Best Easthampton, Massachusetts Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

The best Easthampton, Massachusetts auto insurance, comes from Progressive, Allstate, and USAA. Progressive leads with the lowest rates starting at $40 per month. Progressive's "Snapshot" program offers customized savings for safe drivers, while Allstate and USAA provide versatile coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in MA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in MA

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in MA

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsWhen it comes to securing the Best Easthampton, Massachusetts auto insurance, Progressive, Allstate, and USAA are the undisputed leaders. Progressive tops the list for its innovative programs that reward safe driving with personalized savings.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 21% | A+ | Snapshot Program | Progressive | |

| #2 | 18% | A+ | Driver Discounts | Allstate | |

| #3 | 24% | A++ | Military Benefits | USAA | |

| #4 | 17% | B | Coverage Options | State Farm | |

| #5 | 23% | A | Local Agents | Farmers | |

| #6 | 16% | A++ | Affordable Rates | Geico | |

| #7 | 22% | A | Claims Service | American Family | |

| #8 | 25% | A+ | Driver Discounts | Nationwide |

| #9 | 20% | A++ | Bundling Policies | Travelers | |

| #10 | 19% | A | Add-on Coverages | Liberty Mutual |

These companies stand out for their blend of affordability and comprehensive service in Easthampton, Massachusetts. Dive into our article called, “Comprehensive Auto Insurance Defined.”

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Progressive excels with tailored savings for safe drivers

- Allstate offers versatile coverage for Easthampton needs

- USAA provides comprehensive policies for Easthampton residents

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Policy Bundling Savings: Progressive delivers an impressive 21% reduction when you merge various policies, making it a top choice for Easthampton locals aiming to cut down on their insurance expenses.

- Dynamic Rewards through Snapshot: PProgressive’s Snapshot rewards safe driving with discounts. Learn more in our guide, “Best Progressive Auto Insurance Discounts.”

- A+ Financial Rating: With an A+ rating from A.M. Best, Progressive provides Easthampton clients with reliable coverage and a strong commitment to fulfilling claims.

Cons

- Variable Snapshot Benefits: While the Snapshot program can bring notable savings, its rewards vary widely and depend heavily on individual driving habits.

- Restricted Discount Offerings: Progressive’s bundling offer is strong, but other discounts may not benefit high-risk drivers or those with complex needs in Easthampton, limiting its appeal for some.

#2 – Allstate: Best for Driver Discount

Pros

Cons

- Average Bundling Savings: Allstate’s bundling discount is beneficial but lags behind competitors in Easthampton, who offer better deals for budget-conscious buyers.

- Potentially High Premiums: Despite discounts, Allstate’s premiums may be higher, especially for drivers with imperfect records in Easthampton, making it a pricier option.

#3 – USAA: Top Choice for Military Benefits

Pros

- Military-Focused Service in Easthampton: USAA offers a 24% bundling discount for military families, providing significant savings.

- Premier A++ Rating: USAA’s A++ rating from A.M. Best ensures financial strength and reliability for Easthampton policyholders. Access detailed insights in our guide titled “USAA Auto Insurance Review.”

- Extensive Military Perks: USAA provides military-specific benefits like overseas vehicle storage and flexible payment options for active duty members.

Cons

- Restricted Eligibility: USAA’s exclusive service for military members means many Easthampton residents are excluded, limiting access to its specialized benefits for the broader community.

- Limited Options for Civilians: While excellent for military needs, USAA’s civilian offerings are less competitive, lacking the comprehensive scope some non-military Easthampton residents might need.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Coverage Options

Pros

- Broad Coverage Selection: State Farm offers a wide range of coverage options in Easthampton, allowing clients to tailor their policies to specific needs.

- Bundling Benefits: A 17% discount for bundling encourages Easthampton customers to consolidate their insurance, simplifying management and potentially cutting costs.

- Personalized Service: Local agents in Easthampton provide face-to-face consultations for those who prefer direct interaction. Dive into our article called “State Farm Auto Insurance Review.”

Cons

- Lower Bundling Discounts: The 17% discount may be less appealing compared to higher offers from other insurers in Easthampton, Massachusetts.

- Moderate Financial Rating: A B rating from A.M. Best indicates acceptable but not exceptional financial strength in Easthampton, Massachusetts.

#5 – Farmers: Best for Local Agents

Pros

- Local Expertise in Easthampton, Massachusetts: Farmers offers a network of local agents, providing tailored service and advice specific to the community.

- Notable Bundling Discount: Farmers offers a 23% discount for combining policies, providing significant savings for Easthampton residents. Find details in our guide, “Farmers Auto Insurance Review.”

- Strong Financial Health: An A rating from A.M. Best reflects Farmers’ solid financial position, assuring Easthampton policyholders of reliable service.

Cons

- Higher Premium Costs: Despite the generous discounts, Farmers’ premiums can be relatively high, potentially deterring Easthampton residents on a tight budget or those primarily focused on price.

- Service Variability Among Agents: While many Easthampton customers may receive excellent service, the quality can differ between agents, which might affect overall satisfaction with Farmers.

#6 – Geico: Best for Affordable Rates

Pros

- Attractive Bundling Discounts: Geico provides a 16% discount on combined policies in Easthampton, Massachusetts, reducing overall insurance costs for auto, home, and renters insurance.

- Strong Financial Backing: With an A++ rating from A.M. Best, Geico ensures reliable claims and financial stability. Learn more in our guide, “Best Geico Auto Insurance Discounts.”

- Specialized Rates for Infrequent Drivers: Geico provides favorable rates for low-mileage drivers in Easthampton, Massachusetts, offering significant premium savings.

Cons

- Discount Limitations Compared to Rivals: Geico’s 16% bundling discount in Easthampton, Massachusetts, is less competitive compared to some rivals with larger incentives.

- Limited Flexibility in Coverage Options: Geico’s coverage options in Easthampton, Massachusetts, may be less customizable compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Claims Service

Pros

- Generous Bundling Discounts: American Family offers a 22% discount on combined policies in Easthampton, Massachusetts, making it a great choice for consolidating insurance.

- Outstanding Claims Service: Known for efficient claims processing in Easthampton, Massachusetts, with an A rating from A.M. Best.

- Responsive Customer Support: Provides personalized assistance in Easthampton, Massachusetts, for a smoother claims process. Learn more in our guide titled, “American Family Auto Insurance Review.”

Cons

- Variable Premium Costs: Premium rates in Easthampton, Massachusetts, can vary based on individual factors, leading to potential unexpected expenses.

- Limited Range of Coverage Options: May not offer as many specialized coverages in Easthampton, Massachusetts, compared to other providers.

#8 – Nationwide: Best for Driver Discounts

Pros

- Bundling Benefits: Nationwide’s 25% discount for bundled policies in Easthampton, Massachusetts, is ideal for significant savings on multiple coverages.

- Driver Discounts: Nationwide offers discounts for safe driving and defensive courses in Easthampton, Massachusetts, supported by an A+ A.M. Best rating.

- Strong Financial Performance: Nationwide’s A+ A.M. Best rating ensures claim stability in Easthampton, Massachusetts. More details in our guide titled “Nationwide Auto Insurance Review.”

Cons

- Higher Initial Premiums: Despite discounts, initial premiums in Easthampton, Massachusetts, may be high, which could be a concern for budget-conscious customers.

- Complex Discount Eligibility: Some driver discounts in Easthampton, Massachusetts, have intricate requirements or conditions, like telematics devices, which may not suit all customers.

#9 – Travelers: Best for Bundling Policies

Pros

- Robust Bundling Discounts: Travelers offers a 20% discount on combined policies in Easthampton, Massachusetts, reducing insurance costs for those consolidating auto, home, or business coverage.

- Exceptional Financial Reliability: Travelers has an A++ rating from A.M. Best, ensuring strong financial stability in Easthampton, Massachusetts, for reliable claim fulfillment.

- Varied Coverage Options: Travelers offers customizable insurance in Easthampton, MA, from basic liability to full coverage. For more details, see our guide titled, “Travelers Auto Insurance Review.”

Cons

- Moderate Discount Threshold: The 20% bundling discount is competitive but may not match top competitors, limiting savings in Easthampton, Massachusetts.

- Price Sensitivity: Premiums with Travelers in Easthampton, Massachusetts, might still seem high even with bundling discounts, especially for those opting for enhanced or additional coverages.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Add-on Coverages

Pros

- Appealing Bundling Offers: Liberty Mutual offers a 19% discount for combined policies in Easthampton, Massachusetts, ideal for consolidating insurance with unified billing.

- Extensive Add-On Options: Liberty Mutual provides a wide range of optional coverages in Easthampton, Massachusetts, such as accident forgiveness and new car replacement.

- Dependable Financial Stability: Liberty Mutual’s A.M. Best A rating ensures strong financial health in Easthampton, Massachusetts. Learn more in our guide titled “Liberty Mutual Auto Insurance Review.”

Cons

- Less Competitive Discount: The 19% bundling discount may be lower than competitors in Easthampton, Massachusetts, affecting savings.

- Higher Comprehensive Costs: Liberty Mutual’s comprehensive coverage in Easthampton, Massachusetts, can be pricier, which may not fit all budgets.

Monthly Auto Insurance Rates in Easthampton: Compare Coverage Costs

When evaluating auto insurance options in Easthampton, Massachusetts, it’s crucial to compare coverage rates across different providers. The table below highlights the monthly rates for minimum and full coverage from various companies, offering a snapshot of the best rates available.

Best Easthampton, Massachusetts Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$60 $150

$50 $135

$65 $155

$50 $130

$70 $160

$55 $145

$55 $140

$45 $125

$60 $140

$40 $120

USAA provides the most cost-effective coverage, with minimum coverage at $40 and full coverage at $120. State Farm offers competitive rates as well, with minimum coverage at $45 and full coverage at $125.

Auto Insurance Discounts From the Top Providers for Easthampton, Massachusetts

| Company | Available Discounts |

|---|---|

| Safe driver, multi-policy, new car, early signing, anti-theft, responsible payer | |

| Multi-policy, loyalty, good driver, good student, defensive driving, young volunteer | |

| Multi-policy, safe driver, good student, alternative fuel, homeowner, military | |

| Multi-policy, good driver, good student, military, emergency deployment, vehicle equipment | |

| Multi-policy, new car, paperless, hybrid vehicle, good student, newly married, accident forgiveness |

| Multi-policy, accident-free, safe driver, paperless, smart ride, defensive driving |

| Multi-policy, safe driver, homeownership, pay-in-full, automatic payment, paperless billing | |

| Safe driver, multi-policy, good student, accident-free, defensive driving course | |

| Multi-policy, homeownership, hybrid/electric vehicle, good payer, continuous coverage, new car | |

| Safe driver, family legacy, good student, defensive driving, military affiliation |

On the higher end, Liberty Mutual’s rates are $70 for minimum coverage and $160 for full coverage, making it less budget-friendly compared to other providers. Uncover details in our guide titled, “Full Coverage Auto Insurance.”

Minimum Auto Insurance in Easthampton, Massachusetts

Easthampton, Massachusetts auto insurance laws require that you have at least the Massachusetts minimum auto insurance to be financially responsible in the event of an accident. Take a look at the required auto insurance in Easthampton, Massachusetts.

Easthampton, MA Liability Auto Insurance Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $20,000 per person and $40,000 per accident |

| Property Damage Liability | $5,000 minimum |

While every Massachusetts driver needs to meet the minimum auto insurance requirements, many drivers choose to add coverage and increase limits.

USAA offers the lowest monthly rates for full coverage in Easthampton, at just $120, making it a top choice for budget-conscious drivers.Brandon Frady Licensed Insurance Producer

Assessing your specific needs and comparing rates can help ensure you have adequate coverage that meets your requirements and provides peace of mind on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Affordable Easthampton Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Easthampton, Massachusetts are affected by age, gender, and marital status. See how demographics impact the monthly cost of insurance.

Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender in Easthampton, Massachusetts

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $647 | $647 | $201 | $201 | $179 | $179 | $179 | $179 | |

| $540 | $540 | $210 | $210 | $185 | $185 | $170 | $170 | |

| $575 | $575 | $220 | $220 | $195 | $195 | $180 | $180 | |

| $391 | $391 | $137 | $137 | $132 | $132 | $121 | $121 | |

| $730 | $730 | $229 | $229 | $219 | $219 | $191 | $191 |

| $480 | $480 | $195 | $195 | $172 | $172 | $160 | $160 |

| $515 | $515 | $153 | $153 | $141 | $141 | $135 | $135 | |

| $176 | $176 | $62 | $62 | $62 | $62 | $62 | $62 | |

| $455 | $455 | $248 | $248 | $225 | $225 | $199 | $199 | |

| $249 | $249 | $118 | $118 | $107 | $107 | $106 | $106 |

Although auto insurance rates are high for teens and new drivers, rates tend to decrease with age and experience. However, a poor driving record can easily raise rates. Gain insights from our guide titled, “What age group has the most fatal crashes?”

Best Easthampton, Massachusetts Auto Insurance for Teen Drivers

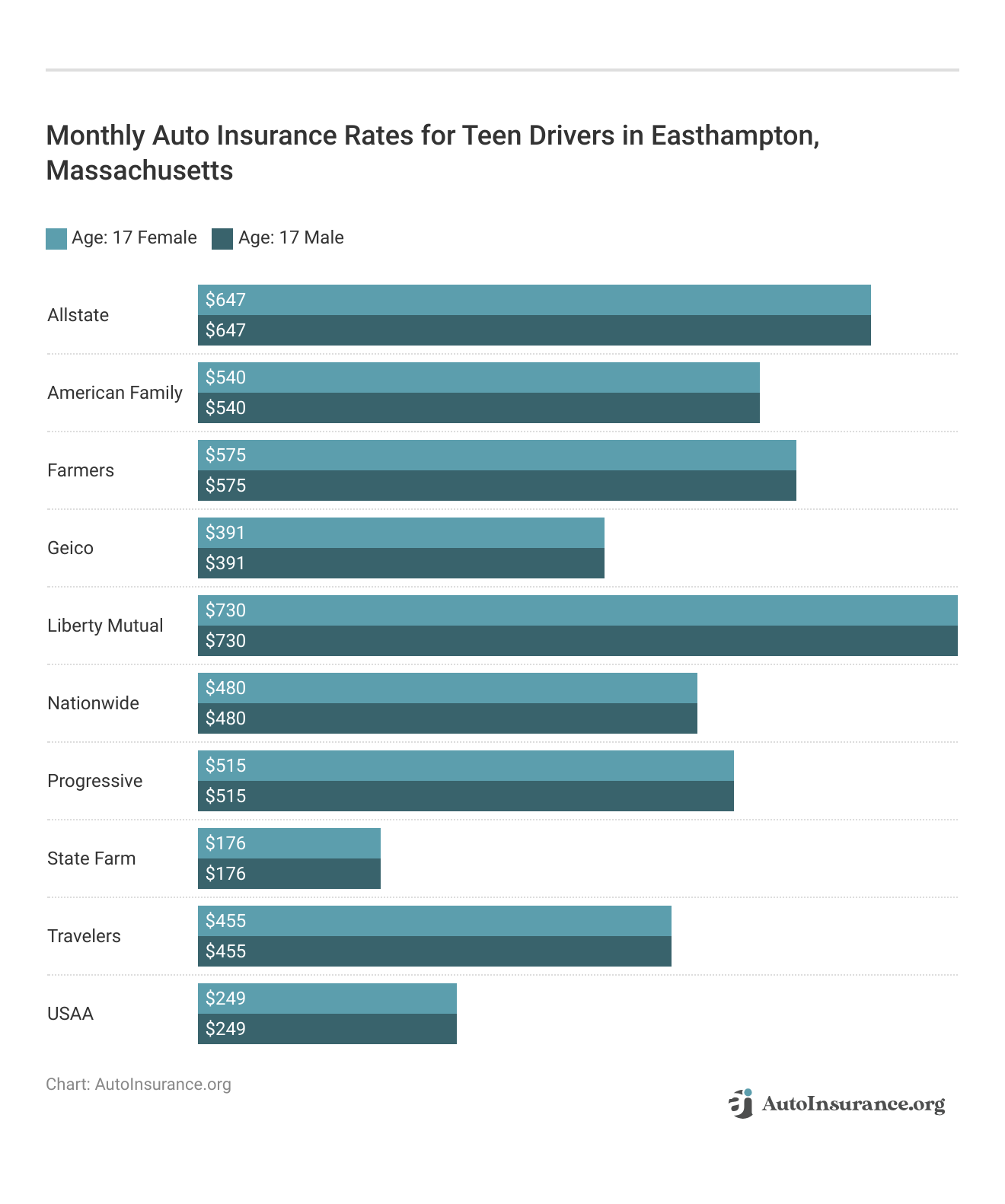

Finding best teen auto insurance in Easthampton, Massachusetts is a challenge. Take a look at the monthly teen auto insurance rates in Easthampton, Massachusetts.

Teens typically pay very high auto insurance rates since they lack experience behind the wheel. Although State Farm offers the lowest rates at $176 a month, teens may pay as much as $730 a month with Liberty Mutual.

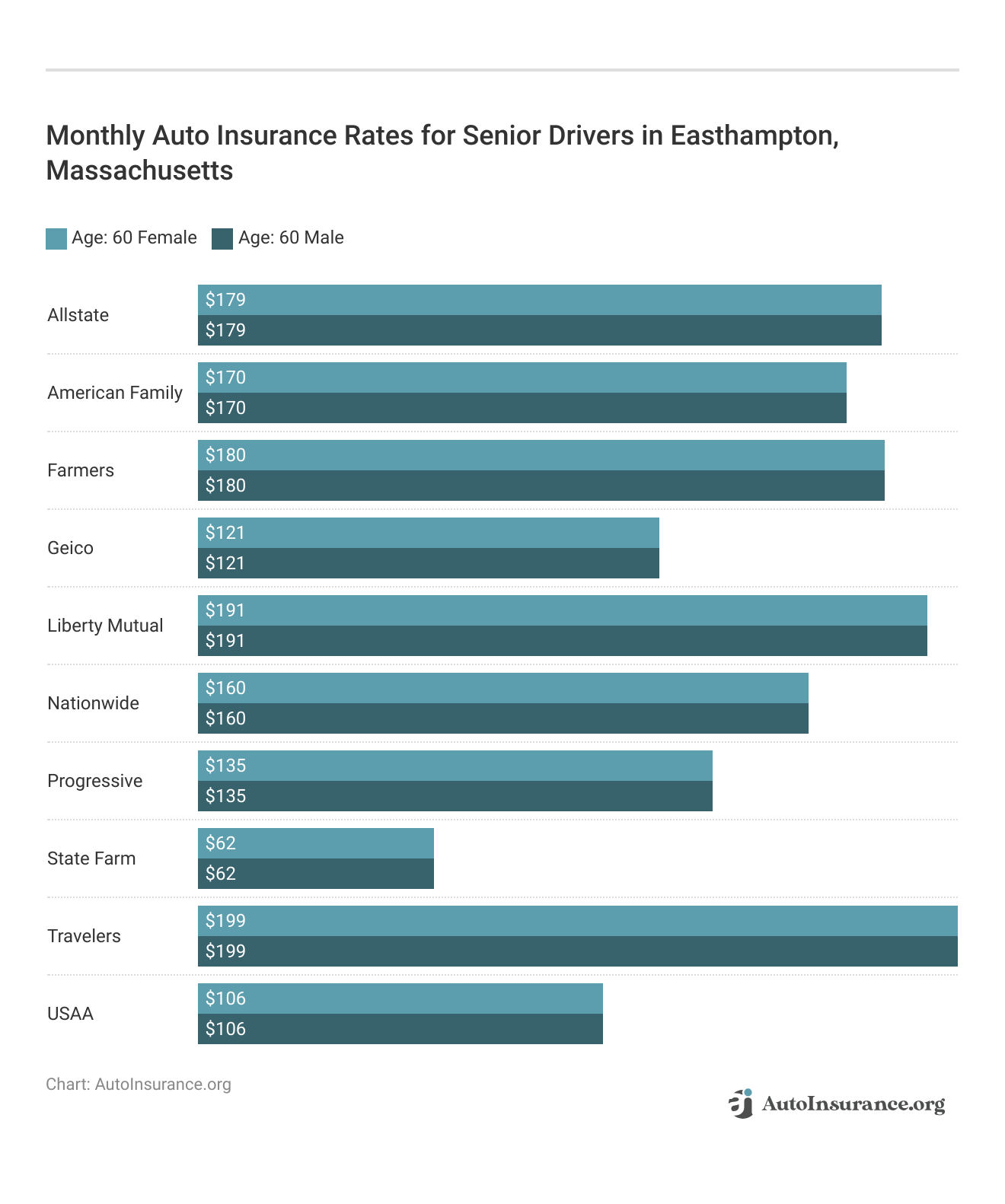

Best Easthampton, Massachusetts Auto Insurance for Seniors

Explore the monthly average auto insurance rates specifically for older drivers to see how costs compare across different providers.

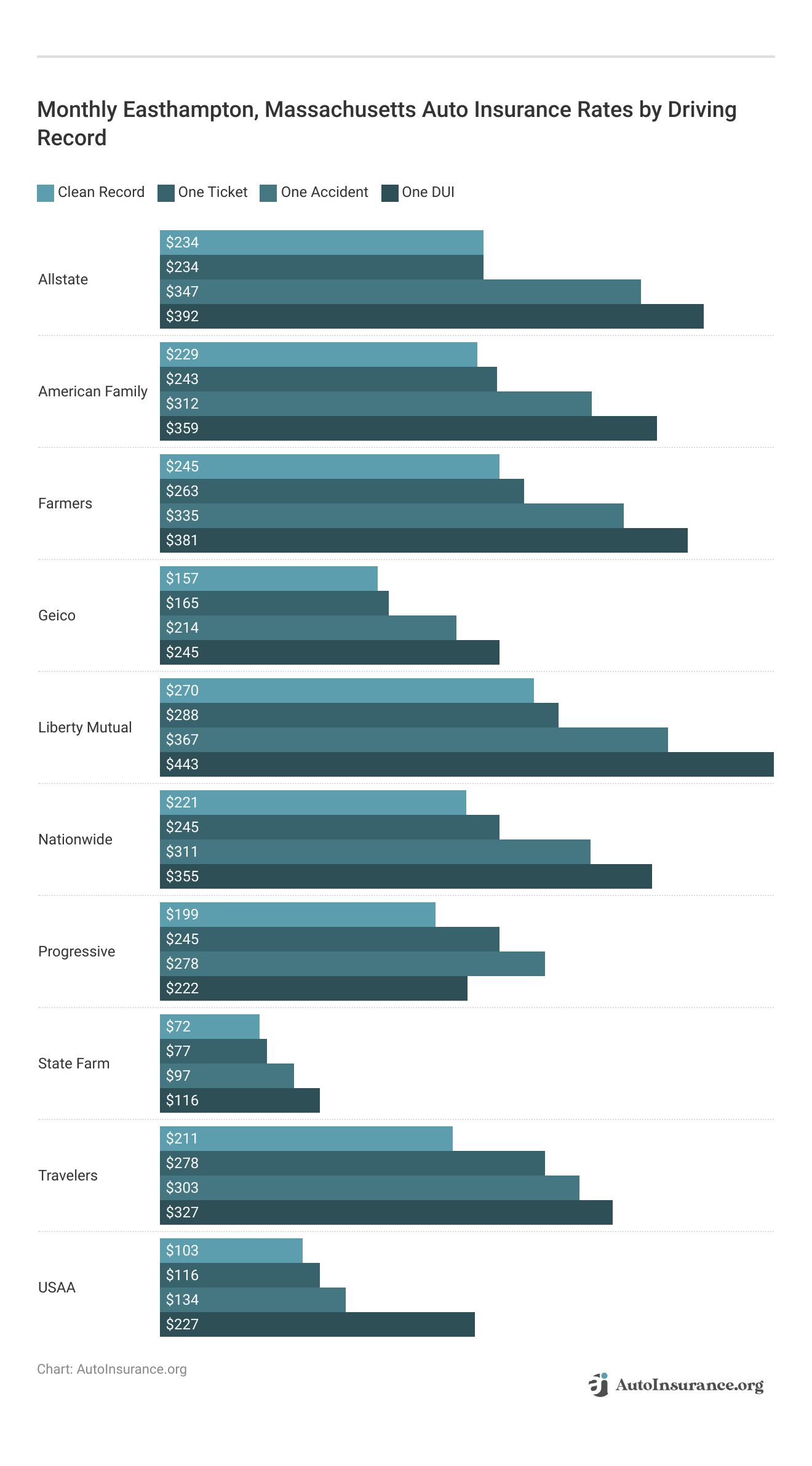

Best Easthampton, Massachusetts Auto Insurance By Driving Record

Your driving record has a big impact on your auto insurance rates. See the monthly auto insurance rates for a bad record in Easthampton, Massachusetts compared to the monthly auto insurance rates with a clean record in Easthampton, Massachusetts.

Accidents, tickets, and DUIs significantly increase Easthampton, MA auto insurance rates. To discover more about the company, visit our guide titled, “Best Yearly Premium Auto Insurance.”

Easthampton, Massachusetts, experiences a moderate level of auto accidents and insurance claims each year. With 1,100 accidents and 850 insurance claims annually, understanding key statistics such as average claim costs, the percentage of uninsured drivers, and the impact of weather-related incidents is crucial for both drivers and insurers in the region.

Easthampton, Massachusetts Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 1,100 |

| Claims per Year | 850 |

| Average Claim Cost | $6,500 |

| Percentage of Uninsured Drivers | 17% |

| Vehicle Theft Rate | 320 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | High |

These statistics highlight the importance of comprehensive auto insurance coverage in Easthampton, where high weather-related incidents, medium traffic density, and a notable percentage of uninsured drivers contribute to the risk on the road.

By staying informed, drivers can better navigate the local auto insurance landscape and protect themselves against potential losses.

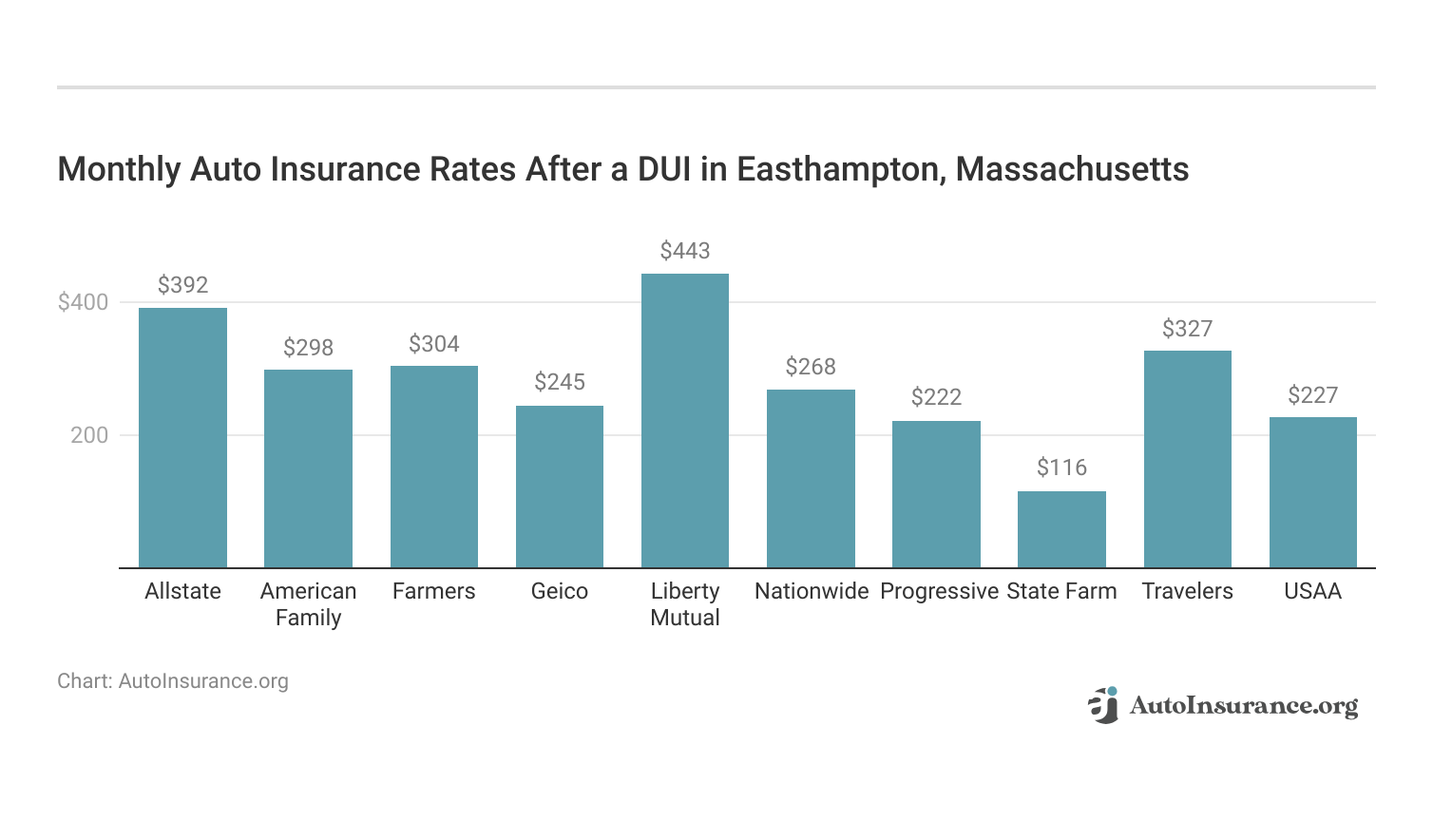

Best Easthampton, Massachusetts Auto Insurance Rates After a DUI

Finding best auto insurance after a DUI in Easthampton, Massachusetts is not easy. Compare the monthly rates for DUI auto insurance in Easthampton, Massachusetts to find the best deal.

Securing affordable auto insurance after a DUI in Easthampton, Massachusetts can be challenging due to the significant rate increases associated with DUI convictions, which impact rates for six years.

While State Farm offers the lowest rates for drivers with a DUI in Easthampton, these rates are still substantially higher compared to those for drivers with a clean record. To find the best deal, it’s essential to compare monthly rates across different insurers to identify the most cost-effective option available.

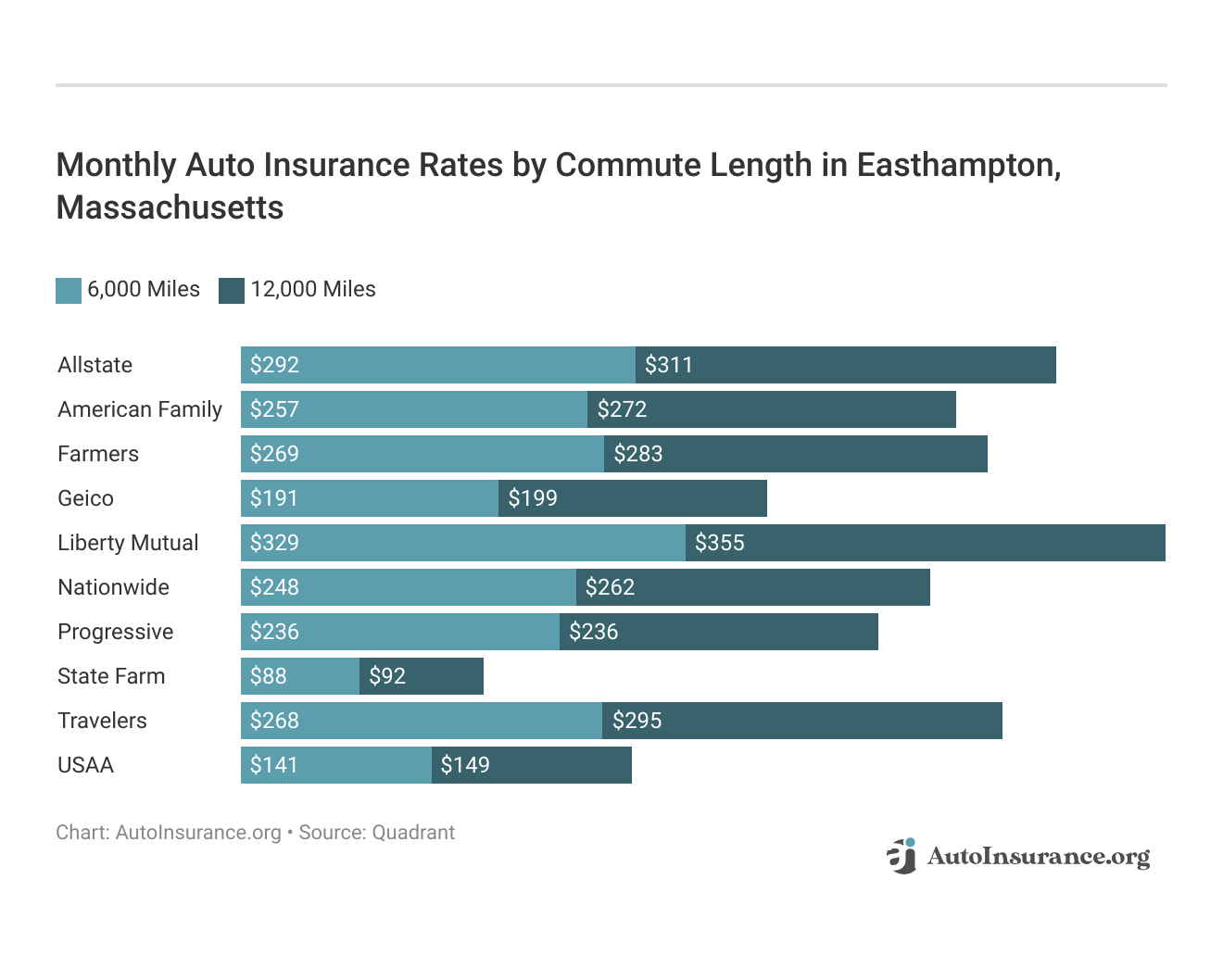

Best Easthampton, Massachusetts Auto Insurance Rates By Commute

Commute length and monthly mileage affect Easthampton, Massachusetts auto insurance. Find the monthly Easthampton, Massachusetts auto insurance by commute length.

By understanding these variables, drivers can explore the best auto insurance options tailored to their specific commuting habits. Finding the right coverage at the best rate helps ensure both affordability and protection while on the road in Easthampton.

For more information, check out our complete guide titled, “Where to Compare Auto Insurance Rates.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Easthampton, Massachusetts Auto Insurance Rates By Coverage Level

When selecting auto insurance in Easthampton, Massachusetts, the coverage level you choose can significantly impact your costs. To help you make an informed decision, explore a comparison of monthly auto insurance rates based on different coverage levels available in Easthampton.

Although more coverage equals higher rates, adding collision and comprehensive coverage means fewer out-of-pocket costs if your vehicle is damaged. For further details, see our guide titled, “Does auto insurance cover interior damage?”

Best By Category: Auto Insurance in Easthampton, Massachusetts

Compare the best auto insurance companies in Easthampton, Massachusetts in each category to find the company with the best rates for your personal needs.

Best Easthampton, Massachusetts Auto Insurance Providers by Driver Profile

| Driver Profile | Insurance Company |

|---|---|

| Teenagers | |

| Seniors | |

| Clean Record | |

| One Accident | |

| One DUI | |

| One Ticket |

State Farm provides the best rates for teens, seniors, and drivers with dings on their driving records. Discover more by exploring our in-depth guide titled, “How Insurance Providers Determine Rates.”

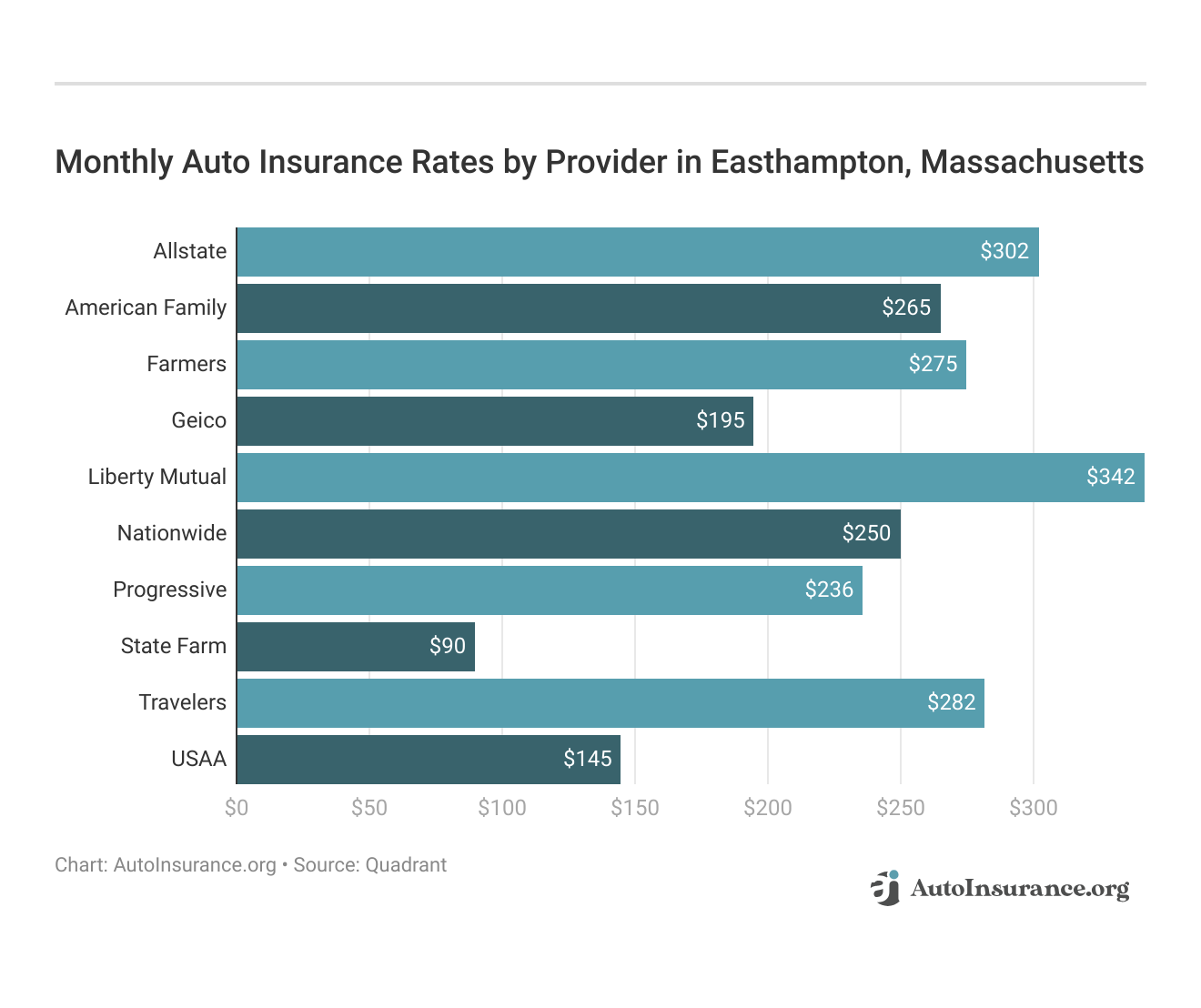

The Best Easthampton, Massachusetts Auto Insurance Companies

Compare the leading auto insurance companies in Easthampton, Massachusetts to identify the best monthly rates tailored to your needs. By exploring various providers, you can discover a range of options that offer competitive pricing, coverage benefits, and exceptional customer service.

State Farm offers the best Easthampton, Massachusetts auto insurance rates, and Liberty Mutual has the highest rates. Obtain detailed insights by reading our guide titled, “Liberty Mutual vs. Progressive Auto Insurance.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Influencing Auto Insurance Rates in Easthampton, Massachusetts

There are a lot of reasons why auto insurance rates in Easthampton, Massachusetts are higher or lower than in other cities. These include traffic and the number of vehicle thefts in Easthampton, Massachusetts.

Easthampton, Massachusetts Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | Low traffic density, with minimal congestion outside of larger cities. |

| Vehicle Theft Rate | B | Lower-than-average vehicle theft rate, especially in rural areas. |

| Average Claim Size | B | Claims are generally average, with moderate repair costs. |

| Uninsured Drivers Rate | B | Slightly lower-than-average rate of uninsured drivers compared to national levels. |

| Weather-Related Risks | C | Higher risk due to severe winter weather, including snowstorms and icy roads. |

Many local factors may affect your Easthampton auto insurance rates.

Easthampton Commute Time

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Easthampton, Massachusetts commute length is 23.2 minutes according to City-Data.

Access detailed insights in our guide titled, “Top 7 Factors That Affect Auto Insurance Rates.”

Compare Easthampton, Massachusetts Auto Insurance Quotes

Easthampton, Massachusetts drivers must meet the state minimum auto insurance requirements of 20/40/5 in liability coverage, and rates average $227 a month. However, rates vary by driver and coverage.

Before you buy Easthampton, Massachusetts auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Easthampton, Massachusetts auto insurance quotes.

Dive into our article called, “Does the car a teen drives affect auto insurance rates?“

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a type of insurance coverage that protects vehicle owners against financial losses resulting from accidents, theft, or other unforeseen incidents involving their vehicles. It provides coverage for property damage, medical expenses, liability, and more.

Is auto insurance mandatory in Easthampton, Massachusetts?

Yes, auto insurance is mandatory in Easthampton, Massachusetts, as it is in most states in the United States. Massachusetts law requires all registered vehicles to have a minimum amount of auto insurance coverage.

What factors can affect auto insurance rates in Easthampton, Massachusetts?

Auto insurance rates in Easthampton, Massachusetts, are influenced by several factors. Key considerations include your driving record, age, gender, vehicle make and model, annual mileage, and credit history. The coverage limits, deductible chosen, claims history, and even your location within Easthampton can also impact your premiums.

What are the minimum auto insurance requirements in Easthampton, Massachusetts?

In Easthampton, Massachusetts, the minimum auto insurance requirements include $20,000 per person and $40,000 per accident for bodily injury to others, $8,000 per person for Personal Injury Protection (PIP), $20,000 per person and $40,000 per accident for bodily injury caused by an uninsured motorist, and $5,000 per accident for property damage to others.

Explore insurance savings in our full guide titled, “Personal Injury Protection (PIP) Auto Insurance Defined.”

How can I find affordable auto insurance in Easthampton, Massachusetts?

To get affordable auto insurance in Easthampton, Massachusetts, compare quotes from various providers, maintain a clean driving record, and consider higher deductibles. Look for discounts, such as safe driver or multi-policy discounts, and consider bundling your auto insurance with other policies for added savings.

What should I do if I’m involved in an accident in Easthampton, Massachusetts?

If you’re involved in an accident in Easthampton, Massachusetts, first ensure everyone’s safety and call for medical help if needed. Exchange contact and insurance details with the other parties, and document the scene with photos and witness statements if possible. Report the incident to your insurance company promptly and cooperate fully by providing any required information or documentation during the claims process.

Can I use my auto insurance coverage outside of Easthampton, Massachusetts?

Yes, your auto insurance coverage typically extends beyond Easthampton, Massachusetts. Most auto insurance policies provide coverage throughout the United States and may also offer limited coverage in Canada. However, it’s essential to review your policy or consult with your insurance provider to understand the extent of your coverage when traveling outside the state or country.

What is the average cost of auto insurance in Easthampton, Massachusetts?

The average cost of auto insurance in Easthampton, Massachusetts, varies based on factors such as age, driving history, and vehicle type. On average, rates can range from $100 to $125 monthly, but shopping around and comparing quotes can help you find lower premiums.

Learn more about the offerings in our guide titled, “Does a criminal record affect auto insurance rates?“

How can I find the best auto insurance companies in Easthampton, Massachusetts?

To find the best auto insurance companies in Easthampton, Massachusetts, consider researching local providers, checking online reviews, and getting quotes from multiple insurers. Look for companies that offer good customer service, competitive rates, and appropriate coverage options.

What auto insurance coverage options are available in Easthampton, Massachusetts?

In Easthampton, Massachusetts, auto insurance options include liability coverage, collision and comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). You can customize your policy to meet your needs and budget.

Get fast and bes auto insurance coverage today with our quote comparison tool below.

Are there any specific requirements for auto insurance in Easthampton, Massachusetts?

Easthampton, Massachusetts requires drivers to carry minimum liability coverage, which includes $20,000 per person and $40,000 per accident for bodily injury, $5,000 for property damage, and $8,000 for personal injury protection (PIP).

How can I reduce my auto insurance premiums in Easthampton, Massachusetts?

To lower your auto insurance premiums in Easthampton, Massachusetts, you can maintain a clean driving record, increase your deductibles, bundle your auto insurance with other policies, take advantage of discounts, and compare quotes from different providers regularly.

Access detailed insights in our guide titled, “Best Farmers Auto Insurance Discounts.”

What should I do after an accident in Easthampton, Massachusetts regarding my auto insurance?

If you’re involved in an accident in Easthampton, Massachusetts, first ensure everyone’s safety and call emergency services if needed. Then, report the incident to your insurance provider as soon as possible, providing all necessary details and documentation, such as the police report and photos of the damage.

Can I get temporary auto insurance in Easthampton, Massachusetts?

Yes, some providers in Easthampton, Massachusetts offer temporary or short-term auto insurance policies, which can be useful if you need coverage for a rental car, a temporary vehicle, or while visiting the area.

What is the best auto insurance for new drivers in Easthampton, Massachusetts?

For new drivers in Easthampton, Massachusetts, Geico is considered the best option. It offers competitive rates, averaging $146 per month for minimum coverage, and has high ratings for customer satisfaction and financial stability.

Is auto insurance required for car registration in Easthampton, Massachusetts?

Yes, auto insurance is mandatory for car registration in Easthampton, Massachusetts. To register a vehicle, you must have automobile insurance that meets or exceeds the state’s minimum coverage requirements, known as Compulsory Coverages.

For further details, see our guide titled, “Minimum Auto Insurance Requirements by State.”

What type of auto insurance offers the most protection in Easthampton, Massachusetts?

In Easthampton, Massachusetts, comprehensive auto insurance provides the most extensive coverage. It protects you and your vehicle in all types of accidents, regardless of who is at fault, offering the highest level of security.

Which auto insurance group is the most affordable in Easthampton, Massachusetts?

In Easthampton, Massachusetts, Group 1 represents the most affordable auto insurance category. Policies in this group generally offer lower premiums.

How quickly should you get auto insurance after purchasing a car in Easthampton, Massachusetts?

In Easthampton, Massachusetts, you should obtain auto insurance as soon as possible after purchasing a car. Insurance is required before you can register your vehicle, and having coverage is crucial for legal and safety reasons.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Can I drive a newly purchased car in Easthampton, Massachusetts without insurance?

No, you cannot drive a newly purchased car in Easthampton, Massachusetts without insurance. State law requires you to have valid auto insurance before you can register and drive your vehicle. It’s important to arrange for coverage immediately after purchasing your car.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.