete coverage offers additional security by covering vehicle repairs and non-collision incidents.

Does the Just Insure app provide full policy management and tracking?

Yes, the Just Insure app allows users to fully manage their policies, track mileage for pay-per-mile coverage, and receive real-time updates on their insurance status. The app will enable policyholders to customize their coverage, make payments, submit odometer readings, and access renewal options for a seamless and efficient experience.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.