Best Monroeville, Alabama Auto Insurance in 2025 (Top 10 Companies Ranked)

Allstate, Farmers, and Travelers have the best Monroeville, Alabama auto insurance, providing top coverage options starting at $52 monthly. With competitive rates and bundling discounts of up to 20%, these providers offer the best value for Monroeville drivers seeking reliable and affordable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Monroeville Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Monroeville Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Monroeville Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

The best Monroeville, Alabama auto insurance providers are Allstate, Farmers, and Travelers, known for their exceptional coverage options and strong customer service.

These companies deliver value by offering comprehensive policies tailored to the needs of Monroeville drivers. They excel in reliability and affordability, making them top choices for securing the best protection.

Our Top 10 Company Picks: Best Monroeville, Alabama Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 11% A+ Comprehensive Coverage Allstate

#2 15% A Personalized Service Farmers

#3 12% A++ Specialized Coverage Travelers

#4 14% B Local Agents State Farm

#5 10% A+ Innovative Tools Progressive

#6 12% A Discount Options American Family

#7 15% A++ Coverage Flexibility Auto-Owners

#8 17% A+ Value Pricing Nationwide

#9 13% A Customizable Policies Liberty Mutual

#10 20% A++ Military Benefits USAA

Whether you’re looking for robust coverage or dependable claims handling, these insurers stand out in every category. Discover insights in our analysis titled “How to File an Auto Insurance Claim.”

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Allstate is the top pick for Monroeville, Alabama auto insurance

- Monroeville drivers get tailored coverage and great discounts

- Local expertise makes these insurers perfect for Monroeville

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

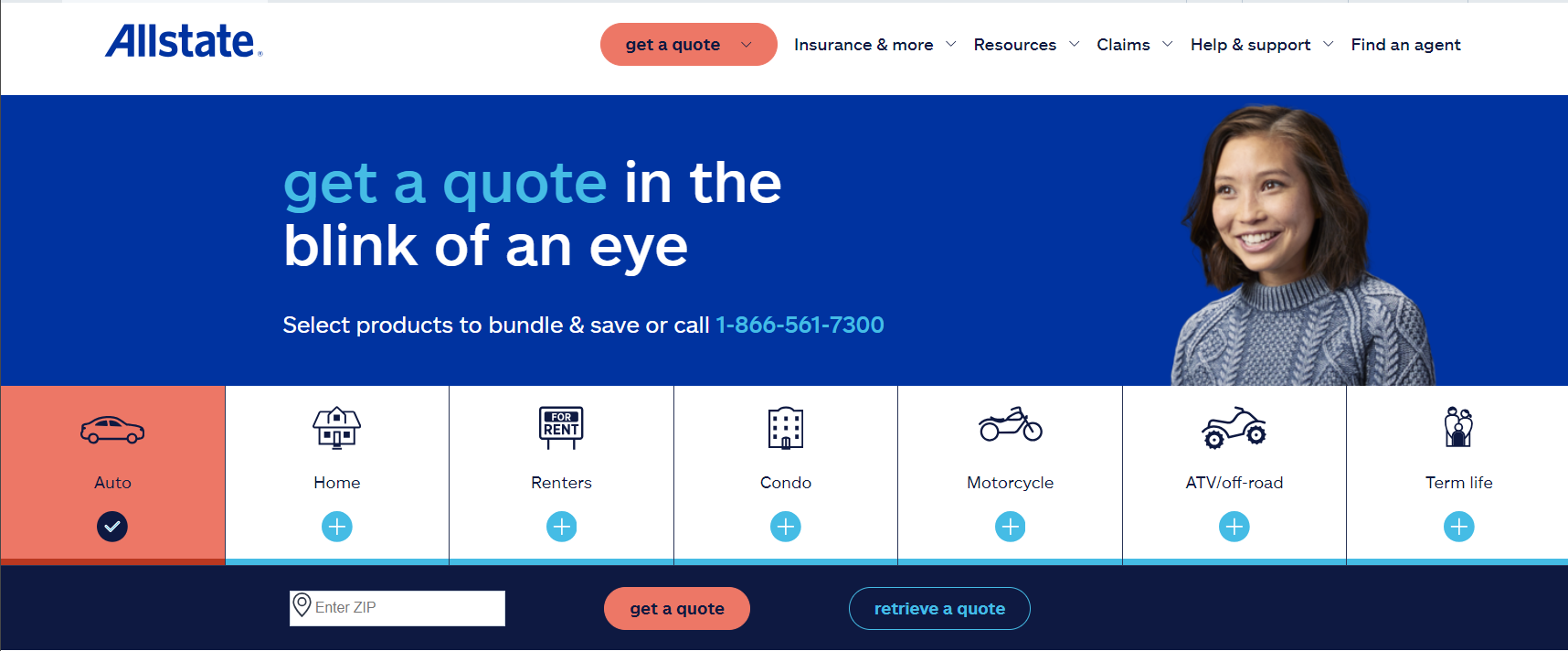

#1 – Allstate: Best for Comprehensive Coverage

Pros

- Generous Multi-Policy Savings: Allstate offers an 11% discount for bundling multiple policies, providing significant savings for Monroeville, Alabama residents.

- Extensive Coverage Options: Allstate offers a broad selection of coverage types, including liability, collision, and comprehensive, makes Allstate a versatile choice for Monroeville, Alabama.

- Accident Forgiveness Feature: This program helps drivers in Monroeville, Alabama avoid rate increases after their first accident, promoting long-term affordability. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Higher Premium Rates: Even with discounts, Allstate’s premiums in Monroeville, Alabama can be higher than those of some competitors, affecting affordability.

- Strict Eligibility for Discounts: The criteria to qualify for certain discounts can be stringent, making it challenging for some Monroeville, Alabama drivers to benefit.

#2 – Farmers: Best for Personalized Service

Pros

- Significant Bundling Discounts: Farmers offers a 15% discount for bundling policies, making it an attractive option for Monroeville, Alabama households looking to save.

- Strong Claims Support: Farmers delivers effective claims assistance, ensuring Monroeville, Alabama drivers receive prompt help when needed.

- Variety of Specialty Coverages: Offers unique policy options, such as rideshare coverage, that meet specific needs for Monroeville, Alabama residents. Find more details in our review of Farmers auto insurance.

Cons

- Higher Premiums for High-Risk Drivers: Insurance rates can be expensive for drivers with poor records or higher risk factors in Monroeville, Alabama.

- Limited Online Service Options: Compared to other insurers, Farmers offers fewer digital tools and online management options for Monroeville, Alabama customers.

#3 – Travelers: Best for Specialized Coverage

Pros

- Competitive Bundling Discounts: Travelers provides a 12% discount for combining policies, which is beneficial for Monroeville, Alabama drivers looking to save on overall insurance costs.

- Exceptional Financial Strength: With an A++ rating from A.M. Best, Travelers guarantees exceptional financial stability, making it a reliable choice for Monroeville, Alabama clients.

- Comprehensive Roadside Assistance: Travelers offers robust roadside support services in Monroeville, Alabama, providing drivers with essential help during emergencies. Read our full review of Travelers insurance for more information.

Cons

- Higher Premiums for Basic Coverage: The cost for standard coverage options may be higher in Monroeville, Alabama, making it less affordable for budget-conscious drivers.

- Complex Policy Terms: Some of Travelers’ specialized coverage options might be difficult for Monroeville, Alabama drivers to understand, leading to confusion.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Local Agents

Pros

- Attractive Bundling Discounts: State Farm offers a 14% discount for bundling multiple insurance policies, making it a cost-saving option for Monroeville, Alabama residents. Read more in our full review on State Farm’s auto insurance review.

- User-Friendly Digital Resources: The State Farm mobile app and website offer intuitive tools, allowing Monroeville, Alabama customers to manage their policies conveniently.

- Comprehensive Insurance Options: State Farm offers a full range of coverage types, including auto, home, and life insurance, catering to the diverse needs of Monroeville, Alabama residents.

Cons

- Limited Specialty Coverage Options: For Monroeville, Alabama residents seeking niche coverages, such as rideshare insurance or classic car coverage, options may be limited.

- Discounts Not as Extensive: While discounts are available, Monroeville, Alabama policyholders may find fewer discount opportunities compared to other insurance providers.

#5 – Progressive: Best for Innovative Tools

Pros

- Affordable Bundling Discounts: Progressive offers a 10% discount for bundling policies, making it a budget-friendly option for Monroeville, Alabama drivers looking to save on their insurance costs.

- Diverse Coverage Options: Progressive provides a wide array of coverage choices, including gap insurance, rideshare insurance, and custom parts coverage, meeting the specific needs of Monroeville, Alabama drivers.

- Safe Driving Discounts: Monroeville, Alabama drivers can benefit from significant discounts based on safe driving behavior tracked through Progressive’s Snapshot program. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

Cons

- Premium Increases After Incidents: Monroeville, Alabama drivers may face substantial premium hikes after accidents or violations, even if they previously maintained a good driving record.

- Limited In-Person Support: With a focus on digital platforms, Progressive has fewer local agents in Monroeville, Alabama, which might limit the availability of personalized, in-person service.

#6 – American Family: Best for Discount Options

Pros

- Good Bundling Discounts: American Family offers a 12% discount for policy bundling, providing Monroeville, Alabama residents with opportunities to save on multiple insurance products.

- Solid Financial Stability: With an A rating from A.M. Best, American Family demonstrates financial soundness, ensuring dependable service for Monroeville, Alabama policyholders.

- Reputable Customer Service: Known for high-quality customer support, American Family provides responsive and helpful service to policyholders in Monroeville, Alabama. Learn more about AmFam in our review of American Family insurance.

Cons

- Higher Costs for High-Risk Drivers: Premiums can be relatively expensive for drivers with poor driving histories or high-risk profiles in Monroeville, Alabama, affecting affordability.

- Complex Coverage Choices: The broad array of coverage options might be overwhelming for some Monroeville, Alabama drivers, making it challenging to select the best policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Auto-Owners: Best for Coverage Flexibility

Pros

- Generous Bundling Discounts: Auto-Owners offers a 15% discount for bundling multiple policies, providing significant savings for Monroeville, Alabama residents seeking comprehensive coverage.

- Top-Tier Financial Rating: With an A++ rating from A.M. Best, Auto-Owners assures Monroeville, Alabama customers of its strong financial security and reliability. See our review of Auto-Owners auto insurance for more details.

- Flexible Policy Customization: Allows Monroeville, Alabama drivers to customize their coverage to fit specific needs, whether for auto, home, or other insurance types, offering versatility.

Cons

- Limited Online and Mobile Tools: Compared to other insurers, Auto-Owners provides fewer digital management options, which may be less appealing to Monroeville, Alabama customers who prefer online services.

- Higher Premiums for Basic Coverage: Even with bundling discounts, basic coverage options may come at a higher cost for Monroeville, Alabama drivers, affecting affordability.

#8 – Nationwide: Best for Value Pricing

Pros

- Significant Bundling Discounts: Nationwide offers a 17% discount for bundling policies, making it a cost-effective option for Monroeville, Alabama residents looking to save on multiple types of insurance.

- Diverse Policy Offerings: Provides a wide range of coverage, including auto, home, and life insurance, making it easy for Monroeville, Alabama residents to manage all their insurance needs in one place.

- On Your Side Review Program: Nationwide offers personalized policy reviews, helping Monroeville, Alabama drivers optimize their coverage and identify potential savings opportunities. Learn more about SmartRide in our Nationwide auto insurance review.

Cons

- Higher Costs for Enhanced Coverage: While Nationwide offers affordable basic plans, adding comprehensive or collision coverage can significantly increase premiums for Monroeville, Alabama drivers.

- Complex Discount Requirements: Some discounts come with strict eligibility criteria, which can make it difficult for Monroeville, Alabama customers to qualify for all potential savings.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Good Bundling Discounts: Liberty Mutual provides a 13% discount for bundling different types of insurance policies, which can help Monroeville, Alabama residents save on their overall insurance costs.

- Variety of Coverage Options: Offers comprehensive coverage choices, including accident forgiveness and new car replacement, which are attractive to Monroeville, Alabama drivers looking for additional protection.

- 24/7 Claims Support: Provides round-the-clock claims service, ensuring that Monroeville, Alabama customers can receive assistance at any time, day or night. You can learn more about Liberty Mutual’s insurance options in our Liberty Mutual auto insurance review.

Cons

- Premium Increases Post-Claim: Monroeville, Alabama drivers may experience premium hikes after filing claims, even for relatively minor accidents or incidents.

- High Costs for Specialized Coverage: Premiums for specialized policies, such as new car replacement or accident forgiveness, can be higher in Monroeville, Alabama, potentially limiting affordability.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Benefits

Pros

- Largest Bundling Discounts: USAA offers a generous 20% discount for bundling policies, providing substantial savings for Monroeville, Alabama families who qualify. More information is available about this provider in our USAA auto insurance review.

- Exceptional Financial Security: With an A++ rating from A.M. Best, USAA offers top-tier financial strength, ensuring that Monroeville, Alabama policyholders can count on dependable service.

- Exclusive Military Benefits: Tailored for military members, USAA offers unique benefits such as deployment discounts, vehicle storage options, and specialized coverage that cater to the needs of Monroeville, Alabama military families.

Cons

- Lack of Local Agents: USAA’s focus on digital and phone services means fewer opportunities for face-to-face interactions with agents in Monroeville, Alabama.

- Potentially High Premiums: Despite generous discounts, some coverage types can be costly, making premiums higher for certain Monroeville, Alabama drivers.

Monroeville, Alabama Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $58 $142

American Family $56 $138

Auto-Owners $59 $144

Farmers $55 $139

Liberty Mutual $62 $150

Nationwide $58 $143

Progressive $57 $140

State Farm $54 $136

Travelers $60 $148

USAA $52 $133

Auto insurance rates in Monroeville, Alabama vary based on the coverage level and the insurance provider. For minimum coverage, USAA offers the most affordable rate at $52 per month, making it an attractive choice for those looking to save money. Compare State Farm vs. USAA auto insurance to evaluate cheap rates from two reliable providers.

State Farm and Farmers also offer competitive rates, priced at $54 and $55 per month, respectively. When it comes to full coverage, USAA once again provides the lowest rate at $133 per month, with State Farm at $136 and American Family at $138 following closely.

Liberty Mutual charges higher rates, with minimum coverage at $62 per month and full coverage at $150 per month, indicating a premium for its extensive service offerings. These variations underscore the importance of comparing different providers to find the best coverage that suits your financial needs and coverage preferences.

Essential Auto Insurance Requirements in Monroeville

In Monroeville, Alabama, state laws mandate that drivers carry at least the minimum auto insurance required by Alabama to ensure financial responsibility in the event of an accident. These state requirements are designed to protect both the driver and others involved in a collision. Below are the necessary auto insurance requirements for Monroeville, Alabama:

Alabama Liability Auto Insurance Requirements

Coverages Limits

Bodily Injury Liability $25,000 per person

$50,000 per accident

Property Damage Liability $25,000 minimum

To comply with Monroeville, Alabama auto insurance laws, drivers must carry at least the state’s minimum liability coverage. Ensuring you meet these requirements is essential to maintain financial protection in the event of an accident. Get more info in our detailed report titled “How long does an accident stay on your record?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Demographic Factors Influencing Auto Insurance Costs in Monroeville

Monroeville, Alabama Auto Insurance Monthly Rates by Age, Gender & Provider

Insurance Company Age: 17 Female Age: 17 Male Age: 25 Female Age: 25 Male Age: 35 Female Age: 35 Male Age: 60 Female Age: 60 Male

Allstate $575 $617 $197 $203 $172 $165 $154 $157

Farmers $732 $753 $221 $232 $192 $191 $172 $182

Geico $448 $442 $186 $175 $176 $174 $164 $166

Liberty Mutual $870 $968 $264 $283 $248 $268 $203 $227

Nationwide $368 $479 $160 $180 $145 $147 $131 $137

Progressive $749 $838 $219 $234 $187 $176 $153 $162

State Farm $682 $858 $269 $307 $239 $239 $213 $213

Travelers $620 $969 $113 $131 $119 $121 $111 $111

USAA $335 $372 $148 $160 $114 $116 $106 $104

Understanding how these demographic details affect monthly insurance costs can help drivers anticipate their expenses and make informed decisions when choosing a policy. Explore how these factors influence the rates you might pay each year for auto insurance coverage.

Finding Affordable Teen Auto Insurance in Monroeville

Securing affordable auto insurance for teens in Monroeville, Alabama can be quite difficult due to the higher risk factors associated with young drivers. Teen drivers often face higher premiums because they lack experience and are statistically more likely to be involved in accidents.

Allstate offers Monroeville drivers comprehensive coverage with monthly rates starting at $58.Daniel Walker Licensed Auto Insurance Agent

However, comparing the monthly auto insurance rates for teens in Monroeville, Alabama can help identify more budget-friendly options.

Monroeville, Alabama Teen Auto Insurance Monthly Rates by Gender & Provider

Insurance Company Age: 17 Female Age: 17 Male

Allstate $575 $617

Farmers $732 $753

Geico $448 $442

Liberty Mutual $870 $968

Nationwide $368 $479

Progressive $749 $838

State Farm $682 $858

Travelers $620 $969

USAA $335 $372

By carefully reviewing different providers and taking advantage of available discounts, such as those for good students or safe driving, parents and teens can find insurance policies that provide both comprehensive coverage and reasonable costs.

Senior Auto Insurance Costs in Monroeville

Curious about how much seniors are paying for auto insurance in Monroeville, Alabama? Senior drivers often face unique challenges when it comes to finding affordable coverage. To better understand the costs, it’s essential to review the average monthly insurance rates specifically for older drivers in this area.

Monroeville, Alabama Senior Auto Insurance Monthly Rates by Gender & Provider

Insurance Company Age: 60 Female Age: 60 Male

Allstate $154 $157

Farmers $172 $182

Geico $164 $166

Liberty Mutual $203 $227

Nationwide $131 $137

Progressive $153 $162

State Farm $213 $213

Travelers $111 $111

USAA $106 $104

These rates can vary widely depending on factors such as driving history, the type of vehicle insured, and the level of coverage chosen. By examining the typical rates for seniors, you can gain insights into what to expect and how to potentially lower your insurance premiums as you age.

Driving History and Its Effect on Monroeville Auto Insurance Rates

Your driving history plays a significant role in determining your auto insurance premiums. Drivers with a history of accidents or traffic violations typically face higher rates compared to those with clean records. To better understand how this affects your costs, take a look at the monthly auto insurance rates in Monroeville, Alabama.

Monroeville, Alabama Auto Insurance Monthly Rates by Driving Record & Provider

Insurance Company Clean Record One Accident One DUI One Ticket

Allstate $240 $281 $330 $269

Farmers $280 $363 $354 $339

Geico $165 $262 $317 $222

Liberty Mutual $327 $454 $445 $440

Nationwide $191 $191 $279 $213

Progressive $308 $385 $329 $338

State Farm $343 $419 $374 $374

Travelers $239 $251 $366 $292

USAA $140 $175 $261 $151

You’ll see how rates differ for drivers with poor driving records compared to those who maintain clean, violation-free records. This comparison will help highlight the financial benefits of safe driving and how maintaining a good driving record can lead to substantial savings on your auto insurance in Monroeville, Alabama. Get more info in our detailed guide titled “Best Alabama Auto Insurance.”

Finding the Best DUI Auto Insurance Rates in Monroeville

Securing affordable auto insurance after a DUI in Monroeville, Alabama can be challenging due to the increased risk perceived by insurers. However, comparing monthly rates from various providers is a critical step in identifying the most economical options.

Monroeville, Alabama Auto Insurance Rates After a DUI

Insurance Company Monthly Rates

Allstate $330

Farmers $354

Geico $317

Liberty Mutual $445

Nationwide $279

Progressive $329

State Farm $374

Travelers $366

USAA $261

By thoroughly evaluating the different insurance companies and their policies for drivers with a DUI on their record, you can find coverage that offers both the protection you need and a rate that fits your budget.

Remember, rates can vary significantly between insurers, so obtaining multiple quotes is key to finding the best deal for DUI auto insurance in Monroeville, Alabama.

Impact of Credit History on Monroeville Auto Insurance Rates

Your credit history can significantly influence the cost of your auto insurance premiums. Insurance companies often use credit scores to assess the risk level of policyholders, with lower scores potentially leading to higher rates. To understand how this factor impacts you, explore how auto insurance rates in Monroeville, Alabama vary based on different credit score ranges.

Monroeville, Alabama Auto Insurance Monthly Rates by Credit Score

Insurance Company Poor Credit Fair Credit Good Credit

Allstate $347 $271 $222

Farmers $375 $322 $305

Geico $307 $219 $198

Liberty Mutual $597 $365 $287

Nationwide $264 $206 $186

Progressive $385 $328 $306

State Farm $611 $310 $211

Travelers $313 $271 $276

USAA $245 $159 $142

By comparing these rates, you can see the potential savings or costs associated with maintaining a good credit history versus having a lower credit score. This comparison can help you make more informed decisions about managing your credit and choosing the best insurance policy for your needs. Learn more in our detailed analysis titled “Can you view your auto insurance policy online?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Influence of ZIP Codes on Monroeville Auto Insurance Rates

Auto insurance premiums in Monroeville, Alabama can differ significantly depending on the ZIP code. Certain areas may have higher rates due to factors like local accident statistics, crime rates, and traffic density. Unlock details in our article titled “Does a criminal record affect auto insurance rates?”

Monroeville, Alabama Auto Insurance Monthly Rates by ZIP Code

ZIP Code Rates

36460 $303

To understand how these factors impact your insurance costs, it’s important to compare the monthly car insurance expenses across different ZIP codes in Monroeville, Alabama. By doing so, you can see how location influences pricing and find the most affordable rates for your specific area.

Impact of Commute and Mileage on Monroeville Auto Insurance Rates

The distance you drive to work and the total miles you accumulate monthly can significantly influence your auto insurance premiums in Monroeville, Alabama. Insurance providers consider both commute length and yearly mileage when determining your rates, as longer distances and higher mileage often increase the risk of accidents. Delve into our evaluation of our article titled “Best Low-Mileage Auto Insurance Discounts.”

Monroeville, Alabama Auto Insurance Monthly Rates by Annual Mileage & Provider

Insurance Company 6,000 Miles 12,000 Miles

Allstate $280 $280

Farmers $334 $334

Geico $237 $246

Liberty Mutual $416 $416

Nationwide $219 $219

Progressive $340 $340

State Farm $368 $387

Travelers $287 $287

USAA $174 $190

To identify the most affordable auto insurance options in Monroeville, Alabama, it’s important to compare policies that take into account your specific driving habits, including the length of your daily commute. By understanding how these factors impact your rates, you can find a policy that offers the best coverage at the lowest cost based on your driving patterns.

Impact of Coverage Levels on Monroeville Auto Insurance Rates

How does the coverage level you choose impact the cost of your auto insurance in Monroeville, Alabama? The amount of coverage you select can significantly influence your premium rates. Opting for minimum coverage typically results in lower monthly payments, but it may offer less protection in the event of an accident. Access comprehensive insights into our article titled “Auto Insurance Premium Defined.”

Monroeville, Alabama Auto Insurance Monthly Rates by Coverage Level

Insurance Company Low Medium High

Allstate $226 $241 $288

Farmers $398 $414 $353

Geico $219 $216 $258

Liberty Mutual $307 $338 $436

Nationwide $358 $377 $221

Progressive $307 $338 $374

State Farm $358 $377 $398

Travelers $274 $293 $294

USAA $175 $181 $189

On the other hand, choosing full coverage provides more comprehensive protection but comes with higher premiums. To make an informed decision, take a look at the comparison of monthly auto insurance rates in Monroeville, Alabama based on different coverage levels. This comparison will help you understand how various coverage options affect your overall insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Choices for Affordable Auto Insurance in Monroeville

To find the most budget-friendly auto insurance in Monroeville, Alabama, it’s important to compare companies across different categories. By evaluating the lowest-cost options from various insurers, you can identify which company offers the most competitive rates that align with your specific requirements and coverage preferences.

Cheapest Auto Insurance in Monroeville, Alabama

Category Insurance Company

Teenagers USAA

Seniors USAA

Clean Record USAA

With 1 Accident USAA

With 1 DUI USAA

With 1 Speeding Violation USAA

This approach allows you to not only save money but also ensure you’re getting the best value and protection tailored to your individual needs. Whether you need basic liability coverage or a comprehensive plan, comparing the cheapest auto insurance providers helps you make an informed and economical decision. Discover more about offerings in our analysis titled “Cheapest Liability-Only Auto Insurance.”

Finding the Best Low-Cost Auto Insurance in Monroeville

Which auto insurance providers in Monroeville, Alabama offer the most affordable rates? By comparing the leading auto insurance companies in Monroeville, you can discover which ones provide the best monthly premiums for your budget. Different insurers offer various pricing structures, discounts, and coverage options, so it’s important to evaluate them side-by-side.

Cheapest Monroeville, Alabama Auto Insurance Companies

Insurance Company Rates

Allstate $280

Farmers $334

Geico $242

Liberty Mutual $416

Nationwide $219

Progressive $340

State Farm $377

Travelers $287

USAA $182

This comparison will help you find the most cost-effective solution without compromising on the level of protection you need. Explore the top-rated insurance providers in Monroeville, Alabama to identify the best rates and coverage for your specific needs. Check out insurance savings in our complete guide titled “Cheap Auto Insurance in Alabama.”

Local Factors Impacting Monroeville Auto Insurance Rates

Several factors can cause auto insurance rates in Monroeville, Alabama to fluctuate compared to other cities. Elements such as the volume of traffic and the frequency of vehicle thefts in Monroeville play a significant role in determining insurance costs.

Additionally, local conditions like weather patterns, accident rates, and population density can influence how much you pay for auto insurance. Each of these factors contributes to the overall risk assessment made by insurance companies, ultimately affecting the premiums set for Monroeville drivers. Learn more in our guide titled “Does auto insurance cover lightning strikes?”

Commute Time in Monroeville

In urban areas, longer average commute times often lead to increased auto insurance premiums due to the higher risk of accidents. According to City-Data, drivers in Monroeville, Alabama experience an average commute time of 18.1 minutes.

This moderate commute length can influence insurance rates as more time on the road generally increases the likelihood of incidents, thus impacting the overall cost of auto insurance for Monroeville residents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Auto Insurance Deals in Monroeville

When looking for auto insurance in Monroeville, Alabama, it’s crucial to review quotes from various insurers to find the most competitive rates and suitable coverage choices. Each insurer sets different prices based on factors like your driving record, the type of car you drive, and the coverage level you select. By evaluating quotes, you can pinpoint the most affordable policy that aligns with your particular requirements.

Whether you’re in need of minimum coverage to comply with state laws or full coverage for extra security, spending the time to collect and compare quotes ensures that you get the best deal for your budget. Use available tools to get tailored quotes and make an informed decision on car insurance in Monroeville, Alabama. See more details on our article titled “What are the recommended auto insurance coverage levels?”

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

What is liability insurance?

Liability insurance covers the costs associated with injuries or property damage caused by you in an accident. It typically includes bodily injury liability, which pays for medical expenses and lost wages of the other party, and property damage liability, which covers the repair or replacement costs for the other person’s vehicle or property.

What are the minimum liability insurance requirements in Monroeville, AL?

The minimum liability insurance requirements in Monroeville, AL are as follows: $25,000 for injury or death to one person, $50,000 for injury or death to multiple people, and $25,000 for property damage. These are the minimum limits, but it’s often recommended to consider higher coverage amounts for better protection.

Explore more discount options in our guide titled “Best Commercial General Liability Insurance.”

What other types of auto insurance coverage are available?

Besides liability insurance, other auto insurance options include collision coverage for vehicle damage, comprehensive coverage for non-collision incidents, uninsured/underinsured motorist coverage for accidents with inadequately insured drivers, and medical payments or personal injury protection for medical expenses and related costs.

How are auto insurance premiums determined in Monroeville, AL?

Auto insurance premiums in Monroeville, AL are influenced by your driving record, personal demographics, vehicle details, credit history, coverage choices, deductible, mileage, and local risk factors.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Are there any discounts available for auto insurance in Monroeville, AL?

Many insurance companies offer various discounts on auto policies. Common options include safe driver discounts for a clean driving record, multi-policy discounts when bundling auto insurance with other policies like homeowners insurance, good student discounts for maintaining a certain GPA, and discounts for vehicles equipped with anti-theft devices.

See what coverage options you have in our article titled, “How to Get an Anti-Theft Auto Insurance Discount.”

Can I use my personal auto insurance for business purposes in Monroeville, AL?

Generally, personal auto insurance policies do not provide coverage for vehicles used for business purposes in Monroeville, AL. If you use your vehicle for business activities such as deliveries, transportation of goods, or ridesharing, you may need a commercial auto insurance policy to ensure adequate coverage.

What factors can affect my auto insurance rates in Monroeville, AL?

Auto insurance rates in Monroeville, AL are affected by factors such as your driving record, age, gender, vehicle type, coverage options, credit history, location, and annual mileage.

Can my auto insurance policy be canceled or non-renewed in Monroeville, AL?

Auto insurance policies in Monroeville, AL can be canceled or non-renewed for reasons like non-payment, misrepresentation, or multiple at-fault accidents. Maintaining a good driving record and paying premiums on time is crucial to avoid cancellation or non-renewal.

Find out more in our guide titled “Cheap Auto Insurance for a Bad Driving Record.”

What coverage options does Allstate offer in Monroeville?

Allstate in Monroeville provides a range of coverage options, including liability, collision, comprehensive, and more, tailored to meet local drivers’ needs.

How can I get auto insurance quotes in Monroeville?

You can obtain auto insurance quotes in Monroeville by visiting online comparison websites, contacting local agents, or using the quote tools on individual insurance company websites.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

What are the best auto insurance companies in Monroeville?

Some of the top car insurance companies in Monroeville include Allstate, State Farm, Geico, Progressive, and Farmers, offering various coverage options and rates.

Find cheaper and better coverage by comparing Geico vs. State Farm auto insurance options.

What services does Farmers insurance offer in Monroeville?

Farmers insurance in Monroeville offers a variety of services including auto, home, and life insurance, with personalized plans to fit individual customer needs.

What makes Progressive insurance a good choice in Monroeville?

Progressive insurance in Monroeville stands out for its innovative tools, like the Snapshot program, which can help drivers save money based on their driving habits.

How do Geico’s rates compare in Monroeville?

Geico in Monroeville is known for competitive rates, offering discounts for good drivers, multiple policies, and vehicle safety features.

For additional details, explore our comprehensive resource titled “Best Geico Auto Insurance Discounts.”

What types of coverage does State Farm provide in Monroeville, AL?

State Farm in Monroeville, AL offers comprehensive auto insurance coverage, including liability, collision, and personal injury protection, with options for additional coverages.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.