Preferred Mutual Auto Insurance Review for 2025 (Rates, Discounts, & Options)

Explore rates starting at $70 a month in our Preferred Mutual auto insurance review. The Preferred Mutual insurance rating is 3.4/5 for competitive discounts of up to 25% and essential add-ons like roadside assistance and accident forgiveness, but it only offers coverage in New York and Massachusetts.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

![]()

Preferred Mutual Auto Insurance

Monthly Rates:

$120A.M. Best Rating:

A-Complaint Level:

LowPros

- Competitive rates from $70 per month

- Bundled discounts of up to 25% in savings for eligible drivers

- Convenient online portal for claims and payments

Cons

- Limited availability in only two states

- Lower brand visibility compared to national insurers

With insurance discounts of up to 25%, Preferred Mutual is a solid option for anyone interested in saving on multiple types of auto insurance, including accident forgiveness and roadside assistance.

Preferred Mutual Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.4 |

| Business Reviews | 4.0 |

| Claims Processing | 4.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.6 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.3 |

| Digital Experience | 3.5 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.3 |

| Plan Personalization | 4.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.5 |

Our Preferred Mutual auto insurance review gives it a solid 3.4/5 for competitive rates that average just $120 per month, but coverage is limited to New York and Massachusetts.

- Preferred Mutual earns a 3.4/5 insurance rating for competitive rates

- Qualified drivers save up to 25% with multiple discount options

- Preferred Mutual car insurance is only available in NY and MA

If you’re looking for affordable, reliable auto insurance, this provider is well worth considering. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Preferred Mutual Auto Insurance Costs

Your Preferred Mutual insurance quote depends on the coverage level, and full coverage will always be more expensive. Monthly premiums vary from $117 to $617, illustrating how experience and coverage determine premiums.

Preferred Mutual Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $497 | $580 |

| 16-Year-Old Male | $559 | $617 |

| 18-Year-Old Female | $374 | $448 |

| 18-Year-Old Male | $422 | $505 |

| 25-Year-Old Female | $181 | $241 |

| 25-Year-Old Male | $190 | $260 |

| 30-Year-Old Female | $139 | $167 |

| 30-Year-Old Male | $142 | $170 |

| 45-Year-Old Female | $117 | $137 |

| 45-Year-Old Male | $118 | $138 |

| 60-Year-Old Female | $118 | $129 |

| 60-Year-Old Male | $120 | $132 |

| 65-Year-Old Female | $123 | $130 |

| 65-Year-Old Male | $125 | $133 |

Full coverage auto insurance offers added protection but costs more, especially for new drivers. As experience grows, rates typically drop, making Preferred Mutual a more affordable option for older drivers.

Young drivers pay more due to higher risk, but rates drop with experience. For example, a 30-year-old often pays less than a teen for the same coverage.Jeff Root Licensed Insurance Agent

When compared to competitors, Preferred Mutual offers $70 for minimum and $185 for full coverage, aligning with recommended auto insurance coverage levels for balanced protection and value.

Preferred Mutual Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $70 | $185 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

Preferred Mutual is more expensive than popular providers like Geico, but it remains competitive in states like New York and Massachusetts, where car insurance rates are higher than average.

Preferred Mutual High-Risk Auto Insurance Rates

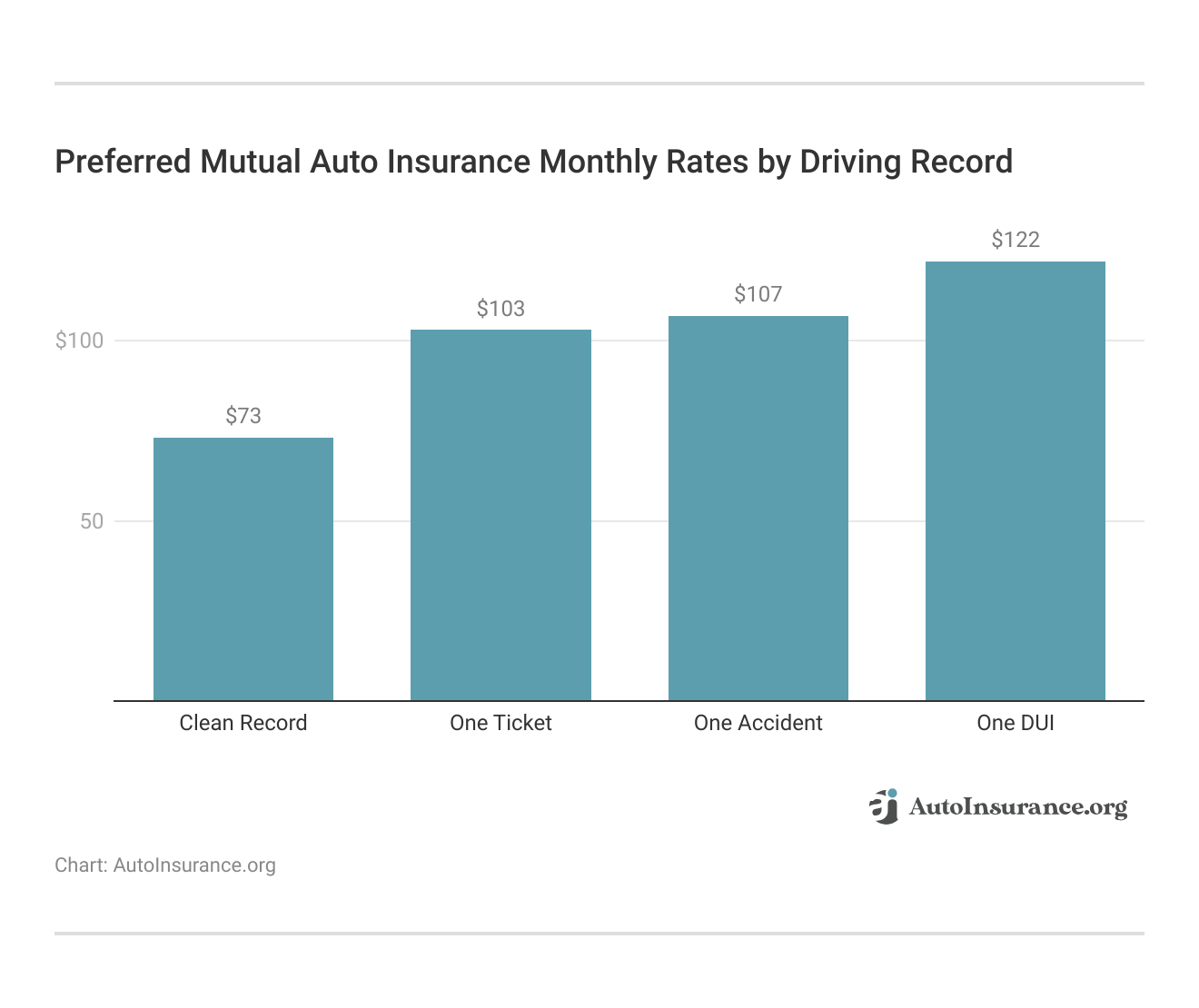

Preferred Mutual’s auto insurance rates vary significantly based on driving history. Drivers with a clean record pay the lowest monthly rates, starting at $73 for minimum coverage and $100 for full coverage.

A single ticket or accident raises premiums moderately, while a DUI results in the highest rates, reaching $220 for full coverage. However, this is still cheaper than the national average of $262 per month after a DUI. Compare these rates to cheap Auto insurance for high-risk drivers in New York to see how violations directly impact insurance costs and the value of maintaining a clean driving record.

As explained in how credit scores affect auto insurance rates, your credit rating could raise your insurance rates. Lower scores often result in higher premiums due to increased risk. This table shows full coverage auto insurance rates based on credit score tiers such as good, fair, and poor.

Preferred Mutual Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $125 | $145 | $200 | |

| $128 | $148 | $198 | |

| $135 | $160 | $220 | |

| $110 | $130 | $180 | |

| $130 | $155 | $210 |

| $118 | $138 | $188 |

| $140 | $165 | $225 | |

| $120 | $140 | $190 | |

| $105 | $125 | $175 | |

| $115 | $135 | $185 |

Preferred Mutual Insurance Company is more expensive for drivers with bad credit than other companies, at $225 monthly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save With Preferred Mutual Auto Insurance

Preferred Mutual offers a variety of car insurance discounts that aim to reward safe habits, policy bundling, and good grades for teen driver discounts. Drivers can unlock some of the best auto insurance discounts available while still keeping solid coverage.

Preferred Mutual Auto Insurance Discounts

| Discount | |

|---|---|

| Multi-Policy | 25% |

| Safe Driver | 20% |

| Anti-Theft Device | 15% |

| Good Student | 10% |

| Defensive Driving | 8% |

| Paid-in-Full | 7% |

| Auto Pay | 5% |

The biggest discount is for policyholders who combine home and auto coverage and save up to 25% with a multi-policy discount. Additional savings include 20% for safe drivers and 15% for anti-theft devices. Smaller discounts like 8% for defensive driving, 7% for paying in full, and 5% for autopay can be stacked to help drivers save more.

Preferred Mutual Auto Insurance Coverage

Preferred Mutual offers extensive coverage to protect you, your vehicle, and your financial peace of mind. Policies cover everything from liability and medical payments to collision and comprehensive coverage:

- Liability Coverage: Protects you financially if you’re at fault in an accident that causes injury or property damage to others.

- Medical Payments Coverage: Helps pay for medical expenses if you or your passengers are injured in a covered accident.

- Underinsured/Uninsured Motorist Coverage: Covers damages if you’re hit by a driver with no insurance or not enough coverage.

- Collision Coverage: Pays to repair or replace your car after an accident, regardless of who’s at fault.

- Comprehensive Coverage: Covers non-collision damage like theft, vandalism, storms, floods, or animal-related incidents.

Preferred Mutual also offers add-ons like roadside assistance, rental reimbursement, and accident forgiveness. Massachusetts auto insurance with Preferred Mutual is eligible for new car replacement, but this perk is not available in New York.

If you buy coverage, how do auto insurance payments work with Preferred Mutual? It offers flexible options like monthly billing or paying in full through its Quick Pay and the MYPreferred portal, which makes it easy to manage your policy online.

Preferred Mutual Auto Insurance Ratings and Reviews

The Preferred Mutual rating indicates comparable financial stability and high marks for customer satisfaction. A.M. Best gives them an A-, while the Better Business Bureau has assigned an A+ rating for exceptionally good business practices.

Preferred Mutual Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A- Good Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 78 / 100 Positive Customer Feedback |

|

| Score: 0.50 Fewer Complaints Than Avg. |

Consumer Reports scored Preferred Mutual Insurance Company 78 out of 100 on overall customer satisfaction, reflecting positive reviews. The NAIC’s 0.50 score shows fewer complaints than average, so it has a stellar reputation for reliable service.

Comment

byu/dhayes16 from discussion

inInsurance

This Reddit user review shares a positive early experience with Preferred Mutual after switching from Liberty Mutual. The user reports saving $3,800 per year and describes the overall experience as good, despite limited information found during their initial research.

Read More: Liberty Mutual Auto Insurance Review

The combination of these ratings, actual savings, and positive customer feedback proves that Preferred Mutual is a sound and secure option for auto insurance. Several drivers report that Preferred Mutual customer service is helpful and easy to work with, too, which adds to the company’s overall value.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Preferred Mutual Insurance Pros and Cons

Like any insurance provider, Preferred Mutual comes with its own set of strengths and limitations. Here’s a quick look at some of the key pros to consider when reading Preferred Mutual Insurance Company reviews:

- Competitive Rates: Average premiums start at $70 monthly for minimum coverage and $185 per month for full coverage.

- Bundled Discount Options: Offers up to 25% off for multi-policy holders, plus discounts for safe driving, good students, and more.

- Essential Auto Endorsements: Optional packages include roadside assistance, accident forgiveness, and new car replacement.

Preferred Mutual is a solid option for drivers looking for competitive rates and valuable coverage add-ons, especially in Massachusetts, but it is missing some important add-ons.

Ask about gap insurance or ride-sharing coverage, as these important options are not included in Preferred Mutual’s listed offerings.Tonya Sisler Insurance Content Team Lead

National providers like State Farm and Geico also have better rates, and Preferred Mutual’s limited availability and lower brand visibility may be a factor for those outside its core service area.

- Limited Availability: Primarily serves New York and Massachusetts, and is not available nationwide.

- Less Brand Recognition: May be unfamiliar to some drivers due to limited national marketing and presence.

Understanding the pros and cons of Preferred Mutual Insurance can help you decide if it fits your needs. For those in its service area, it remains a strong choice.

Learn More: Best Windshield Replacement Coverage in Massachusetts

Choosing Preferred Mutual Insurance Company

Our Preferred Mutual auto insurance review highlights competitive rates starting at $70 per month for minimum insurance. It also has solid financial ratings and discounts of up to 25% for multi-policyholders.

Its strengths in affordability, coverage flexibility, and customer-focused features make it a smart choice for drivers within its service area of New York and Massachusetts who want reliable and personalized comprehensive auto insurance.

However, if you don’t live in those states, you can start shopping for local insurance companies with our free comparison tool. Enter your ZIP code to find out where you can get the best deal on auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Does Preferred Mutual create a user-friendly experience for customers when making payments?

Yes, customers can make quick, one-time payments without logging in using the Quick Pay feature, making bill payment fast and hassle-free.

Is Preferred Mutual a good insurance company for drivers in New York?

Yes, Preferred Mutual is a solid choice for New York drivers, offering competitive rates, strong local support, and unique coverage options like the Premier Auto Endorsement.

What type of insurance does Preferred Mutual offer for personal vehicles?

Preferred Mutual offers auto insurance with liability auto insurance coverage, collision, comprehensive, uninsured motorist, and optional add-ons like towing and accident forgiveness.

What is Preferred Mutual’s customer service availability?

Preferred Mutual customer service is available during regular business hours on weekdays, with 24/7 claims support accessible through the MYPreferred portal and mobile app.

Where is the Preferred Mutual Insurance Company headquarters, and does it only serve New York?

The headquarters is in New Berlin, New York, and while the company primarily serves New York, it also sells policies in Massachusetts.

Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool.

What discounts does Preferred Mutual offer for students?

Preferred Mutual offers a 10% discount for full-time students with a B average, making it a solid option for the best good student auto insurance discounts.

Are Preferred Mutual auto insurance reviews positive about pricing and affordability?

Yes, many Preferred Mutual insurance reviews mention competitive pricing, with rates starting around $120 per month and additional savings through discounts.

I forgot my Preferred Mutual agent login credentials. What should I do?

If you forget your Preferred Mutual agent login details, click on the “Forgot Username or Password” link on the login page to reset your credentials securely.

What is Preferred Mutual’s average claim response time frame?

Preferred Mutual typically responds to a comprehensive auto insurance claim within 24 to 48 hours, depending on the nature and complexity of the claim.

What is the Preferred Mutual rating compared to national insurers?

Preferred Mutual is considered a strong regional insurer with competitive ratings, though it may not have the same nationwide recognition as larger carriers.

Can I check the status of a claim by calling the Preferred Mutual claims phone number?

Yes, you can get updates on your claim by contacting the Preferred Mutual claims phone number during business hours.

Who owns Preferred Mutual Insurance Company, and how does that affect customers?

Because Preferred Mutual is policyholder-owned, profits are reinvested to benefit the auto insurance policyholder with better rates, service, and coverage options.

Does Preferred Mutual bill pay accept automatic recurring payments?

Yes, you can set up recurring payments through Preferred Mutual bill pay by logging into your MYPreferred account and enabling autopay.

Is a Preferred Mutual quote free, and does it affect my credit score?

Yes, getting Preferred Mutual insurance quotes is free and typically does not impact your credit score since it’s considered a soft inquiry. Enter your ZIP code to start comparing premiums from highly-rated insurers in your area.

Is the Preferred Mutual login secure for making payments online?

Yes, the Preferred Mutual login portal is encrypted with SHA-256 to protect your personal and payment information. Similarly, the portal is also available to pay auto insurance online safely.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.