Best Live Oak, Florida Auto Insurance in 2025 (Check Out the Top 10 Companies)

The top picks for the best Live Oak, Florida auto insurance are State Farm, AAA, and Erie, with State Farm offering the best overall rate at just $48 per month. These providers deliver excellent car insurance options, combining affordability with comprehensive coverage tailored to meet your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Live Oak Florida

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Live Oak Florida

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Live Oak Florida

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews

The best options for best Live Oak, Florida auto insurance are State Farm, AAA, and Erie, with State Farm offering the most competitive rates at $48 per month.

These companies provide many discounts, a user-friendly online app, and 24/7 support, making them ideal choices for Live Oak drivers seeking convenience and savings.

Our Top 10 Company Picks: Best Live Oak, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 12% B Many Discounts State Farm

#2 15% A Online App AAA

#3 10% A+ 24/7 Support Erie

#4 18% A++ Custom Plan Geico

#5 14% A+ Usage Discount Nationwide

#6 16% A+ Innovative Programs Progressive

#7 11% A++ Accident Forgiveness Travelers

#8 17% A+ Add-on Coverages Allstate

#9 13% A++ Military Savings USAA

#10 19% A Local Agents Farmers

Comparing these auto insurance companies provides you the best coverage suited for your needs. To learn more, explore our comprehensive resource on commercial auto insurance titled “What is Auto Insurance”

Get the car insurance at the best price — enter your ZIP code above to shop for right coverage from the top insurers.

- Providers offer 24/7 support and easy online tools simplify insurance management

- State Farm offers top Live Oak, Florida auto insurance starting at $48 monthly

- Top companies offer customized coverage and discounts for Live Oak drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm flaunts a broad range of discounts, making it a top choice for the best Live Oak, Florida auto insurance, which you can discover in our State Farm review.

- Wide Network: Extensive network of local agents for personalized service in Live Oak.

- Strong Financial Stability: State Farm’s financial strength ensures reliability in claims processing for Live Oak members.

Cons

- Higher Premiums for Some: Premiums might be higher in Live Oak for certain coverage options compared to other providers.

- Basic Online Tools: Online tools are less advanced compared to some competitors in Live Oak.

#2 – AAA: Best for Online App

Pros

- Exclusive Member Benefits: AAA offers unique discounts and benefits for Live Oak members.

- Online App: AAA features a highly functional online app, spotlighting ease and convenience for Live Oak drivers managing their insurance, fully detailed in our AAA review.

- Roadside Assistance: Comprehensive roadside assistance included in auto insurance policies for Live Oak Members.

Cons

- Membership Requirement: Must be a AAA member in Live Oak to access insurance, which may involve additional costs.

- Higher Premiums: Premiums may be higher for non-members for Live Oak Drivers.

#3 – Erie: Best for 24/7 Support

Pros

- Customizable Policies: Erie offers tailored coverage options to suit the specific needs of Live Oak drivers.

- Excellent Customer Service: Known for responsive and friendly customer service in Live Oak.

- 24/7 Support: Erie demonstrates comprehensive 24/7 support, ensuring reliable assistance for those seeking the best Live Oak, Florida auto insurance, thoroughly explained in our Erie review.

Cons

- Limited Availability: Erie has a more limited presence, with fewer agents in Live Oak, Florida.

- Fewer Discounts: Erie offers fewer discount opportunities in Live Oak compared to other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Custom Plan

Pros

- Custom Plan: Geico highlights adaptable custom plans, catering effectively to the diverse needs of Live Oak residents, which you can read more about in our Geico review.

- Affordable Rates: Geico is known for offering some of the lowest rates in Live Oak, Florida.

- User-Friendly Online App: Geico’s online app simplifies policy management and claims in Live Oak.

Cons

- Limited Local Agents: Fewer local agents available in Live Oak for in-person assistance.

- Basic Coverage Options: May not offer as many specialized coverage options as other providers in Live Oak.

#5– Nationwide: Best for Usage Discount

Pros

- Strong Reputation: Nationwide is highly regarded for its comprehensive coverage in Live Oak, Florida.

- Usage Discount: Nationwide flaunts attractive usage-based discounts, helping Live Oak drivers save significantly on their auto insurance, as elaborated in our Nationwide review.

- SmartRide Program: Nationwide’s telematics program helps Live Oak drivers save based on safe driving habits.

Cons

- Higher Premiums: In Live Oak, Nationwide’s premiums can be higher, especially for full coverage policies.

- Slower Claims Process: Some customers report a slower claims process in Live Oak.

#6 – Progressive: Best for Innovative Programs

Pros

- Affordable Rates: Progressive offers competitive rates for auto insurance in Live Oak, Florida.

- Flexible Payment Options: Progressive provides multiple payment options to suit Live Oak drivers.

- Innovative Programs: Progressive exhibits cutting-edge innovative programs, making it a leading option for the best Live Oak, Florida auto insurance, outlined in our Progressive review.

Cons

- Average Customer Service: Customer service may not be as strong as competitors in Live Oak

- Rate Increases: Rates in Live Oak may increase significantly after claims or changes in policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7– Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers parades valuable accident forgiveness, offering added protection and peace of mind for Live Oak drivers, described in detail in our Travelers review.

- Green Discounts: Discounts available for hybrid or electric vehicles in Live Oak, Florida.

- Comprehensive Roadside Assistance: Policies include enhanced roadside assistance services, providing added convenience for drivers in Live Oak.

Cons

- Higher Premiums: Travelers’ premiums may be on the higher side compared to others in Live Oak.

- Limited Online Tools: Online tools and apps may fall short compared to competitors, particularly in Live Oak.

#8 – Allstate: Best for Add-On Coverages

Pros

- Robust Discounts: Allstate provides various discounts, helping reduce premiums for Live Oak drivers.

- Add-On Coverages: Allstate spotlights extensive add-on coverages, providing enhanced value for your Live Oak, Florida auto insurance, as presented in our Allstate review.

- Strong Financial Stability: Allstate’s financial stability ensures reliable claims payments, particularly valuable for drivers in Live Oak.

Cons

- Higher Rates: Allstate’s premiums may be higher than other providers in Live Oak, Florida.

- Mixed Customer Service Reviews: Customer service experiences can vary, with some negative reports reported in Live Oak.

#9– USAA: Best for Military Savings

Pros

- Top-Tier Customer Service: Renowned for exceptional customer service and claims handling in Live Oak.

- Comprehensive Coverage: Offers comprehensive coverage options tailored for military families in Live Oak.

- Military Savings: USAA demonstrates impressive savings for military families, making it ideal for those in Live Oak, Florida, discussed in our USAA review.

Cons

- Eligibility Restrictions: Available exclusively to military members, veterans, and their families in Live Oak.

- Limited Local Agents: Fewer local agents in Live Oak for in-person support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10– Farmers: Best for Local Agents

Pros

- Local Agents: Farmers manifests a strong network of local agents, offering personalized and attentive service for Live Oak residents, as explored in our Farmers review.

- Comprehensive Coverage Options: A broad selection of coverage options is available to meet diverse needs in Live Oak.

- Discount Programs: Live Oak drivers can benefit from various discount opportunities, including bundling options for additional savings.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to other providers in Live Oak.

- Limited Digital Tools: Online tools and app offered in Live Oak are less sophisticated compared to those of competitors.

Minimum Auto Insurance in Live Oak, Florida

Minimum Auto Insurance in Live Oak, Florida specifies the required coverage for liability, including bodily injury and property damage.

State Farm offers the best Live Oak, Florida auto insurance with unmatched discounts and comprehensive coverage options.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Meeting these minimum requirements ensures compliance with state laws and provides essential financial protection, making it the baseline for the best Live Oak, Florida auto insurance.

Best Live Oak, Florida Auto Insurance Rates by Coverage Level

The best Live Oak, Florida auto insurance rates vary based on coverage level. Comprehensive auto insurance coverage typically costs more but offers extensive protection. Basic coverage provides essential liability at a lower cost.

Live Oak, Florida Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

AAA $43 $103

Allstate $53 $98

Erie $54 $101

Farmers $48 $104

Geico $46 $96

Nationwide $51 $108

Progressive $45 $106

State Farm $48 $99

Travelers $50 $100

USAA $53 $102

Comparing these options helps find the most affordable rates for your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Live Oak, Florida Auto Insurance by Age, Gender, and Marital Status

The best Live Oak, Florida auto insurance can differ by age, gender, and marital status. These are factors that affect auto insurance rates and coverage options.

Auto insurance rates in Live Oak, Florida, vary significantly by age, gender, and marital status, impacting the overall cost and options available to drivers.

Young drivers might face higher premiums, while married individuals often enjoy discounts. Tailoring your search based on these aspects helps secure the most cost-effective annual auto insurance.

Best Live Oak, Florida Auto Insurance by Driving Record

Best Live Oak, Florida auto insurance rates vary based on your driving record. Clean driving records often secure lower premiums, while a history of accidents or violations can lead to higher costs.

To get the best auto insurance in Live Oak, Florida, maintain a good driving record and shop around for quotes. Different providers may offer varying rates based on your driving history.

To gain further insights, consult our comprehensive guide titled “ How Auto Insurance Companies Check Driving Record.”

Best Live Oak, Florida Auto Insurance Rates by ZIP Code

Discover the best Live Oak, Florida auto insurance rates by ZIP code to find tailored coverage options for your area. Comparing rates by ZIP code helps you identify the most affordable and suitable insurance policies available.

State Farm offers the best Live Oak, Florida auto insurance with exceptional coverage and extensive local support.Michelle Robbins Licensed Insurance Agent

The best Live Oak, Florida auto insurance can vary depending on your specific location, so checking local rates ensures you get the best value. Use ZIP code data to secure optimal coverage and cost savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

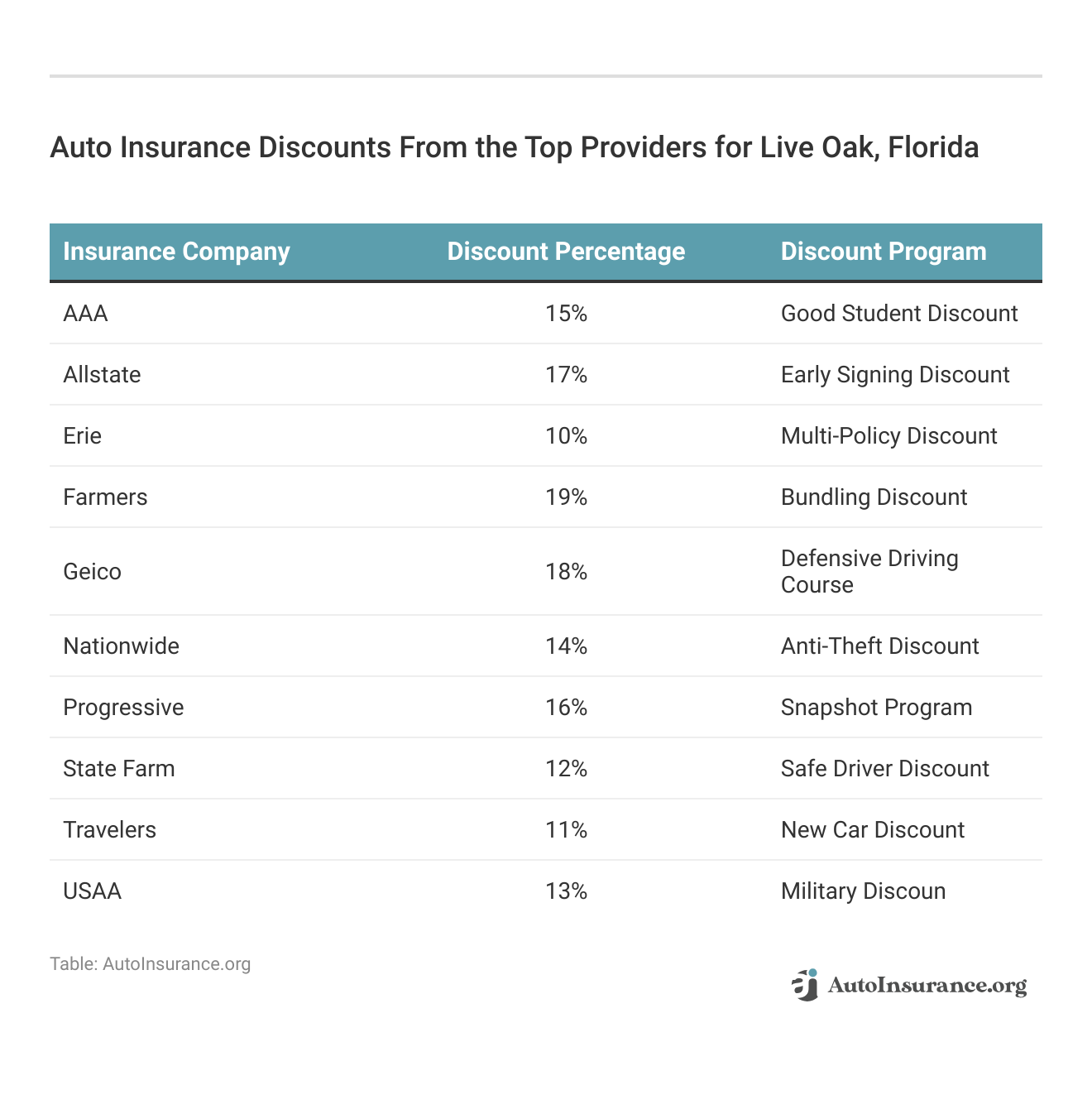

Best by Category: Best Auto Insurance in Live Oak, Florida

Discover the best auto insurance in Live Oak, Florida by category, highlighting top choices for various needs. From comprehensive coverage to competitive rates, explore how each provider excels.

This guide breaks down the best Live Oak, Florida auto insurance options to fit different preferences. Find the ideal policy to suit your specific requirements and get the best protection.

The Best Live Oak, Florida Auto Insurance Companies

When looking for the best Live Oak, Florida auto insurance companies, consider those offering competitive rates and comprehensive coverage.

Companies like State Farm excel in providing extensive discounts and excellent service. Top choices highlight affordability and tailored options to meet diverse needs.

What affects auto insurance rates in Live Oak, Florida?

Several factors impact the best Live Oak, Florida auto insurance rates, including your driving record, vehicle type, and coverage levels. Local regulations and your credit history also play significant roles in determining your premium.

- Driving Record: Your driving history impacts your auto insurance rates, with clean records often leading to lower premiums.

- Vehicle Type: The make and model of your car affect insurance costs, with higher-value or high-performance vehicles usually costing more to insure.

- Coverage Levels: The extent of coverage you choose influences rates, with more comprehensive plans generally costing more.

- Local Regulations: Local insurance laws and requirements in Live Oak can impact your auto insurance rates.

- Credit History: Your credit score can affect the best Live Oak, Florida auto insurance rates, with higher scores often resulting in better rates.

Understanding these elements can help you find the most affordable and comprehensive coverage.

For additional details, explore our comprehensive resource titled “Factors That Affect Auto Insurance Rates”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Live Oak, Florida Auto Insurance Quotes

Before you buy the best Live Oak, Florida auto insurance, make sure you have compared rates from multiple companies. Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What is the best car insurance company in Florida?

The best car insurance company in Florida for top coverage is often State Farm, recognized for offering the best Live Oak, Florida auto insurance with excellent coverage options.

Where can I find the Best auto insurance rates in Florida?

To find the best auto insurance rates in Florida, compare quotes from providers like State Farm and Progressive, known for their competitive rates and the best Live Oak, Florida auto insurance. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Why is car insurance so expensive in Florida?

Car insurance in Florida is costly due to high rates of uninsured drivers and weather-related claims, contributing to the overall high premiums for the best Live Oak, Florida auto insurance.

For detailed information, refer to our comprehensive report titled “What are the average collateral insurance premiums?.”

Which insurance company has the highest customer satisfaction?

State Farm is noted for its high customer satisfaction in Florida, making it a top contender for the best Live Oak, Florida auto insurance with reliable service.

Does Florida have the highest car insurance rates?

Florida is known for having some of the highest car insurance rates in the nation, influenced by factors such as a high number of claims and the need for the best Live Oak, Florida auto insurance.

What is the best car insurance for seniors in Florida?

Seniors in Florida can benefit from the best Live Oak, Florida auto insurance with providers like State Farm and AAA, which offer tailored coverage and discounts for older drivers.

To delve deeper, refer to our in-depth report titled “Best Auto Insurance for Seniors in Florida.”

Which insurance company denies most claims in Florida?

To avoid companies with high claim denial rates, choose insurers with a strong track record, such as State Farm, known for reliable claims processing in the best Live Oak, Florida auto insurance.

How much is the average car insurance in Florida?

The average car insurance cost in Florida is between $1,500 and $2,000 annually, reflecting the expense of obtaining the best Live Oak, Florida auto insurance.

What is the best car insurance coverage to have in Florida?

The best car insurance coverage in Florida includes comprehensive and collision options, along with personal injury protection (PIP), ensuring comprehensive protection as part of the best Live Oak, Florida auto insurance.

To expand your knowledge, refer to our comprehensive handbook titled “Types of auto insurance.”

What is the basic car insurance in Florida?

The basic car insurance required in Florida includes Personal Injury Protection (PIP) and Property Damage Liability (PDL), forming part of the best Live Oak, Florida auto insurance.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.