General Motors Auto Insurance Review for 2025 (Find a Top-Rated Policy)

Unlock rates from $32 per month in this General Motors auto insurance review for GM vehicle owners seeking exclusive pricing. General Motors auto insurance features the OEM parts coverage program and OnStar Smart Driver, exclusive to Buick, Cadillac, Chevrolet, and GMC drivers.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

General Motors Auto Insurance

Monthly Rates:

$32A.M. Best Rating:

A+Complaint Level:

LowPros

- Comprehensive coverage options

- Generous discounts and incentives

- Mobile app and online tools for convenient policy management

Cons

- Limited availability

- Rates are higher for drivers who don’t own eligible vehicles

Explore the General Motors auto insurance review, which offers exclusive coverage, equipment protection, and telematics-based discounts for GM vehicle owners.

General Motors Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Insurance Rating | 4.5 |

| Business Reviews | 5 |

| Claim Processing | $5 |

| Company Reputation | $4 |

| Coverage Availability | $5 |

| Coverage Value | $5 |

| Customer Satisfaction | $3 |

| Digital Experience | $4 |

| Discounts Available | $5 |

| Insurance Cost | $5 |

| Plan Personalization | $5 |

| Policy Options | $4 |

| Savings Potential | $5 |

The OEM parts coverage program ensures factory-grade repairs, while OnStar Smart Driver tracks driving behavior to unlock savings. Policies are issued by GM National Insurance Company and OnStar National Insurance Company. Find out which providers rank as the best auto insurance companies that offer OEM parts coverage.

General Motors insurance, formerly OnStar Insurance, offers auto policies tailored for GM vehicle owners, including Chevrolet, Buick, GMC, and Cadillac drivers. Now available in 11 states, it recently expanded into Alabama, Iowa, and Tennessee, joining Arizona, Georgia, Illinois, Indiana, Missouri, Ohio, Pennsylvania, and Texas.

- General Motors insurance reviews cover GM-exclusive options only

- Coverage includes custom wheels, spoilers, and body modifications

- Policies are issued by GM and OnStar National Insurance companies

Affordable GM auto insurance quotes may be available to you, but you should always shop around. Before reading more about General Motors review, enter your ZIP code to see multiple options for affordable auto insurance quotes. You may even be able to get a quote from General Motors.

What Impacts General Motors Auto Insurance Rates

The table below shows how age and gender affect what you pay for GM auto insurance. Teenagers, mainly young boys, pay the most, sometimes up to $560 each month.

General Motors Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $370 | $520 |

| 16-Year-Old Male | $400 | $560 |

| 18-Year-Old Female | $320 | $450 |

| 18-Year-Old Male | $350 | $490 |

| 25-Year-Old Female | $190 | $270 |

| 25-Year-Old Male | $210 | $290 |

| 30-Year-Old Female | $160 | $230 |

| 30-Year-Old Male | $170 | $245 |

| 45-Year-Old Female | $140 | $210 |

| 45-Year-Old Male | $150 | $220 |

| 60-Year-Old Female | $130 | $195 |

| 60-Year-Old Male | $135 | $205 |

| 65-Year-Old Female | $125 | $185 |

| 65-Year-Old Male | $130 | $190 |

As drivers age, their insurance rates typically decrease. When women reach 65, they can pay as little as $125 for basic coverage. This makes them the group with the lowest risk according to insurance companies.

Here is a quick overview of GM’s car insurance prices. Erie has the lowest costs, with only $32 for minimum and $84 for full coverage auto insurance.

General Motors Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $32 | $84 |

| $76 | $198 | |

| $65 | $145 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

GM is priced in the middle, with $65 and $145. If you’re spending more than $240, for example, with Liberty Mutual or Travelers, it might be a good idea to look at other options. State Farm and Progressive keep it pretty affordable, too.

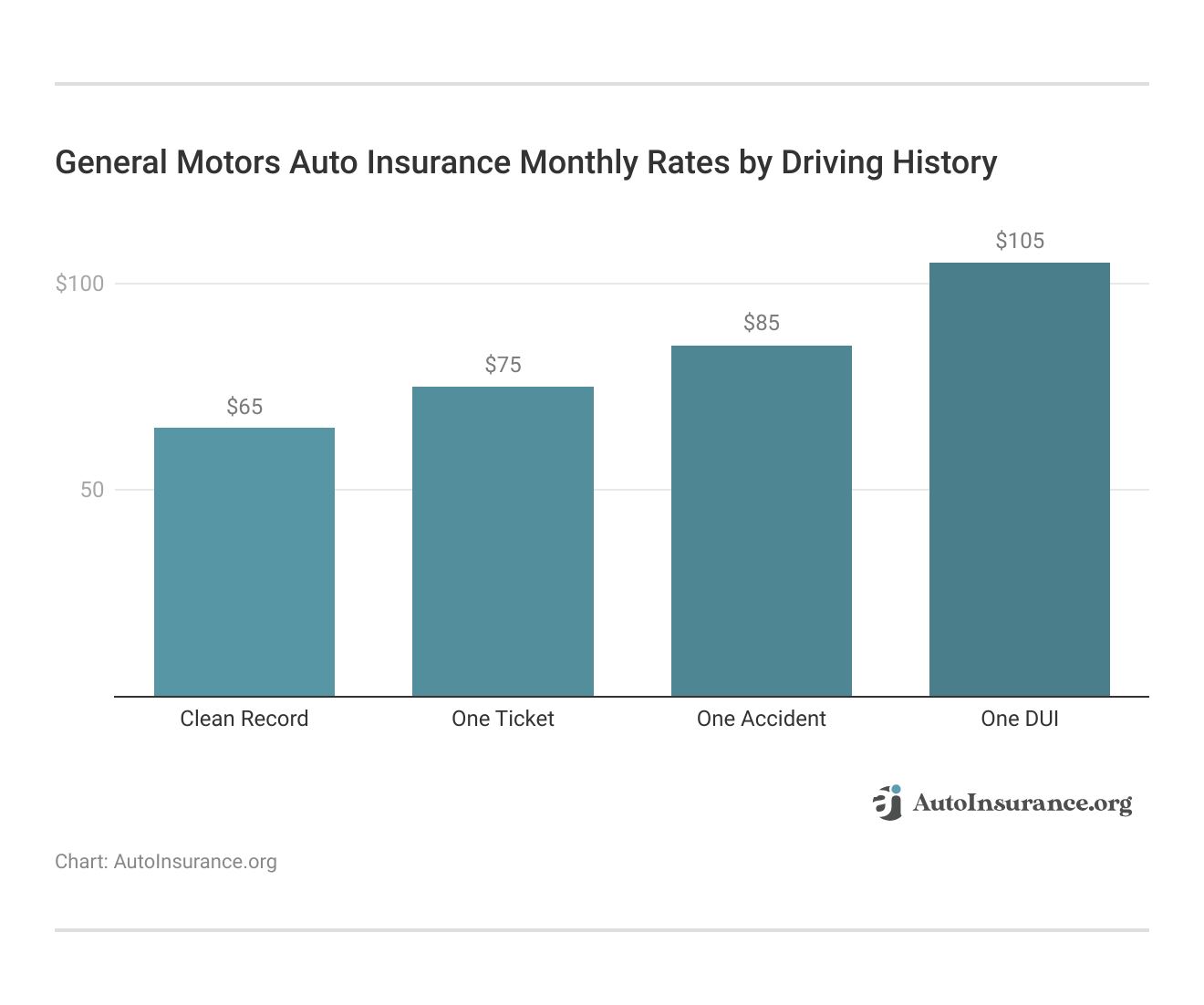

Your driving history is important for how much you pay for General Motors car insurance. If you have no accidents or violations, your rates stay around $100 for minimum and about $200 for full coverage.

General Motors Auto Insurance Monthly Full Coverage Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $185 | $210 | $275 |

| $165 | $195 | $220 | $280 | |

| $135 | $160 | $180 | $235 |

| $155 | $180 | $205 | $265 | |

| $145 | $170 | $190 | $245 | |

| $160 | $190 | $215 | $275 |

| $150 | $175 | $200 | $250 |

| $155 | $185 | $210 | $270 | |

| $140 | $160 | $180 | $230 | |

| $145 | $170 | $195 | $255 |

Just one ticket or accident can increase your monthly rates by $45 to $90. If you get a DUI, the full coverage jumps to $245, which is the most expensive risk factor on this list.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Coverage That Fits General Motors Vehicles

Curious about what comes with a General Motors auto insurance policy? You’ll get basic coverages such as liability and collision insurance. Additionally, it includes support for medical expenses and rental vehicles.

General Motors Car Insurance Coverage Options

| Coverage Type | |

|---|---|

| Liability | Injuries or damage you cause to others |

| Collision | Damage from crashes with vehicles or objects |

| Comprehensive | Non-crash damage like theft, fire, or weather |

| Uninsured/Underinsured | Costs if the other driver has little or no insurance |

| Medical Payments | Medical bills for you and passengers |

| PIP | Medical costs and lost wages, regardless of fault |

| Roadside Assistance | Towing, flat tire, lockout, and jump-start help |

| Rental Reimbursement | Rental car costs while your GM car is repaired |

| Gap Insurance | Pays loan/lease balance if your car is totaled |

| Custom Parts | Covers aftermarket upgrades or accessories |

If you have upgraded your GM vehicle with special wheels or spoilers, coverage is also available. The package includes roadside assistance and gap insurance, all specifically tailored for GM drivers.

Programs Available From General Motors

OnStar Insurance has created a range of services that provide peace of mind, convenience, and flexibility to its customers.

We are committed to providing jobs that support American workers, their families, and the communities where they live and work. Take a closer look at the @OxfordEconomics report on our impact on the U.S. economy and the states where we operate from.

— General Motors Manufacturing (@MFG_GM) June 14, 2023

These services are designed to make things run a bit smoother when you do have an accident or need to file a claim for some reason. The most popular of GM’s programs are outlined in the table below:

General Motors Auto Insurance Programs

| GM Auto Insurance Programs/Advantages | |

|---|---|

| Collision Repairs Guarantee | GMAC provides a lifetime guarantee on all the collision repairs that are done at their approved repair shops. |

| Guaranteed Claims Service Satisfaction | A lack of good service will result in waiving a part of your deductible, up to $250. You also have 24-hour claims reporting. |

| SmartInspect® | SmartInspect® allows customers to request an inspection following a repair after an approved claim so as to ensure that the car has been completely fixed. |

| SmartReplacement® | SmartReplacement® will help find a replacement car if your car has been deemed totaled in an accident. |

| SmartValet® | SmartValet® is a registered GMAC Insurance service that picks up your damaged vehicle after you make a claim, provides you with a rental vehicle for the duration of the repairs, and delivers your repaired car back to you. |

| Unexpected Claims | In the case of an unexpected claim, the company will cover up to $500 in emergency expenses such as food and lodging. If your claim is the result of theft then GMAC Insurance offers a reward of up to $500 for information that leads to the conviction of your car’s thieves. |

OnStar Insurance also allows you to add coverage for specialized equipment and accessories such as custom wheels, spoilers, and body alterations.

Read more: Types of Auto Insurance

Real Discounts From General Motors Auto Insurance

Trying to save on your GM auto insurance? You’ve got options. Safe drivers can save 25%, and combining home insurance can get you an additional 20%. Learn how to qualify for the best auto insurance discounts with GM coverage.

General Motors Auto Insurance Discounts by Savings Potential

| Discount Type | |

|---|---|

| Safe Driver | 25% |

| Bundling (Home + Auto) | 20% |

| Multi-Vehicle | 15% |

| Good Student | 10% |

| Low Mileage | 10% |

| Anti-Theft Device | 10% |

| Defensive Driving Course | 10% |

| Pay-in-Full | 10% |

| Paperless Billing | 5% |

| GM Loyalty/OnStar Use | 20% |

Drive less, use anti-theft devices, or opt for paperless options for more savings. If you like GM a lot or use the OnStar service, you can get big discounts just for staying with the brand.

General Motors Auto Insurance Ratings Breakdown

Let’s discuss how the major rating agencies rate General Motors’ auto insurance. A.M. Best gave it an A+ rating, indicating very good financial strength.

General Motors Business Insurance Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A- Good Business Practices |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: 1.20 Avg. Complaints |

At the same time, BBB gave it an A-rating for its business behavior and practices. J.D. Power and NAIC show average satisfaction and complaint levels. Consumer Reports scores were mixed, signaling room for improvement in user experience.

Discover more by reading our guide: Who are the reputable auto insurance companies?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About GM Auto Insurance

General Motors started in Flint, Michigan, in the early 1900s. Although the company filed for bankruptcy in 2009 and had to discontinue some of the vehicle models, it received help from the government and is still going strong today. Discover what sets the best comprehensive auto insurance companies apart.

GM auto insurance had been underwritten by subsidiaries of American Family and known as OnStar Insurance. GM dropped American Family in 2023, and OnStar Insurance policies are now underwritten and issued by OnStar National Insurance Company and GM National Insurance Company. GM also offers home insurance policies sold through OnStar Insurance Services, Inc.

In early 2024, GM Financial announced that OnStar Insurance will be renamed General Motors Insurance. OnStar insurance is currently available only in Arizona, Illinois, and Texas. Additional states, including Indiana, Ohio, and Pennsylvania, are coming soon.

How to Make a GM Auto Insurance Claim

Making a claim with General Motors Auto Insurance is easy and convenient. You can access your account online or contact the claims support team directly by calling 1-877-558-8352. Get step-by-step help on how to file an auto insurance claim now.

GM drivers now have access to the Tesla Supercharger Network!

With 17k+ new fast charging locations, all you need is your vehicle mobile app and a GM-approved NACS DC Adapter to enjoy even more access to public charging.

Learn more at https://t.co/S4sQ5imTur. pic.twitter.com/oPIfvTqqlH

— General Motors (@GM) September 18, 2024

Make sure you have your policy number, details of the accident, and any photos or documents ready. After you submit these, an adjuster will contact you to evaluate your claim and explain what to do next.

How to Cancel Your GM Auto Insurance

What should you do if you need to cancel your policy? Is there a fee to cancel, and can you cancel at any time? You can cancel your policy at any time by contacting your insurance agent and letting them know that you’d like to cancel it.

Your agent will let you know when the changes will take effect and whether you’re entitled to a refund of any policy rates you’ve paid. Some customers have reported a cancellation fee for their insurance. Ask before you cancel. Understand policy terms by reviewing how to cancel auto insurance properly.

Refund From GM Auto Insurance After Cancellation

Whether you can get a refund on your policy depends on the type of policy and when you cancel it. If you choose to cancel a refundable policy, you’ll receive half of what you paid. This applies if you cancel during the policy term.

Since refund amounts may vary and depend on several factors, it’s best to check with your insurance agent to determine which factors apply to you.

Learn more: Can you cancel an auto insurance claim after filing it?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How GM Auto Insurance Ranks Among Providers

GM auto insurance competes with several prominent auto insurance providers in the market. Some of its main competitors include:

- Allstate: Allstate is one of the largest publicly held personal lines insurers in the United States. It offers a wide range of insurance products, including auto insurance, with customizable coverage options and various discounts for policyholders. Learn more in our Allstate auto insurance review.

- Geico: Geico, owned by Berkshire Hathaway, is another major player in the auto insurance industry. Known for its catchy advertising campaigns and direct-to-consumer model, GEICO offers competitive rates and a variety of coverage options, along with a user-friendly online experience. See our Geico auto insurance review.

- Progressive: Progressive is a well-known auto insurance company that offers innovative features such as Snapshot, which tracks driving habits to potentially lower premiums. It provides a range of coverage options and discounts, along with a strong emphasis on technology and customer service. Find out more in our Progressive auto insurance review.

- State Farm: State Farm is one of the largest auto insurance providers in the United States, known for its extensive network of agents and competitive rates. It offers a wide range of coverage options and discounts to policyholders. Check out our State Farm auto insurance review.

- USAA: USAA primarily serves military members and their families, offering auto insurance along with a suite of financial products and services. Known for its excellent customer service and member benefits, USAA competes with GM Auto Insurance by providing tailored coverage options for military personnel. Details are available in our USAA auto insurance review.

These competitors, among others, vie for market share by offering competitive rates, diverse coverage options, innovative features, and strong customer service to attract and retain policyholders. While each company has its strengths and weaknesses, the competition in the auto insurance industry ultimately benefits consumers by providing a variety of choices to meet their insurance needs.

General Motors' direct-to-consumer model gives it pricing power in select states. In particular, it benefits Buick and Cadillac owners seeking equipment coverage.Daniel Walker Licensed Insurance Agent

Before you buy GM auto insurance, compare your options. Just enter your ZIP code to compare affordable auto insurance rates right now and go deeper with our GM car insurance reviews.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What should you expect from GM insurance reviews and consumer reports?

You’ll find that GM insurance reviews earn high marks for financial strength but mixed feedback on customer experience, with monthly rates starting around $32. Understand how to evaluate auto insurance quotes before choosing coverage.

Is GM insurance good according to Reddit?

Yes, many Reddit users say GM Insurance offers fair pricing and helpful tech like OnStar Smart Driver, but coverage availability can vary by state.

What do OnStar insurance reviews say about coverage and cost?

You’ll see OnStar insurance reviews highlighting solid pricing for GM vehicles, with standout features like OEM parts coverage and monthly rates ranging from $32 to $48. You can get a GM insurance quote online by entering your ZIP code and vehicle details.

Does GM insurance offer new car replacement coverage?

Yes, GM insurance company offers new car replacement if your GM vehicle is totaled early in the loan or lease, helping you replace it with a similar model.

What is the General Motors customer support phone number for insurance?

You can reach GM insurance claims or policy support by calling 1-877-558-8352. This number is available for questions about coverage, quotes, or claim updates. Find out how a comprehensive auto insurance claim affects your rates.

What does the GM insurance app help you do?

The GM insurance app lets you file claims, manage your policy, access ID cards, and track driving behavior through OnStar Smart Driver for potential discounts.

What does the GM insurance Reddit feedback say about policy value?

You’ll find GM insurance Reddit threads discussing ease of use, digital claims, and discounts for safe driving, especially for owners of newer GM models.

What should you know about GMC car insurance before buying?

GMC auto insurance typically includes exclusive savings for GMC owners, with monthly rates starting around $48, depending on your model, location, and driving history. Learn where to buy auto insurance online and compare top-rated options.

How much does GMC Sierra 3500HD CC car insurance cost?

GMC Sierra 3500HD CC car insurance typically costs more due to its size and value, with average monthly premiums ranging from $95 to $135, depending on the level of coverage. Explore low General Motors auto insurance rates by using our ZIP code search tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.