USAA Auto Insurance Review for 2025 (Rates & Coverage Options)

United Services Automobile Association (USAA) is widely regarded as the best option for military families seeking affordable auto insurance. Our USAA auto insurance review shows that the starting rate is just $84 monthly. However, coverage excludes military members and their families, limiting broader access.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Feb 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

USAA

Monthly Rate

$84A.M. Best Rating:

A++Complaint Level:

HighPros

- Offers multiple products including financial services and banking

- High customer satisfaction and financial ratings

- Rates are lower than average

- Coverage is available in all 50 states

- Easy-to-use mobile app

Cons

- Coverage isn’t available to everyone

- DUIs drastically increase rates

- SafePilot isn’t available in every state

- Customer complaints are higher than competitors

This USAA auto insurance review highlights the top benefits of USAA, including its low starting rates of just $84/month and its outstanding customer satisfaction ratings. With a claims satisfaction score of 90%, USAA stands out for its efficient claims process.

Nevertheless, while USAA provides competitive rates and excellent service, this can only be taken advantage of by military personnel and their families, restricting its availability.

The company’s online tools and resources benefit tech-savvy drivers who prefer managing their policies digitally. Clients ought to be aware of the constrained range of coverage choices available to higher-risk drivers.

USAA Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.8 |

| Business Reviews | 4.5 |

| Claim Processing | 5.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.7 |

| Customer Satisfaction | 4.7 |

| Digital Experience | 5.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.7 |

| Plan Personalization | 5.0 |

| Policy Options | 4.7 |

| Savings Potential | 4.7 |

USAA is an excellent choice for military families seeking reliable auto insurance, but it’s always wise to compare multiple quotes to find the best fit for your needs. See if you’re getting the best deal on car insurance by entering your ZIP code above.

- USAA offers auto insurance starting at just $84/month for members

- It has a 90% claims satisfaction score, ensuring efficient claims processing

- USAA is ideal for military families but may not be available to all drivers

Essential Information About USAA

The USAA is recognized for its commitment to providing support to families and service members. It is reasonably priced and has many features that are specially tailored to meet the unique requirements of military people. Discover our comprehensive guide to “What is auto insurance?” for additional insights.

USAA Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $137 | $349 |

| Age: 16 Male | $146 | $356 |

| Age: 18 Female | $111 | $257 |

| Age: 18 Male | $125 | $289 |

| Age: 25 Female | $43 | $114 |

| Age: 25 Male | $46 | $122 |

| Age: 30 Female | $40 | $106 |

| Age: 30 Male | $43 | $113 |

| Age: 45 Female | $32 | $84 |

| Age: 45 Male | $32 | $84 |

| Age: 60 Female | $29 | $75 |

| Age: 60 Male | $29 | $82 |

| Age: 65 Female | $29 | $82 |

| Age: 65 Male | $31 | $82 |

At an average monthly fee of only $84, USAA’s competitive price is evident, especially when accounted for in with the potential savings of up to 30% through the SafePilot program, which rewards safe driving behaviors.

USAA Auto Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 17 Male | Age: 17 Female | Age: 25 Male | Age: 25 Female | Age: 35 Male | Age: 35 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| $740 | $640 | $271 | $258 | $252 | $240 | $220 | $214 | |

| $591 | $435 | $210 | $178 | $195 | $165 | $150 | $148 | |

| $897 | $853 | $256 | $246 | $239 | $228 | $183 | $171 | |

| $362 | $313 | $133 | $138 | $124 | $128 | $106 | $104 | |

| $893 | $745 | $306 | $267 | $285 | $249 | $227 | $211 |

| $552 | $432 | $213 | $194 | $194 | $177 | $149 | $141 |

| $944 | $843 | $209 | $201 | $194 | $187 | $136 | $131 | |

| $405 | $327 | $158 | $144 | $147 | $133 | $108 | $108 | |

| $1,056 | $757 | $165 | $152 | $154 | $142 | $129 | $127 | |

| $289 | $257 | $122 | $114 | $113 | $106 | $75 | $75 | |

USAA provides a range of coverage alternatives to service personnel and their families at the lowest prices. It is regarded as one of the top auto insurance suppliers for veterans and the armed forces because of this.

USAA returning an additional $280M to members, bringing total to $800M. Members will automatically receive a credit to their auto and property insurance account. There is no need to call and no additional action is required. Learn more at https://t.co/bsVE9jEOAw pic.twitter.com/15nLJW0TuO

— USAA (@USAA) May 1, 2020

Regarding J.D. customer satisfaction, USAA likewise scores highly in strength and stability of finances via A.M. Best. Because USAA will support them in times of need, drivers who have insurance with the firm can feel comfortable.

USAA Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

Only military personnel and their families are eligible for coverage, offered in all 50 states, including Washington, D.C. USAA, which also provides insurance for homeowners, renters, boats, RVs, and motorcycles in addition to auto insurance.

Some drivers can also fully take advantage of life and health insurance, auto loans, and investment possibilities with USAA. This company is also a great choice for military personnel since it offers many coverage options, excellent ratings, and reasonable rates that offer peace of mind and financial stability.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA Insurance Coverage Options

USAA offers many car insurance coverages and other insurance products. Since USAA provides many products, drivers may find the company meets all their needs. For further details, check out our in-depth “What are the recommended auto insurance coverage levels?” article.

USAA Auto Insurance Coverage Options

| Coverage | Description |

|---|---|

| Liability | Covers injury and property damage you cause to others |

| Comprehensive | Pays for damage from non-collision events like theft or fire |

| Collision | Covers damage from collisions with vehicles or objects |

| Uninsured/Underinsured Motorist | Protects in accidents with underinsured drivers |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages for you and passengers |

| Medical Payments (MedPay) | Pays medical expenses for you and passengers |

| Rental Reimbursement | Pays for rental car during vehicle repair after an accident |

| Roadside Assistance | Provides towing, jump-starts, and flat tire repairs |

| Rideshare | Covers drivers working for rideshare services |

| Accident Forgiveness | Prevents rate hikes after your first at-fault accident |

Because of USAA’s all-inclusive approach to auto insurance, drivers can combine their policy with a number of benefits and services, such as reimbursement for roadside assistance and rental car costs.

USAA's commitment to serving military members and their families is unmatched, offering tailored coverage options that address their unique needs.Scott W. Johnson Licensed Insurance Agent

Additionally, USAA offers options for policy suspension during deployments and savings for car storage, which can significantly reduce insurance costs for service personnel deployed far from home. The demands of military people and their families might be taken into consideration when customizing these options.

Other USAA coverages and products include:

- Homeowners

- Renters

- Life

- Pet

- Auto loans

USAA rates are typically lower than those of other insurance companies, so using the company for multiple needs saves money.

Rate Stability and Predictions

USAA’s rates are noted for their stability, which is a significant consideration given the potential fluctuations in the insurance market. Explore our detailed analysis on “How to Evaluate Auto Insurance Quotes” for additional information.

USAA Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A++ Excellent Business Practices |

|

| Score: 96/100 High Customer Satisfaction |

|

| Score: 1.74 More Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength |

While nominal rate increases might occur, USAA’s history of careful rate adjustments suggests that any changes would be moderate and aligned with industry standards, ensuring that rates remain reasonable for the quality of coverage provided.

Filing a Claim with USAA: A Step-by-Step Guide

While you can file a car insurance claim with USAA on the mobile app, you can also call USAA if you prefer to speak with someone. The USAA claims phone number is 1-800-531-8722, and the USAA customer service phone number is also available.

How does USAA handle total loss anyways? First accident – solo wreck. Collision center mechanic believes it will be totaled but she has some more checks to do. I have GAP insurance and full coverage.

byu/FreeAtLast25U inUSAA

While rare, most USAA complaints revolve around claims and customer service. However, USAA still has very high satisfaction ratings since most drivers are very satisfied with how claims are resolved. Drivers can also use the USAA app or website to access policy information, pay bills, or apply for loans.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

SR22 Insurance Coverage

USAA offers SR22 insurance filings for those required to prove financial responsibility following serious driving offenses. This coverage is crucial for drivers looking to reinstate or maintain their driving privileges under state requirements. Get more insights by reading our expert “What does standard auto insurance cover?” advice.

USAA simplifies obtaining SR22 certification, integrating it seamlessly with existing auto insurance policies, which helps minimize the hassle for members needing this service.

USAA Insurance Rates Breakdown

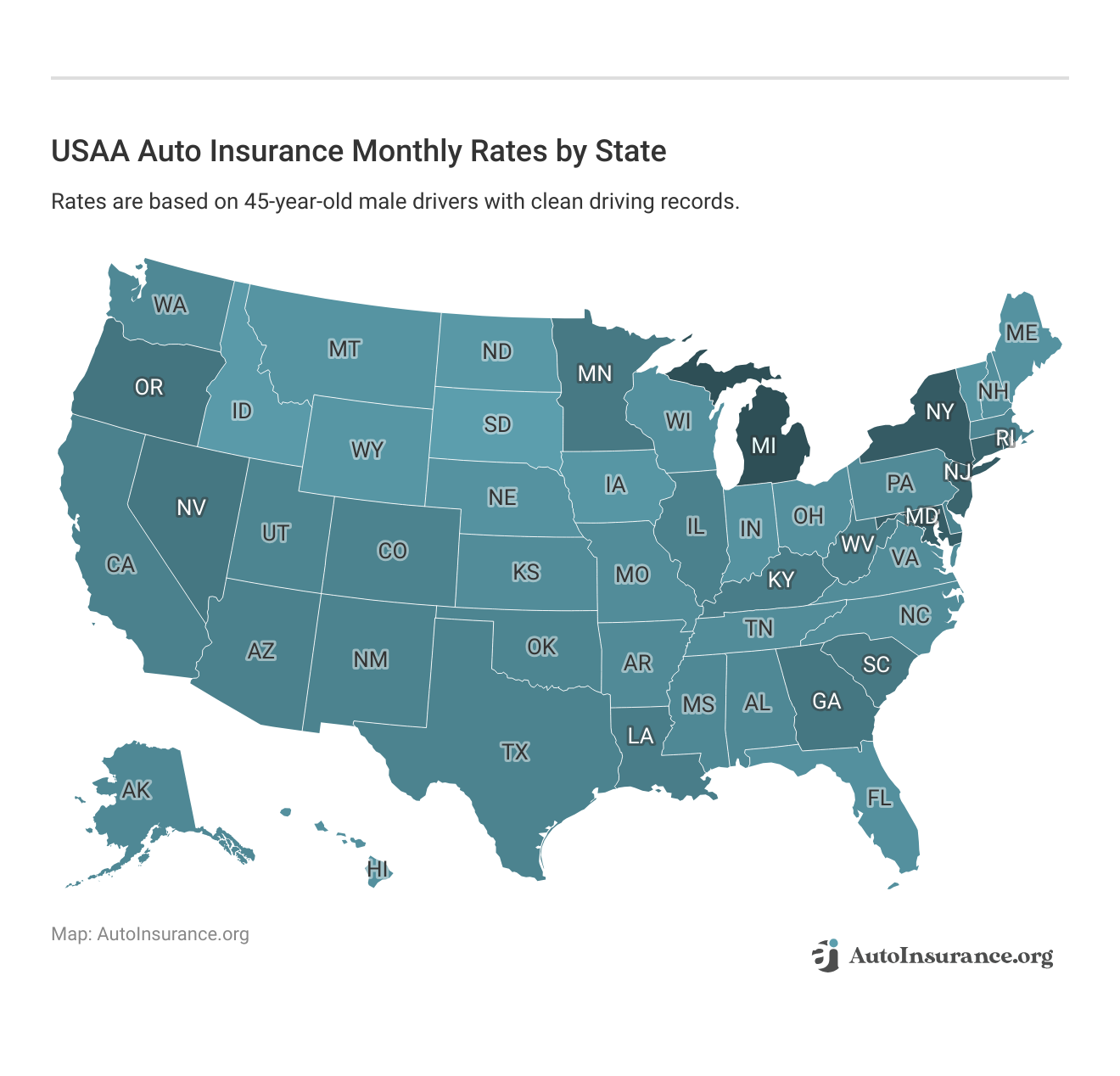

Many factors affect auto insurance rates, including age, driving history, and credit score. Therefore, USAA auto insurance quotes are different for each driver. The map below gives an idea of auto insurance rates nationwide.

USAA auto insurance rates are the lowest, but you’re only eligible if you’re a military member or family member. Other drivers don’t qualify for coverage. Most states require at least a minimum amount of liability coverage. However, liability coverage only pays for damages to others. Therefore, drivers should add collision and comprehensive coverages to protect their vehicles.

Full coverage auto insurance includes liability, collision, comprehensive, and other required coverages. While more coverage equals higher rates, you’re better protected and pay less out of pocket if your vehicle gets damaged.

This table shows average rates based on full coverage from USAA and other top insurers. We’ve also put together a table showing monthly rates based on minimum coverage.

USAA vs. Competitors: Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $228 | |

| $166 | |

| $198 | |

| $185 | |

| $114 | |

| $248 |

| $164 |

| $150 | |

| $123 | |

| $141 | |

| $84 | |

| U.S. Average | $170 |

As you can see, USAA rates are the cheapest regardless of coverage. Considering full coverage is only around $84 a month more than liability-only coverage, choosing the most protection available makes sense.

Impact of Driving History on USAA Auto Insurance Rates

Auto insurance companies check driving records, so drivers with accidents, tickets, and DUIs see the highest rates since they’re more likely to cost the insurance company money. While USAA rates increase with speeding tickets or accidents, they almost double with a DUI.

Drivers with multiple dings on their driving record see extremely high rates. Additionally, drivers with multiple infractions may be considered high-risk and require costly special coverage.

The Effect of Credit Scores on USAA Insurance Pricing

Your credit score affects many aspects of your life, such as loan rates, credit card interest rates, and apartment qualification. However, many drivers aren’t aware that their credit score can affect their insurance rates. While some states, like California, don’t allow insurers to use this factor to determine rates, most states allow auto insurance companies to use credit scores.

USAA vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $104 | $124 | $144 | |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Most insurance companies believe drivers with good credit are more likely to avoid filing a claim and will pay for damages themselves. On the other hand, drivers with poor credit are more likely to file a claim and possibly miss payments. USAA uses credit scores to calculate insurance rates. This table shows how much more drivers with fair or poor credit pay for USAA coverage.

USAA drivers with poor credit pay double compared to drivers with good credit. The good news is that you can raise your credit score by making on-time payments and using credit responsibly.

USAA Discounts Available

We’ve already shown that USAA auto insurance is the cheapest. However, there are ways to get even lower rates. The easiest way to lower rates is to take advantage of auto insurance discounts. USAA auto insurance discounts are based on the driver, policy, and vehicle. In addition, drivers can bundle eligible discounts for the most significant savings.

USAA Auto Insurance Discounts

| Discount | Savings | Description |

|---|---|---|

| Safe Driver | 30% | For drivers with no accidents or violations over time |

| Multi-Vehicle | 25% | Applied when insuring more than one vehicle |

| Bundling | 10% | For combining auto insurance with other USAA products |

| Defensive Driving | 10% | For completing an approved defensive driving course |

| Good Student | 10% | For students maintaining good grades (B average) |

| Military Installation | 15% | For garaging your vehicle on a military base |

| New Vehicle | 5% | For insuring a vehicle less than three years old |

| Annual Mileage | 12% | For drivers with low annual mileage |

| Vehicle Storage | 60% | For storing your vehicle and not driving it long-term |

| EFT (Auto-Pay) | 5% | For setting up automatic electronic payments |

Drivers can also participate in the USAA SafePilot program to earn additional savings. SafePilot is a telematics program that monitors your driving habits, such as speed and hard braking. As a result, drivers who exhibit safe driving can save up to 30% on their auto insurance.

Lastly, look closely at your policy. Lower coverage amounts and raised deductibles to lower your rates. However, doing so means higher out-of-pocket costs if your vehicle gets damaged.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA Auto Insurance: Military-Focused Service

USAA’s customer service is structured around the needs of military families. It offers 24/7 support through various channels, including a comprehensive auto insurance phone system, online portals, and mobile app support. Check out our in-depth “Comprehensive Auto Insurance Claim” article for further details.

This ensures that members can reach out for assistance, manage their policies, and file claims anytime and from anywhere, which is particularly beneficial for families dealing with irregular schedules or deployments. Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How does USAA accident forgiveness work?

USAA accident forgiveness prevents your premium from increasing after your first at-fault accident. This benefit is available to qualifying members based on their driving record and insurance history.

How do USAA insurance rates compare to other providers?

USAA insurance rates are generally more competitive compared to many other providers, especially for those in the military community. Reviews and studies show that policyholders often find USAA’s rates to be lower than competitors when considering similar coverage levels and discounts available.

How much is USAA car insurance a month?

The cost of USAA car insurance per month varies depending on location, vehicle type, driving history, and coverage options. On average, members may pay around $50 to $100 per month.

Learn more by visiting our detailed “How to Find Auto Insurance Quotes Fast” section.

Is USAA a good insurance company?

USAA is considered a highly reputable insurance company. It consistently receives high ratings for customer satisfaction, claims handling, and financial stability, making it a popular choice for military families.

Is USAA car insurance cheap?

USAA car insurance is often considered affordable, unlike other major insurers. However, rates depend on driving history, location, and coverage options.

What is the average cost of USAA auto insurance?

The USAA auto insurance average cost varies, but many policyholders pay between $85 and $125 annually. However, this can fluctuate based on coverage selections, driving records, and the state of residence.

For more information, explore our informative “What is the average auto insurance cost per month?” page.

Where can I find USAA insurance reviews?

USAA insurance reviews can be found on various review platforms, such as Consumer Reports, J.D. Power, and Trustpilot. Many customers praise their service quality, military focus, and competitive rates.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

How to apply for USAA auto insurance?

To apply for USAA auto insurance, you need to verify your eligibility as a military member, veteran, or family member. Once verified, you can apply online by visiting their website or contacting their customer service at 1-800-531-8722 to begin the application process and select your desired coverage.

Read our extensive guide on “Full Coverage Auto Insurance Defined” for more knowledge.

What is the best auto insurance for military members?

USAA is the best auto insurance for military members due to its military-specific benefits, excellent customer service, and competitive pricing.

How can I get USAA insurance if I am not a military member?

USAA primarily serves military members, veterans, and their families. If you are eligible through these criteria, you can apply for coverage. However, if you are not a military member, you may not qualify. If you have a family member who is a current USAA member, you might still be able to join through family eligibility.

Does USAA have commercial insurance?

No, USAA does not offer commercial auto insurance. However, it provides personal auto insurance to individuals who meet its membership requirements.

Dive deeper into “How to Compare Auto Insurance Quotes” with our complete resource.

Does USAA offer car warranty coverage?

No, USAA does not offer traditional car warranty coverage. However, they do partner with third-party companies that provide extended warranty and mechanical breakdown insurance options for their members.

Does USAA raise rates after a claim?

Yes, USAA may raise rates after a claim, especially if it’s an at-fault accident. However, if you qualify, their accident forgiveness program may prevent an increase after your first accident.

Does USAA offer gap insurance?

USAA offers gap insurance, which helps cover the difference between your car’s actual cash value and the remaining balance on your auto loan if your car is totaled or stolen.

Explore our detailed analysis on “Gap Insurance” for additional information.

How can I get a free car insurance quote from USAA?

To receive a free car insurance quote from USAA, visit their official website or call 1-800-531-8722. You will need to provide details such as your vehicle type, driving history, and coverage preferences to receive an accurate estimate tailored to your needs.

What is the USAA insurance quotes phone number?

To get a quote directly, call USAA’s customer service at their insurance quotes phone number: 1-800-531-8722. This line connects you to a representative who can provide a personalized automobile insurance quote based on your specific needs and details.

What types of automobile insurance coverage does USAA offer?

USAA provides a comprehensive range of automobile insurance coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). Each policy can be tailored to meet different coverage requirements, ensuring you have the protection needed for your vehicle.

Discover our comprehensive guide to “How do insurance companies determine car value?” for additional insights.

Are the best automotive insurance reviews for USAA positive?

Yes, USAA consistently receives high ratings and positive reviews for its automotive insurance policies. Customers frequently highlight exceptional customer service, competitive rates, and comprehensive coverage options, which makes USAA a popular choice for military members and their families.

Does USAA really save money for its customers?

USAA is known for offering affordable rates and exclusive discounts that help military members and their families save money. Many policyholders report saving significant amounts compared to other insurance providers, thanks to benefits like safe driver discounts and multi-policy savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Jeremy Autz

USAA review

AnTonyC

Active Duty and Veterans Beware!

Poteattony

Usaa not so great anymore

ioam

Customer service got bad

Sandy_H

Unresolved billing issue for months

davidwells

USAA: Always hire a lawyer

chanelcinq

Completely incompetent

HB23

Incompetent company

JonB36

USAA's exemplary service legacy has hit rock bottom.

Cvinny10_

Do NOT get this insurance