How to Get Free Online Auto Insurance Quotes in 2025 (8 Easy Steps to Follow)

To get free online auto insurance quotes, start by assessing your coverage needs and evaluating your existing policy, compare quotes side by side, inquire about discounts, and review policy renewals. Over 66% of drivers who shop around find better rates by following these steps for optimal savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Producer

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Finding out how to get free online auto insurance quotes can help you by assessing your coverage, comparing quotes, inquiring about discounts, reviewing renewals, and checking for premium increases after accidents to make informed choices.

This guide helps you compare quotes to maximize savings and find the best policy. Learn more in our “What does an auto insurance policy look like?” for further information.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers

- Step #1: Assess Coverage Requirements – Determine needed insurance coverage

- Step #2: Evaluate Existing Coverage – Review current insurance details

- Step #3: Compare Auto Quotes – Evaluate offers from insurers

- Step #4: Side-by-Side Comparison – Direct feature-by-feature comparison

- Step #5: Inquire About Discounts – Ask about available savings

- Step #6: Compare Policy Renewals – Evaluate insurance policy renewals

- Step #7: Post-Accident Comparison – Review insurance after incidents

- Step #8: Premiums Increase Comparison – Compare rates after increases

Evaluating Car Insurance Cost Online for Free: 8 Easy Steps

Step #1: Assess Coverage Requirements

The first step in finding cheap auto insurance is to check the minimum auto coverage requirements in your state. Drivers are usually required to carry minimum levels of liability and personal injury protection insurance. Uninsured/underinsured motorist coverage is required in some states. It is advisable to buy additional coverage even if you are on a tight budget. Check out our ranking of the top providers:

Before you buy car insurance, conduct a cost-benefit analysis. If your vehicle is only worth $1,500, it doesn’t make sense to pay for collision or comprehensive coverage. General recommendations for liability insurance limits are $100,000 for all people injured in an accident and $50,000 bodily injury liability for one person injured in a car accident.

Step #2: Evaluate Existing Coverage

Many people remain with the same insurance provider for years, potentially spending more than needed. To avoid overpaying, it’s wise to spend a few minutes reviewing your current policy, including its coverage and costs, especially for comprehensive auto insurance.

Contact your insurer to discuss possible adjustments or discounts. Since auto insurance rates vary widely, switching to a new provider could save you hundreds of dollars annually while maintaining or improving your coverage.

Step #3: Compare Auto Quotes

Try to get at least five car insurance quotes from multiple carriers. Some drivers prefer to compare free auto insurance quotes online, while others go shopping the old fashioned way. Make sure you get as many offers as you can. Statistics indicate that shopping around for car insurance at renewal time can help you save as much as $200 on your policy.

Many insurance companies offer discounts to customers who buy coverage online because the applications are cheaper to process.

By filling in one form you can get over 150 free auto insurance quotes from leading companies. The difference between the highest and lowest quotes can be thousands of dollars. Make sure you are comparing car insurance quotes on a like-for-like basis. Some policies may seem cheaper, but they might not offer sufficient coverage.

Increasingly more companies are offering flexible policies tailored to fit your individual needs. Some of them feature discount plans for young drivers, seniors, and good students. Setting a maximum budget before you start shopping will help you be financially responsible. Check out our ranking of the top providers: Six Reasons Auto Insurance Costs More for Young Drivers

Step #4: Side-by-Side Comparison

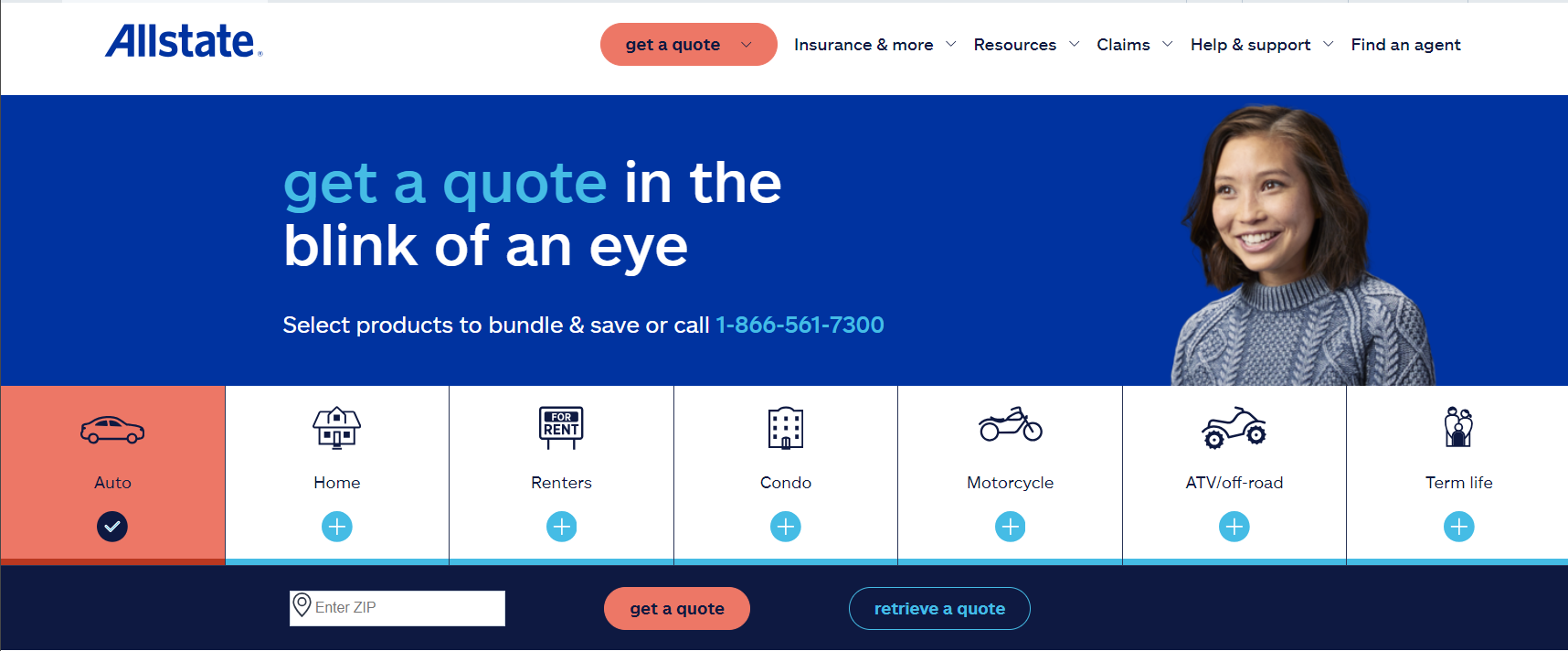

When comparing auto insurance quotes online, you should first decide what exactly you want from your car insurance provider. Make sure you choose a company that will be there when needed. Select a car insurance provider that has a good reputation and millions of customers, or one that has been in business for many years.

This table provides a comparison of monthly auto insurance rates from various providers for both minimum and full coverage plans. The data highlights how much each company charges on average, with USAA offering the lowest rates at $22 for minimum coverage and $59 for full coverage.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $22 | $59 |

On the other end, Liberty Mutual is the most expensive, charging $68 for minimum and $174 for full coverage. Geico, State Farm, and Progressive also offer competitive pricing, particularly for minimum coverage options. The table helps consumers easily compare costs and find affordable car insurance based on their coverage needs.

Go for a company that offers 24/7 assistance. Many insurance providers who sell coverage through their websites allow customers to file claims and pay their car insurance rates online. Make sure the company you choose responds to you promptly when you need to make a claim. For a comprehensive overview, explore our detailed resource titled “How to File an Auto Insurance Claim.”

Some customers focus on cost and coverage options, while others are looking for reliable companies with a strong financial background.

Major insurance carriers often have extensive networks and dedicated claims centers nationwide. Use online resources to read reviews, compare free quotes, and find competitively priced policies in your state. Choose companies with high ratings and few complaints, and check your state’s Department of Insurance for more details.

Step #5: Ask About Discounts

Comparing auto insurance quotes online helps you find discounts, such as those for paying upfront or maintaining a clean driving record. Safe drivers and those who drive fewer miles often save significantly, with additional savings for not commuting and adding experienced drivers to your policy. To gain profound insights, consult our extensive guide titled “How Auto Insurance Companies Check Driving Records.”

Avoid adding inexperienced drivers to your policy, as it increases costs. Insurance companies offer significant discounts for good credit, safety features, and professional affiliations. Ensure you have your car’s details ready before shopping around for better rates.

Step #6: Compare Policy Renewals

One of the best times to compare your current auto insurance rates with other options is when your current policy is getting ready to come up for renewal. But when you choose to switch policies after your current policy has renewed, you can avoid those penalties.

Some auto insurance policies have penalties for canceling the policy before it expires.

When gathering quotes, also ask your current insurer for a new quote. They might renew your policy without offering a better deal, but requesting a comparison could lead to greater savings. To gain further insights, consult our comprehensive guide titled “How to Manage Your Auto Insurance Policy.”

Step #7: Post-Accident Comparison

Even if there is a penalty for leaving your current company, it may be worth it to pay the penalty and move to a company that is more responsive to your needs. Many consumers feel like they are getting a great deal on their auto insurance when they first sign a new policy. But the cost savings they think they are getting are quickly offset by poor service.

Do not stay with a company that has not earned your business. Compare quotes from other auto insurance companies and move to a better organization.

Step #8: Premiums Increase Comparison

In the auto insurance world, it is common for premiums to go up without notice. When you get your new premiums and you see that your rates have been raised, then that should be a cue for you to start comparing the insurance you have with what is available in the open market.

To maximize savings on your auto insurance, compare quotes from multiple providers and evaluate both coverage and costs carefully.Justin Wright Licensed Insurance Agent

There are many reasons why your insurance premiums go up. Some of the most common reasons include:

- Increased Risk Factors: Higher premiums result from changes in your risk profile, such as a new job with more driving or a move to a higher-risk area.

- Changes in Coverage: Adjustments to your policy, like adding coverage or increasing limits, can lead to higher premiums.

- Claims History: Frequent or recent insurance claims can raise premiums as they indicate higher risk to the insurer.

While it is common for auto insurance premiums to go up, that does not mean that you should accept having to pay more for the same coverage. Use your insurance premium increase as an excuse to shop around and find a better deal that fits your budget. For additional details, explore our comprehensive resource titled “Which cars have the lowest auto insurance premiums?“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

A Quick Guide to Getting Free Quotes: How to Save on Auto Insurance

Finding affordable auto insurance can significantly lower your premiums. Understand your state’s coverage requirements, review your policy, and compare quotes from at least five insurers, considering discounts for good driving records. See our top provider rankings: Cheap Auto Insurance for a Bad Driving Record

When your policy is up for renewal, compare new quotes to your current rates to spot potential savings. If your premiums increase or if you’re unhappy with your service, don’t hesitate to shop around for better options. By comparing quotes and leveraging discounts, you can secure the best deal for your auto insurance.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

How often should I get new auto insurance quotes?

It’s a good idea to get new quotes at least once a year or when your policy is up for renewal. Also, consider getting new quotes if you experience major life changes, such as buying a new car or moving to a new state.

Can I get free auto insurance quotes without providing personal information?

Most quote tools require some personal information to provide accurate quotes, such as your ZIP code, age, and driving history. However, many tools do allow you to see initial quotes with minimal information.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.

What factors can affect the accuracy of my auto insurance quotes?

Factors such as your driving history, credit score, vehicle details, and coverage preferences can impact the accuracy of your quotes. Ensure all information provided is accurate to get the most precise estimate.

For a comprehensive overview, explore our detailed resource titled “How Credit Scores Affect Auto Insurance Rates.”

Are there any fees for using an online auto insurance quote comparison tool?

No, using an online auto insurance quote comparison tool is typically free. The service is often funded through partnerships with insurance providers, not by charging users.

Can I negotiate the quote I receive from an insurance company?

Yes, many insurance companies are open to negotiating premiums, especially if you have competitive quotes from other providers. It’s worth asking about discounts or adjustments based on your driving record or other factors.

How can I make sure the quotes I receive are for comparable coverage?

When comparing quotes, ensure that each policy includes similar coverage limits, deductibles, and additional protections. Review each policy’s details carefully to ensure you’re comparing like-for-like coverage.

To expand your knowledge, refer to our comprehensive handbook titled “Is auto insurance tax deductible?“

What should I do if I find a better rate but my current policy is not yet expired?

If you find a better rate, contact your current insurer to see if they can offer a competitive rate to keep your business. If not, you may choose to switch providers, but be aware of any cancellation fees or penalties.

How do I know if the insurance company offering the lowest quote is reputable?

Research the insurance company’s reputation by checking customer reviews, ratings from independent rating agencies, and their financial stability. You can also consult your state’s Department of Insurance for more information.

What types of discounts should I look for when comparing auto insurance quotes?

Look for discounts related to safe driving, bundling policies (e.g., home and auto), having a good credit score, low annual mileage, and installing safety features in your vehicle. Some insurers also offer discounts for students or members of certain organizations.

To learn more, explore our comprehensive resource on insurance titled “How to Save Money by Bundling Insurance Policies.”

Is it better to get quotes directly from insurance companies or through a comparison website?

Both methods have their advantages. Comparison websites provide a quick way to see multiple quotes from various insurers, while getting quotes directly from companies might offer access to exclusive discounts or more detailed information about their coverage options.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.