Best Customer Loyalty Auto Insurance Discounts in 2025 (Save up to 25% With These 10 Companies)

Liberty Mutual, Farmers, and Allstate offer the best customer loyalty auto insurance discounts. With a loyalty discount, drivers can save up to 25% on their auto insurance policy, depending on the company. Companies may also offer accident forgiveness and decreasing deductibles for loyal customers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Liberty Mutual, Farmers, and Allstate have the best customer loyalty auto insurance discounts for customers who stick with them.

Many of the best auto insurance companies offer a customer loyalty discount, but auto insurance rates may also increase often.

Because the value may not offset the increase in your rates, shopping around at the best companies with loyalty discounts often is vital to ensure you’re getting the best deal.

Our Top 10 Company Picks: Best Customer Loyalty Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 25% | A | Long-term customers with over 5 years of loyalty |

| #2 | 19% | A | Allstate customers with years of loyalty | |

| #3 | 18% | A+ | Applies to policyholders with continuous coverage | |

| #4 | 15% | A | For customers with a long history with Progressive | |

| #5 | 12% | A++ | Eligible for customers with multiple renewals | |

| #6 | 12% | A+ | Applies to long-term policyholders | |

| #7 | 11% | A++ | For loyal customers with over 3 years of coverage | |

| #8 | 10% | A+ | Customers with multiple policy renewals |

| #9 | 9% | A++ | Available for long-term military families | |

| #10 | 7% | B | Applies to policyholders with long-term loyalty |

Keep reading to learn more about customer loyalty auto insurance discounts and other ways to lower rates. To shop for affordable auto insurance today, compare rates with our free quote tool.

- Some insurers reward drivers for keeping a policy for a specific amount of time

- An auto insurance loyalty discount may not offset a raise

- Staying loyal to one insurance company may cost you money in the long run

How to Qualify for a Customer Loyalty Discount

What is a customer loyalty auto insurance discount? Auto insurance companies love drivers who are loyal. Loyal customers mean a steady source of revenue and lower costs since they don’t have to advertise for those customers.

Each auto insurance company determines its own rates, discounts, and requirements for a loyalty discount.

Unfortunately, there isn’t a formula that works across the board to earn discounts. For example, Progressive auto insurance discounts for loyal customers vary by the length of time you’ve had insurance and how long you’ve been with Progressive.

Drivers with auto insurance for at least six months are Gold members and earn a small discount. On the other hand, Crown members have been with Progressive for over 20 years and receive a much more significant discount.

Other insurers offer loyalty discounts in different ways. For example, State Farm auto insurance discounts don’t include specific loyalty savings but offer claims-free, multi-car, and multi-policy discounts.

Types of Customer Loyalty Auto Insurance Discounts

While some auto insurance companies offer a specific customer loyalty discount, others provide savings in different categories.

Types of customer loyalty savings include:

- Renewal Discounts: Some insurers provide a discount when you renew your policy. However, each insurer has different requirements and may require you to renew your policy early.

- Loyalty Discounts: Staying with an auto insurance company for a specific time can earn you a loyalty discount. Progressive, for example, increases the discount the longer you’re a customer.

- Good Driver Discounts: Drivers with a clean driving record can earn a good driver auto insurance discount. However, the length of time your record must be clear varies by insurer.

- Accident Forgiveness Discounts: Drivers who have been with an insurance company for a while may earn accident forgiveness for their first at-fault accident. However, some insurers only offer this benefit if your accident causes minor damage.

- No-Claims Discounts: If you haven’t filed a claim, you may earn a discount. So, if your vehicle is damaged, it may be cheaper to pay for repairs out of pocket to keep rates low and receive this discount.

Many insurers also offer discounts for having multiple vehicles or policies. Although these aren’t strictly loyalty discounts, they offer savings for drivers using one company for multiple insurance needs.

In addition, Progressive and several other insurers offer a vanishing deductible saving, which rewards drivers with no accidents after a certain amount of time. While this isn’t a loyalty discount, you do have to be a customer for a specific amount of time before you can earn the savings.

Remember, each auto insurance company decides discount qualifications and how much you can save. Drivers can usually bundle discounts to get the lowest rates available.

How to Find Customer Loyalty Discounts

The best way to find insurance companies with loyalty discounts is to do research. It’s helpful to read customer reviews and shop around. Compare rates and discounts from multiple companies to find the best deal.

It’s essential to compare overall rates as well as discounts. Even though one company may offer a loyalty discount, it may not have the cheapest rates.

In addition, drivers should regularly compare quotes with their current policy to get the best auto insurance savings. Don’t assume you’ll get the best rates because you have a loyalty discount. To see what the average customer loyalty discount saves you at the top companies, view the rates below.

Best Customer Loyalty Savings: Min. Coverage Auto Insurance Monthly Rates Before & After Discount

| Insurance Company | Rank | After Discount | Before Discount |

|---|---|---|---|

| #1 | $72 | $96 |

| #2 | $61 | $76 | |

| #3 | $71 | $87 | |

| #4 | $53 | $62 | |

| #5 | $38 | $43 | |

| #6 | $49 | $56 | |

| #7 | $28 | $32 | |

| #8 | $56 | $63 |

| #9 | $49 | $53 | |

| #10 | $44 | $47 |

Insurance companies use numerous factors to calculate rates, and each one weighs those factors differently. Rates change often, and you may be stuck paying higher rates than necessary if you don’t look around.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Companies for Customer Loyalty Auto Insurance Discounts

So what are the best auto insurance companies for customer loyalty discounts? Liberty Mutual, Farmers, and Allstate are the top three companies for loyalty discounts. However, it’s important to realize that a loyalty discount is just one factor that goes into your rates.

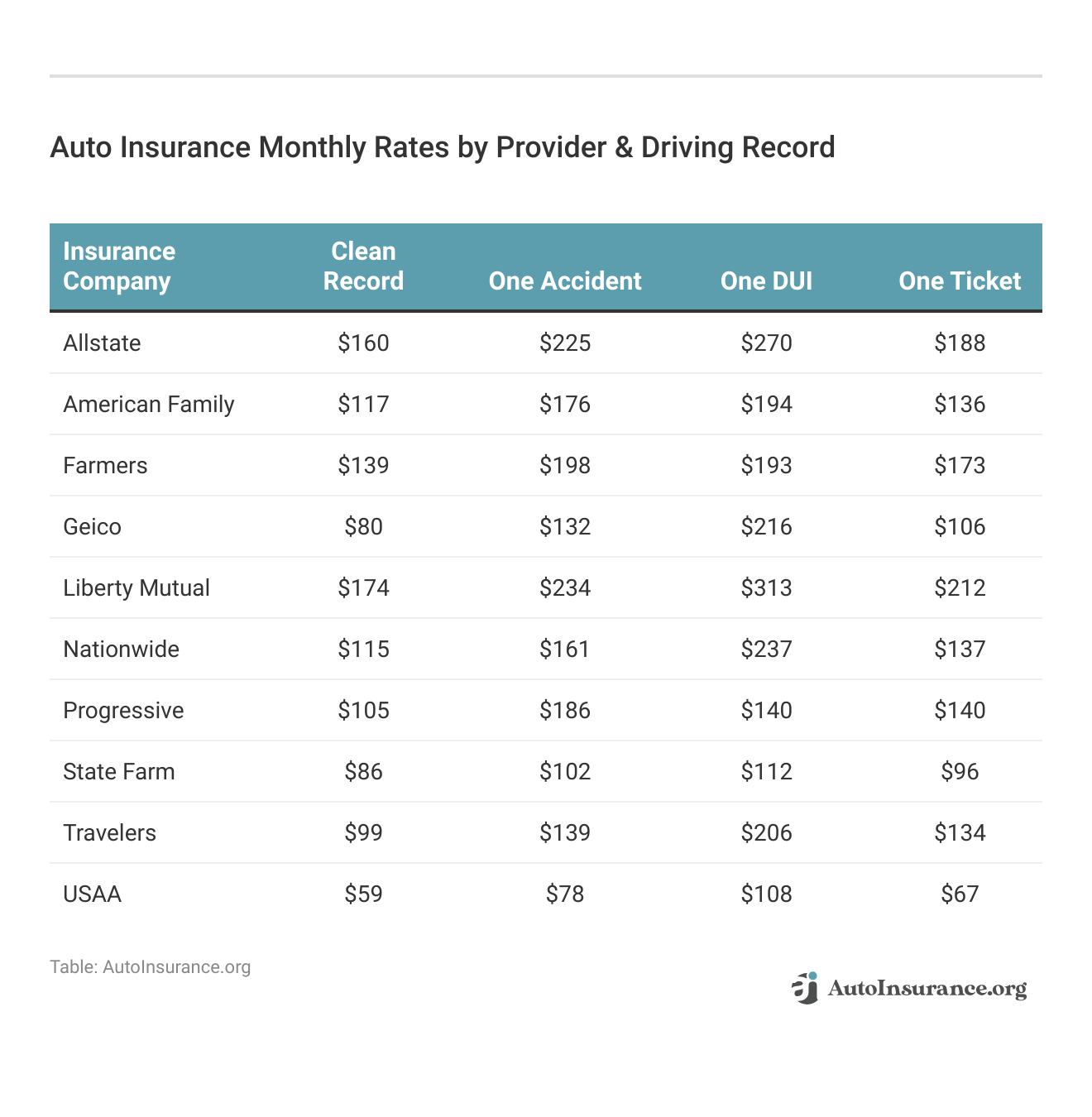

For example, your driving record will impact what you pay for auto insurance. To see what average rates are at the best companies before you apply loyalty discounts, view the table below.

While Liberty Mutual has the biggest loyalty discount of 25%, it may not be the cheapest company for all drivers because it has higher rates for drivers with clean records. The only way to see which company is actually the most affordable is to get quotes.

Other top companies with loyalty discounts may have smaller loyalty discounts, but rates are cheaper overall. Get quotes directly from companies, or use a quote comparison tool.

Other Ways to Save on Auto Insurance

While customer loyalty is excellent for insurers, drivers might not benefit as much. Staying loyal to your auto insurance company might sound like the easy thing to do, and you may get auto insurance discounts. However, rate raises typically outpace discounts. So, although you feel like you’re getting a good deal with a loyalty discount, you might actually be paying higher rates.

Comparison shopping for auto insurance allows you to see if the rates and discounts offered by your current insurer are the best deal.

Other ways to save include checking your coverages, changing deductibles, applying for other discounts, and more.

First, consider removing unnecessary coverages. For example, paying for a tow truck when you need it may be cheaper than paying for roadside assistance. In addition, if your vehicle is older and you can afford to repair or replace it, consider dropping full coverage.

Drivers can increase auto insurance deductibles to get lower rates. However, as with reducing coverage, drivers will have to pay more out of pocket for repairs.Dani Best Licensed Insurance Producer

Next, look at the factors used to determine your rates and make changes where you can. For example, you can’t change your age, but avoiding infractions on your driving record and improving your credit score can lower your rates.

Finally, take advantage of all auto insurance discounts available. Most insurance companies offer savings based on the driver, policy, and vehicle, allowing you to bundle the discounts. For example, you may qualify for a defensive driver discount if you’ve attended a course recently.

Read more: How to Get a Multi-Vehicle Auto Insurance Discount

You may also save money by enrolling in a telematics program. Insurers monitor specific driving habits, like speeding or distracted driving, and offer a discount based on your safe driving. However, read the fine print because some insurers increase rates for risky driving.

Saving With Customer Loyalty Auto Insurance Discounts

Liberty Mutual, Farmers, and Allstate have the best loyal customer discounts. Auto insurance companies may also offer loyalty savings in many forms, such as renewal, multi-policy, vanishing deductible, or specific customer loyalty discounts.

Staying with one auto insurance company might seem like a good idea. The company may even offer you up to a 20% discount for keeping your policy with them. However, staying with one insurer long-term might not be the best idea.

Since each insurance company determines the requirements to earn a customer loyalty discount, savings amounts and years of loyalty vary.

Although staying with the company you know may be tempting, a loyalty discount may not be the best deal for you. Shop around often to ensure you get the most affordable auto insurance. Compare rates and auto insurance discounts from multiple companies to find the coverage you need with the lowest rates.

Ready to shop for cheap auto insurance with loyalty discounts today? Enter your ZIP in our free tool to comparison shop for cheap auto insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What does customer loyalty mean?

Customer loyalty means staying with a specific insurer for a determined amount of time. In some cases, you can also be seen as a loyal customer if you have all your insurance policies with one company and can earn a bundling discount.

What is a customer loyalty discount?

A loyalty insurance discount rewards drivers who are with their insurer for a certain amount of time. However, every auto insurance company’s requirements differ, and the car insurance loyalty discount amount also changes.

Does State Farm have a customer loyalty discount?

State Farm offers a customer loyalty discount if you bundle multiple policies or are accident-free for a specified amount of time. You can also earn a multi-car discount for insuring more than one vehicle with State Farm. Learn more in our article on State Farm auto insurance review.

What are the loyalty levels with Progressive?

Progressive offers loyalty discounts based on how long you’ve had insurance coverage and how long you’ve been with the company. Progressive auto insurance loyalty programs include Silver, Gold, Platinum 1, and Platinum 2 levels.

Progressive’s Diamond level offers a discount if you’ve been with the company for five years, Emerald is 10 years, and Crown is 20 years.

How much of a discount can I expect to receive?

The amount of discount you can receive for customer loyalty varies among insurance companies. Some providers may offer a percentage-based discount on your premiums, while others may offer a fixed amount reduction.

The actual loyalty discount amount will depend on your insurance provider’s policies and auto loyalty programs. To find your area’s cheapest auto insurance company, compare rates with our free quote tool.

Which insurance company offers the most discounts?

State Farm has one of the highest number of auto insurance discounts to offer to customers.

Do all insurance companies offer customer loyalty discounts?

Not all insurance companies offer customer loyalty discounts. It’s important to research and compare different insurance providers to see which ones have the best automotive loyalty programs and how their offerings compare to other companies.

What is loyalty discount reserved?

You may hear the term loyalty discount reserved thrown around, but it simply refers to a loyalty rewards program. Different auto insurance companies will use different terms for their loyalty auto insurance programs.

Which insurance company is usually the cheapest?

USAA is usually the cheapest company, but it sells exclusively to military and veterans (Learn More: USAA Auto Insurance Review). The most affordable options besides USAA are usually State Farm and Geico.

Which insurance company is most expensive?

Allstate is usually one of the more expensive companies, even with a car insurance loyalty discount.

Is car insurance loyalty worth it?

Car insurance loyalty discounts can be worth it if you are happy with your company and it is an affordable choice. In most cases, loyalty discounts are a great perk.

However, you’ll want to make sure that you are still periodically shopping around at insurance companies to insure you are getting the best coverage and rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.