Sun Coast Auto Insurance Review for 2025 (See if They’re a Good Fit)

Sun Coast General Insurance Agency partners with a variety of providers to help high-risk drivers find the best insurance possible in 11 states. With rates as low as $95 per month, our Sun Coast auto insurance review shows that it can help you find affordable coverage if your driving record is less than perfect.

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Sun Coast General Insurance Agency, Inc.

Average Monthly Rate For Good Drivers

$95A.M. Best Rating:

AComplaint Level:

HighPros

- Rates are often affordable

- Multiple coverage options

- Higher acceptance for high-risk drivers

Cons

- Only available in 11 states

- Lackluster customer service

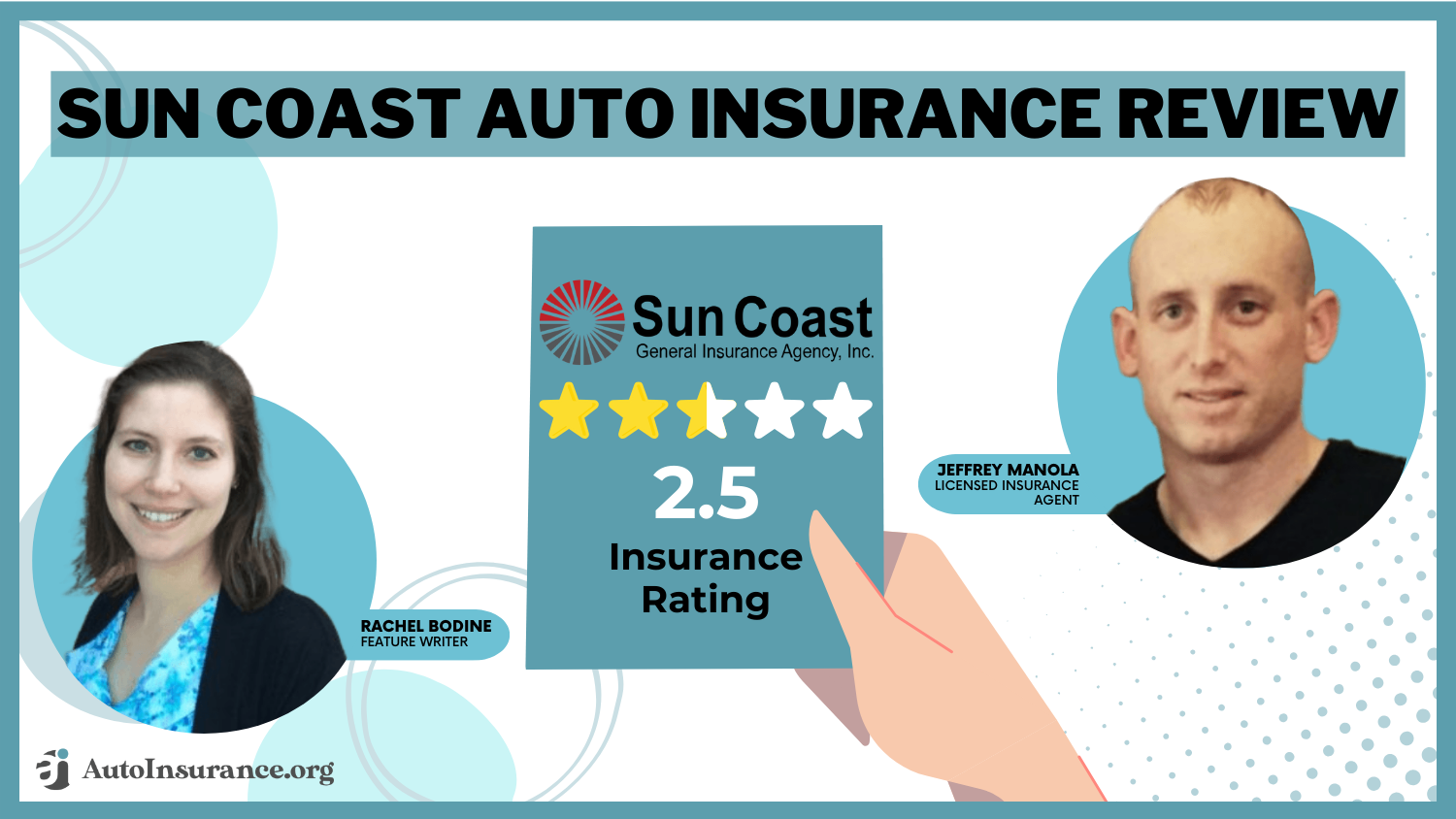

Our Sun Coast auto insurance review shows how it helps high-risk drivers find affordable coverage in 11 states. However, poor customer service is why it earned a low 2.5/5 rating.

Sun Coast Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 2.5 |

| Business Reviews | 3.0 |

| Claims Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 2.5 |

| Discounts Available | 2.0 |

| Insurance Cost | 2.6 |

| Plan Personalization | 3.0 |

| Policy Options | 1.5 |

| Savings Potential | 2.4 |

Sun Coast General doesn’t actually sell car insurance. Instead, it partners drivers with the best provider for their needs. It may not count among the best insurance companies, but Sun Coast might be right if you need high-risk auto insurance.

Sun Coast isn’t the best choice for everyone, but it’s a great option for high-risk drivers struggling to find standard coverage.

- Sun Coast insurance reviews are 2.5/5 for poor customer service

- Sun Coast General sells insurance in 11 states

- High-risk drivers can find affordable rates with Sun Coast General

Learn more about Sun Coast General Insurance below to see if it’s the best fit. Then, enter your ZIP code to see the lowest rates in your area.

Sun Coast Auto Insurance Rate Breakdown

When it comes to Sun Coast car insurance reviews, many customers praise this company for helping them find low rates. However, Sun Coast may not be the least expensive option. Check below to see the average Sun Coast car insurance rates.

Sun Coast Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $275 | $375 |

| 16-Year-Old Male | $305 | $415 |

| 25-Year-Old Female | $130 | $210 |

| 25-Year-Old Male | $150 | $230 |

| 30-Year-Old Female | $115 | $195 |

| 30-Year-Old Male | $125 | $205 |

| 45-Year-Old Female | $105 | $175 |

| 45-Year-Old Male | $110 | $185 |

| 60-Year-Old Female | $95 | $165 |

| 60-Year-Old Male | $100 | $175 |

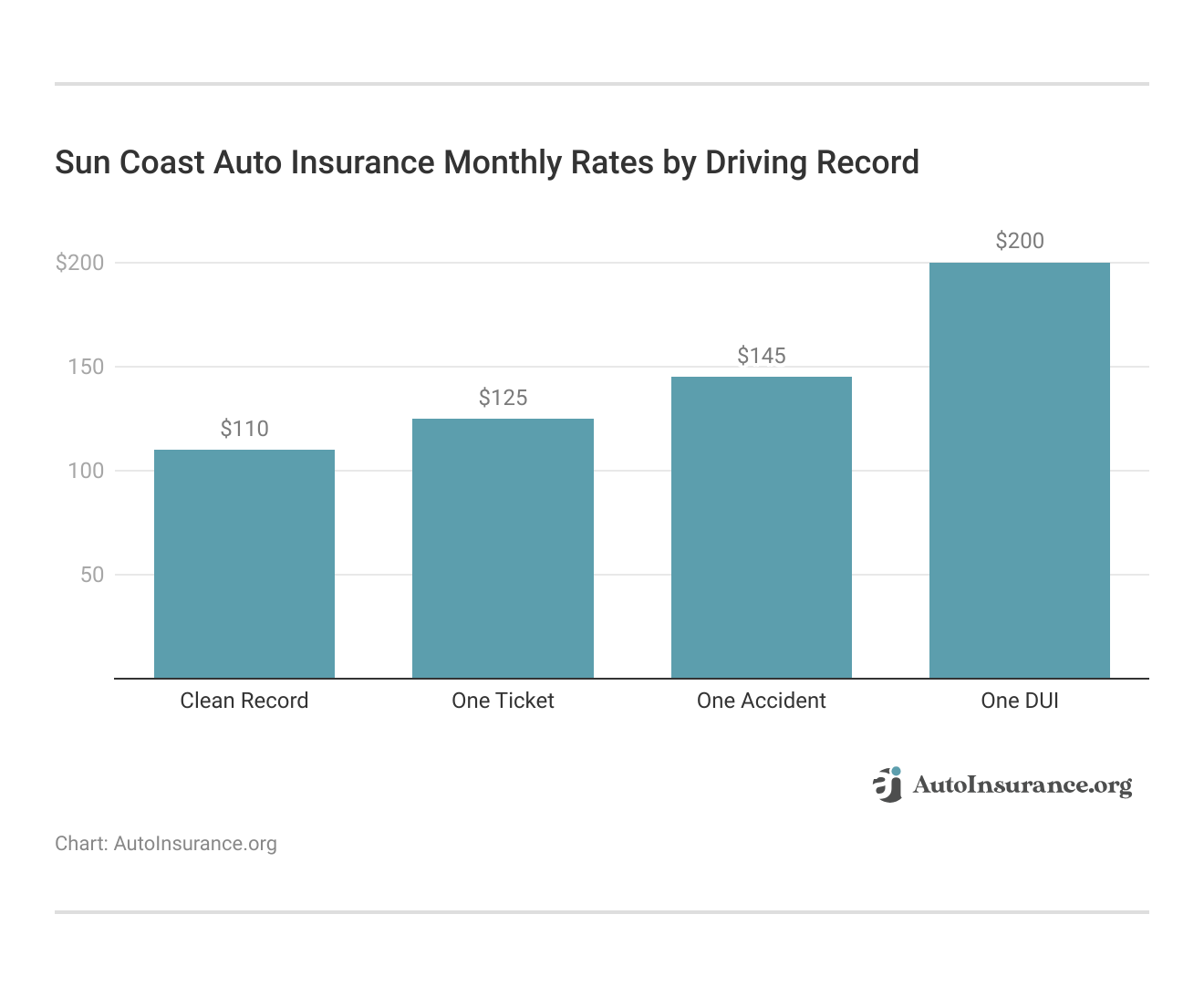

Factors that affect your auto insurance rates include things like your age and location, but your driving record has one of the biggest impacts on your premiums. Sun Coast car insurance rates may not be the most impressive for the average driver, but it is a good option for high-risk drivers.

Sun Coast can help drivers struggling to get coverage after too many speeding tickets, at-fault accidents, or DUI convictions find affordable coverage.Schimri Yoyo Licensed Agent & Financial Advisor

Since Sun Coast works with a variety of companies, you’ll have a better chance of finding affordable prices. Check below to compare the average cost of Sun Coast auto insurance based on your driving record.

Compared to many other companies, Sun Coast Insurance reviews frequently mention low-cost rates for high-risk drivers. Of course, you’ll still need to compare rates to find an affordable policy — especially if you want the best high-risk auto insurance — but Sun Coast is definitely worth checking out.

Sun Coast Auto Insurance Rates vs. the Competition

No matter what type of driver you are, one of the most important steps to take when shopping for insurance is learning how to get multiple auto insurance quotes to compare.

Why is this so important? Take a look at the rates below to see how Sun Coast General compares with some of the largest providers in the nation.

Sun Coast Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $98 | $168 |

|

| $53 | $248 |

As you can see, Sun Coast is not usually the cheapest option for car insurance. However, high-risk drivers often find more affordable rates with Sun Coast compared with popular providers. This difference in price is why it’s important to compare rates. Sun Coast makes it easy by offering quote applications on their websites.

While you’ll fill out the same form that you would find anywhere else, Sun Coast works a bit differently. Rather than writing a policy for you, Sun Coast will pair you with one of the partner providers. However, you can still use our free quote-generating tool to compare Sun Coast auto insurance rates with other providers by entering your ZIP code.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Sun Coast Auto Insurance Options

Sun Coast General Insurance Agency, Inc. sells policies for a variety of companies, so you won’t know which provider will write your policy until you get a quote. However, there are specific coverage options you’ll have, no matter what. These include:

- Liability: Liability-only auto insurance covers your financial responsibility when you cause property damage or injuries after an at-fault accident.

- Collision: If you want help with your repair bills after an accident, you need collision insurance. It covers all accidents, no matter who was at fault.

- Comprehensive: Comprehensive auto insurance protects your vehicle against life’s unexpected events, like theft, vandalism, fire, weather, and damage from animals.

- Uninsured/Underinsured Motorist: The states Sun Coast General operates in require insurance, but that doesn’t mean everyone follows the law. Uninsured/underinsured motorist coverage protects you from uninsured drivers.

- Personal Injury Protection/Medical Payments: Depending on the state you live in, you can purchase either personal injury protection insurance or medical payments coverage to pay for your medical expenses after an accident.

Aside from these types of insurance, Sun Coast Insurance doesn’t offer much else, although its website says many of its plans include roadside assistance.

While these are the only insurance types Sun Coast mentions on its site, you may have the opportunity to buy more coverage. You’ll see all your options when you get a Sun Coast car insurance quote.

Sun Coast Auto Insurance Discounts

Taking advantage of the best auto insurance discounts is one of the best ways to keep your rates low. Since Sun Coast acts as an insurance agency, knowing what discounts you’ll be eligible for before getting a quote can be difficult.

However, Sun Coast does list a few discounts available on most policies. When you buy a policy through Sun Coast General Insurance, you might be eligible for the following:

- Homeowner: If you have homeowners insurance on your house, you might get a discount on your auto insurance. However, this discount may not be available everywhere.

- Early Quote: Get a Sun Coast auto insurance quote before your current policy expires to get this discount.

- Continuous Coverage: Sun Coast might reward you with this discount if you’ve maintained steady car insurance, even at a different company.

- Multi-Car: Insure more than one car on your Sun Coast policy to earn extra savings.

- Good Driver: You can save up to 20% on your auto insurance if you’ve kept your driving record clean of things like speeding tickets, at-fault accidents, and DUIs.

Keep in mind that these are the most common discounts Sun Coast customers qualify for. Depending on which company manages your policy, you may see different Sun Coast car insurance discounts.

Sun Coast Auto Insurance Customer Service and Business Reviews

Sun Coast auto insurance reviews are a mixed bag. Some customers love their experience with Sun Coast, particularly because it works with the best auto insurance companies for high-risk drivers. As you can see in the video below, finding affordable high-risk coverage can be a challenge.

Like all insurance companies, Sun Coast also receives negative reviews. The most commonly occurring complaints involve price increases and communication.

While it’s normal for premiums to increase occasionally, some Sun Coast customers report frequent price hikes for no apparent reason.Michelle Robbins Licensed Insurance Agent

Sun Coast representatives also have a reputation for being difficult to get hold of. Customers who use the Sun Coast insurance claims phone number for help after an accident report long wait times and inconsistent callbacks.

Despite these mixed reviews, Sun Coast General does well with its third-party ratings. Third-party rating companies offer valuable insights into how well a company performs. Take a look below to see how Sun Coast Insurance does.

Sun Coast Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: B Good Business Practices |

|

| Score: 70 / 100 Avg. Customer Satisfaction |

|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: 2.40 More Complaints Than Avg. |

One area that Sun Coast Insurance struggles with is the number of complaints it receives. With a 2.40 from the NAIC, Sun Coast Insurance gets twice as many customer complaints compared to similarly sized companies.

Read More: Best Auto Insurance Companies For Drivers With Speeding Tickets

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Sun Coast Auto Insurance Pros and Cons

Every company has strengths and weaknesses, including Sun Coast General. While you’ll need more information than just the pros and cons when you’re figuring out how to get auto insurance, it’s a good place to start. When you shop with Sun Coast, you’ll have access to the following advantages:

- Low Prices: Many customers agree that Sun Coast found them insurance at a more affordable price than they could have on their own.

- High-Risk Insurance: Drivers who struggle to get coverage elsewhere will have better luck with Sun Coast Insurance.

- Additional Insurance Options: Aside from car insurance, you can also purchase M,exico travel, yacht, boat and watercraft, and commercial auto insurance.

While Sun Coast can be a great option for car insurance, it’s not the right choice for everyone. Here are the major cons to watch for when you shop at Sun Coast Insurance:

- Not Available Everywhere: Sun Coast currently sells insurance in just 11 states: Arizona, Alaska, California, Colorado, Florida, Hawaii, Nevada, Oregon, Texas, Utah, and Washington.

- Doesn’t Sell Directly: Sun Coast General doesn’t write its own policies. Instead, it pairs its customers with the best insurance providers in their area.

At the end of the day, the best way to decide which company to purchase insurance from is to research your options. Sun Coast General may not be the cheapest option, but it’s a great choice for high-risk drivers struggling to find coverage.

Learn More: How Auto Insurance Companies Check Driving Records

Explore Sun Coast Auto Insurance Quotes Today

Learning how to evaluate auto insurance rates is a crucial step when shopping for coverage, but that’s especially true for high-risk drivers. Sun Coast General may not be the best choice for the average driver, but it does make it easier to find high-risk auto insurance.

If an insurance provider considers you high-risk, you will pay high premiums💰. You might have a hard time finding 🔎coverage. https://t.co/27f1xf131D has the information you need to lower your costs as much as possible. Check it out here👉: https://t.co/J52mqqaRQj pic.twitter.com/N2kOV5uYXY

— AutoInsurance.org (@AutoInsurance) September 27, 2023

Whether you need to find cheap auto insurance after a DUI or want standard coverage, Sun Coast is worth comparing with other providers. To start comparing quotes, enter your ZIP code into our free comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Sun Coast Insurance legit?

Although it’s a small company without the name recognition of larger providers, Sun Coast General is a legitimate insurance provider. It offers many types of auto insurance coverage, plenty of discounts, and decent customer service.

How many states is Sun Coast General in?

You can purchase Sun Coast car insurance in 11 states — Arizona, Alaska, California, Colorado, Florida, Hawaii, Nevada, Oregon, Texas, Utah, and Washington.

How much does Sun Coast auto insurance cost?

While it’s not one of the cheapest auto insurance companies, some drivers will see affordable rates from Sun Coast. Sun Coast General insurance rates vary based on several factors, but you can get minimum insurance starting at $95 per month. For full coverage, Sun Coast rates start at $110 per month.

How do you get a Sun Coast auto insurance quote?

The easiest way to get a quote from Sun Coast is to visit their website. If you prefer to speak with someone, call the Sun Coast auto insurance phone number. To compare quotes now, enter your ZIP code into our free comparison tool.

Is Sun Coast auto insurance worth it?

For many drivers, a Sun Coast auto insurance policy is completely worth it. High-risk drivers who struggle to find coverage often find affordable coverage through Sun Coast General.

Is Sun Coast affordable?

The affordability of Sun Coast Insurance depends on what type of driver you are. If you’re an average driver with a clean driving record, you’ll probably find cheaper options than Sun Coast. However, Sun Coast is a great option for high-risk drivers since their rates tend to be lower.

Is Sun Coast cheaper than Allstate?

Allstate offers cheaper average minimum insurance, but Sun Coast has cheaper full coverage rates. However, Sun Coast is likely cheaper than Allstate for high-risk drivers. Compare rates in our Allstate auto insurance review.

Is there a lawsuit against Sun Coast General?

While you may have read about a Suncoast insurance lawsuit, it’s for a different company. Sun Coast may not be the perfect insurance company, but it doesn’t have pending lawsuits against it.

Does Sun Coast General sell roadside assistance?

It depends on which company Sun Coast pairs you with, but you’ll more than likely be able to purchase roadside assistance. If this coverage is important to you, make sure to compare the best roadside assistance plans to find the right coverage.

Does Sun Coast General sell gap insurance?

Sun Coast General doesn’t mention selling gap insurance on its website, but you may be able to purchase it when you sign up for a policy.

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.