West Bend Auto Insurance Review for 2025 (Impartial Company Report)

Our West Bend auto insurance review found it’s an affordable option for drivers with poor records looking for full coverage insurance and add-ons like roadside assistance. West Bend car insurance rates are competitive, starting at $74 monthly, but West Bend Insurance Company only sells policies in 14 states.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

West Bend

Monthly Rates:

$74A.M. Best Rating:

AComplaint Level:

LowPros

- Fewer customer complaints lodged at the NAIC

- Superior A rating for financial strength from A.M. Best

- Affordable rates for drivers with accidents or tickets

Cons

- Only available in 14 states

- Higher minimum coverage rates

Our West Bend auto insurance review found that West Bend has competitive full coverage rates and low customer complaint scores.

West Bend Mutual Insurance Company offers lower rates for full coverage, even for drivers with poor records. Additionally, West Bend boasts a low NAIC complaint score of just 0.22, which indicates fewer customer complaints than most competitors.

West Bend Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 4.0 |

| Claims Processing | 4.0 |

| Company Reputation | 4.0 |

| Coverage Availability | 3.7 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.0 |

| Discounts Available | 4.0 |

| Insurance Cost | 3.3 |

| Plan Personalization | 4.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.5 |

These factors make West Bend Insurance most beneficial for drivers who prioritize full coverage or those looking for cheap auto insurance with a bad driving record.

However, there are some drawbacks, such as West Bend’s limited availability in only 14 states and higher rates for drivers seeking minimum coverage. It’s crucial to compare quotes from multiple insurers to ensure that your chosen company’s coverage and rates are the best fit for your needs.

- West Bend car insurance rates start at $74 per month

- West Bend has few customer complaints and high financial strength scores

- Customers will only be able to buy West Bend auto insurance in 14 states

West Bend Auto Insurance Rates

Is West Bend insurance expensive? Several key factors, including driving record, age, and coverage level, will influence your West Bend car insurance rates.

Age plays a significant role in determining rates, as younger drivers face higher premiums due to lack of experience. Take a look at average quotes at West Bend below to see the factors that affect auto insurance rates.

West Bend Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $217 | $463 |

| 16-Year-Old Male | $243 | $487 |

| 18-Year-Old Female | $196 | $414 |

| 18-Year-Old Male | $223 | $439 |

| 25-Year-Old Female | $119 | $239 |

| 25-Year-Old Male | $133 | $256 |

| 30-Year-Old Female | $97 | $211 |

| 30-Year-Old Male | $106 | $225 |

| 45-Year-Old Female | $86 | $192 |

| 45-Year-Old Male | $94 | $199 |

| 60-Year-Old Female | $74 | $177 |

| 60-Year-Old Male | $81 | $185 |

| 65-Year-Old Female | $78 | $162 |

| 65-Year-Old Male | $84 | $173 |

The level of West Bend auto insurance coverage selected also directly affects rates. Customers who choose higher coverage limits, such as a full coverage policy, will have higher rates. While choosing minimum coverage can help keep rates lower, it does offer less financial protection to customers.

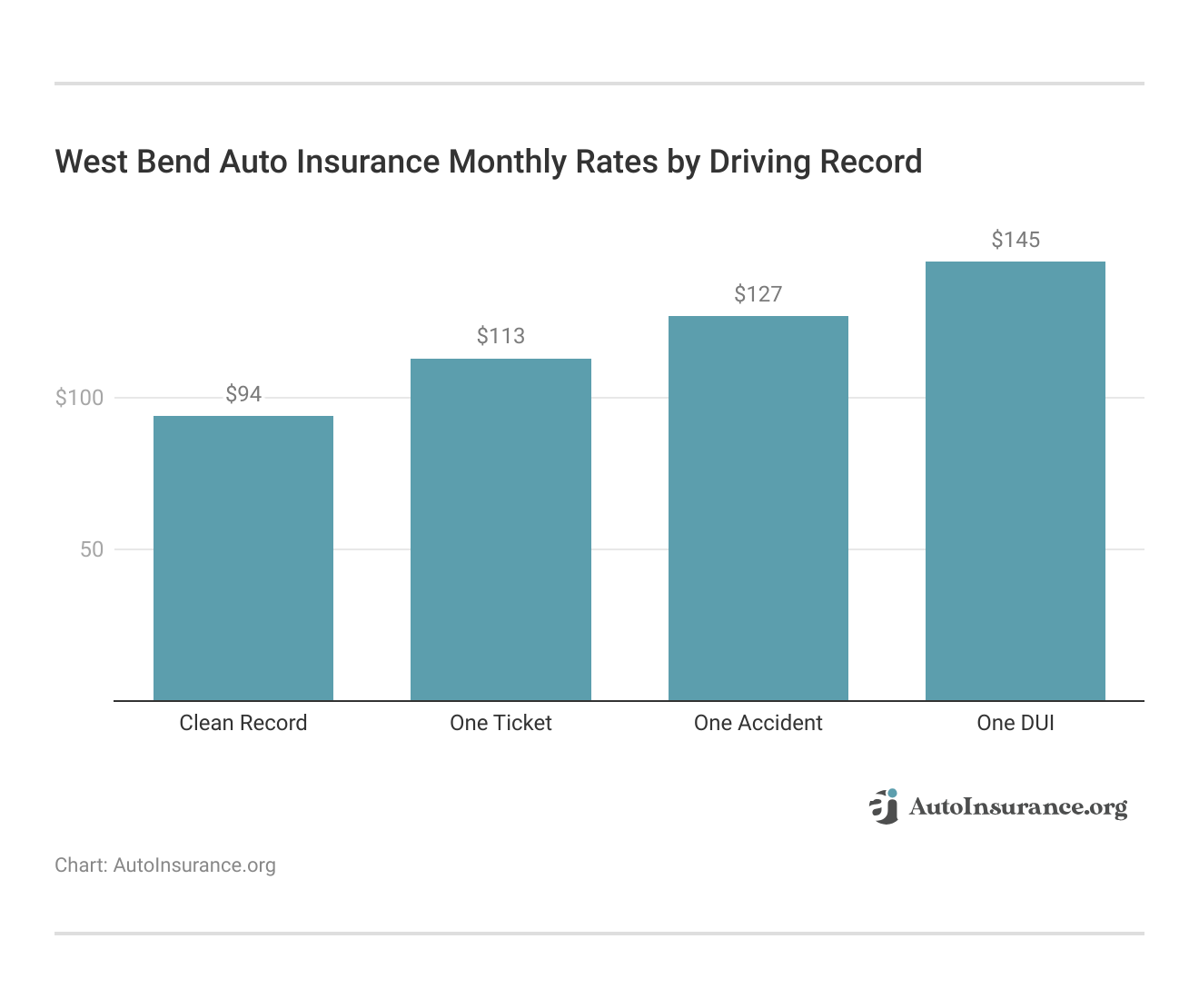

Driving record also influences rates at West Bend. A clean driving record means lower rates, as West Bend views drivers with safe driving histories as less risky.

On the other hand, a history of accidents or traffic violations can raise rates due to the higher likelihood of future claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

West Bend Auto Insurance Rates vs. The Competition

If you are in the market for full coverage auto insurance, West Bend offers competitive rates compared to other major companies. However, West Bend is a pricier choice for those looking for minimum coverage for their vehicle, as you can see in the rates displayed below.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $102 | 150 |

Because coverage levels are just one factor that determines rates, we also want to see how West Bend compares to competitors based on customers’ driving records.

Below, you can see average rates among companies for drivers with clean driving records versus drivers with accidents, tickets, or DUIs.

Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $166 | $251 | $276 | $194 | |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $248 | $199 | $294 | $192 | |

| $131 | $145 | $165 | $180 |

When looking at the average rates by driving record, West Bend is a great choice. It provides competitive rates that are often more affordable than those of many competitors, particularly for drivers with less-than-perfect records.

Coverage Options at West Bend Insurance Company

Now that you know how much West Bend insurance costs on average, we want to explore what you can get for your monthly payments to West Bend. Take a look at the complete list of coverages it offers to customers below.

West Bend Auto Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage to others if you're at fault. |

| Collision | Pays for repairs or replacement of your car after an accident. |

| Comprehensive | Covers damage from theft, vandalism, weather, and animal collisions. |

| Uninsured/Underinsured Motorist | Protects you if you're hit by a driver with little or no insurance. |

| Medical Payments (MedPay) | Covers medical expenses for you and your passengers. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages, regardless of fault. |

| Roadside Assistance | Provides help for towing, flat tires, battery jumps, and lockouts. |

| Rental Car Reimbursement | Covers the cost of a rental car if your car is being repaired. |

| Gap Insurance | Pays the difference between what you owe on your car and its value if totaled. |

Some less common coverages that are missing from West Bend include new car replacement and modified car coverage. However, in addition to standard types of auto insurance like collision and comprehensive coverage, West Bend offers optional add-ons like TravelNet coverage, which is similar to roadside assistance.

TravelNet is a roadside assistance program. It is best for drivers who want to ensure they have help with dead batteries, flat tires, and more.Dani Best Licensed Insurance Producer

The company has useful programs like the Silver Lining Repair Program. If your vehicle needs repaired, you can opt to choose one of West Bend’s trusted repair shops. West Bend also offers gap coverage for new vehicles, which ensures you don’t lose money if your new car is totaled.

Discount Availability on West Bend Insurance

If you are looking to save at West Bend, there are some discounts that you can apply to your policy to lower rates. See below if you qualify for any West Bend auto insurance discounts.

West Bend Auto Insurance Discounts and Percentages

| Discount Name | |

|---|---|

| Multi-Policy | 15% |

| Safe Driver | 12% |

| Paid-in-Full | 10% |

| Good Student | 8% |

| Defensive Driving | 7% |

| Loyalty Discount | 6% |

| Vehicle Safety Features | 5% |

| Paperless & Auto-Pay | 4% |

If you aren’t sure if you qualify for a discount, you can call the West Bend insurance phone number at 1-262-334-5571 or ask your agent about eligibility.

The multi-policy discount at West Bend is the largest discount available (Read More: How to Save Money by Bundling Insurance Policies). There are also small discounts available for simple things like going paperless and signing up for auto payments.

With West Bend’s standard coverages, you can also adjust your deductibles as needed to lower your auto insurance rates. Just make sure that your deductible is something you can still pay out of pocket on a covered claim.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of West Bend Auto Insurance

Reading through West Bend customer reviews can help interested drivers understand how West Bend handles issues like claims and its customer service. Take a look at the Reddit thread below to see what customers think of West Bend insurance.

You can also check West Bend insurance reviews on Yelp and Google for more feedback from customers. Reading the pros and cons that other customers have listed will help you decide if West Bend suits your needs (Learn More: Auto Insurance Companies With the Best Customer Service).

Multiple negative reviews about the same aspect, such as poor agent communication, could indicate an issue with the company. On the other hand, multiple positive reviews could indicate that the company does something especially well.

West Bend Insurance Company Business Ratings

Because customers don’t always offer the most accurate assessment of a company, especially if they are unhappy with it, it is also important to look at West Bend’s business ratings (Read More: Best Auto Insurance Companies According to Consumer Reports).

So, what is West Bend insurance ranked? The table below contains multiple important ratings, from the West Bend Mutual A.M. Best rating to NAIC complaints.

West Bend Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 84 / 100 High Customer Satisfaction |

|

| Score: 849 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.22 Fewer Complaints Than Average |

All of West Bend’s ratings are excellent. According to A.M. Best and BBB, it has solid financial strength and business practices, meaning it will be able to pay out claims.

J.D. Power also found that customers are more than satisfied with West Bend, and the NAIC found that it has fewer complaints than the average. West Bend also has a good customer satisfaction score based on Consumer Reports.

Pros and Cons of West Bend Insurance

Considering the pros and cons of West Bend should help you decide if the company is right for you. West Bend has several advantages for customers, such as competitive rates and few customer complaints.

- Competitive Full Coverage Rates: West Bend offers full coverage rates on the lower end, even for drivers with poor driving records.

- Low Customer Complaints: West Bend has a 0.22 score from the NAIC, which is lower than average.

- Discount Opportunities: West Bend has discounts for bundling insurance, setting up auto-pay, and more (Learn More: Best Auto-Pay Insurance Discounts).

West Best has some great perks for potential customers. However, there are some downsides to consider, such as West Bend’s availability.

- Availability: West End is only sold in 14 states (Arizona, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin).

- Higher Minimum Coverage Rates: While West End is affordable for full coverage, drivers who want to carry just minimum coverage will find cheaper rates elsewhere.

It’s important to weigh these pros and cons to ensure that a policy from West Bend meets both your coverage needs and budget while also considering the level of service you expect.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if West Bend Auto Insurance is Right for You

Our West Bend auto insurance review found that it offers competitive full coverage rates, even for drivers with poor records, making it a great option for those seeking comprehensive protection. West Bend also stands out with its impressive customer satisfaction ratings, with a low 0.22 score for customer complaints from the NAIC.

However, West Bend is less ideal for drivers only looking to carry the minimum auto insurance requirements by state, as rates tend to be higher than competitors. Its limited state availability also means that interested drivers may not be able to buy it in their state.

Remember to compare multiple car insurance companies online with our free quote tool to find the best policy that fits both your needs and budget, ensuring you get the right coverage at the most competitive rate.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is West Bend Insurance a good company?

Yes, West Bend is a respected auto insurance company with an A+ rating from the Better Business Bureau.

What is the financial rating of West Bend Insurance Company?

West Bend has an A financial strength rating from A.M. Best.

Who owns West Bend Insurance?

West Bend Mutual Insurance Company is a mutual insurance company, meaning policyholders own it (Learn More: How to Research Auto Insurance Companies).

What states does West Bend cover?

West Bends sells insurance through agents in 14 states: Arizona, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

Is West Bend auto insurance nationwide?

No, West Bend does not sell insurance nationwide. It is only sold in 14 states. If West Bend is not in your state, you can shop for affordable auto insurance by entering your ZIP in our quote finder.

What is the phone number for West Bend Mutual Insurance claims?

The West Bend insurance claims phone number is 1-877-922-5246. You can check on your West Bend insurance claim status by using your West Bend insurance login on the website or app (Learn More: How to File an Auto Insurance Claim).

How long has West Bend Insurance been in business?

West Bend has been in business since 1894.

What does West Bend insurance cover?

West Bend offers insurance for vehicles, dwellings, and businesses.

How big is West Bend Insurance Company?

West Bend is not one of the largest auto insurance companies in the U.S. It is a medium-sized company operating in 14 states with over 1,400 agents.

What is the A.M. Best rating for West Bend Mutual Insurance Company?

A.M. Best gave West Bend Insurance Company an A rating.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Linds44

Quick Service

Hildy90

Happy Customer

Kaytee123

Great customer service

wrmcam

True Professionals and Very Trustworthy

Ashleydid

West Bend is good

wrmcam

Amazing Customer Service

Mommytoc

West Bend is the best around

lance0007

Very appealing

elg

Claims adjuster

bukrub

Outstanding Coverage for all of our needs