Tower Hill Auto Insurance Review for 2025 (+Rates & Discounts)

Tower Hill auto insurance has important coverage for property owners in Florida, with starting cost of $113/mo. This Tower Hill auto insurance review talks about the special Emerald Coverage program they have. It is made to guard personal things and handle high needs from areas often hit by hurricanes well.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Tower Hill Insurance

Average Monthly Rate For Good Drivers

$113A.M. Best Rating:

A-Complaint Level:

LowPros

- Strong home and business property insurance in Florida

- Large Florida agent network for convenient local support

- Additional coverage options for hurricane-prone areas

Cons

- Coverage is limited mainly to Florida residents only

- Limited online service options available for filing claims

- Tower Hill doesn't write auto insurance

- Tower Hill is a regional property insurance company based out of Florida

- You might be able to get auto insurance from one of Tower Hill's affiliated companies

This Tower Hill auto insurance review is about Tower Hill’s special property coverage designed for people living in Florida.

With its Emerald Coverage program, Tower Hill gives extra safety for personal belongings from bad weather damage, especially where hurricanes happen often. Supported by many agents around the state, Tower Hill provides dependable and individual help with property claims. Discover how comprehensive auto insurance covers unexpected damages.

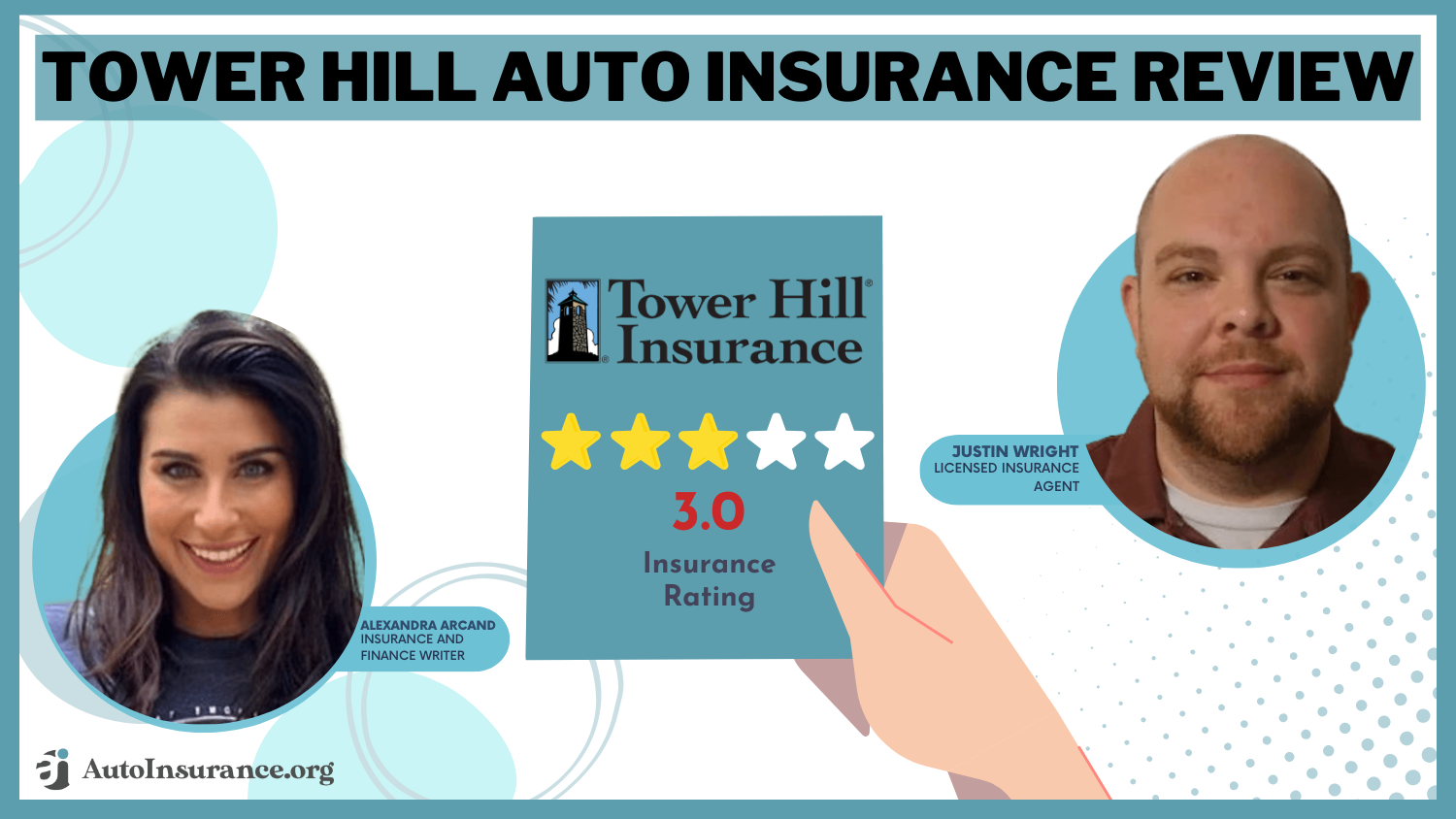

Tower Hill Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.0 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 4.0 |

| Coverage Availability | 1.0 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 3.1 |

| Digital Experience | 3.5 |

| Discounts Available | 3.8 |

| Insurance Cost | 2.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.5 |

| Savings Potential | 3.1 |

Even if they do not offer auto insurance directly, Tower Hill has partnerships that allow people to reach other companies for more comprehensive coverage requirements. The review discusses Tower Hill’s intense money situation and good name, making it a top pick for full property insurance.

Use our free comparison tool above to find the cheapest coverage in your area.

- Tower Hill holds a 3.0 rating for reliable property coverage

- Emerald Coverage protects personal items from severe weather

- Florida residents enjoy strong local support from agents

What You Should Know About Tower Hill Insurance

Tower Hill is a regional insurance company that touts itself as one of Florida’s largest residential property insurers. Tower Hill repeatedly comes up as a legitimate provider of residential and commercial property insurance.

With home and business insurance taken care of, it is natural to wonder if Tower Hill offers auto insurance bundling options and if it is an excellent company to purchase commercial auto insurance.

Our detailed guide for Tower Hill Insurance in Gainesville, FL, provides contact information. It claims processes to company history and quote options, and we have the answers to your questions regarding Tower Hill car insurance. See our guide on how to file an auto insurance claim seamlessly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tower Hill Auto Insurance

The table below shows Tower Hill auto insurance monthly prices depending on age, gender, and how much coverage one wants. It points out that rates change significantly for different groups of people; younger drivers have to pay more for their insurance plans.

Tower Hill Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $412 | $541 |

| Age: 16 Male | $435 | $982 |

| Age: 18 Female | $318 | $568 |

| Age: 18 Male | $364 | $644 |

| Age: 25 Female | $159 | $315 |

| Age: 25 Male | $186 | $347 |

| Age: 30 Female | $138 | $293 |

| Age: 30 Male | $142 | $284 |

| Age: 45 Female | $113 | $238 |

| Age: 45 Male | $118 | $243 |

| Age: 60 Female | $126 | $177 |

| Age: 60 Male | $128 | $192 |

| Age: 65 Female | $132 | $181 |

| Age: 65 Male | $137 | $197 |

Rates for the least coverage are always cheaper than full coverage. This is even more true for young drivers, with boys aged 16 and 18 paying the most. Their monthly costs can go up to $982 if they want full coverage.

Prices for insurance go lower as you get older, and when reaching 45 years old, the costs become more stable. For women, the least expensive option at this age is $113 each month. Older drivers, both men and women, like to have lower rates because they are seen as less dangerous for insurance.

Tower Hill Auto Insurance Monthly Rates by Driving Record

| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $118 | $243 |

| One Ticket | $134 | $218 |

| One Accident | $147 | $257 |

| One DUI | $160 | $283 |

This table shows Tower Hill car insurance prices depending on driving history, showing how events change coverage costs. It looks at minimum and full coverage rates for different driving records, providing a clear view of possible price changes. Understand how auto insurance companies check driving records quickly.

Tower Hill’s Market Positioning in Coverage Pricing

The table shows how Tower Hill’s monthly prices compare with other well-known companies in the industry for two main coverage types: minimum and full. This simple comparison helps to understand how competitive Tower Hill’s plans are.

Tower Hill Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $55 | $135 |

Tower Hill’s monthly price for basic coverage is $55, putting it in the middle when compared to other leading choices. The cheapest one is Geico with a very low rate of $30, and Liberty Mutual has one of the highest prices at $68.

For full insurance, Tower Hill asks for $135. This price is cheaper than higher rates like Liberty Mutual’s at $174 but more costly compared to Geico’s fee of $80, which is the cheapest choice you can find. Allstate, Farmers, and Travelers are companies in the middle range. They offer various price options for minimum coverage plans as well as full coverage plans.

Tower Hill Auto Insurance Discounts by Savings Potential

| Discount Type | |

|---|---|

| Bundling | 20% |

| Safe Driver | 15% |

| Good Student | 10% |

| Paid-in-Full | 8% |

| Anti-Theft Device | 5% |

| Paperless Billing | 3% |

| Early Renewal | 2% |

The table above shows different discount options for Tower Hill auto insurance customers. Each type of discount gives a specific percentage off, helping policyholders to lower their total premium possibly. Uncover the best auto insurance discounts for good drivers right here.

Tower Hill Insurance’s Headquarters

Tower Hill Insurance is located at 7201 NW 11th Pl., Gainesville, FL 32605. The company also has over 850 partnered agencies throughout the state of Florida.

If you are looking for the closest Tower Hill Insurance location near you, the company does provide a search option on its website to find your local affiliate.

Tower Hill Insurance Agents

Tower Hill has agents throughout the state of Florida. The company has a search engine on its site that can assist you with finding the closest Tower Hill insurance agents near you. Tower Hill Insurance is partnered with over 850 insurance agencies throughout Florida, so chances are you will not have difficulty finding an agent in your area.

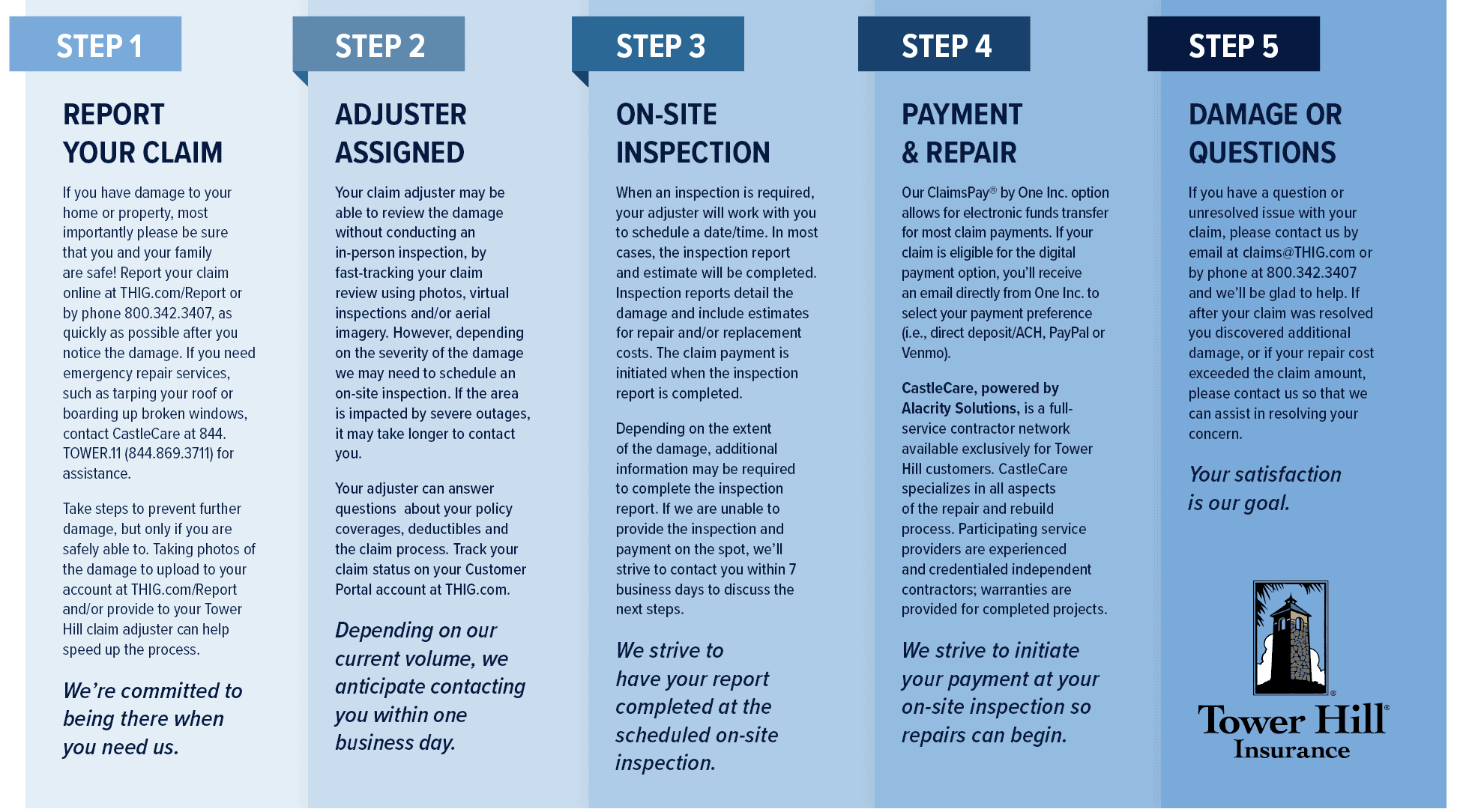

How to File a Claim With Tower Hill

Tower Hill Insurance claims can be filed online or by calling Tower Hill Insurance’s phone number for Claims Services at 1-800-342-3407. Claims documentation, such as Tower Hill Insurance photos, estimates, and receipts, can be emailed to [email protected]. Be sure to include your claim number in the subject line.

How to Get a Tower Hill Insurance Quote

Tower Hill has a quick quote and a search option for potential policyholders to receive Tower Hill homeowners insurance quotes, which are on its website. If you would rather a more personable approach, you can reach out a Tower Hill agent, at the phone number: 1-800-342-3407. Once again, an agent search option is available online to speak directly about estimates on your home or commercial property.

Even though Tower Hill does not offer auto insurance quotes, you can still get detailed auto insurance estimates in your area with our free online quote option. You only type in your ZIP code; we care for the rest. In no time, you’ll receive a list of quotes from your area’s top auto insurance companies. It is that simple. Get insights on how to check your auto insurance claims history now.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

History of the Tower Hill Insurance Company in Florida

Tower Hill is a young company that began operations in 1972 with the same focus they have today on residential and commercial property insurance in the Florida region. Founded by W.T. Shively in Miami, Florida, like Mobile Home Insurance Associates, the company quickly partnered with Omega Insurance by 1987, expanding its operations outside the mobile home division to all residential and commercial properties.

You may have heard 👂that comparing car🚗 insurance quotes can lead to savings🤑, but are you intimidated by the process? It’s time to figure it out so you can save. We have the step-by-step guide for you right here👉:https://t.co/7c2R2bodbp pic.twitter.com/8vc6ZXcmhX

— AutoInsurance.org (@AutoInsurance) October 1, 2024

The Office of Coastal Management reports that in the Florida region, hurricanes have accounted for close to 14 percent of damaged property costs in the U.S. since 1986, 68.6 billion out of the measured 515.4 billion in catastrophic damage costs.

Tower Hill saw this need in the Florida insurance market for better coverage in case of catastrophic hurricanes and has been there for its policyholders for over 13 of Florida’s most devastating hurricanes.

Tower Hill Insurance’s popularity in the Florida region is warranted, given its track record in paying out claims following hurricanes. Tower Hill home insurance policy plans were structured to promote full coverage on both property and personal items.

According to the Insurance Information Institute (III), standard homeowner policies only provide 50–70 percent of the amount of insurance you take out on the structure of your home. Since hurricanes generally damage closer to 100 percent of residents’ property, Tower Hill adapted its homeowners’ insurance policies to offer additional coverage options for personal items under the Tower Hill Emerald Coverage.

The video below explains the Florida region’s need for such add-ons and endorsements.

Today, Tower Hill has continued its expansion, extending operations to out-of-state while merging with Hillcrest and Royal Palm Insurance divisions. It has even begun to rival larger insurance-affiliated companies, such as Frontline, having serviced over 1.7 million customers since the company’s inception.

Is Frontline a good insurance company? How does the rating of Frontline, a larger property insurance company in the Southeastern region of the U.S., compare with Tower Hill? The Tower Hill Insurance Demotech rating (a credit rating agency for regional insurance carriers) is an A superior rating, as Frontline’s.

What is Tower Hill Insurance Company rated by consumer agencies? Regarding customer reviews of Tower Hill Insurance, its BBB rating is a solid A+. It seems Tower Hill has emerged as the Southeastern front-runner for residential and commercial property insurance in the short time it has been in operation. See how auto insurance competition helps customers get lower rates effectively.

Evaluating Tower Hill Insurance: Key Pros and Cons

Tower Hill Insurance gives a big benefit to people living in Florida who need dependable protection for their properties. They have special choices that are good for tough weather situations.

- Property Coverage Strength: Known for solid home and business insurance options across Florida.

- Extensive Agent Network: Over 850 agents provide accessible, hands-on support throughout the state.

- Hurricane-Related Options: Unique coverage add-ons for residents in hurricane-prone zones.

Tower Hill is good for people living in Florida, but there are some things that future customers should consider.

- Limited Service Area: Tower Hill’s insurance is mostly available in Florida, so people living in other states find it tough to use their services.

- Online Claims Access: Making claims online has extra steps since there are not many options available. This can be a hassle for customers who know how to use technology well.

Tower Hill’s focus on the Florida area brings good advantages in that state, but these limits might make some people want insurance from companies with a bigger online or wider geographic presence. Explore top options on where to buy auto insurance online today.

Tower Hill’s Consumer Satisfaction Rating

This table highlights Tower Hill’s strengths in customer satisfaction and financial stability. It reflects a blend of consumer opinions and solid business ratings. Learn about the recommended auto insurance coverage levels for comprehensive security.

Tower Hill Insurance Business Ratings & Consumer Reviews

| Ratings | |

|---|---|

| Score: 760 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Rating |

|

| Score: 80/100 Positive Customer Feedback |

|

| Score: 0.68 Fewer Complaints Than Avg. |

|

| Score: A- Strong Financial Stability |

Tower Hill scores a 760/1,000 on J.D. Power, showing high customer satisfaction. A A+ business rating show company has very good name in industry, and Consumer Reports score of 80/100 mean customers give positive feedback. Tower Hill have low complaint ratio of only 0.68, showing it take care customer well. Finally, an A- from A.M. Best confirms its dependable financial footing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Choosing Tower Hill for Localized Property Support

Tower Hill is a good choice for Florida property owners looking for robust, locally focused insurance options. Significant is their focus on hurricane coverage. The company does well in helping homeowners with local agents and policies that fit Florida’s unique risks. However, Tower Hill has a limited range of digital claim services, which some other insurers offer.

ower Hill’s clean-record rate of $118 offers Florida drivers substantial savings.Jeff Root Licensed Insurance Agent

For people living in Florida, Tower Hill gives reliable insurance for homes and businesses. However, there might be better choices for those who want auto insurance that covers multiple states. In the end, Tower Hill is a good option if you need property protection focused on Florida because they have a solid network to meet local needs. Discover if owning a home affects auto insurance rates here.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Does Tower Hill offer auto insurance?

No, Tower Hill primarily provides home and business property insurance but does not offer auto insurance directly. Access comprehensive insights into our guide, “Best Auto Insurance by Vehicle Type.”

What is the phone number for Tower Hill Insurance?

The phone number for Tower Hill Insurance’s customer support is 800-342-3407. To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Where is Direct Auto located in Gainesville, Florida?

Direct Auto is located at 3721 NW 13th Street, Gainesville, Florida, providing auto insurance solutions to local residents.

What is the focus of Direct Auto Insurance’s expansion?

Direct Auto Insurance is expanding to provide accessible, affordable auto insurance options in more regions across the U.S. To find out more, explore our guide titled “Types of Auto Insurance.”

What is the A.M. Best rating for Frontline Insurance?

Frontline Insurance holds an A- (Excellent) rating from A.M. Best, indicating strong financial stability.

What are common complaints about Frontline Insurance?

Some common complaints about Frontline Insurance focus on claims handling delays and customer service experiences.

Are there any reviews for Frontline Insurance in Florida?

Yes, Florida customers review Frontline Insurance positively for hurricane coverage but mention mixed experiences with claims support.

Is Tower Hill considered a good insurance company?

Tower Hill is a reputable insurance company, known for its strong home coverage and extensive local agent network in Florida. To find out more, explore how to buy auto insurance online instantly.

Is Tower Hill Insurance going out of business?

No, Tower Hill Insurance is not going out of business but is restructuring to better manage its portfolio.

Is Tower Hill Insurance leaving Florida?

No, Tower Hill Insurance is not leaving Florida and continues to serve property insurance needs in the state.

Does Tower Hill offer a comprehensive car insurance policy?

No, Tower Hill focuses on home and business property insurance and does not provide a comprehensive car insurance policy.

How can agents access the Tower Hill agent login?

Agents can access the Tower Hill agent login by visiting the company’s official website and entering their Agency ID, username, and password (To learn more, explore our “Is online cheap auto insurance a good idea?“).

Where is the Tower Hill agent portal located?

The Tower Hill agent portal is available on the Tower Hill website, providing agents access to policy management tools and resources.

What is the customer service contact number for Tower Hill?

Tower Hill’s customer service can be reached at 800-342-3407 for assistance with policy inquiries and claims.

What is Tower Hill’s Demotech rating?

Tower Hill holds an “A” (Exceptional) rating from Demotech, reflecting strong financial stability.

What is the A.M. Best rating for Tower Hill Exchange?

Tower Hill Exchange currently holds a “B” (Fair) rating from A.M. Best, indicating a moderate level of financial stability. Read our “Best Auto Insurance Discounts” guide to learn more.

What is the insurance rating for Tower Hill Exchange?

Tower Hill Exchange has a Financial Stability Rating of “A” from Demotech, reflecting a solid financial standing.

Are there reviews available for Tower Hill home insurance?

Yes, Tower Hill home insurance reviews generally highlight strong coverage options in Florida, with some concerns about claims handling.

What are the BBB reviews for Tower Hill insurance?

Tower Hill holds an A+ rating on BBB, though customer reviews vary, with positive feedback on coverage and some negative experiences with claims.

Does Consumer Reports provide reviews for Tower Hill insurance?

Tower Hill insurance reviews on Consumer Reports are limited, but available feedback focuses on the company’s Florida-centric home insurance options. Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.