Best Hyattsville, Maryland Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Hyattsville, Maryland auto insurance are State Farm, Geico, and Progressive are leading companies for auto insurance, with rates starting at $35 per month. They offer the best Hyattsville, Maryland auto insurance with cheap pricing, and usage-based discounts, ensuring great value for coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Hyattsville Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Hyattsville Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Hyattsville Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are the top providers for best Hyattsville, Maryland auto insurance. Among them, Geico is noted for offering the cheapest rates starting at $35 per month.

Hyattsville, Maryland auto insurance requirements are 30/60/15 according to Maryland auto insurance laws. Finding cheap auto insurance in Hyattsville can seem like a difficult task, but all of the information you need is right here.

We’ll cover factors that affect auto insurance rates in Hyattsville, Maryland, including driving record, credit, commute time, and more.

Our Top 10 Company Picks: Best Hyattsville, Maryland Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Service | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 12% | A+ | Customizable Plans | Progressive | |

| #4 | 10% | A+ | New Drivers | Allstate | |

| #5 | 10% | A++ | Military Members | USAA | |

| #6 | 20% | A+ | Policy Bundling | Nationwide |

| #7 | 10% | A+ | Senior Drivers | The Hartford |

| #8 | 12% | A | Custom Coverage | Liberty Mutual |

| #9 | 13% | A++ | Flexible Policies | Travelers | |

| #10 | 15% | A | Personal Attention | Farmers |

Before you buy Hyattsville, Maryland auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Hyattsville, Maryland auto insurance quotes.

- The cheapest auto insurance in Hyattsville is Geico

- Auto insurance rates in Hyattsville for senior drivers are $27 per month

- The most expensive auto insurance in Hyattsville is Liberty Mutual

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Wide Agent Network: State Farm’s extensive network of agents ensures that you have easy access to personalized customer support. This contributes to its reputation as one of the best auto insurance providers in Hyattsville, Maryland.

- Financial Strength: Known for its strong financial ratings, State Farm is a reliable choice for those seeking the best Hyattsville, Maryland auto insurance, ensuring that claims are paid promptly and efficiently.

- Many Discounts: With numerous discounts available, including those for safe driving and policy bundling, State Farm offers competitive pricing that aligns with finding the best auto insurance in Hyattsville, Maryland. You may check in State Farm auto insurance review.

Cons

- Potentially Higher Premiums: For some drivers, especially those with less favorable driving histories, State Farm’s rates can be higher compared to other providers offering the best Hyattsville, Maryland auto insurance.

- Limited Digital Tools: State Farm’s digital tools and app may not be as advanced as those offered by competitors, which can be a drawback for tech-savvy users seeking the best Hyattsville, Maryland auto insurance experience.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is known for its competitive pricing, making it a standout choice for those looking for the best auto insurance rates in Hyattsville, Maryland. Discover our full list in Geico review.

- Numerous Discounts: Geico offers various discounts, including for good drivers and military personnel, helping you find the most cost-effective auto insurance in Hyattsville, Maryland.

- 24/7 Assistance: With around-the-clock customer support, Geico ensures that you have access to help whenever needed, aligning with the top-tier service expected from the best auto insurance providers in Hyattsville.

Cons

- Less Personal Interaction: Geico’s emphasis on digital and phone services may limit opportunities for face-to-face interactions, which some may miss when seeking the best Hyattsville, Maryland auto insurance experience.

- Basic Coverage Options: Geico’s coverage options might be more limited compared to competitors, potentially impacting those seeking more customizable plans among the best Hyattsville, Maryland auto insurance options

#3 – Progressive: Best for Customizable Plans

Pros

- Customizable Plans: Progressive’s customizable insurance plans, including the Snapshot program, allow for tailored coverage options, helping you find the best auto insurance suited to your needs in Hyattsville, Maryland.

- Competitive Pricing: Known for its competitive rates, Progressive makes it easier to secure affordable auto insurance, aligning with the goal of finding the best Hyattsville, Maryland auto insurance. You can read more about in Progressive auto insurance review.

- Flexible Payment Options: Progressive’s variety of payment plans makes it easier to manage insurance costs, which is a key consideration when looking for the best auto insurance in Hyattsville, Maryland.

Cons

- Variable Customer Service: Customer service experiences with Progressive can vary, which might affect those seeking consistent quality from the best auto insurance providers in Hyattsville, Maryland.

- Complex Pricing: The intricate pricing structure can be confusing, potentially complicating efforts to understand and compare rates for the best Hyattsville, Maryland auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for New Drivers

Pros

- New Driver Support: Allstate provides special programs and discounts for new drivers, making it a top choice for new drivers seeking the best auto insurance in Hyattsville, Maryland.

- Extensive Coverage: Offers a wide range of coverage options and add-ons, allowing for a more tailored insurance plan that aligns with the best Hyattsville, Maryland auto insurance needs.

- Local Agent Network: With numerous local agents, Allstate offers personalized service and support, contributing to its status as one of the best auto insurance options in Hyattsville. Read more in our “Allstate Auto Insurance Review.”

Cons:

- Higher Premiums: Insurance premiums with Allstate might be higher for some drivers compared to other providers, potentially impacting its competitiveness among the best Hyattsville, Maryland auto insurance options.

- Mixed Reviews: Customer reviews can be inconsistent, with some dissatisfaction related to claims processing, which may affect perceptions of Allstate’s status as the best auto insurance provider in Hyattsville.

#5 – USAA: Best for Military Members

Pros

- Exceptional Rates: USAA is renowned for offering highly competitive rates, particularly for military members, making it a leading option for the best auto insurance in Hyattsville, Maryland.

- Comprehensive Coverage: Offers extensive coverage options and benefits for military members, aligning with the needs of those seeking the best auto insurance in Hyattsville, Maryland. Learn more on USAA auto insurance review.

- Strong Financial Stability: USAA’s strong financial stability ensures reliable claims handling, reinforcing its position as a top choice for the best auto insurance in Hyattsville.

Cons

- Eligibility Limits: USAA’s services are available only to military members, veterans, and their families, which limits its accessibility for the general public seeking the best auto insurance in Hyattsville, Maryland.

- Fewer Local Offices: The limited number of physical locations may be inconvenient for those who prefer in-person service, potentially impacting the overall experience of finding the best auto insurance in Hyattsville.

#6 – Nationwide: Best for Policy Bundling

Pros

- Bundling Savings: Nationwide offers significant discounts for bundling auto insurance with other policies, making it a valuable option for those seeking the best Hyattsville, Maryland auto insurance. You can know more about Nationwide auto insurance review here.

- Accident Forgiveness: Includes programs to prevent rate increases after an accident, contributing to its appeal as one of the best auto insurance providers in Hyattsville.

- 24/7 Support: Nationwide’s round-the-clock customer service ensures that assistance is available whenever needed, enhancing its reputation among the best auto insurance options in Hyattsville, Maryland.

Cons

- Potentially Higher Costs: Nationwide’s rates may be higher compared to some competitors, which could impact its overall standing among the best Hyattsville, Maryland auto insurance providers.

- Mixed Claims Experience: Customer experiences with claims processing can be inconsistent, which might affect perceptions of Nationwide’s service quality in the context of the best auto insurance in Hyattsville.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – The Hartford: Best for Senior Drivers

Pros

- Flexible Coverage: Provides a range of customizable coverage options suited for retirees and seniors, aligning with the needs of those looking for the best Hyattsville, Maryland auto insurance.

- Bundling Discounts: Offers savings for bundling auto insurance with other types of coverage, adding value to its offerings for the best auto insurance in Hyattsville, Maryland. Learn more about it on The Hartford auto insurance review.

- Accident Forgiveness: Features programs that help prevent rate increases after an accident, enhancing its appeal among the top choices for auto insurance in Hyattsville.

Cons

- Potentially Higher Premiums: Rates with The Hartford may be higher for some drivers, which could impact its competitiveness as one of the best auto insurance providers in Hyattsville, Maryland.

- Complex Coverage Options: The extensive range of coverage options might be overwhelming for some customers, affecting their ability to easily find the best auto insurance plan in Hyattsville.

#8 – Liberty Mutual: Best for Custom Coverage

Pros

- Bundling Discounts: Significant savings are available for bundling auto insurance with other policies, which contributes to its value as a top choice for the best auto insurance in Hyattsville.

- Innovative Features: Includes unique features such as accident forgiveness and new car replacement, enhancing its appeal for those seeking the best auto insurance options in Hyattsville, Maryland.

- Flexible Payment Options: Provides a range of payment plans, including monthly and annual options, which helps in managing insurance costs effectively. Learn more in our “Liberty Mutual Auto Insurance Review.”

Cons

- Higher Premiums: Insurance rates with Liberty Mutual can be higher compared to some competitors, which may impact its status among the best auto insurance providers in Hyattsville, Maryland.

- Variable Service: Customer service experiences can be mixed, with some reports of slower responses, potentially affecting its overall reputation for the best auto insurance in Hyattsville.

#9 – Travelers: Best for Flexible Policies

Pros

- Safe Driving Discounts: Offers discounts for safe driving practices and vehicle safety features, you can check out in our “Travelers Auto Insurance Review.”

- Broad Coverage Options: Includes various coverage levels, from basic to extensive protection.

- User-Friendly Tools: Features an easy-to-use online platform for managing policies and filing claims.

Cons

- Potentially Higher Costs: Premiums can be higher for drivers with less favorable records or those in high-risk categories.

- Complex Pricing: The pricing structure may be complex, making it difficult for some customers to understand their rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Personal Attention

Pros

- Personal Service: Known for its focus on personalized service and building relationships with customers.

- Wide Coverage Options: Provides a broad selection of coverage options and add-ons. For a complete list, read our “Farmers Auto Insurance Review.”

- Strong Local Presence: Many local agents offer tailored advice and support.

Cons

- Higher Premiums: Insurance rates might be higher for some drivers, especially those with less favorable risk profiles.

- Inconsistent Claims Processing: Customer experiences with claims can be varied, with some reporting inconsistencies.

Minimum Auto Insurance in Hyattsville, Maryland

In Hyattsville, Maryland, auto insurance laws require drivers to have at least the Maryland minimum auto insurance to be financially responsible in the event of an accident.

This includes liability coverage with minimums of $30,000 per person and $60,000 per accident for bodily injury, $15,000 for property damage, personal injury protection (PIP) with at least $2,500 coverage, and uninsured/underinsured motorist coverage at the same levels as liability coverage.

Hyattsville, Maryland Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $140 | |

| $53 | $132 | |

| $35 | $110 | |

| $58 | $135 |

| $48 | $125 |

| $50 | $130 | |

| $45 | $120 | |

| $44 | $138 |

| $47 | $127 | |

| $40 | $115 |

State Farm, Geico, and Progressive are the best Hyattsville, Maryland, auto insurance companies.

Meeting these requirements is essential for legal compliance and financial protection.

Cheap Hyattsville, Maryland Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Hyattsville, Maryland are affected by age, gender, and marital status. See how demographics impact the monthly cost of insurance.

Male drivers, especially younger ones, often encounter higher insurance costs compared to females, reflecting historical risk assessments.

Additionally, married drivers usually receive lower premiums than single drivers, as insurers view marriage as a marker of stability and lower risk. Enter your ZIP code now to begin comparing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Hyattsville, Maryland Auto Insurance by Driving Record

Driving record has a big impact on your auto insurance rates. See the monthly auto insurance rates for a bad record in Hyattsville, Maryland compared to the monthly auto insurance rates with a clean record in Hyattsville, Maryland.

Compare auto insurance in Hyattsville to other Maryland cities, including Gaithersburg auto insurance rates, Rockville auto insurance rates, and Annapolis auto insurance rates to see how Hyattsville, Maryland auto insurance rates stack up.

Cheap Hyattsville, Maryland Auto Insurance by Credit History

Credit history plays a significant role in determining auto insurance rates.

In Hyattsville, Maryland, those with higher credit scores typically enjoy lower annual insurance premiums compared to those with poorer credit histories and check the minimum auto insurance.

Include in your comparing the best Hyattsville, Maryland auto insurance, State Farm, Geico, and Progressive. Enter your ZIP code to begin comparing.

Best by Category: Cheapest Auto Insurance in Hyattsville, Maryland

Compare cheap auto insurance companies in Hyattsville, Maryland in each category to find the company with the best rates for your personal needs.

By analyzing which companies offer the lowest premiums for different credit histories, you can identify the insurer that best matches your financial situation and personal insurance needs.

This comparison helps ensure you get the most competitive rates tailored to your specific credit profile.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Hyattsville, Maryland Auto Insurance Quotes

Before purchasing auto insurance in Hyattsville, Maryland, it is crucial to compare auto insurance rates from various insurance companies to ensure you get the best deal. Different insurers offer varying coverage options and rates, so comparing quotes helps you find the most cost-effective policy that meets your needs.

Tim Bain Licensed Insurance Agent

By entering your ZIP code below, you can obtain free auto insurance quotes specific to Hyattsville, Maryland. This allows you to evaluate and compare the prices and coverage options offered by different providers including the best options, State Farm, Geico, and Progressive.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a type of coverage that protects you financially in case of accidents, theft, or damage to your vehicle. It provides financial compensation for repairs, medical expenses, and liability claims resulting from an accident involving your vehicle.

Is auto insurance mandatory in Hyattsville, MD?

Yes, auto insurance is mandatory in Hyattsville, MD, as it is in most states. Maryland law requires drivers to carry minimum liability coverage to ensure financial responsibility in case of an accident. Enter your ZIP code to begin comparing.

What are the minimum auto insurance requirements in Hyattsville, MD?

In Hyattsville, MD, the minimum auto insurance requirements are $30,000 for bodily injury liability per person, $60,000 for bodily injury liability per accident, $15,000 for property damage liability per accident, and $30,000 for uninsured motorist coverage per person and $60,000 per accident.

What factors affect auto insurance rates in Hyattsville, MD?

Several factors impact auto insurance rates in Hyattsville, MD, including age, gender, and marital status; driving record and claims history; type and value of the vehicle; annual mileage; credit history; coverage limits and deductibles; ZIP code and location; as well as available discounts and bundled policies.

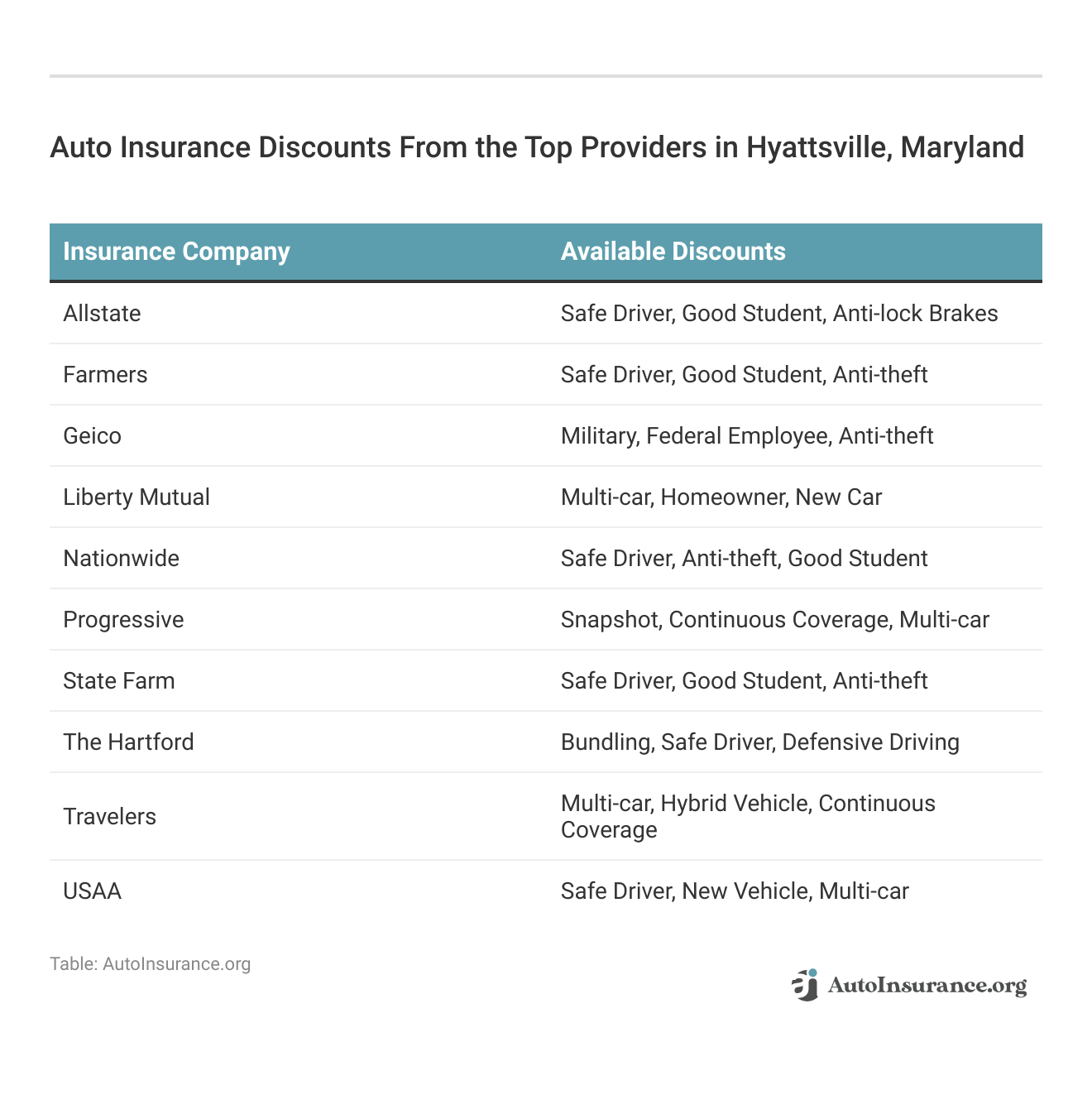

Are there any discounts available on auto insurance in Hyattsville, MD?

Yes, insurance providers often offer various discounts on auto insurance in Hyattsville, MD. Common discounts include safe driver discounts, multi-vehicle discounts, bundling policies, good student discounts, and discounts for safety features in your vehicle.

It’s advisable to check with different insurance companies to find out which discounts you may qualify for. Enter your ZIP code to begin comparing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.