Best Gastonia, North Carolina Auto Insurance in 2025 (Find the Top 10 Companies Here)

Get protected for as low as $48 per month with top picks like Allstate, Geico, and Progressive, providing the best Gastonia, North Carolina auto insurance. They provide affordable rates and personalized service, meeting the diverse needs of Gastonia drivers from historic streets to Crowders Mountain trails.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Gastonia NC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage in Gastonia NC

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Gastonia NC

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews

The three best Gastonia, North Carolina auto insurance companies are Allstate, Geico, and Progressive starting at $48/month. They offer good rates, solid coverage, and reliable service. Allstate has tailored policies and a straightforward app.

Knowing the ins and outs of Gastonia, North Carolina auto insurance is essential for keeping your wallet as safe as your ride, whether you are a seasoned road warrior or a first-time driver.

Our Top 10 Company Picks: Best Gastonia, North Carolina Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 22% A++ Affordable Rates Geico

#2 15% B Personalized Service State Farm

#3 13% A+ Safe-Driving Discount Nationwide

#4 12% A+ Snapshot Program Progressive

#5 14% A Online Tools Liberty Mutual

#6 11% A+ Accident Forgiveness Allstate

#7 10% A+ Local Agents Farmers

#8 9% A++ Comprehensive Coverage Travelers

#9 17% A+ Roadside Assistance Erie

#10 20% A++ Military Families USAA

Find your cheapest car insurance quotes in Gastonia, NC by entering your ZIP code above into our free comparison tool.

- Demographic characteristics that might influence auto insurance premiums

- Car insurance in Gastonia, NC has some mandatory regulations

- Policyholders with higher credit scores may benefit from more favorable rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Commuter-Focused Savings: Tailored rates for Gastonia’s 24.8-minute average commute, with potential discounts for frequent local drivers.

- Technology-Driven Discounts: App-based rewards for safe driving habits, reflecting Gastonia’s modernizing infrastructure.

- Community Engagement Initiatives: Local support programs aligned with Gastonia’s civic engagement history. Check Geico auto insurance review for a thorough examination of their policies.

Cons

- Urban Density Pricing: Higher premiums for central Gastonia residents due to increased traffic density.

- Limited Classic Vehicle Coverage: Restricted options for vintage car enthusiasts in this historically rich area.

#2 – State Farm: Best for Personalized Service

Pros

- Residential Integration Policies: Specialized coverage linking homeowners insurance in Gastonia, NC and auto protection.

- Local Industry Support: Tailored packages for Gastonia’s diverse business sectors, from traditional to emerging industries.

- Civic Employee Considerations: Unique policies for municipal workers, recognizing Gastonia’s public service sector. See State Farm auto insurance review for a guide to their insurance options.

Cons

- Historical Property Complexities: Potentially higher rates for residences in Gastonia’s older districts.

- Digital Service Limitations: Less advanced online tools compared to some competitors in this growing tech market.

#3 – Nationwide: Best for Safe-Driving Discount

Pros

- Environmental Incentive Program: Discounts for eco-friendly vehicles, supporting Gastonia’s green initiatives.

- Urban Incident Forgiveness: Accident forgiveness tailored to Gastonia’s busy commercial areas. Get in-depth information in Nationwide auto insurance review for a thorough understanding of their policies.

- Historical Vehicle Specialization: Dedicated coverage options for classic cars, reflecting Gastonia’s rich automotive heritage.

Cons

- New Resident Policy Challenges: Complex procedures for recent transplants to Gastonia.

- Suburban Coverage Limitations: Restricted options for residents in Gastonia’s expanding outskirts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Snapshot Program

Pros

- Usage-Based Premium Adjustments: Rates based on actual mileage, ideal for Gastonia’s varied commuting patterns.

- Gig Economy Coverage: Comprehensive policies for rideshare drivers in Gastonia’s growing service sector. Get all the details you need in Progressive auto insurance review for a look at their offerings.

- Educational Institution Partnerships: Student-friendly policies recognizing Gastonia’s proximity to multiple colleges.

Cons

- Urban Development Rate Fluctuations: Potentially volatile premiums in Gastonia’s rapidly evolving downtown areas.

- Inter-City Commuter Limitations: Restricted multi-city coverage for students and workers commuting beyond Gastonia.

#5 – Liberty Mutual: Best for Online Tools

Pros

- Enhanced Natural Disaster Protection: Comprehensive coverage addressing Gastonia’s diverse geographical risks.

- Long-Term Resident Benefits: Loyalty programs for established Gastonia community members. Discover the full range of coverage options with our detailed Liberty Mutual auto insurance review.

- Local Tourism Integration: Unique savings related to Gastonia’s historical and cultural attractions.

Cons

- Urban Renewal Pricing Instability: Fluctuating rates in areas undergoing significant development.

- Event-Specific Coverage Gaps: Less protection during Gastonia’s major local events and peak seasons.

#6 – Allstate: Best for Accident Forgiveness

Pros

- Community-Based Discount Program: Incentives fostering local connections within Gastonia’s neighborhoods. Review all the important details on Allstate auto insurance review for a guide.

- Multi-Modal Transportation Coverage: Enhanced options for cyclists and pedestrians in Gastonia’s developing urban areas.

- Motorsports Enthusiast Policies: Specialized coverage recognizing the region’s automotive sporting heritage.

Cons

- Inter-Municipal Policy Complexities: Challenges for drivers frequently crossing Gastonia’s city boundaries.

- Urban Redevelopment Claim Processes: Potential complications during ongoing infrastructure improvements in Gastonia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Urban Agriculture Vehicle Coverage: Specialized policies supporting Gastonia’s local food production initiatives. Discover more in Farmers auto insurance review for full details on their coverage.

- Industrial Transition Protection: Tailored coverage for businesses evolving from traditional to modern sectors in Gastonia.

- Educational Partnership Discounts: Rate reductions for participants in local museum and educational programs.

Cons

- Interstate Commuter Rate Adjustments: Potentially higher premiums for frequent I-85 corridor users.

- Metropolitan Area Parking Limitations: Restricted coverage for vehicles in Gastonia’s revitalized urban center.

#8 – Travelers: Best for Comprehensive Coverage

Pros

- International Business Travel Coverage: Enhanced protection for Gastonia’s globally connected workforce. For a complete overview, read Travelers auto insurance review for detailed information.

- Recreational Vehicle Safeguards: Specialized policies for outdoor enthusiasts accessing Gastonia’s natural attractions.

- Innovation Sector Support: Customized coverage for startups operating in Gastonia’s repurposed historical buildings.

Cons

- Demographic Shift Policy Adaptations: Potentially complex procedures for new residents in Gastonia’s changing communities.

- Limited Local Representative Presence: Reduced in-person service options in Gastonia’s insurance market.

#9 – Erie: Best for Roadside Assistance

Pros

- Civic Engagement Coverage: Tailored policies for community organizers and volunteers in Gastonia. For an extensive guide, see Erie auto insurance review for full coverage details.

- Aquatic Recreation Protection: Specialized coverage for water sports enthusiasts utilizing Gastonia’s waterways.

- Local Culinary Industry Support: Unique policies for food service vehicles, recognizing Gastonia’s gastronomic landmarks.

Cons

- Metropolitan Commuter Rate Variations: Potential premium increases for frequent travelers to nearby urban centers.

- Digital Platform Limitations: Inferior online services relative to competitors within the dynamic technological environment of Gastonia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Families

Pros

- Military Community Rate Advantage: Superior pricing and services for Gastonia’s significant veteran and active-duty population.

- Inter-Base Transition Coverage: Seamless policies for service members moving between Gastonia and regional military installations.

- Veteran Reintegration Programs: Specialized services facilitating military members’ return to civilian life in Gastonia. Read USAA auto insurance review for a detailed look at what they offer.

Cons

- Restricted Eligibility: Limited accessibility for non-military Gastonia residents despite competitive rates.

- Historical Residence Underwriting Challenges: Complex policy formulation for properties in Gastonia’s heritage districts.

Comprehensive Auto Insurance in Gastonia, North Carolina

When it comes to comprehensive auto insurance in Gastonia, North Carolina, residents have a variety of providers and coverage levels to choose from. This bustling city, known for its rich textile history and modern amenities, presents unique driving conditions that impact insurance rates.

Let’s examine the monthly premiums offered by various insurance companies in Gastonia, comparing both minimum and full coverage options to help you make an informed decision.

Gastonia, North Carolina Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $56 $132

Erie $50 $123

Farmers $54 $130

Geico $50 $120

Liberty Mutual $58 $135

Nationwide $52 $125

Progressive $53 $128

State Farm $55 $130

Travelers $51 $127

USAA $48 $115

Gastonia is a beautiful city in North Carolina that offers different auto insurance policies to its citizens. Now let us look at the demographic characteristics that might influence auto insurance premiums in this progressive city.

Gastonia, North Carolina Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $463 | $463 | $381 | $381 | $1,101 | $1,101 | $473 | $473 |

| Geico | $232 | $228 | $229 | $225 | $429 | $426 | $204 | $203 |

| Liberty Mutual | $173 | $173 | $179 | $179 | $310 | $310 | $173 | $173 |

| Nationwide | $225 | $225 | $225 | $225 | $388 | $388 | $225 | $225 |

| Progressive | $168 | $168 | $154 | $154 | $399 | $399 | $187 | $187 |

| State Farm | $249 | $249 | $216 | $216 | $369 | $369 | $308 | $216 |

| Travelers | $430 | $430 | $256 | $256 | $250 | $250 | $248 | $248 |

There is therefore the need for Gastonia drivers to understand the basics of how certain variables like age, gender, and marital status affect the premiums of their insurance.

Auto Insurance Costs in Gastonia, NC by ZIP Code

Location within Gastonia can affect your auto insurance premiums. Insurers consider factors like traffic density, accident rates, and crime statistics specific to each ZIP code. there are some top 28054 car insurance in our article titled “Best States for Affordable DUI Auto Insurance.”

Gastonia, North Carolina Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 28052 | $285 |

| 28054 | $287 |

| 28056 | $272 |

This localized approach to risk assessment means that even within the city, rates can vary depending on where you park your car overnight. Once you know where you are moving, feel free to compare and ask for discounts from insurers, as illustrated in the chart below:

Make sure that you contact your insurance broker and inquire about the discounts that are available to you.

Driving Habits Influence Auto Insurance Rates in Gastonia, NC

The length of your daily drive impacts your auto insurance costs in Gastonia. Insurers typically charge higher premiums for longer commutes due to increased time on the road and higher accident risk.

Gastonia, North Carolina Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $604 | $604 |

| Geico | $272 | $272 |

| Liberty Mutual | $209 | $209 |

| Nationwide | $266 | $266 |

| Progressive | $227 | $227 |

| State Farm | $285 | $286 |

| Travelers | $296 | $296 |

Whether you’re a short-distance driver or regularly travel longer routes, your commute distance is a key factor in determining your insurance rates.

Auto Insurance Factors in Gastonia, North Carolina

Local insurers scrutinize past incidents such as accidents, traffic violations, and DUIs when calculating rates. Safe drivers often enjoy lower premiums, while those with infractions may face higher costs.

Gastonia, North Carolina Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $327 | $580 | $442 | $1,070 |

| Geico | $144 | $215 | $200 | $528 |

| Liberty Mutual | $125 | $160 | $160 | $390 |

| Nationwide | $157 | $203 | $203 | $502 |

| Progressive | $109 | $158 | $153 | $489 |

| State Farm | $151 | $220 | $220 | $551 |

| Travelers | $175 | $232 | $227 | $550 |

Knowing what this means can help drivers in Gastonia make better driving practices and select the appropriate insurance.

Compare Rates by Credit History in Gastonia, NC

Policyholders with higher credit scores may benefit from more favorable rates, highlighting the importance of maintaining good credit alongside safe driving habits.

Gastonia, North Carolina Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $814 | $532 | $468 |

| Geico | $293 | $271 | $251 |

| Liberty Mutual | $209 | $209 | $209 |

| Nationwide | $266 | $266 | $266 |

| Progressive | $255 | $222 | $204 |

| State Farm | $401 | $256 | $199 |

| Travelers | $317 | $288 | $284 |

Credit scores play a role in determining auto insurance rates for Gastonia drivers. While controversial, this practice is common among insurers who view credit history as an indicator of risk.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Gastonia, NC Auto Insurance: Local Factors and Commute Times

There are a lot of reasons why auto insurance rates in Gastonia, North Carolina are higher or lower than in other cities. These include traffic and the number of vehicle thefts in Gastonia, North Carolina. Many local factors may affect your Gastonia auto insurance rates.

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Gastonia, North Carolina commute length is 24.8 minutes according to City-Data.

Read More: Most Dangerous and Safest States for Drivers

Gastonia, NC Auto Insurance Requirements

Gastonia is a city in North Carolina with a dynamic population, a lot of history and much more. Like the rest of the state, Gastonia has set some mandatory car insurance regulations that drivers are required to meet in order to be on the road.

In Gastonia North Carolina for instance, it is mandatory to have minimum auto insurance cover.Michelle Robbins Licensed Insurance Agent

The state requires drivers to obtain liability insurance coverage that covers bodily injury as well as property damage. For bodily injury liability, drivers have to have at least $30,000 for each wounded person and $60,000 for all wounded people in one accident. Furthermore, property damage liability coverage of not less than $25,000 is obligatory.

Read More: What do the three numbers on auto insurance mean?

To find out if you can get the best cheap car insurance in Gastonia, NC enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

Can I transfer my out-of-state auto insurance policy to Gastonia, NC?

If you are moving to Gastonia, NC, you will need to update your auto insurance policy to comply with North Carolina’s state requirements. Some insurance providers may offer a transitional period during which they can help you transfer your existing coverage or assist in finding a new policy that meets the state regulations.

Read More: How to Change Auto Insurance When Moving Out of State

What is a deductible in auto insurance?

A deductible in auto insurance is the amount of money you agree to pay out of your pocket toward a claim before your insurance provider starts covering the remaining costs. For instance, if your deductible is $500 and you file a claim for $2,000, you would pay the first $500, while your insurer would cover the remaining $1,500.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheapest car insurance in Gastonia, NC.

What steps should I take after a car accident in Gastonia, NC?

If you are involved in a car accident in Gastonia, NC, you should immediately ensure your safety and the safety of others involved. Call 911 to report the accident and get medical assistance if needed. Exchange insurance and contact information with the other parties, document the scene with photos, and notify your insurance company to file a claim as soon as possible.

Can my auto insurance policy be canceled or non-renewed?

Yes, under certain circumstances, your insurance provider may cancel or refuse to renew your auto insurance policy. Common reasons include non-payment of premiums, a record of frequent claims, or failing to meet the insurer’s underwriting guidelines. For more information on how to prevent these circumstances, see our article “What to Do if You Can not Pay Your Auto Insurance.”

How are auto insurance premiums determined in Gastonia, NC?

Auto insurance in Gastonia, NC premiums are determined by several factors, including your driving record, age, gender, vehicle type, coverage limits, deductible amounts, and eligibility for any discounts. Insurance companies use this information to assess your risk level and calculate your insurance premium.

What should I consider when choosing auto insurance coverage in Gastonia, NC?

When selecting auto insurance coverage in Gastonia, NC, consider factors such as the type and level of coverage that suits your needs, the cost of premiums, available discounts, the insurer’s customer service reputation, and the insurer’s claims process. Make sure the coverage you choose aligns with your driving habits, financial situation, and personal risk tolerance.

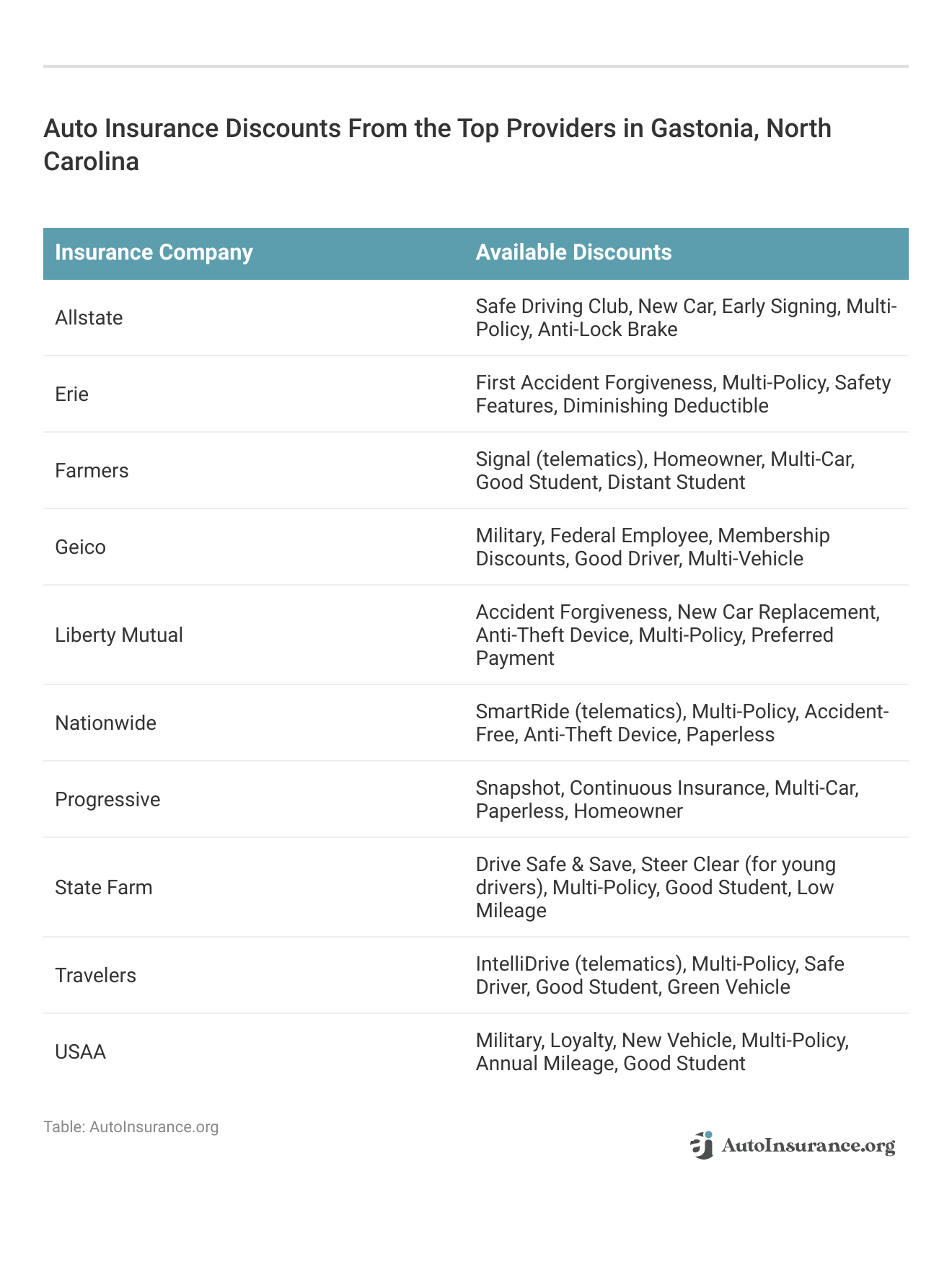

Are there specific discounts available for Gastonia drivers?

Yes, many insurance companies offer various discounts for Gastonia drivers, such as safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features. Be sure to ask car insurance agents in Gastonia, NC about any discounts you may qualify for to help lower your insurance premiums.

Does my credit score affect my auto insurance rates in Gastonia, NC?

In Gastonia, NC, your credit score can influence your auto insurance rates. Insurance companies often consider credit scores as part of their risk assessment process, viewing them as an indicator of a policyholder’s reliability and likelihood to file claims. Maintaining a good credit score can help you qualify for lower auto insurance quotes in Gastonia, NC.

Read More: Does not paying your auto insurance affect credit?

What are the minimum auto insurance requirements in Gastonia, NC?

In Gastonia, NC, drivers must carry liability insurance that includes bodily injury and property damage coverage. The state minimum requirements are $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage per accident. It is important to ensure that your policy meets or exceeds these minimum coverage requirements to comply with state laws.

What should I know about high-risk drivers and auto insurance in Gastonia, NC?

High-risk drivers, such as those with a history of accidents, traffic violations, or DUIs, may face higher insurance premiums in Gastonia, NC. If you are considered a high-risk driver, you may benefit from enrolling in a defensive driving course or maintaining a clean driving record to reduce your premiums over time. Some insurers also offer specific policies designed for high-risk drivers.

Uncover affordable best car insurance rates in Gastonia, NC from the top providers by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.