Auto Insurance Givebacks (2025)

Compare Quotes from Top Companies and Save

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Please include attribution to AuotInsurance.org with this graphic.

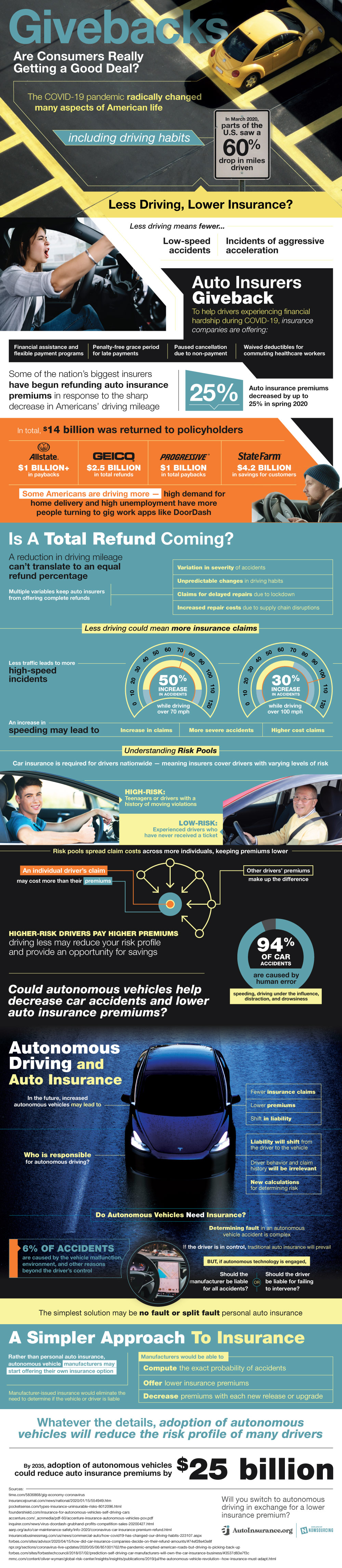

Givebacks: Are Consumers Really Getting a Good Deal?

The COVID-19 pandemic radically changed many aspects of American life — including driving habits.

Less Driving, Lower Insurance?

- In March 2020, parts of the U.S. saw a 60% drop in miles driven

- Less driving means fewer

- Low-speed accidents

- Incidents of aggressive acceleration

- Less driving means fewer

- Auto Insurers Giveback

- To help drivers experiencing financial hardship during COVID-19, insurance companies are offering:

- Financial assistance and flexible payment programs

- Penalty-free grace period for late payments

- Paused cancellation due to non-payment

- Waived deductibles for commuting healthcare workers

- To help drivers experiencing financial hardship during COVID-19, insurance companies are offering:

Some of the nation’s biggest insurers have begun refunding auto insurance premiums in response to the sharp decrease in Americans’ driving mileage.

- Auto insurance premiums decreased by up to 25% in spring 2020

- In total, $14 billion was returned to policyholders

- Allstate: More than $1 billion in paybacks

- Geico: $2.5 billion in total refunds

- Progressive: $1 billion in total paybacks

- State Farm: $4.2 billion in savings for customers

- In total, $14 billion was returned to policyholders

Some Americans are driving more — high demand for home delivery and high unemployment have more people turning to gig work apps like DoorDash.

Is a Total Refund Coming?

- A reduction in driving mileage can’t translate to an equal refund percentage

- Multiple variables keep auto insurers from offering complete refunds

- Variation in severity of accidents

- Unpredictable changes in driving habits

- Claims for delayed repairs due to lockdown

- Increased repair costs due to supply chain disruptions

- Multiple variables keep auto insurers from offering complete refunds

- Less driving could mean more insurance claims

- Less traffic leads to more high-speed incidents

- 50% increase in accidents while driving above 70 mph

- 30% increase in the rate of drivers going over 100 mph

- An increase in speeding may lead to

- Increase in claims

- More severe accidents

- Higher cost claims

- Less traffic leads to more high-speed incidents

- Understanding Risk Pools

- Car insurance is required for drivers nationwide — meaning insurers cover drivers with varying levels of risk

- High-risk: Drivers with a history of moving violations, teenagers

- Low-risk: Experienced drivers who have never received a ticket

- Risk pools spread claim costs across more individuals, keeping premiums lower

- An individual driver’s claim may cost more than their premiums

- Other drivers’ premiums make up the difference

- Higher-risk drivers pay higher premiums — driving less may reduce your risk profile and provide an opportunity for savings

- Car insurance is required for drivers nationwide — meaning insurers cover drivers with varying levels of risk

94% of car accidents are caused by human error — speeding, driving under the influence, distraction, and drowsiness.

Could autonomous vehicles help decrease car accidents and lower auto insurance premiums?

Autonomous Driving & Auto Insurance

- In the future, increased autonomous vehicles may lead to

- Fewer insurance claims

- Lower premiums

- Shift in liability

- Who is responsible for autonomous driving?

- Liability will shift from the driver to the vehicle

- Driver behavior and claim history will be irrelevant

- New calculations for determining risk

- Do Autonomous Vehicles Need Insurance?

6% of accidents are caused by a vehicle malfunction, environment, and other reasons beyond the driver’s control.

- Determining fault in an autonomous vehicle accident is complex

- If the driver is in control, traditional auto insurance will prevail

- BUT, if autonomous technology is engaged,

- Should the manufacturer be liable for all accidents?

- Or, should the driver be liable for failing to intervene?

- The simplest solution may be no fault or split fault personal auto insurance

- A Simpler Approach To Insurance

- Rather than personal auto insurance, autonomous vehicle manufacturers may start offering their own insurance option

- Manufacturer-issued insurance would eliminate the need to determine if the vehicle or driver is liable

- Manufacturers would be able to

- Compute the exact probability of accidents

- Offer lower insurance premiums

- Decrease premiums with each new release or upgrade

- Whatever the details, the adoption of autonomous vehicles will reduce the risk profile of many drivers

- By 2035, the adoption of autonomous vehicles could reduce auto insurance premiums by $25 billion