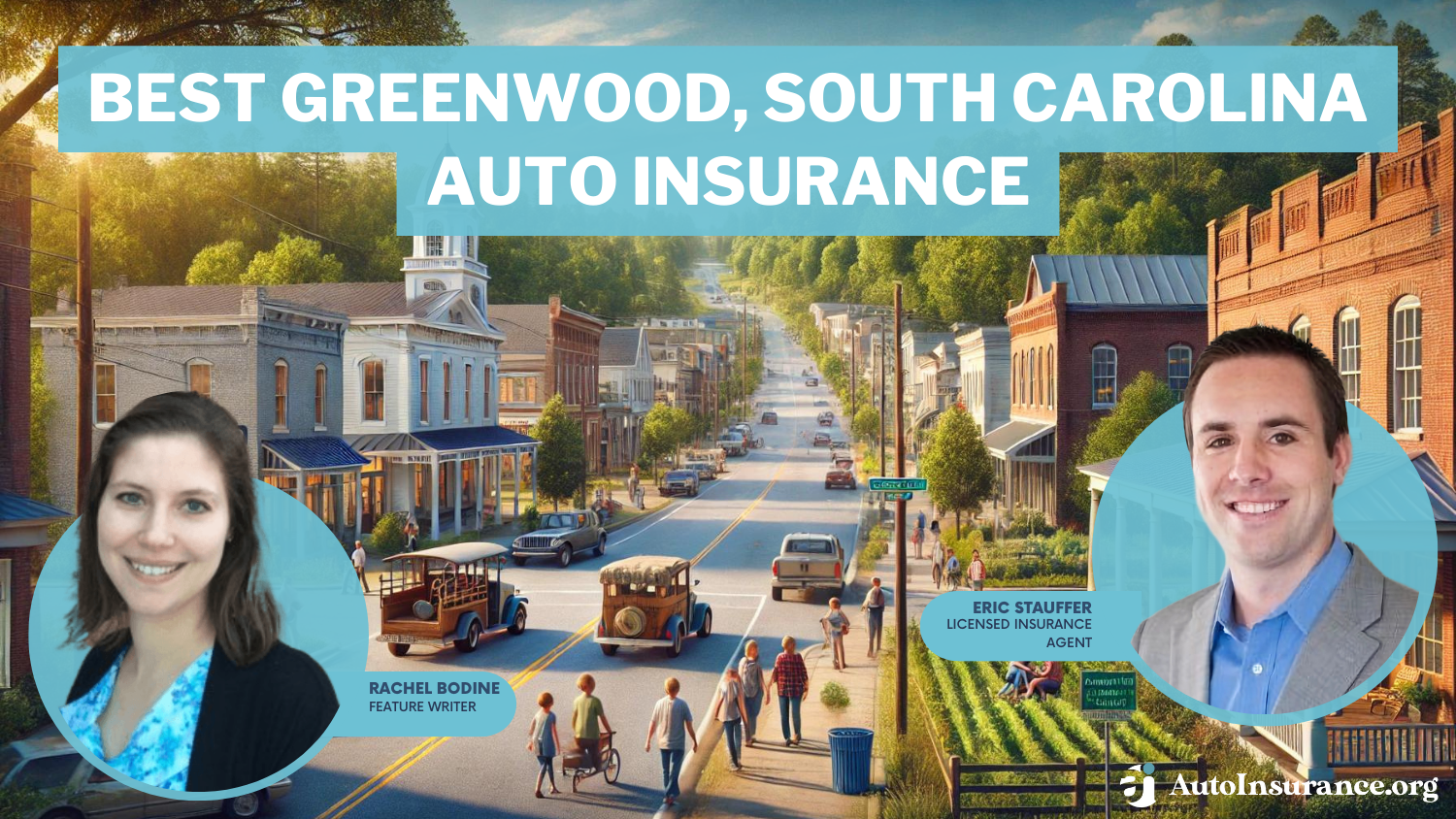

Best Greenwood, South Carolina Auto Insurance in 2025 (Compare the Top 10 Companies)

USAA, Allstate, and Travelers offer the best Greenwood, South Carolina auto insurance, with rates starting at $38/month. USAA leads in customer service, Allstate excels in coverage options, and Travelers provides competitive pricing, making them the top choices for the best Greenwood, South Carolina auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Greenwood SC

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Greenwood SC

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Greenwood SC

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsUSAA, Allstate, and Travelers emerge as the top providers for the best Greenwood, South Carolina auto insurance, offering a combination of competitive rates, robust coverage options, and strong customer service.

USAA leads with affordable premiums and excellent customer service, making it ideal for military members and their families. Allstate and Travelers also offer strong coverage options with customizable policies, ensuring value for diverse requirements.

Our Top 10 Company Picks: Best Greenwood, South Carolina Auto Insurance

| Company | Rank | Good Student Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | A++ | Military Benefits | USAA | |

| #2 | 7% | A+ | Customized Policies | Allstate | |

| #3 | 8% | A++ | Specialized Coverage | Travelers | |

| #4 | 6% | A+ | Competitive Rates | Progressive | |

| #5 | 11% | A | Claims Service | American Family | |

| #6 | 7% | B | Financial Strength | State Farm | |

| #7 | 8% | A++ | Coverage Options | Geico | |

| #8 | 9% | A+ | Accident Forgiveness | Nationwide |

| #9 | 9% | A | Online Tools | Safeco | |

| #10 | 10% | A | Add-on Coverages | Liberty Mutual |

With their proven track record, they stand out as the best choices for drivers seeking quality and value in auto insurance coverage.

Before you buy Greenwood, South Carolina auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Greenwood, South Carolina auto insurance quotes.

- USAA provides the best Greenwood, South Carolina auto insurance for $110/month

- Local residents can find affordable, tailored coverage from Allstate and Travelers

- Greenwood’s driving factors impact auto insurance rates and coverage choices

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Military Benefits: USAA offers tailored benefits for military personnel, making it one of the best Greenwood, South Carolina auto insurance providers for those in the armed forces.

- Competitive Rates for Military Families: USAA delivers competitive rates, providing excellent value for military members seeking the best Greenwood, South Carolina auto insurance. Learn more in our USAA auto insurance review.

- Excellent claims service: USAA’s prompt claims handling ensures a smooth experience for policyholders in Greenwood, South Carolina needing the best auto insurance coverage.

Cons

- Restricted Eligibility: USAA is not available to the general public, limiting access for non-military residents looking for the best Greenwood, South Carolina auto insurance.

- Fewer Local Agents: USAA’s lack of local agents in Greenwood, South Carolina may be inconvenient for those preferring in-person assistance.

#2 – Allstate: Best for Customized Policies

Pros

- Customized Policies: Based on our Allstate auto insurance review, the company allow drivers to customize their policies, providing one of the best Greenwood, South Carolina auto insurance options for unique coverage needs.

- Comprehensive Roadside Assistance: Allstate offers a well-rounded roadside assistance program, which is ideal for drivers in Greenwood, South Carolina seeking the best auto insurance support.

- Variety of Discounts : Allstate offers various discounts, making it a solid choice for those looking for affordable yet the best Greenwood, South Carolina auto insurance.

Cons

- Higher Premium Rates: Allstate’s customized policies may result in higher premiums, making it less cost-effective for some residents seeking the best Greenwood, South Carolina auto insurance.

- Mixed Customer Service Reviews: Allstate’s customer service can vary, potentially causing issues for drivers in Greenwood, South Carolina searching for reliable auto insurance.

#3 – Travelers: Best for Specialized Coverage

Pros

- Specialized Coverage: Travelers provides specialized coverage options, making it one of the best Greenwood, South Carolina auto insurance providers for drivers with specific needs.

- Accident Forgiveness: Travelers offers accident forgiveness, helping drivers in Greenwood, South Carolina maintain the best auto insurance rates after a mishap.

- Solid Online Tools: Travelers provides easy-to-use digital tools, ideal for managing the best Greenwood, South Carolina auto insurance policy from anywhere. See more details on our Travelers auto insurance review.

Cons

- Higher Costs for Certain Add-Ons: Travelers may charge more for additional coverage, making it less affordable for those looking for the best Greenwood, South Carolina auto insurance.

- Fewer Local Agents: Travelers may lack local agents in Greenwood, South Carolina, which could be a drawback for those preferring face-to-face assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: Progressive’s affordable pricing makes it one of the best Greenwood, South Carolina auto insurance providers for budget-conscious drivers. Detailed information can be found in our Progressive auto insurance review.

- Snapshot Program for Discounts: Progressive offers the Snapshot program, helping safe drivers in Greenwood, South Carolina get the best auto insurance rates based on driving habits.

- Variety of Coverage Options: Progressive provides a wide range of coverage options, ensuring drivers in Greenwood, South Carolina have access to the best auto insurance choices.

Cons

- Rates May Increase at Renewal: Some Progressive policyholders in Greenwood, South Carolina have reported rate increases upon renewal, impacting those seeking consistent best auto insurance prices.

- Less Personalized Customer Service: Progressive’s online-first approach may result in less personalized service for those in Greenwood, South Carolina who prefer a local agent for their auto insurance.

#5 – American Family: Best for Claims Service

Pros

- Top Claims Support: American Family is recognized for its efficient claims process, making it one of the best Greenwood, South Carolina auto insurance companies for handling claims quickly.

- Wide Range of Discounts: American Family provides various discounts, allowing drivers in Greenwood, South Carolina to access the best auto insurance savings. Explore further in our American Family auto insurance review.

- Flexible Payment Options: American Family offers flexible payment options, which is ideal for policyholders in Greenwood, South Carolina seeking the best auto insurance plans that suit their budget.

Cons

- Limited Coverage Areas: American Family’s policies may not be available in all parts of South Carolina, reducing accessibility for residents looking for the best Greenwood auto insurance.

- Higher Premiums for Certain Drivers: Some drivers in Greenwood, South Carolina may face higher premiums, making it less affordable for those seeking the best auto insurance rates.

#6 – State Farm: Best for Financial Strength

Pros

- National Coverage Advantage: State Farm’s wide availability across the U.S. makes it a solid choice for the best Greenwood, South Carolina auto insurance, ensuring access to a trusted provider.

- Local Agents Available: State Farm offers personalized service through local agents, which is great for Greenwood, South Carolina residents seeking the best in-person auto insurance assistance.

- Comprehensive Coverage Options: State Farm provides a variety of coverage options, making it one of the best Greenwood, South Carolina auto insurance providers for full protection. View additional details in our State Farm auto insurance review.

Cons

- Lower Financial Stability: State Farm’s B rating may raise concerns for Greenwood, South Carolina residents looking for the best auto insurance backed by stronger financial security.

- Fewer Specialized Coverages: State Farm may offer fewer specialized coverages, limiting options for those seeking more tailored best Greenwood, South Carolina auto insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Coverage Options

Pros

- Diverse Coverage Options: According to our Geico auto insurance review, the company provides a wide variety of coverage options, making it one of the best Greenwood, South Carolina auto insurance companies for customizable plans.

- Competitive Rates for Most Drivers: Geico’s competitive pricing makes it a strong contender for the best Greenwood, South Carolina auto insurance for those seeking affordable rates.

- Strong Digital Experience: Geico’s easy-to-use online platform offers one of the best Greenwood, South Carolina auto insurance experiences for managing policies and claims digitally.

Cons

- Fewer Local Agents: Geico primarily operates online, which may not be ideal for residents in Greenwood, South Carolina seeking in-person support for their auto insurance needs.

- Less Personalized Service: With its focus on digital interaction, Geico may not offer the best Greenwood, South Carolina auto insurance experience for drivers who prefer face-to-face assistance.

#8 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness Benefits: Nationwide offers accident forgiveness, helping drivers in Greenwood, South Carolina maintain the best auto insurance rates after their first at-fault accident. Access full details in our Nationwide auto insurance review.

- Vanishing Deductible Feature: Nationwide’s vanishing deductible is a standout feature, making it one of the best Greenwood, South Carolina auto insurance options for drivers who value savings.

- Comprehensive Coverage: Nationwide offers a variety of coverage options, providing one of the best Greenwood, South Carolina auto insurance solutions for comprehensive protection.

Cons

- Higher Premiums for Added Features: Nationwide’s accident forgiveness and vanishing deductible features may lead to higher costs for Greenwood, South Carolina residents seeking the best auto insurance.

- Limited Discount Availability: Some discounts may not be available in Greenwood, South Carolina, reducing savings opportunities for drivers seeking the best auto insurance rates.

#9 – Safeco: Best for Online Tools

Pros

- Advanced Digital Features: Safeco offers excellent online tools for managing policies and claims, making it one of the best Greenwood, South Carolina auto insurance providers for tech-savvy drivers.

- Flexible Coverage Options: Safeco’s range of coverage options provides flexibility, allowing Greenwood, South Carolina drivers to select the best auto insurance plan for their needs. Discover more in our Safeco auto insurance review.

- Convenient Digital Claims Process: Safeco’s digital claims process makes it easier for residents of Greenwood, South Carolina to handle their best auto insurance claims quickly and efficiently.

Cons

- Fewer Local Agents: Safeco’s focus on digital tools means fewer local agents in Greenwood, South Carolina, which may not appeal to drivers seeking more personalized auto insurance service.

- Higher Premiums for Certain Coverages: Safeco may charge higher premiums for specific coverage options, impacting those in Greenwood, South Carolina seeking affordable yet the best auto insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Add-on Coverages

Pros

- Exceptional Add-On Options: Liberty Mutual provides a variety of add-ons, making it one of the best Greenwood, South Carolina auto insurance options for drivers seeking additional protection.

- Convenient Online Policy Management: As outlined by our Liberty Mutual auto insurance review, the company offers an easy-to-use online platform, making it simple for Greenwood, South Carolina drivers to manage the best auto insurance policies digitally.

- Comprehensive Accident Forgiveness: Liberty Mutual’s accident forgiveness feature helps Greenwood, South Carolina residents avoid premium increases after their first accident.

Cons

- Higher Premiums for Customized Policies: Liberty Mutual’s wide range of add-on coverages may lead to higher premiums for drivers in Greenwood, South Carolina seeking the best auto insurance.

- Limited Discount Availability in Some Areas: Some discounts may not be offered in Greenwood, South Carolina, reducing savings opportunities for those seeking the best auto insurance rates.

Minimum Auto Insurance in Greenwood, South Carolina

In Greenwood, South Carolina, drivers are required to meet minimum auto insurance standards to ensure financial responsibility in the event of an accident. South Carolina mandates that all drivers carry liability insurance with specific coverage limits.

USAA consistently delivers the best Greenwood, South Carolina auto insurance with unbeatable rates and exceptional service.Brandon Frady Licensed Insurance Producer

This includes Bodily Injury Liability Coverage of at least $25,000 per person and $50,000 per accident, as well as Property Damage Liability Coverage with a minimum of $25,000. These requirements are intended to offer fundamental protection for both the insured and others involved in an accident, covering basic costs associated with injuries and property damage.

Greenwood, South Carolina Auto Insurance Monthly Rates by Coverage Level & Providers

Insurance Company Minimum Coverage Full Coverage

Allstate $48 $115

American Family $46 $125

Geico $40 $130

Liberty Mutual $50 $145

Nationwide $47 $135

Progressive $43 $125

Safeco $45 $140

State Farm $52 $130

Travelers $44 $120

USAA $38 $110

The table displays the monthly auto insurance rates for Greenwood, South Carolina, categorized by coverage level and provider. It compares the costs of minimum and full coverage insurance from ten companies, including Allstate, Geico, and USAA. Rates for minimum coverage range from $38 to $52, while full coverage rates vary from $110 to $145.

This table outlines auto insurance discounts offered by leading providers in Greenwood, South Carolina. It lists ten insurance companies alongside their available discounts, highlighting options like multi-policy discounts, safe driver discounts, and specific incentives for new cars and hybrid vehicles.

Greenwood, South Carolina Auto Insurance by Age, Gender, and Marital Status

In Greenwood, South Carolina, auto insurance premiums vary significantly based on age, gender, and marital status. This overview illustrates how these demographic factors influence monthly insurance costs with data from leading providers.

Greenwood, South Carolina Auto Insurance Monthly Rates by Provider, Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $515 | $660 | $220 | $239 | $197 | $197 | $189 | $189 |

| American Family | $530 | $660 | $205 | $225 | $180 | $185 | $170 | $175 |

| Farmers | $533 | $587 | $222 | $223 | $204 | $205 | $195 | $212 |

| Geico | $396 | $405 | $188 | $193 | $161 | $161 | $147 | $147 |

| Liberty Mutual | $590 | $700 | $240 | $250 | $210 | $215 | $190 | $195 |

| Nationwide | $462 | $593 | $216 | $235 | $191 | $194 | $173 | $179 |

| Progressive | $669 | $736 | $186 | $193 | $163 | $150 | $140 | $146 |

| State Farm | $470 | $590 | $182 | $205 | $162 | $162 | $147 | $147 |

| Travelers | $550 | $680 | $230 | $240 | $200 | $205 | $180 | $185 |

| USAA | $556 | $609 | $180 | $189 | $137 | $138 | $126 | $126 |

Understanding how age, gender, and marital status influence auto insurance rates in Greenwood, South Carolina, helps in making informed decisions when selecting a policy. With varying costs from different providers, it’s essential to compare options to find the most affordable coverage tailored to your demographic profile.

By evaluating these rates, you can better manage your insurance expenses and secure the best deal for your situation.

Greenwood, South Carolina Auto Insurance for Teen Drivers

Securing affordable auto insurance for teen drivers in Greenwood, South Carolina, can be a daunting task. Rates vary significantly between providers and are influenced by factors such as gender. Here’s a breakdown of the average monthly auto insurance rates for 17-year-old drivers in Greenwood, offering insight into which companies provide the best value.

Greenwood, South Carolina Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $515 | $660 |

| American Family | $530 | $660 |

| Farmers | $533 | $587 |

| Geico | $396 | $405 |

| Liberty mutual | $590 | $700 |

| Nationwide | $462 | $593 |

| Progressive | $669 | $736 |

| State Farm | $470 | $590 |

| Travelers | $550 | $680 |

| USAA | $556 | $609 |

This table provides a clear comparison of the average monthly rates for 17-year-old drivers by gender, helping you understand the reasons auto insurance costs more for young drivers and make an informed decision on the most cost-effective insurance options in Greenwood.

Greenwood, South Carolina Auto Insurance for Seniors

Senior drivers in Greenwood, South Carolina, can find a range of auto insurance options that cater to their needs. Rates for seniors vary based on gender and provider, with significant differences between companies. Here’s a snapshot of the annual average monthly rates for drivers aged 60 in Greenwood:

Greenwood, South Carolina Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $189 | $189 |

| Farmers | $195 | $212 |

| Geico | $147 | $147 |

| Nationwide | $173 | $179 |

| Progressive | $140 | $146 |

| State Farm | $147 | $147 |

| USAA | $126 | $126 |

| American Family | $170 | $175 |

| Liberty Mutual | $190 | $195 |

| Travelers | $180 | $185 |

The average monthly premiums for auto insurance in Greenwood, South Carolina, show a clear range of costs for seniors. For those seeking the most affordable coverage, the lowest rates are available, with several options offering competitive pricing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Greenwood, South Carolina Auto Insurance By Driving Record

Driving record has a big impact on your auto insurance rates. See the annual auto insurance rates for a bad record in Greenwood, South Carolina compared to the annual auto insurance rates with a clean record in Greenwood, South Carolina. For a comprehensive overview, explore our detailed resource titled “How Auto Insurance Companies Check Driving Records.”

Greenwood, South Carolina Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $227 | $359 | $318 | $300 |

| American Family | $230 | $325 | $410 | $280 |

| Farmers | $249 | $344 | $286 | $311 |

| Geico | $172 | $222 | $334 | $172 |

| Liberty Mutual | $270 | $395 | $485 | $325 |

| Nationwide | $224 | $288 | $362 | $246 |

| Progressive | $245 | $355 | $297 | $295 |

| State Farm | $234 | $288 | $256 | $256 |

| Travelers | $240 | $330 | $420 | $295 |

| USAA | $203 | $251 | $349 | $228 |

These rates demonstrate the significant impact that driving history has on auto insurance premiums in Greenwood, South Carolina. A clean driving record generally results in lower insurance costs, while accidents, DUIs, and traffic tickets lead to higher rates.

By comparing the monthly premiums for various driving records across different insurance providers, you can identify which company offers the best coverage for your specific situation. Understanding these variations can guide you in selecting an insurance provider that aligns with your needs and budget, ensuring you receive the best possible rates based on your driving history.

Greenwood, South Carolina Auto Insurance Rates After a DUI

Securing affordable auto insurance in Greenwood, South Carolina, following a DUI can be challenging. Comparing annual rates for DUI auto insurance in the area helps identify the most cost-effective options available. Here are the monthly rates from several top insurers for those with a DUI on their record:

Greenwood, South Carolina DUI Auto Insurance Monthly Rates by Provider

| Company | Rates |

|---|---|

| Allstate | $318 |

| American Family | $310 |

| Farmers | $286 |

| Geico | $334 |

| Liberty Mutual | $375 |

| Nationwide | $362 |

| Progressive | $297 |

| State Farm | $256 |

| Travelers | $330 |

| USAA | $349 |

This comparison highlights the variance in monthly premiums across different insurers, enabling you to make an informed decision on securing the best and most cost-effective auto insurance after a DUI.

Greenwood, South Carolina Auto Insurance By Credit History

Credit history significantly impacts auto insurance rates in Greenwood, South Carolina. Insurance companies use credit scores to gauge risk, influencing the premiums you pay. To help you find the most affordable coverage, we’ve compared annual auto insurance rates for different credit histories across various providers. Here’s how rates vary based on your credit score:

Greenwood, South Carolina Auto Insurance by Provider & Credit History

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $377 | $285 | $240 |

| American Family | $350 | $290 | $250 |

| Farmers | $342 | $288 | $263 |

| Geico | $342 | $184 | $147 |

| Liberty Mutual | $415 | $320 | $280 |

| Nationwide | $333 | $270 | $238 |

| Progressive | $332 | $291 | $271 |

| State Farm | $371 | $226 | $178 |

| Travelers | $385 | $305 | $265 |

| USAA | $402 | $197 | $173 |

Comparing these rates offers valuable insight into how your credit history influences auto insurance costs in Greenwood. Understanding this relationship allows you to pinpoint the most budget-friendly insurance options, ensuring you get the best coverage for your needs without overspending.

By assessing these variations, you can make an informed decision and potentially save significantly on your annual premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Greenwood, South Carolina Auto Insurance Rates By ZIP Code

Auto insurance rates by ZIP code in Greenwood, South Carolina can vary. Compare the annual cost of auto insurance by ZIP code in Greenwood, South Carolina to see how car insurance rates are affected by location.

| ZIP | Rate |

|---|---|

| 29646 | $255 |

| 29649 | $252 |

These rates illustrate the differences in auto insurance costs across various areas in Greenwood, South Carolina. Factors such as local risk assessments, population density, and regional insurance claims influence these cost differences. Therefore, understanding how your specific ZIP code affects your insurance rate is crucial for making well-informed decisions about coverage options and potentially finding savings

Greenwood, South Carolina Auto Insurance Rates By Commute

Commute length and annual mileage play crucial roles in determining auto insurance rates in Greenwood, South Carolina. Understanding how annual mileage affects your auto insurance rates can help you find the most economical coverage. To assist you, we have compiled a comparison of monthly insurance rates based on various annual mileage figures.

Greenwood, South Carolina Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $295 | $307 |

| American Family | $265 | $275 |

| Farmers | $298 | $298 |

| Geico | $223 | $226 |

| Liberty Mutual | $310 | $320 |

| Nationwide | $280 | $280 |

| Progressive | $298 | $298 |

| State Farm | $252 | $265 |

| Travelers | $270 | $278 |

| USAA | $255 | $260 |

Selecting the optimal auto insurance in Greenwood, South Carolina, depends on your annual mileage. By comparing these rates, you can choose the best insurance option for your driving needs and potentially save money.

Best By Category: Cheapest Auto Insurance in Greenwood, South Carolina

If you’re searching for the most affordable auto insurance in Greenwood, South Carolina, it’s crucial to compare rates across various providers. The table below highlights the cheapest auto insurance companies in Greenwood, showcasing their rates to help you find the best deal tailored to your needs.

Top Greenwood, South Carolina Auto Insurance Companies

| Company | Rates |

|---|---|

| Allstate | $301 |

| American Family | $270 |

| Farmers | $298 |

| Geico | $225 |

| Liberty Mutual | $320 |

| Nationwide | $280 |

| Progressive | $298 |

| State Farm | $258 |

| Travelers | $275 |

| USAA | $258 |

This comparison provides a clear overview of the most budget-friendly auto insurance options available in Greenwood, South Carolina.

By examining the rates from leading providers, you’ll be able to identify which company offers the best value for your auto insurance needs, ensuring you get comprehensive coverage at a competitive price.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Greenwood, South Carolina?

Auto insurance rates in Greenwood, South Carolina, can vary significantly due to a range of local factors. Key influences include traffic density, local accident rates, and vehicle theft statistics. Additionally, factors such as the prevalence of uninsured drivers, regional weather conditions, and the overall cost of living in Greenwood also play a crucial role.

USAA stands out as the top choice for Greenwood, South Carolina auto insurance, offering affordable rates and reliable coverage.Justin Wright Licensed Insurance Agent

Understanding these elements and other factors affecting auto insurance rates can help you better gauge why your auto insurance rates might differ from those in other areas.

Greenwood Commute Time

Longer commute times are associated with increased insurance costs. In Greenwood, the average commute time is 21.1 minutes, as reported by City-Data. This relatively moderate commute length affects insurance rates, with longer commutes generally leading to higher premiums due to increased risk exposure.

Overall, while Greenwood’s specific factors such as local traffic conditions, vehicle theft rates, and average commute times contribute to its auto insurance rates, they interact with broader regional and national trends. Understanding these elements can help you better navigate insurance options and potentially find ways to lower your premiums.

Compare Greenwood, South Carolina Auto Insurance Quotes

Finding the best auto insurance rates in Greenwood, South Carolina, requires a strategic approach. Start by entering your ZIP code below to obtain free, personalized insurance quotes from various providers. This will allow you to compare multiple offers, each tailored to the specific coverage requirements and pricing available in Greenwood.

By evaluating these quotes, you can identify the most competitive rates and optimal coverage options that best suit your individual needs and budget. Taking the time to compare ensures you secure the most value for your auto insurance investment.

Frequently Asked Questions

How often should I update my Greenwood, South Carolina auto insurance policy?

It’s a good practice to review and update your Greenwood, South Carolina auto insurance policy annually or after major life changes, such as moving, buying a new car, or changes in your driving habits. Regular reviews ensure you have the appropriate coverage and may help you find better rates.

What’s the minimum auto insurance coverage required in Greenwood, South Carolina?

In Greenwood, South Carolina, the minimum auto insurance coverage required includes liability insurance with limits of $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. It’s advisable to consider higher coverage limits for better protection.

For more information, read our article titled “Bodily Injury Liability (BIL) Auto Insurance Defined.”

Is South Carolina a no-fault state?

No, South Carolina does not have the no-fault law in effect. Instead, it follows an at fault model with comparative negligence. This means that so long as you are under 50% responsible for your accident, you can file a claim against the driver that caused your accident.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Why is insurance in South Carolina so expensive?

Car insurance in South Carolina is expensive because drivers are required to have personal injury protection and some drivers can legally drive uninsured if they pay a fee to the state.

Are there specific discounts available for Greenwood, South Carolina auto insurance?

Yes, insurers in Greenwood, South Carolina often offer discounts such as multi-policy discounts, safe driver discounts, and discounts for having anti-theft devices. Check with individual insurers to find out which discounts you may be eligible for.

To expand your knowledge, refer to our comprehensive handbook titled “How to Get an Anti-Theft Auto Insurance Discount.”

What factors influence Greenwood, South Carolina auto insurance rates?

Greenwood, South Carolina auto insurance rates are influenced by factors such as your driving record, the type of vehicle you drive, your age, credit score, and coverage levels. Local factors like crime rates and weather conditions can also impact your premium.

Can you drive without insurance in South Carolina?

Driving without insurance in South Carolina is illegal unless you have paid the $600 uninsured motorist registration fee. The penalties may be severe and costly if you are pulled over or cause an accident while uninsured.

How does my driving history affect my Greenwood, South Carolina auto insurance?

Your driving history significantly impacts your Greenwood, South Carolina auto insurance rates. A clean driving record generally results in lower premiums, while accidents or traffic violations may lead to higher rates.

To gain profound insights, consult our extensive guide titled “How long does a speeding ticket affect your auto insurance rates?”

How can I find the best Greenwood, South Carolina auto insurance policy?

To find the best Greenwood, South Carolina auto insurance policy, compare quotes from multiple insurers, review coverage options, and consider discounts for which you may qualify. Analyzing customer reviews and the financial stability of insurers can also help.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Can my credit score impact my Greenwood, South Carolina auto insurance rates?

Yes, your credit score can impact your Greenwood, South Carolina auto insurance rates. Insurers often use credit scores as a factor in determining premiums, with higher credit scores potentially leading to lower rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.