Best Mazda 3 Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Progressive, Allstate, and USAA are the best Mazda 3 auto insurance providers, offering rates as low as $55/month. Progressive stands out for competitive pricing, Allstate for excellent customer service, and USAA for military benefits. Get comprehensive coverage tailored to your needs and budget.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mazda 3

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Mazda 3

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Mazda 3

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

Allstate excels in customer service, ensuring a smooth auto insurance claims process, while USAA provides unparalleled benefits for military members. Get the best coverage tailored to your Mazda 3 needs today.

Our Top 10 Company Picks: Best Mazda 3 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Flexible Coverage | Progressive | |

| #2 | 25% | A+ | Customer Service | Allstate | |

| #3 | 10% | A++ | Military Benefits | USAA | |

| #4 | 25% | A | Comprehensive Policies | Liberty Mutual |

| #5 | 20% | A+ | Affordable Rates | Nationwide |

| #6 | 20% | A | Customizable Plans | Farmers | |

| #7 | 25% | A++ | Competitive Prices | Geico | |

| #8 | 20% | B | Reliable Service | State Farm | |

| #9 | 10% | A+ | Local Support | Erie |

| #10 | 8% | A++ | Extensive Coverage | Travelers |

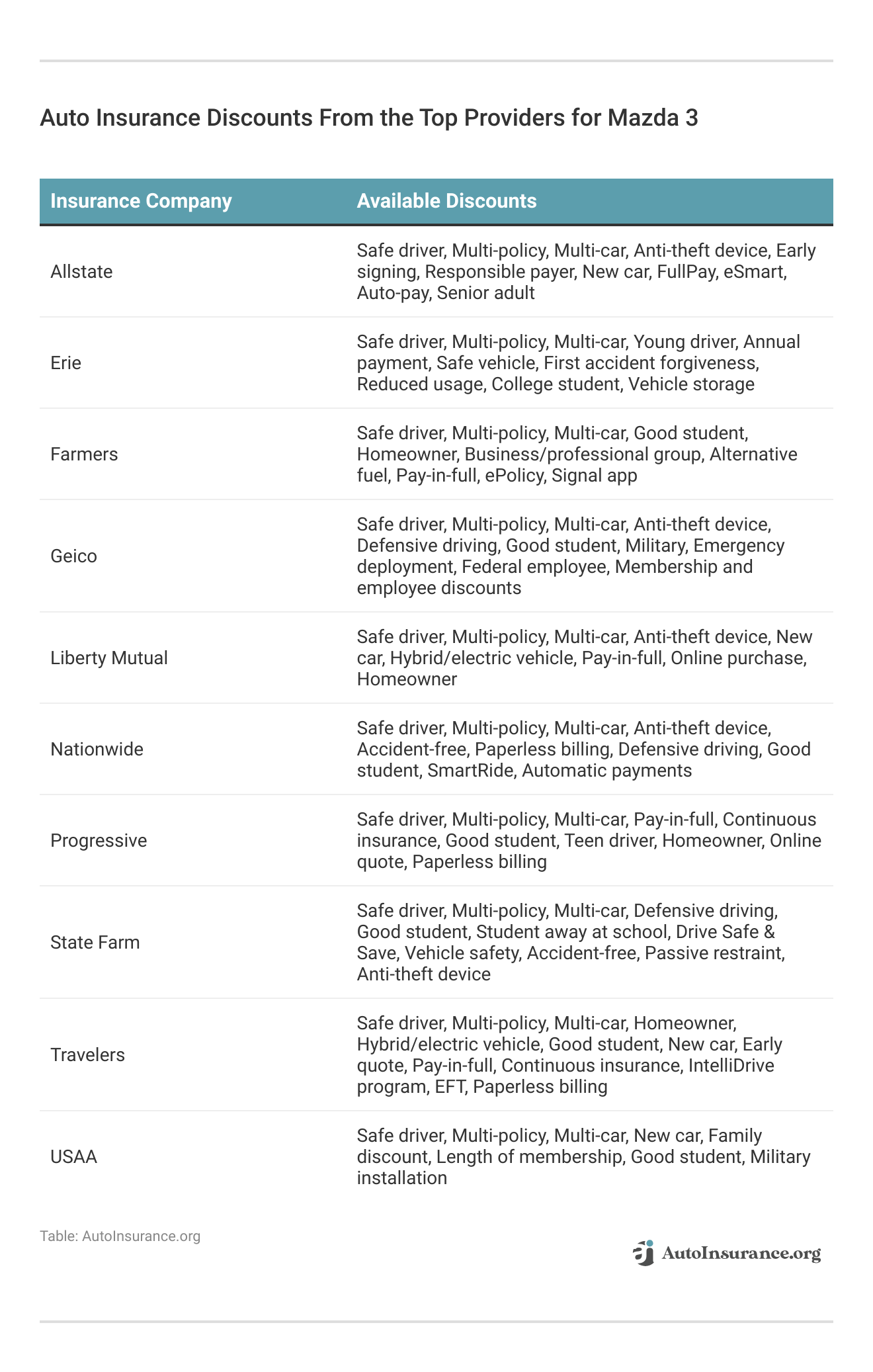

Explore the Mazda 3 insurance rates for full coverage and for liability-only insurance. Good drivers can save up using policy discounts.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Get the best Mazda 3 auto insurance with rates as low as $55/month

- Progressive is the top pick for the best Mazda 3 auto insurance

- Ensure comprehensive coverage and excellent service with top providers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Flexible Coverage: Progressive offers a wide range of coverage options, making it ideal for Mazda 3 owners seeking tailored policies.

- Affordable Monthly Rates: Progressive auto insurance review provides competitive rates at $60 per month for minimum coverage on the Mazda 3.

- Snapshot Program: Progressive’s usage-based insurance program, Snapshot, can lead to additional savings for Mazda 3 drivers with safe driving habits.

Cons

- Customer Service: Some customers have reported mixed experiences with Progressive’s customer service.

- Rate Increases: Progressive’s rates can increase significantly after an accident or violation, affecting Mazda 3 owners.

#2 – Allstate: Best for Customer Service

Pros

- Customer Service Excellence: Allstate is renowned for its exceptional customer service, benefiting Mazda 3 drivers with reliable support.

- Discounts for Safe Drivers: Allstate auto insurance review highlighted its offers on multiple discounts for safe driving, reducing the cost of insuring a Mazda 3.

- Drivewise Program: The Drivewise program rewards Mazda 3 drivers for safe driving behaviors with lower premiums.

Cons

- Higher Initial Rates: Allstate’s initial rates for minimum coverage on the Mazda 3 are slightly higher at $65 per month.

- Complex Discount Structure: The discount structure can be complicated, making it difficult for some Mazda 3 owners to maximize savings.

#3 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA auto insurance review provides exclusive benefits and discounts for military members and their families, making it ideal for Mazda 3 owners with military ties.

- High Customer Satisfaction: USAA is known for high customer satisfaction and excellent service, benefiting Mazda 3 drivers.

- Competitive Rates: USAA offers competitive rates at $55 per month for minimum coverage on the Mazda 3.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting its availability to Mazda 3 owners.

- Limited Physical Locations: USAA has fewer physical locations compared to some competitors, which might be inconvenient for Mazda 3 owners preferring in-person service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Comprehensive Policies

Pros

- Comprehensive Policies: Liberty Mutual auto insurance review highlighted that it excels in offering comprehensive coverage options for Mazda 3 drivers.

- Customizable Coverage: Liberty Mutual allows Mazda 3 owners to customize their coverage to fit their specific needs.

- Accident Forgiveness: The accident forgiveness program helps Mazda 3 owners avoid premium increases after their first accident.

Cons

- Higher Premiums: Liberty Mutual’s premiums for minimum coverage on the Mazda 3 can be higher, starting at $62 per month.

- Limited Discount Options: Fewer discount options compared to competitors can result in higher costs for some Mazda 3 owners.

#5 – Nationwide: Best for Affordable Rates

Pros

- Affordable Rates: Nationwide auto insurance review provides some of the most affordable rates for Mazda 3 drivers, with minimum coverage costing $58 per month.

- Vanishing Deductible: Nationwide’s vanishing deductible program rewards Mazda 3 drivers for safe driving by reducing their deductible.

- SmartRide Program: The SmartRide usage-based program provides additional savings for Mazda 3 drivers with good driving habits.

Cons

- Limited Coverage Options: Nationwide’s coverage options might be more limited compared to other providers for Mazda 3 owners.

- Average Customer Service: Customer service experiences can vary, with some Mazda 3 owners reporting average service.

#6 – Farmers: Best for Customizable Plans

Pros

- Customizable Plans: Farmers offers highly customizable insurance plans, allowing Mazda 3 owners to tailor their coverage.

- Multiple Discounts: Farmers auto insurance review provides a range of discounts that can significantly reduce premiums for Mazda 3 drivers.

- Good Student Discount: Farmers offers a discount for students with good grades, benefiting young Mazda 3 drivers.

Cons

- Higher Base Rates: Farmers’ base rates for minimum coverage on the Mazda 3 can be higher, starting at $63 per month.

- Limited Availability: Farmers insurance may not be available in all areas, limiting options for some Mazda 3 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Best for Competitive Prices

Pros

- Competitive Prices: Geico is known for offering some of the most competitive prices, with minimum coverage for the Mazda 3 costing $57 per month.

- Excellent Mobile App: Geico’s mobile app provides easy access to policy information and claims for Mazda 3 drivers.

- Variety of Discounts: As mention in Geico auto insurance discounts, Geico offers a variety of discounts, including for good drivers and multi-policy holders, benefiting Mazda 3 owners.

Cons

- Customer Service Variability: Customer service experiences can vary, with some Mazda 3 owners reporting less satisfactory interactions.

- Online-Only Policy Management: Geico’s focus on online services might not suit Mazda 3 owners who prefer in-person assistance.

#8 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm is known for its reliable service and extensive agent network, providing support for Mazda 3 drivers.

- Low Monthly Rates: State Farm offers competitive monthly rates at $61 for the Mazda 3 with minimum coverage.

- Bundling Policies: State Farm auto insurance review provides significant discounts for bundling multiple insurance policies, enhancing savings for Mazda 3 owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Mazda 3.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Mazda 3 owners.

#9 – Erie: Best for Local Support

Pros

- Local Support: Erie is known for its strong local agent support, providing personalized service for Mazda 3 drivers. Read more about their ratings in our Erie auto insurance review.

- Rate Lock Program: Erie’s rate lock program prevents rate increases for Mazda 3 owners, offering financial stability.

- High Customer Satisfaction: Erie receives high marks for customer satisfaction, benefiting Mazda 3 drivers.

Cons

- Limited Availability: Erie is only available in certain states, limiting its accessibility for some Mazda 3 owners.

- Higher Minimum Coverage Rates: Erie’s rates for minimum coverage on the Mazda 3 can be higher, starting at $59 per month.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Extensive Coverage

Pros

- Extensive Coverage: Travelers offers a wide range of coverage options, ideal for Mazda 3 drivers seeking comprehensive policies.

- Discounts for Hybrid Vehicles: Travelers Auto insurance review provides discounts for hybrid Mazda 3 models, promoting eco-friendly driving.

- IntelliDrive Program: The IntelliDrive program rewards safe Mazda 3 drivers with lower premiums based on driving behavior.

Cons

- Higher Base Premiums: Travelers’ base premiums for minimum coverage on the Mazda 3 can be higher, starting at $64 per month.

- Customer Service: Some Mazda 3 owners have reported mixed experiences with Travelers’ customer service.

Mazda 3 Insurance Cost

The cost of insuring a Mazda 3 can vary significantly depending on the insurance provider and the level of coverage chosen. For minimum coverage, USAA offers the most affordable rate at $55 per month, making it an attractive option for those who qualify for membership. Geico follows closely with a rate of $57 per month, while Erie and Nationwide offer slightly higher rates at $59 and $58, respectively.

Progressive, Liberty Mutual, State Farm, and Farmers have rates ranging from $60 to $63 per month, with Allstate and Travelers being the most expensive at $65 and $64 per month. These variations highlight the importance of comparing different providers to find the most cost-effective option for minimum coverage.

Mazda 3 Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Progressive | $60 | $130 |

| Allstate | $65 | $140 |

| USAA | $55 | $120 |

| Liberty Mutual | $62 | $135 |

| Nationwide | $58 | $125 |

| Farmers | $63 | $138 |

| Geico | $57 | $122 |

| State Farm | $61 | $132 |

| Erie | $59 | $128 |

| Travelers | $64 | $137 |

When it comes to full coverage auto insurance, the rates naturally increase due to the additional protection provided. USAA remains the most affordable with a rate of $120 per month, followed by Geico at $122 and Nationwide at $125. Progressive, Erie, and State Farm offer mid-range rates between $128 and $132 per month.

Mazda 3 Auto Insurance Monthly Rates by Coverage Type

| Type | Rate |

|---|---|

| Discount Rate | $69 |

| High Deductibles | $101 |

| Average Rate | $117 |

| Low Deductibles | $147 |

| High Risk Driver | $249 |

| Teen Driver | $426 |

Liberty Mutual, Farmers, and Travelers present higher rates, with Farmers and Travelers at $138 and $137, respectively, and Allstate at $140 per month. These differences underscore the need for Mazda 3 owners to carefully evaluate their insurance needs and budget, considering both the cost and the comprehensive protection offered by full coverage plans.

Expensiveness of Mazda 3 to Insure

Frequently Asked Questions

Where can I compare Mazda 3 insurance quotes online?

Use free online tools to compare Mazda 3 insurance quotes from multiple companies and make an informed decision. Discover more insight on our guide “Best Auto Insurance Companies.”

How can I find the best insurance company for Mazda 3 coverage?

Top insurance companies for Mazda 3 coverage based on market share include State Farm, Geico, Progressive, Liberty Mutual, Allstate, Travelers, USAA, Chubb, Farmers, and Nationwide.

Explore relevant guide titled “How to Cancel USAA Auto Insurance.”

Can adding a more experienced driver to my Mazda 3 policy help save money?

Yes, adding an experienced driver to your Mazda 3 insurance policy can potentially lower rates due to their favorable driving history. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Should I consider insurance rates before financing a Mazda 3?

Yes, consider insurance costs before financing a Mazda 3, as purchasing insurance at the dealership may result in higher rates.

How does the insurance loss probability of the Mazda 3 impact rates?

The Mazda 3 has favorable insurance loss probabilities for comprehensive and collision coverage, which can potentially lead to lower rates.

Are there any specific safety features in the Mazda 3 that can lower insurance rates?

The Mazda 3 has safety features like airbags, ABS, and stability control that may help lower insurance rates.

What factors affect Mazda 3 insurance rates the most?

Factors such as driver age, driving record, location, and the age of the vehicle significantly impact Mazda 3 insurance rates. Check out our guide “Why You Should Take a Defensive Driving Class.”

Is full coverage necessary for a Mazda 3?

Full coverage may be necessary if you are financing or leasing your Mazda 3, but liability-only coverage can be considered if you own the car outright and want to save on premiums.

How can I save money on Mazda 3 insurance?

You can save money on Mazda 3 insurance by comparing quotes, maintaining a clean driving record, bundling policies, and taking advantage of discounts offered by insurers.

Which company offers the best rates for Mazda 3 insurance?

Progressive is known for offering the best rates and comprehensive coverage for Mazda 3 insurance, making it a top choice for many drivers. Delve into our guide “Progressive Auto Insurance Discounts.”

What is the average cost of insuring a Mazda 3 for a teenager?

The average cost of insuring a Mazda 3 for a teenager is approximately $426 per month, so it’s beneficial to shop around for the best rates. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.