Progressive vs. Travelers Auto Insurance in 2025 (Best Value Revealed)

Progressive and Travelers auto insurance offers competitive rates at $110 and $105 per month. After comparing Progressive vs. Travelers auto insurance, our review found Progressive has cheaper rates for teens and seniors, while Travelers excels with its discount programs for middle-aged drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsProgressive vs. Travelers auto insurance offers different benefits for various drivers. Progressive is notable because it has good rates for young and older drivers, while Travelers shines with many discounts and more choices in coverage options.

The article goes into details about financial ratings, how happy customers are, and the way claims are handled. This helps you decide which provider is best for your needs.

Progressive vs. Travelers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.5 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.3 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.5 | 4.3 |

| Progressive Review | Travelers Review |

Every company gives special advantages, making sure drivers can get customized choices according to their age and what kind of coverage they want. Discover how auto insurance rates by age impact your premiums with Progressive and Travelers.

Before comparing Progressive vs. Travelers, enter your ZIP code to find free auto insurance quotes from companies in your area.

- Progressive vs. Travelers auto insurance starts at $105/month

- Travelers excels with discounts and flexible coverage options

- Progressive offers competitive rates for teens and seniors

Comparing Progressive and Travelers Rates by Age and Gender

This table shows how Progressive vs. Travelers auto insurance prices change depending on age and gender. The comparison helps to see which company gives cheaper choices for different groups of people.

Progressive vs. Travelers Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $801 | $719 |

| Age: 16 Male | $814 | $910 |

| Age: 30 Female | $131 | $99 |

| Age: 30 Male | $136 | $108 |

| Age: 45 Female | $112 | $98 |

| Age: 45 Male | $105 | $99 |

| Age: 60 Female | $92 | $89 |

| Age: 60 Male | $95 | $90 |

For teenage drivers, Travelers give better prices for girls, but Progressive has cheaper rates for boys. At 30 years old, Travelers offers lower costs for both men and women and keeps being affordable until age 45.

At age 60, the difference in rates becomes smaller, but Travelers still provides somewhat lower prices for both men and women drivers. This analysis can help identify which insurance company is a better match for you, making sure you get the most affordable choice.

Progressive vs. Travelers Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $105 | $99 |

| Not-At-Fault Accident | $186 | $139 |

| Speeding Ticket | $140 | $134 |

| DUI/DWI | $140 | $206 |

Drivers who have clean records will see that Travelers provides somewhat cheaper rates compared to Progressive. But, if the accident is not their fault, Travelers’ rates become much more favorable in comparison to Progressive.

Progressive have lower prices for drivers who get speeding tickets, but Travelers charge much more if driver has DUI/DWI. This information helps to understand which insurance company is better choice depending on driver’s past driving behavior. Uncover the top factors that affect auto insurance rates and how they vary by driver.

Progressive vs. Travelers Monthly Auto Insurance by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $120 | $240 | |

| $115 | $230 | |

| $100 | $200 |

| $125 | $250 | |

| $95 | $190 | |

| $110 | $220 |

| $105 | $210 |

| $110 | $215 | |

| $100 | $205 | |

| $115 | $230 |

| $105 | $220 |

Understanding the costs of auto insurance by coverage level can help drivers make informed decisions. This table compares monthly premiums for minimum and full coverage offered by major providers, showcasing affordability and coverage variations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Available Coverages With Progressive vs. Travelers

Auto insurance companies offer numerous forms of coverage to customers. Combining these coverages allows customers to create their ideal policy. Basic coverages provided by Progressive and Travelers include:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection

- Uninsured/Underinsured Motorist Coverage

- Medical Payment Coverage

- Collision Insurance

- Comprehensive Insurance

- Rental Car Reimbursement

- Rideshare Insurance

In addition to the basic coverages, Travelers offers GAP insurance, new car replacement, and accident forgiveness.

Available Discounts With Progressive vs. Travelers Auto Insurance

Auto insurance discounts allow customers to save on their coverage. Comparing Progressive vs. Travelers auto insurance company discounts will help you determine the provider that offers the most savings.

Progressive vs. Travelers Auto Insurance Discount by Savings Potential

| Discount Name | ||

|---|---|---|

| Anti-Lock Brakes | 5% | 5% |

| Anti-Theft | 25% | 15% |

| Bundling | 10% | 17% |

| Claim-Free | 26% | 15% |

| Continuous Coverage | 10% | 5% |

| Daytime Running Lights | 1% | X |

| Defensive Driver | X | 5% |

| Distant Student | X | 15% |

| Driver’s Ed | X | 15% |

| Driving Device/App | 25% | 50% |

You can also obtain Travelers and Progressive windshield replacement coverage should you suffer glass damage.

Financial Strength of Progressive and Travelers Auto Insurance

Credit rating agencies review and rate insurance companies based on financial strength. These financial ratings determine the company’s likelihood of providing a payout when you file a claim. The most trusted rating agencies have rated Progressive and Travelers. Get insights into how long you can file a claim after a car accident to stay informed.

Progressive has been rated an A+ by A.M. Best, an A2 by Moody’s, and an AA by S&P. These are solid ratings, indicating that Progressive will provide a payout when you file a claim.

Travelers has been rated an A+ by A.M. Best, an Aa2 by Moody’s, and an AA by S&P. These are excellent ratings and suggest that Travelers is very financially strong. While Progressive and Travelers have been rated the same by A.M. Best and S&P, Travelers is rated higher by Moody’s.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Analyzing Complaints for Progressive vs. Travelers Auto Insurance

The Better Business Bureau (BBB) and the National Association of Insurance Commissioners (NAIC) allow customers to list complaints about insurance companies. The organizations have received complaints about Progressive and Travelers.

At the time of this comparison, the BBB has received 2,812 complaints about Progressive. The company’s NAIC complaint index ratio is also 1.66, indicating that Progressive has more complaints than similarly-sized companies.

The best offense is a good defense! Bundling your home and auto with Progressive gives you double coverage when life calls a trick play. Whose defense are you counting on this Sunday? pic.twitter.com/oyH9Vvm050

— Progressive (@progressive) September 22, 2024

The BBB has received 427 complaints about Travelers. According to the NAIC, the company’s complaint index ratio is 0.90, indicating fewer complaints than competitors of a similar size. These numbers show that Travelers has greater customer satisfaction than Progressive.

Read more:

Progressive vs. Travelers Roadside Coverage

Progressive and Travelers offer roadside assistance plans to customers. This coverage is helpful when policyholders suffer car trouble while on the road.

In most states, Progressive includes roadside assistance with comprehensive insurance and collision insurance coverage. Travelers offers two levels of roadside assistance. The basic plan includes:

- Towing up to 15 Miles

- Battery Service

- Fuel Delivery

- Tire Change

- Locksmith Service

The Travelers premium option includes everything in the basic plan and trip interruption reimbursement, allowing drivers to obtain up to $200 per day for a rental car.

If you purchase roadside assistance as an add-on, it will increase your Progressive or Travelers auto insurance quotes.

Mobile App Features of Progressive vs. Travelers

Progressive and Travelers offer mobile apps that are accessible on any mobile device. Entering a Progressive or Travelers Insurance login allows customers to access digital ID cards, manage policies, request roadside assistance, and make payments.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Steps to File a Claim With Progressive or Travelers

Customers that buy Progressive or Travelers can file auto insurance claims through the companies’ mobile apps, websites, or by calling customer service. You can reach Progressive Insurance customer service by calling (800) 776-4737. You can claim Travelers Insurance by calling (800) 252-4633.

Evaluating the Top Choice: Progressive or Travelers

The decision on the best auto insurance company depends on your age and personal preference. Younger and older drivers will often find Progressive to be the cheaper option. On the other hand, those between the ages of 30 and 60 will find lower rates with Travelers.

🔔 #SafeDrivingTip: Turning on your phone’s “do not disturb” function before you begin driving can help reduce the temptation to browse online at a red light or immediately respond to a text message.

Find more tips from the @NatlDDCoalition: https://t.co/iS4wx4sbQW #FocusOn pic.twitter.com/y0btT0vBOt

— Travelers (@Travelers) October 19, 2023

Even if Progressive offers lower rates for your age, Travelers has more discount opportunities, allowing customers to decrease their monthly rates. Examining these discounts will help you find the best choice for your auto insurance.

Evaluating Progressive and Travelers Auto Insurance Business Ratings

The table display how Progressive compare to Travelers auto insurance according to different business rating agencies. It show important differences in customer happiness, number of complaints, and financial health.

Insurance Business Ratings & Consumer Reviews: Progressive vs. Travelers

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 860 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Feedback | Score: 76/100 Good Customer Feedback |

|

| Score: 1.11 Avg. Complaints | Score: 1.12 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

J.D. Power rates Travelers slightly higher in customer satisfaction, reflecting its strong service performance. Both companies get very good grades from A.M. Best, showing they have strong financial power. But Travelers is a little bit better with an A++ rating.

Consumer Reports says Travelers has better feedback from customers, but both companies have good reputations. Progressive has a little higher complaint index, which means they can get better at dealing with customer issues.

Comment

byu/alterego_001 from discussion

inInsurance

This content from a Reddit post highlights why Travelers is a recommended choice for insurance. A commenter, who sells Travelers Insurance in Texas, emphasizes its benefits, including deductible savings, first-claim protection, and no rate hikes for total loss claims. They shared an example of a customer with a totaled Infiniti who avoided paying a deductible, showcasing the value Travelers offers compared to Geico and Progressive.

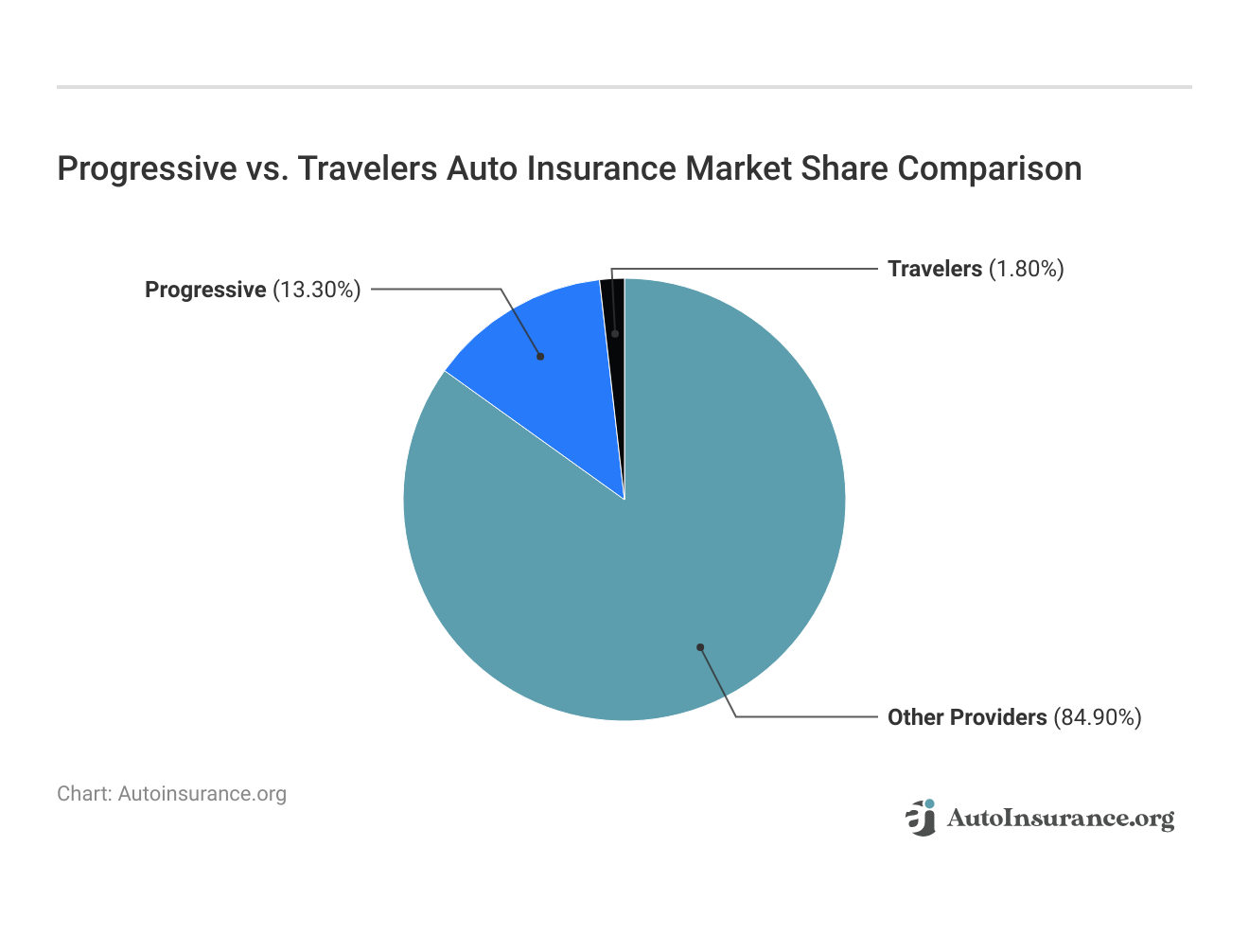

Progressive has big market share, showing it has many customers and does a lot of advertising. Travelers is smaller but gives special coverage and good prices, staying strong in important groups of people.

The difference in market share shows Progressive’s appeal to various age groups, while Travelers focuses on price-sensitive customers with specific plans. Knowing these details helps people pick an insurance company that fits their wants and needs better. Get the details on the best auto insurance companies to find the perfect fit for your policy.

Concluding Thoughts on Progressive vs. Travelers Auto Insurance

The choice between Progressive and Travelers insurance depends on what’s most important to you. While Travelers generally has lower rates than Progressive, the companies are rated the same by A.M. Best and offer similar coverages.

Progressive’s higher complaint index of 1.11 contrasts with Travelers’ lower 1.12, indicating slightly better customer satisfaction for Travelers.Brandon Frady Licensed Insurance Producer

Comparing Travelers vs. Progressive auto insurance will help you determine the best option for your situation. If you aren’t happy with your decision, check out our guides for how to cancel Progressive auto insurance or how to cancel Travelers auto insurance. Now that you’ve compared Progressive vs. Travelers, enter your ZIP code to get free auto insurance quotes from companies in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Travelers Insurance better than Progressive?

Travelers Insurance may be better than Progressive for middle-aged drivers due to its discounts and flexible coverage, while Progressive offers lower rates for teens and seniors. Learn how auto insurance rates by age impact premiums for different driver groups.

How does Allstate vs Progressive compare?

The comparison of Allstate vs Progressive highlights Progressive’s lower monthly rates for younger and older drivers, while Allstate offers robust bundling options and coverage features.

What are the differences between Allstate and Travelers?

The comparison of Allstate vs Travelers shows Allstate’s bundling options and Travelers’ affordable rates with discounts for middle-aged drivers. Uncover affordable auto insurance rates from the top providers by entering your ZIP code.

How does Amica vs Travelers compare for auto insurance?

Amica vs Travelers highlights Amica’s focus on customer satisfaction while Travelers provides affordable monthly rates and extensive discount programs.

Does Progressive offer new car replacements?

Yes, Progressive offers new car replacement insurance through its “Progressive Advantage” program, covering replacement for a totaled vehicle within the first few years.

How does Erie vs Travelers Insurance compare?

Erie vs Travelers Insurance contrasts Erie’s strong regional service focus with Travelers’ competitive rates and discounts for drivers of all ages.

What are the benefits of Esurance vs Travelers?

Esurance vs Travelers examines Esurance’s digital-first insurance experience and Travelers’ broader discounts and affordable monthly rates.

How do Farmers vs Travelers compare for coverage?

Farmers vs Travelers highlights Farmers’ tailored policies for rural drivers and Travelers’ extensive coverage and discount flexibility.

What does Geico vs Travelers offer for affordability?

Geico vs Travelers compares Geico’s low-cost policies across most age groups to Travelers’ competitive rates and additional discount opportunities for middle-aged drivers.

How expensive is Travelers Insurance?

Travelers Insurance is reasonably priced, with rates starting at $37 per month, offering competitive pricing and savings through various discount programs.

Is Travelers a good insurance?

Travelers is a good insurance option, offering affordable monthly rates, extensive discounts, and strong financial ratings, making it a reliable choice for many drivers.

How does Liberty Mutual vs Travelers compare?

Liberty Mutual vs Travelers highlights Liberty Mutual’s coverage customization options, while Travelers offers more competitive monthly rates and a variety of discounts for drivers.

What are the differences between National General and Travelers?

National General vs Travelers compares National General’s niche focus on high-risk drivers with Travelers’ competitive rates and broad coverage for all age groups. Dive into our National General review to explore its features and pricing.

How does Nationwide vs Travelers stack up?

Nationwide vs Travelers contrasts Nationwide’s vital customer service with Travelers’ affordable monthly rates and flexible coverage options for middle-aged drivers.

What is the Progressive AM Best rating?

The Progressive AM Best rating is A+, indicating strong financial stability and a high likelihood of paying claims.

What does Progressive auto insurance in Florida cover?

Progressive auto insurance in Florida offers liability, collision, comprehensive coverage, and additional options like rental reimbursement and roadside assistance.

What is the difference between Progressive basic vs choice coverage?

Progressive basic includes essential coverages like liability, while choice adds benefits like accident forgiveness and small claims forgiveness for added protection.

How does Progressive car insurance quote comparison work?

Progressive car insurance quote comparison allows drivers to evaluate customized rates, helping them find affordable monthly premiums based on their unique profiles.

What is the Progressive car insurance quote phone number?

The Progressive car insurance quote phone number is 1-800-776-4737, where you can request a quote or speak with a representative for assistance. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.