Missouri Minimum Auto Insurance Requirements for 2025 (Coverage MO Drivers Need)

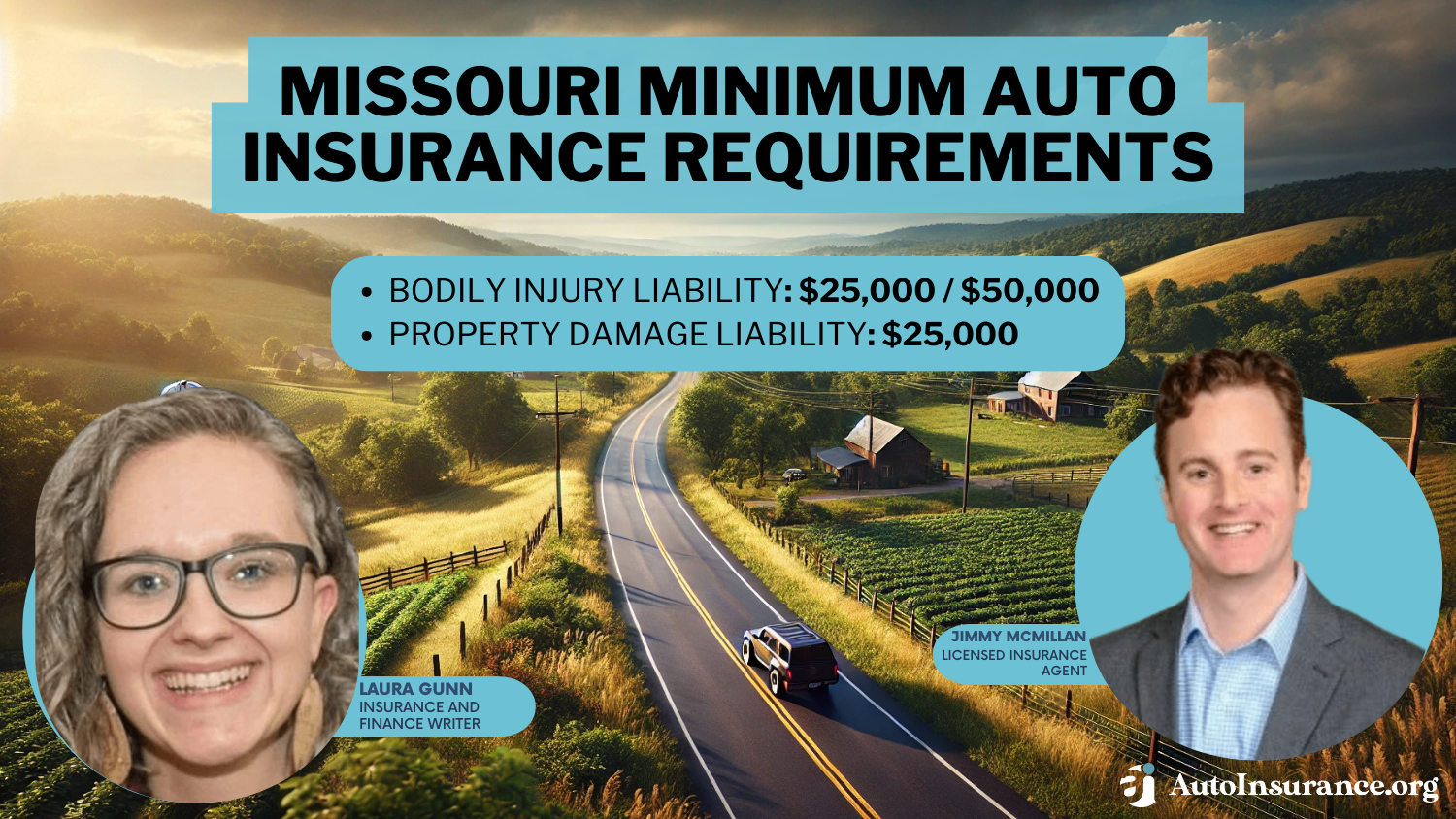

Missouri minimum auto insurance requirements are 25/50/25, meaning drivers should carry coverage up to $25,000 for bodily injury per person, $50,000 for all persons injured in an accident, and $25,000 for property damage. Missouri car insurance rates start at $27/mo, but comparing rates can help you save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Understanding Missouri’s minimum auto insurance requirements is important. The state requires drivers to have at least 25/50/25 coverage, that’s $25,000 for injuries per person, $50,000 for all injuries in an accident, and $25,000 for property damage.

While some states offer alternatives to insurance, Missouri drivers who choose to comply through auto insurance must meet these minimum coverage amounts.

Missouri Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

The good news is that rates in Missouri start at just $27 per month, making it easier to stay covered without breaking the bank.

Some of the cheapest auto insurance companies in Missouri include USAA, Nationwide, and State Farm. If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

- Missouri minimum auto insurance requires 25/50/25 liability coverage for drivers

- Meeting the state’s insurance law helps avoid fines and license suspension

- USAA offers the cheapest rates in Missouri, starting at $27 per month

Missouri Minimum Coverage Requirements & What They Cover

Understanding Missouri car insurance requirements is essential for staying legal on the road. While Missouri auto insurance laws allow alternative ways to prove financial responsibility, most drivers meet the Missouri state minimum auto insurance standards by purchasing car insurance.

According to Missouri auto insurance requirements, drivers must carry at least $25,000 per person and $50,000 per accident for bodily injury liability, $25,000 per accident for property damage liability, and uninsured motorist coverage matching the bodily injury limits ($25,000/$50,000).

These Missouri minimum car insurance requirements only apply to personal-use vehicles. If you drive a commercial or special-use vehicle, check Missouri auto insurance laws for specific coverage needs.

Failing to meet these Missouri auto insurance minimums can result in fines, license suspension, or even higher insurance premiums under the Missouri automobile insurance plan. Use this Missouri auto insurance guide to ensure your policy covers the minimum car insurance Missouri requires and keeps you compliant with car insurance laws in Missouri.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Missouri

Finding the cheapest car insurance in Missouri can save drivers hundreds of dollars each year. Based on current rates, USAA offers the lowest monthly premium at just $27, making it the best choice for eligible members, including military personnel and their families.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Missouri

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsSecond is Nationwide, with a monthly minimum rate of $36, which provides solid coverage at an affordable price. Third is State Farm, which offers reliable customer service and a competitive monthly rate of $46.

These companies consistently earn high customer satisfaction ratings, making them top picks for Missouri drivers seeking affordable coverage. Beyond the top three, several other providers offer competitive rates. Geico stands out at $48per month, known for its budget-friendly policies.

Monthly Minimum Auto Insurance Rates from Top Providers in Missouri

| Insurance Company | Monthly Rates |

|---|---|

| $80 | |

| $57 | |

| $73 | |

| $48 | |

| $70 |

| $36 |

| $53 | |

| $46 | |

| $61 | |

| $27 | |

| U.S. Average | $61 |

American Family follows closely at $57, offering great coverage options for families. Progressive, Farmers, and Liberty Mutual have monthly rates between $35 and $48, depending on coverage needs. While Allstate and Travelers have higher rates, starting at $80 and $61, respectively, comparing quotes from multiple providers ensures you’ll find the best rate that fits your budget.

Read more: Best Missouri Auto Insurance

How to Read Car Insurance Requirements

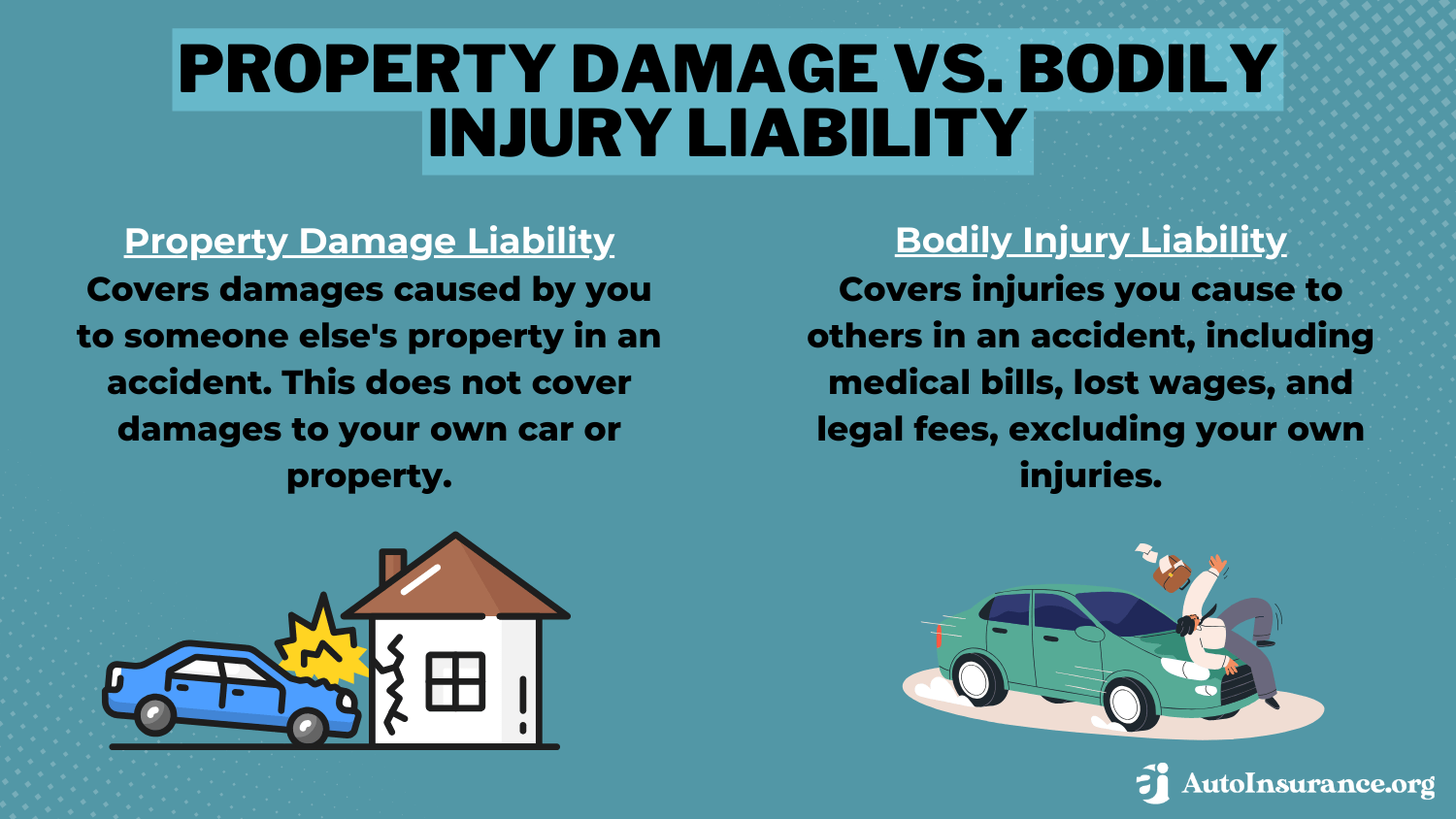

Car insurance has numerous financial benefits, such as decreasing your expenses related to an accident and paying for your liability expenses. Each type of auto insurance offers unique benefits, and you can assign a coverage limit to each type of insurance that you buy.

With this in mind, let’s take a closer look at some of the more common types of insurance available to Missouri drivers.

Missouri Auto Insurance Coverage

| Coverage | Description |

|---|---|

| Collision Coverage | Pays for damage to your vehicle after an accident, regardless of who is at fault |

| Comprehensive Coverage | Covers non-collision incidents, like theft, vandalism, or natural disasters |

| Gap Insurance | Pays the difference between the car's value and the amount still owed on a loan or lease |

| Liability Insurance | Covers damages or injuries to others when you're at fault in an accident |

| Medical Payments (MedPay) | Helps cover medical expenses for you and your passengers after an accident |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs after an accident |

| Rental Car Reimbursement | Covers rental car costs while your car is being repaired after a covered accident |

| Roadside Assistance | Provides towing and emergency services for breakdowns or accidents |

| Underinsured Motorist Coverage | Covers costs when the other driver's insurance is insufficient |

| Uninsured Motorist Coverage | Protects you if you're in an accident with an uninsured driver |

Each coverage type has unique benefits. When you buy coverage in Missouri, you will need to specify the type of coverage you want to buy and the coverage limit for each type of insurance.

Remember that adding coverage types and increasing limits could increase your premium. However, this step could also decrease your personal expenses if you need to file a claim.

Penalties for Driving Without Auto Insurance in Missouri

Missouri law requires drivers to prove financial responsibility, typically through auto insurance that meets the state’s minimum coverage requirements. Failing to carry the required insurance can lead to serious consequences that affect both your driving record and your ability to drive legally.

Penalties for Driving Without Auto Insurance in Missouri

| Penalty | Details |

|---|---|

| Fines | Up to $300 for the first offense |

| License Suspension | 0 to 90 days for repeated offenses or failure to provide proof of insurance |

| Reinstatement Fee | $20 for the first offense, $200 for the second, and $400 for subsequent offenses |

| SR-22 Requirement | Required for 3 years to prove financial responsibility after certain violations |

| Vehicle Registration Suspension | Suspension of vehicle registration until proof of insurance is provided |

| Points on Driving Record | 4 points added for driving without insurance, impacting future insurance premiums |

| Jail Time | Possible for repeat offenses, especially if involved in an accident while uninsured |

If you’re caught driving without insurance, you could face up to four points added to your driving record, which could increase your insurance premiums significantly. In some cases, the court may issue an order of supervision, requiring you to meet specific conditions to avoid further penalties.

Carrying more than the minimum required coverage in Missouri can save you from costly out-of-pocket expenses after an accident.Chris Abrams Licensed Insurance Agent

The most severe consequence is suspending your driver’s license, making it illegal for you to operate a vehicle in Missouri. If your driving record accumulates eight points within 18 months, your auto insurance policy may be canceled, leaving you uninsured and unable to obtain standard coverage.

To avoid these penalties and stay protected, consider learning what full coverage insurance in Missouri is and reviewing Missouri auto insurance limits to ensure you have adequate coverage.

Read more: Does a suspended license affect auto insurance rates?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Missouri Minimum Requirement vs. Recommended Coverage

Understanding Missouri car insurance laws is essential when choosing the right policy. The minimum liability auto insurance in MO requires drivers to carry 25/50/25 coverage. While this Missouri minimum car insurance meets the legal requirements, it may not provide enough financial protection in a serious accident. You could be held personally responsible for the remaining costs if damages exceed these limits.

To avoid financial hardship, consider purchasing more than the state minimum car insurance in Missouri requires. Increasing your coverage limits or adding extras like collision and comprehensive auto insurance can help cover costly repairs, medical bills, and even legal fees.

If you’re wondering, “Does a permit driver need insurance in Missouri?” The answer is yes—permit drivers must be listed on a parent or guardian’s policy. Choosing coverage beyond the minimum car insurance in Missouri ensures better protection and greater peace of mind on the road.

Setting Up Your Coverage in Missouri

Getting the right car insurance in Missouri doesn’t have to be stressful. Shopping for Missouri minimum insurance coverage can be quick and easy when done online. Start by gathering quotes from several providers, ensuring you compare similar coverage types and limits.

This approach helps you find the best policy at the most affordable rate while staying legally covered. Take time to research the insurance companies you’re interested in before applying. This way, you focus only on trustworthy providers that fit your needs (Read more: How to Compare Auto Insurance Quotes).

Since rates and coverage options change, consider comparing quotes every six months to ensure your policy stays up-to-date and affordable. Enter your ZIP code into our free rate comparison tool to explore your options and find the best car insurance policy in Missouri today.

Frequently Asked Questions

What is the minimum auto insurance coverage in Missouri?

Missouri requires a minimum of 25/50/25 coverage, meaning $25,000 for bodily injury per person, $50,000 for all persons injured in an accident, and $25,000 for property damage (Read more: Best Property Damage Liability (PDL) Auto Insurance Companies).

Does a permit driver need insurance in Missouri?

Yes, permit drivers must be covered under a parent or guardian’s car insurance policy, even if they don’t have their own policy. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Is full coverage required in Missouri?

No, full coverage auto insurance isn’t required, but it offers more protection by covering damage to your car in addition to liability coverage.

How much does minimum car insurance in Missouri cost?

Monthly rates for minimum coverage in Missouri start as low as $18, depending on factors like your driving record, age, and vehicle type.

What happens if I drive without insurance in Missouri?

Driving without auto insurance can lead to fines, license suspension, and points on your driving record, increasing future insurance costs.

How can I find cheap car insurance in Missouri?

Compare quotes from multiple providers, look for discounts, maintain a clean driving record, and consider bundling policies for lower rates.

Are there penalties for not meeting Missouri’s car insurance laws?

Yes, failing to meet Missouri’s car insurance requirements can result in license suspension, fines, and even canceling your insurance policy.

What types of car insurance are recommended beyond Missouri’s minimum requirements?

Consider adding collision insurance, comprehensive, and uninsured motorist coverage to protect against accidents, theft, and uninsured drivers.

What is the difference between minimum liability auto insurance and full coverage in Missouri?

Minimum liability only covers damage you cause to others, while full coverage includes protection for your vehicle as well.

How often should I compare car insurance quotes in Missouri?

It’s a good idea to compare quotes every six months or after major life changes, such as moving or buying a new vehicle. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.