Liberty Mutual vs. State Farm Auto Insurance in 2025 (Head-to-Head Review)

Liberty Mutual vs. State Farm auto insurance shows a clear gap in pricing—$96 vs. $47 per month—while Liberty Mutual includes new car replacement, and State Farm offers up to 30% savings through Drive Safe & Save. Compare their key differences to decide which policy delivers the most value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsLiberty Mutual vs. State Farm auto insurance starts with a price difference—$96 for Liberty Mutual and $47 for State Farm.

State Farm’s Drive Safe & Save can lower rates by up to 30% for safe drivers, while Liberty Mutual’s new car replacement fully reimburses the value of a totaled vehicle within its first year.

Liberty Mutual vs. State Farm Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.2 | 4.3 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 3.3 | 4.3 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 3.8 |

| Savings Potential | 4.5 | 4.4 |

| Liberty Mutual Review | State Farm Review |

State Farm regularly provides lower premiums, with 25-year-old drivers saving more than $1,800 per year compared to Liberty Mutual.

However, Liberty Mutual offers exclusive discounts, such as a federal employee savings program and improved bundling choices.

- State Farm costs $47 per month, while Liberty Mutual charges $96

- Liberty Mutual vs. State Farm auto insurance differs in pricing and perks

- State Farm offers bigger discounts, while Liberty Mutual has more coverage options

Simply enter your ZIP code into our quick, no-cost comparison tool to begin exploring your best alternatives for auto insurance.

Liberty Mutual vs. State Farm Rate Comparison

Gender and age have a big influence on full coverage auto insurance rates. The table illustrates how rates vary by demographic by contrasting Liberty Mutual and State Farm vehicle insurance rates. State Farm is the most affordable option because it constantly has reduced rates.

Liberty Mutual vs. State Farm Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $1,031 | $444 |

| 16-Year-Old Male | $1,121 | $498 |

| 30-Year-Old Female | $249 | $133 |

| 30-Year-Old Male | $285 | $147 |

| 45-Year-Old Female | $244 | $123 |

| 45-Year-Old Male | $248 | $123 |

| 60-Year-Old Female | $211 | $108 |

| 60-Year-Old Male | $227 | $108 |

Teen drivers face the highest costs, with 16-year-old males paying $1,121 with Liberty Mutual and only $498 with State Farm. Female teens see similar trends, with Liberty Mutual at $1,031 compared to State Farm’s $444.

At 30, rates drop, with State Farm charging $133 for females and $147 for males, while Liberty Mutual remains higher at $249 and $285, respectively. By 60, State Farm offers the lowest rate of $108 for both genders, while Liberty Mutual still charges $211 for females and $227 for males.

State Farm is the cheaper option for all age groups, saving young drivers over $600 per month. The gender gap is widest for teens but narrows with age. Older drivers see the lowest premiums, with State Farm offering the best rates. Liberty Mutual remains the pricier choice, especially for younger drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Impact of Driving Records on Liberty Mutual vs. State Farm Rates

Your driving history plays a big role in how much you pay for car insurance. The table below compares Liberty Mutual vs. State Farm auto insurance rates, showing how tickets, accidents, and DUIs affect costs. State Farm keeps prices lower across the board, making it the better deal for most drivers.

Liberty Mutual vs. State Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $248 | $123 |

| Not-At-Fault Accident | $335 | $146 |

| Speeding Ticket | $302 | $137 |

| DUI/DWI | $447 | $160 |

A clean record gets the best rates, with Liberty Mutual at $248 and State Farm at just $123. A not-at-fault accident raises Liberty Mutual’s rate to $335, while State Farm increases only to $146. Speeding tickets push Liberty Mutual’s premium to $302, compared to $137 with State Farm. The steepest hike comes with a DUI—Liberty Mutual jumps to $447, while State Farm remains much lower at $160.

State Farm offers lower rates across all driving records, with a clean record that is nearly half the price of Liberty Mutual Insurance Company. Not-at-fault accidents and speeding cause bigger increases with Liberty Mutual, while State Farm stays more stable. DUI penalties are the most severe, with Liberty Mutual charging nearly triple its base rate.

Liberty Mutual vs. State Farm: Comparing Auto Insurance Discounts

Auto insurance discounts can considerably reduce your premiums, but each carrier offers greater savings in different ways. The discount choices offered by Liberty Mutual and State Farm are contrasted in the table to highlight where each provider offers the best value.

Liberty Mutual vs. State Farm Auto Insurance Discounts

| Discount |  | |

|---|---|---|

| Accident-Free | 20% | 17% |

| Anti-Theft | 35% | 15% |

| Bundling | 25% | 17% |

| Claims-Free | 8% | 11% |

| Defensive Driving | 10% | 15% |

| Good Driver | 20% | 25% |

| Good Student | 15% | 25% |

| Low Mileage | 30% | 30% |

| Loyalty | 10% | 6% |

| Safe Driver | 20% | 25% |

| Pay-in-Full | 12% | 15% |

| Paperless Billing | 3% | 7% |

| Military | 10% | 20% |

| Early Signing | 8% | 10% |

| Federal Employee | 10% | 9% |

| Membership | 10% | 12% |

| Homeowner Discount | 10% | 15% |

Liberty Mutual offers a higher bundling discount at 25%, making it ideal for those combining policies, while State Farm provides 17%. State Farm rewards students and safe drivers more, offering 25% discounts in both categories, compared to Liberty Mutual’s 15% and 20%. Liberty Mutual stands out with a 35% anti-theft device discount, over double State Farm’s 15%.

Even if an insurer has the lowest rates, it’s important to check their claims process and customer satisfaction ratings before signing up.Jeff Root Licensed Insurance Agent

Defensive driving courses bring slightly better savings, with State Farm at 15%, while Liberty Mutual offers 10%. Liberty Mutual provides the best bundling and anti-theft discounts, while State Farm is better for students and safe drivers. State Farm also offers slightly better savings for defensive driving courses.

Liberty Mutual vs. State Farm: Credit Score Pricing Differences

Your credit score can seriously impact how much you pay for car insurance. The table compares State Farm vs. Liberty Mutual auto insurance rates, showing how costs change based on credit history.

Full Coverage Insurance Monthly Rates by Credit: Liberty Mutual vs. State Farm

| Credit Score |  | |

|---|---|---|

| Good Credit (670-739) | $366 | $181 |

| Fair Credit (580-669) | $467 | $238 |

| Bad Credit (300-579) | $734 | $413 |

Drivers with good credit pay $366 per month with Liberty Mutual, while State Farm offers a much lower $181. Liberty Mutual’s rate jumps to $467 for fair credit, while State Farm remains more affordable at $238. The biggest increase happens with poor credit—Liberty Mutual charges $734 monthly, compared to State Farm’s lower $413.

This shows that Liberty Mutual penalizes poor credit scores more, making State Farm the better choice for drivers with lower credit. State Farm consistently offers lower rates across all credit scores. Liberty Mutual increases premiums more sharply for poor credit, costing drivers over $300 extra per month. Checking state laws on credit-based auto insurance pricing can help drivers secure better rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual vs. State Farm Coverage Comparison

When you stack up Liberty Mutual vs. State Farm auto insurance, both give you the basics, but Liberty Mutual comes with more extras that can really matter depending on your car, driving habits, or loan situation. The table shows where they match up and where Liberty Mutual goes a step further.

Auto Insurance Coverage Offered by Liberty Mutual & State Farm

| Coverage Type |  | |

|---|---|---|

| Liability Coverage | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| New Car Replacement | ✅ | ❌ |

| Accident Forgiveness | ✅ | ✅ |

| Gap Insurance | ✅ | ❌ |

| Custom Parts & Equipment Coverage | ✅ | ✅ |

| Vanishing Deductible | ✅ | ❌ |

| SR-22 Insurance | ✅ | ✅ |

Both companies include liability, collision, comprehensive, personal injury protection (PIP), medical payments (MedPay), uninsured/underinsured motorist, rental reimbursement, roadside assistance, rideshare auto insurance, and accident forgiveness—ensuring a solid foundation of protection. However, Liberty Mutual adds key features that State Farm does not:

- New Car Replacement: Liberty Mutual will replace your totaled car with a brand-new model—not just the depreciated value.

- Gap Insurance: Covers the discrepancy in the event that your loan or lease exceeds the value of your vehicle following a total loss.

- Vanishing Deductible: Lowers your deductible for every year you drive claims-free.

- Custom Parts & Equipment Coverage: Covers aftermarket modifications like stereo systems or performance upgrades.

- Original Parts Replacement: Offers OEM parts in repairs (available in some states).

State Farm offers reliable core coverages but lacks these important policy extensions, which can make a real difference for new car owners, high-mileage drivers, or those financing vehicles.

Liberty Mutual vs. State Farm: Customer Satisfaction and Ratings

Customer satisfaction, business reputation, and financial strength are key factors when comparing auto insurers. J.D. Power scores both companies above average for customer satisfaction, with Liberty Mutual slightly ahead at 717/1,000 compared to State Farm’s 710/1,000.

Liberty Mutual holds an A- rating for business practices, while State Farm scores higher with an A+, reflecting a stronger reputation. Consumer Reports rates them nearly equal—Liberty Mutual at 74/100 and State Farm at 75/100, both showing positive feedback.

Insurance Business Ratings & Consumer Reviews: Liberty Mutual vs. State Farm

| Agency |  | |

|---|---|---|

| Score: 717 / 1,000 Above Avg. Satisfaction | Score: 710 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Complaint ratios indicate both insurers perform well, with Liberty Mutual at 0.55 and State Farm at 0.78, meaning both receive fewer complaints than the industry average. A.M. Best rates Liberty Mutual higher in financial strength, awarding it an A for excellent stability, while State Farm lags behind with a B, indicating fair financial health.

Among the best auto insurance companies, Liberty Mutual edges out State Farm in J.D. Power’s satisfaction ratings. State Farm has a stronger business reputation with an A+ rating, but Liberty Mutual leads in financial strength. Both insurers receive fewer complaints than the industry average, showing solid customer experiences.

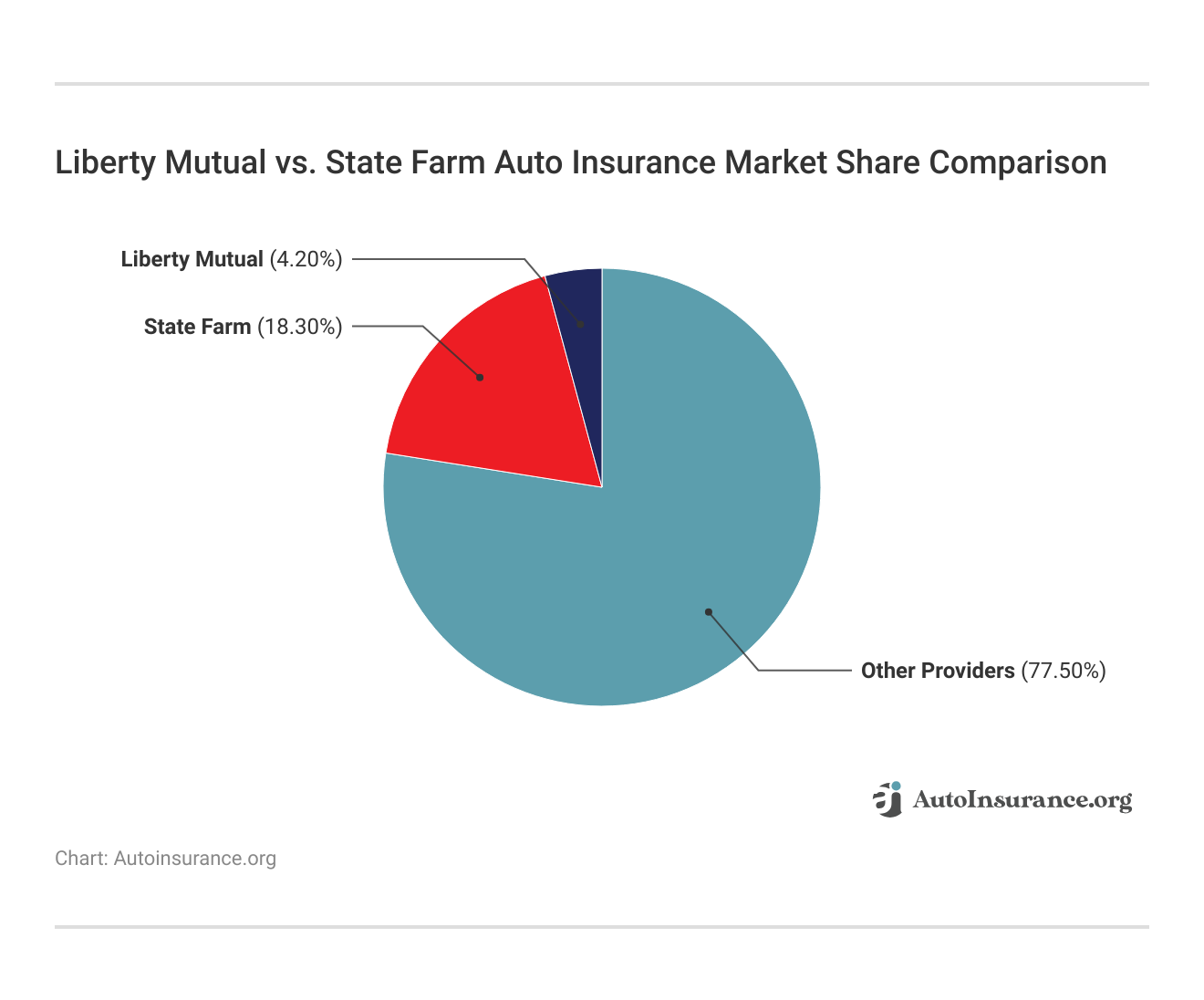

Market share gives insight into which insurers dominate the industry. The chart compares Liberty Mutual, State Farm, and other providers to show their market presence. State Farm leads with 18.3% of the market, while Liberty Mutual holds 4.2%.

The remaining 77.5% is spread across other insurers, showing plenty of competition. State Farm’s large share comes from its strong customer base and widespread agent network. Liberty Mutual, though smaller, attracts drivers with flexible policies and discounts. The large percentage held by other companies means plenty of alternative options for consumers.

One Reddit user compared State Farm vs. Liberty Mutual for auto and renters insurance in this discussion. They break down key factors like pricing, bundling discounts, and how each company handles claims.

Comment

byu/marcphero from discussion

inInsurance

State Farm is often less expensive, according to their experience, but Liberty Mutual provides superior bundle discounts and additional policy benefits. The way the two handle claims and customer support should be taken into account while choosing between them.

Pros and Cons of Liberty Mutual Insurance

Pros

- Strong Bundling Savings: Liberty Mutual provides a 25% discount when you bundle your vehicle with home or renters insurance, significantly lowering your overall expenses.

- High Anti-Theft Device Discount: Drivers who install anti-theft devices can save up to 35%, more than double State Farm’s 15% discount.

- Better Financial Strength: Liberty Mutual is rated A by A.M. Best, indicating good financial stability and guaranteeing policyholders are protected by a dependable insurer.

Cons

- Expensive for Poor Credit: With a $734 monthly rate for drivers with low credit scores, Liberty Mutual charges significantly more than State Farm’s $413.

- Higher DUI Rates: A DUI pushes premiums to $447 per month, nearly triple its base rate and far higher than State Farm’s $160. Discover more about offerings in our Liberty Mutual insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of State Farm Insurance

Pros

- Lower Overall Rates: State Farm’s full coverage costs $47 per month, while Liberty Mutual charges $96, making it the more affordable choice across all driver profiles. Unlock details in our State Farm insurance review.

- Better for Young Drivers: State Farm offers a 25% good student discount, compared to Liberty Mutual’s 15%, helping young drivers save more on their premiums.

- Safe Driving Incentives: State Farm’s Drive Safe & Save program can cut rates by up to 30%, rewarding drivers for maintaining good driving habits, while Liberty Mutual does not offer a similar program.

Cons

- Fewer Coverage Perks: State Farm doesn’t offer new car replacement coverage, so if your car is totaled in the first year, you won’t get the full value back as you would with Liberty Mutual.

- Smaller Bundling Discount: State Farm’s 17% bundling discount isn’t as generous as Liberty Mutual’s 25%, making it less appealing for those looking to save by combining policies.

Finding the Best Auto Insurance Policy for Your Needs

Liberty Mutual and State Farm auto insurance policies cover different types of drivers. State Farm is the more affordable option, offering complete coverage for $47 per month, although Liberty Mutual provides a significant 25% bundling discount, making it perfect for multi-policyholders.

However, Liberty Mutual’s $734 monthly rate for poor credit drivers makes it an expensive option, while State Farm lacks new car replacement coverage, which helps cover a totaled car’s full value in the first year. A key standout feature is State Farm’s Drive Safe & Save program, which offers up to 30% in savings for safe drivers.

Use our free comparison quote tool to compare prices for auto insurance from nearby providers before deciding between Liberty Mutual and State Farm.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which provider offers the best coverage and value in Liberty Mutual vs. State Farm home insurance?

State Farm has lower home insurance premiums and an A++ financial strength rating from A.M. Best, making it a strong choice for affordability and claims reliability. Liberty Mutual offers customization options, including water backup, earthquake, umbrella insurance, and a 25% bundling discount when paired with auto insurance.

Which company provides better policy options and discounts in Liberty Mutual vs. Farmers?

Liberty Mutual offers a 25% bundling discount and a mobile-friendly claims process. Farmers offers strong personalized service through local agents and flexible coverage add-ons like customized vehicle equipment protection.

Which insurer is better for high-risk drivers in Liberty Mutual vs. The General?

Liberty Mutual provides better financial stability (A rating from A.M. Best) and comprehensive policy options like accident forgiveness and gap insurance. The General caters to high-risk drivers but has higher premiums and fewer policy options.

Who offers better discounts and coverage options in Farmers vs. Liberty Mutual?

Liberty Mutual provides a 25% bundling discount and accident forgiveness, while Farmers offers customized auto policies and a telematics program rewarding safe drivers with lower rates.

Which insurer provides better coverage for budget-conscious drivers in Liberty Mutual vs. Safe Auto?

Liberty Mutual offers full coverage, accident forgiveness, and strong financial backing, while Safe Auto specializes in minimum liability policies for high-risk drivers at lower rates.

Which company has better coverage and discounts in Liberty Mutual vs. Mercury?

Liberty Mutual offers more coverage options, accident forgiveness, and a 25% bundling discount, while Mercury is often cheaper in California but has limited policy add-ons.

Who provides better protection and savings in Liberty Mutual vs. 21st Century?

Liberty Mutual offers comprehensive coverage, accident forgiveness, and bundling discounts, while the 21st Century focuses on affordable liability-only policies with fewer extras.

Which insurer is better for bundling and roadside assistance in Liberty Mutual vs. AAA?

AAA offers exclusive member benefits and top-rated roadside assistance, while Liberty Mutual provides stronger bundling discounts and accident forgiveness policies.

Which company is better for high-risk drivers in Liberty Mutual vs. Infinity?

Liberty Mutual offers strong financial stability, better coverage options, and lower complaint ratios, while Infinity focuses on non-standard policies with higher premiums for high-risk drivers. For those seeking auto insurance for high-risk drivers, Infinity may provide more flexible approval, but Liberty Mutual offers better long-term value and broader coverage choices.

Who provides better rates and customer service in State Farm vs. Infinity?

State Farm has lower rates, better customer service, and nationwide availability, while Infinity specializes in high-risk auto insurance with limited coverage options.

Which insurer offers better discounts and coverage flexibility in the 21st Century vs. Liberty Mutual?

Liberty Mutual provides more coverage options, accident forgiveness, and a 25% bundling discount, while 21st Century is better for affordable liability-only policies.

Who has better safe driving rewards and coverage options in Liberty Mutual vs. Allstate?

Liberty Mutual gives accident forgiveness and substantial bundling discounts, while Allstate offers the Allstate Drivewise program, which tracks safe customers’ driving behaviors using telematics and allows them to save up to 40%.

Who offers lower auto insurance rates, and is Liberty Mutual cheaper than State Farm?

State Farm is more affordable, with full coverage starting at $47 per month, while Liberty Mutual offers better bundling discounts that may lower costs for multi-policyholders.

Which provider offers better home and auto coverage in State Farm vs. Country Financial?

State Farm has lower auto insurance rates, nationwide availability, and strong financial backing, while Country Financial offers better home insurance policies and personalized agent service.

Who has better insurance rates than State Farm?

Some insurers, like Geico and USAA, often offer lower auto insurance rates than State Farm, especially for safe drivers and military members. However, rates vary based on location, driving record, and coverage needs.

What insurance company denies the most claims?

While claim denial rates vary, some reports suggest Allstate and Farmers have higher-than-average claim denials than other major insurers. However, denials often depend on policy exclusions, coverage limits, and claim circumstances.

Is State Farm good at paying claims?

State Farm has a strong reputation for paying claims, holding an A++ financial strength rating from A.M. Best and earning high J.D. Power claims satisfaction scores. However, auto insurance claim processing time can vary depending on the case’s complexity, required documentation, and claim investigation procedures.

Which insurance provider has the most satisfied customers?

According to J.D. Power’s Auto Insurance Study, USAA consistently ranks highest in customer satisfaction, followed by Amica and State Farm in certain regions. However, USAA is only available to military members and their families.

Use our comparison tool now to find the best auto insurance quotes, regardless of the coverage you require.

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.