Novo Auto Insurance Review for 2025 (See Pricing & Options Here!)

Our Novo auto insurance review highlights why it’s the best option for drivers looking for telematics-based insurance rates based on mileage, braking, acceleration, and speeding. Novo car insurance rates start at $56 a month, but coverage is only available in Arizona, Indiana, Ohio, Tennessee, and Wisconsin.

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

![]()

Novo

Monthly Rate:

$56A.M. Best:

A-Complaint Level:

LowPros

- Novo offers cheaper rates to safe drivers

- Novo has an A rating from BBB for business practices

- Discount of up to 15% for automatic enrollment

Cons

- Novo is only available in five states

- Novo only offers standard coverages like collision and comprehensive

Our Novo auto insurance review found it best for drivers looking for telematics insurance policies, where monthly rates are based on driving behavior.

Novo Insurance adjusts your rates each month based on factors like acceleration, braking, and mileage. This means that safe drivers should be able to get cheap usage-based auto insurance at Novo.

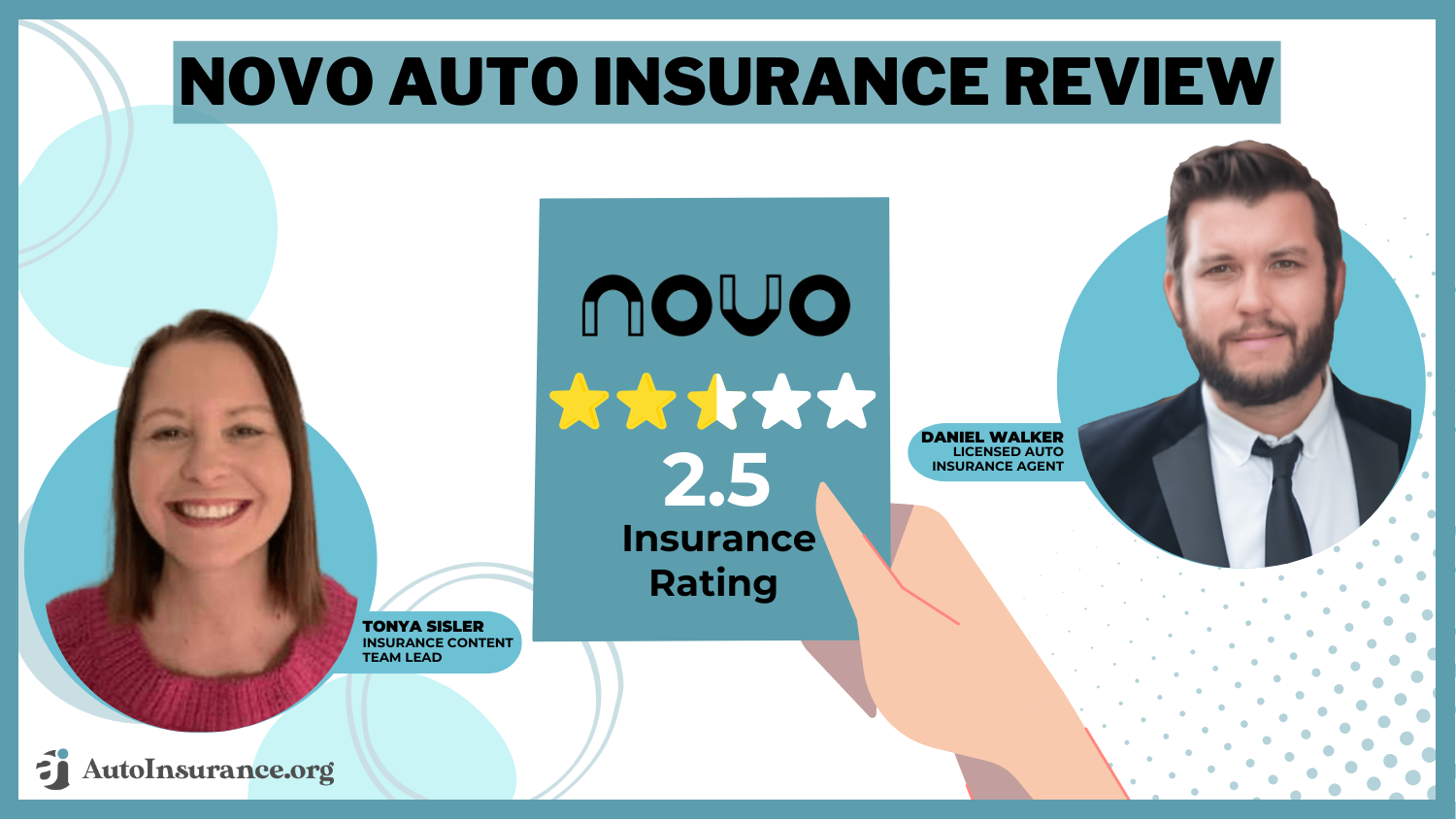

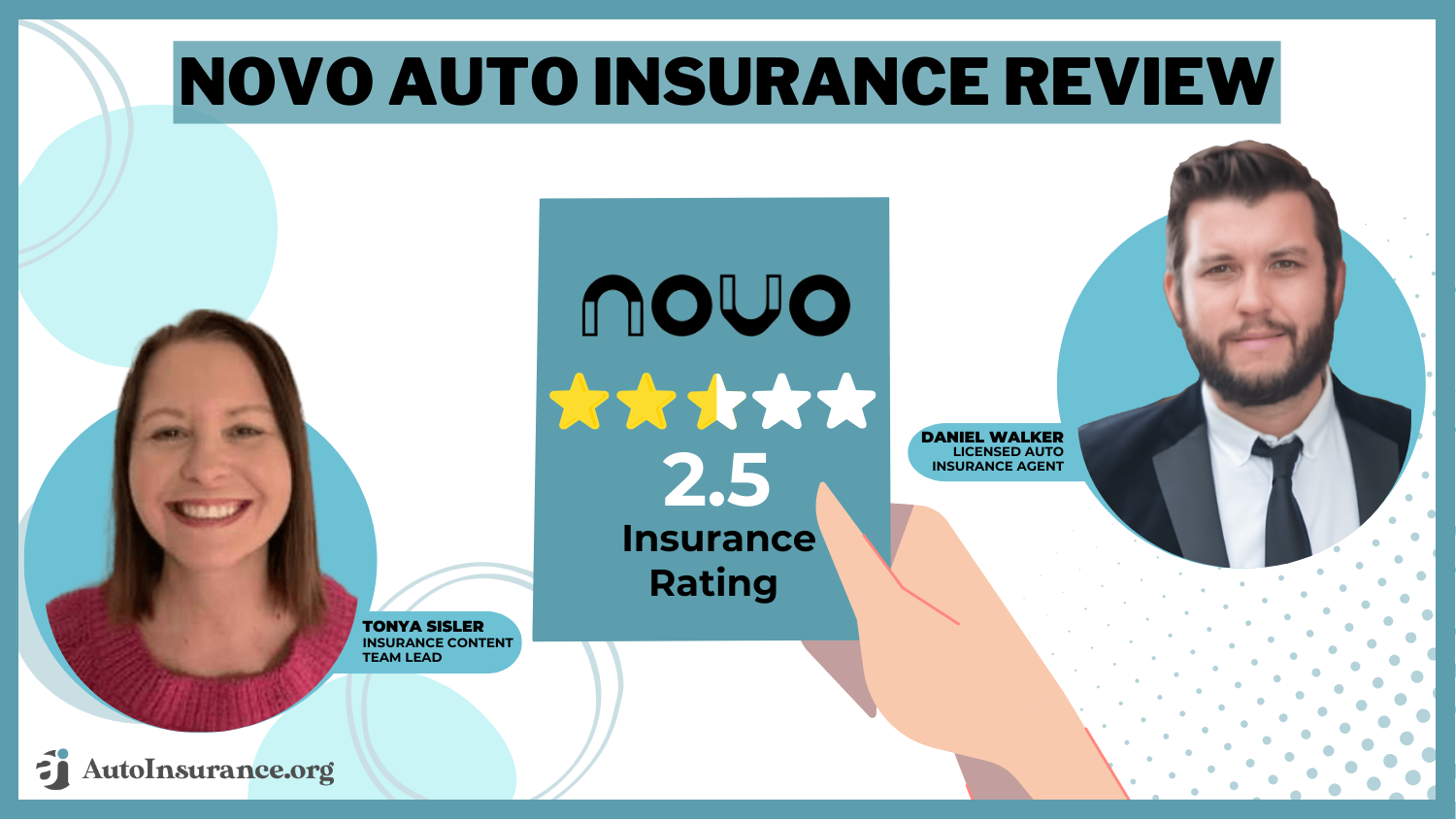

Novo Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 2.5 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 2.5 |

| Discounts Available | 2.0 |

| Insurance Cost | 2.6 |

| Plan Personalization | 3.0 |

| Policy Options | 1.5 |

| Savings Potential | 2.4 |

However, Novo’s limited availability — only in five states — and lack of additional coverage options like roadside assistance may not appeal to everyone.

Looking to find a new auto insurance provider? Be sure to compare multiple quotes to find the best coverage for your needs.

- Novo Insurance, LLC is a telematics-based insurance provider

- Novo average insurance rates start at $56 per month

- Novo auto insurance is only sold in five states: AZ, IN, OH, TN, WI

Novo Auto Insurance Rates

Novo car insurance operates a bit differently than other companies in that its rates are based on your driving behaviors and mileage each month. This means that the rate you pay one month may be different than the rate you pay next month.

Who pays the highest auto insurance premiums? Take a look at average Novo rates for full and minimum coverage options by age and gender below to see who pays the most for coverage.

Novo Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $97 | $181 |

| Age: 16 Male | $112 | $198 |

| Age: 18 Female | $92 | $158 |

| Age: 18 Male | $104 | $172 |

| Age: 25 Female | $78 | $134 |

| Age: 25 Male | $84 | $146 |

| Age: 30 Female | $69 | $118 |

| Age: 30 Male | $73 | $126 |

| Age: 45 Female | $62 | $104 |

| Age: 45 Male | $67 | $113 |

| Age: 60 Female | $56 | $97 |

| Age: 60 Male | $63 | $106 |

| Age: 65 Female | $66 | $109 |

| Age: 65 Male | $72 | $119 |

The better you drive each month, the cheaper your rates will be. However, we can still give you a baseline of what auto insurance rates look like at Novo.

Novo is a telematics insurance program, meaning it tracks driving information and calculates your rates each month based on acceleration, speeding, hard braking, and mileage.Brandon Frady Licensed Insurance Producer

Make sure to pick a coverage amount that matches your needs. For most drivers, full coverage auto insurance is necessary and is even required if a vehicle is leased.

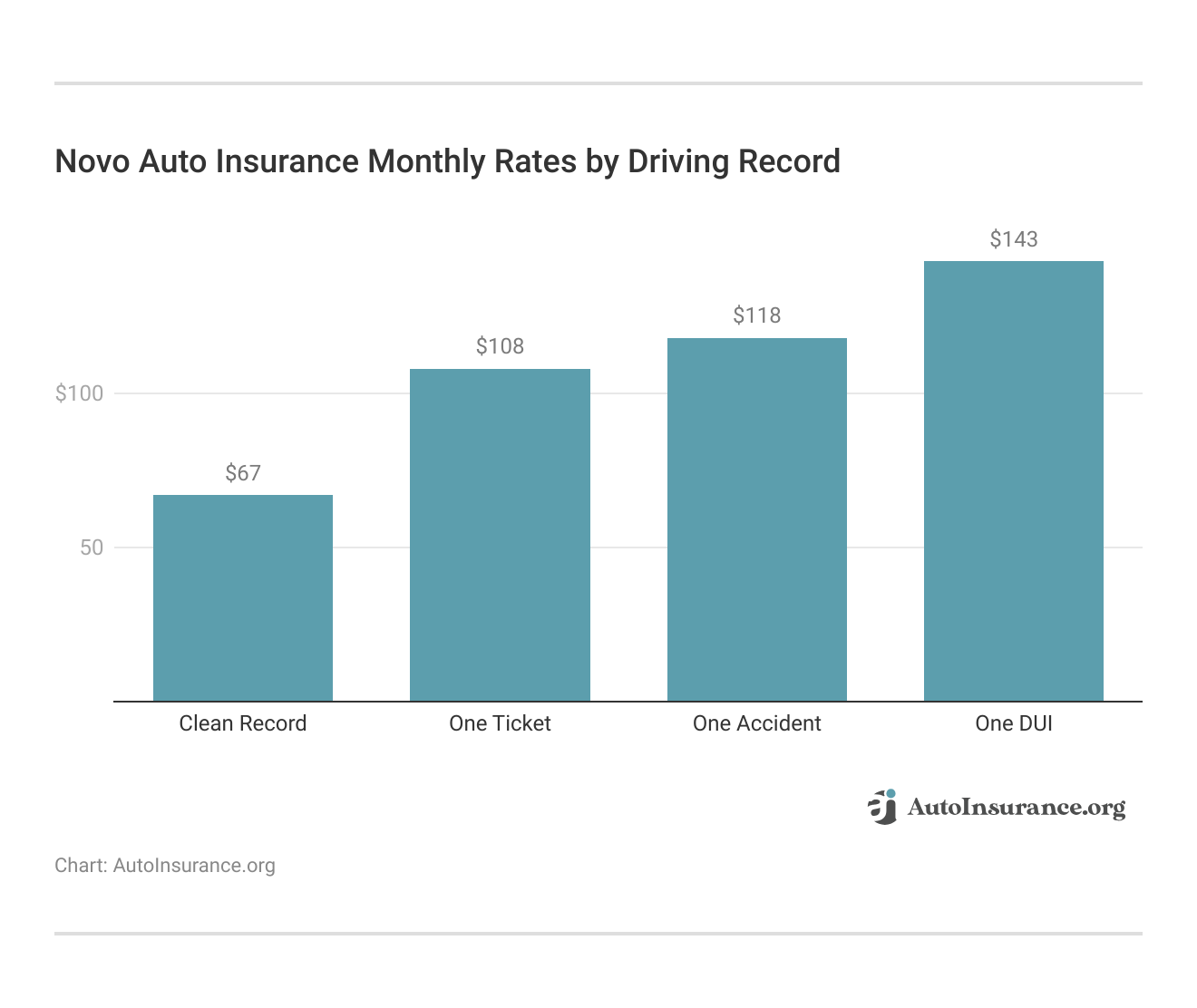

Driving habits are the other major factors that affect Novo rates besides coverage and age. A poor driving record will make coverage more expensive.

Based on the rates, Novo is best for drivers with clean driving records and safe driving habits. Novo’s telematic rate program makes it less than ideal for poor drivers who will score poorly in Novo’s Safety Program.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Novo Auto Insurance Rates vs. The Competition

It is wise to shop around and compare rates from Novo and other major insurers to ensure you are getting the best deal. See how Novo compares to its competitors based on coverage levels below.

Novo Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $160 | $188 | |

| $117 | $136 | |

| $139 | $173 | |

| $80 | $106 | |

| $174 | $212 |

| $115 | $137 |

| $84 | $124 | |

| $105 | $140 | |

| $86 | $96 | |

| $99 | $134 |

Novo is one of the cheapest companies for both minimum and full coverage plans. State Farm and Geico are the only companies cheaper on average than Novo (Learn More: Geico vs. State Farm Auto Insurance). While Novo may seem like the clear choice price-wise, bear in mind that there are other things to consider besides just price, which we will cover in the next few sections.

Because driving record will play a large role in what you pay at Novo and other companies, see rates based on driving record below.

Novo Full Coverage Insurance Monthly Cost vs. Top Competitors by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 |

|

| $248 | $302 | $335 | $447 |

| $164 | $196 | $198 | $230 |

| $145 | $164 | $173 | $195 | |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $198 | $294 |

Novo auto insurance coverage prices fall more in the middle for drivers with poor records. Several companies, such as State Farm, will be cheaper on average than Novo if you have a poor driving record.

Auto Insurance Coverage Available at Novo

If you are looking for a company with multiple add-on coverages, Novo may not be the right fit for you. Novo carries just the basic auto insurance coverages, as you can see in the table below.

Available Auto Insurance Coverages at Novo

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers damages and injuries you cause to others in an accident, including bodily injury and property damage. |

| Collision Coverage | Pays for damages to your vehicle resulting from a collision, regardless of fault. |

| Comprehensive Coverage | Protects against non-collision damages such as theft, vandalism, natural disasters, or animal collisions. |

| Uninsured Motorist Coverage (UM) | Covers damages if you're hit by an uninsured driver. |

| Underinsured Motorist Bodily Injury Coverage (UIMBI) | Pays for medical expenses if the at-fault driver lacks sufficient insurance. |

If you want extras like roadside assistance, gap coverage, modified car coverage, and other add-on coverages, you’ll have to choose a different company.

However, if you are just looking for basic coverages that fulfill your state’s minimum coverages, then Novo will meet your needs.

Read More: Types of Auto Insurance

Novo Auto Insurance Discounts

Because Novo is a telematics-based auto insurance company that discounts rates based on driving, it doesn’t offer as many discounts as traditional providers.

However, this doesn’t mean that there aren’t any discounts offered. Take a look at Novo auto insurance discounts below.

Novo Auto Insurance Savings and Discounts

| Discount Name | |

|---|---|

| Safe Driver | 40% |

| Usage-Based | 40% |

| Multi-Vehicle | 10% |

| Good Student | 15% |

| Anti-Theft Device | 2% |

| Paperless Billing | 4% |

| Paid-in-Full | 9% |

| Automatic Payments | 5% |

| Low Mileage | 10% |

Safe driving habits will result in the biggest discount on your car insurance rates at Novo. Autopayments will also earn you a discount while eliminating Novo bank problems that may occur without automatic payments.

You can also get small discounts for paperless billing and having an anti-theft device installed in your car, such as a GPS tracking system (Learn More: Best Anti-Theft Auto Insurance Discounts).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of Novo Auto Insurance

Customer reviews give valuable insight into a company. For example, you can check Novo Trustpilot for reviews or read a Novo auto insurance review on Reddit to see what customers think.

We’ve included a Novo auto insurance thread on Reddit below to give you a glimpse into what customers think of Novo Insurance.

Social Novo reviews with negative feedback tend to center around telematics tracking. Customers aren’t happy with increased rates for things like braking while sitting in traffic and the uncertainty of different charges each month.

This is a common complaint about telematics auto insurance companies. While technology has improved, even the best auto insurance apps may still have inaccuracies in the data recorded.

Business Ratings of Novo Insurance

Is Novo reputable? Researching Novo company reviews from businesses is important to answering that question. Businesses have rated Novo for financial health, customer satisfaction, and more.

Novo Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 765 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 80 / 100 High Customer Satisfaction |

|

| Score: 0.82 Fewer Complaints Than Avg. |

|

| Score: A- Strong Financial Strength |

Novo’s ratings from businesses are average. It has an A- rating from A.M. Best for financial strength, and the Novo BBB rating is an A. However, it has a high customer satisfaction rating from Consumer Reports.

The overall picture of Novo, based on these business ratings, is that the company is trustworthy, and most customers are satisfied with its services. However, the company doesn’t have the highest ratings possible.

Learn More: Best Auto Insurance Companies According to Consumer Reports

Novo Auto Insurance Pros and Cons

Novo offers flexible insurance that is best for drivers looking for basic coverage based on their driving habits. Below are the key benefits of Novo Insurance.

- Telematics-Based Rates: Novo offers cheap car insurance rates to safe drivers with low mileage.

- Business Practices: Novo auto insurance customer service has an A rating from the BBB for its business practices.

- Automatic Enrollment Discount: Novo offers up to 15% for automatic enrollment.

While Novo may be great for drivers looking for quick, flexible insurance policies, it’s not perfect. The disadvantages of Novo insurance include:

- Limited Availability: Novo currently only sells insurance in five states (Arizona, Indiana, Ohio, Tennessee, and Wisconsin).

- Coverage Options: Novo doesn’t sell any add-ons besides the basics like collision and comprehensive.

Make sure to compare Novo to other auto insurance options to make sure it’s the right choice for you (Read More: How to Get Multiple Auto Insurance Quotes).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Choosing Novo Auto Insurance as Your Provider

Our Novo auto insurance review found its telematics-based rate structure rewards safe drivers with lower premiums. If you’re a safe driver with low mileage, Novo could be a great fit for you if you are looking to pay as you go (Learn More: Best Pay-As-You-Go Auto Insurance Companies).

However, notable cons are its limited availability, as it only operates in five states, and its limited coverage options. Some customers also complain about Novo auto insurance claims service, as experiences vary by state.

Not sure Novo is right for you? Be sure to compare multiple car insurance quotes online to ensure you find the best policy and rate for your needs.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Novo Insurance legit?

Wondering can Novo be trusted? Nova is a reputable company that A.M. Best, BBB, and other businesses have rated highly.

Who is Novo backed by?

Novo Insurance, LLC is underwritten by KnightBrook Insurance Company.

What type of company is Novo?

Novo is a telematics auto insurance company, meaning it tracks driving behavior and mileage to calculate rates. This type of coverage is best for good drivers (Read More: Best Auto Insurance for Good Drivers).

Who owns Novo Insurance?

Novo is owned by Telenav, Inc., a mobile GPS technology company.

How long has Novo been around?

Novo was established in 1999.

Who is #1 in auto insurance?

State Farm currently has the largest share in the auto insurance marketplace. Find out more about the company in our State Farm auto insurance review.

How long does Novo take to approve?

Novo will approve or reject you for insurance within a day or two.

Is it safe to pay insurance online?

Wondering is Novo a good company to trust with online payments? Novo has secure payment avenues for policies (Read More: Can I pay my auto insurance online?).

Should I pay for auto insurance with a credit card?

Credit cards are just one way to pay for car insurance. You can also pay with direct bank transfers, debit, and check. However, most people prefer credit cards as they can earn credit card points.

Why is auto insurance cheaper online?

The reason it’s often cheaper to get car insurance online is that you can quickly compare rates among multiple companies, allowing you to find the cheapest rate. Find affordable auto insurance today with our free quote comparison tool.

What is the most trusted auto insurance company?

One of the most trusted car insurance companies is USAA, which has an A++ rating from A.M. Best. Learn more in our USAA auto insurance review.

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.