Best Idaho Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Geico, and Progressive are the top picks for best Idaho Auto Insurance. State Farm offers the best overall coverage, Geico provides the cheapest rates starting at $15 per month, and Progressive excels in customer service. This guide will detail why these companies stand out in Idaho car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Sep 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Idaho

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Idaho

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage for Idaho

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Geico, and Progressive are the top picks for best Idaho auto insurance. State Farm is the best overall, offering comprehensive coverage options and strong customer satisfaction.

Geico stands out for its competitive rates and wide range of discounts, while Progressive excels in customer service and unique policy options. This article explores why these three providers are the best choices for Idaho car insurance.

Learn More: Geico Auto Insurance Review (See How Much You Could Save)

Our Top 10 Company Picks: Best Idaho Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Agents State Farm

#2 15% A++ Competitive Rates Geico

#3 14% A+ Comprehensive Coverage Progressive

#4 13% A+ Local Agents Allstate

#5 12% A Customizable Policies Liberty Mutual

#6 11% A+ Comprehensive Coverage Farmers

#7 10% A Customer Service American Family

#8 9% A Affordable Premiums Safeco

#9 8% A+ May Discounts Nationwide

#10 7% A++ Customer Service Auto-Owners

Idaho auto insurance averages $81/mo for full coverage. Even high-risk drivers with DUIs or accidents can find affordable options by shopping around and following our savings tips.

Enter your ZIP code above to shop for coverage from the top insurers.

- State Farm is Idaho’s top auto insurer for coverage and customer satisfaction

- Geico offers competitive rates and discounts for various car insurance needs

- Progressive excels in customer service and unique car insurance policies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs.

- Strong Local Presence: State Farm has many local agents for personalized service. Learn more in our “State Farm Auto Insurance Discounts.”

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

- Limited Online Tools: Fewer digital tools and resources compared to some competitors.

#2 – Geico: Best for Competitive Rates

Pros

- Competitive Pricing: Geico consistently offers some of the lowest rates in the industry.

- Online Tools: Comprehensive digital tools for managing policies and filing claims.

- Extensive Discounts: Various discounts available for good drivers, military personnel, and more.

- Strong Financial Rating: A++ rating from A.M. Best for financial stability. See more details on our “Geico Auto Insurance Review.”

Cons

- Limited Local Agents: Fewer local agents compared to competitors, which might limit personalized service.

- Coverage Gaps: Certain coverage options may be more limited compared to other providers.

- Claim Handling: Some customers report longer processing times for claims.

#3 – Progressive: Best for Comprehensive Coverage

Pros

- Customizable Coverage: Offers extensive and customizable coverage options to suit diverse needs.

- Snapshot Program: Innovative usage-based insurance program that can lead to significant discounts.

- Competitive Rates: Offers competitive pricing and multiple discount opportunities. More information is available about this provider in our “Progressive Auto Insurance Review.”

- Strong Financial Rating: A+ rating from A.M. Best indicating strong financial stability.

Cons

- High Rates for High-Risk Drivers: Premiums can be higher for drivers with a poor driving record.

- Customer Service: Mixed reviews regarding customer service quality.

- Discounts: Multi-policy discounts are slightly lower compared to some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Local Agents

Pros

- Strong Agent Network: Extensive network of local agents for personalized service.

- Good Discounts: Offers multiple discounts, including for bundling policies and safe driving.

- Financial Stability: A+ rating from A.M. Best for financial strength. Check out insurance savings in our complete “Allstate Auto Insurance Reviews.”

- Claim Satisfaction Guarantee: Commitment to customer satisfaction with claims handling.

Cons

- Higher Premiums: Premiums can be higher compared to other providers.

- Mixed Customer Reviews: Some customers report inconsistent experiences with customer service.

- Limited Digital Tools: Fewer online tools compared to leading competitors.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Offers highly customizable insurance policies to meet specific needs.

- Discounts: Provides a variety of discounts, including for bundling, safe driving, and more.

- Flexible Payment Options: Multiple payment plans and options for policyholders.

- Financial Strength: A rating from A.M. Best indicating solid financial health. Unlock details in our “Liberty Mutual Auto Insurance Review.”

Cons

- Higher Rates: Premiums can be higher compared to competitors offering similar coverage.

- Limited Local Agents: Fewer local agents, which may affect personalized service.

- Claims Process: Some customers report issues with the claims process and resolution times.

#6 – Farmers: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Offers a wide range of comprehensive coverage options.

- Discounts: Multiple discounts available for bundling policies, safe driving, and more.

- Strong Customer Service: Good reputation for customer service and claims handling.

- Financial Stability: A+ rating from A.M. Best for financial strength. Discover insights in our “Farmers Auto Insurance Review.”

Cons

- Higher Premiums: Premiums can be higher than those of some competitors.

- Limited Digital Experience: Fewer online tools and resources compared to some competitors.

- Availability: Coverage options may vary significantly by location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Customer Service

Pros

- Strong Customer Service: High ratings for customer service and satisfaction.

- Competitive Rates: Offers competitive rates and various discount opportunities.

- Multi-Policy Discounts: Significant discounts available for bundling multiple policies.

- Comprehensive Coverage: Wide range of coverage options to suit different needs. Access comprehensive insights into our “American Family Auto Insurance Review.”

Cons

- Limited Availability: Coverage options and discounts may not be available in all areas.

- Digital Tools: Fewer online tools and resources compared to leading competitors.

- Premium Costs: Premiums might be higher for certain coverage levels.

#8 – Safeco: Best for Affordable Premiums

Pros

- Affordable Rates: Consistently offers some of the most affordable premiums.

- Wide Range of Discounts: Offers various discounts, including for bundling and safe driving.

- Online Tools: Robust online tools and mobile app for managing policies.

- Financial Stability: A rating from A.M. Best for financial health. Discover more about offerings in our “Safeco Auto Insurance Review.”

Cons

- Limited Local Agents: Fewer local agents compared to some competitors.

- Customer Service: Mixed reviews regarding customer service quality.

- Coverage Options: Some coverage options may be more limited compared to other providers.

#9 – Nationwide: Best for Many Discounts

Pros

- Extensive Discounts: Offers a wide range of discounts, including for bundling and safe driving.

- Comprehensive Coverage: Provides a variety of coverage options to meet different needs.

- Strong Financial Rating: A+ rating from A.M. Best for financial stability.

- Digital Tools: Comprehensive online tools for managing policies and claims.

- Customer Service: Good reputation for customer service and support. Read up on the “Nationwide Auto Insurance Review.“

Cons

- Higher Premiums: Premiums can be higher compared to some competitors.

- Limited Local Agents: Fewer local agents, which might limit personalized service.

- Claims Handling: Some customers report issues with claims processing times.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Customer Service

Pros

- Excellent Customer Service: High ratings for customer service and satisfaction.

- Competitive Rates: Offers competitive rates and multiple discount opportunities.

- Comprehensive Coverage: Wide range of coverage options to meet various needs.

- Financial Stability: A++ rating from A.M. Best for financial strength. Delve into our evaluation of “Auto-Owners Auto Insurance Review.”

- Strong Local Presence: Extensive network of local agents for personalized service.

Cons

- Limited Online Tools: Fewer digital tools and resources compared to leading competitors.

- Availability: Coverage options may vary significantly by location.

- Premium Costs: Premiums might be higher for certain coverage levels.

Idaho Auto Insurance Monthly Rates: Minimum and Full Coverage by Provider

When choosing the best Idaho auto insurance, it’s essential to compare monthly rates across different providers and coverage levels. This section provides a detailed look at the cost of both minimum and full coverage plans offered by top insurance companies in Idaho.

Idaho Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$37 $128

$27 $93

$33 $87

$26 $92

$16 $57

$23 $79

$24 $82

$26 $91

$27 $71

$15 $53

The table below highlights the monthly rates for minimum and full coverage from various providers. State Farm stands out with the lowest rates at $15 for minimum coverage and $53 for full coverage, making it a top choice for budget-conscious drivers.

Geico also offers competitive pricing, with rates at $16 for minimum coverage and $57 for full coverage. On the higher end, Allstate charges $37 for minimum coverage and $128 for full coverage, reflecting its extensive range of services and customer support.

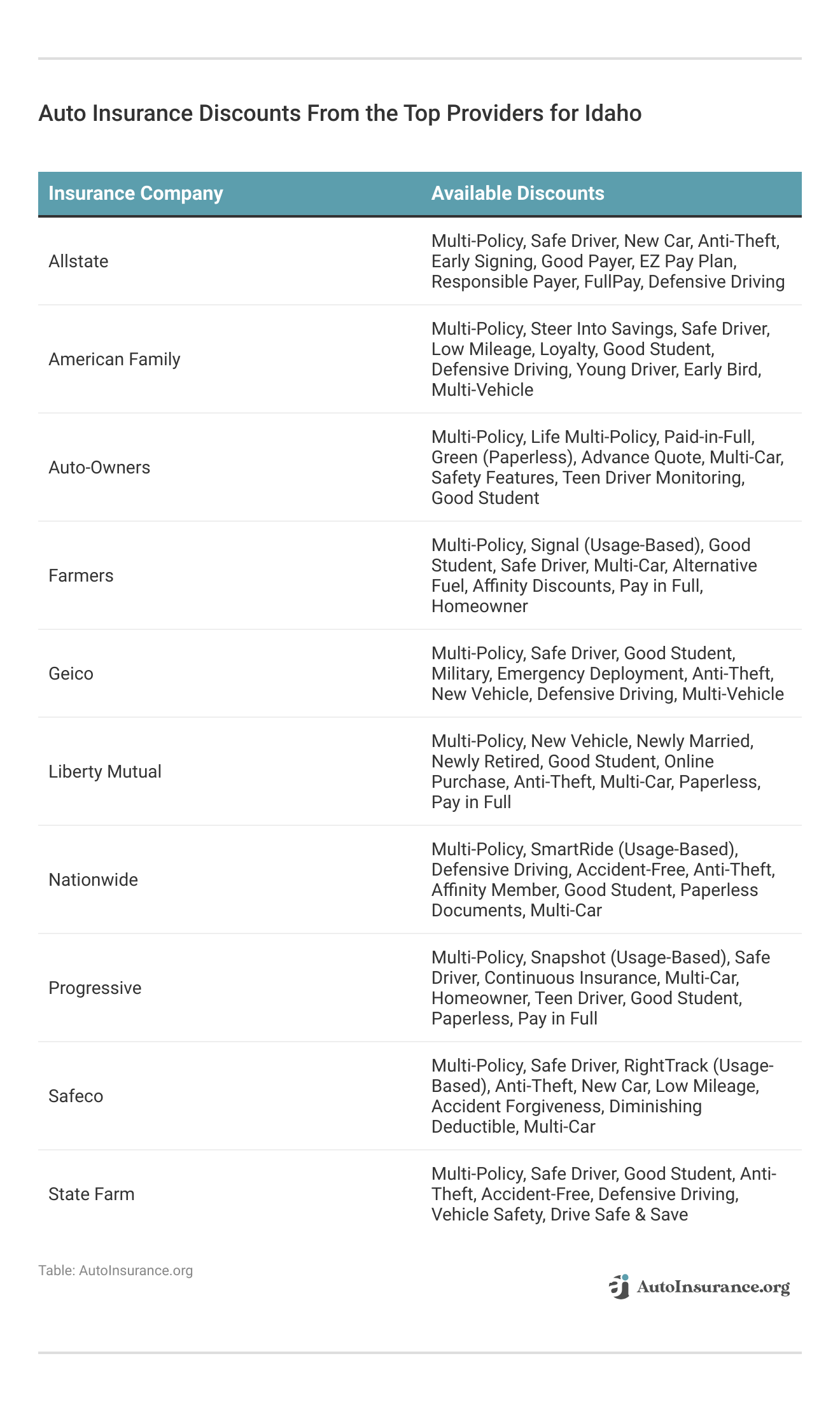

By comparing these rates, you can identify the best provider that meets your specific coverage needs and budget. Access comprehensive insights into our “Auto Insurance Discounts.”

Finding Cheap Auto Insurance in Idaho

Understanding how auto insurance rates vary based on driving record, coverage amount, and individual profile is critical to finding the cheapest car insurance provider in Idaho.

We’ve covered the cheapest companies in Idaho for many driver types — from young drivers to drivers with a DUI on their record — to offer a starting point for companies you should get car insurance quotes from.

Cheapest Idaho Auto Insurance Companies for Minimum Coverage

Idaho requires minimum liability auto insurance, so all drivers must carry it to drive legally. It’s important to see which auto insurers have cheap liability car insurance in Idaho, so your starting rates are more affordable. Lower rates will also allow you more funds to purchase additional coverage.

Idaho’s average minimum liability insurance rates are $23 monthly, though this average varies by company. Look at the table below to see which Idaho insurance companies have the cheapest average rates for minimum liability insurance.

Idaho Minimum Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $37 | |

| $27 | |

| $26 | |

| $16 | |

| $23 |

| $24 |

| $26 | |

| $15 | |

| $16 | |

| $11 | |

| U.S. Average | $45 |

State Farm and Geico have the cheapest rates on average for minimum liability insurance, costing less than the state average. On the other hand, Allstate costs much more than the cheapest companies, with an average monthly rate over the state’s insurance average. Our Allstate auto insurance review shows some of the other pros and cons of getting coverage with this company.

It’s best to get quotes from the cheapest companies on our list to see which is cheapest for you, rather than wasting time getting quotes from the most expensive companies in Idaho.

Cheapest Idaho Auto Insurance Companies for Full Coverage

Drivers looking for full coverage insurance will pay more than if they just purchased minimum liability insurance, but they can still find affordable rates by comparing companies. In addition, the higher price tag on full coverage is often worth it, as it protects drivers better financially after an accident than just minimum liability insurance.

The Idaho state average for full coverage insurance is $81 monthly. Below, you can see how insurance companies’ average rates compare to the Idaho state average.

Idaho Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $128 | |

| $93 | |

| $92 | |

| $57 | |

| $79 |

| $82 |

| $91 | |

| $53 | |

| $57 | |

| $40 | |

| U.S. Average | $119 |

State Farm has some of the cheapest average rates for full coverage insurance in Idaho. Its average rates are about half that of the most expensive companies on our list, such as Allstate. Therefore, whether you’re getting a minimum liability policy or full coverage, State Farm is a good choice for most drivers looking to save on their rates.

You can look to compare State Farm vs. Allstate auto insurance to find out more about picking between the two companies.

Cheapest Idaho Auto Insurance Companies for Young Drivers

If you’re a younger driver, you’ll pay more than older drivers for car insurance, regardless of where you live. Even if you don’t have an accident or traffic ticket on your record, insurers charge you more, as younger drivers are statistically more likely to file claims due to their driving inexperience.

So if you’re purchasing your own car insurance policy as a young driver in Idaho, compare companies to find the insurance company offering the cheapest rates.

Idaho Full Coverage Auto Insurance Monthly Rates for Teens

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $574 | $602 | $423 | $489 | |

| $557 | $660 | $411 | $537 | |

| $753 | $706 | $555 | $574 | |

| $230 | $267 | $169 | $217 | |

| $276 | $278 | $204 | $226 |

| $309 | $355 | $228 | $288 |

| $693 | $704 | $511 | $572 | |

| $198 | $226 | $146 | $184 | |

| $390 | $554 | $287 | $450 | |

| $171 | $174 | $126 | $141 | |

| U.S. Average | $566 | $618 | $416 | $501 |

Young drivers should avoid companies like Allstate and Farmers, whose average rates are at least twice that of the cheapest auto insurance companies for younger drivers. Instead, young drivers should look into companies like Geico or State Farm for insurance policies.

Another economical option for young drivers is to join an existing auto insurance policy, like their parents, since rates are significantly cheaper. If offered by their insurer, parents can also apply for a student away discount if the young driver is at least 100 miles away from home and didn’t take a car. There are also discounts for good students with at least a B+ average.

Cheapest Idaho Auto Insurance Companies for Bad Credit

Bad credit can impact how much you pay for car insurance. While this may seem strange, a bad credit score indicates that a driver is more likely to miss car insurance payments. Missed payments lead to serious issues like getting dropped by an insurance company and driving without insurance, which is illegal.

However, it can be hard for drivers to fix their credit scores when their auto insurance company charges them hundreds of dollars more for their credit scores.

State Farm's combination of coverage, affordability, and customer satisfaction make it the best option for Idaho auto insurance.Chris Abrams Licensed Insurance Agent

Searching for the best auto insurance companies for bad credit will help drivers keep their rates low and get their credit scores back on track. Look below at the average rates for bad credit scores at major Idaho insurance companies.

Idaho Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $162 | $180 | $200 | |

| $89 | $104 | $123 | |

| $134 | $150 | $170 | |

| $98 | $115 | $130 | |

| $124 | $140 | $155 |

| $125 | $145 | $160 |

| $134 | $150 | $165 | |

| $93 | $105 | $120 | |

| $105 | $121 | $140 | |

| $87 | $100 | $120 |

Geico, State Farm, and Travelers are all good companies to get quotes from if you have a bad credit score. However, drivers with bad credit should stay away from companies like Allstate and Progressive, where rates are extremely high for drivers with bad credit scores.

Cheapest Idaho Auto Insurance Companies for Speeding Tickets

You may have noticed higher auto insurance rates if you recently got a traffic ticket. Traffic tickets for moving violations like speeding put drivers in the high-risk category. After all, these behaviors are more likely to result in crashes, so insurers charge higher rates for drivers with traffic tickets.

Below, you can see how your auto insurance rates will change at different companies in Idaho for a traffic ticket.

Idaho Full Coverage Auto Insurance Monthly Rates: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $149 | $128 | |

| $111 | $93 | |

| $110 | $92 | |

| $135 | $57 | |

| $99 | $79 |

| $97 | $82 |

| $121 | $91 | |

| $58 | $53 | |

| $87 | $57 | |

| $47 | $40 | |

| U.S. Average | $147 | $119 |

State Farm, Travelers, and Liberty Mutual are good choices if you’re looking for cheaper rates after a traffic ticket. Companies like Geico and Allstate tend to be more expensive, so if you have multiple traffic tickets on your record, it’s best to stay away from these companies.

It’s important to learn about the answer to how long does a speeding ticket affects your car insurance so you don’t spend too much.

Cheapest Idaho Auto Insurance Companies for At-Fault Accidents

Like with traffic tickets, insurers consider drivers with at-fault accidents higher risk, so they generally see higher rates to offset the risk of insuring a high-risk driver. Below, you can see how rates change from company to company for drivers with at-fault accidents.

Idaho Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $181 | $128 | |

| $178 | $93 | |

| $130 | $92 | |

| $123 | $57 | |

| $98 | $79 |

| $125 | $82 |

| $161 | $91 | |

| $63 | $53 | |

| $79 | $57 | |

| $54 | $40 | |

| U.S. Average | $173 | $119 |

An at-fault accident can raise your insurance rates by a few hundred dollars a year. However, with companies like State Farm, Geico, and Travelers, you can lower the amount your rates increase after you have an at-fault accident.

You should also look into the best accident forgiveness auto insurance companies. Your first at-fault accident at the company gets forgiven with accident forgiveness, meaning your insurance rates won’t go up. Since rates tend to increase for a few years, these programs can save you a lot.

To qualify, you may have to stay accident-free for a few years at the same company, or you may have to pay a fee to join your insurance company’s program. Either way, these programs merit consideration, especially if you have a high likelihood of getting into a crash in your area.

Cheapest Idaho Auto Insurance Companies for DUIs

We’ve reviewed several factors impacting your auto insurance rates in Idaho, like bad credit scores or at-fault accidents. However, one of the worst offenses a driver can have on their driving record is a DUI, as they usually raise rates the most at auto insurance companies.

If you have a DUI conviction, it’s important to shop around and see if you can get a better rate at a different company. You can also look to move to one of the best states for affordable DUI auto insurance. Below, you can see the average rates at different companies for DUI offenders in Idaho.

Idaho Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $128 | $181 | $174 | $149 | |

| $93 | $178 | $191 | $111 | |

| $92 | $130 | $118 | $110 | |

| $57 | $123 | $187 | $135 | |

| $79 | $98 | $101 | $99 |

| $82 | $125 | $194 | $97 |

| $91 | $161 | $121 | $121 | |

| $53 | $63 | $58 | $58 | |

| $57 | $79 | $134 | $87 | |

| $40 | $54 | $82 | $47 | |

| U.S. Average | $119 | $173 | $209 | $147 |

As you can see from the average rates above, DUIs can significantly raise your insurance rates, regardless of the company. However, some cheaper options for DUI drivers include State Farm and Farmers.

You might have also noticed that Geico is one of the most expensive companies on the list above, a great example of how a company that’s normally cheaper can become one of the most expensive companies for certain drivers. So it’s important to get quotes based on your driving record and coverage needs.

Cheapest Idaho Auto Insurance Companies by City

nsurance companies take into account your location when determining insurance rates, as different areas present varying levels of risk. Several factors related to location are considered in rate calculations. For instance, the presence of animals such as deer can lead to increased costs for comprehensive insurance.

High crash rates and heavy traffic can also result in higher rates for collision and liability coverage. Additionally, areas with high crime rates may incur higher comprehensive insurance premiums due to increased vandalism or theft risks.

Furthermore, regions prone to severe weather conditions like fires, hail, and icy roads may see higher costs for comprehensive coverage.

These factors vary by state but can also change as drivers move around Idaho. Idaho Falls and Boise, Idaho are some of the most expensive cities for car insurance, so compare companies carefully to find cheap auto insurance. Other expensive cities for auto insurance include Caldwell and Nampa.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Way to Save on Idaho Auto Insurance Rates

Naturally, the best way to find savings is to shop around and compare car insurance rates based on your coverage needs and driving record.

However, if you’ve shopped around and are still struggling to find cheap rates, there are some tips and tricks you can try to bring your rates down to a more reasonable level. Look below at other ways to save on car insurance:

- Apply for Usage-Based Insurance: Drivers who travel less than 10,000 miles annually should consider switching to a non-traditional usage-based insurance policy. You pay a low daily rate and a per-mile rate for insurance coverage.

- Apply for Discounts: You may have to apply for certain car insurance discounts to add them to your insurance policy, like a good student or student away discount.

- Buy a Cheaper Car to Insure: Some cars are significantly cheaper to insure, like mass-produced cars or those with good safety ratings, making part repair and replacement easier and cheaper after an accident. Taking the time to compare auto insurance rates by make and model is always helpful for finding cheaper rates.

- Drop Any Non-Vital Coverages: To save money, drivers can drop add-on coverages, such as roadside assistance. They may also consider a liability-only insurance policy for older, depreciated vehicles.

- Raise Your Insurance Deductible: Increasing one or more of your auto insurance deductibles will decrease your rates, as you agree to pay more towards your repairs after a car crash.

Following the tips above can help you shave money off your monthly payments. However, don’t increase your deductible beyond an amount you can’t afford to pay out of pocket. For example, if you raise your deductible to $2,000, your payout gets reduced by that amount. So if you have $10,000 in damages, insurance will only give you $8,000.

Idaho Auto Insurance Comparison

Discover the contrast in auto insurance expenses between Kooskia and Payette, ID.

Idaho Auto Insurance Cost by City

Make informed decisions by comparing rates today and securing the best deal for your coverage needs. More information is available about this provider in our “Compare Auto Insurance Rates by Vehicle Make and Model.”

Idaho Auto Insurance and DUI Laws

Idaho auto insurance laws impact how much you pay for car insurance, but why? If Idaho requires drivers to carry a higher minimum amount of insurance, the base cost of Idaho insurance will be higher.

For Idaho drivers seeking reliable coverage and excellent customer service, State Farm is the go-to choice.Michelle Robbins Licensed Insurance Agent

DUI laws can also impact insurance rates, depending on the severity of penalties and the high-risk insurance required. Read on to learn about required Idaho insurance coverages, DUI penalties, and more.

Idaho’s Required Auto Insurance Coverages

You must meet Idaho minimum auto insurance requirements to drive legally, including bodily injury liability, property damage liability, and underinsured/uninsured motorist insurance coverage.

We’ve explained each of these coverages and the limits required below.

Bodily Injury Liability Auto Insurance

Bodily injury liability insurance steps in if you cause an accident, paying the other party’s medical bills up to your policy limits. In Idaho, all drivers must purchase bodily injury liability with a limit of $25,000 per person and $50,000 per accident.

Of course, you can purchase a higher limit than what Idaho requires, but these amounts are the minimum you must carry to drive legally.

Property Damage Liability Auto Insurance

Property damage liability insurance is similar to bodily injury liability insurance. However, instead of paying for medical bills, property damage liability pays for other parties’ property damage bills in an accident you caused.

In Idaho, all drivers must carry a limit of $15,000 in property damage liability insurance to drive legally in the state. You may also purchase more than this limit if you can afford to, as any property damage costs beyond $15,000 come out of your pocket.

Underinsured/Uninsured Motorist Auto Insurance

Insurers often sell underinsured and uninsured motorist coverages as a package deal, and drivers must carry both in Idaho, unless rejected in writing.

The best underinsured motorist coverage auto insurance companies help pay for medical bills and property damage if the driver who caused the accident doesn’t have enough insurance to pay them. Uninsured motorist coverage pays for medical bills and property damage if the driver who caused the accident has no insurance.

Idaho’s Optional Auto Insurance Coverages

Beyond the required coverages in Idaho, most auto insurance coverages are optional. Idaho doesn’t require other coverages, though lenders in Idaho may require drivers to carry comprehensive and collision insurance in their loan or lease contracts.

Beyond that, drivers can choose whether to carry the following auto insurance coverages:

- Collision auto insurance

- Comprehensive auto insurance

- Gap insurance

- Medical payments

- Modified car insurance

- New car insurance

- Personal injury protection insurance

- Roadside assistance

Your Idaho auto insurance company may not offer all these coverages, but they’re common ones across Idaho. The two coverages we recommend are collision and comprehensive, which comprise a full coverage policy alongside Idaho’s minimum required insurance.

These coverages offer valuable protection to drivers. Collision insurance pays for your car repairs if you crash into another vehicle or an object like a tree stump. Comprehensive auto insurance pays for your car repairs if you crash into an animal or your car gets damaged from falling objects, weather, vandalism, or theft.

If you crash your car🚘, will your insurance cover it? With only liability coverage, you're out of luck😟. With full coverage, you're set👍. https://t.co/27f1xf1ARb has a guide to help you decide if full coverage is right for you. Check it out here👉: https://t.co/ZzJApDghSE pic.twitter.com/TKIDrrTjhC

— AutoInsurance.org (@AutoInsurance) September 25, 2023

Searching for full coverage auto insurance quotes in Idaho will help you find an affordable rate for these optional coverages. See more details on our “Motorcycle vs. Car Accident Statistics.”

Idaho DUI Penalties

DUI convictions in Idaho come with various penalties ranging in severity. Drivers may face only a few of the penalties listed below, or they may face all of them:

- Fines and reinstatement fees

- Ignition interlock device (IID)

- Jail time

- License suspension

- SR-22 certificate

- Substance abuse evaluation

- Substance abuse treatment

DUI costs can quickly add up, as drivers must pay for IIDs, substance abuse evaluation and treatment, and other mandatory penalties. Since DUIs put drivers in the high-risk category, drivers must also pay increased auto insurance rates and apply for SR-22 certificates, which we cover in the next section.

Idaho SR-22 Auto Insurance Certificates

SR-22 certificates show drivers carry Idaho’s required auto insurance coverage. High-risk drivers often must get an SR-22 certificate to resume driving after a license suspension or serious driving infraction. Some common situations where drivers would need one include drivers caught driving without insurance, with a suspended license, or driving impaired.

Contact your insurance company if you need an SR-22 certificate, though you may get charged a filing fee. Also, your insurer may choose to drop you as a customer, but this is rare. Finding cheap SR-22 auto insurance doesn’t have to be so difficult if you know where to shop.

If you get dropped for being a high-risk driver or don’t have a car insurance company, you’ll need to let companies know you need an SR-22 certificate when applying. In addition, if you don’t own a car but need an SR-22 certificate, you’ll have to purchase non-owner car insurance to qualify for one.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Buy Cheap Idaho Auto Insurance Coverage

Finding the cheapest car insurance in Idaho requires research and time. Still, drivers who put in the effort to compare Idaho car insurance companies and apply our savings tips may receive great savings on Idaho auto insurance policies. Read more about how to lower your auto insurance.

Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

How much is car insurance in Idaho per month?

On average, Idaho car insurance costs $23 per month for minimum liability insurance and $81 per month for full coverage. However, these average car insurance rates vary drastically depending on the chosen company and individual driving records.

For additional details, explore our comprehensive resource titled “Auto Insurance Rates by Age.”

What is Idaho full coverage insurance?

Full coverage insurance includes comprehensive, collision, and liability insurance.

Is Idaho a no-fault insurance state?

No, Idaho is a “tort” state, which means at-fault drivers are held financially liable damages they cause in an accident.

Do you legally have to have car insurance in Idaho?

Yes, auto insurance is mandatory in Idaho. All drivers in the state are required to carry liability insurance coverage that meets the minimum requirements set by Idaho law.

Can I drive without insurance in Idaho?

No, driving without auto insurance in Idaho is illegal. All registered vehicles must have valid insurance coverage. Failure to comply with this requirement can result in penalties, such as fines, license suspension, and vehicle registration suspension.

To find out more, explore our guide titled “How to Choose an Auto Insurance Company.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.