National Unity Auto Insurance Review for 2025 (See Ratings & Cost Here!)

Our National Unity auto insurance review found rates starting at $85 a month, plus multi-vehicle discounts up to 20%. Specializing in liability coverage for Mexican vehicles in the U.S. and Canada, National Unity also offers reliable roadside assistance and fast claims support for cross-border drivers.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

National Unity Insurance

Monthly Rates:

$85A.M. Best Rating:

B++Complaint Level:

LowPros

- Specialized cross-border coverage

- Affordable rates

- Discounts for multiple factors

Cons

- Mixed customer satisfaction

- Limited online reviews

- National Unity specializes in selling insurance for Mexican cars and commercial trucks that are traveling from Mexico to the U.S. and/or Canada.

- National Unity was founded in 1969 but didn't start selling insurance until 1995.

- National Unity sells commercial and personal vehicle insurance, roadside assistance, and homeowners insurance.

Our National Unity auto insurance review reveals rates starting at $85 per month, offering specialized liability coverage for Mexican vehicles traveling to the U.S. or Canada.

With over 50 years of experience and a 40% market share, National Unity provides tailored insurance options, including multi-vehicle discounts up to 15%.

National Unity Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.0 |

| Business Reviews | 3.0 |

| Claim Processing | 2.8 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.5 |

| Coverage Value | 3.0 |

| Customer Satisfaction | 2.3 |

| Digital Experience | 2.5 |

| Discounts Available | 3.7 |

| Insurance Cost | 3.8 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.8 |

National Unity has become a top cheap full coverage auto insurance that provides affordable and dependable coverage customized to each driver’s needs, along with temporary coverage policies for cross-border travel, flexible claims processes, and customers win once again.

If you want to know if you can pay less for auto insurance, just enter your ZIP code into our free quote tool to compare rates from different companies in your area right now.

- National Unity auto insurance starts at $85/month with tailored coverage

- Specialized liability policies cover Mexican vehicles traveling to the U.S. or Canada

- Drivers get up to 20% multi-vehicle discounts and easy claims support

National Unity Auto Insurance: Affordable Rates and Tailored Coverage

National Unity Insurance offers the cheapest liability-only auto insurance for Mexican vehicles traveling in the U.S. or Canada, starting at $85/month with up to 20% discounts for multi-vehicle policies. With 40% of the market and over 50 years of experience, it offers tailored coverage and seamless claims support for cross-border drivers.

National Unity Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $250 | $500 |

| Age: 16 Male | $270 | $550 |

| Age: 18 Female | $230 | $450 |

| Age: 18 Male | $255 | $510 |

| Age: 25 Female | $120 | $270 |

| Age: 25 Male | $135 | $300 |

| Age: 30 Female | $100 | $230 |

| Age: 30 Male | $110 | $245 |

| Age: 45 Female | $90 | $210 |

| Age: 45 Male | $100 | $225 |

| Age: 60 Female | $85 | $205 |

| Age: 60 Male | $95 | $215 |

| Age: 65 Female | $88 | $210 |

| Age: 65 Male | $98 | $220 |

National Unity offers competitive car insurance rates based on coverage, age, and gender. Minimum coverage starts at $85/month for 60-year-old women, while full coverage peaks at $550/month for 16-year-old males. Premiums decrease with age, and females typically pay less than males.

National Unity provides customized car insurance policies with coverage options for cross-border drivers, so carefully review to determine the level of coverage and available discounts before purchasing insurance to make sure you are getting the most value for your investment, and directly contact to the claims department any time an incident occurs in order to prevent delays in processing.Tim Bain Insurance Agent

Whether you’re seeking temporary or full coverage, the competitive pricing ensures options for every need and budget. Explore National Unity to find a policy that fits your unique requirements today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

National Unity vs. Major Auto Insurance Providers: Monthly Rate Comparison

When choosing an auto insurance provider, understanding the differences in pricing can help you find the best coverage for your budget and determine how much car insurance you need to ensure you’re adequately protected without overpaying.

This table shows how National Unity’s monthly auto insurance rates stack up against the best providers for both minimum and full coverage. How much you pay varies widely among companies based on their pricing and the types of coverage.

National Unity Auto Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $220 | $220 | |

| $220 | $220 | |

| $80 | $131 | |

| $160 | $160 |

| $312 | $345 |

| $149 | $149 |

| $105 | $105 | |

| $76 | $141 | |

| $149 | $149 | |

| $86 | $149 |

For instance, the full-damage coverage of National Unity is priced competitively with major insurers like Farmers, Liberty Mutual, and Allstate, while Geico has the cheapest minimum-coverage rates. Knowing these rates can help you make a better decision based on your budget and coverage.

National Unity Auto Insurance Rates: Driving Records, Credit Scores, and Competitor Comparison

National Unity’s rates for auto insurance are competitive with the best providers, and premiums differ based on your driving record and credit score. Although USAA has the cheapest rates at $110/month if you have good credit, National Unity specializes in providing lower rates for cross-border drivers, so is among the leaders for specialized needs.

National Unity Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $150 | $180 | $230 | |

| $140 | $170 | $220 | |

| $130 | $160 | $210 | |

| $135 | $165 | $215 |

| $145 | $175 | $225 |

| $125 | $155 | $205 |

| $140 | $170 | $220 | |

| $120 | $150 | $200 | |

| $130 | $160 | $210 | |

| $110 | $140 | $190 |

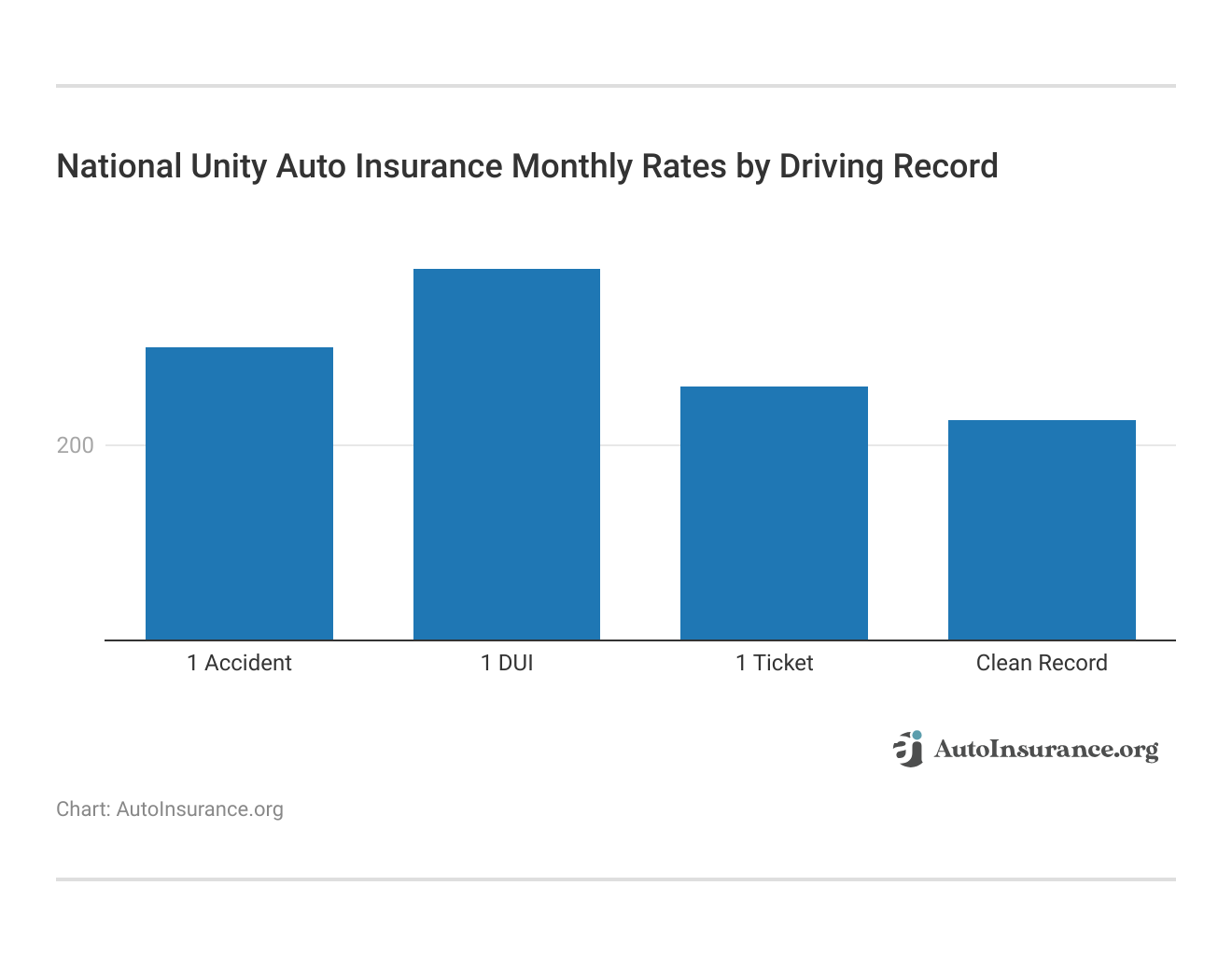

National Unity auto insurance rates are influenced by driving history, with how auto insurance companies check driving records affecting premiums. Drivers with a clean record pay as low as $200, while one ticket increases rates to $260, an accident to $300, and a DUI to $380.

Not only do you have access to cheap and affordable insurance rates with a good driving record; it is an indication of what kind of driver you are, and because of it, you may be able to get discounts, and even qualify for a better policy as time goes on. Not only does a clean record help drivers get reliable, cost-effective coverage, it builds trust in insurance providers as well.

Maximize Your Savings With National Unity Auto Insurance Discounts

National Unity auto insurance provides a number of discounts to help drivers reduce their premiums. The discounts are between 7% and 25% on coverage type and eligibility. For example, bundling policies can save you 25% or more, and safe drivers may get a 22% discount.

National Unity Auto Insurance Discounts

| Discount Name |  |

|---|---|

| Bundling | 25% |

| Safe Driver | 22% |

| Multi-Vehicle | 20% |

| Good Student | 18% |

| Defensive Driving | 15% |

| Low Mileage | 12% |

| Paid-in-Full | 10% |

| Senior Driver | 10% |

| Anti-Theft | 8% |

| Paperless | 7% |

Other opportunities include discounts for multi-vehicle policies, good students, and those with low mileage, along with additional savings for senior drivers, anti-theft devices, and paperless billing. The best multi-vehicle auto insurance discounts further enhance National Unity’s appeal, making it a competitive option for those looking to reduce their auto insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comprehensive Coverage Options With National Unity Auto Insurance

National Unity auto insurance offers a variety of types of auto insurance coverage options tailored to drivers, especially those traveling across borders, ensuring that you have the right protection whether you need liability, comprehensive, or collision coverage.

- Liability Coverage: This is the core coverage that helps pay for damages and injuries to others if you’re at fault in an accident. It is essential for meeting legal requirements in the U.S. and Canada.

- Collision Coverage: Covers damage to your car either in an accident, however who you are at fault. This coverage pays for repairs to your car or a replacement after an accident.

- Comprehensive Coverage: It pays for things not related to a collision, like theft, vandalism, natural disasters, or hitting an animal. It assists you in paying for your vehicle repairs or replacements.

- Personal Injury Protection (PIP): This type of coverage pays for medical expenses and lost wages for you and your passengers after an accident, regardless of who caused it. It can be especially useful in no-fault states.

- Uninsured/Underinsured Motorist Coverage: Offers protection if you are in an accident with another driver who has no insurance or not enough coverage to pay for your damages. This means you won’t be stuck with high costs due to another party’s lack of insurance.

The coverage options from National Unity auto insurance are customizable to fit your specific requirements, providing you protection wherever you travel.

Discover these coverage types to suit your every car need, driving with confidence that you are insured for it by an affordable provider.

National Unity Auto Insurance: Ratings, Reviews, and Claims Experiences

National Unity Auto Insurance holds an A rating from A.M. Best, indicating strong financial strength and stability. Despite this, customer satisfaction is relatively low, with Consumer Reports giving the company a score of 68/100.

National Unity Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: A Good Business Practices |

|

| Score: 68/100 Fair Customer Satisfaction |

|

| Score: 1.80 Above Avg. Complaints |

|

| Score: B++ Good Financial Strength |

Additionally, National Unity holds a concerning 1.80-star rating, which reflects above-average complaints from policyholders. While the company boasts strong financial security, potential customers should carefully consider the mixed customer feedback.

National Unity Auto Insurance: Key Benefits and Drawbacks

National Unity auto insurance has the advantage of good financial ratings and specialized coverage for cross-border drivers, but customer reviews and online feedback may be concerning.

Pros

- Solid Financial Stability: National Unity holds a B++ (Good) rating from A.M. Best, ensuring financial reliability and the ability to meet its obligations.

- Specialized Coverage: Offers unique coverage options for cross-border travel, making it an excellent choice for drivers in the U.S. and Canada.

- Comprehensive Insurance: Provides a range of coverage options, including liability, collision, and comprehensive, to meet diverse customer needs.

Cons

- Low Customer Review Score: Customers rated this company 1/5 star, implying their services are not satisfactory.

- Limited Online Reviews: The company has limited online consumer feedback, making it harder for prospective customers to gauge service quality.

National Unity auto insurance has solid financial stability and customized coverage options, but potential customers should weigh the limited online reviews and extremely low customer satisfaction scores.

After a long drive over the border, my car was damaged in a small collision; National Unity's cross-border coverage meant that the repairs were completely covered, the claims process was fast and seamless, and I could rest easy during the whole experience.Tonya Sisler Insurance Content Team Lead

Considering the pros and cons will help you decide if this insurer is right for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

National Unity Auto Insurance: Strengths, Weaknesses, and What You Need to Know

National Unity auto insurance is is also recognized for its good financial strength, receiving a B++ rating from A.M. Best. It specializes in cross-border coverage, for unique protection for drivers in the U.S. and Canada, with a variety of comprehensive auto insurance options.

However, National Unity faces challenges with a low 1/5 star customer rating and lacks BBB accreditation. Limited online feedback makes it hard to fully assess its reputation. While the company offers strong financial stability and specialized coverage, its customer service and online reputation may require careful consideration.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What sets National Unity Insurance Company apart from other providers in the industry?

National Unity Insurance Company focuses on cross-border coverage for vehicles going from Mexico to the U.S. or Canada. It has been in business for over 50 years and has a 40% market share. Its policies can be tailored to your needs like multiple vehicle discounts and temporary travel coverage.

How do National Unity Insurance Company reviews reflect their customer service and overall satisfaction?

While National Unity Insurance Company has strong financial stability with a B++ rating from A.M. Best, customer reviews are mixed, with some expressing dissatisfaction due to limited communication after claims. The company is not accredited by the BBB, and customer ratings tend to reflect challenges in customer service, despite its solid financial standing.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

What do National Unity Insurance reviews say about their customer service and claims process?

National Unity Insurance reviews highlight mixed feedback from customers. While some value the competitive pricing and cross-border coverage, others have faced delays in communication and comprehensive auto insurance claim processing. Understanding these experiences can help set expectations when choosing this provider.

What is the National Unity Insurance Company claims phone number for reporting an incident?

National Unity Insurance Company provides their claims reporting number for 24/7 access. For the latest and most accurate claims contact information for your area, we recommend reviewing the official website or your policy documentation.

What are the benefits of choosing National Unity Insurance Co for cross-border coverage?

National Unity Insurance Co specializes in providing low-cost and dependable auto coverage for Mexican cars traveling in the U.S. and Canada. With coverage that provides the peace of mind and freedom to cross borders, their policies are tailored specifically to the needs of cross-border drivers, making cross-border travel hassle-free.

How can I find the best coverage options under a National Unity policy for cross-border driving?

Drivers crossing between the U.S. and Canada or Mexico can take advantage of specific liability coverage with a National Unity policy. Discounts like these help drivers maximize coverage benefits while minimizing their auto insurance premiums, but drivers can explore additional options such as multi-vehicle discounts, low-mileage savings, and anti-theft device discounts.

How does National Unity roadside assistance compare to other providers?

National Unity roadside assistance provides a range of services including towing, battery jump-starts, and tire changes, catering to both short and long-distance drivers. Their roadside assistance is specifically designed to support policyholders who frequently travel across borders, ensuring that you receive help when you need it most, regardless of location.

How can I access and manage my National Unity auto insurance policy online?

National Unity auto insurance has an online portal where policyholders can manage their accounts. However, simply log into the National Unity online portal and you will be able to update your personal details, view and pay for bills, review the policy documents, and file claims. This handy feature makes it easy for you to take care of your policy whenever you need to.

How do I handle National Unity claims if I experience damage caused by an uninsured driver?

If you’re hit by an uninsured driver, National Unity will guide you through the claims process, helping you provide evidence and police reports, while determining if your best uninsured and underinsured motorist (UM/UIM) coverage applies.

Does National Unity auto insurance provide an online quote tool for potential customers?

Yes, National Unity auto insurance has an online quote tool available on their website. Potential customers can input their ZIP code and other information to get customized quotes. This tool lets you see options for coverage and underwriting along with prices to help you find the best policy that suits you.

What are the benefits of choosing cheap National Unity auto insurance for budget-conscious drivers?

Starting at $85/month, National Unity has competitive rates, appealing to drivers wanting to save. With discounts ranging from bundling to safe driving, you can have both a lower premium and quality coverage.

How can I find the best National Unity rates for my specific coverage needs?

To get the best National Unity rates, compare coverage options like liability, comprehensive, and collision auto insurance. Consider factors like vehicle age, driving history, and location. Use online tools to compare quotes from National Unity and other insurers to find the most competitive price.

What benefits does National Unity Insurance Company offer for drivers in Mexico?

National Unity Insurance Company also specializes in offering coverage for vehicles operating in the U.S. and Canada, including liability for Mexican vehicles. It is perfect for people that travel often between these countries, offering reliable insurance services that always keep you covered for any eventualities encountered on your travels.

What makes National Unity the best option for cross-border insurance?

National Unity is a top choice for cross-border insurance, especially for travel between the U.S., Canada, and Mexico. With 50+ years of experience, competitive pricing, and services like temporary border-crossing policies, they offer tailored coverage for unique auto insurance needs in these regions.

Is there a National Unity insurance office near me for in-person assistance?

If you’re searching for National Unity near me, you can easily find their offices through their website or a map service. Whether it’s for face-to-face assistance with policy changes, claims, or learning how to manage your auto insurance policy, National Unity offers personalized support at various locations, especially for cross-border coverage.

How does National Unity Premium vary depending on the type of coverage?

National Unity premium prices vary according to coverage level, driving record, and the location of the vehicle. Premiums range from basic liability to comprehensive coverage due to the driver’s unique requirements but will start at $85/month for liability coverage.

What distinguishes National Unity Company in the U.S. from other insurance providers?

Some insurance providers, like National Unity Company U.S., carve out a market niche by specializing in insurance solely for cross-border drivers, particularly those with vehicles moving between the U.S. and Mexico. Their flexible policies, such as temporary and liability coverage, offer niche protection not commonly provided by any other U.S. provider.

How does the National Unity deductible structure work for policyholders?

National Unity auto insurance offers deductible options from $250 to $1,000, with higher deductibles lowering your monthly premium to better fit your budget and risk tolerance. To pay your auto insurance deductible, simply follow the instructions provided during the claims process or through your online account.

How does National Unity auto insurance handle cross-border coverage between the U.S. and Canada?

Specialized auto insurance coverage when driving between the U.S. and Canada is available through National Unity auto insurance with a variety of liability and comprehensive options to find the right coverage for drivers within both countries.

What is the significance of the business rating for National Unity when choosing an insurance provider?

National Unity holds a B++ rating from A.M. Best, reflecting solid financial stability and the ability to meet financial obligations. Despite lower customer satisfaction, this strong rating makes it a reliable choice, especially for cross-border coverage.

You can find affordable auto insurance no matter your driving record by entering your ZIP code in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Luzcla

THEY DON'T COMMUNICATE AFTER OVER 2 MONTHS OF THE ACCIDENT

Rashuna

Great insurance equals great customers!!