VOOM Auto Insurance Review for 2025 (Do Rideshare Drivers Actually Save?)

Our VOOM auto insurance review found it is a good choice for rideshare drivers looking for protection while using their cars for work, with rates starting at $85/mo. VOOM ratings show solid customer satisfaction, with a score of 85 / 100 from Consumer Reports, but it has a lower financial strength score.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

![]()

VOOM

Monthly Rate:

$85A.M. Best Rating:

B+Complaint Level:

LowPros

- Hybrid rideshare policies cover waiting for passengers

- Discounts for good driving

- Adjustable limits and coverages on rideshare coverage

Cons

- Rideshare insurance is only available in 16 states

- Only a B+ A.M. Best rating for financial strength

Our VOOM auto insurance review found a major plus is its hybrid policy, which provides different levels of coverage while rideshare drivers are waiting for passengers and during rides. VOOM also offers pay-per-mile motorcycle insurance and coverage for light aircraft and drones through SkyWatch.

Voom Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 4.0 |

| Claim Processing | 3.8 |

| Company Reputation | 4.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 3.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 3.0 |

| Savings Potential | 3.7 |

VOOM has affordable rates, making it a good option for drivers seeking basic rideshare insurance. However, it’s not the cheapest option for the best rideshare auto insurance when compared to competitors.

VOOM Insurance offers just the coverage that meets state requirements, so you’ll need to shop elsewhere if you need full coverage or gap insurance while ridesharing.

- VOOM sells rideshare insurance exclusively to Uber and Lyft drivers

- Coverage limits can be adjusted on policies to suit customers’ needs

- Customers can save by being good drivers and having low mileage

Before committing to VOOM or another company, compare multiple auto insurance quotes to find the best deal for your needs.

VOOM Auto Insurance Rates

Rideshare drivers under 30 will see the highest rates from VOOM, as young drivers have less experience behind the wheel.

Voom Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $210 | $520 |

| 16-Year-Old Male | $240 | $590 |

| 18-Year-Old Female | $180 | $420 |

| 18-Year-Old Male | $211 | $480 |

| 25-Year-Old Female | $110 | $250 |

| 25-Year-Old Male | $120 | $270 |

| 30-Year-Old Female | $102 | $210 |

| 30-Year-Old Male | $112 | $230 |

| 45-Year-Old Female | $90 | $180 |

| 45-Year-Old Male | $100 | $192 |

| 60-Year-Old Female | $85 | $171 |

| 60-Year-Old Male | $95 | $181 |

| 65-Year-Old Female | $92 | $175 |

| 65-Year-Old Male | $101 | $185 |

Because VOOM is a rideshare insurance company, rates may be a bit higher to compensate for the added liability risk of driving passengers. Rideshare drivers are responsible for other people, it is important that they have good driving records. Most rideshare companies will not hire drivers without perfectly clean driving records.

Insurance companies will also check driving records to calculate risk and base their rates accordingly (Learn More: How Auto Insurance Companies Check Driving Records).

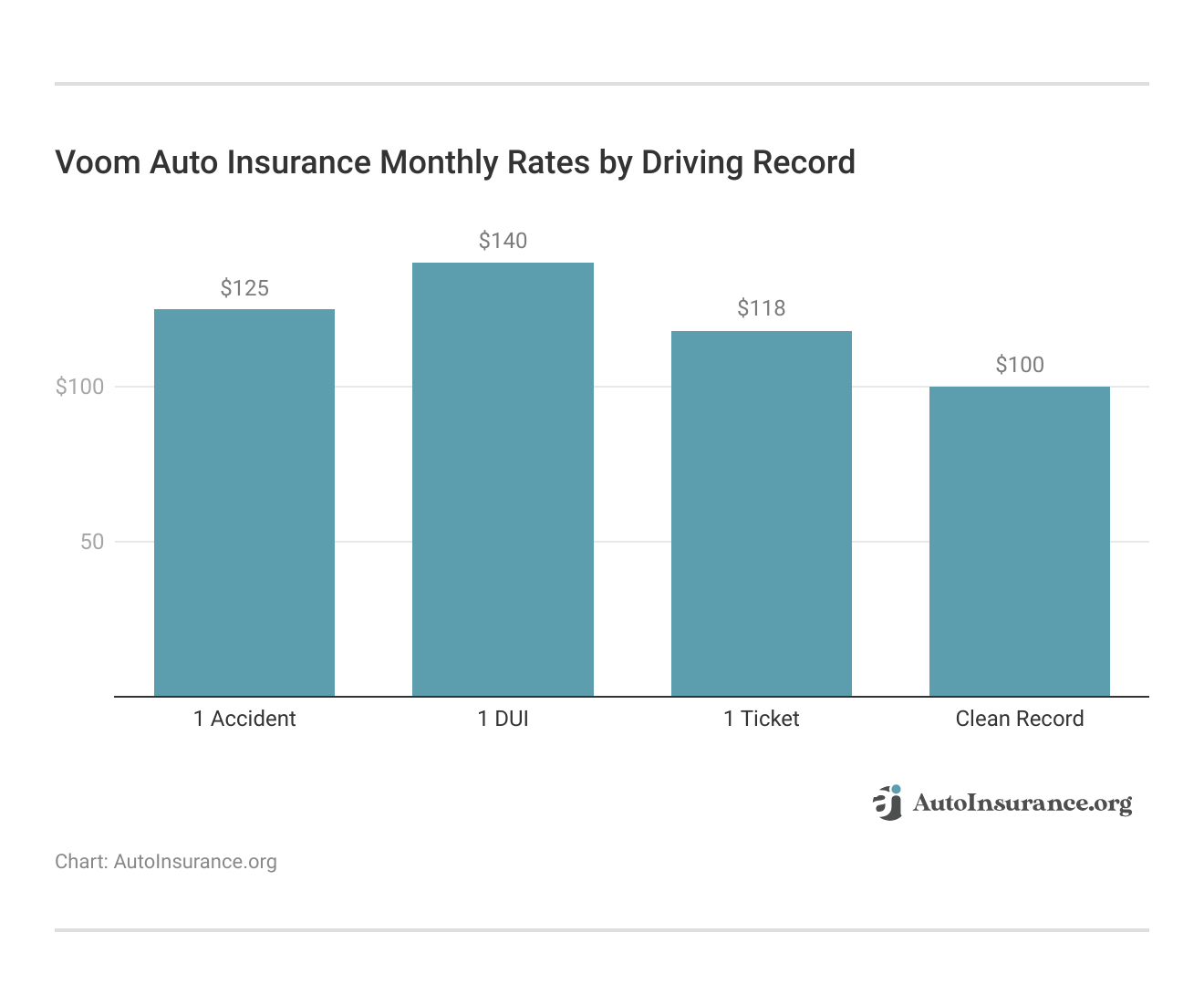

VOOM customers with clean driving records will get the best rates. Even one traffic ticket will raise car insurance rates.

VOOM Auto Insurance Rates vs. the Competition

VOOM has competition with other companies that provide rideshare insurance, and it’s important to compare rates to see if VOOM is competitive price-wise.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $120 | $245 |

| $32 | $84 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $32 | $84 | |

| $67 | $124 |

While VOOM is not the most expensive company for minimum and full coverage auto insurance, it is not the cheapest either. USAA will be one of the cheapest rideshare companies, but its customer base is limited to military members and veterans.

VOOM’s rates among competitors show similar trends when compared by driving record, with VOOM falling in the middle for affordability. Take a look at VOOM auto insurance rates versus competitors by driving record below.

Full Coverage Insurance Monthly Rates by Driving Record

| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $83 | $118 | $153 | $100 |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $84 | $111 | $154 | $96 | |

| $124 | $190 | $300 | $160 |

Because these are just rate averages, and rates can vary greatly by location, vehicle, and more, it is best to get quotes from a few of your top companies to see which offers the best deal on rideshare insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How VOOM Rideshare Coverage Works

VOOM works by protecting drivers with different coverage levels as they work in ridesharing. VOOM’s hybrid policies work as follows:

- Waiting for Customers: While drivers wait to accept a ride, VOOM will protect the vehicle with basic liability auto insurance coverage that meets state requirements.

- Driving To and With Customers: When actually driving to pick up a customer and driving with the customer in the car, VOOM will protect the vehicle with the state-required liability coverage and collision and comprehensive.

In order to get coverage with VOOM, you will have to give VOOM access to your Uber and Lyft accounts so they can check mileage. They will also require you to submit odometer readings every month.

Auto Insurance Coverages Available at VOOM

VOOM car insurance coverage options are more limited, as it is a rideshare company. This means that you will get the bare bones coverage required by your state, such as liability, and then just collision and comprehensive coverage.

VOOM Auto Insurance Coverages

| Coverage Type | What It Covers |

|---|---|

| Liability | Injury and property damage to others |

| Collision | Vehicle repairs after an accident |

| Comprehensive | Theft, vandalism, and natural disasters |

| Uninsured/Underinsured (UM/UIM) | Accidents with uninsured or underinsured drivers |

| Personal Injury Protection (PIP) | Medical bills and lost income |

| Medical Payments (MedPay) | Medical expenses after an accident |

| Rideshare Insurance | Gaps in Uber/Lyft insurance |

This is typical for a rideshare insurance company, as rideshare insurance is not your personal auto insurance policy. If you are looking for extras like roadside assistance or guaranteed auto protection (gap) insurance coverage, you can add these onto your personal auto insurance policy.

Auto Insurance Discounts at VOOM

VOOM has fewer discounts than other companies, but that doesn’t mean customers can’t still save on their rideshare insurance. Some of the discounts VOOM offers are listed below.

VOOM Auto Insurance Discounts

| Discount | |

|---|---|

| Anti-Theft | 5% |

| Bundling | 10% |

| Defensive Driving | 10% |

| Electric/Hybrid | 5% |

| Good Credit | 10% |

| Low Mileage | 30% |

| Loyalty | 10% |

| Pay-Per-Mile | 25% |

| Safe Driver | 15% |

| Usage-Based | 25% |

Driving less and being a safe driver will make rideshare insurance rates cheaper at VOOM. Uber and Lyft drivers should take advantage of as many VOOM discounts as possible.

Read More: Best Auto Insurance Discounts for Uber Drivers

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of VOOM

VOOM rideshare insurance reviews from customers are valuable for getting insight into a company’s customer service and conflict resolution.

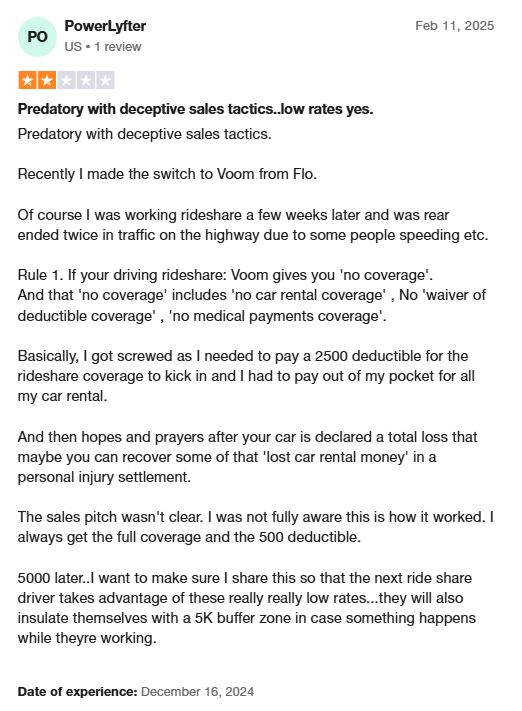

You can find VOOM insurance reviews on Reddit, Yelp, and more. For an example of some negative feedback of VOOM, take a look at the TrustPilot review below.

It is important to read through the fine print of VOOM’s auto insurance coverages for rideshare drivers so you fully understand what your policy covers. This will avoid any confusion when filing VOOM insurance claims.

Read More: How to File an Auto Insurance Claim

Not all VOOM insurance Reddit and TrustPilot reviews are negative, however. Take a look at some positive feedback from a VOOM customer below.

Customers who have positive things to say about VOOM mention the affordability and ease of getting coverage. Customers who don’t have rideshare insurance coverage offered by their current provider can purchase VOOM for rideshare coverage.

Business Ratings of VOOM

Several companies have rated VOOM, from financial ratings by A.M. Best to customer complaint ratings from the NAIC. Take a look at VOOM’s business ratings below.

Voom Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: 85 / 100 High Customer Satisfaction |

|

| Score: 3.9 / 5.0 14 Reviews |

VOOM has decent ratings, but it is not rated by several important businesses like the BBB and J.D. Power.

The BBB rates companies based on customer complaints, transparency, business practices, and conflict resolution, providing a rating from A+ to F.Dani Best Licensed Insurance Producer

VOOM insurance reviews from Consumer Reports show high customer satisfaction with the company (Learn More: Best Auto Insurance Companies According to Consumer Reports).

However, J.D. Power has not rated VOOM, so we don’t know how customer claim satisfaction would rate on other sites.

VOOM Auto Insurance Pros and Cons

If you are considering VOOM as your rideshare insurance provider, it is important to weigh the pros and cons to make sure VOOM is the right fit for you. We found that some attractive features of VOOM include:

- Hybrid Policy: VOOM’s two forms of coverage, one for drivers waiting for passengers online and one for driving to and with customers, offer complete protection to rideshare drivers.

- Customizable Coverage: Customers can adjust the limits and coverages on the personal use part of their policy when they are waiting for passengers.

- Discount Opportunities: VOOM does offer a few discount opportunities, such as a discount for safe driving.

Like all companies, though, there are some cons to consider before jumping into signing up with VOOM auto insurance.

- Availability: VOOM is not yet sold in every state, so some interested customers may be unable to buy VOOM insurance.

- Affordability: VOOM’s average rates fall in the middle compared to competitors, so drivers may be able to score cheaper rates elsewhere.

Make sure to review the pros and cons of VOOM and consider your budget and what types of auto insurance you need for rideshare before committing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if VOOM Auto Insurance is the Right Fit for You

Our VOOM auto insurance review found that VOOM is best for drivers who want a hybrid policy that provides protection for both driving with passengers and waiting for rides. VOOM also allows customers to adjust coverage limits on their policies.

View this post on Instagram

However, VOOM is only sold in 16 states, and its affordability is just average. Rideshare drivers may be able to score cheaper rates elsewhere, although rates can vary greatly based on factors like location (Learn More: Factors That Affect Auto Insurance Rates).

If you are searching for affordable rideshare insurance to protect you while you’re working, it’s essential to compare multiple auto insurance quotes. Find the best deal today by entering your ZIP in our free quote tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is VOOM Insurance real?

Yes, VOOM is a real auto insurance company. Its rideshare insurance is provided by Cimarron Insurance Company.

Where is VOOM Insurance available?

VOOM rideshare insurance is only sold in 16 states: Alabama, Arizona, Colorado, Georgia, Indiana, Louisiana, Maryland, Minnesota, Mississippi, Missouri, Nevada, Ohio, Oklahoma, South Carolina, Tennessee, and Texas.

Is VOOM available in Georgia?

Yes, VOOM insurance is available in Georgia (Read More: Best Georgia Auto Insurance).

Who is the CEO of Voom Insurance?

The CEO of VOOM is Tomer Kashi.

Is VOOM insurance any good?

Wondering is VOOM a good insurance company? Consumer Reports gave VOOM an 85 out of 100 rating. VOOM is, therefore, a solid option for car insurance for rideshare drivers.

Where is VOOM Insurance located?

VOOM headquarters are located in Palo Alto, California. If you are looking for coverage in California, read our guide on the best California auto insurance.

Is VOOM rideshare insurance legit?

Yes, VOOM rideshare insurance is a legitimate coverage from a reputable company.

What is VOOM’s phone number?

You can contact VOOM for assistance by calling the VOOM insurance phone number at +1 (650) 613-5065. Alternatively, you can use your VOOM insurance login to chat with a representative online.

Does VOOM cover theft?

VOOM comprehensive coverage will cover vehicle theft (Read More: Does auto insurance cover vehicle theft?).

Why is online car insurance so cheap?

Getting online car insurance with a comparison tool is often cheaper because you can compare multiple companies’ quotes to find the best rate. Enter your ZIP using our free tool today to get started.

What is rideshare car insurance?

Rideshare auto insurance is insurance that covers rideshare drivers while driving passengers.

How does VOOM insurance work?

VOOM provides hybrid insurance policies to rideshare drivers that protect them with basic liability while rideshare drivers are waiting for a customer and liability with collision and comprehensive coverage when driving to or with a customer. You will have to give VOOM access to your rideshare accounts so they can see the mileage you drive for Uber or Lyft and submit odometer readings each month.

Learn More: How Annual Mileage Affects Your Auto Insurance Rates

What is SkyWatch?

SkyWatch is VOOM’s aircraft and drone insurance. VOOM also offers pay-per-mile VOOM motorcycle insurance.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.