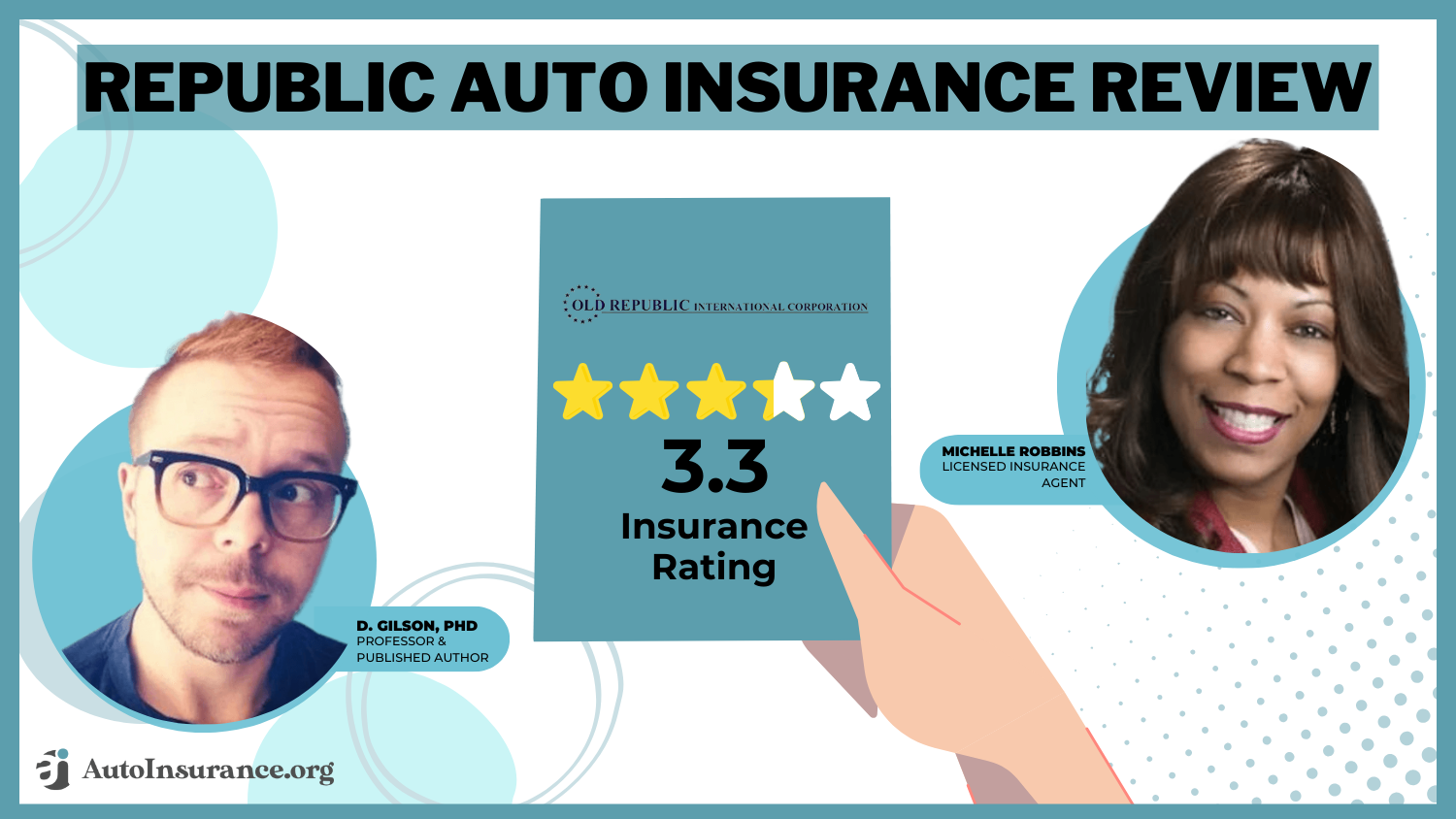

Republic Auto Insurance Review for 2025 (Check Out Their Score!)

In this Republic auto insurance review, we look at the insurance lines they offer after being acquired by AmTrust. Rates are not publicly available; however, you can find a quote on the company website. Scroll down to discover if the Republic insurance company is right for you.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Republic Insurance Group

Average Monthly Rate For Good Drivers

$120A.M. Best Rating:

A-Complaint Level:

LowPros

- Republic Group offers tailored commercial insurance products like commercial auto and property coverage to meet businesses’ needs.

- Republic Companies Group, Inc. policies are sold through experienced local agents who provide personalized service and guidance.

Cons

- Republic Group no longer offers personal lines products since the integration with AmTrust.

- Republic auto insurance rates are not made publicly available.

- In this Republic auto insurance review, we uncovered six different lines offered by this company. That includes auto, homeowners, renters', condominium, dwelling fire insurance, and umbrella insurance.

- Republic Group sells auto policies primarily in Texas, Oklahoma, Louisiana, Mississippi, New Mexico, and Arkansas.

- Republic auto insurance rates are not made publicly available, however, your age, driving record, and where you live will impact your average costs.

- Republic agents work one-on-one with new policyholders to secure the highest possible level of affordable coverage

Our Republic auto insurance review found that the company no longer sells personal lines insurance like auto, homeowners, and renters insurance.

After being acquired by AmTrust Financial on April 18, 2016, at an approximately $233 million valuation, AmTrust announced its decision to exit the personal lines insurance written through its Republic carriers in March 2020 and decided to transfer it to Safeco Insurance.

Republic Auto Insurance Rating

| Rating Criteria | Score |

|---|---|

| Business Reviews | 3 |

| Claim Processing | 2.8 |

| Company Reputation | 3.5 |

| Coverage Availability | 2.4 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.9 |

| Plan Personalization | 3.5 |

| Policy Options | 2.5 |

| Savings Potential | 4.1 |

| Insurance Rating | 3.3 |

While Republic Insurance no longer offers personal lines products, this review covers what types of insurance they currently provide and the factors that affect your rates with this company, how to seek out a quote, file a claim, and even cancel an existing policy.

Before buying Republic auto insurance, enter your ZIP code into our free quote comparison tool above and compare rates from reputable providers near you.

- Rates are not publicly available. However, age, record, and location impact your average costs

- AmTrust Financial acquired Republic Group on April 18, 2016

- Republic Insurance no longer offers personal line products

Republic Group Insurance Coverage Options

Republic Group Insurance is currently focusing on supporting AmTrust in its commercial and specialty insurance products. Here is a list of what they currently offer:

- Workers’ Compensation Insurance: Provides coverage for employee’s injuries or work-related illnesses.

- Business Owners Policy (BOP): Combines general liability and property insurance for small businesses.

- Commercial Package Policies: Provides customizable policies for property, liability, and other risks.

- General Liability Insurance: Protection against claims involving bodily injury or property damage.

- Employment Practices Liability Insurance (EPLI): Coverage for claims like wrongful termination or workplace discrimination.

- Cyber Insurance: Republic Group provides protection against cyber threats like data breaches and ransomware attacks.

- Specialty Programs: Tailored solutions for niche industries and specific coverage needs.

Additionally, their parent company, AmTrust Financial, offers commercial auto insurance to businesses with other existing policies, like workers’ compensation and general liability insurance. It covers company cars, trucks, fleet vehicles, specialty vehicles like food trucks, and construction vehicles.

AmTrust Commercial Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $280 | $600 |

| Age: 16 Male | $310 | $650 |

| Age: 18 Female | $200 | $450 |

| Age: 18 Male | $230 | $500 |

| Age: 25 Female | $120 | $280 |

| Age: 25 Male | $135 | $300 |

| Age: 30 Female | $100 | $240 |

| Age: 30 Male | $110 | $260 |

| Age: 45 Female | $90 | $210 |

| Age: 45 Male | $95 | $225 |

| Age: 60 Female | $85 | $200 |

| Age: 60 Male | $90 | $215 |

| Age: 65 Female | $87 | $205 |

| Age: 65 Male | $92 | $220 |

It includes liability coverage for accidents, vehicle damage, and protection against uninsured or underinsured motorists. Additional options such as fleet, non-owned, and hired auto coverage are available for businesses with specific needs. Read the recommended auto insurance coverage for more information.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Republic Group Insurance Quote Acquisition

To get a quote from Republic Insurance Group, you must go through AmTrust’s official website, as they have no website since the integration with their parent company.

Another method of getting a quote is to call the company’s corporate office, which is open from 8:00 a.m. to 4:30 p.m. Monday through Friday.

Read More: How to Compare Auto Insurance Quotes

AmTrust Commercial Auto Insurance Rates Breakdown

Since Republic Group Insurance no longer offers auto insurance and other personal lines products, here is a breakdown of AmTrust’s commercial auto insurance monthly rates by driving history compared to other companies instead:

Commercial Auto Insurance Monthly Rates by Provider and Driving History

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $130 | $160 | $220 | $310 | |

| $120 | $150 | $200 | $280 | |

| $127 | $157 | $215 | $295 | |

| $115 | $145 | $195 | $290 | |

| $135 | $165 | $225 | $320 |

| $122 | $152 | $205 | $285 |

| $125 | $155 | $210 | $300 | |

| $110 | $140 | $190 | $270 | |

| $118 | $148 | $198 | $275 | |

| $105 | $135 | $185 | $260 |

For businesses with clean driving records, AmTrust offers commercial auto insurance for just $120, $150 for having one ticket, and $200 for one accident, while having one DUI gets a $280 monthly insurance rate. For more information, read how auto insurance companies check driving records.

Republic Group Discounts Available

Republic Group provides several discounts to make insurance more affordable. You can significantly save money by bundling multiple policies, maintaining a claims-free record, or having safety features in your vehicle or property.

Additional discounts may be available for loyal customers or those with good credit. Contact an agent to learn about all qualifying discounts.

Read More: Auto Insurance Discounts

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Republic Insurance Claims Filing

It is essential to know how to file an auto insurance claim with Republic Group to determine if the company is right for you and your needs. You don’t want to wait until you experience an accident before you learn how to do it or whether they have good claims processing.

To file a claim with Republic Insurance, contact your local agent or their parent company, AmTrust, on their official website.

Republic Auto Insurance Policy Cancellation

Before buying insurance from any provider, understanding how to cancel auto insurance is crucial. This knowledge will be useful when you decide to stop your policy or shift to another insurance company.

Contact AmTrust at (877) 528-7878 for general inquiries and policy cancellation.

To cancel your existing policy with Republic Companies Group, Inc., contact the insurance agent who manages it and notify them about your intent to cancel. Alternatively, you can directly go to AmTrust if they manage your policy.

Factors That Affect Commercial Auto Insurance Rate With Republic Group

There are several factors affecting Republic Group’s commercial auto insurance rates. For example, the type and usage of vehicles, employee driving records, and the overall safety record of the business cause insurance premiums to fluctuate.

Republic Insurance Group's commercial auto insurance covers liability for bodily injury and property damage caused by business vehicles.Jeff Root Licensed Insurance Agent

However, having safety features on the vehicles reduces costs and offers savings for businesses intending to insure their automobiles. Learning which cars have the lowest auto insurance premiums gives you an idea of how to save money on auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Republic Group Insurance

Republic Companies Group, Inc. is known for providing specialized commercial lines products like commercial auto insurance, and choosing them gives you the same benefits as their parent company, including the following:

- Specialized Coverage Options: Republic Group Insurance provides a variety of specialized coverage like commercial auto and property.

- Strong Regional Focus: Provides personalized solutions with a deep understanding of the local market.

- Financial Stability: Backed by AmTrust Financial, Republic Group benefits from solid financial support, ensuring reliability in claims handling.

These advantages garner trust from the people due to the backing of one of the largest private companies in America, as listed by Forbes. However, there are also drawbacks like any other insurance company. The disadvantages are as follows:

- Limited Personal Lines Products: Republic Group no longer offers personal auto or homeowners insurance, which may not suit customers looking for bundled personal policies.

- Restricted Availability: Their focus on regional markets may limit access to services in certain areas outside their primary service regions.

Due to the limited personal lines products and availability restrictions, some customers may look for other companies instead. If you have already decided to buy auto insurance, enter your zip code into our free quote tool below to get multiple auto insurance quotes.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What coverage options does Republic Group Auto Insurance offer?

Republic Group no longer offers auto insurance or other personal lines products. After its acquisition by AmTrust Financial, the company shifted its focus to commercial insurance lines, leaving personal insurance policies such as auto coverage discontinued.

Can I bundle insurance policies with Republic Group?

The Republic Group Insurance allows businesses to bundle their commercial auto insurance with other policies for more savings. Enter your zip code below into our free comparison tool and start saving on auto insurance.

What factors affect my commercial auto insurance rates with Republic Group?

Factors that influence commercial auto insurance rates with Republic Group include the type of vehicles insured, their usage, employees’ driving records, coverage limits, and the business’s location. Additionally, claims history and safety features in the vehicles can impact rates.

Read More: Factors That Affect Auto Insurance Rates

Who bought Republic Insurance?

AmTrust Financial acquired Republic Insurance Company and now focuses on commercial insurance products.

What is the net worth of Republic Company?

The net worth of Republic Company is not publicly disclosed as it is a subsidiary of AmTrust Financial. For detailed financial information, it is best to refer to AmTrust Financial’s official reports or contact them directly.

Which insurance cover is best for a car?

Comprehensive coverage is typically the best for cars as it covers both accidents and non-collision-related damages.

Who is the founder of Republic Insurance?

Republic Insurance was founded by a group of Texas-based businessmen in 1903.

Where did Republic Insurance start?

Republic Insurance was established in Dallas, Texas. Compare quotes from multiple companies in your area by entering your zip code into our free tool below.

Which type of car insurance is the cheapest?

Liability auto insurance is typically the cheapest type of car insurance, covering only damages to other vehicles and injuries.

How long has Republic Insurance been around?

Republic Insurance has been in business since 1903, providing over a century of service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

WhitneyCH

HORRIBLE

mrmauser06

Helped with better rate when adding teen driver

bethanng51702

Good company

Rodney Mouton

Republic review

weatherball

Discounts

128Lala

Great

mandasman_71749

The Best Dad Gum Insurance Company In The World!

Lee

Republic review

Laronica Williams

Republic review