Mile Auto Insurance Review for 2025 (See if This Provider Is Right for You)

Mile Auto offers affordable auto insurance rates for pay-per-mile coverage, costing around $157/mo. Low-mileage drivers could save 40% with Mile Auto compared to other insurers, and you won't need an app or tracking device. See how to buy affordable coverage for auto insurance by miles below.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Apr 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Mile Auto Insurance

Average Monthly Rate For Good Drivers

$157A.M. Best Rating:

A-Complaint Level:

HighPros

- Cheap rates for drivers with low annual mileage

- Mile Auto doesn’t have a preferred repair network

- Unlike most pay-per-mile program, no tracking device or app is required

- Has an A- rating for financial strength from A.M. Best

Cons

- Only available in Arizona, Florida, Georgia, Oregon, Tennessee, and Texas

- Mile Auto has limited coverage options and doesn’t offer discounts

- Has a high NAIC complaint index and many negative customer service reviews

Our Mile Auto insurance review found that the company is one of the few pay-as-you-go car insurance providers offering an alternate way to buy car insurance. So, you only pay for the miles you drive rather than a flat monthly fee.

Standard car insurance rates are set using various factors. While the traditional model works for many people, low-mileage drivers often feel they’re overpaying for insurance.

Mile Auto Insurance Rating

Rating Criteria

Overall Score 3.3

Insurance Cost 3.9

Discounts Available 0.7

Claim Processing 4.5

Customer Satisfaction 2.2

Coverage Availability 1.8

Coverage Value 3.8

Digital Experience 3.5

Company Reputation 4.0

Business Reviews 4.0

Plan Personalization 3.0

Policy Options 2.8

Savings Potential 2.8

Generally, Mile Auto caters to those who drive fewer than 10,000 miles annually. However, drivers looking for a low-mileage insurance discount without a tracking device might find Mile Insurance is their best option.

Read on to learn more about Mile Auto insurance and if it’s the right choice for your coverage needs. You can also enter your ZIP code into our free comparison tool above to see quotes from other pay-per-mile companies and find the best plan for you.

Mile Auto Insurance Rates Breakdown

Pay-per-mile insurance is usually cheaper for drivers who put less than 10,000 miles on their cars yearly. Even among the best pay-per-mile car insurance, Mile Auto insurance tends to offer the lowest prices.

Mile Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $300 $400

Age: 16 Male $320 $420

Age: 18 Female $250 $350

Age: 18 Male $270 $370

Age: 25 Female $150 $200

Age: 25 Male $170 $220

Age: 30 Female $130 $170

Age: 30 Male $140 $180

Age: 45 Female $110 $150

Age: 45 Male $115 $157

Age: 60 Female $100 $135

Age: 60 Male $105 $140

Age: 65 Female $110 $145

Age: 65 Male $115 $150

For full coverage auto insurance, Mile drivers pay about $157 a month. However, these rates are typical for low-mileage drivers, and the amount you pay for your coverage varies by several factors. You’ll see much higher prices if you drive more than 10,000 miles per year.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 | |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

| U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

Other factors affecting your auto insurance from Mile include your location, age, and driving history, but your annual mileage is the most important. Check out the table below to see how much you could pay for full or minimum coverage based on driving record:

As you can see, you’ll pay much more for Mile Auto coverage if you have an accident or DUI on your record. Keep reading this pay by miles car insurance review to see how how Mile Auto ratings are.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mile Auto Insurance Reviews

Founded over a decade ago, Mile Auto insurance is underwritten by the older company, Spinnaker Insurance. So, is Mile Auto insurance good?

Mile Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 65/100 Avg. Customer Satisfaction |

|

| Score: 0.97 Avg. Complaint Volume |

|

| Score: A- Great Financial Strength |

While it struggles with complaints, Spinnaker has an excellent rating from A.M. Best. A.M. Best rates companies on their financial strength, and Spinnaker’s A- grade means Mile won’t struggle to pay any claims you need to make.

Spinnaker has a lot of experience in the insurance industry, but it also receives more complaints.

In fact, the National Association of Insurance Commissioners (NAIC) reports that Spinnaker receives nine times as many complaints as similarly sized companies. However, it’s unclear how Spinnaker’s high number of complaints affects Mile auto reviews.

As a pay-per-mile company, Mile insurance isn’t for everyone. However, you might find the lowest rates with Mile if you’re looking for auto insurance for infrequent drivers. Mile is currently only available in seven states, though the company plans to expand throughout the U.S.

Unfortunately, Mile insurance reviews aren’t always favorable. The Better Business Bureau (BBB) rates companies on their ability to resolve customer complaints. Mile Auto doesn’t have a rating from the BBB, but the company site lists several complaints.

Negative MileAuto insurance reviews mainly focus on how hard it is to contact customer service. Mile’s customer service line is only available during business hours, Monday through Friday, and representatives are often slow to respond to requests.Tracey L. Wells Licensed Insurance Agent & Agency Owner

People also say the window of time Mile provides to submit odometer pictures is inconveniently small. Its lack of online options to update your payment details can also make managing your insurance policy challenging.

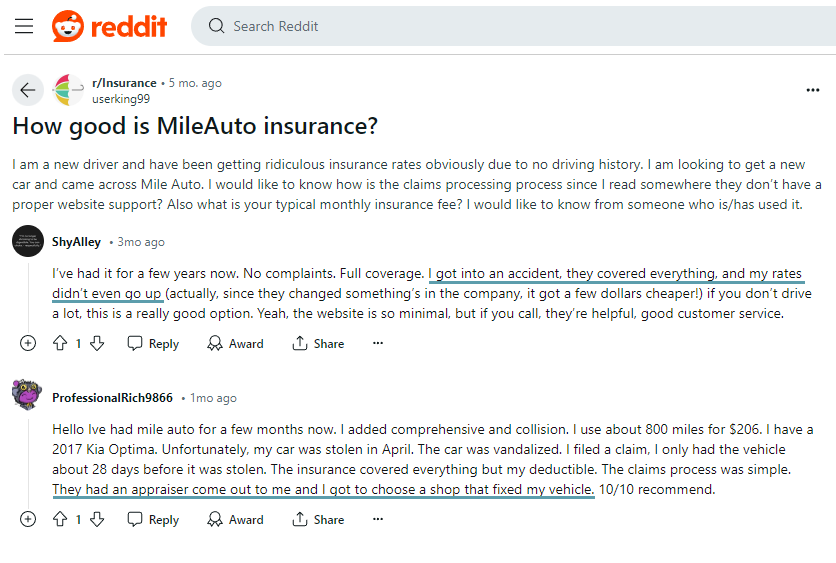

However, it’s not all bad news. MileAuto reviews rave about their cheap coverage, and often say they can’t find lower rates elsewhere. While its customer service leaves something to be desired, most Mile drivers report overall satisfaction with the claims process.

Mile Auto Insurance Coverage Options

Mile sells enough coverage to meet state minimum auto insurance requirements and full coverage needs. It doesn’t have as long a list as some competitors, but you can buy the following coverages from Mile:

- Property Damage Liability: This part of liability insurance covers damage you cause to other people’s property in an accident, such as cars, buildings, or fences.

- Bodily Injury Liability Insurance: As the other half of liability insurance, this part pays for damages resulting from injuries to others when you’re at fault in an accident..

- Collision Insurance: Liability insurance doesn’t cover any of your repair bills after an accident you cause. You’ll need collision insurance if you want help with your repair bills.

- Comprehensive Insurance: There’s a lot more than accidents that can damage your car. Comprehensive insurance covers unexpected events like fire, extreme weather, flooding, vandalism, theft, and animal contact. (Find out More: Does car insurance cover hitting a deer?)

- Uninsured/Underinsured Motorist Coverage: Every state selling Mile coverage requires car insurance before you can drive, but not all drivers follow the law. Uninsured motorist protects you from drivers with inadequate or no coverage.

- Personal Injury Protection/Medical Payments Coverage: Medical bills after a car accident can get pricey quickly. Medical payments or personal injury protection insurance helps pay health care expenses after an accident.

These are the most basic options for car insurance you can find at most companies. Mile doesn’t have the extended insurance options as larger companies, but it offers roadside assistance and rental car reimbursement.

Understanding the Mile Auto Insurance Pricing Model

Standard insurance companies calculate a flat fee based on your unique characteristics. Once your insurance premium gets calculated, you can split your payments into monthly increments or pay in full.

Mile Auto insurance doesn’t work like a standard company. Instead, Mile offers pay-per-mile coverage, meaning you pay for each mile you drive. So the fewer miles you drive, the less you’ll pay.

To start, Mile calculates a base rate. Your base rate is the amount you’ll pay for car insurance every month, no matter how many miles you drive.

Mile sets your base rate the same way standard companies craft rates. The company considers your age, gender, location, coverage needs, vehicle type, and driving history to determine your base rate. Then, you’ll get a price for every mile you drive.

For example, a common base rate with Mile is $35 a month. If your per-mile rate is $0.05 per mile and you drive 400 miles in a month, your monthly bill would be $55.

Most pay-per-mile insurance companies track your mileage through a smartphone app or a device you plug into your car. Mile Auto takes a slightly different approach — you’ll need to submit a photo of your odometer once a month.

You don’t need to worry about remembering to submit your photos since Mile sends reminders through email and text. You simply need to click on the link Mile sends you to submit your monthly photo and follow the instructions. Learn more about how your annual mileage affects auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Considerations When Planning a Long Road Trip as a Mile Auto Policyholder

Low-mileage insurance is great for your daily routine, but what happens if you want to spend the weekend out of town? U.S. drivers frequently put hundreds of miles on their cars in a single road trip, which can cause your rates to double or more. Pay-per-mile companies usually limit the number of daily miles they charge to avoid making it cheaper to get insurance from a standard company.

Mile Auto isn’t clear about its policy towards road trips, but similar competitors like Metromile car insurance cap daily miles at 250.

When you buy pay-per-mile insurance, check with a representative before you go on a long trip. While Mile Auto probably has a plan for long trips, checking beforehand might save you money. Also, find out how to get a low-mileage discount.

Mile Auto Discounts Available

Since Mile Auto insurance offers low rates by charging by the mile, it doesn’t offer other auto insurance discounts. So if you’re not a low-mileage driver and want to take advantage of discounts, you should consider a standard insurance company instead.

Keep reading our Mile Auto car insurance by miles insurance review to see how this top provider compares against competitors.

How Mile Auto Ranks Among Providers

Mile Auto, Inc. has few competitors for pay-per-mile coverage, so finding companies to compare can be tricky. However, you have a few options, including the following:

- Metromile: Metromile is a pay-per-mile company available in eight states and is ideal for people looking for more technological options. With Metromile, you use a plug-in device to track your miles.

- Allstate Milewise: Milewise is a mileage tracking program offered by Allstate to give low-mileage drivers an option to save. Milewise is available in 21 states and uses a plug-in device paired with an app. Check out Allstate Milewise reviews from customers to see if the program is right for you (Learn More: Allstate Milewise Review).

- Liberty Mutual ByMile: Available in 17 states, ByMile also uses a plug-in device paired with an app. ByMile is a good choice for low-mileage drivers who go on the occasional road trip.

- Nationwide SmartMiles: SmartMiles has the widest availability, covering 40 states. SmartMiles uses a plug-in device to track your miles and has some of the best customer service ratings.

Like standard car insurance, comparing your options is important when looking for pay-per-mile coverage. Another consideration is whether low-mileage insurance is right for you, but a representative can help you decide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

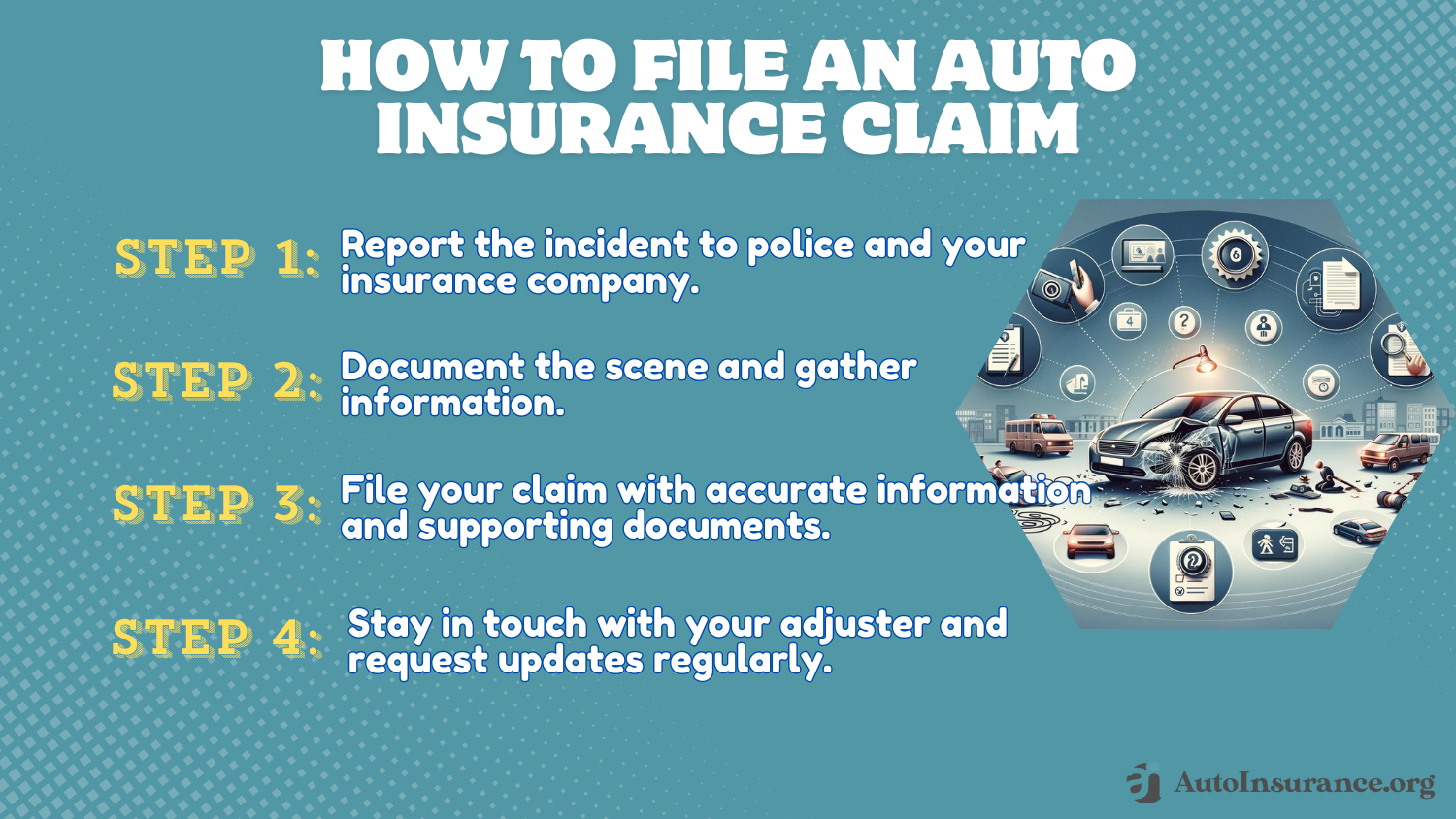

How the Mile Auto Insurance Claims Process Works

Our MileAuto review found that the company has a simplified claims process for car insurance policyholders, despite the mixed Mile Auto insurance rating found in reviews.

When an unfortunate incident occurs, initiating an auto insurance claim with Mile Auto involves promptly reaching out to their customer service. This direct approach is designed to facilitate a smooth process, even as some customers have expressed desires for improvement in service responsiveness.

Mile Auto insurance reviews on Reddit show policyholders enjoy a smooth claims process, and one user noted that their rates didn’t go up after a claim.

Another Reddit user noted the convenience of the claims process by mentioning how an appraiser came to them and they were able to pick their own repair shop.

Learn More: How to File an Auto Insurance Claim

When filing a claim, policyholders must provide a comprehensive account of the incident, supported by documentation such as damage photos, police reports, and witness statements. This thorough documentation aids in Mile Auto’s claims process. The company may conduct a vehicle inspection to accurately assess repair costs, a step integral to the Mile Auto claims process.

Communication is emphasized throughout, with Mile Auto keeping the insured informed from the initial filing to the claim’s resolution, whether it involves repair authorizations or dispute resolutions. This communication is key to addressing any concerns about how to cancel Mile Auto insurance or queries about coverage specifics.

Pay-Per-Mile Car Insurance Defined

Pay-per-mile car insurance, including offerings like pay per mile auto insurance and car insurance by the mile, presents a modern solution tailored for drivers who use their vehicles sparingly. This insurance model allows drivers to pay a car insurance premium based on how many miles they drive each month.

The primary benefit of pay-per-mile car insurance, as seen in offerings like pay per mile car insurance, is lower auto insurance rates if you drive less. This model departs from traditional flat-rate policies, introducing a more equitable approach where the amount you drive directly influences your insurance costs.

However, questions like “What is Mile Auto?” and “How does by the mile car insurance work?” often arise, highlighting the need for clarity and understanding of these innovative policies. When deciding whether you want to pay for coverage by miles, auto insurance reviews from customers are a great place to start.

Drivers That Wouldn’t be a Good Fit for Mile Auto

Mile Auto insurance emerges as a compelling option for drivers with specific needs, yet questions like “Is Mile Auto legit?” and “Is Mile Auto a good insurance company?” are common among those considering this pay-per-mile car insurance model. Given its unique approach, understanding its suitability involves looking at mile pay per mile insurance reviews and reviews on Mile Auto insurance more broadly.

For frequent drivers accumulating over 10,000 miles annually, the appeal of Mile Auto might wane compared to traditional insurance policies with a flat rate. This shift in cost-effectiveness prompts those considering Mile Auto to delve into pay-per-mile car insurance reviews to see if the savings associated with fewer miles driven align with their driving habits.

The availability of Mile Auto in certain states also means that not everyone can access its services. So, the company’s insurance offerings might not meet the needs of drivers looking for various types of auto insurance coverage, according to reviews on Mile Auto insurance.

Exploring Mile Auto Insurance reveals a pivotal truth: while its pay-per-mile model offers substantial savings for the low-mileage driver, understanding its full value requires a deep dive into user reviews and the nuances of its customer service.Brad Larson Licensed Insurance Agent

When it comes to customer support, Mile Auto customer service reviews reveal some challenges, particularly around the process for submitting odometer readings and reaching support staff. These aspects are crucial for drivers who prioritize customer service and efficient digital interactions for managing their insurance needs.

Learn More: Auto Insurance Companies With the Best Customer Service

For those accustomed to the convenience of automatic mileage tracking, the manual submission process for odometer readings that Mile Auto employs might seem less appealing, despite its advantage of not requiring GPS tracking. This approach, while valued for its privacy considerations, is an essential factor to weigh, based on mile auto customer service feedback and operational preferences.

Lastly, while exploring “Is Mile Auto a good insurance company?” you may wonder if the provider offers discounts. Unfortunately, pay-per-mile car insurance reviews show that Mile Auto offers no discount opportunities unlike most traditional companies.

So, is Mile Auto legit for me? While Mile Auto Insurance holds promise for low-mileage drivers and those concerned about privacy without GPS tracking, it’s vital to consider individual driving habits, service expectations, and the need for comprehensive coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

See if Pay-Per-Mile Coverage Is Right for You and Get Cheap Mile Auto Insurance Today

Although Mile Auto insurance struggles with its customer service, it does well with its claims process and offers some of the lowest rates for low-mileage drivers. If you drive fewer than 27 miles per day, MileAuto car insurance might be right for you.

Mile Auto rewards you for driving less. Customers can save up to 40% when they switch to Mile Auto from traditional insurers. Switch and save today by visiting https://t.co/Pu4sPLQ2EM! pic.twitter.com/kZTCXxVwFs

— Mile Auto (@DriveMile) June 28, 2022

Of course, you should still compare rates with other companies before you sign up for a policy. Mile Auto has low rates, but you might find a company better suited for your needs elsewhere. Use our free quote comparison tool below to find cheap usage-based auto insurance rates near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How much does Mile Auto insurance cost?

Expect to pay around $157 monthly for Mile Auto insurance rates, though they vary by driver. In addition, the company boasts savings of up to 40% compared to standard car insurance companies, since they use your mileage to set rates.

Learn More: How Annual Mileage Affects Your Auto Insurance Rates

Your Mile insurance rates consist of two parts. First, you’ll pay a monthly base price, no matter how many miles you drive. The second half is your per-mile fee, which you’ll pay for each mile you drive in a month.

Does Mile Auto have a maximum number of miles it charges per day?

Mile Auto is vague about whether it caps the number of miles you get charged daily, and its policy likely varies by state. However, most pay-per-mile insurance allows drivers to take occasional road trips without paying high prices.

Is Mile Auto insurance affordable?

Mile Auto can be much more affordable compared to standard providers. As for pay-per-mile insurance, Mile Auto is one of the cheapest auto insurance companies on the market.

Wondering if another provider has lower rates? Find out by entering your ZIP code into our free quote comparison tool below.

How does Mile Auto Insurance work?

Mile Auto Insurance uses a telematics device, often referred to as a “dongle,” that plugs into your car’s OBD-II port or utilizes a mobile app. This device collects data about your driving habits, such as mileage, speed, braking, and acceleration. The collected data is used to calculate your insurance premiums, with safer driving behavior potentially resulting in lower rates.

Is Mile Auto Insurance suitable for everyone?

Mile Auto Insurance may be a good fit for individuals who drive less frequently, exhibit safe driving habits, and are comfortable with the use of telematics technology. However, it may not be ideal for those who have concerns about privacy or who drive extensively, as their rates may not be as competitive for high-mileage drivers.

What factors affect the cost of insurance with Mile Auto Insurance?

The cost of insurance with Mile Auto Insurance is influenced by these five factors, including:

- Mileage

- Driving behavior

- Vehicle type

- Location

- Personal details

Read More: Factors That Affect Car Insurance Rates

Is Mile Auto good insurance?

A top question readers ask is, “Is Mile Auto insurance legit?” Mile Auto Insurance can be an excellent option for certain drivers, especially those who drive less frequently.

The company stands out for offering low auto insurance rates for pay-per-mile insurance, potentially allowing low-mileage drivers to save up to 40% on their insurance coverage compared to traditional insurers. A significant advantage is that the Mile Auto insurance company does not require an app or tracking device for mileage verification, which is a unique feature in the pay-per-mile insurance space.

How does Mile Auto work?

MileAuto insurance operates on a pay-per-mile model, which is designed to offer a more flexible and often cheaper insurance option for drivers who use their vehicles less frequently. Check out pay by miles auto reviews to see if this system works for your driving habits.

Is there a Mile Auto insurance app?

There is not a Mile Auto app for tracking mileage. Instead of relying on GPS tracking devices or mobile apps, Mile Auto asks customers to manually submit photos of their car’s odometer to calculate your insurance costs based on the miles you drive, aligning with Mile Auto’s pay-per-mile model.

This approach caters to those who prioritize privacy, as it avoids continuous location tracking. Customers receive email reminders to submit their odometer readings, ensuring they remember to report their mileage for accurate billing.

What is the Mile Auto insurance phone number?

Mile Auto insurance customer service can be reached through their business line, which operates during standard business hours from Monday to Friday. If you’re wondering how to manage your auto insurance policy with Mile Auto, visit the official website for the latest contact information and insurance documents.

Who owns Mile auto insurance?

Our review of pay by miles car insurance found that Spinnaker Insurance owns Mile Auto.

Who has the best pay-per-mile car insurance in Texas?

We found that Safeco, Progressive, and Allstate offer the best pay-as-you-go auto insurance in Texas. However, you should check out various pay-per-mile car insurance reviews to find the right program for you.

Learn More: Best Texas Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Bm7

If I could give Negative 10 Stars

Jett95

Just don’t do it!

LaTrina_Roberson_

Fraudulent company

Account_User

Liars

Shugs

Horrible Insurance Company

TrippleB

Stay Away!

Bobby_provost

Great company

Bobby_provost

Impossible to cancel

INGRA

THE GOOD AND BAD - WHY I LOVE MILE AUTO

Atlanta1996

Great service and saved a lot of money