Best Garner, North Carolina Auto Insurance in 2025 (Compare the Top 10 Companies)

For the best Garner, North Carolina auto insurance, State Farm, Geico, and Nationwide lead the way, offering competitive rates with a starting point as low as $63 per month. Compare coverage options and save on your policy with these top-rated providers for optimal protection and affordability in Garner.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Garner NC

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Garner NC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Garner NC

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsFor the best Garner, North Carolina auto insurance, State Farm, Geico, and Nationwide provides excellent coverage and competitive price starting as low as $63 per month.

For the best overall value, State Farm emerges as the top choice, combining affordable premiums with robust coverage options and exceptional customer service.

This analysis highlights these leading providers based on pricing, coverage flexibility, and customer satisfaction, helping you find the ideal insurance solution for your needs.

Our Top 10 Company Picks: Best Garner, North Carolina Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | B | Roadside Assistance | State Farm | |

| #2 | 16% | A++ | Competitive Rates | Geico | |

| #3 | 20% | A+ | Customer Service | Nationwide |

| #4 | 14% | A+ | Online Tools | Progressive | |

| #5 | 12% | A+ | Customer Support | Allstate | |

| #6 | 15% | A | Bundling Discounts | Liberty Mutual |

| #7 | 11% | A+ | Rental Reimbursement | Farmers | |

| #8 | 10% | A++ | Robust Coverage | Travelers | |

| #9 | 19% | A+ | Personalized Service | Erie |

| #10 | 21% | A++ | Military Families | USAA |

Evaluate your choices today to find the most comprehensive auto insurance at the most competitive rates. By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- State Farm offers the best overall rates and coverage in Garner, NC

- Geico and Nationwide provide competitive rates starting from $63/month

- Top providers balance affordable premiums with excellent customer service

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Unbeatable Rates: State Farm excels in offering some of the most cost-effective insurance rates in Garner, North Carolina. This affordability is particularly advantageous for budget-conscious drivers who seek maximum value without compromising on essential coverage, as highlighted in our State Farm auto insurance review.

- Robust Discounts: In Garner, North Carolina, State Farm provides a variety of savings options that can dramatically reduce insurance costs. These financial rewards are available for careful driving, consolidating several plans, and upholding a perfect driving record.

- Extensive Coverage Choices: The wide range of policy options offered by State Farm in Garner, North Carolina, includes basic liability as well as full insurance coverage. Customers can customize the protection they have with this variety to suit their particular requirements and tastes.

Cons

- Premiums for Riskier Drivers: While State Farm generally offers competitive rates, drivers with a history of high-risk behavior in Garner, North Carolina, may encounter higher premiums. This can be a disadvantage for those with less-than-ideal driving records.

- Online Experience Limitations: State Farm’s digital tools and online interface may not be as advanced as some competitors, which can affect the ease with which customers in Garner, North Carolina, manage their policies and file claims online.

#2 – Geico: Best for Economical Rates

Pros

- Economical Rates: Geico is widely recognized for its exceptionally low insurance rates in Garner, North Carolina. This makes it an attractive option for drivers looking for cost-effective insurance solutions without sacrificing essential coverage, as highlighted in our Geico auto insurance review.

- Highly Rated App: Geico’s mobile app, popular among users in Garner, North Carolina, is lauded for its user-friendly design. The app simplifies policy management, allowing users to easily access their policy details, file claims, and make payments from their smartphones.

- Advanced Online Tools: The company’s website features a range of advanced tools, such as the easy-to-use quote tool and straightforward policy adjustments, which make managing insurance policies in Garner, North Carolina, more efficient.

Cons

- Sparse Local Presence: Geico’s focus on online operations means that there are fewer local agents in Garner, North Carolina. This can limit the availability of personalized, face-to-face service that some customers may prefer.

- Inconsistent Customer Service: Although Geico generally provides good customer service, some users in Garner, North Carolina, have reported variable experiences. This inconsistency can lead to occasional dissatisfaction among policyholders.

#3 – Nationwide: Best for Diverse Coverage Options

Pros

- Diverse Coverage Options: Nationwide offers a broad range of coverage options in Garner, North Carolina, including specialized policies for various needs. This flexibility allows customers to find the exact coverage they require, whether it’s basic liability or comprehensive protection.

- Attractive Discounts: Nationwide provides several discount opportunities in Garner, North Carolina, such as those for safe driving, multi-policy bundles, and good student discounts. These discounts can help reduce overall insurance costs.

- Reliable Roadside Assistance: The company’s robust roadside assistance program in Garner, North Carolina, is a valuable feature, offering support during emergencies such as breakdowns or accidents, and providing peace of mind while on the road.

Cons

- Potentially Higher Rates: Some drivers in Garner, North Carolina, may find Nationwide’s rates to be on the higher side, especially if they have a history of traffic violations or accidents. This could make it less appealing for those with less favorable driving records, according to Nationwide auto insurance review.

- Overwhelming Policy Choices: The extensive variety of policy options offered by Nationwide can be overwhelming for some customers in Garner, North Carolina. Navigating through the different coverage types and add-ons may require careful consideration and potentially expert advice.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexible Coverage

Pros

- Flexible Coverage: In Garner, North Carolina, the business provides adaptable coverage alternatives that may be tailored to satisfy different insurance requirements. Progressive can customize a policy to meet your needs, whether you need more extensive coverage or just basic protection, as highlighted in our Progressive auto insurance review.

- Innovative Online Tools: Progressive is known for its innovative online tools in Garner, North Carolina, such as the Name Your Price® tool, which allows users to find coverage that fits their budget. This feature provides a unique way to balance cost and coverage.

- Snapshot® Program: Progressive’s Snapshot® program in Garner, North Carolina, rewards safe driving behaviors with potential discounts. By tracking driving habits, the program encourages safer driving and can result in lower premiums.

Cons

- Complex Discount Structure: Progressive’s numerous discount options can be confusing for customers in Garner, North Carolina. Understanding and utilizing all available discounts may require effort, and some customers might find it challenging to fully leverage potential savings.

- Customer Service Variability: While generally effective, Progressive’s customer service in Garner, North Carolina, can be inconsistent. Some users have reported issues with support and claims processing, leading to variable experiences.

#5 – Allstate: Best for Broad Coverage Options

Pros

- Broad Coverage Options: Allstate provides an extensive range of coverage options in Garner, North Carolina, including numerous add-ons and extras. This variety allows customers to build a policy that precisely matches their needs and preferences, as noted in our Allstate auto insurance review.

- Flexible Policy Options: Because Allstate’s policies are flexible, Garner, North Carolina consumers can modify their insurance coverage to suit their changing requirements and preferences.

- Diverse Discounts: In Garner, North Carolina, the company offers a variety of discounts, such as those for safe driving, combining multiple regulations, and getting particular security features installed in your car. Overall insurance prices may be lowered with the aid of these savings.

Cons

- Higher Premiums for Some: Allstate’s premiums can be relatively high in Garner, North Carolina, especially for drivers with less-than-ideal driving records. This might make it less attractive for those seeking lower-cost options.

- Complicated Claims Process: The claims process with Allstate can be intricate and time-consuming in Garner, North Carolina. Some customers have reported challenges with navigating the process, which can lead to frustration and delays.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Liberty Mutual offers a broad spectrum of coverage options in Garner, North Carolina, that can be tailored to fit various needs. This customization allows policyholders to select coverage that best suits their individual requirements.

- Discount Opportunities: In Garner, North Carolina, Liberty Mutual offers a number of discount alternatives, such as incentives for installing safety features, bundling many policies, and keeping a clean driving record. Lower rates may result from these savings.

- New Car Replacement Coverage: The company offers valuable new car replacement coverage in Garner, North Carolina, which is beneficial if your vehicle is totaled in an accident. This feature helps ensure you can replace your car with a new one of similar make and model.

Cons

- Potentially Higher Premiums: Some customers in Garner, North Carolina, may find that Liberty Mutual’s premiums are on the higher side compared to other providers. This could be a disadvantage for those seeking more budget-friendly options, as mentioned in our Liberty Mutual auto insurance review.

- Inconsistent Customer Service: Customer service reports indicate that Liberty Mutual in Garner, North Carolina, may offer unpredictable results. Some clients can experience prolonged resolution periods or less efficient help.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Comprehensive Coverage Range

Pros

- Comprehensive Coverage Range: In Garner, North Carolina, Farmers provides a wide selection of coverage alternatives, including customized plans for certain need. Customers can select coverage that exactly matches their needs thanks to this wide choices, as detailed in our Farmers auto insurance review.

- Discount Availability: In Garner, North Carolina, Farmers provides a variety of discounts, including those for careful driving, combining more than one car, and possessing particular safety features. These savings can assist in lowering the overall cost of insurance.

- Comprehensive Claims Handling: The business is commended for its rapid claims handling procedure in Garner, North Carolina, which guarantees prompt and effective claim resolution and offers comfort in trying times.

Cons

- Higher Premiums: Farmers’ rates in Garner, North Carolina, can be higher, particularly for drivers with less-than-ideal driving records or high-risk profiles. This may make it less appealing for those seeking lower-cost insurance options.

- Overwhelming Policy Choices: The wide array of policy options offered by Farmers can be overwhelming for customers in Garner, North Carolina. Customers may find it challenging to navigate through the various coverage types and select the best fit for their needs.

#8 – Travelers: Best for Attractive Rates

Pros

- Attractive Rates: Travelers is known for its competitive insurance rates in Garner, North Carolina, providing good value for coverage. This makes it a strong contender for drivers seeking cost-effective insurance solutions, according to Travelers auto insurance review.

- Wide Coverage Options: In order to accommodate a wide range of insurance requirements and preferences, the company provides an extensive selection of options for protection and personalized policies in Garner, North Carolina.

- Discount Programs: Travelers provides various discount opportunities in Garner, North Carolina, including those for bundling policies, maintaining a good driving record, and having safety features in your vehicle. These discounts contribute to lower premiums.

Cons

- Limited Local Presence: Travelers may have fewer local agents in Garner, North Carolina, compared to some competitors. This reduced local presence might affect the level of personalized service and face-to-face interaction.

- Complex Discount System: The company’s discount structure in Garner, North Carolina, can be complex, making it challenging for some customers to fully understand and take advantage of all available savings opportunities.

#9 – Erie: Best for Competitive Rates

Pros

- Competitive Rates: Erie is known for its competitive pricing in Garner, North Carolina, offering affordable insurance solutions without compromising on coverage. This can be particularly beneficial for drivers looking for budget-friendly options.

- Comprehensive Coverage: Erie offers a wide range of coverage options in Garner, North Carolina, allowing customers to select policies that meet their specific needs. The variety of choices ensures that coverage can be customized to fit various requirements.

- Flexible Payment Plans: Erie offers flexible payment options in Garner, North Carolina, making it easier for customers to manage their insurance premiums according to their financial situation.

Cons

- Regional Focus: Erie’s regional focus means that its services may be more limited outside of North Carolina. This can affect its availability and service quality in other regions, as noted in our Erie auto insurance review.

- Fewer Discount Opportunities: Compared to some competitors, Erie offers a more limited range of discount options in Garner, North Carolina. This could impact the potential savings available to policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Competitive Rates for Military Families

Pros:

- Competitive Rates for Military Families: USAA offers highly competitive rates and discounts in Garner, North Carolina, particularly advantageous for military families and veterans. This focus on serving the military community results in favorable pricing and benefits, as highlighted in our USAA auto insurance review.

- Comprehensive Coverage Options: The company provides a wide range of coverage options in Garner, North Carolina, including specialized policies designed to meet the needs of military personnel. This extensive selection ensures that customers can find suitable coverage.

- Highly Rated Mobile App: In Garner, North Carolina, the USAA mobile app is well-liked for its intuitive UI, which makes managing policies, submitting claims, and getting help while on the move simple.

Cons:

- Eligibility Restrictions: Only veterans and military families are eligible for USAA services, which restricts access for non-members. This limitation may keep out a sizable percentage of prospective Garner, North Carolina clients.

- Limited Local Agents: In comparison to suppliers with a larger local presence, Garner, North Carolina may offer less individualized care due to the small number of local agents. This may affect the availability of in-person counseling and support.

Essential Auto Insurance Requirements in Garner, North Carolina

Minimum auto insurance in Garner, North Carolina refers to the least amount of coverage you are legally required to have in order to drive a vehicle. Discover our comprehensive guide to “What is auto insurance?” for additional insights.

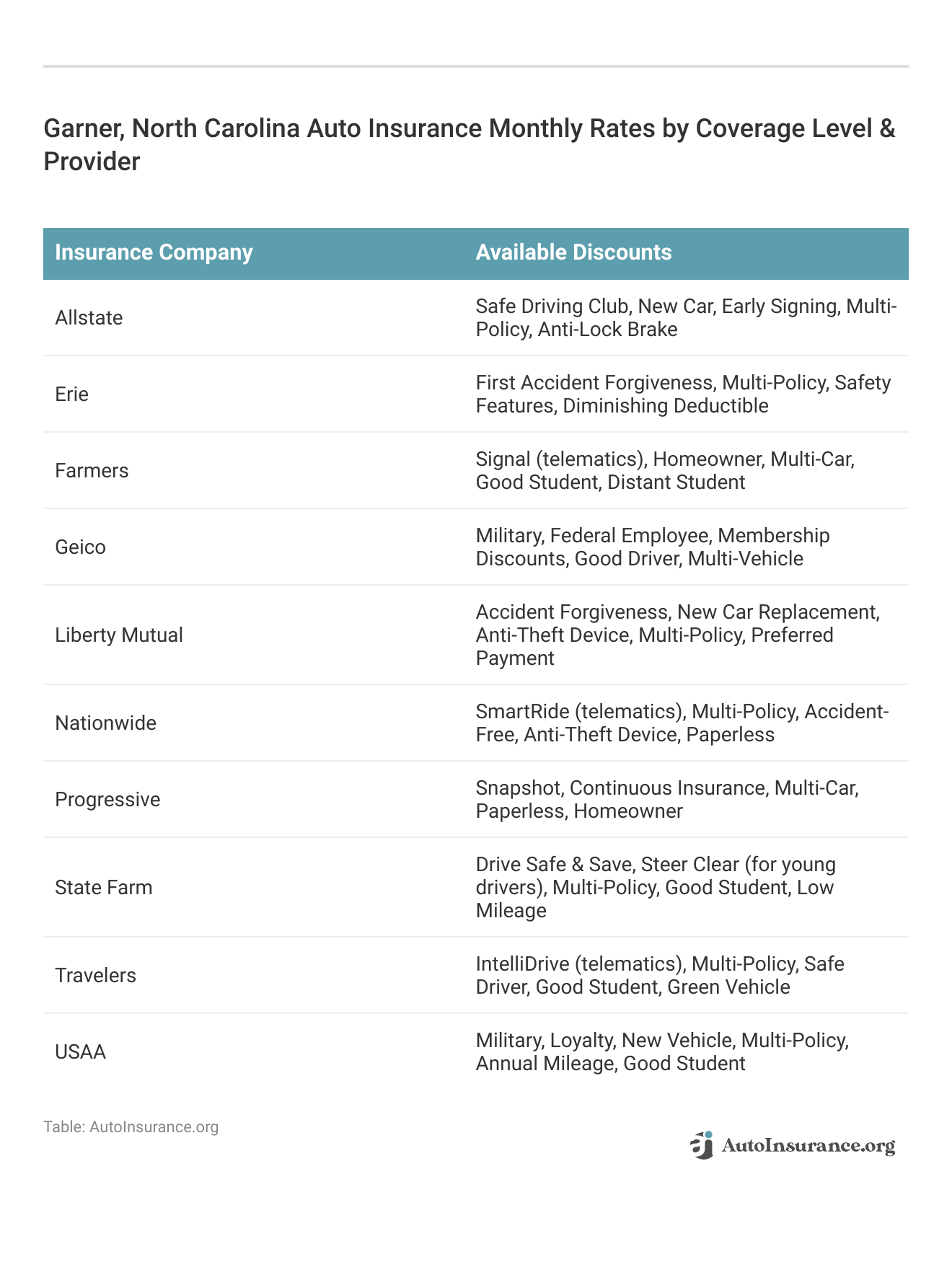

Garner, North Carolina Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $73 | $160 |

| Erie | $66 | $146 |

| Farmers | $72 | $158 |

| Geico | $65 | $145 |

| Liberty Mutual | $75 | $165 |

| Nationwide | $69 | $148 |

| Progressive | $71 | $155 |

| State Farm | $68 | $150 |

| Travelers | $70 | $150 |

| USAA | $63 | $140 |

The state mandates specific liability limits to ensure that drivers can cover the costs associated with bodily injuries and property damage in the event of an accident. In Garner, as in the rest of North Carolina, the minimum required auto insurance coverage includes:

- Insurance for Bodily Injury: This pays for other people’s medical costs and lost income in the event that you are judged to be at fault in an accident. A minimum of $30,000 per individual and $60,000 per accident is needed.

- Property Damage Liability Coverage: If you’re at fault in an accident, this insurance covers the cost of repairing another person’s property, such as their car or a fence. A minimum of $25,000 in coverage is required.

The minimum coverage requirements offer a basic level of financial protection, ensuring that drivers have some level of liability coverage in the event of an accident.

However, many drivers choose to exceed these minimums by opting for higher coverage limits or additional types of insurance, such as comprehensive coverage. This additional coverage helps protect against a wider range of risks, including damage from non-collision events like theft, vandalism, or natural disasters, providing more robust financial security and peace of mind.

Garner Auto Insurance Savings: Age, Gender, and Marital Status Insights

Auto insurance rates in Garner, North Carolina, fluctuate dramatically based on various demographic factors such as age, gender, and marital status. Insurance companies meticulously analyze these attributes to determine risk profiles and set premiums accordingly, resulting in significant variances in insurance costs.

Garner, North Carolina Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $481 | $481 | $394 | $394 | $1,166 | $1,166 | $490 | $490 |

| Geico | $212 | $208 | $209 | $205 | $387 | $383 | $187 | $185 |

| Liberty Mutual | $158 | $158 | $164 | $164 | $279 | $279 | $158 | $158 |

| Nationwide | $217 | $217 | $217 | $217 | $367 | $367 | $217 | $217 |

| Progressive | $151 | $151 | $138 | $138 | $355 | $355 | $168 | $168 |

| State Farm | $231 | $231 | $200 | $200 | $341 | $341 | $286 | $200 |

| Travelers | $393 | $393 | $237 | $237 | $231 | $231 | $229 | $229 |

For example, younger drivers, often viewed as higher risk due to inexperience, may face substantially higher premiums compared to their older, more seasoned counterparts. For further details, check out our in-depth “Companies With the Cheapest Teen Auto Insurance” article.

Similarly, gender and marital status play pivotal roles, with married individuals frequently enjoying lower rates than their single peers, reflecting a perceived stability and lower risk. Understanding these demographic influences is crucial for navigating the complex landscape of insurance pricing and securing the most cost-effective coverage.

Best Cheap Auto Insurance for Teens in Garner, North Carolina

Securing affordable auto insurance for teenagers in Garner, North Carolina proves to be quite the endeavor. The quest for budget-friendly rates for young drivers reveals a labyrinth of high costs and complex pricing structures.

Garner, North Carolina Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $481 | $481 |

| Geico | $212 | $208 |

| Liberty Mutual | $158 | $158 |

| Nationwide | $217 | $217 |

| Progressive | $151 | $151 |

| State Farm | $231 | $231 |

| Travelers | $393 | $393 |

Dive into the annual teen auto insurance rates in Garner to unravel the intricacies and uncover the most economical options amidst a sea of expensive premiums.

Finding Low-Cost Auto Insurance for Seniors in Garner, NC

Wondering about the auto insurance rates for seniors in Garner, North Carolina? Unravel the complexities of senior auto insurance by examining the annual average premiums specifically tailored for older drivers.

Garner, North Carolina Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $490 | $490 |

| Geico | $187 | $185 |

| Liberty Mutual | $158 | $158 |

| Nationwide | $217 | $217 |

| Progressive | $168 | $168 |

| State Farm | $286 | $200 |

| Travelers | $229 | $229 |

Dive deep into the nuanced data and trends that influence these rates, revealing how factors such as age, driving history, and insurance choices impact the cost of coverage for seasoned motorists. By understanding these details, you can better navigate the often intricate landscape of senior auto insurance and make informed decisions to ensure optimal coverage at competitive rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Garner Auto Insurance: Affordable Rates Based on Driving Record

Your driving record wields substantial influence over your auto insurance premiums. Delve into the intriguing disparity between annual insurance rates for those with a blemished driving history versus a spotless record in Garner, North Carolina.

Garner, North Carolina Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $343 | $464 | $604 | $1,120 |

| Geico | $130 | $181 | $195 | $482 |

| Liberty Mutual | $113 | $145 | $145 | $356 |

| Nationwide | $149 | $193 | $193 | $481 |

| Progressive | $97 | $136 | $141 | $439 |

| State Farm | $141 | $203 | $203 | $509 |

| Travelers | $163 | $210 | $213 | $506 |

Uncover how each infraction or clean slate significantly shifts the cost dynamics, and explore the fluctuating rates that underscore the financial impact of your driving behavior. Learn more by visiting our detailed “How Auto Insurance Companies Check Driving Records” section.

Finding Cheap Auto Insurance in Garner After a DUI

Navigating the world of auto insurance after a DUI in Garner, North Carolina presents a considerable challenge. The landscape of insurance rates for those with a DUI record can be complex and varied, often resulting in significantly higher premiums. To find the most economical option, one must meticulously compare the annual DUI insurance rates across different providers in Garner.

Garner, North Carolina DUI Auto Insurance Rates

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $1,120 |

| Geico | $482 |

| Liberty Mutual | $356 |

| Nationwide | $481 |

| Progressive | $439 |

| State Farm | $509 |

| Travelers | $506 |

This involves delving into detailed rate comparisons, understanding how each insurer adjusts their pricing based on DUI infractions, and evaluating the best deals available. Thorough research and careful comparison are crucial for securing the most affordable coverage in this high-risk category.

Inexpensive Auto Insurance in Garner by Credit History

Credit history wields a powerful influence over auto insurance costs, shaping how premiums are set with dramatic effects. In Garner, North Carolina, the interplay between your credit score and insurance rates can lead to stark differences. Read our extensive guide on “How Credit Scores Affect Auto Insurance Rates” for more knowledge.

Garner, North Carolina Auto Insurance by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $488 | $556 | $854 |

| Geico | $229 | $246 | $267 |

| Liberty Mutual | $190 | $190 | $190 |

| Nationwide | $254 | $254 | $254 |

| Progressive | $183 | $198 | $229 |

| State Farm | $184 | $237 | $371 |

| Travelers | $262 | $265 | $291 |

Dive into the intricate world of how various credit histories impact annual auto insurance rates, revealing how your financial background can swing the cost of coverage. Explore the nuanced variations and uncover the significant impact your credit profile has on insurance pricing.

Explore Top Auto Insurance Rates in Garner by ZIP Code

In Garner, North Carolina, auto insurance rates fluctuate dramatically from one ZIP code to another, revealing a complex web of location-based pricing dynamics. The annual cost of car insurance is intricately tied to your specific ZIP code, with each area exhibiting its own unique set of influences on premiums.

Delve into the fascinating variations in insurance costs across Garner’s ZIP codes and uncover how geographical factors intricately weave into the pricing tapestry of auto coverage. Expand your understanding with our thorough “Minimum Auto Insurance Requirements by State” overview.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Save on Auto Insurance in Garner, NC by Commute Distance

In Garner, North Carolina, the length of your daily commute and total annual mileage exert a significant influence on your auto insurance premiums, creating a complex interplay between driving habits and insurance costs. For more information, explore our informative “How Much Coverage You Need” page.

Garner, North Carolina Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $633 | $633 |

| Geico | $247 | $247 |

| Liberty Mutual | $190 | $190 |

| Nationwide | $254 | $254 |

| Progressive | $203 | $203 |

| State Farm | $263 | $265 |

| Travelers | $273 | $273 |

Dive into the intriguing world of insurance pricing as you explore how varying commute distances and mileage figures impact the cost of coverage. Discover which commuting scenarios offer the most cost-effective insurance options and navigate the nuanced relationship between your travel patterns and insurance rates.

Coverage Levels and Affordable Auto Insurance in Garner, NC

How does your chosen coverage level dramatically shift the cost of auto insurance in Garner, North Carolina? Delve into the dynamic fluctuations of annual insurance rates based on different coverage tiers and uncover how varying levels of protection can transform your insurance expenses.

Explore the intriguing variations in costs as you compare Garner’s auto insurance rates across a spectrum of coverage options and see how your choices can lead to unexpected changes in your car insurance premiums.

Top Picks: Most Affordable Auto Insurance in Garner, NC by Category

Dive into the labyrinth of auto insurance options in Garner, North Carolina, and compare the most budget-friendly companies across various categories to unearth the insurer that offers the optimal rates tailored to your unique needs. Continue reading our full “What does standard auto insurance cover?” guide for extra tips.

Cheapest Garner, North Carolina Auto Insurance Providers by Driver Profile

| Driver Profile | Insurance Company |

|---|---|

| Teenagers | Liberty Mutual |

| Seniors | Progressive |

| Clean Record | Progressive |

| One Accident | Progressive |

| One DUI | Liberty Mutual |

| One Ticket | Progressive |

Uncover the secrets behind the most cost-effective choices, dissecting how each provider stacks up in different categories, and discover which company delivers the best value for your specific insurance requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Most Affordable Auto Insurance Providers in Garner, NC

Which auto insurance providers in Garner, North Carolina offer the most affordable rates? Navigating the maze of insurance options can be daunting, but comparing the leading companies in Garner reveals critical insights into the most cost-effective annual premiums. Get more insights by reading our expert “Where can I compare online auto insurance companies?” advice.

By examining the intricacies of each insurer’s pricing structure, you can uncover the most economical choices tailored to your specific needs and preferences. This in-depth analysis helps you make an informed decision and secure the best value for your auto insurance coverage.

Driving Forces Behind Auto Insurance Rates in Garner, North Carolina

Numerous variables contribute to the fluctuations in auto insurance rates across Garner, North Carolina, setting them apart from those in other locales. Explore our detailed analysis on “How to Find Auto Insurance Quotes Fast” for additional information.

Factors such as traffic congestion and the incidence of vehicle theft play pivotal roles, alongside myriad local influences that can impact your insurance premiums.

Garner Commute Time

In cities where drivers endure extended commute times, insurance costs often rise accordingly. For Garner, North Carolina, the average commute stretches to 28.6 minutes, as detailed by City-Data, underscoring a significant factor in the region’s insurance rate landscape.

Compare and Save: Auto Insurance Quotes in Garner, NC

To compare Garner, North Carolina auto insurance quotes involves a detailed examination of various insurance proposals from multiple providers in the Garner area. For further details, check out our in-depth “Compare Cheap Online Auto Insurance Quotes” article

State Farm stands out for its combination of affordable rates and reliable coverage options, making it a top choice for drivers in Garner, NC.Jeff Root Licensed Insurance Agent

This intricate process includes scrutinizing the rates, coverage options, and terms each insurer offers, allowing you to unearth the most advantageous policy tailored to your unique needs. By diving into this comparison, you can uncover the most economical insurance solution while ensuring comprehensive coverage, ultimately maximizing both value and protection.

Before you buy Garner, North Carolina auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Garner, North Carolina auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Who pays the most for car insurance in Garner, North Carolina?

In Garner, North Carolina, the highest car insurance rates usually fall on the shoulders of young drivers, particularly teenagers, who find themselves in the costly crosshairs of insurance companies. Their lack of road experience and higher likelihood of accidents thrusts them into the priciest premium bracket.

What is the difference between a premium and a deductible in Garner, North Carolina?

In Garner, North Carolina, the terms premium and deductible might seem interchangeable, but they’re worlds apart. The premium is the recurring fee you shell out, whether monthly, semi-annually, or annually, to keep your auto insurance policy active.

What is the most important auto insurance coverage in Garner, North Carolina?

When it comes to crucial auto insurance coverage in Garner, North Carolina, liability insurance takes the crown. This coverage is essential because it pays for damages and injuries you might cause to others in an accident. But don’t overlook comprehensive and collision coverage, which many drivers also prioritize for their expansive protection against a broader range of risks.

Explore our detailed analysis on “Cheapest Liability-Only Auto Insurance” for additional information.

What is the required auto insurance coverage in Garner, North Carolina?

In Garner, North Carolina, drivers are mandated to carry liability insurance. This includes both bodily injury and property damage coverage. The state has set minimum limits to ensure that if you’re at fault in an accident, you’re financially equipped to cover the basic costs.

Is comprehensive insurance required by law in Garner, North Carolina?

Nope, comprehensive insurance isn’t legally required in Garner, North Carolina. It’s an optional safety net that shields you from non-collision-related incidents—think theft, vandalism, or Mother Nature’s wrath.

What is the best type of car insurance in Garner, North Carolina?

The “best” car insurance in Garner, North Carolina, is a matter of personal preference and needs, but full coverage is often touted as the gold standard. It bundles liability, collision, and comprehensive insurance, giving you a robust defense against a wide array of potential mishaps.

Get more insights by reading our expert “Full Coverage Auto Insurance Defined” advice.

What is the most popular insurance in Garner, North Carolina?

Liability insurance reigns supreme as the most popular choice in Garner, North Carolina, largely because the law requires every driver to have it. Its widespread adoption makes it the go-to option for most motorists.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What are the top 3 types of insurance in Garner, North Carolina?

In Garner, North Carolina, the big three in the insurance world are liability, comprehensive, and collision insurance. These cover the broad spectrum of risks you might face while driving.

What is the most common insurance plan in Garner, North Carolina?

The go-to plan for most drivers in Garner, North Carolina, is a basic liability policy. It ticks the box for the state’s legal requirements and offers just enough coverage to keep you on the right side of the law.

Continue reading our full “Collision Auto Insurance Defined” guide for extra tips.

What are the basic types of insurance in Garner, North Carolina?

The basic insurance types you’ll encounter in Garner, North Carolina, include liability, comprehensive, and collision coverage. Together, they form the foundation of most auto insurance policies.

What insurance is legally required in Garner, North Carolina?

In Garner, North Carolina, liability insurance isn’t just a suggestion—it’s the law. This essential coverage takes care of bodily injuries and property damage you might inflict on others in an accident.

What is the definition of an insurance premium in Garner, North Carolina?

In the context of Garner, North Carolina, an insurance premium is the regular payment you make to your insurance company. This payment keeps your policy active and ensures you’re covered for the agreed-upon period.

For more information, explore our informative “Auto Insurance Coverage” page.

How much does car insurance cost in Garner, North Carolina?

The price tag on car insurance in Garner, North Carolina, isn’t one-size-fits-all. It can range from a few hundred to several thousand dollars annually, depending on factors like your age, driving history, and the level of coverage you choose.

What is full coverage insurance in Garner, North Carolina?

Full coverage insurance in Garner, North Carolina, is a comprehensive package that includes liability, comprehensive, and collision coverage. It’s designed to protect you in a wide variety of situations, not just accidents involving other vehicles.

Is it legal to drive without insurance in Garner, North Carolina?

Absolutely not. Driving without insurance in Garner, North Carolina, is illegal. The state mandates that all drivers carry at least the minimum required liability insurance to legally hit the road.

Expand your understanding with our thorough “Types of Auto Insurance” overview.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.