The General Auto Insurance Review in 2025 (See Average Rates Here!)

This "The General auto insurance review" focuses on affordable options, starting at $54 monthly. The General is known for catering to high-risk drivers. Thus, its policies are accessible and flexible regarding payment choices. Discover if The General car insurance meets your coverage requirements.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The General

Average Monthly Rate For Good Drivers

$54A.M. Best Rating:

AComplaint Level:

HighPros

- Policies start at $54 per month.

- Multiple payment plans.

- Fast and easy quote process.

Cons

- Fewer options than larger insurers.

- Some report issues with claims handling.

The General auto insurance review highlights affordable rates starting at $54 and flexible payment options. The General car insurance is best for budget rates and less-than-perfect records.

The General review finds this provider has limited coverage options for some customers, yet it boasts fast online quotes and excellent customer service for high-risk drivers.

The General Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Insurance Rating | 3.4 |

| Business Reviews | 3.5 |

| Claim Processing | 2.5 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.5 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3.5 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.3 |

| Plan Personalization | 3.5 |

| Policy Options | 3.1 |

| Savings Potential | 3.5 |

The most effective way to determine exactly how much car insurance you need is to compare quotes from various providers, ensuring you find the coverage that best fits your needs and budget.

No matter how much coverage you need, you can find the best rates for The General auto insurance by entering your ZIP code into our free comparison tool.

- The General car insurance offers up to 25% discounts for safe drivers

- Flexible payment plans set The General auto insurance apart from competitors

- Military members enjoy exclusive perks with The General insurance policies

Coverage Cost With The General Auto Insurance

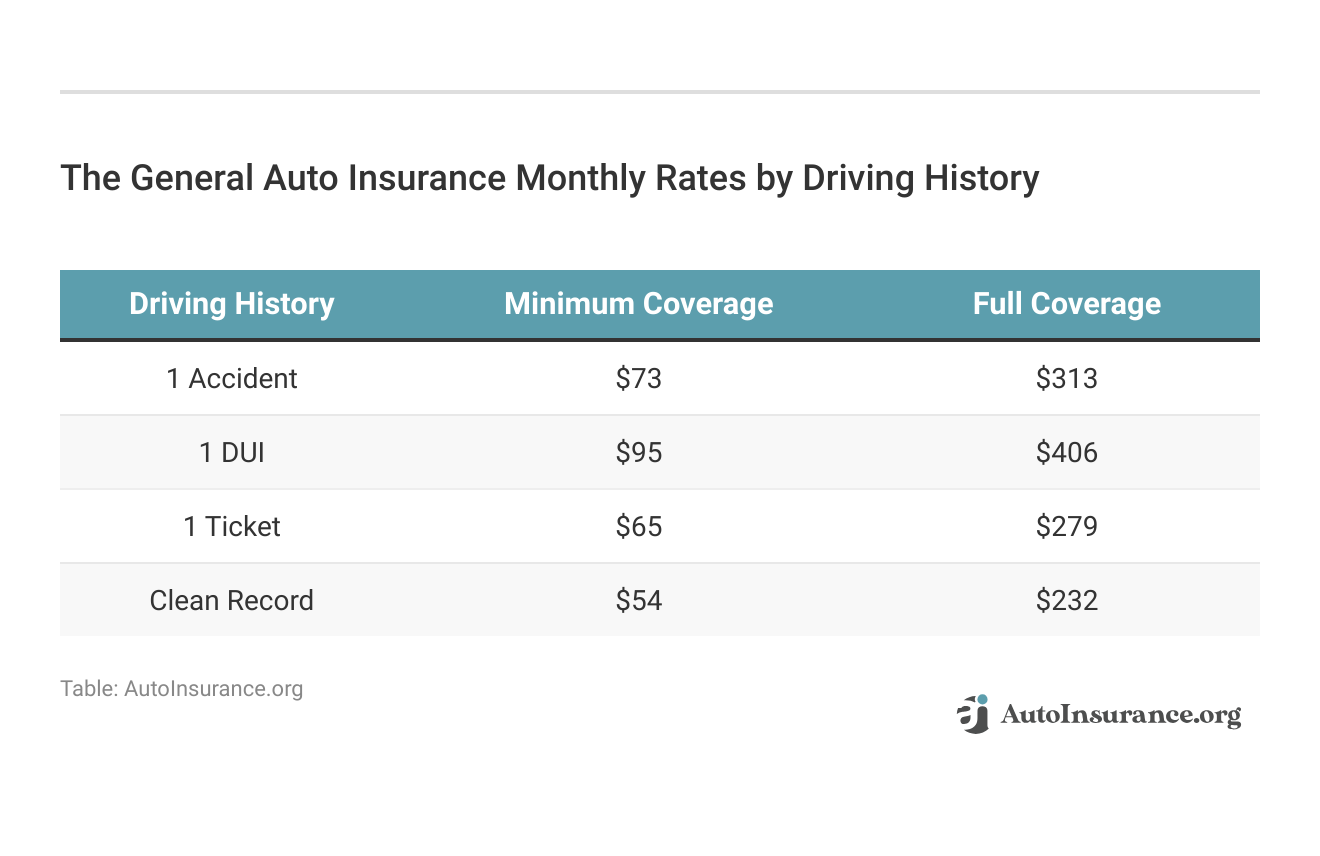

During a review of The General car insurance coverage costs, many factors that affect auto insurance rates will be considered, such as the driver’s age, driving history, gender, and location.

The General Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $471 | $1,207 |

| 16-Year-Old Male | $526 | $1,289 |

| 18-Year-Old Female | $383 | $890 |

| 18-Year-Old Male | $451 | $1,048 |

| 25-Year-Old Female | $149 | $393 |

| 25-Year-Old Male | $155 | $409 |

| 30-Year-Old Female | $135 | $357 |

| 30-Year-Old Male | $141 | $372 |

| 45-Year-Old Female | $127 | $333 |

| 45-Year-Old Male | $77 | $331 |

| 60-Year-Old Female | $122 | $310 |

| 60-Year-Old Male | $124 | $316 |

| 65-Year-Old Female | $122 | $318 |

| 65-Year-Old Male | $121 | $317 |

Premiums often change with these particular factors, giving a personal figure to each driver. The General frequently has competitive premiums, especially for high-risk drivers, and these rates are often cheaper than the other insurance companies to go along with it.

This review of The General auto insurance emphasizes its competitive coverage costs, with rates starting at just $54, offering excellent value for budget-conscious drivers.Michelle Robbins Licensed Insurance Agent

From AutoInsurance.org reviews, The General scored 3.3, meaning it is affordable but still not at its best.

However, it also calls for lower premiums for older drivers at this stage. Younger or inexperienced drivers would have higher ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Cost vs. Competitors for The General Auto Insurance

On the other hand, when you evaluate The General with a major insurer such as State Farm for pricing, significant differences occur due to demographic effects.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $274 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $890 | $1,048 | $357 | $372 | $333 | $331 | $318 | $317 | |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $289 | $257 | $106 | $113 | $84 | $84 | $82 | $82 |

One example may be State Farm offering cheaper rates to a young male with a clean driving record, while The General typically serves the high-risk auto insurance audience.

Lastly, considering the question “Is The General insurance good?” it can be a good choice for specific drivers. Yet, its rates may be higher than those of other companies, such as State Farm, for those with minimal risk indicators.

Those choosing options should look for cheap autoinsurance.org reviews and determine autoinsurance.org legitimacy before selecting a company. For further insights, you can visit AutoInsurance.org. Additionally, check cheap AutoInsurance.org reviews for more information on various insurance options.

Coverage Options Available Through The General Auto Insurance

As for you, The General insurance company review provides that coverage available through The General auto insurance varies to suit your personal needs as a diver or owner of a car such includes:

- Complete Coverage: Comprehensive protection, including liability, collision, and comprehensive coverage.

- Minimum Coverage: It protects you from liability only—the minimum insurance required by law in your state.

- Comprehensive Coverage: This coverage is against non-collision damages (stolen car or getting keyed).

- Gap Insurance: This pays the difference between how much is owed on a car loan and what that particular vehicle would be worth if it were stolen or involved in an automobile accident.

- Add-Ons and SR-22 Filings: Customizable options like roadside assistance and proof of financial responsibility after certain violations.

The General score is 4.5 regarding the recommended auto insurance coverage levels, which implies a good score showing that they have robust offerings for many of their customers’ needs.

Available Discounts From The General Auto Insurance

The General insurance review highlights several discounts that can substantially reduce your premiums. Some of the critical discounts available are:

Auto Insurance Discounts With The General

| Discount Name | Savings Potential | Who Qualifies? |

|---|---|---|

| Multi-Vehicle | 25% | Owns multiple vehicles |

| Good Student | 20% | High GPA students |

| Homeowner | 10% | Homeowners |

| Defensive Driving | 10% | Completed driving course |

| Paid-in-Full | 10% | Pays premium upfront |

| Military | 15% | Military members |

| Safe Driver | 15% | Clean driving record |

| Bundling | 10% | Bundles policies |

| Low Mileage | 8% | Low annual mileage |

The General receives a solid score of 4 for its discount offerings. The General is also an excellent choice if you seek the best auto insurance discounts for good drivers. For more details on common reviews of The General car insurance, see the information on AutoInsurance.org.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of The General Auto Insurance

General customer reviews about their experience with The General automobile insurance are reflected in various customer opinions. On Reddit and Quora, some users rave about cheap coverage auto insurance rates and the no-fuss claim process.

Is The General a good place to get auto insurance?

byu/zenlifey inInsuranceAgent

A user on Reddit stated: “Switched to The General after having a hard time getting covered elsewhere, and I’m content with it.” However, several users have questioned The General’s customer services, particularly with claims. Find out more at www.autoinsurance.org.

The General Car Insurance certainly isn’t for everyone, but it might be a good✅ last and only resort🛟 for those who have difficulty finding auto insurance thanks to their record. https://t.co/27f1xf1ARb has the details and you can check them out here👉: https://t.co/Z7j7VJXMno pic.twitter.com/4Bmg3ab4JV

— AutoInsurance.org (@AutoInsurance) December 21, 2023

Customer feedback indicates that the overall experience with The General auto insurance reviews tends to hover around a 3.6 rating, with positive reviews slightly outnumbering negative ones. For further insights, check out AutoInsurance.org Reviews to see what others say.

Business Reviews for The General Auto Insurance

Reliable reviews assess The General and show how it ranks in the car insurance industry. Here are reviews of The General auto insurance from some top entities:

The General Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 835 / 1,000 Avg. Satisfaction |

|

| Score: B+ Good Business Practices |

|

| Score: 68/100 Avg. Customer Feedback |

|

| Score: 1.15 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

The rating given by The General company in the insurance review was 3.5 stars, which meant that the company was assessed to be situated in a fair to average standing when it comes to stability within car insurance. If interested in its deals, you can request a quote and decide based on The General car insurance review.

Knowing these ratings is good because it helps you while researching the best commercial auto insurance companies and enables you to make more informed decisions about your coverage options.

Pros and Cons of The General Auto Insurance

When you are exploring your auto insurance options, it is important to weigh the advantages and disadvantages of each provider you look at.

Customer reviews of The General auto insurance highlight its excellent service and competitive rates, starting at $54 per month. The General is known for offering affordable coverage for high-risk drivers.Eric Stauffer Licensed Insurance Agent

This article has been written to focus on the advantages and disadvantages of regular automobile insurance, thereby helping you make an informed selection according to your equity. Moreover, we will refer to The General insurance company reviews for an all-in-one read.

Pros

- Low Cost: The prices are competitive, starting at $54 a month, making it particularly attractive to high-risk drivers.

- Comfortable Repayment: Their policies always include an attractive repayment schedule for whatever financial situation.

- Many Discounts: The organization provides a long list of discounts that push down the policyholder’s coverage price.

Cons

- More Expensive: Drivers with a good driving record may experience The General’s rates as higher than average.

- Customer Service Complaints: Opinions on customer service are split, and some issues with claims are mentioned.

While you are assessing your choices, it is also important to have a clear understanding of how to file an auto insurance claim. This information could help add to your experience with The General and ensure that they can support you in times when it truly matters.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Analyzing The General Auto Insurance Features

The General prides itself on transparent policies and convenient payment options. Additionally, the General auto insurance ratings on the Better Business Bureau highlight customer experience and quality of service.

Competitive pricing and options to tailor coverage make The General auto insurance valuable for any driver, regardless of background or lifestyle.

It also helps to have a solid comprehension of how credit scores affect auto insurance rates so you can equate it with your possible premiums and what kind of coverage might be available.

Start comparing affordable The General auto insurance options by entering your ZIP code below into our free quote comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What types of coverage does The General offer?

The General gives different coverage options: liability, collision auto insurance, comprehensive, uninsured/underinsured motorist protection, and personal injury protection. You will want to learn all these options, especially collision auto insurance since this type of insurance is essential in keeping your car safe in case of collisions.

Is AutoInsurance.org Legit?

AutoInsurance.org is a legitimate and trusted resource for auto insurance shoppers. Our mission is to provide objective, third-party insights into all aspects of auto insurance.

We regularly update our site with comprehensive articles and guides to help you find affordable car insurance rates. Our team consists of licensed insurance agents and financial advisors to ensure our information is accurate and reliable.

Click here to get instant car insurance quotes and find your lowest rates.

Is The General good car insurance?

The General offers affordable car insurance with monthly starting rates of $54, covering even high-risk drivers. However, The General reviews conclude that the general car insurance quotes are higher than competitors, and one of the frequent complaints about customer service from policyholders.

Can I get a quote online from The General?

You can quickly obtain a quote online by visiting The General’s website, which provides basic information about yourself and your vehicle. Enter your ZIP code below in our free tool to receive quotes for The General auto insurance today.

Does The General offer discounts on car insurance?

Yes, The General has some reductions, including safe driver discounts, reductions for insuring multiple vehicles, and the best bundling discounts for home and auto insurance. Knowing what those discounts are can save a lot more on your premiums; seeing everything you qualify for will be worth your while.

How does AutoInsurance.org help consumers?

AutoInsurance.org helps consumers compare insurance rates and reviews from various companies, allowing them to make informed decisions based on customer experiences.

Is The General available in all states?

The General operates in most states, though availability might vary. For specifics, check their website or contact customer service.

Can high-risk drivers get insurance from The General?

Yes, The General specializes in covering high-risk motorists who cannot get other companies to insure them.

How can I file a claim with The General?

You can submit a claim with The General online or by contacting their claims office directly. You might ask how to cancel an auto insurance claim or what happens once you file; learning about this process and your choices will help you better understand how to use your insurance.

What are the common factors affecting car insurance rates?

As has been noted earlier, the cost of car insurance depends on several factors: the driving record of an individual, their age, city or location, model and kind of vehicle, and even credit score.

Is The General car insurance good?

The General is one of the more popular options among high-risk drivers on a budget. It offers competitive rates starting at $54 monthly but generally is for those with imperfect records. A few reviews have mixed feelings about the customer service and claim handling. The General is a decent option for someone looking to save money on their car insurance while being offered flexible payment options.

Is The General good insurance?

The General Insurance company is known for flexible plans with low-priced premiums that may attract even the most desperate motorists. As The General insurance reviews depiction, sometimes, it is described as affordable. Still, the limited choices of coverage and the mostly dissatisfying customer service may disqualify this company from the shortlist of drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Glarison

Great company I'm riding with shack

HWalla

Quick and thorough

Kasarah90

Quick and affordable would recommend

mcgowanjr60_henry_yahoo_com

The Lion of the Jungle

Bentot

Lower monthly rate

Junglezx_3

High Insurance

bwaryasz2012

You get what you buy!

goog39826_

Thank you for great service!

Jessbell19

Poor customer service

counterstrike1911

The general will generally treat you like crap and rip u off