Mercury Auto Insurance Review for 2025 (See Rates & Discounts Here)

Our Mercury auto insurance review highlights how Mercury offers comprehensive coverage options starting at just $27 monthly. The company provides various programs like RealDrive and MercuryGO, enhancing customer savings and driving experience, ensuring robust policy offerings catered to diverse needs.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Mercury Insurance

Monthly Rates

$27A.M. Best Rating:

AComplaint Level:

LowPros

- Robust financial strength rating

- Unique discounts like MercuryGO

- Diverse policy customization options

Cons

- Coverage limited to 11 states

- Rates spike with poor credit

- Mercury Insurance offers a variety of insurance products in 11 states

- Although it struggles with claims handling, customers are generally enthusiastic about Mercury’s low rates and discounts

- Mercury Insurance has solid third-party ratings, including an A from A.M. Best and a 0.71 from the National Association of Insurance Commissioners (NAIC)

Read our Mercury auto insurance review, which provides affordable and comprehensive auto insurance coverage in 11 states, emphasizing customer-focused claims support and adaptable policy options.

Their offerings include essential liability, collision, and comprehensive coverages, enhanced by unique programs like RealDrive® and MercuryGO, which reward safe driving behaviors.

Mercury Auto Insurance Rating

| Rating Criteria | Score |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.0 |

| Claim Processing | 3.3 |

| Company Reputation | 4.0 |

| Coverage Availability | 3.1 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 3.7 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.0 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Mercury emphasizes convenience and quality through an efficient claims process and a dependable network of repair facilities.

Start comparing total coverage auto insurance rates by entering your ZIP code here.

- Mercury offers coverage starting at $27/month with diverse programs

- RealDrive and MercuryGO programs reward safe driving

- Policy includes essential liability, collision, and comprehensive

Mercury Auto Insurance: Impact of Age, Gender, and Driving History on Rates

Mercury auto insurance is based on your age, gender, and driving history, so it can be competitive for many drivers. Young drivers incur much higher charges, such as a 16-year-old male, who would pay $159 per month for minimum coverage and $391 for full coverage. In contrast, older drivers see much lower rates, with a 60-year-old female paying just $27 for minimum coverage and $69 for full coverage.

Mercury Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $213 | $547 |

| 16-Year-Old Male | $227 | $558 |

| 18-Year-Old Female | $173 | $404 |

| 18-Year-Old Male | $195 | $454 |

| 25-Year-Old Female | $50 | $134 |

| 25-Year-Old Male | $52 | $139 |

| 30-Year-Old Female | $47 | $124 |

| 30-Year-Old Male | $49 | $130 |

| 45-Year-Old Female | $43 | $112 |

| 45-Year-Old Male | $42 | $110 |

| 60-Year-Old Female | $39 | $99 |

| 60-Year-Old Male | $40 | $102 |

| 65-Year-Old Female | $42 | $110 |

| 65-Year-Old Male | $41 | $108 |

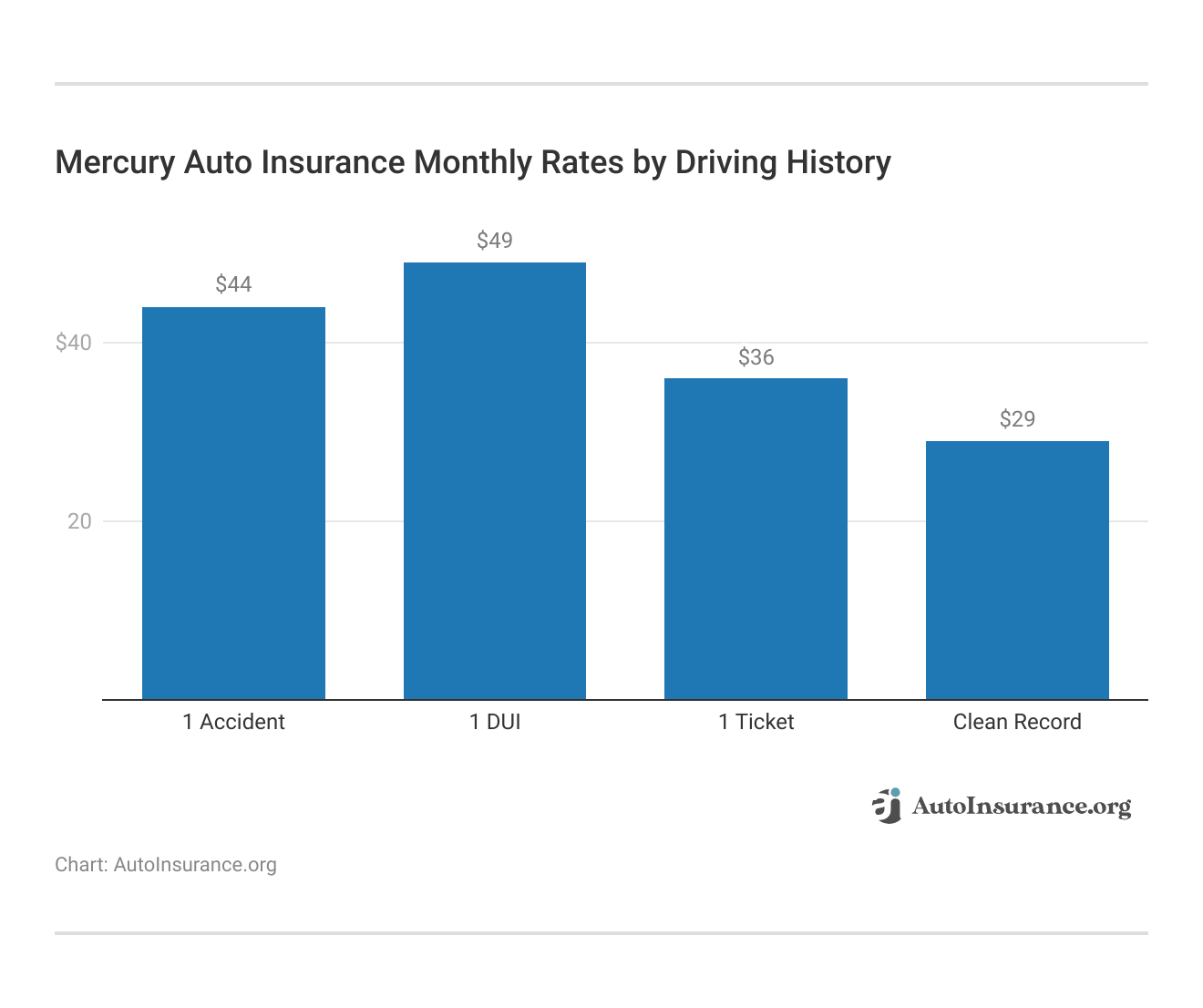

Driving history also impacts pricing. A clean record results in the lowest rates, with minimum coverage costing $29 and full coverage at $77. However, a single accident raises rates to $44 for minimum coverage and $114 for full. DUI leads to the most significant bump, with minimum coverage climbing to $49 and full coverage to $126 a month.

Mercury has an industry-leading pricing structure that punishes younger and higher-risk drivers but rewards experienced, safe drivers with lower monthly rates. Compared to the average national cost, the company’s rates will be competitive enough to make it a plan for those who do not want to pay a fortune.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mercury Auto Insurance: Competitive Pricing Analysis Among Top Providers

Mercury Insurance is one of the most affordable car insurance companies, with an average monthly minimum coverage policy cost of $52 and full coverage cost of $156. You’ve got Mercury scoring well against pricier competitors like Farmers at $235 and Liberty Mutual at $233. But watch out for the potential for a Mercury rate increase, which could affect these pricing advantages.

Mercury Auto Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $42 | $110 | |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

It stands favorably next to industry giants like State Farm and Geico, which provide full coverage at $117 and $113, respectively. This pricing makes Mercury a decidedly viable option for consumers who are looking for adequate coverage without a steep price—especially when compared to Nationwide and Travelers full coverage with rates of $173 and $182, respectively.

Mercury Auto Insurance: Comprehensive Discount Guide

Mercury auto insurance offers diverse driver discounts that meet a range of price-point drivers while improving service offerings. Notable auto insurance discounts for good drivers, violation-free records, and good students for those maintaining a “B” average or higher.

Mercury Auto Insurance Discounts

| Discount Name | |

|---|---|

| Multi-Policy | 15% |

| Multi-Vehicle | 25% |

| Good Driver | 20% |

| Good Student | 10% |

| Pay-in-Full | 10% |

| Anti-Theft Device | 5% |

| Defensive Driving Course | 5% |

| Auto Pay (EFT) | 5% |

| Paperless Billing | 3% |

| Low Mileage | 10% |

Households with multiple cars can benefit from the “Multi-Car” discount, and combining auto insurance with home or renters insurance qualifies for a “Multi-Policy” discount. Additionally, Mercury offers financial management incentives such as the “Pay-in-Full” discount for upfront premium payments and “Auto Pay” for automatic payment setups.

When choosing your coverage, assess your vehicle's value and your usual routes to select appropriate protection; for claims, Mercury's 24/7 support makes filing straightforward either online or via phone.Laura Berry Former Licensed Insurance Producer

With even more technology-based savings available with the “E-Signature” discount for electronically signing documents and “MercuryGO,” a driving app that provides customers with up to 40 percent off just for safe driving, it strengthens Mercury’s promise to help support safer driving habits while making it easier to manage policy.

Mercury Auto Insurance Coverage Options

All 11 states where Mercury operates require car insurance before you can drive legally. Mercury auto insurance quotes will at least include the minimum coverage you need. If you have a loan or lease on your vehicle, you likely need full coverage insurance, too, which Mercury can offer. Here are some types of car insurance Mercury offers:

- Mercury Auto Insurance Requirements: Mercury is offered in 11 states and provides required liability coverage based on state laws, plus full coverage for leased or financed vehicles.

- Comprehensive Coverage Options: Liability, collision, and comprehensive coverage for accidents, theft, and damage. Uninsured/underinsured motorist coverage is also available.

- Additional Coverage Benefits: Provides medical payment coverage for post-accident healthcare costs for all occupants, regardless of fault, and optional rental car coverage during vehicle repairs.

- Rideshare and Mechanical Protection: Tailors coverage for rideshare drivers with affordable monthly options and offers mechanical protection for major vehicle breakdowns, excluding wear and tear.

- State Variability and Customization: Coverage options like rental car, SR22, and mechanical protection vary by state. Mercury reps can help tailor policies.

Mercury rental car, Mercury SR-22 insurance, and Mercury mechanical protection availability vary by state, so make sure to ask.

A Mercury auto insurance representative can also help you decide which types of auto insurance coverage you need, as noted in a detailed Mercury Insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Exploring Additional Insurance Types Offered by Mercury

To qualify for a bundling discount, you must purchase more than one Mercury insurance policy. Fortunately, Mercury is not short of options:

- Multi-Policy Discounts: Mercury provides bundling discounts when you combine multiple policies, so you can save on several different types of insurance.

- Residential Insurance Options: Offers homeowners, condo, and renters insurance, allowing customization based on where you live.

- Property Investment Protection: Landlord insurance for property owners who are renting out their space, including liability and property damage coverage.

- Extended Coverage Choices: Offers umbrella insurance for additional liability coverage over fundamental limits and business owners’ policies to suit many business needs.

- Specialized Vehicle and Equipment Insurance: Provides commercial auto insurance and mechanical protection for major vehicle breakdowns.

When considering how to manage your auto insurance policy, you get simple coverage options doing exactly this when you choose a provider such as Mercury.

Mercury Auto Insurance: Competitive Rates Across Driving Records

In a comparative analysis of full coverage auto insurance rates affected by driving records, Mercury demonstrates competitive pricing across various scenarios. For drivers with one accident, Mercury’s monthly rate is $163, which is lower than most competitors, including well-known providers like Allstate at $321 and Liberty Mutual at $335.

Mercury vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | One Accident | One DUI | One Ticket | Clean Record |

|---|---|---|---|---|

| $321 | $385 | $268 | $228 | |

| $251 | $276 | $194 | $166 | |

| $182 | $185 | $150 | $124 | |

| $282 | $275 | $247 | $198 | |

| $189 | $309 | $151 | $114 | |

| $335 | $447 | $302 | $248 |

| $163 | $180 | $136 | $110 | |

| $230 | $338 | $196 | $164 |

| $265 | $200 | $199 | $150 | |

| $146 | $160 | $137 | $123 | |

| $199 | $294 | $192 | $141 | |

| $111 | $154 | $96 | $84 |

Similarly, for drivers with one DUI, Mercury’s rate of $180 is significantly more affordable compared to Liberty Mutual’s $447 and even Allstate’s $385. Mercury maintains its competitiveness with a rate of $136 for those with one ticket, staying well below the rates of companies like Liberty Mutual at $302.

After upgrading to comprehensive coverage with Mercury, a fallen tree incident was resolved quickly without out-of-pocket costs, truly showing the value of selecting coverage that aligns with your personal risk factors.Aremu Adams Adebisi Feature Writer

Mercury offers a $110 rate—one of the cheapest for drivers with a clean record, after handing over $123 to State Farm and $114 to Geico. This offering makes Mercury an excellent choice for drivers from different driving backgrounds who are looking for a reliable auto insurance provider.

Mercury Auto Insurance: Credit Score Impact on Rates Comparison

Mercury auto insurance provides stable rates for those with good and fair credit scores at $156 that closely match what larger competitors Allstate and Nationwide offer and what does not change across these credit categories. However, the rates for poor credit are extremely high, with Mercury soaring to $288.

Mercury Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $130 | $150 | $180 | |

| $140 | $160 | $190 | |

| $120 | $140 | $170 | |

| $233 | $233 | $280 |

| $156 | $156 | $288 | |

| $128 | $148 | $178 |

| $132 | $152 | $182 | |

| $118 | $138 | $168 | |

| $135 | $155 | $185 | |

| $110 | $130 | $160 |

This rate is higher compared to most competitors, except Farmers and Liberty Mutual, which also exhibit substantial hikes for poor credit ratings at $284 and $280, respectively.

This is significant because companies like Geico and State Farm are much cheaper with low premiums on all credit scores, with State Farm charging $117 and Geico $133 for poor credit, positioning Mercury as in the middle of the road when considering the overall market but on the high end for poor credit.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mercury Auto Insurance: Ratings and Consumer Satisfaction Overview

Mercury auto insurance receives good ratings from reputable agencies, and its financial strength and customer satisfaction reflect that. The “A” financial stability rating provided by A.M. Best shows that a company is stable enough to pay for claims efficiently. The BBB gives Mercury an A-, noting its effective customer service practices and sound business practices.

Mercury Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A- Good Business Practices |

|

| Score: 70/100 Positive Claims Handling |

|

| Score: 663 / 1,000 Avg. Satisfaction |

|

| Score: 0.84 Fewer Complaints Than Avg. |

With scores from Consumer Reports and J.D. Power at 70/100 and 663/1000, respectively, J.D. Power identifies solid but lower than the highest delivery of service. The NAIC’s’ 0.84 ratio suggests fewer than average complaints, revealing overall customer satisfaction.

A Reddit post from a California user says they’ve always gotten much lower quotes from Mercury, including one recent comparison in which Mercury was $800 less than the competition.

To understand how to file an auto insurance claim, take a page out of Mercury’s book, which has a price-competitive service with operational efficiencies and practices that make the price point achievable. It is a company that reads risk management to a T without sacrificing quality or service.

Mercury Auto Insurance: Pros and Cons

Mercury sells cheap, extensive auto insurance coverage in 11 states and emphasizes investing in customer service as well as flexible policy options. Allstate also has a variety of discounts, and its rate averages are competitive—both factors that can make the insurer a good fit for many drivers.

- Customized Coverage: Mercury offers liability, collision, and comprehensive coverage, plus safe-driving programs like RealDrive and MercuryGO.

- Competitive Rates: Known for affordability, especially for young and high-risk drivers, Mercury’s pricing model is designed to offer lower premiums compared to larger national providers.

- Discount Opportunities: Mercury offers good driver, multi-car, and MercuryGO discounts, reducing premiums by up to 30%.

However, potential customers should also consider a few limitations highlighted in Mercury Insurance reviews.

- Limited State Availability: Mercury provides auto insurance in only 11 states; the brand may not be an option for drivers outside its service area.

- Inconsistent Customer Experiences: Feedback on customer service and claims processing varies, indicating that some customers may face challenges in these areas.

Mercury auto insurance provides competitive pricing and a range of discounts that meet the different needs of drivers, showing how the price of a car affects auto insurance rates.

While they do have a good share of auto policies, you should keep in mind that they are only available in a handful of states and have mixed reviews from customers for auto insurance Mercury car insurance.

What You Need to Know: Mercury Auto Insurance

Mercury auto insurance can be an attractive low-cost coverage option in the insurance market, with various discounts available to different drivers. The competitive rates it offers for many different driving perceptions, the money coverage options like RealDrive and MercuryGO, and its overall broader worth of each customer experience and product.

Above-average customer satisfaction ratings and below-average complaints prove Mercury’s reliability. Or have a clean driving record, here’s what you need to know how auto insurance companies check driving records. Mercury Insurance offers adaptable policies and proactive service, making it a solid choice for those looking for a reliable Mercury Insurance quote.

Use our free comparison tool to see what auto insurance quotes look like in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is Mercury car insurance on average?

The average cost of Mercury car insurance varies based on factors like your driving history, vehicle type, and coverage selected, but it is generally considered affordable compared to other major insurers.

Is Mercury Insurance good for drivers seeking both value and customer service?

Mercury Insurance is good for drivers looking for a balance of value and customer service, offering competitive rates and a range of discounts, though some reviews suggest varying experiences with service quality.

What do the Mercury car insurance reviews say about customer satisfaction?

Mercury car insurance reviews highlight the company’s competitive pricing and efficient claims process, including handling comprehensive auto insurance claims. However, customer satisfaction ratings vary, with some customers noting challenges in navigating the claims process.

What should I expect if there’s a Mercury Insurance increase on my next bill?

If there is a Mercury Insurance increase on your bill, it could be due to factors like changes in your driving record, vehicle, or even broader rate increases within the industry.

How often does a Mercury Insurance rate increase occur, and what factors contribute to it?

Rate increases at Mercury Insurance may occur annually or biannually and can be influenced by factors such as statewide changes in insurance regulations, claims history, and overall driving records.

Does Mercury Insurance cover rental cars during repairs?

Yes, Mercury Insurance’s optional rental car coverage does include provisions to auto insurance cover rental cars if your vehicle is in the shop due to a covered accident.

Can you explain what the Mercury Real Drive program entails?

The Mercury Real Drive program is a usage-based insurance option that offers discounts based on the mileage you drive, tracked through a mobile app, allowing drivers to potentially lower their premiums based on less frequent driving.

How does Mercury compare to the California automobile insurance company in terms of pricing and coverage?

Mercury often offers more competitive pricing and similar coverage options compared to other insurers like the California Automobile Insurance Company, making it a cost-effective choice for many drivers.

What is the Mercury Insurance roadside assistance cost?

The cost of Mercury Insurance’s roadside assistance plans is approximately $10 per month, providing services such as towing, battery jumps, and flat tire changes.

How can I enroll in the Mercury RealDrive mileage program?

You can enroll in the Mercury RealDrive mileage program by contacting Mercury Insurance directly through their customer service or by signing up when you purchase or renew your insurance policy.

What benefits does the Mercury RealDrive Program offer to California drivers?

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

Where can I get competitive car insurance quotes, including those from Mercury?

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

The average cost of Mercury car insurance varies based on factors like your driving history, vehicle type, and coverage selected, but it is generally considered affordable compared to other major insurers.

Mercury Insurance is good for drivers looking for a balance of value and customer service, offering competitive rates and a range of discounts, though some reviews suggest varying experiences with service quality.

What do the Mercury car insurance reviews say about customer satisfaction?

Mercury car insurance reviews highlight the company’s competitive pricing and efficient claims process, including handling comprehensive auto insurance claims. However, customer satisfaction ratings vary, with some customers noting challenges in navigating the claims process.

What should I expect if there’s a Mercury Insurance increase on my next bill?

If there is a Mercury Insurance increase on your bill, it could be due to factors like changes in your driving record, vehicle, or even broader rate increases within the industry.

How often does a Mercury Insurance rate increase occur, and what factors contribute to it?

Rate increases at Mercury Insurance may occur annually or biannually and can be influenced by factors such as statewide changes in insurance regulations, claims history, and overall driving records.

Does Mercury Insurance cover rental cars during repairs?

Yes, Mercury Insurance’s optional rental car coverage does include provisions to auto insurance cover rental cars if your vehicle is in the shop due to a covered accident.

Can you explain what the Mercury Real Drive program entails?

The Mercury Real Drive program is a usage-based insurance option that offers discounts based on the mileage you drive, tracked through a mobile app, allowing drivers to potentially lower their premiums based on less frequent driving.

How does Mercury compare to the California automobile insurance company in terms of pricing and coverage?

Mercury often offers more competitive pricing and similar coverage options compared to other insurers like the California Automobile Insurance Company, making it a cost-effective choice for many drivers.

What is the Mercury Insurance roadside assistance cost?

The cost of Mercury Insurance’s roadside assistance plans is approximately $10 per month, providing services such as towing, battery jumps, and flat tire changes.

How can I enroll in the Mercury RealDrive mileage program?

You can enroll in the Mercury RealDrive mileage program by contacting Mercury Insurance directly through their customer service or by signing up when you purchase or renew your insurance policy.

What benefits does the Mercury RealDrive Program offer to California drivers?

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

Where can I get competitive car insurance quotes, including those from Mercury?

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

Mercury car insurance reviews highlight the company’s competitive pricing and efficient claims process, including handling comprehensive auto insurance claims. However, customer satisfaction ratings vary, with some customers noting challenges in navigating the claims process.

If there is a Mercury Insurance increase on your bill, it could be due to factors like changes in your driving record, vehicle, or even broader rate increases within the industry.

How often does a Mercury Insurance rate increase occur, and what factors contribute to it?

Rate increases at Mercury Insurance may occur annually or biannually and can be influenced by factors such as statewide changes in insurance regulations, claims history, and overall driving records.

Does Mercury Insurance cover rental cars during repairs?

Yes, Mercury Insurance’s optional rental car coverage does include provisions to auto insurance cover rental cars if your vehicle is in the shop due to a covered accident.

Can you explain what the Mercury Real Drive program entails?

The Mercury Real Drive program is a usage-based insurance option that offers discounts based on the mileage you drive, tracked through a mobile app, allowing drivers to potentially lower their premiums based on less frequent driving.

How does Mercury compare to the California automobile insurance company in terms of pricing and coverage?

Mercury often offers more competitive pricing and similar coverage options compared to other insurers like the California Automobile Insurance Company, making it a cost-effective choice for many drivers.

What is the Mercury Insurance roadside assistance cost?

The cost of Mercury Insurance’s roadside assistance plans is approximately $10 per month, providing services such as towing, battery jumps, and flat tire changes.

How can I enroll in the Mercury RealDrive mileage program?

You can enroll in the Mercury RealDrive mileage program by contacting Mercury Insurance directly through their customer service or by signing up when you purchase or renew your insurance policy.

What benefits does the Mercury RealDrive Program offer to California drivers?

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

Where can I get competitive car insurance quotes, including those from Mercury?

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

Rate increases at Mercury Insurance may occur annually or biannually and can be influenced by factors such as statewide changes in insurance regulations, claims history, and overall driving records.

Yes, Mercury Insurance’s optional rental car coverage does include provisions to auto insurance cover rental cars if your vehicle is in the shop due to a covered accident.

Can you explain what the Mercury Real Drive program entails?

The Mercury Real Drive program is a usage-based insurance option that offers discounts based on the mileage you drive, tracked through a mobile app, allowing drivers to potentially lower their premiums based on less frequent driving.

How does Mercury compare to the California automobile insurance company in terms of pricing and coverage?

Mercury often offers more competitive pricing and similar coverage options compared to other insurers like the California Automobile Insurance Company, making it a cost-effective choice for many drivers.

What is the Mercury Insurance roadside assistance cost?

The cost of Mercury Insurance’s roadside assistance plans is approximately $10 per month, providing services such as towing, battery jumps, and flat tire changes.

How can I enroll in the Mercury RealDrive mileage program?

You can enroll in the Mercury RealDrive mileage program by contacting Mercury Insurance directly through their customer service or by signing up when you purchase or renew your insurance policy.

What benefits does the Mercury RealDrive Program offer to California drivers?

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

Where can I get competitive car insurance quotes, including those from Mercury?

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

The Mercury Real Drive program is a usage-based insurance option that offers discounts based on the mileage you drive, tracked through a mobile app, allowing drivers to potentially lower their premiums based on less frequent driving.

Mercury often offers more competitive pricing and similar coverage options compared to other insurers like the California Automobile Insurance Company, making it a cost-effective choice for many drivers.

What is the Mercury Insurance roadside assistance cost?

The cost of Mercury Insurance’s roadside assistance plans is approximately $10 per month, providing services such as towing, battery jumps, and flat tire changes.

How can I enroll in the Mercury RealDrive mileage program?

You can enroll in the Mercury RealDrive mileage program by contacting Mercury Insurance directly through their customer service or by signing up when you purchase or renew your insurance policy.

What benefits does the Mercury RealDrive Program offer to California drivers?

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

Where can I get competitive car insurance quotes, including those from Mercury?

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

The cost of Mercury Insurance’s roadside assistance plans is approximately $10 per month, providing services such as towing, battery jumps, and flat tire changes.

You can enroll in the Mercury RealDrive mileage program by contacting Mercury Insurance directly through their customer service or by signing up when you purchase or renew your insurance policy.

What benefits does the Mercury RealDrive Program offer to California drivers?

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

Where can I get competitive car insurance quotes, including those from Mercury?

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

The Mercury Real Drive program benefits California drivers by providing a discount that reflects their actual vehicle usage, which can lead to significant savings for those who drive less frequently.

You can obtain competitive car insurance quotes from Mercury and other insurers by visiting their websites or using online comparison tools. For guidance on how to evaluate auto insurance quotes effectively, consider comparing coverage options, deductibles, and premium costs side by side.

How can I contact Mercury Insurance customer service for a policy query?

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is the Mercury insurance phone number for immediate assistance?

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

You can contact Mercury Insurance customer service for any policy queries by calling their dedicated customer service number or through their online portal for more direct support.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

The Mercury Insurance phone number for immediate assistance is typically listed on their website, along with your insurance policy card. It provides access to customer service and emergency roadside assistance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does mercury insurance offer windshield replacement, and is it covered under comprehensive coverage?

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

Yes, Mercury Insurance’s comprehensive auto insurance policy does include coverage for windshield damage or replacement.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

KamiBahrami

Worse Auto Insurance Of All

steeeeve

Worst Insurance Co.

Shaya

My Review

JuneT

Mercury Insurance High Premiums

shorty22

great service

Evan507

Great customer service.

lordaz

Mercury Review

danimurillo

Great service

asanchez7876

No Problems so Far.

chiver

Good service but high price