Best Garden Grove, California Auto Insurance in 2025 (Cash Savings With These 10 Companies)

USAA, Geico, and Allstate offer the best Garden Grove, California auto insurance, with monthly rates starting as low as $40. These companies are the top choice because they offer competitive rates, a wide range of coverage options, and consistently high customer satisfaction, ensuring both value and reliability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Garden Grove CA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Garden Grove CA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Garden Grove CA

A.M. Best Rating

Complaint Level

Pros & Cons

USAA, Geico, and Allstate are the best Garden Grove, California auto insurance providers, renowned for their exceptional value, broad coverage, and outstanding customer service.

USAA leads with military-specific programs, while Geico and Allstate offer competitive rates and comprehensive coverage.

Our Top 10 Company Picks: Best Garden Grove, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 23% A++ Military Benefits USAA

#2 18% A++ Low Rates Geico

#3 21% A+ Local Support Allstate

#4 20% A+ Snapshot Program Progressive

#5 24% A Claims Service American Family

#6 25% A Add-on Coverages Liberty Mutual

#7 22% A Flexible Options Farmers

#8 17% A+ SmartRide® Saving Nationwide

#9 16% B Local Agents State Farm

#10 15% A++ Bundling Policies Travelers

These top companies in Garden Grove offer reliable and affordable insurance for all drivers. Explore insurance savings in our full guide titled, “Full Coverage Auto Insurance Defined.”

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Exclusive Military Advantages: USAA offers unique benefits in Garden Grove, California, such as savings for deployment and vehicle storage that are not commonly available from other insurers.

- Generous Bundling Savings: USAA offers Garden Grove residents a 23% discount for bundling auto and other policies. Learn more in our guide titled, “USAA Auto Insurance Review.”

- Top-Tier Financial Security: USAA’s A++ rating from A.M. Best guarantees strong financial stability and reliable coverage for Garden Grove residents.

Cons

- Restricted Eligibility: USAA’s benefits are limited to military personnel and their families, excluding non-military residents in Garden Grove from these advantages.

- Comparative Bundling Discount: The 23% bundling discount, while notable, may not match some competitive offers in Garden Grove, potentially limiting overall savings.

#2 – Geico: Best for Low Rates

Pros

- Affordable Premiums: Geico offers low rates in Garden Grove, California, making it a cost-effective coverage choice. For more details, see our guide titled, “Best Geico Auto Insurance Discounts.”

- Significant Bundling Savings: Garden Grove residents can enjoy an 18% discount on bundled auto and home policies with Geico, providing substantial savings.

- Excellent Financial Rating: With an A++ rating from A.M. Best, Geico ensures strong financial stability and reliable coverage for Garden Grove residents.

Cons

- Limited Customization: Geico may offer fewer customization options compared to other insurers in Garden Grove.

- Customer Service Concerns: Geico’s customer service in Garden Grove might be less robust, affecting overall support quality.

#3 – Allstate: Best for Local Support

Pros

- Exceptional Local Agent Assistance: Allstate’s local agents in Garden Grove offer personalized and responsive service.

- Attractive Bundling Savings: A 21% discount for bundling policies makes Allstate a strong choice for those looking to combine coverage.

- Strong Financial Rating: Allstate’s A+ rating from A.M. Best indicates reliable financial stability for managing claims. Gain insights from our guide titled, “Allstate Auto Insurance Review.”

Cons

- Potentially Higher Premiums: Despite bundling discounts, Allstate’s premiums may be higher than some competitors in Garden Grove.

- Outdated Digital Tools: Allstate’s online tools may appear less advanced compared to those of other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Snapshot Program

Pros

- Innovative Snapshot Program: Progressive’s Snapshot rewards safe driving with potential discounts, benefiting confident drivers in Garden Grove, California.

- Solid Bundling Savings: A 20% discount for bundling auto with other policies offers significant savings for Garden Grove residents.

- A+ Financial Stability: Progressive’s A+ rating from A.M. Best ensures reliable coverage and efficient claims processing. Dive into our article called, “Best Progressive Auto Insurance Discounts.”

Cons

- Snapshot Program Limitations: Drivers in Garden Grove not eligible for the Snapshot program might encounter higher rates, reducing the program’s advantages.

- Variable Claims Processing: The claims process in Garden Grove may be less consistent or slower than with other insurers, potentially impacting customer satisfaction.

#5 – American Family: Best for Claims Service

Pros

- Exceptional Claims Handling: American Family is known for its efficient and customer-focused claims service in Garden Grove, California, providing prompt and transparent support.

- Generous Bundling Discount: Residents of Garden Grove, California, can enjoy a 24% discount when bundling auto and other insurance policies with American Family, leading to greater savings.

- Solid Financial Rating: Rated A by A.M. Best, provides reliable coverage and strong financial stability for Garden Grove policyholders. Dive into our article called, “American Family Auto Insurance Review.”

Cons

- Availability Issues: American Family’s products may be unavailable in some parts of Garden Grove, California, which could restrict options for particular residents.

- Less Advanced Digital Platform: Garden Grove, California residents seeking advanced online tools might find American Family’s digital platform less sophisticated than competitors.

#6 – Liberty Mutual: Best for Add-On Coverages

Pros

- Extensive Add-On Coverage: Liberty Mutual offers a wide range of add-ons in Garden Grove, California, such as accident forgiveness and new car replacement, providing extensive customization.

- Top Bundling Savings: Residents of Garden Grove, California, can enjoy a 25% discount by bundling auto with other policies. Discover more in our guide, “Liberty Mutual Auto Insurance Review.”

- Solid Financial Stability: An A rating from A.M. Best indicates Liberty Mutual’s strong financial stability, ensuring reliable coverage and support for Garden Grove, California customers.

Cons

- Higher Premiums: Even with attractive bundling discounts, Liberty Mutual’s premiums may be higher than some alternatives in Garden Grove, California, impacting overall affordability.

- Limited Local Agent Availability: Local agent availability in Garden Grove, California may be more limited compared to other insurers, affecting personalized service and support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Flexible Options

Pros

- Highly Customizable Coverage: Farmers offers flexible policy options for Garden Grove residents to customize their insurance coverage. Dive into our article called, “Farmers Auto Insurance Review.”

- 22% Bundling Savings: Enjoy a 22% discount for bundling policies with Farmers in Garden Grove, California, offering a great option for comprehensive coverage.

- Strong Financial Stability: Farmers’ A rating from A.M. Best ensures solid financial stability, providing dependable support for Garden Grove, California policyholders.

Cons

- Moderate Premium Costs: Even with the bundling discount, Farmers’ premiums in Garden Grove, California, may still be higher than those of competitors, causing budget concerns.

- Digital Platform Limitations: For Garden Grove, California residents who value advanced digital tools, Farmers’ online platform may be less modern and user-friendly compared to other insurers.

#8 – Nationwide: Best for SmartRide Savings

Pros

- SmartRide Program Benefits: Nationwide’s SmartRide program rewards safe driving, making it attractive for Garden Grove, California residents with good driving habits.

- 17% Bundling Discount: Nationwide provides a 17% discount for combining auto with other insurance policies in Garden Grove, California, offering reasonable savings for multi-policy holders.

- A+ Financial Strength: An A+ rating from A.M. Best shows Nationwide’s financial stability for Garden Grove policyholders. Discover more in our guide titled, “Nationwide Auto Insurance Review.”

Cons

- Lower Bundling Discount: The 17% discount for bundling policies in Garden Grove, California is lower compared to some other insurers, which might limit potential savings.

- Higher Rates for Some Drivers: Drivers who do not fully meet SmartRide® criteria in Garden Grove, California might face elevated rates, potentially diminishing the program’s overall value.

#9 – State Farm: Best for Local Agents

Pros

- Tailored Local Service: State Farm’s local agents in Garden Grove, California, offer personalized service and tailored support from familiar professionals.

- Varied Coverage Options: Garden Grove, California residents can choose from a broad range of coverage options with State Farm, providing comprehensive solutions for diverse insurance needs.

- Agent Expertise: State Farm agents know the Garden Grove market, providing customized insurance solutions. Access detailed insights in our guide titled, “State Farm Auto Insurance Review.”

Cons

- Modest Bundling Discount: The 16% discount for bundling policies with State Farm in Garden Grove, California is relatively modest compared to some other providers, which might limit potential savings.

- B Rating from A.M. Best: State Farm’s B rating from A.M. Best could raise concerns regarding financial stability for some Garden Grove, California policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Bundling Policies

Pros

- Expert Bundling Options: Travelers offers a 15% discount for bundling auto with other policies in Garden Grove, California, enhancing savings.

- Comprehensive Coverage Choices: Residents can enjoy diverse insurance products from Travelers for customized coverage. For more details, see our guide titled, “Travelers Auto Insurance Review.”

- Reliable Financial Security: Travelers’ A++ rating from A.M. Best signifies superior financial strength, providing dependable coverage and support for policyholders in Garden Grove, California.

Cons

- Less Competitive Discount: The 15% bundling discount from Travelers, while beneficial, is lower compared to some other insurers in Garden Grove, California, which could impact overall value.

- Potential Premium Variability: Even with bundling discounts, Travelers’ premiums might be higher than those offered by some competitors in Garden Grove, California, affecting affordability.

Monthly Auto Insurance Rates in Garden Grove: Top Providers Compared

When choosing auto insurance in Garden Grove, California, the cost of coverage varies significantly across providers. The table below highlights the monthly rates for minimum and full coverage from leading insurance companies.

Garden Grove, California Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$60 $140

$50 $125

$55 $135

$50 $120

$65 $150

$52 $128

$55 $130

$45 $110

$58 $145

$40 $100

For the most budget-friendly option, USAA offers the lowest rates, with minimum coverage starting at $40 and full coverage at $100. Geico and State Farm also provide competitive rates, with minimum coverage costs of $50 and $45, respectively, and full coverage rates of $120 and $110.

In contrast, Liberty Mutual is on the higher end, with minimum coverage at $65 and full coverage at $150.

Auto Insurance Discounts From the Top Providers for Garden Grove, California

| Insurance Company | Available Discounts |

|---|---|

| Safe driver, multiple policies, early signing, new car, good student, smart home | |

| Loyalty, multi-policy, good driver, young driver, accident-free, generational | |

| Multi-policy, safe driver, mature driver, electronic payments, homeowners, good student | |

| Good driver, multi-policy, federal employee, military, safety equipment, good student | |

| Multi-policy, new car replacement, paperless billing, safe driver, military, good student |

| SmartRide (usage-based), multi-policy, accident-free, good student, automatic payments |

| Multi-policy, safe driver, multi-car, sign online, continuous insurance, teen driver | |

| Safe driver, multi-policy, good student, defensive driving, vehicle safety, accident-free | |

| Multi-policy, hybrid/electric vehicle, safe driver, home ownership, new car, early quote | |

| Military, safe driver, garaging vehicle, loyalty, multi-policy, defensive driving |

Although California auto insurance is among the highest in the U.S., you can still find affordable auto insurance in Garden Grove, California. Shop around and compare rates to find cheap auto insurance.

Monthly Garden Grove, CA Car Insurance Rates by ZIP Code

Discover how car insurance rates vary across Garden Grove, CA by ZIP Code with our detailed monthly rate breakdown.

For tailored insurance solutions, use this ZIP Code-specific data to find the most cost-effective car insurance rates in Garden Grove, CA. Dive into our article called, “How to Lower Your Auto Insurance Rates.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

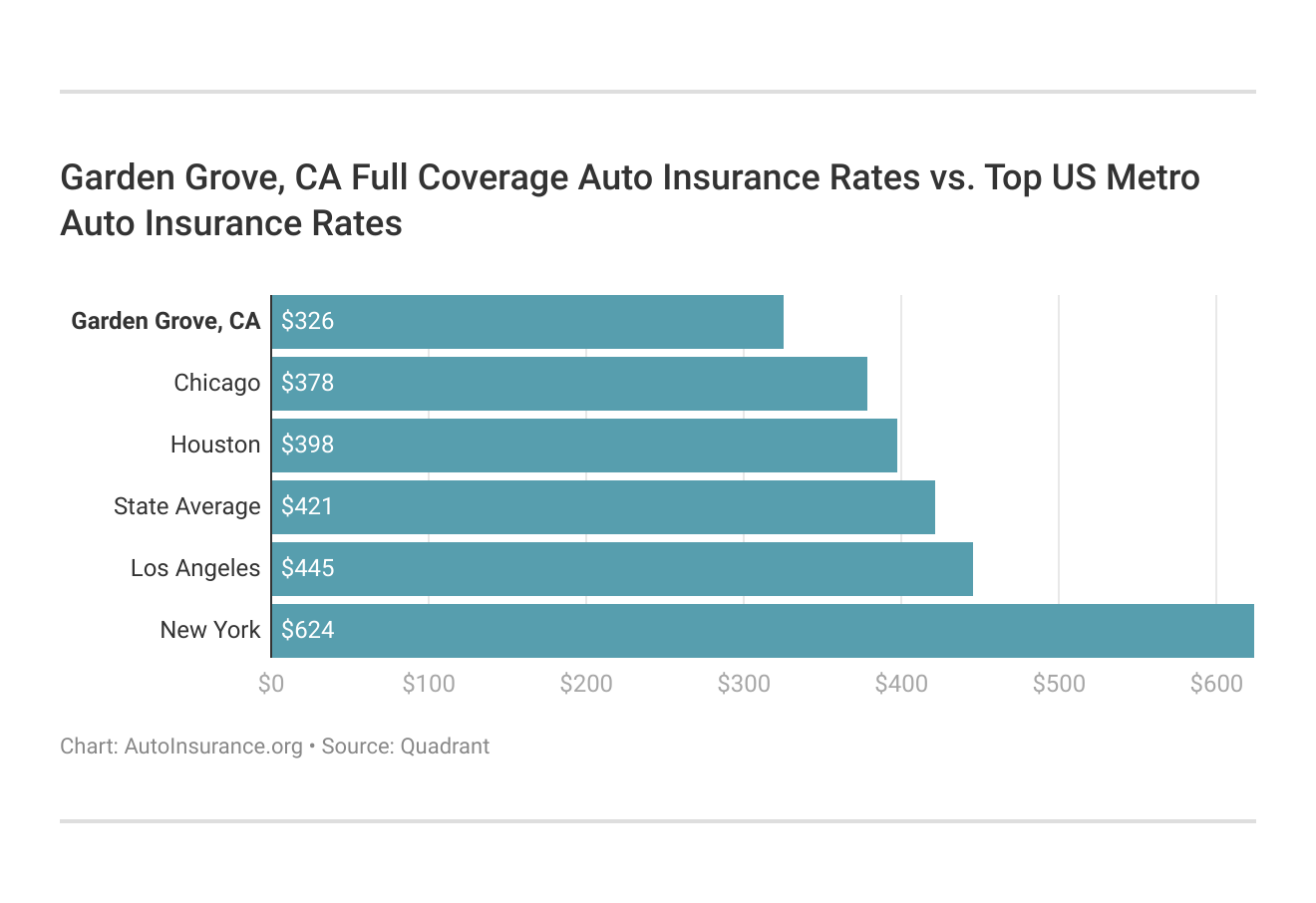

Garden Grove, California Car Insurance Rates vs. Top US Metro Car Insurance Rates

Explore how Garden Grove, California’s car insurance rates compare with those in major US metropolitan areas through our detailed analysis below. Access detailed insights in our guide titled, “How Much Coverage You Need.”

Understanding how Garden Grove’s car insurance rates stack up against top US metro areas can help you make informed decisions and potentially save on your coverage. Explore the insights to find the best deal for your needs.

Finding the most affordable auto insurance company in Garden Grove, California

Although coverage is only offered to the military, veterans, and their family members, USAA actually has the lowest auto insurance rates in Garden Grove, California. However, the auto insurance company with the lowest rates in Garden Grove that offers coverage to everyone is Geico.

For those in the military community, USAA's exclusive benefits and significant 23% bundling discount offer unmatched value and comprehensive coverage.Jeff Root Licensed Insurance Agent

Here are the auto insurance companies offering the most affordable rates in Garden Grove, California, along with a comparison of those rates to the average auto insurance rates across California. Learn more about the offerings in our guide titled, “Where to Compare Auto Insurance Rates.”

Garden Grove, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Low risk of weather-related incidents |

| Average Claim Size | B+ | Average claim size is slightly above the state norm |

| Traffic Density | B | Moderate traffic, leading to average congestion |

| Vehicle Theft Rate | B- | Slightly above average, but still manageable |

| Uninsured Drivers Rate | C+ | Higher than average uninsured driver rate |

The best company for you will depend on many different factors, such as age, marital status, driving record, ZIP code, and credit score. Gender is not allowed to be used to calculate auto insurance rates in California.

Garden Grove, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | B | Lower-than-average vehicle theft rate, especially in rural areas. |

| Traffic Density | B | Medium traffic density, with less congestion outside major cities. |

| Weather-Related Risks | C | Moderate risk due to seasonal storms, including snow and icy conditions in winter. |

| Average Claim Size | B | Claims are generally average compared to other Midwestern states. |

| Uninsured Drivers Rate | B | Slightly lower-than-average rate of uninsured drivers compared to the national level. |

California also offers low-cost auto insurance for low-income drivers. The California Low-Cost Auto (CLCA) program offers very low coverage for drivers who meet certain requirements.

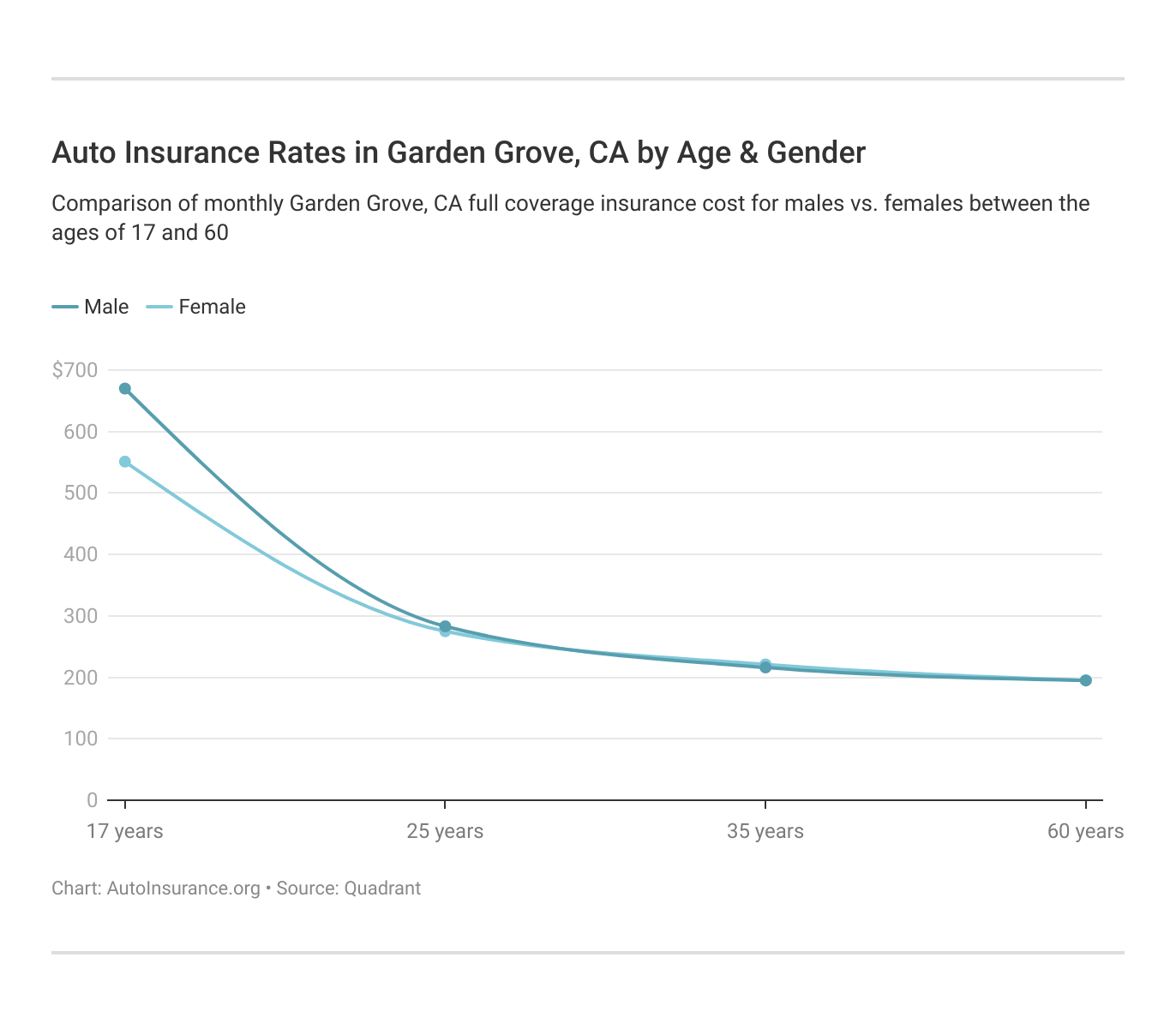

Garden Grove, California auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

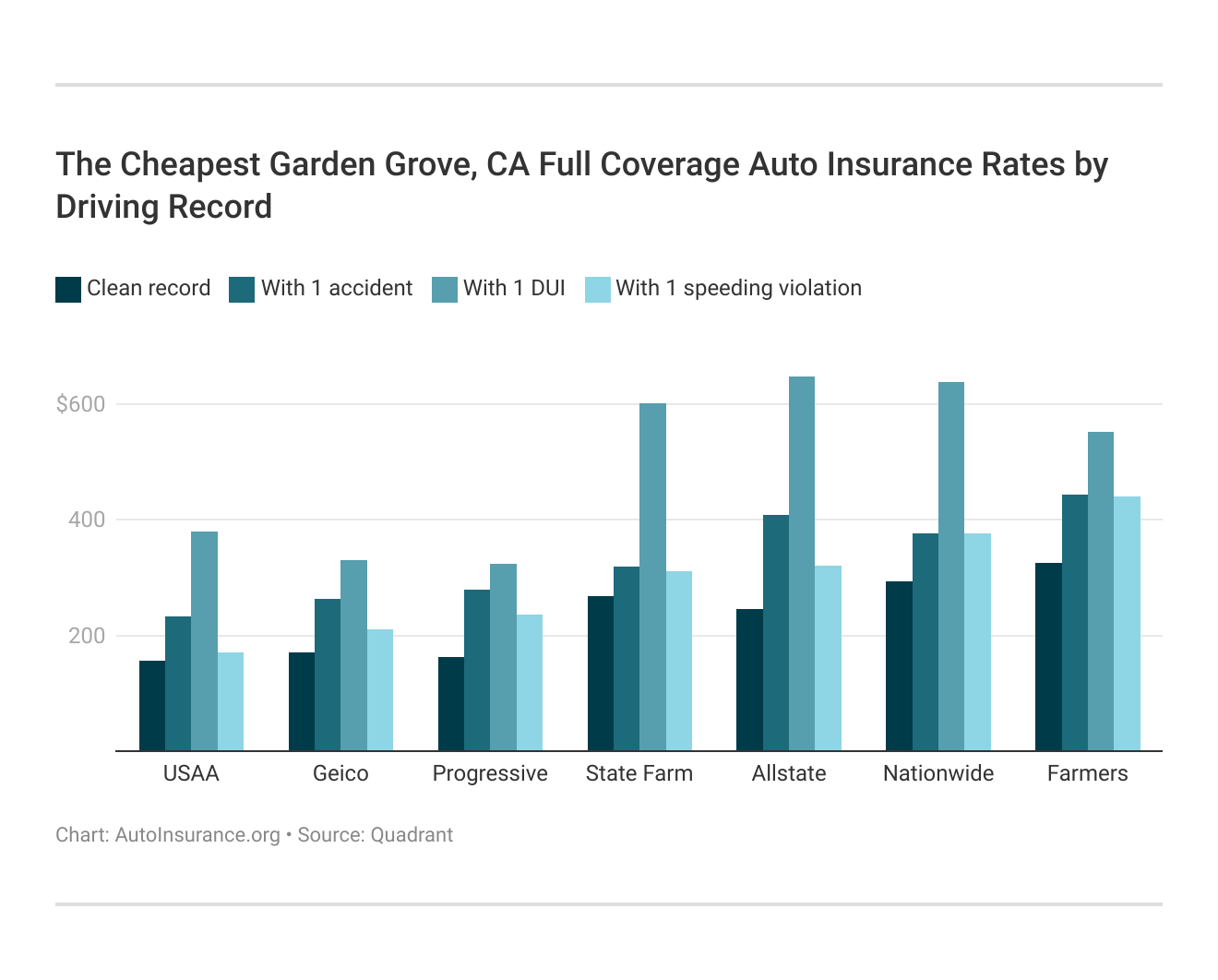

Your driving record will play a major role in your Garden Grove auto insurance rates. For example, other factors aside, a Garden Grove, California DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Garden Grove, California auto insurance rates by driving record.

Factors affecting auto insurance rates in Garden Grove, California may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Garden Grove, California auto insurance.

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk.

California does use gender, so check out the average monthly auto insurance rates by age and gender in Garden Grove, California. For more information, check out our complete guide titled, “How Vehicle Year Affects Auto Insurance Rates.”

Required Auto Insurance Coverage in Garden Grove, California

For drivers to drive lawfully, almost every state requires at least a certain amount of car insurance. The minimum auto insurance requirements in California for Garden Grove drivers are:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These minimums are very low, and extra coverage should be considered by drivers. Such low minimums won’t completely protect you in a major accident, and you’ll be left to pay out of pocket for something not covered.

Garden Grove, California Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,900 |

| Total Claims Per Year | 3,200 |

| Average Claim Size | $5,200 |

| Percentage of Uninsured Drivers | 14% |

| Vehicle Theft Rate | 850 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Low |

Garden Grove, California, faces a significant number of auto accidents and insurance claims annually, coupled with a notable percentage of uninsured drivers.

The high vehicle theft rate also highlights the need for enhanced vehicle security measures, making adequate insurance coverage essential for residents in this densely populated area.

Uncover details in our guide titled, “What are the recommended auto insurance coverage levels?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors That Influence Auto Insurance Rates in Garden Grove, California

Although there are many different factors that affect your auto insurance rates, traffic and the amount of vehicle theft in your area can really push those rates up.

INRIX does not have specific information for Garden Grove but reports that Los Angeles, CA ranks sixth in the country for traffic congestion. Los Angeles also ranks 26th in the world for traffic congestion.

According to City-Data, drivers’ commutes are less than 25 minutes, they prefer to spend that time driving alone.

Vehicle theft is another factor that can affect car insurance rates. The FBI reports that 657 vehicles were stolen in Garden Grove. That means that one car was stolen for every 267 people. To discover more about the company, visit our guide titled, “Does auto insurance cover vehicle theft?”

Before you buy auto insurance in Garden Grove, California, be sure to shop around and compare rates. Enter your ZIP code now to compare Garden Grove, California auto insurance quotes.

Frequently Asked Questions

How often should I review and update my auto insurance policy?

It’s a good practice to review your auto insurance policy annually or whenever you experience significant life changes, such as buying a new car, moving to a different location, or experiencing changes in your driving habits. Regularly reviewing and updating your policy ensures that you have appropriate coverage for your current needs.

Access comprehensive insights into our guide titled, “What does proper auto insurance cover?”

Are there any discounts available for auto insurance in Garden Grove, California?

Yes, many insurance companies offer various discounts that can help reduce your auto insurance premiums in Garden Grove, California. Common discounts include multi-policy discounts (for bundling auto and home insurance), good driver discounts, safety feature discounts, and discounts for completing driver’s education courses.

Can I cancel my auto insurance policy in Garden Grove, California?

Yes, you can cancel your auto insurance policy in Garden Grove, California. However, it’s important to review your policy terms and conditions, as well as any potential penalties for cancellation. Notify your insurance company in writing about your intent to cancel and make sure to have alternative coverage in place before canceling to comply with the state’s mandatory insurance requirement.

What should I do if I’m involved in an auto accident in Garden Grove, California?

If you’re involved in an auto accident in Garden Grove, California, follow these steps:

- Check for injuries and call emergency services if needed.

- Exchange contact and insurance information with the other driver(s) involved.

- Take photos of the accident scene and any damages.

- Notify your insurance company about the accident.

- Cooperate with the insurance company’s investigation and provide all necessary information.

How can I find the best auto insurance rates in Garden Grove, California?

To find the best auto insurance rates in Garden Grove, California, it’s recommended to compare quotes from multiple insurance companies. You can do this by reaching out to different insurers directly or by using online insurance comparison websites. It’s important to consider both the cost and the coverage provided when comparing rates.

Learn more by reading our guide titled, “Auto Insurance Rates by State.”

How are auto insurance premiums determined?

Auto insurance premiums in Garden Grove, California, are determined based on several factors, including your driving record, age, type of vehicle, coverage limits, deductible amount, and where you live. Insurance companies also consider factors such as your credit history and annual mileage.

What are the available options for auto insurance in Garden Grove, California?

In Garden Grove, California, you can choose from several auto insurance providers such as USAA, Geico, Progressive, Liberty Mutual, Travelers, State Farm, Allstate, Nationwide, and Farmers, each offering a range of coverage options and discounts.

Where can I get auto insurance quotes in Garden Grove, California?

Auto insurance quotes in Garden Grove, California can be obtained through online comparison sites, insurance company websites, or by reaching out to local insurance agents.

Which companies offer the best auto insurance rates in Garden Grove, California?

The best auto insurance rates in Garden Grove, California are typically provided by USAA, Geico, and Progressive, with USAA generally offering the most competitive monthly premiums.

To learn more, explore our comprehensive resource on “Top 7 Factors That Affect Auto Insurance Rates.”

Where can I find the zip code map for Garden Grove, California?

The zip code map for Garden Grove, California can be accessed through online mapping services or local municipal websites that provide detailed postal and geographic information.

Which auto insurance company is considered the most reliable in Garden Grove, California?

The top-rated auto insurance companies in Garden Grove, California, as of September 2024, are Nationwide for overall coverage, USAA for military families, Travelers for those with speeding violations, Erie for drivers with accident history, Progressive for those with DUIs, and Geico for those with poor credit.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Is Geico still operating in Garden Grove, California?

Geico has closed all its offices in California, including Garden Grove, California. Progressive has also stopped advertising in the state.

What is the minimum auto insurance requirement in Garden Grove, California?

The minimum liability insurance requirements in Garden Grove, California, are set at $15,000 for injury or death of one person, $30,000 for injury or death of multiple people, and $5,000 for property damage, according to California Insurance Code §11580.1b.

To find out more, explore our guide titled, “How to Evaluate Auto Insurance Quotes.”

Are auto insurance rates high in Garden Grove, California?

Yes, auto insurance rates in Garden Grove, California, are among the highest in the country. Insurify reports a 45% increase in auto insurance rates year-over-year as of June.

Why is obtaining auto insurance challenging in Garden Grove, California?

Securing auto insurance in Garden Grove, California, is difficult due to factors such as inflation, a high number of accidents, and regulatory constraints on rate increases. Additionally, the increasing frequency of wildfires affects both auto and home insurance availability.

Which insurance companies have recently exited the Garden Grove, California market?

From summer 2023 to early 2024, several insurance companies, including AmGUARD, Falls Lake, The Hartford, Tokio Marine Insurance Co, and American National, ceased issuing new home insurance policies in Garden Grove, California, impacting the market.

Who is the largest auto insurer in Garden Grove, California?

State Farm holds the title of the largest auto insurer in Garden Grove, California, leading the market in terms of policyholders.

For additional details, explore our comprehensive resource titled, “Does auto insurance cover interior damage?”

What is the new auto insurance law affecting Garden Grove, California, starting in 2025?

Effective January 1, 2025, the minimum limits for auto insurance in Garden Grove, California, will increase to $30,000 per person, $60,000 per accident, and $15,000 for property damage.

Do you need a license to get auto insurance in Garden Grove, California?

In Garden Grove, California, you do not need a driver’s license to obtain auto insurance; however, having a license is generally required for policy issuance.

Which insurance company in Garden Grove, California, has the highest customer satisfaction?

USAA is recognized for having the highest customer satisfaction among auto insurance providers in Garden Grove, California.

Uncover details in our guide titled, “Best Customer Loyalty Auto Insurance Discounts.”

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.