Liberty Mutual vs. Progressive Auto Insurance in 2025 (Compare Rates & Options Here!)

Liberty Mutual vs. Progressive auto insurance comes down to rates, features, and policy options. Progressive averages $56 for minimum coverage and offers Snapshot for usage-based savings, while Liberty Mutual averages $96 and includes add-ons like Better Car Replacement. Coverage and cost vary by driver.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsComparison of Liberty Mutual vs. Progressive auto insurance features, such as accident forgiveness, usage-based discounts, and bundling options.

Liberty Mutual vs. Progressive Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.2 | 4.3 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.3 | 3.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.2 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.4 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 5.0 |

| Savings Potential | 4.5 | 4.6 |

| Liberty Mutual Review | Progressive Review |

Liberty Mutual offers better new car replacement and gap coverage, while Progressive provides greater flexibility in its savings through Snapshot and loyalty rewards.

We break down how each company performs across customer service, discount programs, and coverage extras. If you’re deciding between the two, this guide helps match your needs with what each provider offers.

- Liberty Mutual offers accident forgiveness & new car replacement at $96 a month

- Progressive provides Snapshot discounts & lower rates starting at $56 a month

- Liberty Mutual includes gap coverage, while Progressive excels in bundling

Ready to see whether Liberty Mutual or Progressive is your best option? Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Liberty Mutual vs. Progressive Auto Insurance Rates by Age & Value

Progressive typically offers lower rates than Liberty Mutual, especially for younger and older drivers. A 16-year-old female pays $1,144 with Progressive and $1,031 with Liberty Mutual.

Liberty Mutual vs. Progressive Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $1,031 | $1,144 |

| 16-Year-Old Male | $1,121 | $1,161 |

| 30-Year-Old Female | $249 | $187 |

| 30-Year-Old Male | $285 | $194 |

| 45-Year-Old Female | $244 | $159 |

| 45-Year-Old Male | $248 | $150 |

| 60-Year-Old Female | $211 | $131 |

| 60-Year-Old Male | $227 | $136 |

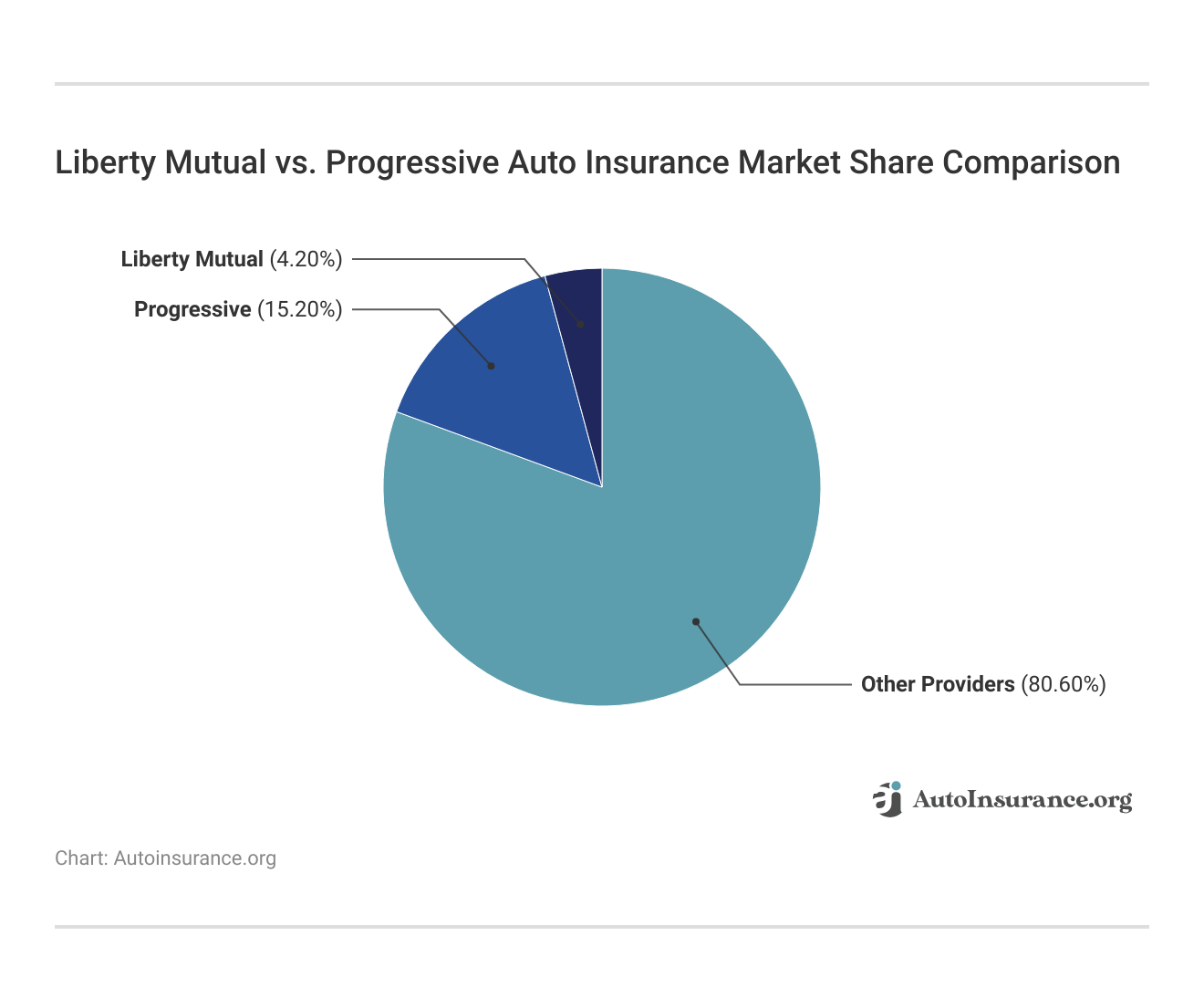

The trend holds across other age groups—Progressive charges $187 for a 30-year-old female, while Liberty Mutual charges $249. Progressive has a larger market share at 15.2% compared to Liberty Mutual’s 4.2%, suggesting more drivers choose Progressive for savings.

Liberty Mutual costs more due to added features like accident forgiveness and new car replacements. Progressive rewards safe drivers through its Snapshot program, making it a better fit for those focused on price.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual vs. Progressive Auto Insurance Rates by Driving Record

Drivers with clean records generally get cheaper rates from Progressive than from Liberty Mutual. Progressive charges $150 a month, while Liberty Mutual comes in at $248.

Liberty Mutual vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $248 | $150 |

| Not-At-Fault Accident | $335 | $265 |

| Speeding Ticket | $302 | $199 |

| DUI/DWI | $447 | $200 |

For high-risk drivers, the gap is even wider—$200 with Progressive versus $447 with Liberty Mutual for a DUI. Even a speeding ticket shows a difference: $199 with Progressive and $302 with Liberty Mutual.

Liberty offers perks, Progressive rewards safe driving—compare what matters.Laura Berry Former Licensed Insurance Producer

Progressive is often the better pick for savings, especially if you’ve had violations. Liberty Mutual costs more, but may be worth it if you value extra policy features.

Liberty Mutual vs. Progressive Auto Insurance Rates by Credit Score

Progressive offers lower auto insurance rates than Liberty Mutual across every credit level. Drivers with good credit pay $115 per month with Progressive, compared to $120 from Liberty Mutual.

Liberty Mutual vs. Progressive: Full Coverage Auto Insurance Monthly Rates by Credit Score

| Credit Score |  | |

|---|---|---|

| Good Credit | $120 | $115 |

| Fair Credit | $180 | $160 |

| Bad Credit | $300 | $270 |

That gap grows with fair credit—$160 versus $180—and it’s widest for bad credit, where Liberty Mutual charges $300 and Progressive charges $270. Progressive stays more affordable overall, especially for drivers with lower scores.

Liberty Mutual’s higher prices reflect added coverage options, but those come at a cost. It’s a clear example of how credit scores affect auto insurance rates—drivers with lower scores often see much higher premiums.

Liberty Mutual vs. Progressive Auto Insurance Discounts Compared

Progressive offers better discount opportunities overall, especially for bundling (12% vs. 10%), good students (10% vs. 8%), and pay-in-full (8% vs. 7%). Liberty Mutual matches Progressive’s 15% safe driver discount and offers a 5% homeowner discount that Progressive doesn’t provide, giving Liberty Mutual and Progressive home insurance options a key difference in savings potential.

Liberty Mutual vs. Progressive: Auto Insurance Discounts

| Discount |  | |

|---|---|---|

| Anti-Theft | 35% | 25% |

| Bundling | 25% | 10% |

| Driver Training | 5% | 10% |

| Good Student | 12% | 10% |

| Homeowner | 5% | 10% |

| Loyalty | 10% | 13% |

| New Car | 10% | 8% |

| Paperless | 3% | 4% |

| Pay-in-Full | 12% | 15% |

| Safe Driver | 23% | 30% |

However, Progressive gives a 6% loyalty discount, while Liberty Mutual offers 12%, making it more rewarding for long-term customers. Driver training discounts are only available with Progressive, while Liberty Mutual provides more policyholder incentives.

If maximizing savings is the priority, Progressive generally offers more opportunities to lower rates, including good student auto insurance discounts for drivers with a B average or higher.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual vs. Progressive: Customer Satisfaction & Company Ratings

Each company has different strategies when it comes to auto insurance. Progressive aims for cheap rates, and Liberty Mutual values customer satisfaction. Progressive is among the best choices for budget-minded drivers, as it almost always has low premiums.

Insurance Business Ratings & Consumer Reviews: Liberty Mutual vs. Progressive

| Agency |  | |

|---|---|---|

| Score: 717 / 1,000 Above Avg. Satisfaction | Score: 672 / 1,000 Avg. Satisfaction |

|

| Score: A- Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 72/100 Avg. Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 1.11 Avg. Complaints |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

However, Liberty Mutual outperforms Progressive in customer experience, scoring 717/1,000 in J.D. Power’s satisfaction survey compared to Progressive’s 672. Liberty Mutual also has fewer consumer complaints, with a 0.55 NAIC score, while Progressive’s score of 1.11 indicates a higher volume of policyholder issues.

Despite its lower prices, Progressive lags behind in customer service ratings, with a Consumer Reports score of 72/100, slightly below Liberty Mutual’s 74/100. In financial strength, Progressive holds an A+ rating from AM Best, while Liberty Mutual maintains a solid A rating, indicating both companies are financially stable.

While Progressive is the more affordable option, Liberty Mutual stands out among auto insurance companies for better service, fewer complaints, and a stronger customer experience.

Pros and Cons of Liberty Mutual Auto Insurance

Liberty Mutual offers solid coverage options, but whether it’s the right fit depends on your budget and what features matter most. Here’s a breakdown of its strengths and weaknesses to help you decide.

Pros

- Accident Forgiveness & New Car Replacement: Prevents rate hikes after the first accident and replaces totaled cars less than a year old with a brand-new model.

- Strong Gap Coverage: Covers the loan balance if your car is totaled, reducing out-of-pocket costs for financed vehicles.

- Fewer Customer Complaints: Liberty Mutual customer service receives fewer complaints about claims and support compared to Progressive, suggesting stronger overall satisfaction.

Cons

- Higher Premiums: Charges significantly more than Progressive, especially for high-risk drivers.

- Fewer Discounts: Lacks savings like Progressive’s continuous coverage discount, limiting cost-cutting options.

Liberty Mutual car insurance stands out for added protections like accident forgiveness and gap coverage, but it comes at a cost. If you’re looking for lower rates or more discount opportunities, Progressive may be the better choice.

Comment

byu/SaabStory06 from discussion

insaab

A Reddit user shared their experience, stating they have home, auto, and motorcycle insurance through Liberty Mutual with no issues. They noted that older cars are often totaled because it’s cheaper for the insurance company. Repair shops also hesitate to work on older vehicles due to limited part availability.

Pros and Cons of Progressive Auto Insurance

Progressive Insurance leads with lower rates and discount programs, but it has disadvantages that could be worth noting, depending on what your priorities are. Here’s what to know before getting a policy.

Pros

- Lower Rates: Offers cheaper premiums than Liberty Mutual, making it a cost-effective option for high-risk drivers.

- Snapshot Program: Uses driving data to reward safe habits with additional discounts, helping lower premiums over time.

- More Discounts: Provides savings opportunities like continuous coverage and multi-policy discounts, giving drivers more ways to cut costs.

Cons

- Higher Complaint Rate: Reports more customer complaints than Liberty Mutual, mainly regarding claims processing and payouts.

- Weaker Accident Forgiveness: Unlike Liberty Mutual, accident forgiveness isn’t built-in and must be purchased separately.

Progressive is a strong choice for budget-conscious drivers who want personalized discounts, but those who prioritize claims service and built-in perks may prefer Liberty Mutual. A Reddit user shared their experience, stating they’ve had Progressive for seven years and found it reliable. After filing a claim for a not-at-fault accident, Progressive covered the damage, and their rates didn’t increase.

Comment

byu/plartoo from discussion

inpersonalfinance

They highlighted the benefits of bundling home and auto insurance for extra savings and noted that higher deductibles significantly lower premiums. The user also mentioned that Progressive was once known for insuring drivers with bad records, but has now become more mainstream. They prefer paying six months upfront due to the savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual vs. Progressive: Which Auto Insurance Is Right for You

Liberty Mutual and Progressive auto insurance are no different; deciding between the two depends largely on your coverage needs. Accident forgiveness, new car replacement, and better gap coverage from Liberty Mutual, but good for extra protection. Progressive writes the lower rates, and Snapshot gives you more discounts because you are a safer driver.

Bundle with Progressive, pay upfront, and drive safely to save more.Aremu Adams Adebisi Feature Writer

If bundling policies is a priority, Progressive offers better multi-policy savings, while Liberty Mutual provides unique perks like lifetime RightTrack discounts. Understanding different types of auto insurance can help you compare these features and choose the company that best fits your budget and coverage needs.

Start comparing total coverage auto insurance rates by entering your ZIP code here.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Are Liberty Mutual and Progressive the same company?

No, they are independent companies. Liberty Mutual is a mutual insurer that was founded in 1912 and Progressive is a publicly traded company founded in 1937. They’re separate from one another with varying coverage options, discount structures and customer service strategies.

What car insurance is better than Progressive?

Geico and State Farm are often considered better than Progressive, depending on the driver’s profile. Geico typically offers cheaper rates for good drivers, while State Farm scores higher in customer satisfaction and claims handling. State Farm earned a 79/100 score from Consumer Reports compared to Progressive’s 72/100.

Are Liberty Mutual and Progressive the same company?

No, Liberty Mutual and Progressive are separate companies with distinct approaches to insurance. Liberty Mutual offers a variety of policies, including home, auto, and life insurance, while Progressive focuses primarily on auto coverage with usage-based discounts like Snapshot. They have different pricing models, underwriting criteria, and customer service policies, operating as independent insurers.

Does Progressive raise rates after 6 months?

Yes, Progressive may raise rates after the first 6-month policy term. This usually happens if you file a claim, add a driver, or change your risk factors. Rate increases can also occur due to inflation, local repair costs, or changes in underwriting guidelines.

Is Progressive good at paying claims?

Progressive handles claims efficiently for most customers but has a higher complaint rate than average. Its NAIC complaint index is 1.11, while the national median is 1.00. Most complaints involve delays or disagreements about coverage. Still, many users report fast digital claim service and good follow-through.

How much is Liberty Mutual car insurance a month?

Liberty Mutual car insurance rates vary based on driving history, location, vehicle type, and coverage level. Full coverage typically ranges from $150 to $300 per month, with higher rates for high-risk auto insurance policies. Liberty Mutual prices are generally higher than Progressive’s, reflecting added benefits like accident forgiveness and new car replacement.

What is the golden rule at Progressive?

Progressive doesn’t have an official “golden rule,” but its marketing emphasizes ease of access, transparency, and customization. Tools like Snapshot and the Name Your Price® tool aim to give drivers more control over rates and coverage levels without dealing with agents.

How good is Liberty Mutual car insurance?

Liberty Mutual offers robust coverage options like Better Car Replacement and accident forgiveness, but charges more than most competitors. It averages $96 per month for minimum coverage and receives fewer consumer complaints than Progressive. J.D. Power rated its customer service at 717/1,000 compared to Progressive’s 672.

What factors determine whether auto insurance is cheaper than Progressive?

Auto insurance is cheaper than Progressive for some drivers, but rates depend on factors like driving record, credit score, age, location, and coverage needs. Progressive typically offers lower rates, especially for drivers with clean records or those who use its Progressive Snapshot program. However, Liberty Mutual may be a better fit for those needing accident forgiveness or enhanced gap coverage, even at a higher price.

Is Progressive known to deny claims?

Progressive is not known for routine claim denials, but complaints about denied or delayed claims are higher than average. Many of these are related to disputes over fault or excluded coverage. The company’s complaint ratio is more than twice that of Liberty Mutual, based on NAIC data.

Who is cheaper than Liberty Mutual?

Progressive is typically cheaper than Liberty Mutual across most driver categories. For example, drivers with a clean record pay about $150 monthly with Progressive versus $248 with Liberty Mutual. Geico, USAA (military only), and State Farm may also offer lower rates depending on age, location, and driving history.

Is Liberty Mutual cheaper than Progressive?

Liberty Mutual is not cheaper than Progressive in most cases. If you are a younger driver or high-risk driver, or if you qualify for telematics discounts, Progressive usually offers the best rates. The higher costs at Liberty Mutual include added perks such as new car replacement and 24/7 roadside assistance. However, bundling home and auto policies or using loyalty programs can help narrow the cost gap.

Liberty Mutual vs. Geico: Which is better?

Geico is better for drivers who want lower rates and streamlined service. Liberty Mutual is better for those seeking more policy features like gap coverage and new car replacements. For full coverage, Geico averages $132 per month, while Liberty Mutual averages $174, based on recent rate data.

What do Reddit users say about Liberty Mutual vs. Progressive auto insurance?

Progressive has better bundling discounts and cheaper premiums, particularly for younger or high-risk drivers, according to Reddit users. Liberty Mutual gets high marks for its claims service and policy add-ons. Liberty Mutual is more expensive, according to some Progressive customers, but they process accident claims more smoothly.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Is Liberty Mutual Insurance expensive?

For many drivers, Liberty Mutual Insurance is expensive compared to Progressive and other major insurers. While it offers accident forgiveness and lifetime repair guarantees, its rates are often higher than competitors. Factors like location, credit history, and vehicle type impact pricing, but drivers seeking lower premiums may find Progressive’s rates more affordable.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.