The Hartford Auto Insurance Review for 2025 (Rates, Discounts, & Options)

Our Hartford auto insurance review highlights competitive premiums for AARP members, with monthly rates as low as $39. The Hartford Advantage Plus offers accident forgiveness and disappearing deductibles, making it a standout choice for seniors. Get quotes to secure the best policy today.

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The Hartford

Average Monthly Rate For Good Drivers

$39A.M. Best Rating:

A+Complaint Level:

LowPros

- Special discounts for AARP members

- Excellent customer satisfaction ratings

- Low rates for older drivers

- Provides disappearing deductibles

Cons

- More than the usual number of customer complaints about auto policies

- Higher rates for people with speeding tickets

- Less affordable for teens and young drivers

- Although it’s well-known for selling AARP car insurance, The Hartford sells policies to all age groups

- AARP members see extra discounts and unique benefits from The Hartford insurance policies

- The Hartford struggles with claims handling, but most customers are satisfied with their service

This The Hartford auto insurance review covers key benefits like special discounts for AARP members and accident forgiveness, with rates starting at $39 per month.

Although older drivers enjoy low premiums and perks like disappearing deductibles, some customers report complaints about claims handling. On the positive side, The Hartford’s customer service is well-rated, but younger drivers might see higher premiums.

The Hartford Auto Insurance Ratings

| Rating Criteria |  |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.5 |

| Policy Options | 4.1 |

| Savings Potential | 4.3 |

With an A+ financial rating, The Hartford remains strong, yet it’s crucial to compare multiple insurance quotes to find the best rate. Drivers over 50 tend to benefit most from The Hartford’s offerings, but exploring other options ensures better savings and coverage flexibility.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tooltoday.

- The Hartford has an A+ insurance rating for financial stability

- AARP members enjoy exclusive benefits like accident forgiveness and discounts

The Hartford’s Premium Variation by Age and Gender

As mentioned, age and gender serve as the primary determinant for The Hartford’s auto insurance premiums. These prices give insight into how The Hartford calculates its rates based on personal factors.To understand what you might expect to pay, reference the rates outlined below.

The Hartford Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $215 | $552 |

| Age: 16 Male | $235 | $577 |

| Age: 18 Female | $175 | $407 |

| Age: 18 Male | $201 | $469 |

| Age: 25 Female | $51 | $135 |

| Age: 25 Male | $54 | $143 |

| Age: 30 Female | $47 | $126 |

| Age: 30 Male | $50 | $133 |

| Age: 45 Female | $44 | $115 |

| Age: 45 Male | $43 | $113 |

| Age: 60 Female | $39 | $101 |

| Age: 60 Male | $40 | $103 |

| Age: 65 Female | $43 | $112 |

| Age: 65 Male | $42 | $109 |

Younger drivers face noticeably elevated premiums, with 16-year-old males paying $577 and females $552 for full protection. As individuals age, the cost of coverage diminishes significantly, with 60-year-olds seeing far more affordable rates, such as $101 for females and $103 for males. Over time, the gap between male and female pricing shrinks, reflecting a more balanced approach in auto insurance rates by age.

On the other hand, violations on your driving record may cause premiums to rise. Receiving a traffic infraction can lead to significant rate hikes. To learn how insurance providers review driving records and determine rate changes, refer to the detailed table below.

Additionally, The Hartford auto insurance premiums can vary widely between states, primarily due to differing state regulations and typical costs. For example, states with higher accident frequencies or costlier claims may see elevated insurance premiums from The Hartford.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Valuable Coverage Options for AARP Members

While The Hartford sells insurance for all age groups, it excels at providing valuable coverage for older drivers. If you’re an AARP member, The Hartford might be one of the best auto insurance companies for your needs.

Although The Hartford offers great car insurance for older drivers, you should still shop around for alternatives. Make sure to compare quotes with as many companies as possible to find the best rates for your car.

Understanding The Hartford’s Insurance Offerings

While it might not be the first name you think of for car insurance, The Hartford auto insurance company has highly-rated coverage plans that most customers enjoy. Most known for the Hartford’s AARP plans, drivers of any age might find affordable auto insurance rates with this Connecticut-based insurance provider.

Whether you need full coverage to finance a car or your state’s minimum insurance to stay on budget, The Hartford has car insurance options you need at affordable prices. While a variety of factors determine how much you’ll pay for your insurance, The Hartford insurance quotes are particularly low for older drivers.

The Hartford might have the best auto insurance, especially if you’re an AARP member. Explore The Hartford auto insurance review, then compare rates to find the best policy for your needs.

While The Hartford is an overall solid choice for car insurance, it’s better for older drivers.

Comparing The Hartford’s Insurance Ratings and Reviews

The Hartford has a partnership with AARP and is the only official provider of insurance to its members. Due to this partnership, The Hartford offers special savings and perks for AARP members. However, you don’t need to be an AARP member to get a good The Hartford insurance policy. To decide if this is the right provider for you, look at The Hartford insurance company ratings, customer service reviews, and online tools.

The National Association of Insurance Commissioners (NAIC) rates companies based on the number of complaints they receive compared to their size. The national average is 1.0 — anything lower means a company receives fewer than the typical number of complaints.

The Hartford Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 905 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

The Hartford car insurance reviews suggest that the company has a score of 0.36, which is far below the national average. While The Hartford insurance receives complaints about its claims handling, most customers are satisfied with its service.

Another popular third-party rating to look at is A.M. Best, which rates companies on their financial stability. The Hartford insurance rating from A.M. Best is an A+, which means it will have no problem paying any claim you might make.

The Better Business Bureau (BBB) gives ratings based on a company’s ability to resolve customer issues. The Hartford insurance reviews from the BBB reveal that the company has an A+, but there are hundreds of complaints about The Hartford auto insurance on the BBB site.

The Hartford’s accident forgiveness and disappearing deductibles make it a standout choice.Jeff Root Licensed Insurance Agent

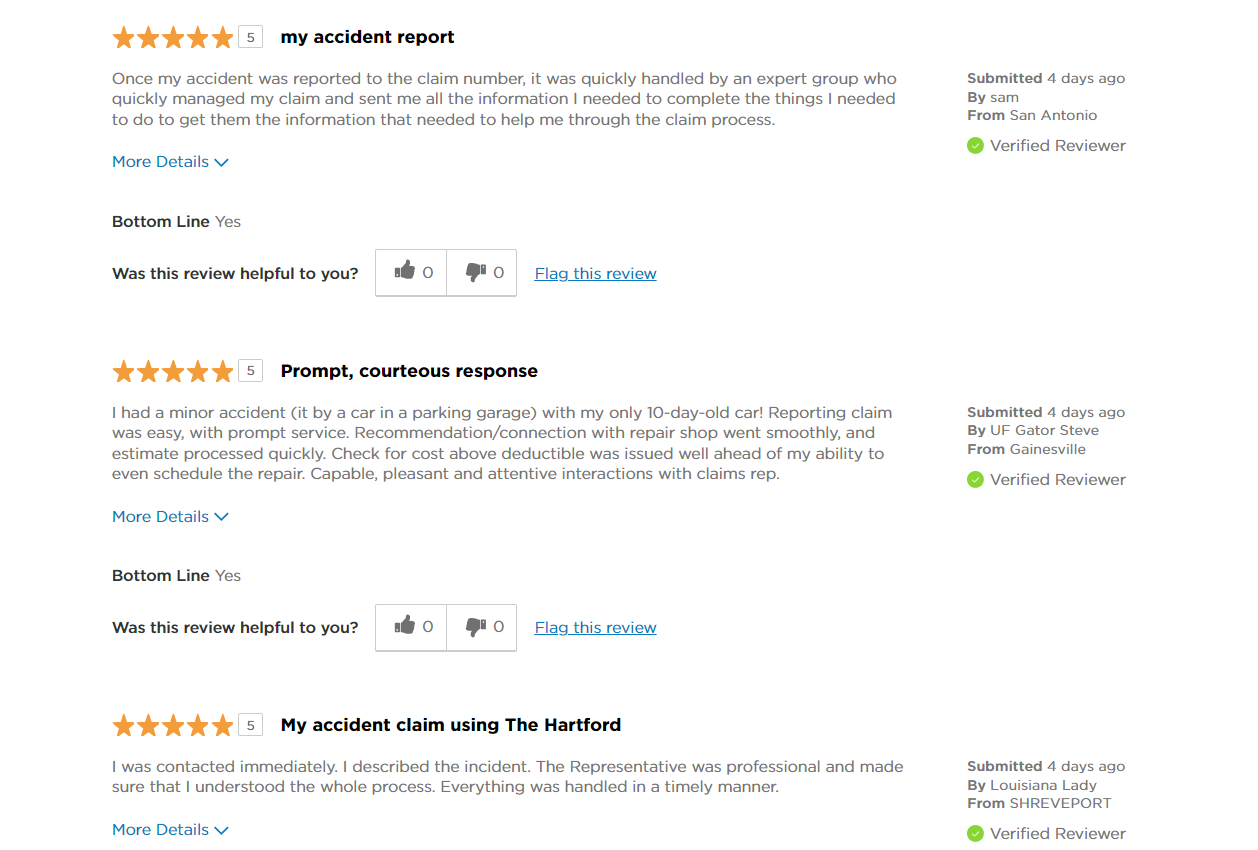

Third-party ratings are a great place to start when you’re looking for the best company, but they’re not your only resource. You should also look at customer reviews.

The Hartford insurance reviews regarding customer reviews are mixed. Some customers enjoy the low rates and say The Hartford representatives are helpful. Others are unsatisfied with how The Hartford handles claims and how often The Hartford insurance rates increase.

The Hartford Auto Insurance Customer Service Review

Although it struggles with some of its claims handling reviews, The Hartford insurance excels in its customer service ratings.

Overall, customers report satisfaction with the service they receive from The Hartford. While there is some grief about The Hartford claims servicing, most customers say they are happy with their settlements once the process is completed. They also report that The Hartford is supportive during car repairs and that rental car reimbursement coverage is easy to work with.

The Hartford car insurance has closed over a million car insurance claims, which it says dedicated, responsive representatives are responsible for. Although it doesn’t always live up to it, most customers say The Hartford lives up to its promise of friendly service.

The Hartford’s Online Tools

To keep up with today’s demands for convenience and speed, The Hartford offers a variety of online tools. These tools include the following:

- Online Quote Calculator: Using your ZIP code, age, marital status, and other personal details, you can get a quick quote online.

- Online Claim Filing: If you don’t want to speak with a representative, you can start and track claims online.

- Online Bill Pay: After you create an account, you can manage The Hartford policy payments online.

- Mobile App: Called Auto & Home at The Hartford, you can use the Hartford mobile app to access insurance cards, make payments, start a claim, and request roadside assistance.

It doesn’t match the variety of technological offerings of some of its competitors, but The Hartford covers the basics that most modern customers expect from their insurance.

The Hartford Insurance Coverage Options

Most states require a specific amount of car insurance before you can drive, while having a loan or lease usually means you need full coverage.

The Hartford Auto Insurance Coverage Options

| Coverage | Description |

|---|---|

| Liability | Covers others' damages and injuries in an accident |

| Collision | Addresses damage to your vehicle from a collision |

| Comprehensive | Protects from non-collision damage (theft, weather) |

| Personal Injury Protection (PIP) | Manages your and passengers' medical costs |

| Medical Payments | Handles medical bills for you and passengers |

| Uninsured/Underinsured Motorist | Protects if hit by a driver with insufficient insurance |

| Rental Car Reimbursement | Reimburses for a rental car while your vehicle is repaired |

| Roadside Assistance | Helps with breakdowns and towing |

| Gap Insurance | Addresses the loan balance vs. car value in a total loss |

| Accident Forgiveness | Prevents premium increases after your first accident |

| Disappearing Deductible | Reduces deductible each accident-free year |

| RecoverCare | Aids with household tasks after injury |

The Hartford auto insurance provides essential coverage options for all your needs. Whether you need full protection or basic plans, they have you covered.

- Liability Insurance: Liability consists of property damage and bodily injury, which work together to pay for damage you cause after an accident.

- Comprehensive Insurance: Your policy won’t cover damage from fire, weather, animal contact, theft, or vandalism unless you have comprehensive insurance.

- Uninsured/Underinsured Motorist Coverage: Although you’re supposed to have insurance, not all drivers follow the law. If you’re involved in an accident where the at-fault driver doesn’t have enough coverage, uninsured motorist kicks in.

- Medical Payments Coverage: Having this coverage on your policy will help pay any medical expenses you have after an accident.

- Personal Injury Protection: Personal injury protection helps pay medical expenses after an accident, no matter who is at fault, and covers lost wages and funeral costs.

Medical payments and personal injury protection are not available in every state, so make sure to check with a representative.

A representative can also help you determine the best options for your situation so you don’t pay for coverage you don’t need.

Additional Auto Insurance from The Hartford

Most of The Hartford’s vehicle insurance add-ons are available to AARP members, but there are a few that nonmembers can purchase. They include the following:

- Rental Car Reimbursement: If you need a temporary vehicle because yours is being repaired after a covered incident, The Hartford will give you a daily allowance for a rental.

- Full Glass Coverage: Purchasing this coverage ensures that your windshield, headlights, and mirrors will be repaired after an incident without paying a deductible.

- Towing: The Hartford insurance towing coverage will tow your car whenever it becomes disabled. While not as in-depth as roadside assistance, towing is an affordable option.

- Umbrella: If you cause an accident and damages exceed your liability policy limits your liability insurance doesn’t cover all the bills, umbrella insurance takes over.

- Gap Coverage: If you total your vehicle while you owe more on a loan than your car is worth, The Hartford Gap insurance coverage will pay the difference.

While The Hartford has great options for additional coverage, it offers its best benefits to AARP members.

The Hartford’s Advantage Program

Aside from the basics, AARP members have access to a host of additional benefits that raise the value of any policy from The Hartford. These benefits include the following:

- Lifetime Renewability. As long as you pay The Hartford bills on time and have a valid driver’s license, The Hartford guarantees that you’ll be able to renew your car insurance.

- 12-Month Rate Protection: Most car insurance companies reevaluate your rates after six months, but rates for AARP members are locked for 12 months.

- RecoverCare: If you find yourself struggling to perform daily activities after a car accident, The Hartford will reimburse you for the price of caretakers, dog walkers, and food preparation.

- New Car Replacement: The Hartford will replace your vehicle without deducting value for depreciation if you total it within the first 15 months or 15,000 miles of ownership.

- Roadside Assistance: If you find yourself stranded on the side of the road, The Hartford’s roadside assistance can help with flat tires, dead batteries, fuel delivery, and tows.

You don’t need to fill out forms or jump through hoops to access these benefits. As long as you’re over 50 and an AARP member, you simply need to speak with a representative to enroll in the Advantage plan.

The Hartford’s Advantage Plus Program

The Advantage Plus program is additional coverage you can purchase if you’re an AARP member. It offers the following benefits as a package:

- Accident Forgiveness: Your rates won’t increase after your first at-fault accident. Only drivers with five years of accident-free driving qualify.

- Disappearing Deductible: Every year you spend accident-free will lower your deductible until it reaches $0.

- One Deductible: You only need to pay one deductible if you need to file a single claim for multiple cars on the same policy. This also applies if you need to file a claim for home and auto at the same time.

- Deductible Waived: The Hartford will often waive your deductible if you’re found to be not at fault in a car accident.

As you can see, choosing The Hartford car insurance as an AARP member dramatically increases the value of your policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Hartford Insurance Rates Breakdown

Car insurance quotes from The Hartford depend on a variety of factors. While every company is different, most look at the following factors:

- Age

- Location

- Gender

- Marital Status

- Credit Scores

The Hartford’s rates are slightly more affected by age than the typical insurance company. While you might see affordable prices as a teen or young adult, The Hartford specializes in offering older adults the lowest prices possible.

Take a look below to see average rates for full coverage auto insurance from the top ten companies.

Minimum vs. Full Coverage Monthly Insurance Rates by Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $47 | $124 | |

| $53 | $138 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 | |

| U.S. Average | $65 | $170 |

Keep in mind that AARP members will see much lower rates than nonmembers. In fact, The Hartford’s AARP rates are so affordable that it beats other larger providers like State Farm and Allstate.

However, The Hartford’s rates are usually affordable for any age group.

The Hartford Auto Insurance Rates by Age

Age is important for all companies, but it’s especially crucial to The Hartford. While drivers older than 50 see the best rates, The Hartford does well for all age groups. Take a look at some of the discounts available to young drivers with The Hartford compared to other companies.

Young Driver Auto Insurance Discounts by Company

| Company | Claim Free | Continuous Coverage | Defensive Driver | Driver's Ed | Driving Device/App | Early Signing | Full Payment | Good Credit | Low Mileage | Loyalty | Married | Multiple Policies | Multiple Vehicles | Occupation | On Time Payments | Online Shopper | Paperless Documents | Paperless/Auto Billing | Safe Driver | Students & Alumni | Young Driver |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10% | 12% | 8% | 5% | 8% | 6% | 7% | 5% | 6% | 4% | 5% | 10% | 9% | 3% | 5% | 6% | 4% | 6% | 15% | 10% | 20% |

| 12% | 10% | 9% | 6% | 7% | 5% | 8% | 6% | 7% | 6% | 4% | 12% | 10% | 4% | 6% | 5% | 5% | 6% | 15% | 10% | 25% |

| 15% | 14% | 10% | 7% | 9% | 7% | 9% | 8% | 8% | 7% | 6% | 15% | 12% | 5% | 7% | 6% | 6% | 7% | 30% | 10% | 20% | |

| 13% | 11% | 9% | 6% | 8% | 5% | 8% | 7% | 7% | 5% | 5% | 12% | 10% | 4% | 6% | 6% | 5% | 6% | 20% | 10% | 15% | |

| 10% | 9% | 8% | 6% | 5% | 7% | 6% | 5% | 5% | 4% | 4% | 9% | 8% | 3% | 4% | 5% | 4% | 5% | 20% | 10% | 15% | |

| 11% | 13% | 10% | 8% | 10% | 7% | 10% | 9% | 8% | 7% | 6% | 14% | 12% | 6% | 8% | 7% | 6% | 7% | 20% | 15% | 15% | |

| 12% | 11% | 9% | 7% | 8% | 7% | 8% | 7% | 6% | 5% | 5% | 11% | 9% | 4% | 5% | 6% | 5% | 6% | 20% | 10% | 25% |

| 13% | 12% | 10% | 8% | 9% | 7% | 9% | 8% | 7% | 5% | 6% | 12% | 10% | 4% | 6% | 5% | 5% | 6% | 15% | 10% | 20% | |

| 12% | 10% | 9% | 6% | 8% | 5% | 7% | 6% | 7% | 5% | 5% | 10% | 9% | 4% | 6% | 6% | 5% | 6% | 22% | 15% | 20% | |

| 14% | 13% | 11% | 9% | 10% | 8% | 10% | 9% | 9% | 7% | 6% | 15% | 13% | 5% | 8% | 7% | 7% | 8% | 30% | 10% | 20% |

| 13% | 12% | 10% | 8% | 9% | 7% | 9% | 8% | 8% | 6% | 6% | 13% | 11% | 5% | 7% | 6% | 6% | 7% | 20% | 15% | 20% |

| 15% | 13% | 11% | 9% | 10% | 8% | 10% | 9% | 9% | 8% | 7% | 15% | 13% | 6% | 8% | 7% | 7% | 8% | 20% | 10% | 15% | |

| 13% | 10% | 9% | 6% | 7% | 6% | 7% | 6% | 5% | 5% | 4% | 10% | 9% | 4% | 5% | 5% | 5% | 6% | 20% | 10% | 15% |

| 12% | 11% | 10% | 7% | 8% | 6% | 8% | 7% | 6% | 5% | 5% | 11% | 9% | 4% | 6% | 5% | 5% | 6% | 15% | 10% | 20% | |

| 14% | 12% | 10% | 8% | 9% | 7% | 9% | 8% | 8% | 6% | 6% | 13% | 11% | 5% | 7% | 6% | 6% | 7% | 30% | 10% | 25% | |

| 15% | 14% | 12% | 9% | 10% | 8% | 10% | 9% | 8% | 7% | 6% | 14% | 12% | 6% | 8% | 7% | 6% | 7% | 15% | 10% | 20% | |

| 14% | 12% | 10% | 8% | 9% | 7% | 9% | 8% | 7% | 6% | 5% | 12% | 10% | 5% | 6% | 6% | 6% | 7% | 20% | 10% | 15% | |

| 14% | 12% | 10% | 9% | 10% | 7% | 9% | 8% | 8% | 6% | 6% | 13% | 11% | 5% | 7% | 6% | 6% | 7% | 20% | 10% | 20% |

| 14% | 12% | 11% | 8% | 9% | 7% | 9% | 8% | 7% | 6% | 5% | 13% | 11% | 5% | 7% | 6% | 5% | 7% | 30% | 15% | 20% | |

| 15% | 14% | 11% | 9% | 10% | 8% | 10% | 9% | 8% | 7% | 6% | 14% | 12% | 6% | 8% | 7% | 6% | 7% | 30% | 10% | 25% |

As you can see, older drivers benefit the most from The Hartford auto insurance. If you’re trying to find cheap insurance for teens, you should compare quotes with companies like Travelers, Progressive, and State Farm to find the best rates.

Top Competitors and The Hartford: Rate Breakdown

The Hartford’s auto insurance premiums fluctuate considerably depending on age and gender in comparison to leading competitors. This analysis underscores how pricing adjusts for both younger and older drivers across various providers.

The Hartford Auto Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male | Age: 25 Female | Age: 25 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $220 | $230 | $190 | $210 | $85 | $90 | $65 | $68 | $58 | $56 | $39 | $40 | $43 | $42 | |

| $165 | $175 | $145 | $155 | $75 | $80 | $60 | $62 | $50 | $48 | $50 | $52 | $55 | $54 | |

| $185 | $195 | $160 | $170 | $88 | $92 | $66 | $69 | $57 | $55 | $48 | $49 | $52 | $51 | |

| $160 | $180 | $140 | $150 | $90 | $95 | $70 | $72 | $60 | $58 | $50 | $52 | $55 | $53 | |

| $190 | $200 | $170 | $180 | $85 | $90 | $65 | $67 | $59 | $57 | $55 | $56 | $60 | $59 |

| $180 | $190 | $160 | $170 | $78 | $82 | $63 | $66 | $54 | $52 | $51 | $53 | $56 | $54 |

| $210 | $220 | $180 | $200 | $100 | $102 | $75 | $78 | $64 | $62 | $52 | $54 | $58 | $55 | |

| $195 | $205 | $165 | $180 | $80 | $82 | $60 | $62 | $55 | $54 | $49 | $51 | $54 | $52 | |

| $215 | $235 | $175 | $201 | $51 | $54 | $47 | $50 | $44 | $43 | $50 | $52 | $53 | $51 |

| $175 | $185 | $155 | $165 | $80 | $85 | $62 | $65 | $53 | $51 | $45 | $47 | $49 | $48 |

Assessing premiums across insurers shows the impact of age and gender on costs, helping drivers make better-informed decisions. Comparing several companies guarantees finding the right coverage at the most competitive rate.

The Hartford Auto Insurance Rates by Driving History

Although age is an important factor for The Hartford, it will also look at your driving history. You’ll pay much more for your insurance if you have traffic violations, multiple accidents, or DUIs.

Check below to see how the top ten insurance companies handle traffic incidents.

The Hartford Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $84 | $94 | $102 | $132 | |

| $153 | $136 | $165 | $223 |

| $99 | $134 | $139 | $206 |

The exact amount that your rates increase depends on other factors like your location and age, but you might see as much as a 50% increase after an incident. However, a traffic incident will only affect your insurance rates for about three years as long as you don’t have any other problems.

The Hartford Discounts Available

The Hartford’s discount list is similar to what most other companies offer. By taking advantage of auto insurance discounts, you can significantly cut your rates. Here are The Hartford’s discount options:

The Hartford Auto Insurance Discounts by Savings Potential

| Discount |  |

|---|---|

| Multi-Car | 25% |

| Bundle Home & Auto | 20% |

| Good Student | 15% |

| Anti-Theft Device | 15% |

| Defensive Driving | 10% |

| Paid-in-Full | 10% |

| Safe Driver | 10% |

| Vehicle Safety Features | 10% |

| AARP Member | 10% |

| Hybrid/Electric Vehicle | 5% |

The Hartford insurance also offers a 10% discount on all car insurance products if you’re an AARP member. Additionally, The Hartford offers several discounts aimed at lowering premiums, with savings based on factors like vehicle safety features, driving behavior, and policy bundling.

While these discounts can help you save, they’re not available in every state. Ask about discount availability when you speak with an insurance representative.

The Hartford’s TrueLane

Most car insurance companies offer usage-based insurance for low-mileage drivers and people who practice safe habits. The Hartford’s usage-based insurance program is called TrueLane.

TrueLane monitors your driving habits through an app, and you’ll earn an automatic 12% discount just for signing up. The TrueLane app monitors you while you drive to detect unsafe habits like speeding or sharp braking. It also tracks what time you drive and how many miles you spend behind the wheel.

The app collects data for 180 days. After that, you can earn up to 25% off your rates if you drive well. You’ll need to check if you’re eligible for TrueLane because it’s not available in every state.

The Hartford Auto Insurance: Advantages and Disadvantages Overview

The Hartford car insurance provides numerous attractive features that make it a solid pick for certain motorists. From exclusive discounts to additional perks for AARP members, it shines in offering great value for senior policyholders.

- AARP Member Savings: AARP members enjoy up to a 10% reduction in premiums.

- Vanishing Deductibles: Safe driving with The Hartford can lead to decreasing deductibles over time through the Advantage Plus program.

- Supportive Customer Service: Many policyholders praise The Hartford for its responsive and helpful customer support team.

The Hartford’s specialized programs and strong financial reliability make it a dependable choice, particularly for seniors looking for competitive rates and comprehensive auto insurance coverage.

Despite its benefits, The Hartford does have a few limitations that might not suit all drivers. Handling of claims and rising premiums are recurring concerns among its customers.

- Higher Costs for Younger Drivers: The rates of The Hartford is not friendly to younger drivers and they may face higher costs.

- Issues with Claims Processing: There are reports that some may experience delay with the claims resolution process,

Although The Hartford offers excellent benefits for older drivers, its higher premiums and occasional service concerns may dissuade younger drivers or those seeking more predictable pricing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Hartford’s Key Advantages for Older Drivers

The Hartford auto insurance proves to be a solid choice for older drivers, particularly AARP members, due to its competitive pricing, accident forgiveness, and decreasing deductibles. However, younger drivers might find the premiums less favorable, and some improvements could be made in claims management.

Switching 🔁auto insurance providers is one thing, but how do you get auto insurance for the first time? It’s not scary👻! You can do it, and our guide will help👉: https://t.co/taBW1ulIVx pic.twitter.com/2noGRWMiiJ

— AutoInsurance.org (@AutoInsurance) October 8, 2024

With an A+ rating for financial stability and a reputation for dependable customer support, The Hartford remains a reliable option for many, though it’s important to compare quotes to ensure the best deal for your specific needs. Whether you’re looking for liability-only auto insurance, full coverage, or just basic protection, it’s vital to assess how The Hartford’s offerings suit your personal circumstances.

Protect your vehicle at the best prices by entering your ZIP code into our >free auto insurance quote comparison tool below.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is The Hartford a good insurance company for auto insurance?

While it offers solid car insurance for everyone, The Hartford insurance is especially good for AARP members. Rates are usually a little lower than the national average for older drivers, and the added benefits make The Hartford stand out.

How do you file auto insurance claims with The Hartford?

To file a claim with The Hartford, you can fill out the online form, use the mobile app, or call The Hartford claims phone number.

Why would The Hartford deny an auto insurance claim?

The Hartford may deny your insurance claim if you didn’t provide enough evidence or failed to respond to their correspondence within a set timeframe when you file an auto insurance claim.

Is The Hartford good at paying claims?

The Hartford consistently ranks above average in claims satisfaction surveys and reviews.

How long do The Hartford auto insurance claims take?

In general, it can take 30 days for The Hartford to process your auto insurance claim.

What are the common complaints about The Hartford auto insurance?

Complaints about The Hartford auto insurance often focus on claims handling and rate increases, though many customers praise their customer service and the best Hartford auto insurance discount options, especially for AARP members.

What is AARP car insurance?

AARP car insurance, offered through The Hartford, provides exclusive benefits like discounts and accident forgiveness for AARP members.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

What do Hartford TrueLane reviews mention?

Hartford TrueLane reviews highlight savings for safe drivers, but some express concerns about constant monitoring and data privacy.

What does Hartford insurance roadside assistance include?

Hartford insurance roadside assistance covers services like towing, battery jump-starts, and flat tire changes for policyholders.

Delve deeper into our detailed guide, href=”https://www.autoinsurance.org/does-auto-insurance-cover-towing-a-trailer/”>Does auto insurance cover towing a trailer?

What is the AARP auto & home insurance program with The Hartford?

The AARP auto & home insurance program with The Hartford offers members combined discounts and added perks like accident forgiveness.

Does Hartford insurance have local agents?

Yes, Hartford insurance has local agents available to assist with policy inquiries and claims services.

Does Hartford insurance cover rental cars?

Yes, Hartford insurance covers rental cars if you have collision auto insurance and comprehensive coverage included in your policy.

Does Hartford insurance have roadside assistance?

Yes, Hartford insurance offers roadside assistance, which provides help in case of emergencies like towing and jump-starts.

Is Hartford insurance only for seniors?

No, Hartford insurance is not exclusively for seniors, but it does offer specific benefits for older drivers, especially through AARP.

Find out more by reading our guide “https://www.autoinsurance.org/best-auto-insurance-for-seniors/”>Best Auto Insurance for Seniors.”

What are pros and cons of The Hartford TrueLane app?

By participating in the TrueLane program, you can initially save 12% on your car insurance premiums, with potential savings up to 25% based on safe driving habits. The app provides feedback on driving behaviors, encouraging users to drive more safely.

However, some users may be hesitant about sharing their driving data, as the app continuously monitors driving behaviour.

Does The Hartford have renters insurance?

Renters insurance from The Hartford can provide coverage for personal property, liability, and additional living expenses if you’re unable to live in your rental due to a covered loss.

Does The Hartford offer homeowners insurance?

Yes, The Hartford provides protection for homes, personal property, and bodily injury liability auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Desert_Diamond

Unscrupulous "Policies"

lw1999

Black Ice Warning

pearly

Better Deal

MamaG2

A good relationship

alyssa111

Hmm

posh52

good company

Cacl1950

The Hartford Insurance Company

liver

good customer service and wonderful experience

Gospel63

wonderful company

Billie16

An Honest Insurance Company