LendingTree Auto Insurance Review for 2025 (Trusted Insurance Quotes?)

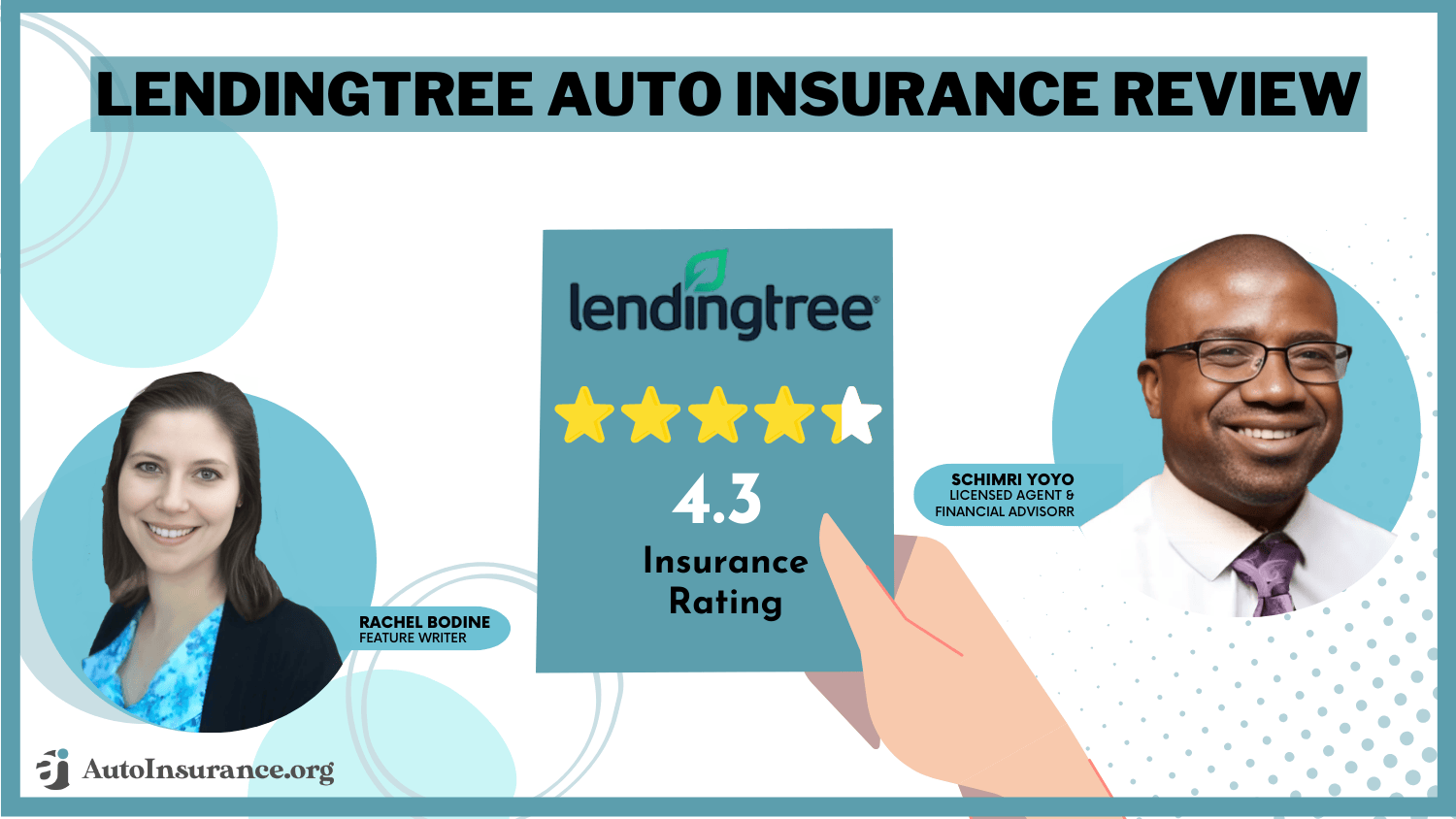

This LendingTree auto insurance review shows it’s best for fast rate comparisons with access to 40+ insurers in under three minutes. LendingTree is rated 4.3/5 for its secure, no-obligation quote tool that filters by coverage type, but negative LendingTree reviews report non-stop follow-up calls from insurers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Apr 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

LendingTree stands out with real-time quotes from over 40 insurers in under three minutes. You can filter quotes by coverage type, such as liability, collision, or full coverage, and compare bundles with home or renters insurance.

LendingTree Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Customer Support | 4.3 |

| Discount Clarity | 4.2 |

| Ease of Use | 4.4 |

| Educational Resources | 4.3 |

| Provider Network | 4.1 |

| Quote Accuracy | 4.3 |

| Quote Speed | 4.4 |

| Savings Potential | 4.3 |

This LendingTree auto insurance review finds it to be a strong option for speed, but it doesn’t provide policy underwriting, final pricing, or detailed insurer breakdowns.

That’s where AutoInsurance.org is stronger. We compare monthly rates that include insurer financial ratings, customer service data, and discount eligibility.

- LendingTree is rated 4.3/5 for quick side-by-side insurance quotes

- Compare coverage options with LendingTree without creating an account

- Getting LendingTree auto insurance quotes doesn’t affect credit scores

Keep reading to see what LendingTree asks for during the quote process and what to expect when you use its network to ask for quotes from an auto insurance company. You can also get free quotes now by entering your ZIP code.

How the LendingTree Quote Tool Works and What You’ll Need

LendingTree makes comparing insurance quotes with its fast and simple online tool. To get started, you’ll enter your ZIP code so the platform can show local rates.

You will next be asked for particular information such as the make, model, year, kind of use (personal or business), and whether your vehicle is financed or leased. Your name, residence, date of birth, marital status, current insurance company, and a brief driving history, including any past infractions or claims, will also be requested.

After that, LendingTree filters real-time quotes based on your selected coverage. Though it’s not a licensed insurance broker, LendingTree acts like one by connecting you with offers from multiple insurers based on your profile. Like an insurance broker, it helps you compare policies from different providers in one place, but it doesn’t sell or service the policies directly — those steps are handled by the insurers you choose.

You won’t need to create an account to get LendingTree car insurance quotes, and you’re not obligated to choose a policy. All personal information is protected using SHA-256 encryption, keeping your data safe while you shop.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

LendingTree Reviews, Ratings & Customer Feedback

LendingTree reviews on Reddit reflect positive user sentiment. One user shared that they had a good experience using LendingTree, saying it was helpful to see multiple loan offers from BBB-accredited lenders when their own bank wouldn’t approve them.

Comment

byu/Kfinch92 from discussion

indebtfree

It’s a solid reminder that LendingTree can give you more options when traditional routes fall short. Here’s a closer look at what real users say about LendingTree. The ratings give a clear picture of what works well and what could be improved.

LendingTree Third-Party Platform Customer Ratings

| Review Platform | |

|---|---|

| 4.8 / 5.0 (37k+ reviews) | |

| A+ | |

| 4.3 / 5.0 (9k+ reviews) | |

| 3.3 / 5.0 | |

| 4.2 / 5.0 (14k+ reviews) | |

| 1.0 / 5.0 (1.8k reviews) |

While the platform earns a strong 4.8 out of 5.0 on the App Store thanks to its quick, ZIP-based quote tool, lower ratings elsewhere reveal growing concerns. WalletHub drops to a 1.0 out of 5.0 from over 1,800 users, mainly because of nonstop follow-up calls and getting bounced between third-party providers. PCMag’s 3.3 rating also points to frustration with a lack of guidance after you submit your information.

See More: Best Auto Insurance Companies According to Reddit

These scores indicate that while LendingTree is good at generating quotes, it leaves users without clear next steps or control over how their data is shared. That’s where AutoInsurance.org is different.

We don’t just help you compare quotes — we guide you through coverage options, explain available discounts, and provide insurer reliability insights, all without triggering a flood of third-party contact. Our goal is to make car insurance comparisons smarter, not harder. Enter your ZIP code to learn more.

LendingTree vs. NerdWallet

NerdWallet scores higher on Google Play and PCMag, suggesting users find its broader tools more reliable and editorially trusted. However, its 3.7 TrustPilot rating shows that when it comes to insurance specifically, users often feel the platform lacks detailed coverage comparisons or transparent insurer breakdowns.

LendingTree vs. NerdWallet: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| 4.8 / 5.0 (37k+ reviews) | 4.8 / 5.0 (115k+ reviews) | |

| A+ | A+ | |

| 4.3 / 5.0 (9k+ reviews) | 4.5 / 5.0 (29.9k reviews) | |

| 3.3 / 5.0 | 4.0 / 5.0 | |

| 4.2 / 5.0 (14k+ reviews) | 3.7 / 5.0 (2k+ reviews) | |

| 1.0 / 5.0 (1.8k reviews) | 1.5 / 5.0 (10+ reviews) |

These patterns matter. High mobile ratings mean little if you’re flooded with calls or unsure who’s handling your policy next. That’s where AutoInsurance.org stands out—it lets you compare monthly rates, view financial strength ratings, check coverage types like liability or full, and avoid aggressive third-party outreach entirely.

If you’re looking for more insight into NerdWallet’s features, the NerdWallet auto insurance review offers a detailed breakdown of how their quote process compares.

LendingTree vs. Insurify

If you’re considering which platform to use, our Insurify insurance review gives a deeper look at how its quoting process stacks up compared to other websites. Here’s how Insurfy compares to LendingTree:

LendingTree vs. Insurify: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| 4.8 / 5.0 (37k+ reviews) | 3.4 / 5.0 (141 reviews) | |

| A+ | A+ | |

| X | 3.8 / 5.0 (130+ reviews) | |

| 4.3 / 5.0 (9k+ reviews) | 3.4 / 5.0 (141 reviews) | |

| 3.3 / 5.0 | NA | |

| 4.2 / 5.0 (14k+ reviews) | 4.7 / 5.0 (2k+ reviews) | |

| 1.0 / 5.0 (1.8k reviews) | 4.1 / 5.0 (70+ reviews) |

Looking at the app ratings gives you a sense of the overall user experience. It makes sense that LendingTree receives a strong 4.8 in the App Store and 4.3 in Google Play. The app is incredibly user-friendly, quick, and clean. It only takes a few minutes to display quotes, and you are not required to log in.

However, those same users often leave much lower reviews elsewhere, like WalletHub, once they deal with what comes after. In other words, LendingTree’s app does a great job pulling you in, but the experience after you click “compare” can feel like a handoff with no guidance.

Insurify, by contrast, scores just 3.4 on both major app stores. That tells us users might be underwhelmed by the app’s design or find the experience clunkier overall. However, Insurify’s superior TrustPilot and WalletHub scores indicate that people find the procedure to be less intrusive and more honest once they pass the interface.

LendingTree’s Corporate Structure and Acquisitions

LendingTree, LLC is fully owned by LendingTree, Inc., and has grown its reach by acquiring key companies along the way. It functions as a centralized online lending marketplace, helping users connect with multiple loan and insurance providers and easily compare online auto insurance companies through its network.

LendingTree Company Overview

| Details | |

|---|---|

| Founders | Doug Lebda |

| Founded | 1996 |

| Headquarters | 1415 Vantage Park Drive, Suite 700 Charlotte, NC 28203 US |

| What They Offer | Online Lending Marketplace |

| Employees | 870 (2023) |

| Revenue | US$673 million (2023) |

| Phone | 1 704 5415351 |

| [email protected] |

In 2018, the company acquired QuoteWizard, an online insurance marketplace founded by Scott Peyree, and in 2017, it added MagnifyMoney to its portfolio—a financial comparison platform based in New York.

LendingTree Customer support is available by phone at 1-704-541-5351 or by emailing [email protected] for questions about services or product offerings.

Pros and Cons of LendingTree

LendingTree makes it easy to check rates fast, but like any tool, it has upsides and trade-offs. Here’s a quick look at where it shines:

- ZIP-Based Quote Filters: Compare prices on LendingTree by entering your ZIP code and then selecting the level of coverage you need—full coverage, collision, or liability—based on your personal needs.

- No Account Required: Receive instant estimates from forty-plus insurance providers in less than three minutes without creating an account or logging in.

- Real-Time Filtering: Users can narrow quotes by ZIP code, coverage type (liability, collision coverage, and more), which is ideal if you need personalized results in seconds.

LendingTree is also free to use and won’t impact your credit score when you’re shopping for insurance policies or a new bank account.

If you're comparing liability and full coverage, LendingTree’s ZIP-based filters help narrow results fast.Daniel Walker Licensed Auto Insurance Agent

However, some LendingTree car insurance reviews report that it falls short when it comes to your personal data. When you use LendingTree, your phone number and email address can be sent to insurance agents.

- Spam Calls: LendingTree earns just 1.0/5.0 on WalletHub from 1.8k+ reviews, mainly due to excessive follow-up calls from partner providers after quote submission.

- Limited to External Partners: It scored 3.3/5.0 on PCMag, where editors noted limited personalization of coverage and a heavy reliance on external partners for final pricing and terms.

While LendingTree works well for quick comparisons, the lack of follow-through and aggressive third-party contact can be a dealbreaker for some.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Get Fast and Secure Insurance Quotes With LendingTree

Our LendingTree auto insurance review found it’s a quick and easy website that provides users with rates from more than 40 insurers in a matter of minutes. One significant benefit is that you may obtain real-time quotations without having to create an account, but a frequent drawback is that third-party partners will often contact you once you enter your information.

It’s a great option for shoppers who want quick comparisons and prefer not to commit to a single insurer immediately. What sets LendingTree apart is that over 37,000 users have given it a 4.8 out of 5.0 rating on the App Store, suggesting that they are extremely satisfied with its speed and usability.

To get the best deal from the best insurance companies, it’s always smart to compare multiple insurance companies online and get real-time quotes from top companies before making a decision.

Curious if LendingTree gave you the best rate? Use our free quote tool to compare and see what you could save.

Frequently Asked Questions

What is LendingTree?

LendingTree, Inc. is an online marketplace that allows you to compare real-time quotations from more than 40 lenders and insurers in less than three minutes.

How trustworthy is LendingTree?

LendingTree, LLC is BBB-accredited, protects your personal data with SHA-256 encryption, and has a 4.8 out of 5.0 App Store rating from 37,000+ users, showing strong consumer trust (Read More: How to Check if an Auto Insurance Company is Legitimate).

Is LendingTree insurance any good?

Yes, LendingTree insurance is effective for comparing auto, home, and renters policies, offering ZIP-based filters and coverage options like liability auto insurance, collision coverage, or bundled packages.

Does a LendingTree loan hurt your credit?

Using LendingTree to check rates triggers only a soft credit pull, so your credit score won’t be affected unless you move forward with a lender and formally apply.

What credit score do you need for LendingTree?

LendingTree doesn’t require a minimum credit score. It matches you with lenders offering insurance or loans tailored to various credit levels, from excellent to fair or rebuilding.

Is LendingTree a good loan company?

LendingTree isn’t a direct lender, but it connects you to trusted partners, including BBB-accredited lenders, so you can get multiple auto insurance quotes, compare monthly payments, and pick a loan or policy that fits your budget.

How fast does LendingTree deposit money?

While LendingTree doesn’t issue loans directly, most partner lenders can fund approved loans as fast as the next business day, depending on their process and your bank.

How does LendingTree work?

LendingTree lets you compare real-time quotes from over 40 insurers in under 3 minutes using your ZIP code, vehicle details, and coverage type without needing to create an account.

Is LendingTree a spammy site?

Not exactly, but many users report receiving frequent calls or emails from third-party insurance partners after submitting their information, especially if they request multiple companies to evaluate auto insurance quotes and compare coverage options.

Is LendingTree free?

Absolutely. LendingTree’s quote tool is 100% free and gives users access to multiple monthly rate comparisons from top insurers with no obligation to buy.

Is LendingTree a scam?

No, LendingTree is a trusted online marketplace with an A+ BBB rating and a 4.8/5.0 score on the App Store from over 37,000 users, offering secure, verified insurer connections.

What can you learn from LendingTree reviews for auto loans?

LendingTree reviews for auto loans highlight how you can compare pre-qualified offers from multiple lenders in minutes without affecting your credit score (Read More: Is it a good time to refinance an auto loan?).

What do LendingTree review complaints on Reddit usually mention?

LendingTree reviews complaints on Reddit and often focuses on aggressive follow-up calls from partner lenders after quote submissions. However, many users still praise the ability to compare auto loan and insurance offers from BBB-accredited lenders when traditional banks turn them down.

What issues do users mention in LendingTree review complaints on BBB?

LendingTree reviews complaints on BBB and frequently mentions unexpected third-party outreach and occasional mismatches in quoted versus final loan or insurance terms. Despite this, customers appreciate the secure SHA-256 encrypted quote tool and the ability to compare over 40 insurers and lenders without signing up.

Read More: Best Auto Insurance Companies According to Consumer Reports

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.