Peak Auto Insurance Review for 2025 (See if They’re a Good Fit)

Peak Insurance, an Alabama insurer, offers rates from $58 a month, with coverage available only to Alabama drivers. Read our Peak auto insurance review to learn about custom coverage from 35+ carriers, 20% discounts, and 24/7 claims support, with rates based on credit score, age, gender, and coverage type.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviews

Peak Insurance

Monthly Rates:

$58A.M. Best Rating:

A+Complaint Level:

MedPros

- Trusted since 1938, Peak Insurance offers decades of local expertise

- Offers diverse personal and business coverage through 35+ carriers

- Peak Insurance offers personal service and great rates

Cons

- Missing policy management, claim tracking, and mobile app support

- Serves only Alabama, limiting access for out-of-state customers

- Peak Property and Casualty Insurance Corporation is a policy provider and subsidiary of the Sentry Insurance Group.

- Peak Property and Casualty is a privately owned mutual insurance company, as is Sentry Insurance

- Peak Property and Casualty strives to maintain excellent customer service and claims management.

Peak Insurance is an Alabama-based insurer offering coverage exclusively to Alabama drivers. Discover our Peak auto insurance review, where qualified drivers can find rates starting at $58 a month.

Peak Insurance offers tailored policies through a network of over 35 carriers, allowing customers to compare options and find the best fit.

Peak Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.4 |

| Business Reviews | 3.0 |

| Claim Processing | 2.3 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.6 |

| Coverage Value | 2.9 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 4.0 |

| Plan Personalization | 3.5 |

| Policy Options | 2.5 |

| Savings Potential | 4.1 |

With 24/7 claims support and flexible personal, commercial, life, and bond coverage, auto insurance rates by age can vary significantly, along with credit score, gender, and coverage type.

- Peak’s liability insurance coverage starts at $58 monthly

- Custom coverage from 35+ carriers with up to 20% discounts for Alabama drivers

- Rates range from $58 to $140 based on age, credit score, and coverage type

To see which insurers offer the lowest minimum auto insurance rates in your area, enter your ZIP code above into our free comparison tool.

Peak Auto Insurance Rates by Age, Gender, Credit and Driving History

Founded in 1938 in Central Alabama, Peak Insurance has grown into one of the state’s largest independent agencies. Serving only Alabama drivers, it offers competitive rates, 24/7 claims support, and professional service through strong partnerships with top insurance carriers.

Peak Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $370 | $575 |

| 16-Year-Old Male | $405 | $615 |

| 18-Year-Old Female | $320 | $510 |

| 18-Year-Old Male | $355 | $550 |

| 25-Year-Old Female | $175 | $250 |

| 25-Year-Old Male | $185 | $260 |

| 30-Year-Old Female | $130 | $200 |

| 30-Year-Old Male | $140 | $210 |

| 45-Year-Old Female | $110 | $165 |

| 45-Year-Old Male | $120 | $175 |

| 60-Year-Old Female | $100 | $155 |

| 60-Year-Old Male | $110 | $165 |

| 65-Year-Old Female | $105 | $153 |

| 65-Year-Old Male | $112 | $160 |

Peak auto insurance monthly rates vary by age and gender, with 16-year-old males paying the highest premiums—up to $615 for full coverage.

Age and gender affect rates as young males pay more and older drivers less. For example, compare quotes to find the best deal.Daniel Walker Licensed Auto Insurance Agent

Rates decrease significantly with age, with 60-year-old females paying as low as $100 for minimum coverage.

Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $181 | $209 | $279 | |

| $114 | $140 | $278 | |

| $177 | $214 | $317 | |

| $106 | $123 | $165 | |

| $192 | $246 | $340 |

| $119 | $138 | $169 |

| $125 | $150 | $200 |

| $129 | $161 | $225 | |

| $107 | $148 | $293 | |

| $109 | $136 | $197 |

Peak Insurance has competitive rates at every tier of credit, with good credit drivers paying about $125 on average per month. Peak’s average rate for fair credit is $150, and $200 for poor credit, making it less expensive than Liberty Mutual and Farmers, but still providing some rather consistent pricing and a personable approach.

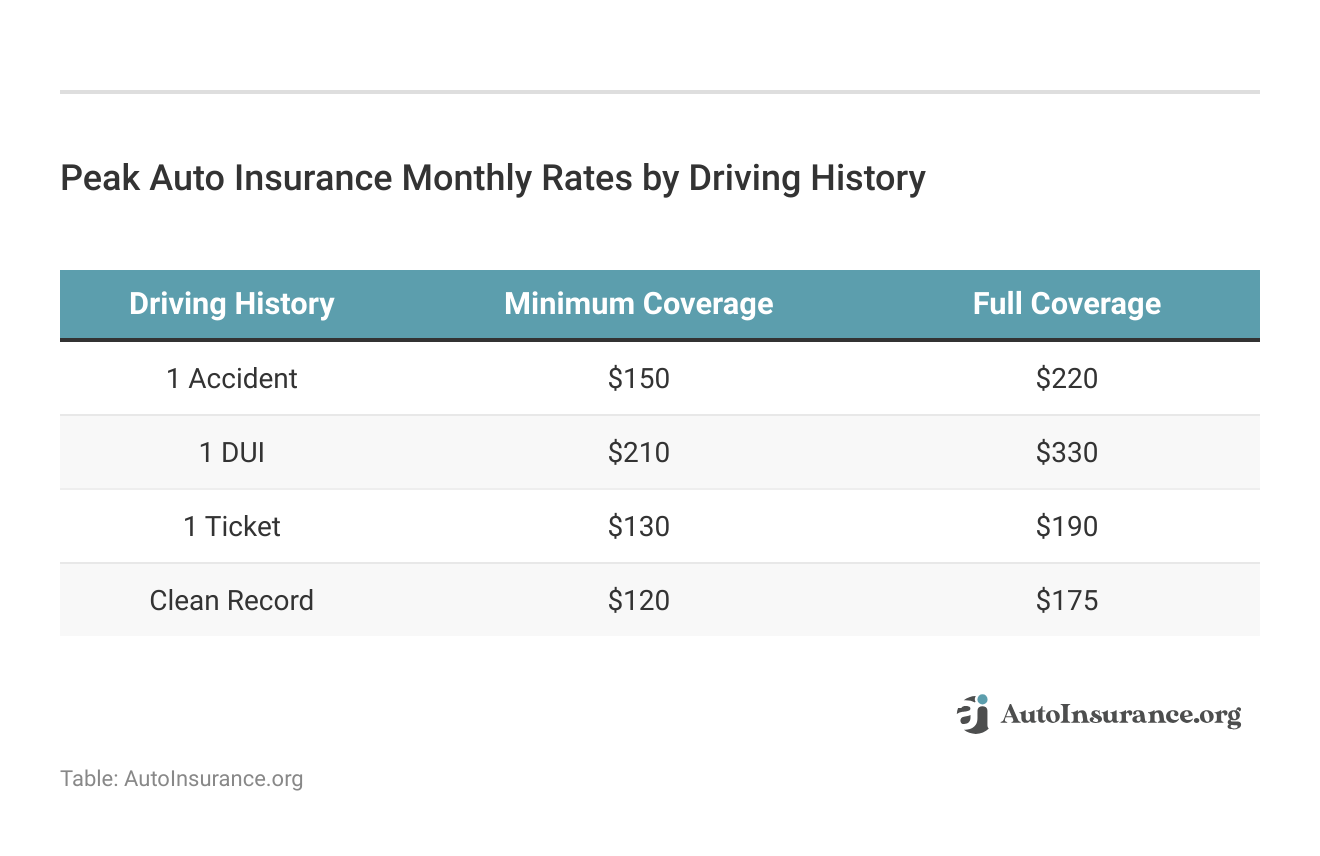

Peak auto insurance monthly rates vary based on driving history, starting at $58 for minimum coverage and $200 for full coverage auto insurance with a clean record.

Rates increase with violations, reaching up to $210 for drivers with a DUI under full coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Peak Auto Insurance Rates Compared to Top Providers

Compare Peak auto insurance review rates with major carriers to see how they compare. Peak’s base plan is priced at $58 for minimum coverage and $156 for full coverage, which is lower than Liberty Mutual, Farmers and Allstate, but similar to Progressive and State Farm.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $58 | $156 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

Reviewing these rates side by side helps drivers identify the most cost-effective auto insurance for different types of drivers based on their driving profiles and insurance needs.

Top Peak Auto Insurance Discounts to Maximize Your Savings

There are several auto insurance discounts with Peak Insurance to reduce monthly premiums they offer to their policyholders to save them money. Drivers are eligible for up to 20% off for having a clean driving record, while bundling policies qualify for a 15% multi-policy discount.

Peak Auto Insurance Discounts

| Discount |  |

|---|---|

| Safe Driver | 20% |

| Multi-Policy | 15% |

| Good Student | 15% |

| Pay-in-Full | 12% |

| Multi-Vehicle | 10% |

| Defensive Driving | 10% |

| Loyalty | 10% |

| Low Mileage | 10% |

| Paperless Billing | 5% |

| AutoPay | 5% |

Additional savings include 15% for good students, 12% for paying in full, and 10% for insuring multiple vehicles or completing a defensive driving course. Loyalty, low mileage, paperless billing, and automatic payments can each provide 5–10% off.

These best auto insurance discounts can be combined to significantly reduce monthly rates and customize coverage to fit your budget.

Peak Auto Insurance Offers Trusted Coverage and Support

Peak auto insurance, available only to Alabama drivers, offers all-in-one coverage designed to protect you on and off the road. The Peak Coverage plan includes liability and collision, optional comprehensive coverage, plus extras like roadside assistance and rental reimbursement for added peace of mind.

- Liability Coverage: Covers bodily injury and property damage you cause to others in an accident.

- Collision Coverage: Pays for damage to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: This covers damage from non-collision events like theft, fire, vandalism, or weather.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance.

- Personal Injury Protection (PIP): Helps pay for medical expenses, lost wages, and more, regardless of fault.

With a strong commitment to service through Peak Service, industry partnerships like SecureRisk, and a dedication to choice and advocacy as a Trusted Choice® agency, Peak auto insurance goes beyond standard coverage.

Customers can also contact Peak Casualty auto insurance through the Peak auto insurance phone number, which is 1-800-473-6879, and is listed for Peak auto insurance claims.

Whether you need to file an auto insurance claim, check on the status of your existing claim, or get some assistance with policy details, the customer support team is incredibly well-equipped to help guide you through the process quickly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Peak Auto Insurance Delivers Strong Ratings With Mixed Reviews

Peak auto insurance review scores well for business ethics and financial stability, and it has an A+ from A.M. Best for superior financial strength and an A+ from the BBB for excellent business practices.

Peak Auto Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 1.40 More Complaints Than Avg. |

Its NAIC score of 1.40 indicates more complaints than the industry average, suggesting lower customer satisfaction than auto insurance companies with the best customer service.

When considering coverage, consumers may want to weigh Peak’s financial reliability and business reputation against its customer service track record.

Peak Insurance Pros Cons and What to Expect

Peak Insurance stands out as a knowledgeable, customer-focused insurance provider capable of doing just that.

- Established Reputation: Peak Insurance has been in operation since 1938. It is decades old and has deep roots in the community.

- Wide Carrier Access: They represent 35+ insurance providers and have a range of policies to suit individual and business needs.

- Independent & Customer-Focused: As a Trusted Choice® Independent Agency, they’re not tied to one insurer, allowing for more personalized service and competitive pricing.

The goal is to make sure their clients have peace of mind when it comes to coverage choices because they value their business, helping clients feel confident in their coverage decisions and ensuring adequate auto insurance coverage.

- Limited Online Tools: The current site doesn’t offer online policy management, claim tracking, or mobile app support, which some customers may expect.

- Localized Operations: Peak Insurance operates exclusively in Alabama, with offices in Selma, Birmingham, and Auburn, which may limit access and support for customers outside the state.

While Peak Insurance offers personalized service and a solid local presence, limited digital tools and regional availability may be considerations for those seeking nationwide reach or online convenience.

Bundling auto and home insurance with Peak can cut premiums by up to 15%. Combining policies is an easy way to maximize savings.Tonya Sisler Insurance Content Team Lead

Peak Insurance remains a solid and reputable choice for those in Alabama seeking a dependable, personalized insurance partner.

Get Affordable Rates With Peak Auto Insurance

Peak auto insurance review highlights competitive rates and personalized coverage from 35+ carriers—exclusively for Alabama drivers. As a local Alabama insurer, Peak offers an A+ financial rating, strong community presence, and 24/7 claims support.

Peak auto insurance has drawbacks like limited online tools and a regional focus, which may not suit drivers seeking nationwide coverage or comprehensive auto insurance with strong online options.

You can find affordable auto insurance, no matter your driving record, by entering your ZIP code into into our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Can I check the status of my auto claim by calling the Peak Insurance claims phone number?

Yes, policyholders can call the Peak Insurance claims phone number to check the status of an existing claim, ask about required documents, or speak directly with a claims representative.

Does Peak Insurance review mention claims process satisfaction?

Yes, many Peak Insurance reviews mention the 24/7 claims support as a key benefit, though experiences vary. While some customers report smooth and efficient claims handling, others note occasional delays or communication gaps.

Avoid expensive auto insurance premiums by entering your ZIP code for the cheapest rates.

Can I lower my Peak auto insurance rate with discounts?

Yes, Peak offers discounts such as safe driver, multi-policy, best good student auto insurance discounts, and low mileage discounts that significantly reduce your monthly Peak auto insurance rate.

How long does it take to process Peak Property and Casualty auto claims?

Processing times for Peak Property and Casualty auto claims can vary depending on the complexity of the claim, but most straightforward claims are processed within 7–14 business days. You may receive updates via phone or email throughout the process.

Are the rates from Peak Insurance in Florida different from those in other states?

Insurance rates often vary by state due to regional regulations, risk factors, and local market conditions. Peak Insurance in Florida may offer different pricing than Alabama or other regions.

Can I track the status of my claim during the Peak Insurance claim process?

Yes, Peak Insurance lets claimants check claim status through customer service or their representative. However, depending on your policy, online tools for managing your auto insurance policy may be limited.

Do Peak Insurance Advisors offer support for filing claims?

Yes, Peak Insurance Advisors provide 24/7 claims support by phone or online, helping clients navigate the claims process efficiently and with expert guidance.

Does Peak Insurance Agency serve clients outside of Alabama?

While Peak Insurance Agency is based in Alabama with offices in Selma, Birmingham, and Auburn, its ability to serve clients in other states depends on carrier partnerships and licensing—it’s best to contact the agency directly to confirm.

Does Peak Claims Group offer 24/7 claims support?

Peak Claims Group provides around-the-clock claims assistance to ensure auto insurance policyholders can report accidents and get help whenever needed.

Is there a separate Peak Insurance phone number for customer service?

No, there is one main Peak Insurance phone number (1-800-473-6879) used for both customer service and claims-related calls. It’s a central line, meant to field most inquiries effectively.

Are there any digital tools or online features available with Peak Insurance services?

While Peak Insurance emphasizes personal service through its local offices, its online capabilities are currently limited. Customers may need to rely more on phone or in-person assistance for policy management, which may be a drawback for those preferring digital self-service tools.

Are peak financial reviews reliable for assessing claim-paying ability?

Peak financial reviews are key to understanding the company’s ability to pay claims, including liability auto insurance coverage, by assessing assets and economic performance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Who should I contact for help with a denied Peak Protection insurance claim?

If your Peak Protection claim is denied, you can request a review by contacting their claims department and providing supporting documents. If the issue remains unresolved, consider escalating to a supervisor or your state’s insurance department.

Does the Peak Property auto insurance phone number connect to policy support for both new and existing customers?

Yes, the phone number 1-800-473-6879 is used for both prospective and existing policyholders. New customers can inquire about coverage options, while current policyholders can get help managing their accounts or updating their coverage.

Can drivers outside Alabama purchase Peak car insurance?

Peak car insurance primarily serves Alabama drivers, with offices in Selma, Birmingham, and Auburn. Out-of-state drivers may find limited availability. Consider comparing providers with nationwide coverage options for the best auto insurance for out-of-state drivers.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.