Wesco Auto Insurance Review for 2025 (See if They’re a Good Fit!)

Wesco auto insurance review covers commercial policies with rates starting at $83 per month for low-risk businesses. While Wesco doesn’t offer personal auto insurance, it provides specialized coverage through AmTrust. This review explores Wesco’s financial stability, claims process, and customer service.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Wesco Insurance

Average Monthly Rate For Good Drivers

$83A.M. Best Rating:

B+Complaint Level:

LowPros

- Specialized commercial coverage for low-risk businesses

- Efficient claims process with experienced representatives

- Solid financial backing from parent company AmTrust (A- rating)

Cons

- Does not offer personal auto insurance

- Mixed customer reviews, with several unresolved complaints

- Wesco Insurance is part of the AmTrust Financial Group Inc

- Wesco no longer sells products under its own brand name, but that of the Amtrust Insurance Company

- Wesco offers credit protection products to help mitigate risk

Wesco auto insurance review covers the company’s specialized commercial auto insurance coverage options provided through its parent company, AmTrust.

Although Wesco does not offer personal auto insurance, it caters to low-risk businesses with rates starting at $83 per month.

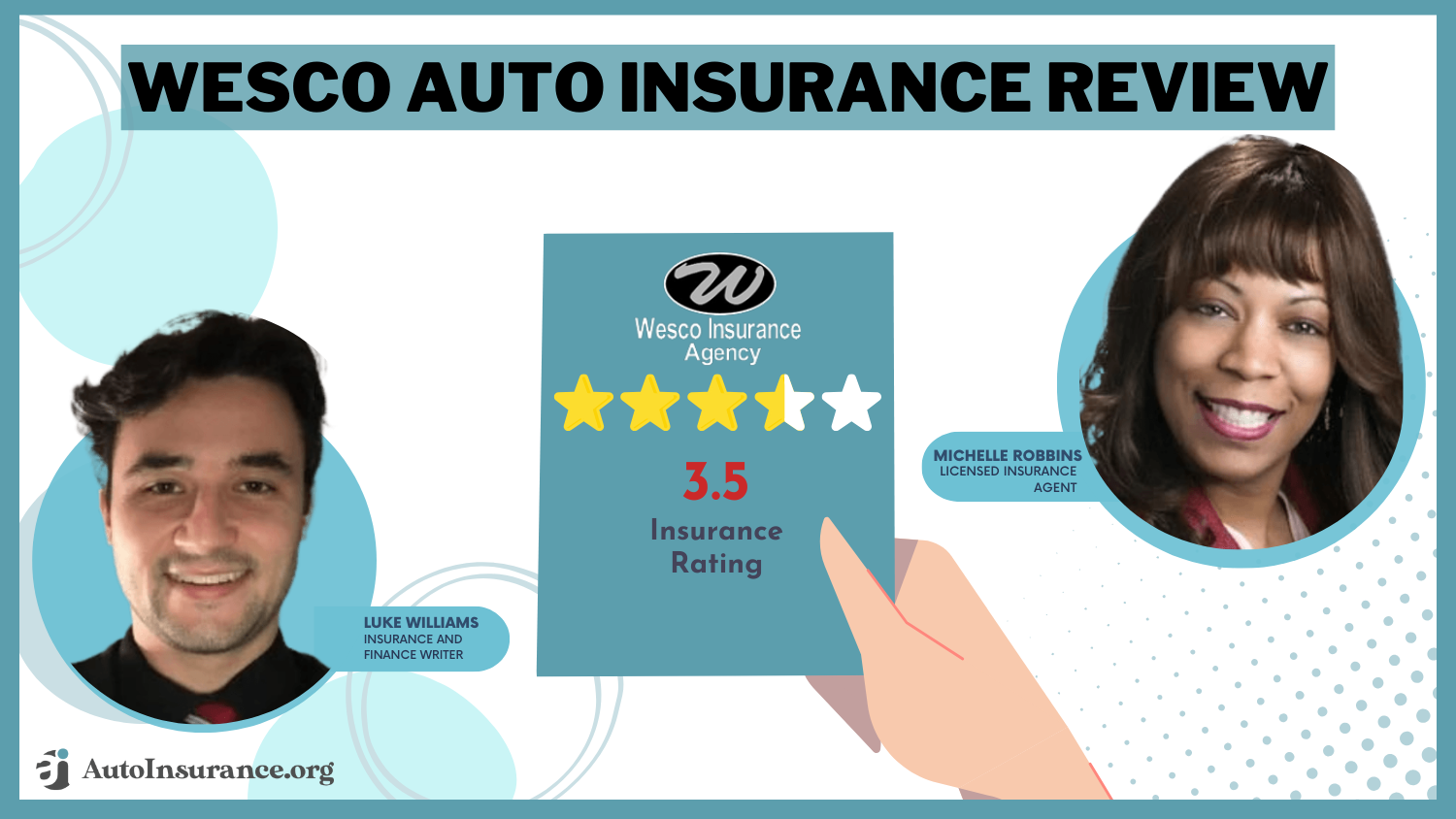

Wesco Auto Insurance Rating

Rating Criteria

Overall Score 3.5

Business Reviews 3.0

Claim Processing 3.4

Company Reputation 3.5

Coverage Availability 5.0

Coverage Value 3.2

Customer Satisfaction 2.5

Digital Experience 3.5

Discounts Available 3.0

Insurance Cost 3.9

Plan Personalization 3.5

Policy Options 2.5

Savings Potential 3.6

This review explores Wesco’s financial stability, efficient claims process, and customer service, providing an in-depth look at what businesses can expect, including Wesco Insurance Company rating and Wesco Insurance Company AM Best rating.

Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

Wesco Auto Insurance Rate Factors

Securing affordable auto insurance with Wesco largely depends on factors like age, gender, and driving history. Younger drivers, especially males, tend to have higher premiums due to their increased risk, while older drivers can enjoy lower rates.

Let’s break down Wesco’s insurance costs based on these key factors, helping you anticipate your potential monthly payments. For business inquiries, you may need access to AmTrust agent login or the AmTrust contact number for more detailed assistance.

Wesco Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $115 $230

Age: 16 Male $120 $240

Age: 18 Female $95 $190

Age: 18 Male $100 $200

Age: 25 Female $60 $120

Age: 25 Male $65 $130

Age: 30 Female $50 $100

Age: 30 Male $55 $110

Age: 45 Female $55 $110

Age: 45 Male $55 $110

Age: 60 Female $45 $90

Age: 60 Male $50 $100

Age: 65 Female $45 $90

Age: 65 Male $50 $100

If your driving record includes infractions like accidents, tickets, or DUIs, you may see a significant increase in your premiums. Wesco adjusts its rates accordingly, with clean records leading to lower costs and driving violations pushing rates upward.

Wesco Insurance offers reliable, specialized commercial coverage, making it a solid choice for low-risk businesses seeking competitive rates and efficient claims service.Brandon Frady Licensed Insurance Producer

This review explores how your driving history could affect Wesco’s pricing. In addition, understanding AmTrust Financial AM Best rating and AmTrust Financial problems can help you assess Wesco’s overall financial stability.

Additionally, while Wesco doesn’t provide personal auto insurance nationwide, understanding how factors that affect auto insurance rates impact your commercial coverage rates is essential. Evaluating age, gender, and driving history gives you the insight needed to make an informed decision when selecting your coverage plan.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About Wesco

The best auto insurance companies have great reviews from the leading Consumer Rating Agencies like A.M. Best and the Better Business Bureau.

Wesco Insurance Company reviews are blanketed under the AmTrust Insurance review, therefore we will look at AmTrust’s data, including AmTrust Insurance rating and any potential AmTrust layoffs.

Rating agencies help consumers understand what it’s like to work with a specific company before committing to buying a policy.

Wesco Insurance Company reviews are blanketed under the AmTrust auto insurance review, therefore we will look at AmTrust’s data. Check out the table below to see what experts and consumers have decided for Wesco Insurance ratings.

| Agency |  |

|---|---|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.20 More Complaints |

|

| Score: B++ Good Financial Strength |

Wesco’s business ratings and reviews, largely reflected through its parent company AmTrust, show solid financial strength but mixed customer feedback. While it maintains a good A.M. Best rating, customer satisfaction varies, making it crucial to compare with other providers before committing to a policy. Consider checking the AmTrust NAIC code and AmTrust reviews for more insights.

Read more: How to Get a Longevity Auto Insurance Discount

Canceling Wesco Auto Insurance: Quick Guide & Tips

Canceling a policy with Wesco Insurance Company is done fully through AmTrust and its online client portal. There is no mention of a cancelation policy or procedure on the website. Before purchasing any type of insurance through this company, we recommend reaching out to an agent and asking questions about any cancelation fees, potential refunds, and when they allow you to cancel your policy.

Read more: How to Cancel Auto Insurance

How to File a Wesco Insurance Claim Easily

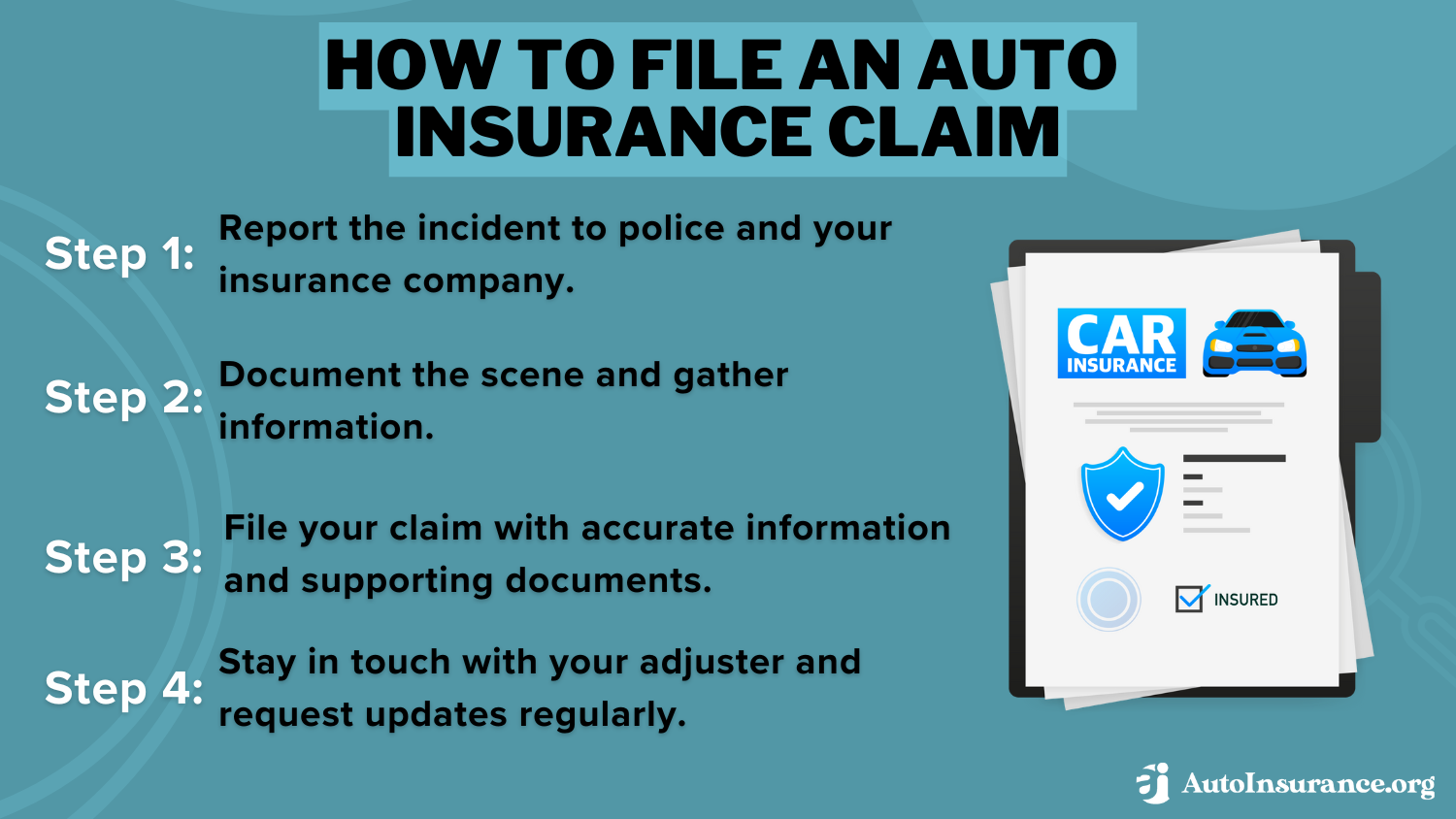

If you’re making a Wesco Insurance Company claim, you’re in luck. Wesco and AmTrust pride themselves on the most efficient and fast claims service in the business. If you’re wondering how to file an auto insurance claim, their process is straightforward and designed for quick resolution.

If you’re making a claim, Wesco provides commercial auto coverage under the name Wesco Automotive. The Wesco Insurance phone number for claims is listed on the AmTrust website.

The company says that its claims representatives average more than 20 years of experience, and are given small workloads so that it can effectively give its full attention to each and every claim. You can use the Wesco Insurance Company claims phone number to contact a Wesco claims agent.

Filing a Claim With Wesco: Simple & Quick Process

The parent company, AmTrust, maintains an automated platform for auto insurance claims that allows its representatives to quickly process claims while remaining completely paperless.

Claims can be initiated 24 hours a day, seven days a week, using a toll-free number that should be available on your policy documents.

If you go to the AmTrust website, you clearly see the correct link to click for information about claims on the left side of the page. Check it out in the image below.

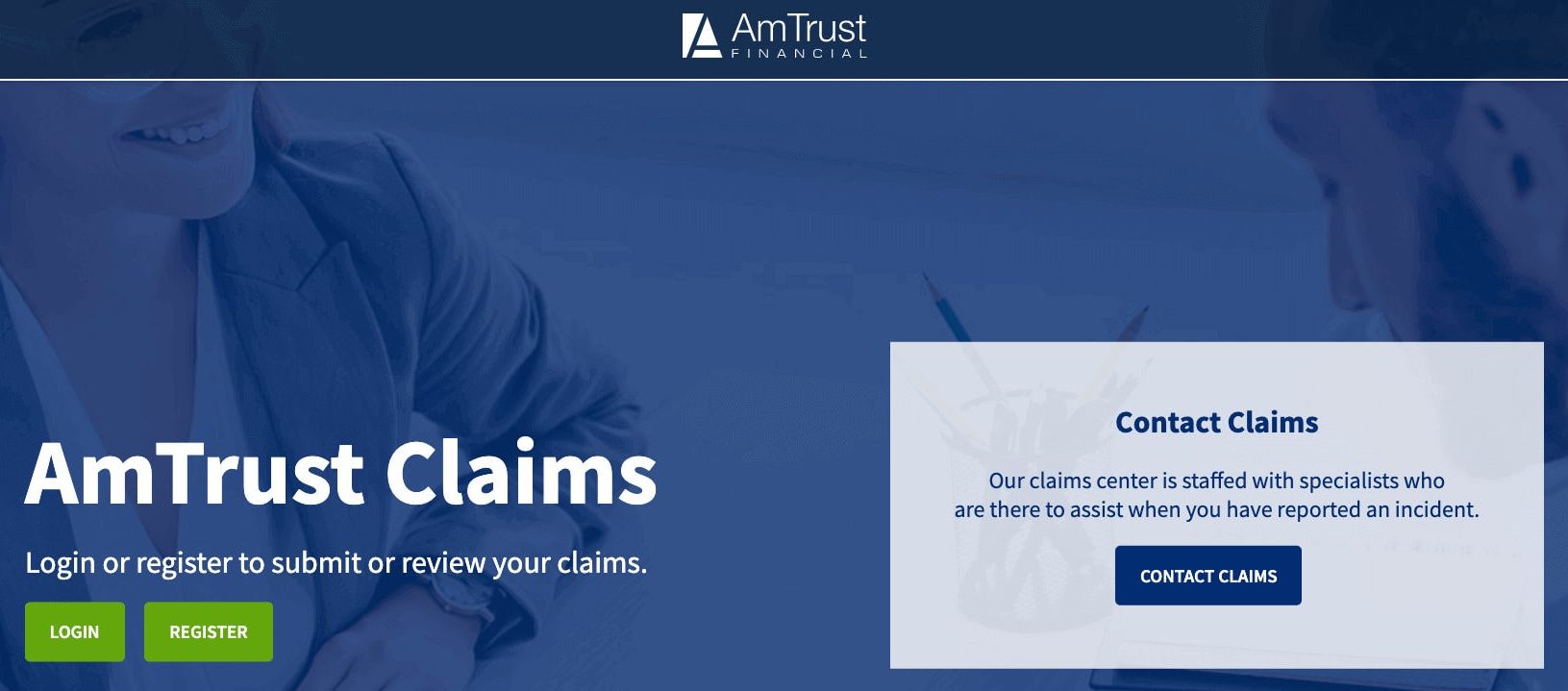

When you click on Claims you are prompted to log in to your account before continuing. The following image displays the client log-in and registration page.

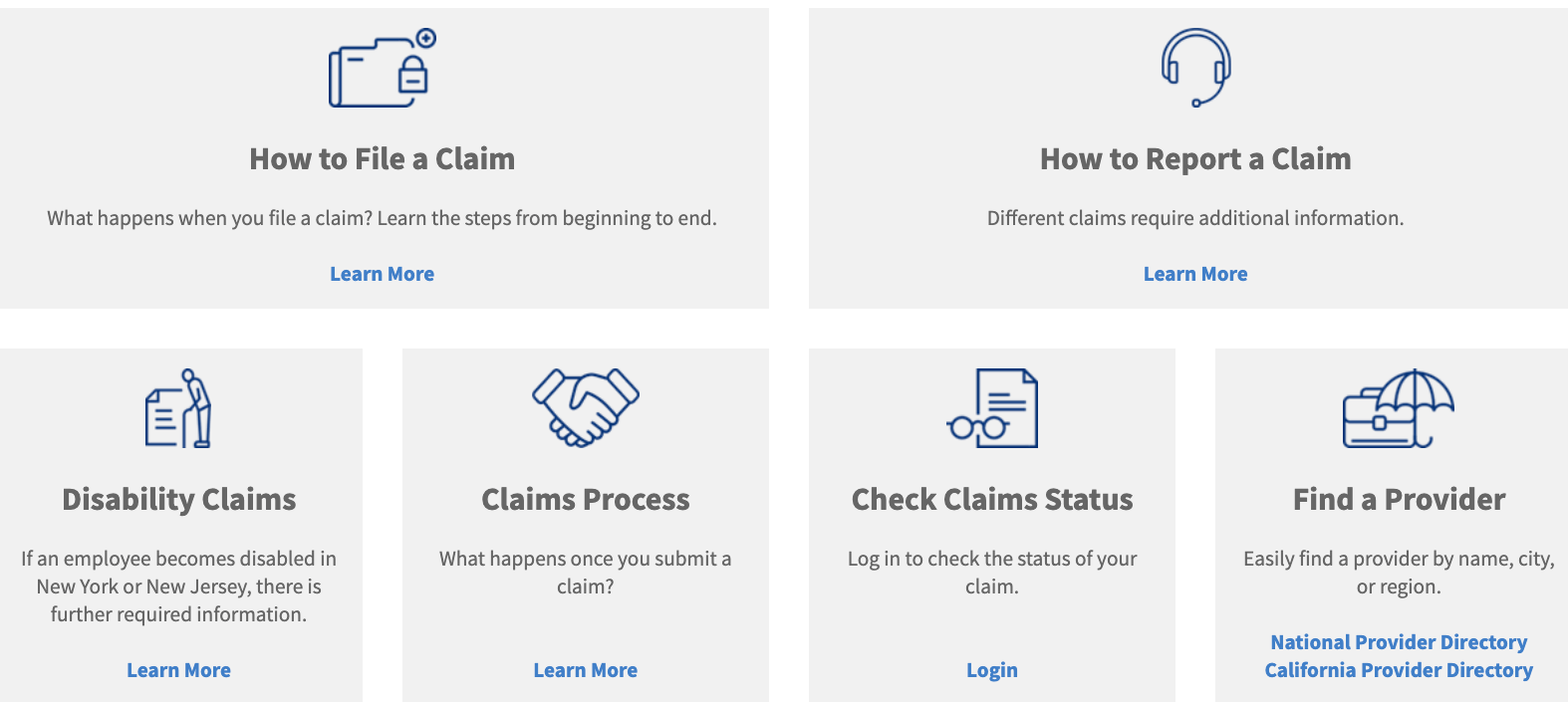

Below the client login is a graphic with many different common questions a customer may have when filing a claim. Some prompt you to still log into your account before you can view any answers. Clicking on Learn More will send you to an anchored section on the same webpage with more detailed information. See the image below.

The company’s medical director assists in evaluating all worker’s compensation and medical claims, while a three-point contact system quickly expedites the processing of automobile and property damage claims. Customers are encouraged to track their claims after filing to ensure that payment is made in a timely manner.

Wesco Insurance Premiums: AmTrust Financial Data Overview

The number of premiums written specifically by Wesco Insurance is not currently available, but we do have access to those numbers for its parent company, AmTrust Financial. Take a look at the table below, which showcases the number of auto insurance premiums written by AmTrust in the private passenger auto industry from 2015-2018.

This includes data on Wesco Insurance Company NAIC and how to file claims. Wesco also covers industries like Wesco trailers, ensuring that specialized business coverage is available.

| Year | Premiums Written |

|---|---|

| 2020 | $1,427,158,000 |

| 2021 | $2,506,084,000 |

| 2022 | $2,905,540,000 |

| 2023 | $215,573,000 |

While specific data for Wesco Insurance is unavailable, examining AmTrust Financial’s premiums provides valuable insight into their broader financial trends. These figures highlight shifts in the parent company’s focus, helping you evaluate Wesco’s stability and growth.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AmTrust Financial Premiums: Shift to Business Insurance

Between 2017 and 2018, the company lost over $2 billion in written premiums. It also no longer displays any personal auto insurance information on its website, including details on which cars have the lowest auto insurance premiums.

The drop in personal auto insurance premiums suggests that the company is transitioning away from that industry and are now focusing primarily on business insurance. If you search for them, though, you can find Amtrust business insurance reviews online.

Wesco Insurance Loss Ratio Trends Explained

An insurance company’s loss ratio is the difference between the number of premiums written versus the claims paid, on average you should expect your insurance company’s loss ratio to be around 60%-70%. Anything higher can indicate severe financial trouble for the company.

If the ratio is much lower, it may mean the company is not giving back enough to their clients. Take a look at AmTrust’s loss ratio for the private passenger auto industry from 2015-2018 in the table below.

| Year | Ratio |

|---|---|

| 2020 | 65.76% |

| 2021 | 68.99% |

| 2022 | 71.09% |

| 2023 | 57.21% |

AmTrust’s loss ratio trends offer insight into Wesco Insurance’s financial health. A steady ratio around the industry average indicates stability, while fluctuations highlight potential risks. Monitoring these trends helps you assess Wesco’s ability to manage claims effectively and determine if private auto insurance companies can meet your needs.

Get a Wesco Auto Insurance Quote Online

To get a commercial auto insurance quote online through AmTrust’s website, you must navigate to the menu and select Insurance Products. The website will autogenerate a form for you to fill out. It appears you must be applying for business insurance in order to receive a quote from AmTrust.

The company seems to be shifting away from personal auto insurance and is focused primarily on business insurance. Understanding how to compare auto insurance quotes can help ensure you find the best coverage for your business needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The History of Wesco Auto Insurance

In 2006, Wesco Insurance Company was acquired by New York-based AmTrust Financial Group Inc. It now operates as a wholly-owned subsidiary of AmTrust, underwriting policies on the company’s behalf.

As such, Wesco Insurance Company no longer maintains its own web presence or sells products under its own brand name. So if you’re looking for Wesco workers comp, Wesco auto insurance, or even Wesco trucking insurance, you are out of luck. If you need information on how to check your auto insurance claim history, you will have to reach out to AmTrust, Wesco’s parent company, for assistance.

Wesco Insurance Rates Breakdown

Unfortunately, auto insurance rates through Wesco Insurance Company and its parent company AmTrust Financial are unavailable. To request a Wesco auto insurance quote, you must click on the Insurance Products page on its website, and select Get a Quote. The webpage generates a form for you to fill out.

At this time, you must include information about your small business in order to receive a quote. Commercial auto insurance packages are available. However, it appears that personal auto insurance policies are no longer available through the AmTrust Financial website.

A Wesco quote will likely be for commercial coverage. Additionally, it’s important to understand how vehicle year affects auto insurance rates when evaluating commercial auto coverage options.

Wesco Insurance Availability by State

On the AmTrust website, they claim that Wesco Insurance Company is certified to work in all fifty states as well as in Washington D.C. Unfortunately, there is very little information about Wesco online to verify the details of what type of insurance work they are certified to perform.

AmTrust claims that Wesco Insurance primarily underwrites statutory disability benefits coverages. It’s also helpful to explore auto insurance rates by state to ensure you’re getting the most competitive pricing for your location.

Wesco Insurance Market Share Overview

Wesco Insurance specific market share details are unavailable, however, we do have access to AmTrust Financial’s data. Take a look at AmTrust’s, Wesco’s parent company, total market share rates for the private passenger auto insurance industry between 2015-2018 in the table below.

| Year | Market Share |

|---|---|

| 2020 | 0.71% |

| 2021 | 1.17% |

| 2022 | 1.26% |

| 2023 | 0.09% |

While specific market share data for Wesco Insurance is not available, AmTrust’s fluctuating market share offers a glimpse into the company’s performance in the auto insurance industry. These shifts reflect changes in their focus and strategy over time.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Wesco Insurance: Market Decline and Limited Online Presence

Between 2017 and 2018, Wesco’s market share dropped by nearly a full percentage, along with a decrease in written premiums. Between 2017 and 2018, Wesco’s market share dropped by nearly a full percentage, along with a decrease in written premiums. This decline may signal broader AmTrust Financial problems and shifts in the company’s focus.

Wesco, with its 85% customer satisfaction rating, consistently delivers dependable commercial coverage that meets the specific needs of businesses, making it a top choice in the industry.Daniel Walker Licensed Auto Insurance Agent

While not all of Wesco’s market share is tied to its claims, this decline raises concerns about stability. If you’re asking can you claim auto insurance if it’s your fault, Wesco’s claims process can clarify how fault impacts coverage. For more details, consider exploring Wesco reviews and Wesco company reviews to assess if it’s the right fit for your business.

Additionally, Wesco’s parent company, AmTrust Financial, has faced financial challenges, suggesting they may be shifting focus away from private auto insurance toward other insurance markets. Wesco Insurance itself has a limited online presence, with no dedicated website, though AmTrust maintains a modest digital footprint through platforms like YouTube, Facebook, Twitter, LinkedIn, and Instagram.

Community Engagement at Wesco Insurance

Wesco Insurance Company doesn’t have its own commercials, but its parent company, AmTrust, posts ads on YouTube. Wesco follows the same values, focusing on supporting small businesses. To verify legitimacy, learn how to check if an auto insurance company is legitimate by reviewing its parent company’s credibility.

While Wesco does not advertise itself independently, AmTrust highlights its community engagement through corporate-sponsored events supporting organizations like the American Heart Association and the Breast Cancer Research Foundation. AmTrust also mentions plans for a Go Green Initiative, though details remain unclear.

Employee reviews for AmTrust, which can be found on Glassdoor, reflect a mixed experience, with a 3 out of 5-star rating, 52 percent CEO approval, and 45 percent of employees recommending the company. These reviews likely represent the general work environment for those handling Wesco Insurance claims, though the exact experiences specific to Wesco employees remain uncertain.

Wesco Insurance: Web & App Experience

Many larger insurance companies have both a website and a phone app for clients. Apps simplify filing claims and tracking payments. Wesco Insurance Company lacks both, but its parent company, AmTrust, has them. AmTrust’s website is easy to navigate, though some information is unclear and lacks depth. While every link leads to a live page, much of the content is filled with buzzwords, making it hard to find concise answers.

Employment opportunities are advertised across nearly every page, even during the quote process. AmTrust’s design is clean, but the lack of substantial content detracts from it. Though Wesco lacks an app, AmTrust offers the AmTrust Online (AO) Mobile app for business owners. Available on Apple and Android, the app isn’t recommended for tablets.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Wesco Insurance: A Pros and Cons Review

Wesco Insurance, operating under its parent company AmTrust, specializes in providing commercial insurance for businesses. While it doesn’t offer personal auto insurance, it’s a good option for businesses seeking targeted and reliable coverage.

- Specialized commercial coverage tailored for low-risk businesses

- A streamlined and efficient claims process supported by AmTrust

- Nationwide availability across all 50 states

Still, there are some drawbacks to using Wesco Insurance, such as:

- No personal auto insurance options

- Mixed customer reviews highlighting service issues

Evaluating these pros and cons will help you decide if Wesco Insurance is the best choice for your business and if it provides the necessary coverage. Additionally, comparing online auto insurance quotes can further guide your decision.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Wesco Insurance Coverage Options

Currently, there is no mention of private auto insurance on the AmTrust website, which means no private auto quotes are being written by Wesco Insurance Company. What is Am Trust Insurance ?

AmTrust does offer commercial auto insurance policies, but only to low-risk fleets like dry van, cargo, intermodal, and refrigerated trucks.

The company says it prefers to insure low-risk businesses to help keep premiums competitive. It avoids insuring commercial fleets involved with cattle transportation, garbage haulers, and gravel trucks.

Their coverage includes auto liability, physical damage, and commercial general liability insurance. The company also offers motor truck cargo coverage, trailer interchange coverage, and hired and non-owned auto coverage.

Assessing Wesco Auto Insurance for Your Business

Wesco Auto Insurance, through its parent company AmTrust, provides dependable commercial coverage for low-risk businesses. By understanding what are the benefits of auto insurance, as well as exploring online auto insurance quotes, you can make an informed decision for your business needs.

For further assistance, the AmTrust contact number can connect you with an agent, and you can manage your policy through the AmTrust agent login portal.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is Wesco Insurance Company’s contact information?

The Wesco Insurance Company phone number is the same as the Amtrust contact number, as is the Wesco Insurance Company address, which is found in the Company Details box at the top of this review.

There is also a toll-free line for AmTrust at 877-528-7878. Wesco Insurance Company agents near you can be found by contacting the customer service line above. There is a Wesco Insurance in Ricky Hill, CT that is an agency and unaffiliated with Wesco Insurance Company.

Is there a Wesco Insurance Company extended warranty branch?

Endurance extended car warranties list Wesco as their underwriter. There is no direct Wesco extended warranty. Be sure to check extended car warranty reviews before purchasing one with any company.

Is Wesco auto insurance available for individuals?

No, Wesco auto insurance is not available for individuals. The company primarily focuses on disability insurance and writes commercial policies.

For more information, check out our comprehensive guide titled “Cheap Auto Insurance for Disabled Drivers” to explore available options.

Who is the parent company of AmTrust insurance?

AmTrust became privately owned in 2019, with ownership held by its original founders, George and Leah Karfunkel, CEO Barry Zyskind, and Stone Point Capital.

Who is Security National Insurance Company?

Security National Insurance Company, a subsidiary of AmTrust Financial, provides coverage for AmTrust clients following its acquisition.

Is Wesco a good choice for auto insurance?

Wesco Insurance Company’s reviews are included under the AmTrust auto insurance review. The ratings from A.M. Best and the Better Business Bureau indicate average service and financial stability.

For a more detailed explanation, refer to our in-depth report titled “What is auto insurance?” to learn more.

Can I purchase Wesco auto insurance as an individual?

No, Wesco auto insurance is primarily focused on commercial policies and does not offer coverage for individual drivers.

Is Wesco insurance the same as AmTrust?

Wesco Insurance Company and AmTrust are not the same company. However, Wesco Insurance and AmTrust are closely related since AmTrust bought Wesco.

How do I cancel my auto insurance policy with Wesco?

Cancellation of a policy with Wesco Insurance Company is done through AmTrust and its online client portal. It is recommended to contact an agent for information on cancellation fees and refund policies. Contact the Wesco Insurance Company customer service line to get even more help.

For a complete understanding, refer to our detailed analysis titled “How to Cancel Auto Insurance” for more information.

Who is AmTrust merging with?

AmTrust merged with Evergreen Parent in 2018.

What insurance company has the most complaints?

When trying to figure out what insurance company has the most complaints, you can check several different rating and review websites. For example, if you want to know more about the Wesco Insurance Company AM Best rating or AmTrust workers comp reviews, you can easily find that online.

Which is the best company for insurance?

The best insurance company is subjective, as factors like driving record, age, and gender influence rates, making it essential to compare multiple providers to find the most affordable or expensive option for your situation.

To broaden your knowledge, check out our comprehensive handbook titled “Best Auto Insurance Companies” for further insights.

Who are the top five insurance companies in the United States?

The top five insurance companies in the United States are typically ranked based on market share, customer satisfaction, and financial stability. These companies include State Farm, Geico, Progressive, Allstate, and USAA. Each of these insurers is known for offering a range of coverage options, competitive rates, and solid customer service, making them popular choices among consumers.

What are the financial problems with AmTrust?

AmTrust has faced financial issues in the past, but appears to have recovered; checking recent AmTrust news and reviews is recommended to stay informed on any new developments.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.