How the claim is handled is determined by a variety of factors, meaning filing a claim for one person may not be the same for another. That’s why we try to make filing a car insurance claim as simple as possible. We carefully help you through each step so you’re not left wondering if you should be doing something differently.

Learn what you need to know about how to file a claim when you’re not at fault. Looking to find the best auto insurance without penalties for no-fault accidents after filing a claim? Enter your ZIP in our free quote tool to get started.

- Step #1: Check State’s Fault Policy – Find out if your state is a fault or no-fault state

- Step #2: Evaluate Your Policy – Make sure your policy covers the accident

- Step #3: Contact Your Insurance – Contact your insurance company first

- Step #4: Provide Detailed Information – Provide as much accident detail as possible

- Step #5: Keep Track of Medical Bills – Keep track of any injuries from the accident

5 Steps to File a Not-at-Fault Car Insurance Claim

Step #1 – Check Your State’s Fault Policy

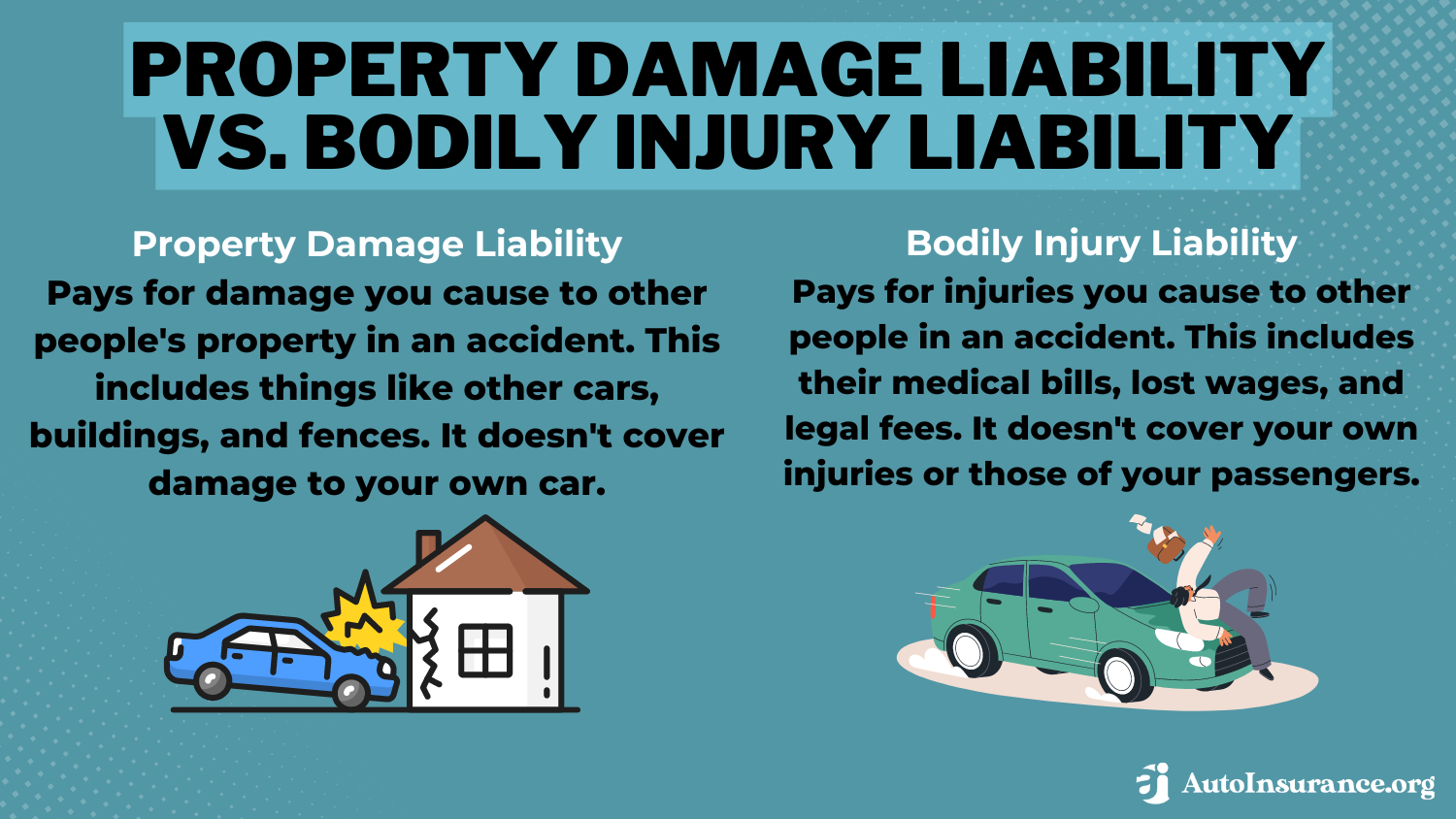

Before filing a claim, ensure you know your state’s auto insurance laws regarding fault. For example, if your accident happens in a fault state — also called a tort state — you may be able to file a claim against the other driver’s property damage or bodily injury liability auto insurance coverages. These coverages will compensate you for your medical bills and damage to your car.

If your accident happens in a no-fault state, however, you can file a claim with your own insurance company for any medical bills. Property damage bills will still be handled through the other driver’s insurance company.

Step #2 – Evaluate Your Policy

Before filing a claim, make sure that your policy actually covers the incident. For example, if a tree fell on your car, you would need a full coverage policy with comprehensive coverage in order for your claim to be covered.

If you don’t have the proper coverage and want to upgrade to a full coverage policy for next time, take a look at the average prices of minimum and full coverage policies at the top providers below.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $65 | $122 |

| Allstate | $87 | $228 |

| Farmers | $76 | $198 |

| Geico | $43 | $114 |

| Liberty Mutual | $96 | $248 |

| Nationwide | $63 | $164 |

| Progressive | $56 | $150 |

| State Farm | $47 | $123 |

| Travelers | $53 | $141 |

| USAA | $32 | $84 |

| U.S. Average | $65 | $170 |

Doublechecking what your policy covers beforehand will make sure you aren’t disappointed by a denied claim (Read More: What to Do if Your Auto Insurance Company Won’t Pay a Claim).

Step #3 – Contact Your Insurance

If you were in an accident with another driver and the police agreed that you were not at fault for the accident, you may feel like you should contact the other driver’s insurance company. However, it would be best if you refrained from doing this because they will be trying to find fault with your statements.

This could influence the swiftness of the claim and your compensation. Instead, contact your insurance company first, not the other driver’s company.

Uh oh! Caught in an auto accident?😱Don’t get run over by the claims process! Learn how to file your claim and get back on the road quickly at https://t.co/27f1xf131D.🚗Find out more information here 👉: https://t.co/Ndz4m4BRIF pic.twitter.com/5cwtCeuTi7

— AutoInsurance.org (@AutoInsurance) April 10, 2023

In addition, the insurance company will test your statements against the other drivers, which will slow down the process. If they offer you a settlement, you will not have your own claims adjuster to help you negotiate.

Not sure how to dispute an auto insurance claim against another driver’s company? Contact your own insurance company. Most companies will offer an online claims filing process, or you can call directly to file a claim. Even if you’re filing a claim through them, it will still be against the other driver’s insurance company.

Step #4 – Provide Detailed Information

To ensure your claim goes smoothly, provide your insurance company with all the relevant information you can. The police report is where your insurance company will begin their investigation, but they also need information from you to determine fault, such as:

- The name of the other driver and the name of the vehicle’s owner, if different.

- The policy number and contact information under which the other car is insured.

- The specific location of your vehicle after the accident.

- Photos of the scene, including any apparent damage each vehicle has sustained.

- Contact information of any passengers or witnesses.

Preparing information ahead of time, such as the other driver’s name and the contact information and policy number of the other car’s insurance company, can speed up your claims process. If you come prepared with this information, the claims process should be swifter than if you aren’t able to provide such evidence.

However, don’t wait too long to file a claim while collecting information, as there are statutes of limitations on claims (Read More: How long after a car accident can you file a claim?).

Step #5 – Keep Track of Medical Bills

Maintain records of all your treatments related to the crash. Always follow up with your doctors, and don’t be afraid to treat new injuries you discover. Your insurance company will want to know about all your medical bills when you file a claim with them.

You will have a much stronger case for your no-fault accident claim if you keep comprehensive documentation.Brandon Frady Licensed Insurance Producer

You may wish to get a second opinion about your injuries to make sure they were a result of the accident and not due to something else. If you can’t prove that your injuries were a direct result of the crash, you may have difficulty receiving compensation for them (Read More: Does auto insurance pay over the limit of bodily injury to settle lawsuits?).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tips for What to Do After an Accident

Not sure what to do after a minor car accident that’s not your fault? It is similar to what to do after an accident that is your fault. First, never flee the scene after an accident. If you do, the best possible outcome is a misdemeanor charge for a hit and run, which includes a fine and possible jail time if no one was injured.

Learn More: Does car insurance cover a hit-and-run?

If anyone was injured in the accident, this can escalate into a felony charge, which can make the potential penalty more severe.

If possible, move your vehicle to a safe place where it’s less likely to be hit by passing traffic. Call the police and then take note of your injuries. If you can see any, take photos of them.

Document the scene if you’re physically able to. Take photos of any damage sustained to the vehicles involved, the other driver’s license plate number, miscellaneous details such as debris or tire marks, and landmarks such as traffic lights and signs or street signs that can determine exactly where the accident took place. Note the time of day as well as the current weather conditions.

If the other driver asks to take a photo of your driver’s license, don’t let them. Identity thieves can use the information on your driver’s license for criminal purposes.

Call the Police Even if the Accident Seems Minor

You can file an insurance claim without a police report, but it is usually a good idea to call the police regardless of the severity of the accident. Calling the police after an accident means the arriving officer will create a report that you may need when filing your car insurance claim.

Read More: Can I file an insurance claim without a police report?

This serves to protect your interests during the investigation. The fault may be determined by details such as if the other driver offers so much as an apology for hitting you, which will be noted in the report.

Get the arriving officer’s name, badge number, and department at the scene when asking for a copy of their report. This can be useful information for your insurer. Your claims adjuster will review this report as the investigation proceeds.

Involve Your Auto Insurance

If you are not at fault in the accident, you may think your insurance shouldn’t be involved. However, that depends on where you live. It’s also important to note that fault will be determined by the insurance company after investigating the accident, so it’s likely both insurance companies will be involved.

Even if you’re not at fault, you still need to notify your insurance company of the accident.

You need to know how to file a car insurance claim regardless of fault. While the process varies by insurer, most companies follow the same general pattern.

Be Confident When Filing a Car Insurance Claim When Not at Fault

If you follow the advice offered in this guide, you should be in a stronger position to file a claim, whether it’s an auto insurance comprehensive claim or a hit-and-run claim. Keep all of these details in mind, and you’re more likely to be compensated for any medical bills and other damages you sustain as a result of the accident.

Even if it seems clear to you that you weren’t at fault for the crash, you will still have to make a strong case with your insurance company.

Being prepared for what comes next after an accident can make all the difference in whether you receive adequate compensation.

If your rates went up after filing a claim, make sure to shop around for cheaper auto insurance. Compare rates now with our free quote tool to find affordable rates post-claim.