Best Minnesota Auto Insurance in 2025 (Top 10 Companies Ranked)

Discover the best Minnesota auto insurance rates offered by State Farm, Progressive, and USAA, with discounts up to 15%. These companies leads with affordable premiums, excellent customer service, and comprehensive coverage options. Compare quotes now to find the best deal for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

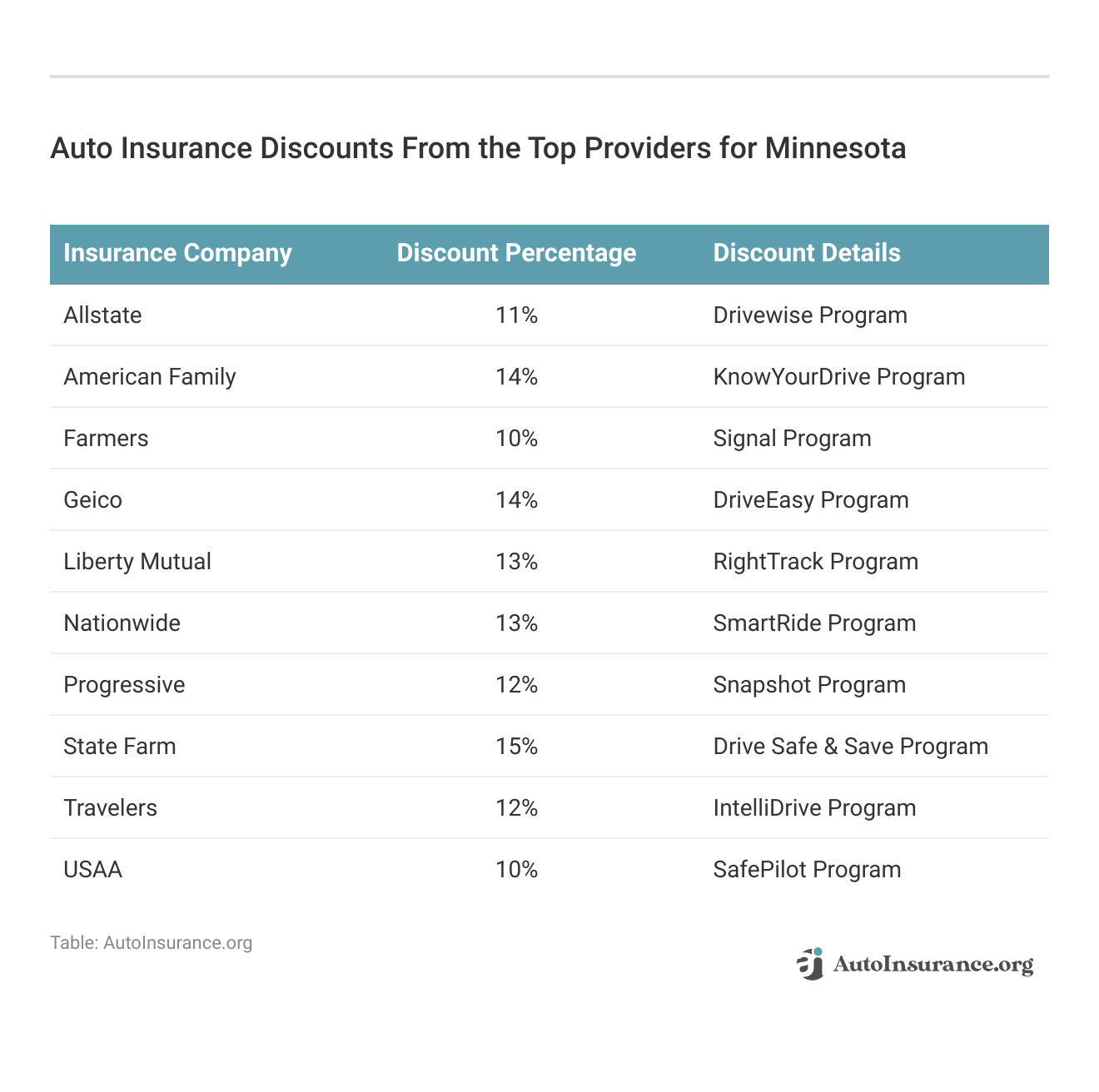

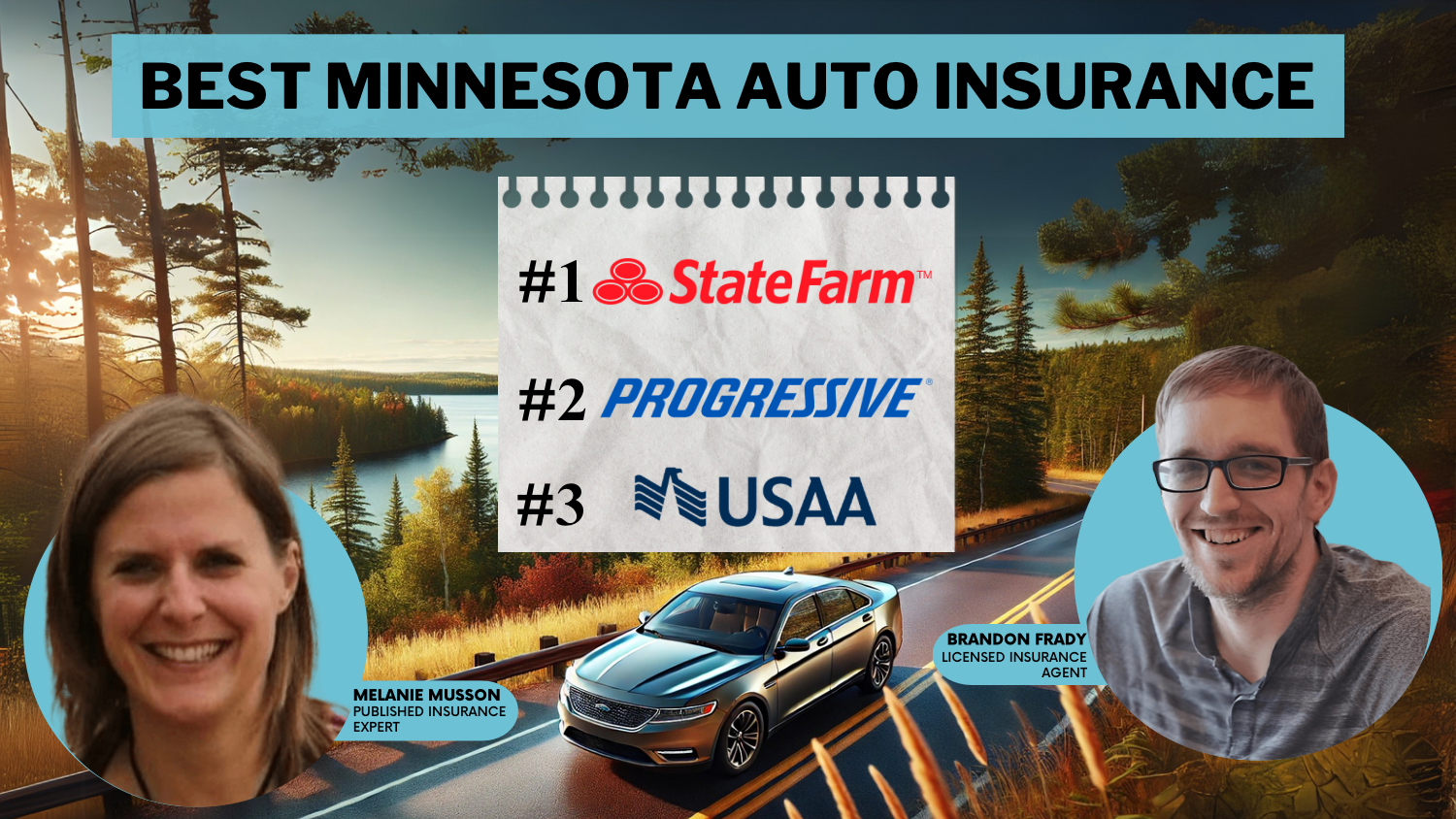

6,589 reviewsThe best Minnesota auto insurance can be found with State Farm, Progressive, and USAA offering competitive rates, up to 15% discount, and top-notch services. State Farm leads with affordable premiums and stellar customer service. Compare quotes to get the best coverage at the best price.

If you’re in search for cheap car insurance in Minnesota, it’s helpful to familiarize what factors affect Minnesota auto insurance rates. This can help you narrow down the best auto insurance companies in Minnesota based on your driving record, desired coverages, and more.

Our Top 10 Company Picks: Best Minnesota Auto Insurance

Company Rank Multi-Vehicle

DiscountA.M. Best Best For Jump to Pros/Cons

#1 15% B Many Discounts State Farm

#2 12% A+ Online Convenience Progressive

#3 10% A++ Military Savings USAA

#4 14% A++ Cheap Rates Geico

#5 13% A+ Usage Discount Nationwide

#6 11% A+ Add-on Coverages Allstate

#7 12% A++ Accident Forgiveness Travelers

#8 13% A Customizable Polices Liberty Mutual

#9 10% A Local Agents Farmers

#10 14% A Student Savings American Family

We’ll cover the cheap car insurance in MN and relevant state laws affecting rates. Use our free comparison tool above to see what auto insurance quotes look like in your area.

- Discover the cheapest car insurance providers in Minnesota

- Understand the state laws that impact auto insurance in MN

- State Farm offers the best rates and customer service in Minnesota

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Agent Network: Provides personalized service through a large network of agents, ensuring customers have access to knowledgeable support and assistance in person.

- Financial Stability: State Farm has strong financial stability and high customer satisfaction ratings, reflecting its reliability and trustworthiness as an insurer.

- Discount Variety: Offers a variety of discounts, including for safe driving and bundling policies. For discounts read our State Farm auto insurance discounts.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, potentially making it less affordable for some customers.

- Limited Online Quoting: Limited online quoting options compared to other insurers, which may inconvenience tech-savvy customers looking for quick and easy quotes online.

#2 – Progressive: Best for Online Convenience

Pros

- Competitive Rates: Offers competitive rates and a variety of discounts, including for safe driving, which can make it an affordable choice for many drivers.

- Coverage Options: Progressive auto insurance review highlights the extensive coverage options, including for high-risk drivers.

- Online Tools: Robust online tools and mobile app for managing policies, making it easy for customers to access and manage their insurance information anytime, anywhere.

Cons

- Mixed Customer Service: Customer service ratings are mixed, with some complaints about claim handling, which could affect the overall customer experience.

- Rate Increases: Rates may increase significantly after an accident or ticket, which could lead to unexpectedly high premiums for some customers.

#3 – USAA: Best for Military Savings

Pros

- Excellent Customer Service: Known for excellent customer service and high customer satisfaction ratings, ensuring that members receive top-notch support.

- Military Discounts: Offers significant discounts for military members and their families, providing substantial savings for those who qualify.

- Financial Stability: As outlined in USAA auto insurance review, the company has strong financial stability, making it a reliable choice for policyholders.

Cons

- Limited Availability: Only available to military members, veterans, and their families, which limits access to a broader customer base.

- Strict Eligibility Requirements: Membership eligibility restrictions may limit access to some customers who do not meet the criteria.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Cheap Rates

Pros

- Low Rates: As mentioned in our Geico auto insurance review, Geico is known for competitive and often lower rates, making it an attractive option for budget-conscious drivers.

- Online Quoting: Easy-to-use online quoting process, allowing customers to quickly obtain and compare insurance quotes.

- Customer Satisfaction: Generally high customer satisfaction ratings, indicating that many customers are happy with their coverage and service.

Cons

- Limited Agent Interaction: Less personal interaction due to reliance on online and phone services, which may not appeal to those who prefer face-to-face support.

- Discounts: May offer fewer discounts compared to some competitors, potentially limiting savings opportunities for some customers.

#5 – Nationwide: Best for Usage Discount

Pros

- Coverage Options: Offers a variety of coverage options and discounts, allowing customers to tailor their policies to their specific needs.

- Customer Service: Generally good customer service and claims handling, ensuring that customers receive the support they need when filing a claim.

- Financial Stability: Strong financial stability. For more information, read our Nationwide auto insurance review.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors, which could make it less affordable for some customers.

- Limited Availability: Fewer local agents compared to other insurers, which might limit personal service options in some areas.

#6 – Allstate: Best for Add-On Coverages

Pros

- Coverage Options: Extensive coverage options and add-ons, allowing customers to customize their policies to meet their unique needs.

- Innovative Features: Offers innovative features like Claim Satisfaction Guarantee, providing added peace of mind for policyholders.

- Digital Tools: User-friendly mobile app and online tools. Learn more about their online tools in our Allstate auto insurance review.

Cons

- Premiums: Higher premiums compared to some competitors, which could be a drawback for price-sensitive customers.

- Customer Satisfaction: Mixed customer satisfaction ratings, indicating that some customers may have experienced issues with service or claims handling.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Coverage Options: Offers a wide range of coverage options, ensuring that customers can find a policy that fits their needs.

- Financial Strength: As outlined in our Travelers auto insurance review, the company established a strong financial stability.

- Online Services: Convenient online services and tools, making it easy for customers to manage their policies and access information.

Cons

- Customer Service: Some complaints about customer service and claims handling, which could impact the overall customer experience.

- Cost: Premiums can be higher compared to some competitors, potentially making it less affordable for some drivers.

#8 – Liberty Mutual: Best for Customizable Polices

Pros

- Coverage Options: Extensive coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

- Discounts: Liberty Mutual auto insurance review highlights the variety of discounts they offer, including for bundling policies.

- Financial Stability: Strong financial stability, providing confidence in the company’s ability to pay out claims.

Cons

- Higher Premiums: Premiums may be higher compared to other insurers, which could be a drawback for those looking for the lowest rates.

- Customer Service: Mixed customer service ratings, indicating that some customers may have experienced issues with service or claims handling.

#9 – Farmers: Best for Local Agents

Pros

- Personalized Service: Provides personalized service through local agents, offering customers face-to-face support and assistance.

- Coverage Options: Offers a variety of coverage options. Check out this page Farmers auto insurance review to know more details.

- Discounts: Available discounts, including for safe driving and bundling policies, which can help customers save on their premiums.

Cons

- Cost: Premiums can be higher compared to some competitors, potentially making it less affordable for some drivers.

- Customer Service: Some complaints about customer service responsiveness, which could affect the overall customer experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Student Savings

Pros

- Coverage Options: Extensive coverage options and add-ons, allowing customers to customize their policies to meet their unique needs.

- Discounts: Offers a variety of discounts, including for bundling policies, which can help customers save money.

- Customer Service: Generally good customer service ratings (Read more: American Family Auto Insurance Review).

Cons

- Cost: Premiums may be higher compared to some competitors, which could be a drawback for price-sensitive customers.

- Availability: Limited availability in certain regions, which may restrict access for some potential customers.

Finding Cheap Auto Insurance in Minnesota

Car insurance rates in Minnesota can vary greatly by driver history, area, and more. A company that is cheap for your friend may not be a cheap auto insurance in Minneapolis for you. If you have a serious infraction on your record, such as a DUI, or you live in an area with high rates, you will have to look harder for cheap insurance.

Read More: Does a criminal record affect auto insurance rates?

Here’s a look at how average annual full coverage auto insurance rates in Minnesota compare with the rest of the U.S.

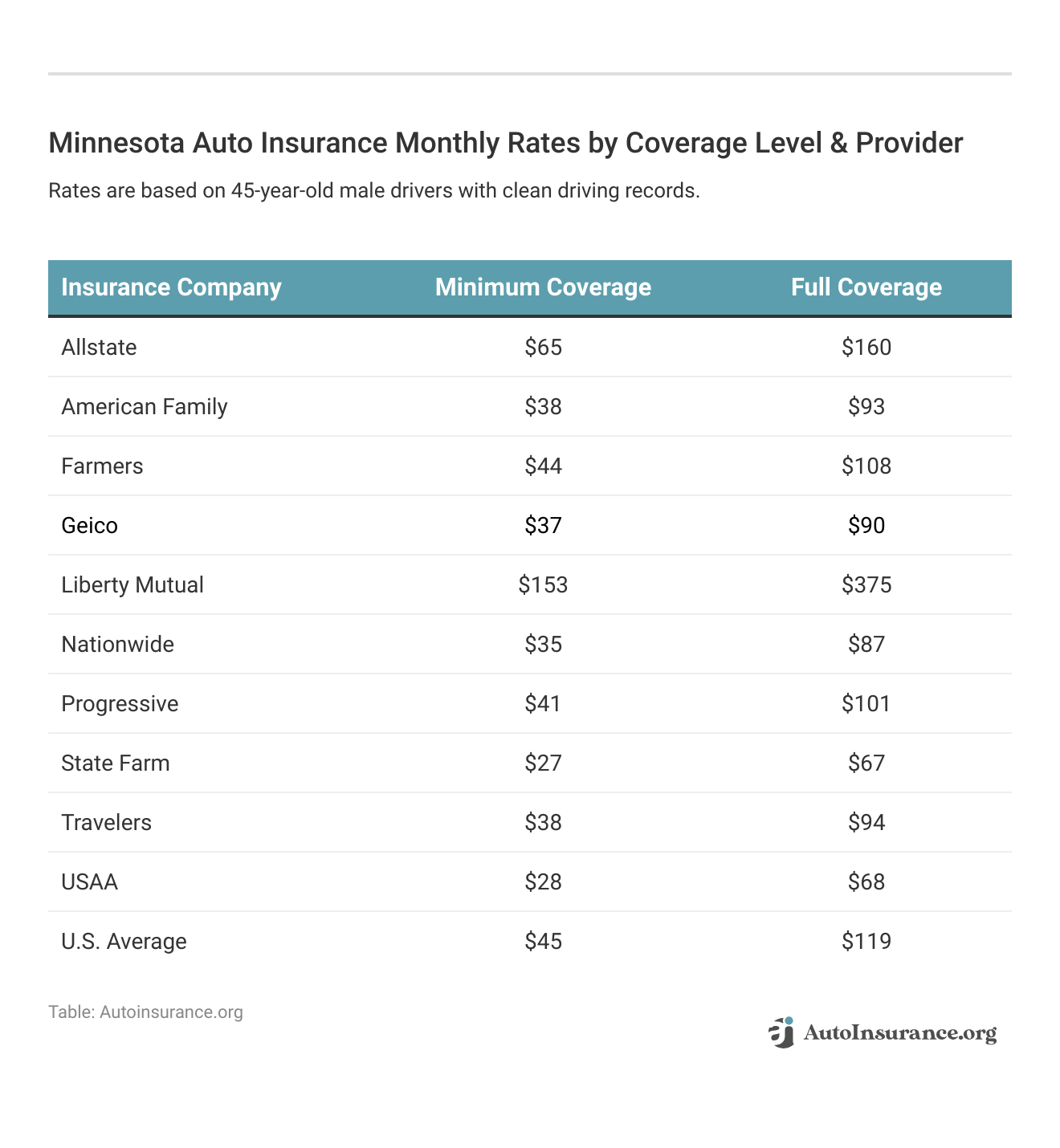

Minnesota Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$115 $283

$67 $165

$78 $191

$65 $160

$270 $664

$62 $153

$73 $180

$48 $118

$68 $166

$49 $120

Read on to see what is the cheapest auto insurance in Minnesota by coverage, driver record, and more.

Cheapest Minnesota Auto Insurance for Minimum Liability and Full Coverage

If you only want to carry a bare minimum policy, then you will find your rates are significantly reduced compared to carrying full coverage auto insurance, with most companies charging an average of around $500 a year. Just keep in mind that if you are in an accident, your out-of-pocket costs will also be significantly higher unless you own an older vehicle.

Look at the table below listing cheap liability car insurance in Minnesota to see how much average minimum liability insurance costs compared to full coverage auto insurance.

USAA and State Farm have some of the cheapest average rates for minimum liability insurance coverage, whereas Geico and Liberty Mutual have some of the highest insurance rates. Progressive’s rates fall in the middle.

If you can afford it, purchasing full coverage is a good idea. It will prevent you from having to pay high out-of-pocket bills to repair your car after an accident you’ve caused. However, rates increase when you add more coverage for better protection. The table below lists the average full coverage rates for different insurance companies in Minnesota, so you can see which offers cheap car insurance in the state.

State Farm has some of the cheapest rates for full coverage in Minnesota, whereas Liberty Mutual once again has some of the most expensive average rates for insurance coverage. Read our State Farm auto insurance review and Liberty Mutual auto insurance review for more information on the companies.

Cheapest Minnesota Auto Insurance for Bad Credit

Your credit score will certainly impact auto insurance rates; drivers with poor credit can pay three times as much as drivers with good credit in Minnesota. This is because insurance companies view drivers with low credit scores as riskier to insure, as they will be more likely to miss payments than drivers with good credit.

Cheapest Minnesota Auto Insurance for Bad Credit

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $279 | $300 | $554 | |

| $214 | $266 | $401 | |

| $221 | $237 | $326 | |

| $238 | $286 | $350 | |

| $796 | $1,019 | $1,576 |

| $208 | $234 | $290 |

| $112 | $154 | $251 | |

| $159 | $183 | $374 |

While USAA is generally one of the cheapest companies, it tends to raise prices substantially for bad credit scores. This is why shopping around is so important, as a cheap company may not actually be the cheapest for you based on your driver profile.

Cheapest Minnesota Auto Insurance for a DUI

A DUI can raise rates by over $1,000 in Minnesota. If you get a DUI, you should shop around and see if an insurance company raises rates less than your current insurance company. The table below shows the average rates that insurance companies will charge after a driver gets convicted of a DUI.

Learn more: DUI Defined

Cheapest Minnesota Auto Insurance for a DUI

| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $283 | $369 | $409 | $484 | |

| $165 | $198 | $332 | $303 | |

| $191 | $221 | $265 | $269 | |

| $160 | $177 | $356 | $533 | |

| $664 | $698 | $968 | $1,730 |

| $153 | $212 | $259 | $322 |

| $118 | $129 | $139 | $129 | |

| $120 | $152 | $162 | $239 |

The cheapest companies for DUI offenders are State Farm, American Family, and Nationwide. It’s important to note that a DUI in Minnesota may also result in fines, jail time, suspended licenses, and other penalties, depending on the severity of the offense.

Cheapest Minnesota Auto Insurance After an At-Fault Accident

If you cause an accident, you will see an increase in your insurance rates unless your insurance company offers accident forgiveness for your first at-fault accident.

However, you may be able to find cheap auto insurance for drivers with accidents by comparing company rates. The table below shows the average rates at an insurance company for an at-fault accident.

Cheapest Minnesota Auto Insurance After an At-Fault Accident

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $283 | $409 | |

| $165 | $332 | |

| $191 | $265 | |

| $160 | $356 | |

| $664 | $968 |

| $153 | $259 |

| $180 | $318 | |

| $118 | $139 | |

| $166 | $234 | |

| $120 | $162 | |

| U.S. Average | $165 | $244 |

State Farm offers some of the cheap auto insurance in MN for drivers who have an at-fault accident on their record. If you find your rates have increased substantially after an accident, make sure to shop around for car insurance quotes in MN to see if another insurance company is cheaper.

Cheapest Minnesota Auto Insurance for Young Drivers

Auto insurance costs more for young drivers, as they are more likely to crash due to inexperience. Teenagers who purchase their own policies often pay thousands more than older drivers.

Cheapest Minnesota Auto Insurance for Young Drivers

| Insurance Company | 16-Year-Old Female | 16-Year-Old Male | 18-Year-Old Female | 18-Year-Old Male |

|---|---|---|---|---|

| $990 | $559 | $560 | $805 | |

| $707 | $399 | $389 | $575 | |

| $888 | 501.47 | $734 | $722 | |

| $672 | $379 | $419 | $546 | |

| $2,908 | $1,643 | $1,491 | $2,364 |

| $690 | $390 | $457 | $561 |

| $1,391 | $786 | $1,010 | $1,131 | |

| $355 | $201 | $236 | $289 | |

| $1,530 | $865 | $892 | $1,244 | |

| $435 | $246 | $327 | $354 | |

| U.S. Average | $761 | $808 | $560 | $656 |

State Farm has some of the cheapest rates for teenagers, whereas Liberty Mutual has some of the most expensive, costing thousands more on average than State Farm.

Cheapest Auto Insurance Rates by City in Minnesota

Even within a state, rates can change from city to city depending on each city’s risk factors, such as local crime or heavy traffic. Some of the most expensive rates can be found in Minneapolis, whereas some of the cheapest rates are in Rochester.

Cheapest Auto Insurance Rates by City in Minnesota

| City | Monthly Rates |

|---|---|

| Ada | $362 |

| Adams | $350 |

| Adolph | $381 |

| Adrian | $338 |

| Afton | $388 |

| Ah Gwah Ching | $399 |

| Aitkin | $404 |

| Akeley | $400 |

| Albany | $372 |

| Albert Lea | $331 |

| Alberta | $344 |

| Albertville | $382 |

| Alborn | $396 |

| Alden | $340 |

| Aldrich | $400 |

| Alexandria | $351 |

| Almelund | $414 |

| Alpha | $339 |

| Altura | $361 |

| Alvarado | $366 |

| Amboy | $350 |

| Andover | $412 |

| Angle Inlet | $358 |

| Angora | $390 |

| Annandale | $386 |

| Anoka | $395 |

| Appleton | $348 |

| Arco | $347 |

| Argyle | $367 |

| Arlington | $359 |

| Ashby | $352 |

| Askov | $399 |

| Atwater | $356 |

| Audubon | $364 |

| Aurora | $385 |

| Austin | $334 |

| Avoca | $346 |

| Avon | $365 |

| Babbitt | $387 |

| Backus | $399 |

| Badger | $366 |

| Bagley | $374 |

| Balaton | $344 |

| Barnesville | $363 |

| Barnum | $380 |

| Barrett | $349 |

| Barry | $344 |

| Battle Lake | $361 |

| Baudette | $361 |

| Baxter | $400 |

| Bayport | $378 |

| Beardsley | $346 |

| Beaver Creek | $347 |

| Becker | $383 |

| Bejou | $371 |

| Belgrade | $365 |

| Belle Plaine | $379 |

| Bellingham | $340 |

| Beltrami | $363 |

| Belview | $347 |

| Bemidji | $397 |

| Bena | $403 |

| Benedict | $405 |

| Benson | $349 |

| Bertha | $397 |

| Bethel | $415 |

| Big Falls | $383 |

| Big Lake | $382 |

| Bigelow | $341 |

| Bigfork | $401 |

| Bingham Lake | $347 |

| Birchdale | $390 |

| Bird Island | $343 |

| Biwabik | $383 |

| Blackduck | $403 |

| Blomkest | $355 |

| Blooming Prairie | $352 |

| Blue Earth | $340 |

| Bluffton | $366 |

| Bock | $402 |

| Borup | $367 |

| Bovey | $397 |

| Bowlus | $408 |

| Bowstring | $408 |

| Boyd | $346 |

| Braham | $407 |

| Brainerd | $405 |

| Brandon | $354 |

| Breckenridge | $360 |

| Brewster | $341 |

| Bricelyn | $342 |

| Brimson | $397 |

| Britt | $387 |

| Brook Park | $402 |

| Brooks | $364 |

| Brookston | $394 |

| Brooten | $365 |

| Browerville | $396 |

| Browns Valley | $352 |

| Brownsdale | $347 |

| Brownsville | $364 |

| Brownton | $353 |

| Bruno | $399 |

| Buffalo | $380 |

| Buffalo Lake | $344 |

| Buhl | $390 |

| Burnsville | $394 |

| Burtrum | $404 |

| Butterfield | $334 |

| Byron | $352 |

| Caledonia | $361 |

| Callaway | $368 |

| Calumet | $399 |

| Cambridge | $410 |

| Campbell | $356 |

| Canby | $343 |

| Cannon Falls | $369 |

| Canton | $365 |

| Canyon | $397 |

| Carlos | $355 |

| Carlton | $377 |

| Carver | $374 |

| Cass Lake | $397 |

| Cedar | $416 |

| Center City | $409 |

| Ceylon | $339 |

| Champlin | $394 |

| Chandler | $343 |

| Chanhassen | $373 |

| Chaska | $374 |

| Chatfield | $361 |

| Chisago City | $409 |

| Chisholm | $383 |

| Chokio | $345 |

| Circle Pines | $389 |

| City | #VALUE! |

| Clara City | $350 |

| Claremont | $361 |

| Clarissa | $400 |

| Clarkfield | $341 |

| Clarks Grove | $343 |

| Clear Lake | $388 |

| Clearbrook | $376 |

| Clearwater | $375 |

| Clements | $346 |

| Cleveland | $358 |

| Climax | $366 |

| Clinton | $340 |

| Clitherall | $362 |

| Clontarf | $346 |

| Cloquet | $379 |

| Cohasset | $395 |

| Cokato | $382 |

| Cold Spring | $368 |

| Coleraine | $397 |

| Cologne | $374 |

| Comfrey | $337 |

| Comstock | $357 |

| Conger | $346 |

| Cook | $391 |

| Correll | $356 |

| Cosmos | $351 |

| Cottage Grove | $384 |

| Cotton | $393 |

| Cottonwood | $343 |

| Courtland | $339 |

| Crane Lake | $394 |

| Cromwell | $385 |

| Crookston | $370 |

| Crosby | $401 |

| Crosslake | $406 |

| Crystal Bay | $376 |

| Currie | $347 |

| Cushing | $403 |

| Cyrus | $352 |

| Dakota | $358 |

| Dalbo | $409 |

| Dalton | $355 |

| Danube | $342 |

| Danvers | $350 |

| Darfur | $340 |

| Darwin | $355 |

| Dassel | $355 |

| Dawson | $340 |

| Dayton | $383 |

| Deer Creek | $363 |

| Deer River | $399 |

| Deerwood | $402 |

| Delano | $381 |

| Delavan | $343 |

| Dennison | $364 |

| Dent | $361 |

| Detroit Lakes | $359 |

| Dexter | $356 |

| Dilworth | $350 |

| Dodge Center | $356 |

| Donaldson | $369 |

| Donnelly | $340 |

| Dover | $358 |

| Dovray | $342 |

| Duluth | $383 |

| Dumont | $346 |

| Dundas | $357 |

| Dunnell | $336 |

| Eagle Bend | $397 |

| Eagle Lake | $351 |

| East Grand Forks | $362 |

| Easton | $341 |

| Echo | $352 |

| Eden Prairie | $382 |

| Eden Valley | $362 |

| Edgerton | $344 |

| Effie | $403 |

| Eitzen | $361 |

| Elbow Lake | $352 |

| Elgin | $356 |

| Elizabeth | $355 |

| Elk River | $398 |

| Elko New Market | $379 |

| Elkton | $358 |

| Ellendale | $350 |

| Ellsworth | $346 |

| Elmore | $335 |

| Elrosa | $365 |

| Ely | $391 |

| Elysian | $357 |

| Embarrass | $389 |

| Emily | $408 |

| Emmons | $344 |

| Erhard | $359 |

| Erskine | $367 |

| Esko | $374 |

| Essig | $338 |

| Euclid | $371 |

| Evansville | $355 |

| Eveleth | $380 |

| Excelsior | $375 |

| Eyota | $355 |

| Fairfax | $340 |

| Fairmont | $336 |

| Faribault | $366 |

| Farmington | $383 |

| Farwell | $356 |

| Federal Dam | $408 |

| Felton | $371 |

| Fergus Falls | $355 |

| Fertile | $367 |

| Fifty Lakes | $407 |

| Finland | $382 |

| Finlayson | $401 |

| Fisher | $362 |

| Flensburg | $405 |

| Flom | $365 |

| Floodwood | $392 |

| Foley | $404 |

| Forbes | $385 |

| Forest Lake | $416 |

| Foreston | $406 |

| Fort Ripley | $403 |

| Fosston | $373 |

| Fountain | $361 |

| Foxhome | $363 |

| Franklin | $343 |

| Frazee | $361 |

| Freeborn | $346 |

| Freeport | $370 |

| Frontenac | $361 |

| Frost | $342 |

| Fulda | $342 |

| Garden City | $354 |

| Garfield | $351 |

| Garrison | $412 |

| Garvin | $346 |

| Gary | $368 |

| Gatzke | $380 |

| Gaylord | $354 |

| Georgetown | $368 |

| Ghent | $343 |

| Gibbon | $355 |

| Gilbert | $383 |

| Gilman | $398 |

| Glencoe | $350 |

| Glenville | $337 |

| Glenwood | $352 |

| Glyndon | $363 |

| Gonvick | $373 |

| Good Thunder | $353 |

| Goodhue | $363 |

| Goodland | $401 |

| Goodridge | $369 |

| Graceville | $350 |

| Granada | $335 |

| Grand Marais | $377 |

| Grand Meadow | $359 |

| Grand Portage | $378 |

| Grand Rapids | $393 |

| Grandy | $412 |

| Granite Falls | $341 |

| Grasston | $405 |

| Green Isle | $371 |

| Greenbush | $367 |

| Greenwald | $365 |

| Grey Eagle | $401 |

| Grove City | $353 |

| Grygla | $376 |

| Gully | $368 |

| Hackensack | $402 |

| Hallock | $378 |

| Halma | $368 |

| Halstad | $365 |

| Hamburg | $377 |

| Hamel | $387 |

| Hampton | $381 |

| Hancock | $339 |

| Hanley Falls | $346 |

| Hanover | $387 |

| Hanska | $337 |

| Hardwick | $349 |

| Harmony | $359 |

| Harris | $403 |

| Hartland | $345 |

| Hastings | $382 |

| Hawley | $361 |

| Hayfield | $357 |

| Hayward | $338 |

| Hector | $348 |

| Henderson | $361 |

| Hendricks | $348 |

| Hendrum | $360 |

| Henning | $363 |

| Henriette | $399 |

| Herman | $354 |

| Heron Lake | $341 |

| Hewitt | $397 |

| Hibbing | $380 |

| Hill City | $403 |

| Hillman | $412 |

| Hills | $354 |

| Hinckley | $399 |

| Hines | $402 |

| Hitterdal | $371 |

| Hoffman | $347 |

| Hokah | $361 |

| Holdingford | $374 |

| Holland | $348 |

| Hollandale | $346 |

| Holloway | $351 |

| Holmes City | $355 |

| Holyoke | $391 |

| Hopkins | $392 |

| Houston | $360 |

| Hovland | $380 |

| Howard Lake | $383 |

| Hoyt Lakes | $386 |

| Hugo | $412 |

| Humboldt | $365 |

| Huntley | $340 |

| Hutchinson | $347 |

| Ihlen | $340 |

| International Falls | $375 |

| Inver Grove Heights | $385 |

| Iona | $352 |

| Iron | $377 |

| Ironton | $400 |

| Isabella | $382 |

| Isanti | $413 |

| Isle | $400 |

| Ivanhoe | $346 |

| Jackson | $342 |

| Jacobson | $408 |

| Janesville | $351 |

| Jasper | $339 |

| Jeffers | $341 |

| Jordan | $380 |

| Kabetogama | $385 |

| Kanaranzi | $347 |

| Kandiyohi | $357 |

| Karlstad | $367 |

| Kasota | $352 |

| Kasson | $355 |

| Keewatin | $401 |

| Kelliher | $404 |

| Kellogg | $361 |

| Kennedy | $369 |

| Kenneth | $344 |

| Kensington | $355 |

| Kent | $360 |

| Kenyon | $364 |

| Kerkhoven | $356 |

| Kerrick | $395 |

| Kettle River | $381 |

| Kiester | $342 |

| Kilkenny | $362 |

| Kimball | $372 |

| Kinney | $389 |

| Knife River | $386 |

| La Crescent | $361 |

| La Salle | $338 |

| Lafayette | $336 |

| Lake Benton | $340 |

| Lake Bronson | $367 |

| Lake City | $363 |

| Lake Crystal | $349 |

| Lake Elmo | $387 |

| Lake George | $417 |

| Lake Hubert | $404 |

| Lake Lillian | $359 |

| Lake Park | $364 |

| Lake Wilson | $339 |

| Lakefield | $339 |

| Lakeland | $382 |

| Lakeville | $383 |

| Lamberton | $343 |

| Lancaster | $368 |

| Lanesboro | $361 |

| Laporte | $405 |

| Lastrup | $403 |

| Le Center | $360 |

| Le Roy | $356 |

| Le Sueur | $358 |

| Lengby | $368 |

| Leonard | $374 |

| Leota | $352 |

| Lester Prairie | $356 |

| Lewiston | $361 |

| Lewisville | $338 |

| Lindstrom | $409 |

| Lismore | $345 |

| Litchfield | $354 |

| Little Falls | $401 |

| Littlefork | $381 |

| Loman | $393 |

| Long Lake | $376 |

| Long Prairie | $394 |

| Longville | $398 |

| Lonsdale | $367 |

| Loretto | $383 |

| Lowry | $353 |

| Lucan | $357 |

| Lutsen | $378 |

| Luverne | $344 |

| Lyle | $344 |

| Lynd | $342 |

| Mabel | $361 |

| Madelia | $336 |

| Madison | $341 |

| Madison Lake | $352 |

| Magnolia | $351 |

| Mahnomen | $372 |

| Makinen | $397 |

| Mankato | $339 |

| Mantorville | $356 |

| Maple Lake | $385 |

| Maple Plain | $381 |

| Mapleton | $355 |

| Marble | $397 |

| Marcell | $400 |

| Margie | $384 |

| Marietta | $343 |

| Marine On Saint Croix | $391 |

| Marshall | $350 |

| Max | $407 |

| Mayer | $375 |

| Maynard | $345 |

| Mazeppa | $357 |

| Mc Grath | $401 |

| Mcgregor | $403 |

| Mcintosh | $367 |

| Meadowlands | $393 |

| Medford | $360 |

| Melrose | $365 |

| Melrude | $389 |

| Menahga | $396 |

| Mendota | $409 |

| Mentor | $369 |

| Merrifield | $398 |

| Middle River | $375 |

| Milaca | $407 |

| Milan | $345 |

| Millville | $361 |

| Milroy | $350 |

| Miltona | $356 |

| Minneapolis | $443 |

| Minneota | $347 |

| Minnesota City | $356 |

| Minnesota Lake | $344 |

| Minnetonka | $378 |

| Minnetonka Beach | $378 |

| Mizpah | $382 |

| Montevideo | $349 |

| Montgomery | $365 |

| Monticello | $385 |

| Montrose | $383 |

| Moorhead | $342 |

| Moose Lake | $378 |

| Mora | $399 |

| Morgan | $346 |

| Morris | $339 |

| Morristown | $361 |

| Morton | $346 |

| Motley | $399 |

| Mound | $378 |

| Mountain Iron | $380 |

| Mountain Lake | $335 |

| Murdock | $353 |

| Nashua | $363 |

| Nashwauk | $399 |

| Navarre | $375 |

| Naytahwaush | $371 |

| Nelson | $355 |

| Nerstrand | $364 |

| Nett Lake | $387 |

| Nevis | $399 |

| New Germany | $377 |

| New London | $355 |

| New Munich | $369 |

| New Prague | $364 |

| New Richland | $348 |

| New Ulm | $336 |

| New York Mills | $361 |

| Newfolden | $366 |

| Newport | $398 |

| Nicollet | $344 |

| Nielsville | $365 |

| Nimrod | $399 |

| Nisswa | $400 |

| Norcross | $352 |

| North Branch | $402 |

| Northfield | $359 |

| Northome | $388 |

| Northrop | $336 |

| Norwood | $400 |

| Norwood Young America | $375 |

| Noyes | $364 |

| Oak Island | $357 |

| Oak Park | $408 |

| Odessa | $346 |

| Odin | $341 |

| Ogema | $370 |

| Ogilvie | $405 |

| Okabena | $343 |

| Oklee | $367 |

| Olivia | $343 |

| Onamia | $403 |

| Ormsby | $337 |

| Oronoco | $353 |

| Orr | $391 |

| Ortonville | $345 |

| Osage | $367 |

| Osakis | $366 |

| Oslo | $368 |

| Osseo | $380 |

| Ostrander | $361 |

| Ottertail | $362 |

| Outing | $405 |

| Owatonna | $353 |

| Palisade | $403 |

| Park Rapids | $403 |

| Parkers Prairie | $363 |

| Paynesville | $366 |

| Pease | $405 |

| Pelican Rapids | $359 |

| Pemberton | $356 |

| Pengilly | $399 |

| Pennington | $403 |

| Pennock | $357 |

| Pequot Lakes | $398 |

| Perham | $356 |

| Perley | $366 |

| Peterson | $359 |

| Pierz | $409 |

| Pillager | $402 |

| Pine City | $402 |

| Pine Island | $356 |

| Pine River | $397 |

| Pipestone | $341 |

| Plainview | $357 |

| Plato | $352 |

| Plummer | $364 |

| Ponemah | $402 |

| Ponsford | $370 |

| Porter | $347 |

| Preston | $355 |

| Princeton | $405 |

| Prinsburg | $354 |

| Prior Lake | $381 |

| Puposky | $407 |

| Racine | $363 |

| Randall | $393 |

| Randolph | $369 |

| Ranier | $380 |

| Raymond | $352 |

| Reading | $345 |

| Reads Landing | $358 |

| Red Lake Falls | $361 |

| Red Wing | $370 |

| Redby | $404 |

| Redlake | $403 |

| Redwood Falls | $352 |

| Remer | $403 |

| Renville | $349 |

| Revere | $360 |

| Rice | $368 |

| Richmond | $371 |

| Richville | $361 |

| Richwood | $362 |

| Rochert | $366 |

| Rochester | $353 |

| Rockford | $382 |

| Rogers | $381 |

| Rollingstone | $362 |

| Roosevelt | $360 |

| Roscoe | $367 |

| Rose Creek | $350 |

| Roseau | $362 |

| Rosemount | $383 |

| Rothsay | $360 |

| Round Lake | $345 |

| Royalton | $402 |

| Rush City | $402 |

| Rushford | $358 |

| Rushmore | $342 |

| Russell | $348 |

| Ruthton | $351 |

| Sabin | $361 |

| Sacred Heart | $342 |

| Saginaw | $388 |

| Saint Bonifacius | $371 |

| Saint Charles | $359 |

| Saint Clair | $353 |

| Saint Cloud | $366 |

| Saint Francis | $417 |

| Saint Hilaire | $359 |

| Saint James | $336 |

| Saint Joseph | $360 |

| Saint Michael | $382 |

| Saint Paul | $435 |

| Saint Paul Park | $401 |

| Saint Peter | $342 |

| Saint Stephen | $363 |

| Saint Vincent | $365 |

| Salol | $364 |

| Sanborn | $347 |

| Sandstone | $398 |

| Santiago | $388 |

| Sargeant | $354 |

| Sartell | $364 |

| Sauk Centre | $365 |

| Sauk Rapids | $367 |

| Savage | $383 |

| Sawyer | $386 |

| Scandia | $410 |

| Schroeder | $378 |

| Seaforth | $347 |

| Searles | $340 |

| Sebeka | $398 |

| Shafer | $409 |

| Shakopee | $382 |

| Shelly | $366 |

| Sherburn | $337 |

| Shevlin | $375 |

| Side Lake | $379 |

| Silver Bay | $377 |

| Silver Creek | $380 |

| Silver Lake | $355 |

| Slayton | $347 |

| Sleepy Eye | $337 |

| Solway | $397 |

| Soudan | $388 |

| South Haven | $371 |

| South International Falls | $378 |

| South Saint Paul | $416 |

| Spicer | $358 |

| Spring Grove | $358 |

| Spring Lake | $407 |

| Spring Park | $393 |

| Spring Valley | $360 |

| Springfield | $336 |

| Squaw Lake | $400 |

| Stacy | $417 |

| Stanchfield | $402 |

| Staples | $399 |

| Starbuck | $352 |

| Steen | $348 |

| Stephen | $364 |

| Stewart | $349 |

| Stewartville | $357 |

| Stillwater | $379 |

| Stockton | $352 |

| Storden | $347 |

| Strandquist | $368 |

| Strathcona | $370 |

| Sturgeon Lake | $399 |

| Sunburg | $360 |

| Swan River | $401 |

| Swanville | $400 |

| Swatara | $412 |

| Swift | $359 |

| Taconite | $397 |

| Talmoon | $399 |

| Tamarack | $403 |

| Taopi | $359 |

| Taunton | $353 |

| Taylors Falls | $412 |

| Tenstrike | $402 |

| Thief River Falls | $362 |

| Tintah | $356 |

| Tofte | $373 |

| Tower | $388 |

| Tracy | $343 |

| Trail | $373 |

| Trimont | $341 |

| Truman | $332 |

| Twig | $384 |

| Twin Lakes | $338 |

| Twin Valley | $365 |

| Two Harbors | $388 |

| Tyler | $344 |

| Ulen | $364 |

| Underwood | $359 |

| Upsala | $407 |

| Utica | $367 |

| Vergas | $361 |

| Verndale | $399 |

| Vernon Center | $356 |

| Vesta | $353 |

| Victoria | $377 |

| Viking | $369 |

| Villard | $359 |

| Vining | $369 |

| Virginia | $380 |

| Wabasha | $356 |

| Wabasso | $345 |

| Waconia | $375 |

| Wadena | $397 |

| Wahkon | $402 |

| Waite Park | $367 |

| Waldorf | $355 |

| Walker | $398 |

| Walnut Grove | $352 |

| Waltham | $355 |

| Wanamingo | $360 |

| Wanda | $350 |

| Wannaska | $367 |

| Warba | $398 |

| Warren | $377 |

| Warroad | $359 |

| Warsaw | $356 |

| Waseca | $349 |

| Waskish | $419 |

| Watertown | $377 |

| Waterville | $362 |

| Watkins | $369 |

| Watson | $351 |

| Waubun | $369 |

| Waverly | $381 |

| Wayzata | $380 |

| Webster | $368 |

| Welch | $373 |

| Welcome | $336 |

| Wells | $339 |

| Wendell | $348 |

| West Concord | $360 |

| West Union | $398 |

| Westbrook | $346 |

| Wheaton | $351 |

| Willernie | $377 |

| Williams | $365 |

| Willmar | $358 |

| Willow River | $399 |

| Wilmont | $341 |

| Windom | $340 |

| Winger | $367 |

| Winnebago | $336 |

| Winona | $335 |

| Winsted | $357 |

| Winthrop | $352 |

| Winton | $390 |

| Wirt | $405 |

| Wolverton | $362 |

| Wood Lake | $347 |

| Woodstock | $345 |

| Worthington | $340 |

| Wrenshall | $377 |

| Wright | $381 |

| Wykoff | $363 |

| Wyoming | $414 |

| Young America | $374 |

| Zimmerman | $408 |

| Zumbro Falls | $358 |

| Zumbrota | $360 |

Comparative Auto Insurance Costs Across Minnesota Cities

Explore the varying costs of auto insurance in different Minnesota cities.

Minnesota Auto Insurance Cost by City

Quickly compare rates and make informed decisions for your coverage.

Minnesota Driving and Insurance Laws

State laws and penalties can affect insurance rates, such as the amount of insurance a state requires drivers to carry. Car insurance is mandatory in Minnesota, so all drivers must carry it. Read on to see how much insurance you must carry, Minnesota’s DUI laws, and when you need high-risk insurance.

Minnesota Minimum Coverage Laws

All Minnesota drivers must carry bodily injury liability, property damage liability, underinsured/uninsured motorist bodily injury, and personal injury protection (PIP). The required minimum amounts are as follows:

- $30,000 per person and $60,000 per accident in bodily injury liability

- $10,000 per accident in property damage liability

- $25,000 per person and $50,000 per accident in uninsured/underinsured motorist bodily injury

- $40,000 ($20,000 for injuries and $20,000 for associated costs like lost wages) in personal injury protection

All Minnesota drivers must carry the coverage amounts above to drive in Minnesota legally.

Optional Coverages in Minnesota

Drivers are only required to carry the coverages listed in the previous section, which means all other coverages are optional. You don’t need to purchase coverages like collision, comprehensive, or roadside assistance in order to drive in Minnesota legally.

However, you will be better protected if you purchase a full coverage policy. Collision auto insurance and comprehensive auto insurance will pay for repairs to your car in accidents caused by you or factors outside of your control, like the weather. Just bear in mind that your prices will increase when you add more comprehensive coverage options to your policy.

Minnesota DUI Laws

There are several penalties if you are charged with a DUI in Minnesota. Some of the consequences of DUIs include the following:

- Fines and court fees

- Suspended licenses

- Ignition interlocks once the license is restored

- Potential jail time

- Increased SR-22 insurance rates

Consequences will increase in severity for each DUI offense. So while a driver might not go to jail for their first DUI offense, they may have to serve jail time for a second offense.

Minnesota SR-22 Insurance Laws

In Minnesota, drivers with serious infractions on their record, such as a DUI or driving without insurance or with a suspended license, must carry an SR-22 certificate. It ensures that you have Minnesota car insurance, although having an SR-22 certificate will increase your rates because it shows you are a high-risk driver.

SR-22 certificates are required for Minnesota drivers with serious infractions, like a DUI or driving without insurance, to ensure coverage but typically result in higher rates due to increased risk.Michelle Robbins LICENSED INSURANCE AGENT

If you are currently insured, you can call and ask MN car insurance companies to apply for your SR-22 certificate. If you are uninsured, you may have to pay a fee to the new insurance company for them to file your SR-22 certificate. Some insurance companies may deny you coverage if you need an SR-22 certificate.

If you don’t have a vehicle, keep in mind that you will need to purchase non-owner auto insurance to get SR-22 insurance because you need to show proof of insurance when applying for SR-22 certificates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Final Verdict on Affordable Minnesota Insurance

Finding cheap insurance in Minnesota requires comparing companies and doing your research into what raises rates. Serious driving infractions, such as a DUI, will raise your rates substantially.

Read More: Auto Insurance Laws

If you want to find cheap insurance in MN, shopping around for Minnesota auto insurance quotes will help you find which company is the cheapest based on your coverage needs and driving profile. Use our free rate comparison tool to find cheap Minnesota auto insurance rates from companies in your area.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Frequently Asked Questions

What are the key factors to consider when choosing the best auto insurance in Minnesota?

When choosing the best auto insurance in Minnesota, consider the factors that affect auto insurance rates such as coverage options, premium rates, customer service quality, discounts offered, and the company’s financial stability. Comparing quotes from multiple providers can also help you find the most affordable and comprehensive coverage for your needs.

What company has the cheapest auto insurance in Minnesota?

State Farm has some of the cheapest average auto insurance rates in Minnesota, but keep in mind that other companies may be cheaper for you depending on your driving record and insurance needs.

Why is car insurance expensive in Minnesota?

Minnesota isn’t one of the most expensive states for insurance in the U.S. Rates may be higher for you than other Minnesota drivers depending on your driving risk and choice of car insurance company.

What is personal injury protection (PIP) coverage in Minnesota?

Personal injury protection (PIP) auto insurance coverage is a type of auto insurance coverage that helps pay for medical expenses, lost wages, and other related costs resulting from injuries sustained in an accident. In Minnesota, PIP coverage is required and provides a minimum of $20,000 for medical expenses and $20,000 for non-medical expenses, such as lost wages and replacement services.

How does having a high-risk driver status affect finding the best auto insurance in Minnesota?

High-risk drivers in Minnesota, such as those with a DUI or multiple traffic violations, will face higher premiums and may have fewer options. Companies like State Farm, Progressive, and American Family tend to offer more competitive rates and options for high-risk drivers, including SR-22 certificates.

How much is car insurance in Minnesota?

On average, Minnesota drivers will pay around $100 a month for full coverage car insurance and less than $100 for minimum coverage insurance in Minnesota. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Is auto insurance mandatory in Minnesota?

Yes, auto insurance is mandatory in Minnesota. The state requires all drivers to carry a minimum amount of liability insurance coverage to legally operate a motor vehicle.

What is the recommended coverages beyond the minimum requirements in Minnesota?

While the minimum Minnesota auto insurance coverage is required by law, it is often advisable to consider additional coverages to provide better protection. Some common additional coverages include uninsured/underinsured motorist coverage, personal injury protection (PIP), collision coverage, and comprehensive coverage.

These coverages can help protect you financially in various situations, such as accidents involving uninsured drivers or non-collision-related damages to your vehicle.

Is Minnesota a no-fault state?

Yes, Minnesota has a no-fault auto insurance system.

What are the consequences for not having auto insurance in Minnesota?

Minnesota drivers can face suspended licenses, fines, and more if they don’t carry the required auto insurance in Minnesota. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code beow in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.