Best Low-Mileage Auto Insurance Discounts in 2025 (Get 8% Off With These 10 Companies)

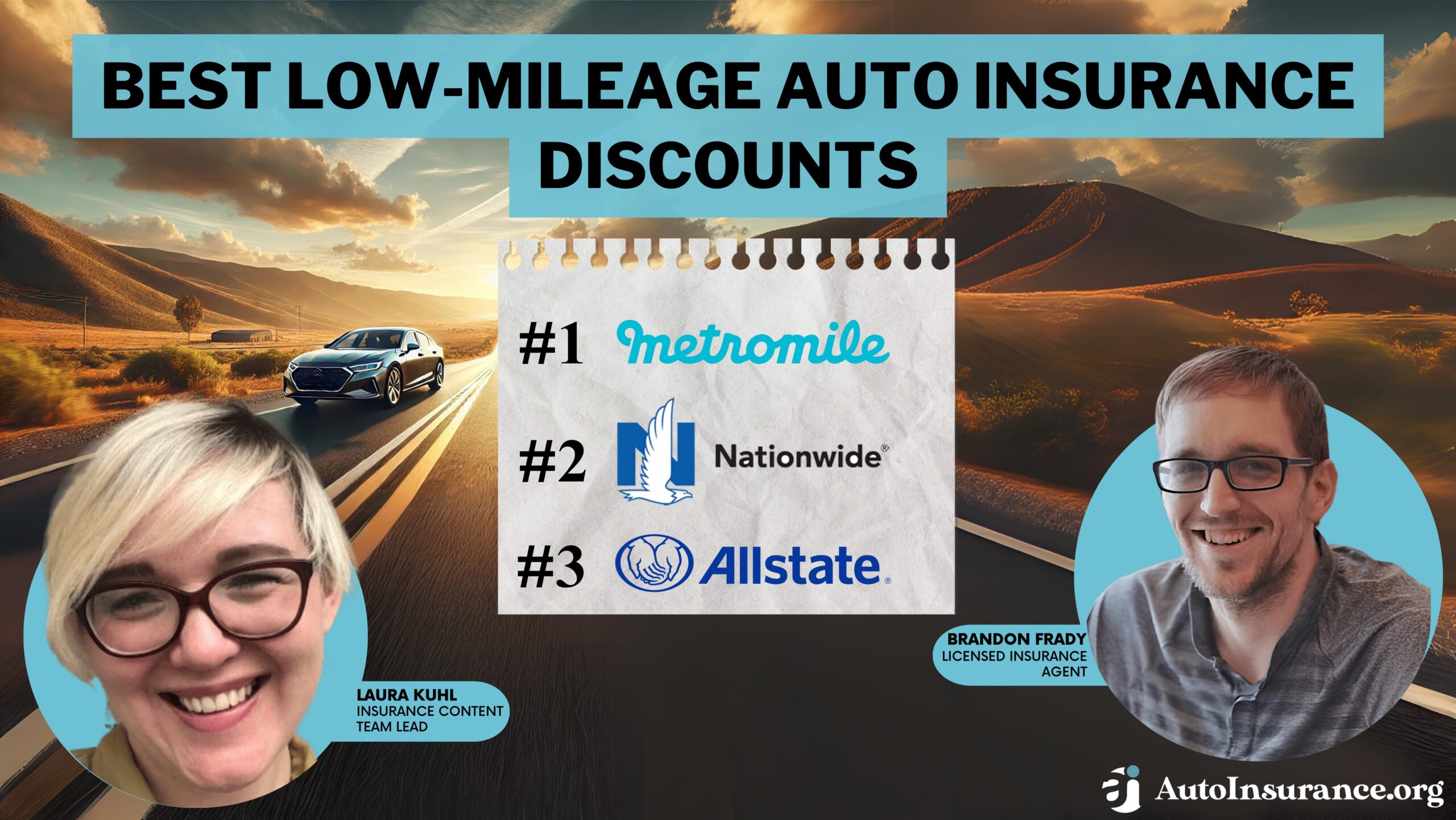

Metromile, Nationwide, and Allstate have the best low-mileage auto insurance discounts, with savings of at least 8% at the top companies. Most auto insurance companies require drivers to travel fewer than a set number of miles per year to qualify. Drivers may also need to use a mileage-tracking device.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Metromile, Nationwide, and Allstate have the best low-mileage auto insurance discounts for drivers looking to save on their coverage.

Not sure how to get a low mileage auto insurance discount? Drivers who aren’t on the road often are less likely to get into an accident and file a claim, so companies offer a discount for low-mileage drivers who drive less than the average each year.

Our Top 10 Company Picks: Best Low-Mileage Auto Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Who Qualifies? |

|---|---|---|---|---|

| #1 | 30% | A- | Drivers who drive less than 10,000 miles annually | |

| #2 | 25% | A+ | Policyholders with annual mileage below 7,500 miles |

| #3 | 20% | A+ | Customers driving under 7,500 miles each year | |

| #4 | 20% | B | Drivers with low mileage, typically under 7,500 miles | |

| #5 | 18% | A | Policyholders driving less than 8,000 miles annually |

| #6 | 15% | A++ | Low-mileage drivers with fewer than 10,000 miles per year | |

| #7 | 12% | A+ | Customers driving fewer than 10,000 miles annually | |

| #8 | 10% | A++ | Military members and families with low annual mileage | |

| #9 | 10% | A | Drivers with annual mileage under 12,000 miles | |

| #10 | 8% | A | Drivers with low mileage, typically under 10,000 miles |

Continue reading to learn all about low-mileage discounts, how to qualify for these auto insurance discounts, and where to buy the best car insurance for low-mileage drivers.

If you’re a low-mileage driver and want to get started on finding discounts, use our free quote comparison tool to get started on finding affordable auto insurance.

- Metromile has the biggest insurance discount for low-mileage drivers

- Low mileage requirements vary among auto insurance companies

- Low-mileage drivers are on the road less and, therefore, are less likely to crash

How to Qualify for Low-Mileage Auto Insurance Discounts

Every auto insurance company doesn’t offer a low mileage discount, but those who offer low mileage auto insurance require drivers to drive under a specific amount of miles annually to qualify.

What is low mileage for an insurance discount? Most auto insurance discounts for low-mileage drivers go to auto insurance policyholders who drive fewer than 7,500 miles per year.

The maximum amount of miles for an auto insurance low-mileage discount differs among companies. A Metromile insurance low mileage discount requires you to drive less than 10,000 miles per year, whereas State Farm auto insurance discounts for low mileage drivers require you to drive less than 7,500 miles per year.

Read more about these two companies in our Metromile auto insurance review and State Farm auto insurance review.

The low-mileage cap varies by insurer. So, a USAA low mileage discount will differ from Travelers’.

This number may be higher or lower depending on what company you pick. So, a USAA low mileage discount will have different requirements than Travelers. Contact your auto insurance company to see if it offers a low mileage discount and what you need to do to qualify for auto insurance discounts for low-mileage drivers.

Most companies require one of the following forms of proof to qualify for a low mileage discount for car insurance:

- Tracking Devices

- Pictures of Odometer Readings

- Verification From a Third Party

For example, if you’re participating in a safe driving program, such as State Farm Drive Safe and Save, your insurer likely uses your mileage from that program to reward you with a discount automatically.

You may also need to submit a picture of your odometer each year to qualify (Read More: State Farm Drive Safe and Save Review). Your insurance company will clearly state how it wants proof of low mileage to issue an auto insurance discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies for Low-Mileage Discounts

Low mileage discounts affect your auto insurance rates, although how much you’ll save depends on the company. In most cases, low-mileage discounts are a great way to get cheap car insurance for low-mileage drivers.

Take a look at the average rates below to see how the amount you’ll save with a low mileage discount varies among companies.

Best Low-Mileage Savings: Min. Coverage Auto Insurance Monthly Rates Before & After Discount

| Insurance Company | Rank | After Discount | Before Discount |

|---|---|---|---|

| Metromile | #1 | $43 | $62 |

| Nationwide | #2 | $47 | $63 |

| Allstate | #3 | $70 | $87 |

| State Farm | #4 | $38 | $47 |

| Liberty Mutual | #5 | $79 | $96 |

| Travelers | #6 | $45 | $53 |

| Progressive | #7 | $49 | $56 |

| USAA | #8 | $29 | $32 |

| Farmers | #9 | $68 | $76 |

| Safeco | #10 | $35 | $38 |

Metromile has some of the best car insurance for low-mileage drivers, but other companies also offer great deals on limited-mileage car insurance.

While the percentage you’ll save also varies from company to company, a company with a higher percentage saved doesn’t necessarily mean it will be the cheapest company for you. You should also consider the average rate of a company before the discount is applied. Take a look at the average rates by driving records at the top companies below.

The cheapest auto insurance companies may offer a smaller discount on insurance for low mileage cars, but because their rates are lower initially, they may still be the cheapest option for most drivers.

Other Ways to Save on Low-Mileage Auto Insurance Policies

Low mileage discounts aren’t the only way to save on your auto insurance policy. So make sure to visit your insurance company’s list of discounts to make sure there aren’t any you are missing out on.

Most insurance companies have a variety of discounts to choose from besides low-mileage insurance discounts, such as a bundling discount for customers who purchase more than one type of insurance from the same company.Dani Best Licensed Insurance Producer

Most auto insurance companies will automatically apply discounts to a policy unless proof of qualifications is provided, such as a good student discount. Some discounts you can find at most auto insurance companies are listed below.

- How to Get a Good Student Auto Insurance Discount

- How to Get a Good Driver Auto Insurance Discount

- How to Get a Membership Auto Insurance Discount

- How to Get an Electronic Automatic Billing Auto Insurance Discount

- How to Get a Multi-Vehicle Auto Insurance Discount

If you have already exhausted your discount options at your company but don’t want to switch companies, you may want to consider raising auto insurance deductibles if it’s low. We don’t recommend raising it to an amount you can’t afford to pay out of pocket.

If you have already raised your deductible and utilized all the insurance discounts possible, shopping around for a new company can be helpful to lower your rates. Read more about how to switch auto insurance. You can also enter your ZIP code into our free quote comparison tool below to find a company that offers a better price.

Saving With Low-Mileage Auto Insurance Discounts

Getting a low mileage discount is a great way to get cheap auto insurance. Most insurance companies require that you drive fewer than 7,500 miles per year and provide proof of your low mileage to get a low annual mileage car insurance discount. You can also take advantage of other discounts to maximize your savings (Read More: How to Lower Your Auto Insurance Rates).

If you want to find a lower rate on auto insurance, no matter what your mileage is, use our free quote comparison tool to help you find the best rate from companies in your area. Enter your ZIP to get started.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is a low mileage auto insurance discount?

A low mileage auto insurance discount is a reduction in insurance premiums offered by insurance companies to policyholders who drive fewer miles than the average driver. It is a way for insurers to reward drivers who have lower exposure to accidents and potential claims.

How much is a low-mileage discount?

The potential savings with a low mileage auto insurance discount can vary depending on the insurance company and your individual circumstances. Discounts typically range from 5% to 30% off the base premium. It’s essential to check with your insurance provider to understand the specific discount percentages they offer.

How does mileage affect auto insurance rates?

Does annual mileage affect auto insurance rates? Yes, annual mileage can affect your auto insurance rates. A low mileage discount is a percentage taken off of your auto insurance coverages if you drive fewer miles than the average driver.

Generally, it applies to coverages not required by your state, so it would be a discount on collision and comprehensive auto insurance, not your required liability auto insurance.

How can I qualify for a low-mileage auto insurance discount?

To qualify for a low mileage auto insurance discount, you typically need to provide your insurance company with accurate information regarding your annual mileage.

Most insurers have a threshold that determines eligibility, such as driving less than a certain number of miles per year. This information can be provided during the insurance application process or when updating your policy details.

How do insurance companies verify my mileage?

Insurance companies may use different methods to verify your mileage. Common methods include self-reporting, using odometer readings from your vehicle, or utilizing mileage tracking devices or telematics apps.

Some insurers may also request periodic mileage updates or verify your mileage during policy renewals. If you are looking to shop for a new policy, make sure to compare multiple companies’ rates to find the best deal on low-mileage vehicle insurance. Get started by entering your ZIP in our free quote tool.

What are the benefits of a low mileage auto insurance discount?

A low mileage auto insurance discount can offer several benefits, including:

- Lower Insurance Premiums: By demonstrating that you drive fewer miles, you present a reduced risk to the insurance company, which can result in lower premiums.

- Potential Savings: The discount can lead to significant savings over time, especially if you consistently maintain low mileage.

- Incentive for Responsible Driving: Encouraging lower mileage promotes responsible driving habits and potentially reduces the risk of accidents.

If you qualify for a low-mileage discount, make sure to let your company know.

What if my mileage increases during the policy period?

If your mileage increases significantly during your policy period, it’s important to notify your insurance company. Some insurers may require you to provide updated mileage information, which could potentially affect your premium.

Failing to inform your insurance company about increased mileage could lead to issues if you need to file a claim (Read More: How to File an Auto Insurance Claim).

Are there any restrictions or limitations with a low mileage auto insurance discount?

Insurance companies may have certain restrictions or limitations associated with their low mileage auto insurance discounts. Some common restrictions include:

- Annual Mileage Limits: There may be a cap on the number of miles you can drive per year to maintain the discount.

- Exclusions for Specific Usage: Discounts may not apply to certain types of driving, such as commercial use or driving for ride-sharing services.

- Verification Requirements: Insurers may request periodic mileage updates or verification to ensure compliance with the discount terms.

Restrictions will vary by company, so check with your provider to see what requirements you need to follow for a low-mileage car insurance discount.

Does low mileage reduce insurance rates?

Yes, low mileage will reduce rates if your auto insurance company offers a low-mileage insurance discount.

What happens if I underestimate my mileage for insurance?

Underestimating your mileage could result in you losing out on your car insurance low-mileage discount. However, mileage is just one of the many factors that affect auto insurance rates, so there are other ways you can save if you have a higher annual mileage.

What is considered low mileage for car insurance?

Generally, under 10,000 miles is considered lower mileage, as this is less than the average driver travels per year.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.