Trustgard Auto Insurance Review for 2025 (Comprehensive Overview)

This Trustgard auto insurance review also shows it offers customized policies through Grange agents. The competitive pricing the auto insurance offered in this company for good drivers is $55 a month. You can opt for liability, collision, and comprehensive coverage with them. More on these options are below.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Trustgard Insurance Company

Average Monthly Rate For Good Drivers

$55A.M. Best Rating:

AComplaint Level:

LowPros

- Affordable premiums from $55.

- Up to 20% bundling discount.

- First accident forgiveness.

- Broad coverage options.

Cons

- Only available in 13 states.

- Delays in claims processing.

- Limited online purchase options.

- Trustgard Insurance Company is part of the Grange Insurance Group

- Trustgard Insurance offers policies that are customized by Grange insurance agents

- Trustgard offers a variety of insurance options including auto, boat, and RV insurance policies

The benefits of this Trustgard auto insurance review include competitive prices from $55 a month and the support of local Grange agents who offer personalized service.

This means that it will be one of the most money-saving insurance companies offering its coverage plans under Trustgard auto with reliable claims handling and all at very competitive prices.

Trustgard Auto Insurance Rating

Rating Criteria Trustgard

Overall Score 3.5

Business Reviews 3.0

Claim Processing 3.4

Company Reputation 3.5

Coverage Availability 4.0

Coverage Value 3.2

Customer Satisfaction 2.5

Digital Experience 3.5

Discounts Available 5.0

Insurance Cost 3.9

Plan Personalization 3.5

Policy Options 2.5

Savings Potential 4.3

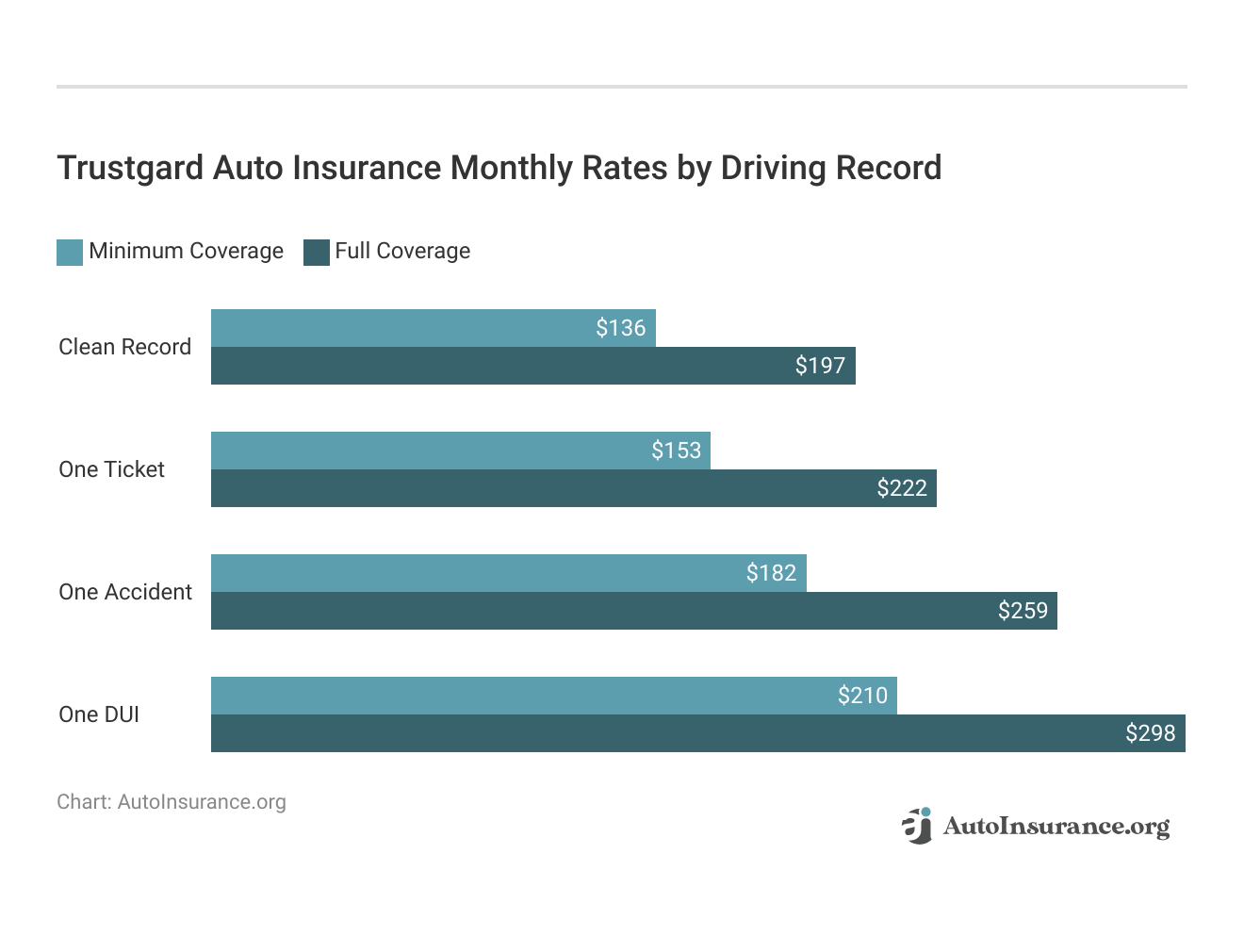

Drivers with clean records can benefit from Trustgard’s low rates, but it’s important to compare quotes from different insurers to get the best deal. Understanding how auto insurance companies check driving records is key, as it can impact your premium.

Start lowering your auto insurance costs by entering your ZIP code above and comparing rates from Trustgard auto insurance and other providers.

Trustgard Auto Insurance Review Coverage Costs by Key Factors

Trustgard Insurance Company’s claims process and pricing are driven by so many factors, including your driving record, age, gender, and location, all of which individually or in combination can greatly influence how high or low the cost of premiums may be.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is Trustgard auto insurance?

Here are the different coverage options in Trustgard auto insurance with Grange Insurance: liability, collision, and comprehensive protection. So, before you have to make a comprehensive auto insurance claim, let’s know about them so that you will know the right kind of coverage to get into your situation.

What states does Trustgard auto insurance operate in?

Trustgard auto insurance is available in 13 states. It’s important to verify if your state is covered by contacting a Grange agent.

How can I get a quote from Trustgard auto insurance?

You can get a quote by contacting a local Grange agent or by visiting their website, where you can input your ZIP code to get a personalized quote.

Does Trustgard auto insurance offer discounts?

Yes, Trustgard provides a range of discounts, including those for safe drivers, multi-vehicle policies, paperless billing, and students with good grades. If you’re purchasing a new car, you’ll want to explore the best auto insurance discounts for a new car to maximize your savings and ensure you’re getting the best deal possible.

What factors affect Trustgard auto insurance premiums?

Premiums are influenced by factors such as your driving record, age, location, vehicle type, and selected coverage levels. Avoid paying too much for auto coverage. Enter your ZIP code below to check if Trustgard auto insurance offers you a better rate.

How do I file a claim with Trustgard auto insurance?

To file a claim, contact the Grange Insurance claims department by phone or through their website. They will guide you through the process.

What coverage options does Trustgard auto insurance offer?

Trustgard provides liability, collision, comprehensive coverage, and additional options like roadside assistance and accident forgiveness.

Can I manage my Trustgard auto insurance policy online?

Yes, Trustgard provides online policy management through the Grange Insurance website or mobile app, where you can easily access and update your policy details. If you’re looking for how to buy auto insurance online instantly, this is essential to understand, as having quick access to manage your policy online is key for staying informed and in control of your coverage.

Is Trustgard auto insurance affordable?

Trustgard is known for offering competitive rates, especially for good drivers. Prices start as low as $55 per month, though premiums vary based on individual factors.

What is the financial stability of Trustgard auto insurance?

Trustgard has an A rating from A.M. Best, indicating strong financial stability and reliability in fulfilling its financial obligations.

How does Trustgard compare to other auto insurance providers?

Trustgard is often more affordable than major competitors like State Farm, particularly for younger drivers with clean driving records, though service and claims processing may vary.

What are the pros and cons of choosing Trustgard auto insurance?

Trustgard auto insurance offers affordable premiums, good discounts, and personalized service from local agents. However, it’s limited to certain states and requires agent-only purchases. Be sure to check the minimum auto insurance requirements by state to ensure you’re meeting the right coverage needs.

Is Grange a good insurance company?

Yes, Grange is considered a reliable insurance company, known for competitive pricing, customizable policies, and strong financial stability (A rating from A.M. Best). However, it has mixed reviews on customer service and claims handling, so comparing with other providers is recommended to find the best fit for individual needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

no image available 0 reviews