Best Emergency Medical Services (EMS) Auto Insurance Discounts in 2025 (Save up to 15% With These Companies)

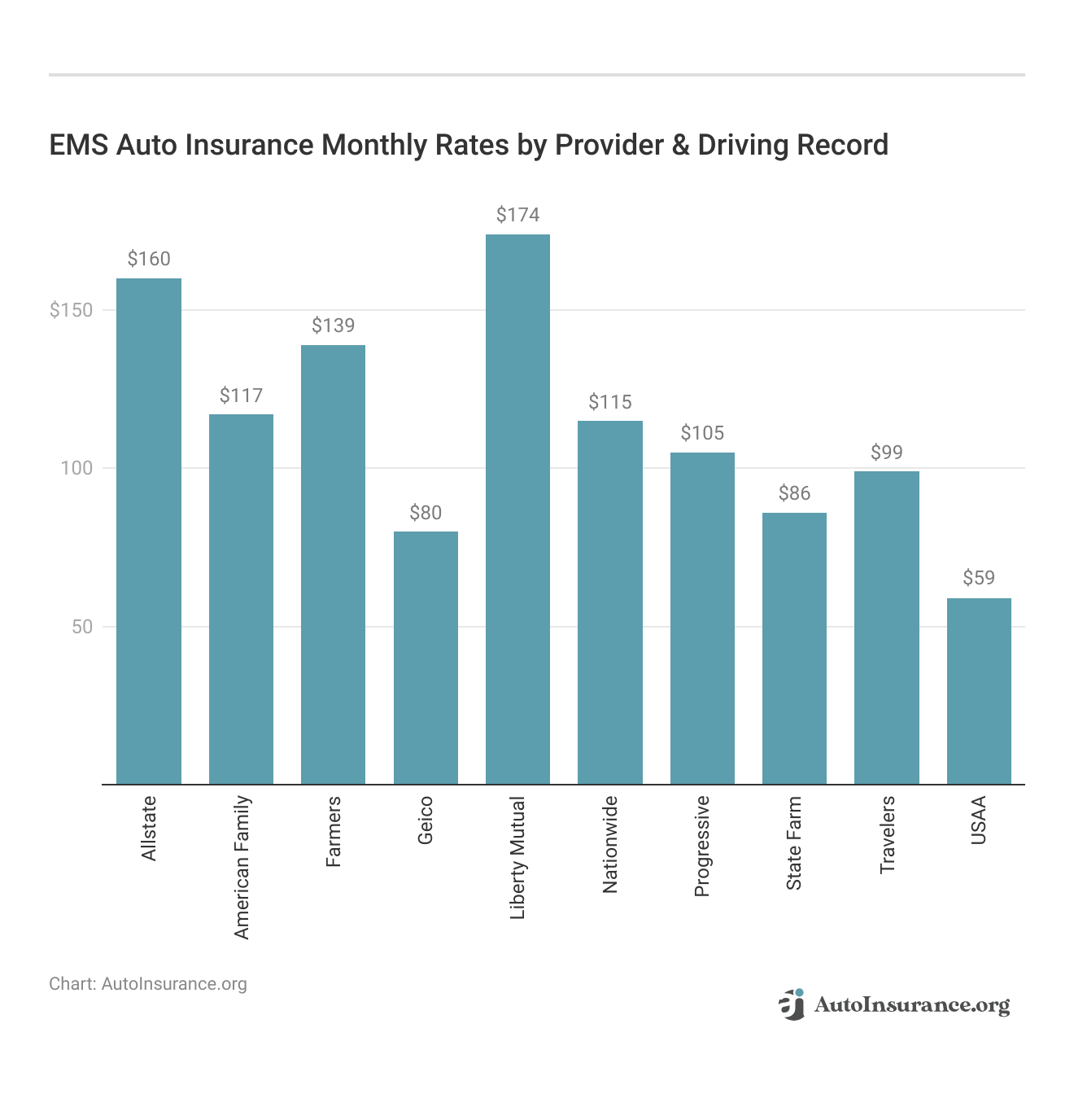

Liberty Mutual, Geico, and Allstate offer the best EMS auto insurance discounts. Liberty Mutual and Geico offer the highest discount of up to 15%. Those working in paramedic services can further lower their auto insurance with safe driving and usage-based insurance. Learn more about EMS discounts below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Liberty Mutual, Geico, and Allstate offer the best EMS auto insurance discounts, where you can save up to 15%. You might qualify for an emergency medical services (EMS) employee auto insurance discount from certain companies.

Many companies offer auto insurance discounts to EMS professionals, so shopping around and comparing rates can help you find the best deals on cheap auto insurance for EMS employees.

Our Top 10 Company Picks: Best EMS Auto Insurance Discounts

Company Rank Savings Potential A.M. Best Who Qualifies?

#1 15% A EMS professionals

#2 15% A++ EMS workers

#3 10% A+ EMS employees

#4 10% B EMS personnel

#5 10% A+ EMS workers

#6 10% A+ EMS professionals

#7 7% A EMS employees

#8 7% A++ EMS workers

#9 5% A++ Military and EMS members

#10 5% A EMS professionals

In this article, we’ll explain the basics of car insurance discounts for first responders and overview companies, such as State Farm, offering first responder car insurance discounts. You can learn more about auto insurance for first responders in our article on the best auto insurance for first responders.

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code above into our free comparison tool to get started.

- Many companies offer discounts to EMS professionals on auto insurance

- Discounts for EMS personnel typically range from 5%-25% off of their total premium

- You must be employed and provide proof to qualify for an EMS discount

How to Get Emergency Medical Service Auto Insurance Discounts

Emergency Medical Service (EMS) professionals often qualify for special auto insurance discounts due to the nature of their work. Many insurance companies offer reduced rates to EMS workers in recognition of their essential role in public safety and emergency response.

These discounts can help lower premiums and make paramedic car insurance and first aid paramedics’ car insurance more affordable. To take advantage of these savings, knowing which insurers provide EMS discounts and what documentation may be required to qualify is important.

In this section, we’ll explore how EMS professionals can access these discounts, what factors may impact eligibility, and how to maximize savings on auto insurance policies.

Employment Verification

Insurance providers typically require proof that you are an active Emergency Medical Technician (EMT) or part of a recognized emergency medical service. You must submit employment documentation to receive discounts for EMTs, such as a recent pay stub, employee ID badge, or a letter from your employer verifying your role.

These EMT car insurance discounts are designed to recognize the valuable services that EMS professionals provide. Verifying your employment confirms eligibility and ensures you can take advantage of the lower premiums that come with first responder auto insurance.

These car insurance discounts for first responders are designed to recognize the valuable services that EMS professionals provide. Verifying your employment confirms eligibility and ensures you can take advantage of the lower premiums that come with first responder auto insurance.Schimri Yoyo Licensed Agent & Financial Advisor

Many insurance companies offer these discounts to public and private EMS workers, including those employed by hospitals, fire departments, and private ambulance services.

Once your employment status is verified, you may qualify for substantial savings on your auto insurance. These discounts can be applied to both personal and family vehicles. Taking the time to provide proper documentation will help you unlock these exclusive benefits, and in turn, you can enjoy the savings offered by first responder auto insurance discounts.

Work for a Qualified Organization

Insurance providers typically offer these discounts only to individuals employed by specific emergency medical service organizations, including public or private EMS services, hospitals, or fire departments. You may be eligible for valuable savings if you work for one of these qualified entities.

For example, the Allstate first responder discount offers EMS professionals reduced rates, but only if employed by a qualifying organization. Allstate also provides an Allstate specialized professional discount, which benefits workers in specialized fields like EMS.

EMS discounts are available for personal and family vehicles, allowing professionals in this field to reduce their insurance premiums significantly.

Be sure to check with your insurance provider to verify whether your EMS employer qualifies for the discount.

Submitting the appropriate proof of employment and confirming your organization’s eligibility will help you maximize your savings and ensure that you receive the specialized benefits tailored to EMS professionals.

Clean Driving Record

Maintaining a clean driving record is an important factor in qualifying for car insurance for first responders. Insurance companies often provide special auto insurance discounts for first responders, including EMS professionals, but a good driving history is typically required to access these savings. A clean driving record shows that you are a low-risk driver, encouraging insurance providers to offer reduced premiums.

When applying for car insurance for emt, insurance companies will review your driving history to assess risk. If you have a record free of accidents, speeding tickets, or other violations, you are more likely to qualify for auto insurance discounts for first responders. Sometimes, a minor violation might not disqualify you, but the cleaner your record, the better your chances of maximizing your savings.

First responders, including EMS professionals, often face high-pressure driving situations at work, but it’s good to demonstrate responsible driving behavior in your vehicle. By maintaining a clean driving record, you not only ensure your eligibility for specialized discounts but also keep your overall insurance costs lower.

This combination of good driving habits and the discounts available to first responders can significantly affect your insurance premiums.

Bundle Insurance Policies

Bundling insurance policies is an intelligent way for EMS professionals and first responders to maximize savings on their car insurance. Many providers offer car insurance for EMS with the option to bundle multiple types of coverage, such as home, life, or renters insurance.

First responders can take advantage of auto insurance discounts for first responders that are even more substantial when multiple lines of insurance are involved.

Shout out to Allstate customers who use our Drivewise app! A national survey found, on average, Drivewise customers:

📞 handle their phones 44% less while driving

🚀 spend 23% less time driving at high speeds

🚙 have an 11% lower rate of hard braking https://t.co/5GeR2nydjm— Allstate (@Allstate) April 19, 2024

For example, if you’re already receiving car insurance for first responders, you can add homeowners or renters insurance to your policy. Doing so typically results in significant cost reductions for both types of coverage. Insurance companies appreciate the added value of keeping multiple policies with them and, in return, offer these bundled discounts as an incentive.

Additionally, bundling policies simplify the management of your insurance, as you will deal with only one provider for all your coverage needs.

This can make things like billing and renewals easier. First responders who bundle their policies can enjoy both the convenience and the savings that come with these auto insurance discounts tailored for their profession.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Companies for EMS Discounts

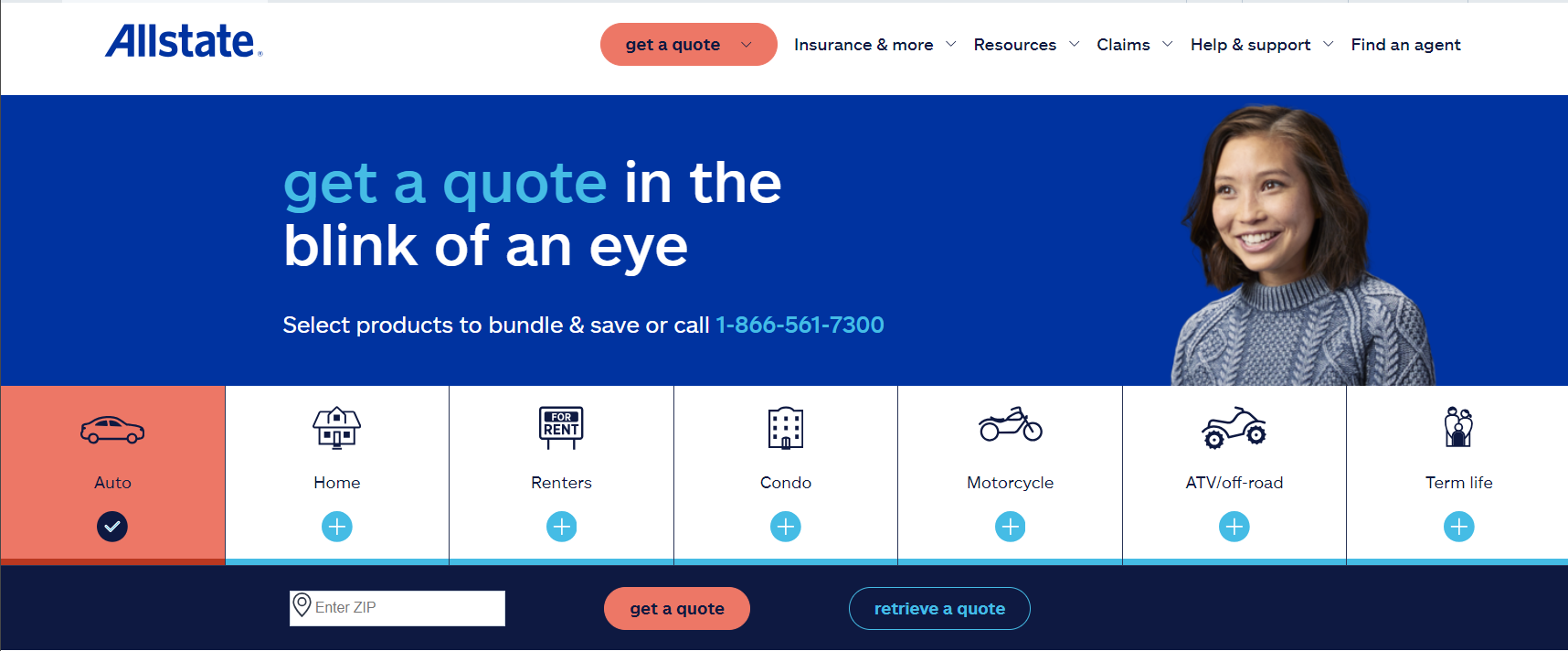

For Emergency Medical Services professionals, several insurance companies offer discounts to help lower premiums. Here are the top three companies that provide notable savings for EMS workers and serve as some of the best insurance for first responders:

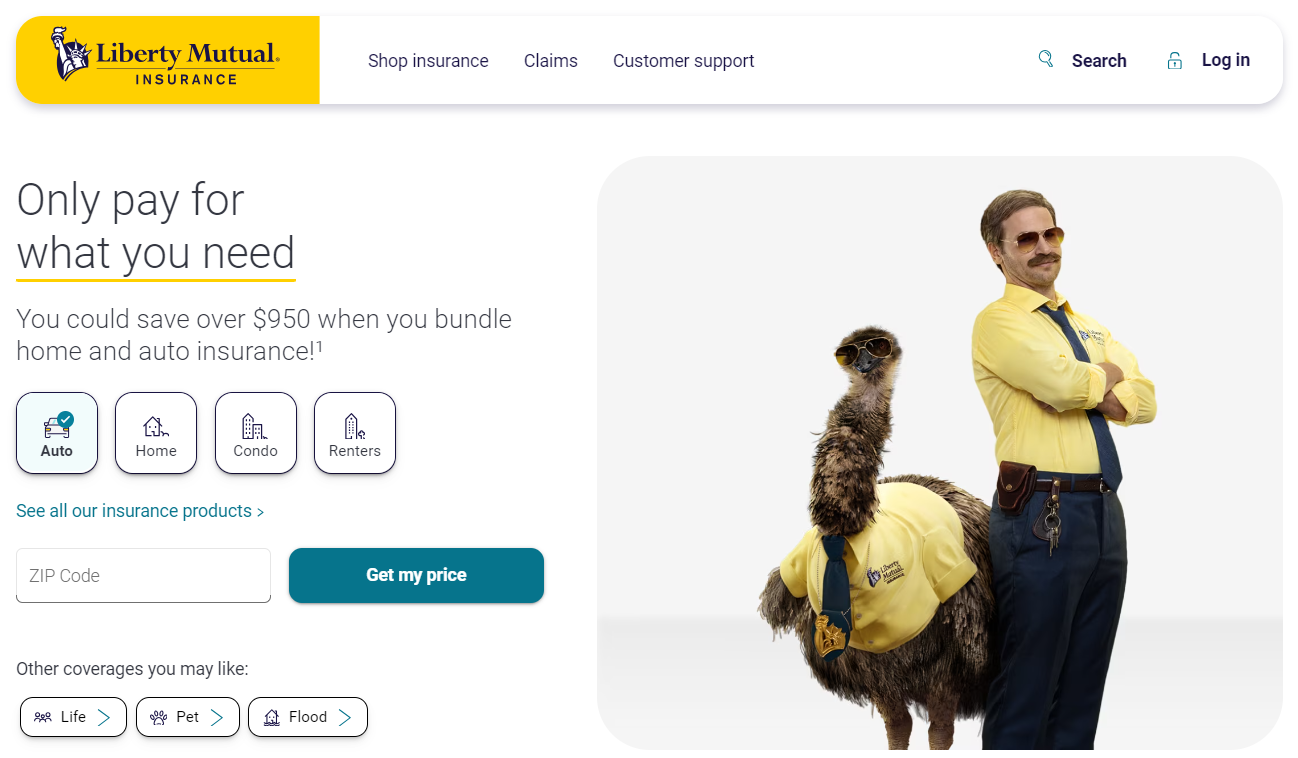

Liberty Mutual – 15% Discount

Liberty Mutual is one of the leading insurance providers offering a 15% discount to EMS workers. This discount is available as part of their commitment to supporting first responders, making it an attractive option for those seeking an auto insurance discount for healthcare workers. Liberty Mutual offers a variety of coverage options, including liability, collision, and comprehensive coverage.

The 15% discount can help lower premiums while allowing EMS workers to focus on their important work without worrying about their insurance costs. Liberty Mutual also offers other deals, such as bundling home and auto insurance, giving further opportunities for savings.

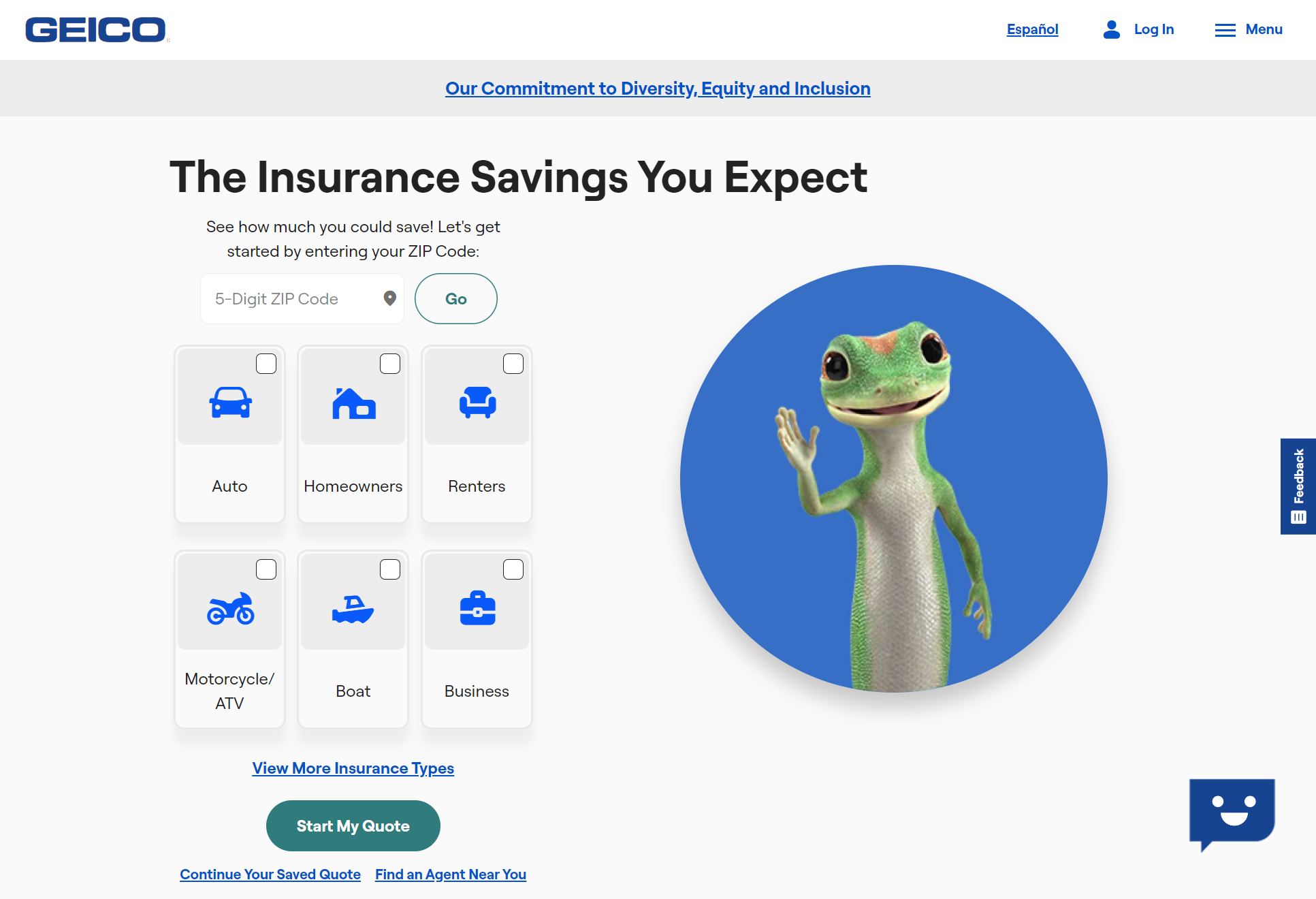

Geico – 15% Discount

Geico is another top choice for EMS professionals, offering a 15% discount on car insurance. Known for its affordability and broad coverage options, Geico is particularly popular for its streamlined digital services, making it easy to manage policies online or through its app.

EMS professionals can combine this discount with other Geico offers, such as multi-policy discounts or savings for safe driving habits. The company’s user-friendly experience and competitive rates make it a preferred option for many first responders seeking the best car insurance for first responders.

Allstate – 10% Discount

Allstate provides a 10% discount for EMS professionals, which may not be as high as the others, but it still offers substantial savings. Allstate is known for its customer service and wide range of coverage options. EMS workers can benefit from the company’s accident forgiveness and safe driving bonuses, which will help to reduce premiums over time.

EMS workers can benefit from the company's accident forgiveness and safe driving bonuses, which will help to reduce premiums over time.Jeff Root Licensed Insurance Agent

Additionally, Allstate’s personalized services, including local agents, allow EMS professionals to get tailored advice and find the best insurance solutions for their needs.

Read More:

These companies stand out for their commitment to supporting EMS professionals through valuable discounts and comprehensive insurance options, making them ideal choices for those in the field.

Overview of Emergency Medical Services Auto Insurance Discounts

You may be eligible for a discount on your auto insurance when you’re an EMS employee. Many companies offer discounts to EMS professionals because of their important work and the risks they take when responding to emergency calls. Typically, these discounts range anywhere from 5-25% depending on the provider and types of auto insurance purchased.

In addition to getting an EMS auto insurance discount, some providers also offer additional perks such as accident forgiveness and free roadside assistance. These can help make your policy even more affordable while still providing excellent protection.

Before moving forward, it’s important to make a distinction here between auto insurance discounts for:

- Firefighters

- EMS Workers

- First Responders

- Law Enforcement Officers

While all three groups may be eligible for some type of discount, the exact discounts and eligibility criteria vary from company to company.

Another distinction is that some companies may offer different discounts based on the type of coverage being purchased. For example, a company might offer an EMS discount for liability auto insurance but not for comprehensive or collision coverage.

Definition of EMS Worker

An EMS worker is a professional healthcare provider who responds to medical emergencies and provides patient care in pre-hospital settings.

They’re typically employed by a local fire department, ambulance service, or hospital and may work as part of an emergency response team. EMS workers must be certified and have specialized training to perform their duties safely and effectively.

They can provide life-saving services such as CPR and first aid outside of the hospital setting. With their expertise and commitment to public safety, they deserve special recognition for their dedication. That’s why many auto insurance companies offer discounts specifically for EMS workers.

Professionals Eligible for EMS Auto Insurance Discounts

To qualify for an EMS auto insurance discount, you must typically be a full-time or part-time EMS worker, including firefighters, paramedics, EMTs, rescue personnel, and health care professionals who provide emergency medical services in pre-hospital settings. You can also get auto insurance discounts for doctors if you are a doctor. This can lower your auto insurance premium further.

You may also need proof of your employment status to qualify for the discount. Some companies may require a pay stub or letter from your employer verifying that you’re employed as an EMS worker.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tips for Finding the Best EMS Auto Insurance Discounts

When shopping for auto insurance, it’s important to compare rates from multiple companies to find the best deal. Many companies offer discounts specifically for EMS workers, so make sure to ask if they have any special offers available.

Auto Insurance Discount Savings Potential by Provider

| Discount Name |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | 10% | 8% | 5% | X | 5% | 8% | 7% | 10% | 9% | 15% |

| Adaptive Headlights | 5% | 5% | 3% | X | 5% | 6% | 4% | 7% | 5% | 8% |

| Anti-lock Brakes | 10% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | X | X |

| Anti-Theft | 10% | 15% | X | 23% | 20% | 25% | 5% | 15% | X | X |

| Claim Free | 35% | 5% | 5% | 26% | 8% | 10% | 7% | 15% | 23% | 12% |

| Continuous Coverage | X | 5% | 5% | X | 8% | 10% | 8% | 12% | 15% | 7% |

| Daytime Running Lights | 2% | X | 5% | 3% | 5% | 5% | 5% | 5% | X | X |

| Defensive Driver | 10% | 10% | 8% | 8% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 5% | 8% | 5% | 6% | 10% | 7% | 15% | 7% | X |

| Driver's Ed | 10% | 8% | 5% | 5% | 10% | 7% | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | 15% | 5% | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | 5% | 5% | 5% | 6% | 8% | 5% | 5% | 10% | 12% |

| Electronic Stability Control | 2% | 5% | 3% | 5% | 5% | 8% | 5% | 7% | 8% | 8% |

| Emergency Deployment | 15% | 8% | 5% | 25% | 8% | 10% | X | 7% | 9% | 6% |

| Engaged Couple | 5% | 5% | 3% | 5% | 5% | 5% | 5% | 4% | 5% | 6% |

| Family Legacy | 7% | 5% | 3% | 8% | 6% | 8% | 10% | 6% | 7% | 10% |

| Family Plan | 5% | 7% | 8% | 10% | 8% | 25% | 7% | 7% | 8% | 8% |

| Farm Vehicle | 10% | 5% | 3% | X | 7% | 8% | X | 5% | 9% | 8% |

| Fast 5 | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Federal Employee | X | 8% | X | 12% | 10% | 5% | X | 6% | 7% | 5% |

| Forward Collision Warning | 8% | 5% | 5% | 5% | 5% | 5% | 8% | 6% | 7% | 5% |

| Full Payment | 10% | 5% | 5% | 5% | 5% | 8% | 5% | 6% | 8% | 5% |

| Further Education | 3% | 5% | 5% | X | 5% | 5% | 5% | 4% | 5% | 5% |

| Garaging/Storing | 5% | 5% | 5% | X | 8% | 5% | 5% | 7% | X | 10% |

| Good Credit | X | X | 8% | 8% | 5% | X | 7% | X | 8% | 7% |

| Good Student | 20% | 8% | X | 15% | 23% | 10% | 5% | 25% | 8% | 3% |

| Green Vehicle | 10% | 5% | 5% | 5% | 10% | 7% | 8% | 10% | 10% | 7% |

| Homeowner | 5% | 8% | 5% | X | 5% | 5% | 5% | 3% | 5% | 5% |

| Lane Departure Warning | 5% | 5% | 5% | 5% | X | 5% | 5% | 5% | 5% | 5% |

| Life Insurance | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Low Mileage | X | 5% | X | 5% | X | X | 5% | 30% | X | X |

| Loyalty | 7% | 8% | 6% | 5% | 8% | 5% | 8% | 6% | 9% | X |

| Married | 5% | 5% | 5% | 5% | X | X | 5% | X | 5% | X |

| Membership/Group | 5% | 5% | 5% | X | 10% | 7% | X | 8% | X | 5% |

| Military | X | 5% | 5% | 15% | 4% | 5% | X | X | 5% | X |

| Military Garaging | 10% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 15% |

| Multiple Drivers | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Multiple Policies | 10% | 29% | 5% | 10% | 20% | 10% | 12% | 17% | 13% | X |

| Multiple Vehicles | X | 5% | 5% | 25% | 10% | 20% | 10% | 20% | 8% | X |

| New Address | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Customer/New Plan | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Graduate | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Vehicle | 30% | 8% | 5% | 15% | 6% | 8% | X | 40% | 10% | 12% |

| Newly Licensed | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Newlyweds | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Non-Smoker/Non-Drinker | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Occasional Operator | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Occupation | X | 5% | X | X | 10% | 15% | 5% | 5% | X | 5% |

| On-Time Payments | 5% | 5% | X | 5% | 5% | 5% | 5% | 5% | 15% | 5% |

| Online Shopper | 5% | 5% | 5% | 5% | 5% | 5% | 7% | 5% | 5% | 5% |

| Paperless Documents | 10% | 5% | X | X | 5% | 5% | $50 | 5% | 5% | 5% |

| Paperless/Auto Billing | 5% | 5% | X | 5% | 5% | 30% | 50 | 20% | 3% | 3% |

| Passive Restraint | 30% | 30% | X | 40% | X | 20% | 5% | 40% | X | X |

| Recent Retirees | 5% | 5% | 5% | 5% | 4% | 5% | 5% | 5% | 5% | 5% |

| Renter | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Roadside Assistance | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Safe Driver | 45% | 8% | X | 15% | 8% | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | 5% | 5% | 5% | 15% | 5% | 5% | X | 5% | 5% | 5% |

| Senior Driver | 10% | 5% | X | 5% | 6% | 8% | 7% | 5% | 5% | X |

| Stable Residence | 5% | 5% | 5% | 5% | 5% | X | 5% | 5% | 5% | 5% |

| Students & Alumni | 5% | 5% | 5% | X | 10% | 7% | X | 5% | 5% | 5% |

| Switching Provider | 5% | X | X | 8% | 10% | 8% | X | 8% | 8% | 10% |

| Utility Vehicle | 15% | 5% | 5% | X | 6% | 7% | X | 8% | 9% | 5% |

| Vehicle Recovery | 10% | 5% | 5% | 15% | 35% | 25% | 5% | 5% | X | X |

| VIN Etching | 5% | 5% | 5% | 5% | 5% | X | 5% | 5% | X | X |

| Volunteer | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Young Driver | 15% | 5% | 8% | 8% | 8% | 6% | 7% | 8% | 8% | 50% |

Taking advantage of online insurance comparison tools and quote generators is also a good idea. These can help you quickly compare rates, coverage options, and EMS insurance discounts from different providers side by side.

In addition, check out customer reviews and ratings when researching different auto insurance companies to understand better which companies offer quality service and the most competitive discounts for emergency medical services professionals.

Apart from discounts, you must know companies that offer the best auto insurance for emergency service workers. This is because these companies often provide the best services and discounts.

Companies That Offer EMS Auto Insurance Discounts

Several of the best auto insurance companies offer special discounts for EMS professionals. Farmers Insurance, AAA, and Nationwide are three of the most popular options that provide discounts specifically for EMS workers.

As you can see, you can also get a State Farm first responder discount of up to 25%. In addition, Farmers offers discounts on liability coverage for full-time employees of fire departments and emergency medical services providers. They also offer accident forgiveness if you maintain a clean driving record over time.

Also, AAA provides a discount on auto insurance premiums to all members employed in fire protection or emergency medical services. This discount is available regardless of whether they purchase just liability coverage or add additional coverage, such as collision and comprehensive auto insurance.

Read More:

Finally, Nationwide auto insurance also offers an exclusive discount on their auto insurance policies to any current or retired EMS workers.

How to Reduce Your Auto Insurance Costs as an EMS Professional

You can take several steps to reduce your auto insurance costs as an EMS professional. Some of these include:

- Purchasing a car with safety features such as anti-lock brakes and airbags.

- Carrying low-mileage auto insurance.

- Maintaining a good driving record.

- Increasing your auto insurance deductible to lower the cost of your premiums.

- Taking a defensive driving course.

You can also take advantage of any available discounts that apply to you, including those specifically for EMS workers. Shopping around and comparing rates from multiple providers to find the best deal is also ideal. By following these tips, you can save money on auto insurance while getting the protection you need. So, if you ever need to make a claim, having adequate coverage will minimize your financial losses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Qualify for an EMS Auto Insurance Discount

Finding the best auto insurance for emergency medical services workers doesn’t have to be difficult or time-consuming. By researching your options, comparing rates from the best auto insurance companies, and taking advantage of available discounts, you can find a policy that will provide you with the protection you need while still saving money.

For example, you’ll likely find cheap EMS auto insurance with the State Farm first responder discount, which saves you up to 25%.

Everyone likes a good neighbor🏘️, but does State Farm live up to its slogan, "Like a good neighbor, State Farm is there?" https://t.co/27f1xf1ARb can help you learn more about one of the leading companies in the U.S. Check out the review here👉: https://t.co/twfTgnzWWC pic.twitter.com/bqBwkOjZb0

— AutoInsurance.org (@AutoInsurance) July 28, 2023

And remember: always check customer reviews when selecting an auto insurance provider to ensure they offer quality service and competitive discount rates for EMS professionals.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

What professional fields are included in emergency medical services?

The system definition for EMS includes a wide range of professional fields, including paramedics, emergency medical technicians (EMTs), nurses, doctors, and other healthcare professionals who provide medical care to patients in an emergency situation.

How much savings does an EMS auto insurance discount provide?

The amount of savings you can get from an EMS auto insurance discount varies depending on the provider and the type of auto insurance coverage you select. However, some providers offer discounts of up to 15% for emergency medical services professionals.

Does insurance cover EMS workers on the job?

Yes, most auto insurance policies will cover EMS workers while they are on the job. However, some providers may exclude certain types of coverage or limit the amount of coverage available. Be sure to check with your provider before starting a new policy.

Does Progressive have a first responder discount?

There is no Progressive first responder discount. However, other progressive auto insurance discounts can help you save on auto insurance.

What is an example of an EMS auto insurance policy?

An example of an EMS auto insurance policy is one that offers liability coverage for full-time employees of fire departments and emergency medical services providers. It may also provide accident forgiveness if you maintain a clean driving record over time.

What provider offers the best EMS auto insurance discounts?

The best EMS auto insurance discounts are offered by Farmers Insurance, AAA, and Nationwide. However, it’s always a good idea to compare rates from multiple providers in order to find the best deal.

Is there a discount code for EMS auto insurance discounts?

No, there is no specific discount code for EMS auto insurance discounts. However, many companies offer special discounts or packages specifically for EMS workers. Make sure to ask your provider if they have any offers available that could help you save money on your premiums.

Do EMS workers need to buy high-risk auto insurance?

No, EMS workers do not need to buy high-risk auto insurance. Many companies offer discounts specifically for EMS workers, so be sure to ask your provider if they have any special offers available.

Do first responders get discounts on car insurance?

Yes, first responders typically qualify for discounts on car insurance from various providers. Many insurance companies, such as Liberty Mutual, Geico, and Allstate, offer specific discounts for first responders, including EMS professionals, police officers, firefighters, and healthcare workers. These discounts can help lower premiums and provide additional savings for those who serve their communities.

Is there an EMS student discount?

Yes, some insurance companies offer an EMS student discount. These discounts are typically available to emergency medical service students and may vary by insurer.

What companies offer EMS auto insurance discounts?

Several major auto insurance companies offer car insurance discounts for healthcare workers and other EMS professionals, including Farmers Insurance, AAA, and State Farm. Apart from EMS discounts, these companies offer more discounts you can claim.

Read More:

Do EMTs get discounts?

Yes, EMTs often receive special discounts as part of recognition for their vital role in emergency services. Many insurance companies, retailers, and service providers offer discounts for emergency services personnel, including EMTs, paramedics, firefighters, and law enforcement. These discounts range from reduced insurance rates to savings on products, services, and travel.

Avoid expensive premiums by using our free comparison tool above to find the lowest rates possible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.