Progressive vs. USAA Auto Insurance in 2025 (Side-by-Side Review)

When comparing Progressive vs. USAA auto insurance, USAA offers cheaper rates than Progressive. Full USAA coverage starts at $84 a month compared to Progressive's $150 a month. However, Progressive has more flexible plans than USAA. Learn more about these two providers in our guide below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsWhen comparing Progressive vs. USAA auto insurance, USAA offers cheaper rates than Progressive. Full USAA coverage starts at $84 a month compared to Progressive’s $150 a month.

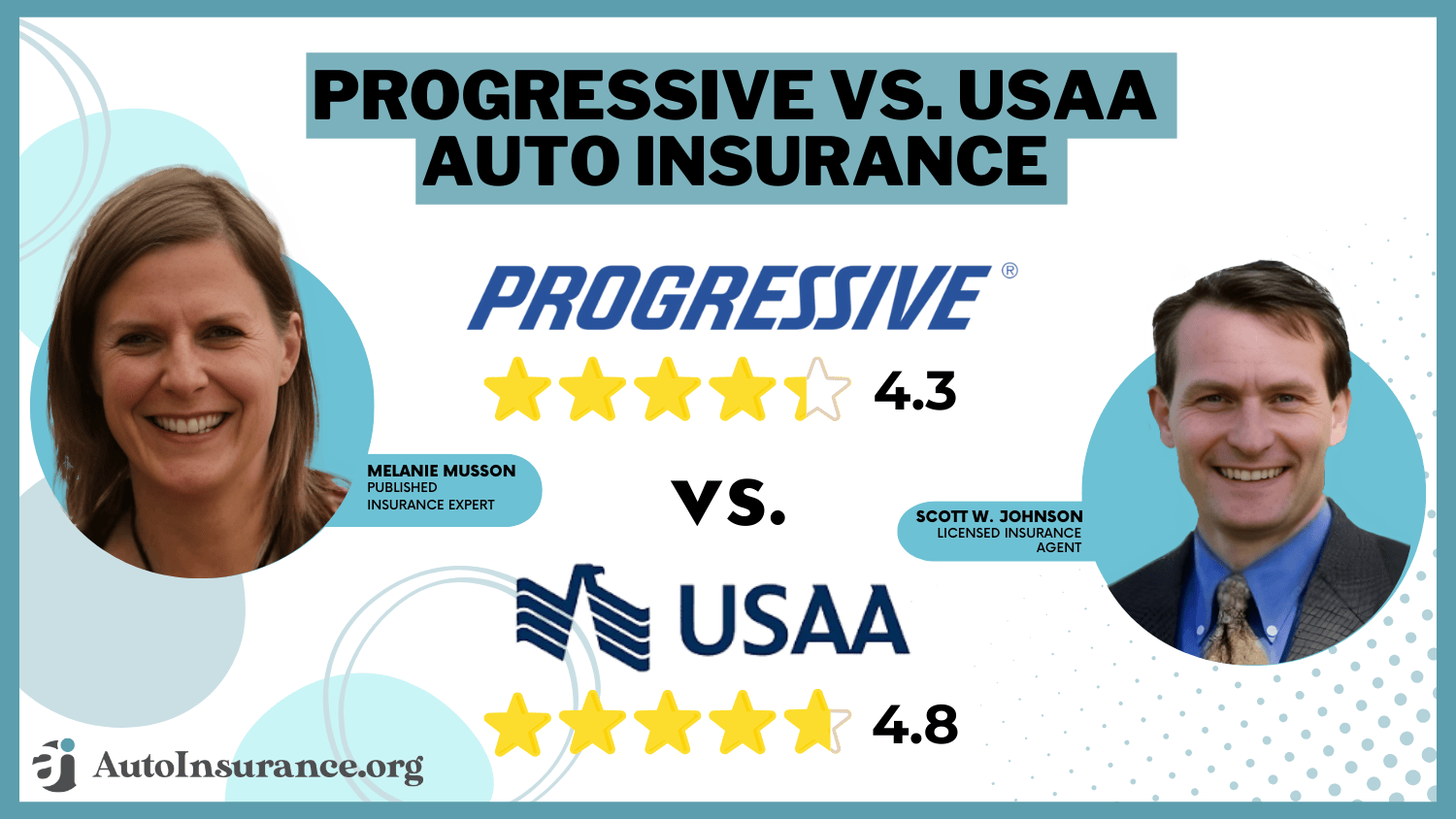

Progressive Vs. USAA Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.8 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.5 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.7 |

| Customer Satisfaction | 2.1 | 2.4 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.4 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.6 | 4.8 |

| Progressive | USAA |

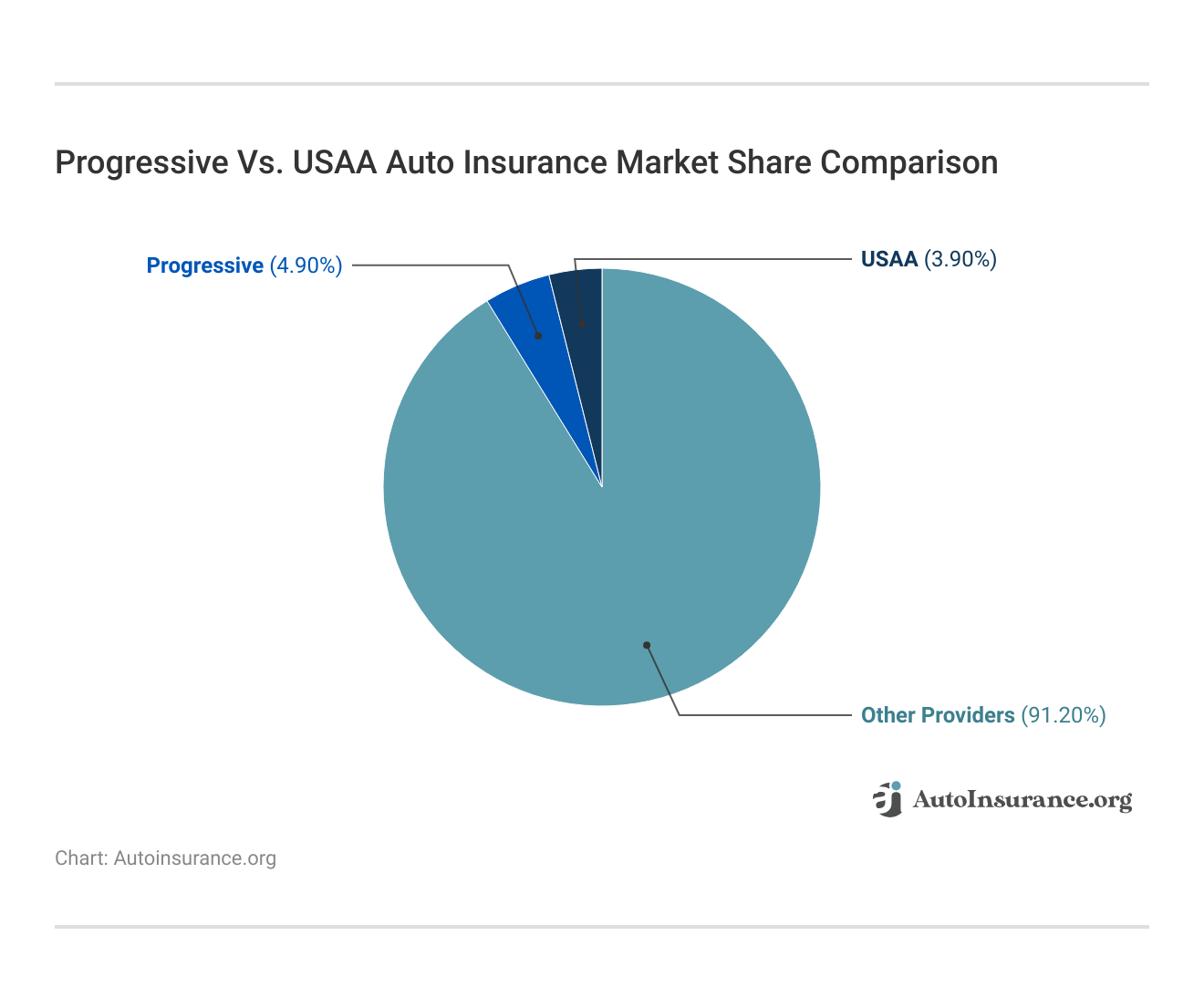

USAA and Progressive are some of the best auto insurance companies, but which is better depends on your auto insurance coverage needs and budget. While USAA is generally cheaper than Progressive, it is only for military members and their families, whereas Progressive sells insurance to non-military drivers.

- On average, USAA has cheaper rates than Progressive for auto insurance policies

- USAA is only available to military members and veterans, as well as their families

- Both insurers offer many discounts and a safe driving program

Read on for more details about the pros and cons of USAA and Progressive insurance. We will cover everything from USAA and Progressive’s average auto insurance rates to their customer service reviews. Enter your ZIP code to get free quotes from both companies.

Coverage Cost Comparison

Your auto insurance rate depends on many factors. Age, gender, driving record, state, and credit score all play a role. Progressive and USAA calculate rates in different ways. For example, Progressive may vary rates more with different driver profiles, while USAA is known for lower rates for military members and their families. Some drivers ask, “Is USAA insurance cheaper?” when they check rates.

Full Coverage Car Insurance Monthly Rates by Driving Record

Driving Record

Clean Record $150 $84

Not-At-Fault Accident $265 $111

Speeding Ticket $199 $96

DUI/DWI $200 $154

The table below shows sample rates for both companies based on several driver profiles. This table shows that USAA generally offers lower rates for most driver profiles, while Progressive has a broader range of prices. The differences become more significant with certain risk factors.

Learn More: Factors That Affect Auto Insurance Rates

USAA tends to charge less, especially for good and average drivers. Progressive may be better for drivers who want extra policy options. Both companies adjust rates based on a driver’s record, age, and other factors. Compare these figures with your profile to see which fits best.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA vs. Progressive Car Insurance Rates

Car insurance rates are important when choosing a car insurance company. You may overpay for car insurance if you don’t pick the right company. While you will see in our analysis of average rates that Progressive has higher rates than USAA, remember that not all drivers can qualify for USAA, making Progressive the only choice of the two if the driver is not military.

Credit Score Insurance Rates

Only a few states ban car insurance companies from using credit scores to charge drivers more, so in most states; you will see your rates go up at Progressive and USAA if you have a bad credit score. Below are the average rates for a bad credit score at Progressive vs. USAA.

Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| U.S. Average | $123 | $148 | $226 |

USAA auto insurance offers cheaper rates on average for a bad credit score. So, if you have a bad credit score and are in the military, USAA will be the better choice over Progressive. Saving money by choosing a cheaper car insurance company for bad credit scores will also help you get your credit score back on track and lower your insurance rates.

Driver Age Insurance Rates

Age is another factor affecting how much you pay at different auto insurance companies. Auto insurance costs more for young drivers due to their inexperience on the road, which makes them more likely to crash and file a claim. Below, we’ve listed average car insurance rates by age for USAA and Progressive customers.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 | |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

| U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

USAA consistently has lower rates than Progressive for drivers, regardless of age. We also want to note that younger drivers will find cheaper rates by joining their parent’s policy rather than purchasing their own at whatever insurance provider they pick. Keeping a clean driving record as a young driver will also help keep rates low.

Driving Record Insurance Rates

Auto insurance companies check driving records to determine how risky a driver is to insure. DUIs, at-fault accidents, and traffic tickets will all raise driver rates. Below, you can see how USAA and Progressive compare.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $154 | $122 |

| $268 | $228 | |

| $194 | $166 | |

| $150 | $124 | |

| $170 | $138 | |

| $100 | $83 |

| $247 | $198 | |

| $151 | $114 | |

| $302 | $248 |

| $196 | $164 |

| $199 | $150 | |

| $137 | $123 | |

| $396 | $331 | |

| $194 | $161 |

| $192 | $141 | |

| U.S. Average | $203 | $165 |

USAA has lower rates on average for drivers with traffic tickets and at-fault accidents. However, Progressive is very similar to USAA in offering lower rates for DUI drivers. So, if you have a DUI, Progressive may be worth looking into if you don’t qualify for USAA.

If you have found that your rates have gone up due to driving infractions, you can work to reduce your auto insurance rates by keeping a clean record in the future. You can also apply for auto insurance discounts, which we cover in the next section.

Available Discounts

Both companies offer discounts that can lower your monthly premium. Discounts might be for bundling policies, safe driving, or being a good student. Progressive and USAA have several discount programs that can help you save money. Check out the discount table below for a side-by-side comparison.

Only a few states ban car insurance companies from using credit scores to charge drivers more, so in most states, Progressive and USAA will raise your rates if you have a bad credit score.Schimri Yoyo Licensed Agent & Financial Advisor

USAA offers substantial discounts, especially for military families and safe drivers. Progressive gives good savings on bundled policies where you can save money by bundling policies. A higher discount percentage may not always lead to the lowest final rate. It depends on your driver profile and policy details.

USAA vs. Progressive: Types of Auto Insurance Discounts

Discounts are a great way to reduce auto insurance rates; most drivers can qualify for at least a few. USAA and Progressive auto insurance have safe driving programs that offer significant discounts to drivers who perform well in the program.

As you can see, there is a lot of overlap between the two companies, with both offering similar benefits to drivers. In the next sections, we’ve outlined some of the best auto insurance discounts from each company.

USAA Discounts

One of USAA’s biggest discounts for drivers is its USAA SafePilot program for safe drivers. It also has discounts specific to the company, such as the following:

- Vehicle Storage Discount: If you are deployed overseas and store your vehicle, you could earn over half off of your policy with a vehicle storage discount.

- Family Discount: Young drivers can get discounts on their auto insurance as long as their parents are USAA members.

Plenty of other discounts, such as bundling discounts and good student discounts, are also designed to save drivers a large sum of money.

Progressive Discounts

Like USAA, Progressive has some great discounts. One of its biggest discounts is Snapshot safe driving program and its bundling discounts. You can also find savings with some other popular discounts, such as the following:

- Homeowner Discount: You can get up to 10% off your auto insurance policy at Progressive if you are a homeowner.

- Sign Online Discount: If you sign all your paperwork online, Progressive offers a discount of up to 9% off your policy.

Progressive doesn’t offer a storage discount to drivers as USAA does, but it has a good selection of deals to save on a policy. If you don’t qualify for USAA auto insurance, you may still find a comparable rate at Progressive by applying for as many discounts as possible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Coverage Options

Both Progressive and USAA offer a range of coverage choices, including full coverage and minimum coverage. Customers can choose comprehensive coverage, collision, and liability coverage with either provider. Each company also supports extra services like roadside assistance and rental reimbursement.

Full Coverage Car Insurance Monthly Rates by Driving Record

Driving Record

Clean Record $150 $84

Not-At-Fault Accident $265 $111

Speeding Ticket $199 $96

DUI/DWI $200 $154

Progressive has add-ons that let you customize your policy. Options such as accident forgiveness and new car replacement are available. USAA offers similar choices and extra benefits for military service members. Their coverage options are designed to be flexible and meet different needs. You can check USAA car insurance quotes online to see which add-ons fit your situation.

Customer Reviews & Business Ratings

Customer feedback and business ratings give insight into how well these companies serve their clients. Many drivers praise Progressive for its online tools and easy claims process, but military families favor USAA for its strong support and low rates.

USAA versus Progressive Opinions

byu/Ultrarunning-0351 inUSAA

USAA auto insurance reviews on websites and social media show customers value prompt service and low premiums. One Reddit user commented, “USAA car insurance review always highlights quick claim handling.” Another review noted that Progressive’s online tools help customers file claims quickly.

Below is a table that shows business ratings from trusted sources.

Insurance Business Ratings & Consumer Reviews: Progressive Vs. USAA

Agency

Score: 672 / 1,000

Avg. SatisfactionScore: 726 / 1,000

Above Avg. Satisfaction

Score: A+

Excellent Business PracticesScore: A+

Excellent Business Practices

Score: 72/100

Avg. Customer FeedbackScore: 96/100

High Customer Satisfaction

Score: 1.11

Avg. ComplaintsScore: 1.74

More Complaints Than Avg.

Score: A+

Superior Financial StrengthScore: A++

Superior Financial Strength

USAA scores slightly higher in customer satisfaction and claims processing. Progressive stands out for its digital experience and coverage value. Both companies have solid ratings, which builds trust for new customers. You can read more USAA car insurance reviews to gather detailed feedback.

Read More:

Other Comparisons with USAA Providers

Many drivers compare USAA to other insurers when choosing car insurance. For example, some look at American Family vs. USAA to see which offers better overall benefits. Others compare AAA vs. USAA to decide who has more substantial roadside support.

Reviews often include comparisons like Allstate vs. USAA to show the differences in policy features. Some people also check out Liberty Mutual vs. USAA to learn how their rates and coverage differ. Other comparisons, such as Mercury vs. USAA and Nationwide vs. USAA, help drivers see the pricing variations.

When you search for Progressive vs. USAA, you will find that each company has its strengths. Root vs. USAA and State Farm vs. USAA also provide insights into extra services. Guides comparing the General vs. USAA and Travelers vs. USAA give a complete picture of the options. Many USAA auto insurance reviews compare USAA vs. AAA or USAA vs. Geico. These discussions help you understand where USAA stands in the market.

Many drivers consider USAA car insurance a strong option when looking for coverage. You can easily find USAA car insurance quotes online to check what plans might cost you. Reading a USAA car insurance review or browsing through several USAA car insurance reviews can help you learn about other customers’ experiences.

These insights often include details on USAA car insurance rates, which may guide your decision. Articles that compare providers also help you make a choice. For example, comparisons like Allstate vs. USAA or Liberty Mutual vs USAA show the differences between the companies. This information gives you an idea of which provider may work best for your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Progressive Pros & Cons

Pros:

- Flexible Coverage: Progressive offers many add-ons that let you adjust your policy to suit your needs. This helps you build a plan that fits your driving habits.

- User-Friendly Digital Tools: Their website and mobile app are simple to navigate. You can easily manage your policy online without much hassle.

- Good Claims Process: Many drivers say filing a claim is fast and clear. The process is straightforward and helps you get back on the road quickly.

- Strong Bundling Discounts: You can save more when you bundle your auto and home insurance. This option reduces your overall costs.

Cons:

- Higher Rates for Some: Drivers with a poor record may face higher prices. The rates are not the lowest for everyone.

- Variable Discounts: Not all drivers can get the best discount. Progressive auto insurance discount amount can vary depending on your situation.

USAA Pros & Cons

Pros:

- Low Premiums: USAA generally offers lower rates for drivers who meet the requirements. This means you might pay less if you qualify.

- Excellent Customer Service: Reviews show that USAA takes care of its members. They are known for friendly and helpful support.

- Safe Driver Discounts: Drivers with a safe record receive notable savings. This discount rewards careful and responsible driving.

- Solid Business Ratings: USAA consistently scores well in reviews from J.D. Power and Consumer Reports. This reflects a high level of service and reliability.

Cons:

- Limited Eligibility: USAA is available only to military members and their families. If you are not eligible, you cannot use their services.

- Less Flexibility: There are fewer options to customize your policy. This may not work for drivers who need very specific features.

USAA vs. Progressive Roadside Assistance

Both USAA and Progressive offer roadside assistance, coverage you can add to your auto insurance policy. If you break down on the side of the road, roadside assistance can help you drive again by fixing your car or towing it to a nearby shop.

Roadside assistance programs will help if you lock yourself out of the vehicle, need a tow, need fuel delivery, need a flat tire change, and more. Progressive will also tow you to the nearest charging station if your electric battery runs out of juice, a nice perk for electric vehicle owners. The company’s roadside assistance programs are comparable, with only a few minor differences.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA vs. Progressive Online and Mobile Apps

A company’s website and mobile app are more important than most customers realize. Confusing layouts and glitchy apps can frustrate customers into choosing a different company. Both Progressive and USAA have easy-to-navigate, user-friendly websites. Look at the sections below to learn about the companies’ mobile apps.

USAA Mobile Experience

USAA has good ratings for its mobile app. Take a look at them below:

- Google Play: 4.2 out of five stars from over 195 thousand reviews.

- Apple Store: 4.8 out of five stars from over 1.5 million reviews.

USAA received better ratings for its app on the Apple Store and decent reviews on Google Play. Customers are generally happy with how the app works; they can pay bills, check their coverages, and more with the USAA insurance app.

Progressive Mobile Experience

Progressive received the following ratings for its mobile app:

- Google Play: 4.6 out of five stars from over 70 thousand reviews.

- Apple Store: 4.8 out of five stars from over 72 thousand reviews.

Progressive did rank slightly higher than USAA on Google Play but remember that USAA has many more reviews of its app. Regarding popularity, USAA’s app is downloaded and reviewed more often than Progressive’s. However, both apps are solid choices for whichever company you choose.

USAA vs. Progressive Quotes and Claims

USAA and Progressive make it easy to get quotes and file car insurance claims. You can get a quote from either company through their website online quote tool or by calling an agent that works with the company. Getting quotes from both companies is simple and quick and gives you a good idea of whether you want to go with the company.

The process of filing claims is similar at both companies, although USAA received better scores in the customer satisfaction study by J.D. Power on claims. So, while both companies handle claims well and most customers are satisfied with their claim service, USAA performs slightly better than Progressive.

USAA vs. Progressive Reviews and Ratings

Looking at ratings and reviews of both companies is a great way to determine which is better for customer service, financial strength, and other factors. There will always be negative customer reviews and company complaints, but both did well in customer service. Their financial ratings are solid, too, meaning they won’t go bankrupt when paying claims.

But if an auto insurance company doesn’t pay your claims, you can always go to your state’s commissioner or director of insurance for help. In threads like Progressive vs. USAA auto insurance on Reddit, you can see that USAA usually ranks better. While the two companies are comparable, USAA comes out slightly ahead.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA vs. Progressive

When comparing USAA and Progressive, USAA is the better choice for most drivers. It has consistently cheaper rates and good customer service reviews. However, USAA is only available for military families and veterans, so if you don’t qualify for USAA, Progressive is one of the next best choices.

We recommend getting auto insurance quotes from different companies to ensure you get the best rate. In addition, you can use our free quote comparison tool to find your area’s best auto insurance rates.

Read More:

- USAA vs. Geico Auto Insurance

- Farmers vs. USAA Auto Insurance

- Progressive vs. Travelers Auto Insurance

- Nationwide vs. Progressive Auto Insurance

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Progressive worse than USAA?

No, Progressive isn’t necessarily worse than USAA. USAA is better regarding rates and customer service, but it is only offered to select drivers. So, if you aren’t a military or veteran, Progressive is a comparable car insurance option.

Is USAA insurance cheaper than Progressive insurance?

USAA’s average insurance rates are cheaper than Progressive’s average insurance rates. Full coverage at USAA starts at only $84 per month, while full coverage at Progressive starts at $150 monthly. However, whether USAA is cheaper depends on your driving record, vehicle, area, and other important factors.

Does Progressive own USAA insurance?

No, Progressive does not own USAA insurance. So you can’t get USAA insurance through Progressive.

What is the difference between Progressive and USAA auto insurance?

Progressive and USAA both offer auto insurance. Progressive serves everyone and is known for reasonable rates and many coverage choices. USAA mainly serves military members and their families and is known for strong customer service and special benefits.

How can I contact Progressive and USAA auto insurance?

You can contact Progressive auto insurance by visiting its website, using its mobile app, or calling their customer service. It provides a customer service phone number and email support. USAA auto insurance can be contacted by visiting its website, using its mobile app, or calling its customer service. USAA also offers additional support through its dedicated member services for military members and their families.

What types of coverage do Progressive and USAA auto insurance offer?

Both Progressive and USAA auto insurance offer a wide range of coverage options. These typically include liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, medical payments coverage, personal injury protection (PIP), and more. However, specific coverage options and policy details may vary between the two companies.

How do I file a claim with Progressive or USAA auto insurance?

To file a claim with Progressive or USAA auto insurance, contact their claims department immediately after an incident. They will guide you through the process and provide the necessary forms and information required to file your claim. It’s important to have all the relevant details, such as the date, time, and location of the incident, as well as any relevant photos or documentation.

Can I manage my Progressive or USAA auto insurance policy online?

Yes, both Progressive and USAA auto insurance typically offer online platforms or customer portals where you can manage your policy. These portals allow you to make payments, view policy details, access digital ID cards, initiate changes to your coverage, and sometimes even file claims.

What factors can affect the cost of my auto insurance with Progressive and USAA?

Several factors can influence the cost of your auto insurance policy with both Progressive and USAA. Common factors include your driving record, the type of vehicle you drive, your age and gender, your location, your credit history, and the coverage options you select.

Do Progressive and USAA auto insurance offer discounts?

Both Progressive and USAA auto insurance offer discounts to eligible customers. The specific discounts available may vary between the companies. Still common types of discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain vehicle safety features. Contact Progressive and USAA directly to find out which discounts you may qualify for.

What are the disadvantages of USAA?

USAA is only available to military members and their families, limiting who can use their services. Their policy choices are not as flexible as those of some other insurers. Some customers feel that the limited options can lead to higher costs. In discussions like USAA vs. Progressive home insurance, many point out that USAA has stricter eligibility and fewer choices for customization.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.