Best Naples, Florida Auto Insurance in 2025 (Compare the Top 10 Companies)

Liberty Mutual, Progressive, and Farmers are leading insurers providing the best Naples, Florida auto insurance, with rates beginning at $80 per month. The minimum auto insurance in Naples is at least 10/20/10 in coverage to comply with Florida auto insurance policies. Compare quotes today to find the best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in Naples Florida

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Naples Florida

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Naples Florida

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsIn Naples, Florida, top auto insurance providers like Liberty Mutual, Progressive, and Farmers offer rates starting at $80 per month. Liberty Mutual excels in coverage, service, and affordability. Compare quotes to find your best rate.

Naples, Florida auto insurance requirements are 10/20/10 according to Florida auto insurance laws. Finding the cheapest auto insurance companies in Naples can seem like a difficult task, but all of the information you need is right here.

We’ll cover factors that affect auto insurance rates in Naples, Florida, including driving record, credit, commute time, and more.

Our Top 10 Company Picks: Best Naples, Florida Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Customizable Coverage | Liberty Mutual |

| #2 | 12% | A+ | Competitive Rates | Progressive | |

| #3 | 25% | A | Broad Options | Farmers | |

| #4 | 25% | A+ | High Satisfaction | Allstate | |

| #5 | 10% | A+ | Local Service | Erie |

| #6 | 20% | A | Strong Discounts | American Family | |

| #7 | 8% | A++ | Comprehensive Coverage | Travelers | |

| #8 | 10% | A++ | Military Discounts | USAA | |

| #9 | 20% | B | Reliable Service | State Farm | |

| #10 | 25% | A++ | Affordable Rates | Geico |

Compare auto insurance in Naples to other Florida cities, including Jacksonville auto insurance rates, St. Petersburg auto insurance rates, and Port St. Lucie auto insurance rates to see how Naples, Florida auto insurance rates stack up. Enter your ZIP code above to get free Naples, Florida auto insurance quotes.

- The cheapest auto insurance company in Naples is USAA

- Average auto insurance rates in Naples, FL for senior drivers are $80/mo

- The most expensive auto insurance company in Naples for teen drivers is Allstate

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Liberty Mutual: Top Overall Pick

Pros

- Comprehensive Coverage Options: Liberty Mutual provides extensive coverage options, including accident forgiveness and new car replacement. Liberty Mutual’s customizable coverage stands out as one of the best Naples, Florida auto insurance offerings for those seeking extensive protection.

- Competitive Rates: With rates starting around $275 per month, Liberty Mutual offers competitive pricing for Naples, Florida car owners. Their rates are designed to appeal to budget-conscious drivers while providing robust coverage, making it a strong contender for the best Naples, Florida auto insurance.

- Discount Opportunities: As mentioned in our Liberty Mutual auto insurance review, the provider offers a variety of discounts, including a 25% multi-vehicle discount, helping Naples, Florida drivers save on their premiums. Liberty Mutual’s discounts, combined with its strong A rating from A.M. Best, make it a highly attractive option for those seeking the best Naples, Florida auto insurance.

Cons

- Higher Premiums for Riskier Drivers: Naples, Florida drivers with a history of accidents or violations may face higher premiums with Liberty Mutual. This can make it less cost-effective for high-risk individuals, potentially leading to higher costs for those who might benefit from other providers.

- Occasional Long Wait Times: Some customers report longer wait times when contacting customer service or filing claims. This can be frustrating for Naples, Florida car owners who require timely assistance, impacting their overall experience with Liberty Mutual.

#2 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: Progressive offers some of the most competitive rates in the industry, starting around $275 per month. This makes it an attractive option for Naples, Florida drivers seeking affordable auto insurance while benefiting from strong coverage options.

- Snapshot Program: As mentioned in our Progressive auto insurance review, their Snapshot program allows Naples, Florida drivers to potentially lower their rates based on driving behavior. This program rewards safe driving habits with discounts, making Progressive a solid choice for those who demonstrate responsible driving practices and seek the best Naples, Florida auto insurance.

- Innovative Technology: Progressive’s mobile app and online tools are highly user-friendly, making policy management and claims processing efficient for Naples, Florida car owners. Their commitment to technological innovation supports their standing as a top provider in the quest for the best Naples, Florida auto insurance.

Cons

- Claims Processing Speed: Progressive’s claims processing can be slower compared to some competitors, which may delay compensation for Naples, Florida drivers. This slower service can be a downside for those needing quick resolution of claims.

- Transparency Issues: Some users find the claims process to be less transparent, which can lead to confusion about coverage and reimbursement for Naples, Florida car owners. This lack of clarity can impact overall satisfaction with Progressive’s services.

#3 – Farmers: Best for Broad Options

Pros

- Wide Range of Coverage Options: Farmers offers extensive coverage options and customization, making it ideal for Naples, Florida drivers who need tailored protection. Their broad selection helps ensure that drivers find the coverage that best fits their unique requirements, contributing to their reputation for the best Naples, Florida auto insurance.

- Personalized Service: Farmers’ large network of agents provides personalized service and support, offering tailored advice to Naples, Florida drivers. This personalized approach helps ensure that each policyholder receives attention suited to their individual needs.

- Strong Customer Support: Farmers is known for effective customer service, with responsive agents who handle policyholder concerns efficiently. This strong support system helps solidify Farmers’ position as one of the top providers of the best Naples, Florida auto insurance.

Cons

- Higher Rates for Some Drivers: Drivers with a history of claims or infractions might find that Farmers’ rates are higher compared to some competitors. This can make it less cost-effective for high-risk Naples, Florida drivers, potentially leading to increased premiums.

- Complex Policy Options: The variety of policy options and coverage add-ons can be overwhelming, especially for those new to insurance. This complexity may make it challenging for Naples, Florida drivers to select the best coverage for their needs, which you can read more about in our review of Farmers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for High Satisfaction

Pros

- High Customer Satisfaction: Allstate is praised for its customer satisfaction, including its service and claims handling. Naples, Florida drivers can expect a high level of satisfaction and support, reinforcing Allstate’s reputation as a leading choice for the best Naples, Florida auto insurance.

- Drivewise Program: The Drivewise program offers potential savings based on driving behavior, rewarding Naples, Florida drivers with discounts for safe driving habits. This program helps reduce premiums while promoting responsible driving, which is covered in our Allstate review.

- Extensive Coverage Options: Allstate provides a broad range of coverage options and add-ons, including roadside assistance and rental car reimbursement. This comprehensive coverage ensures that Naples, Florida car enthusiasts have access to a wide variety of protections.

Cons

- Higher Premiums: Allstate’s rates can be higher compared to some competitors, especially for drivers with a less-than-perfect record. This may make Allstate a less budget-friendly option for Naples, Florida drivers with higher risk profiles.

- Discounts Can Be Hard to Qualify For: Some customers find it challenging to meet the criteria for certain discounts. This can limit potential savings for Naples, Florida car owners and may impact overall cost-effectiveness.

#5 – Erie: Best for Local Service

Pros

- Excellent Local Service: Erie Insurance is known for its strong local service and customer care, particularly valuable for Naples, Florida car owners who prefer personalized support. Their local agents offer tailored assistance, enhancing the overall insurance experience.

- Competitive Rates: Erie offers competitive pricing, with rates starting at $275 per month, appealing to budget-conscious Naples, Florida drivers. Their affordability combined with solid coverage options makes them a strong contender for the best Naples, Florida auto insurance.

- Accident Forgiveness: Erie provides accident forgiveness programs, which help prevent rate increases after a single accident. This feature benefits Naples, Florida drivers by maintaining stable premiums despite occasional incidents. Learn more in our Erie auto insurance review.

Cons

- Limited Availability: Erie’s coverage may not be available in all regions, which can be a limitation for Naples, Florida drivers outside their service areas. This restricted availability may affect those seeking the best Naples, Florida auto insurance but unable to access Erie’s offerings.

- Less Extensive Coverage Options: Their range of coverage options might not be as comprehensive as some larger national providers. This limitation can impact Naples, Florida drivers looking for highly customizable insurance plans.

#6 – American Family: Best for strong Discounts

Pros

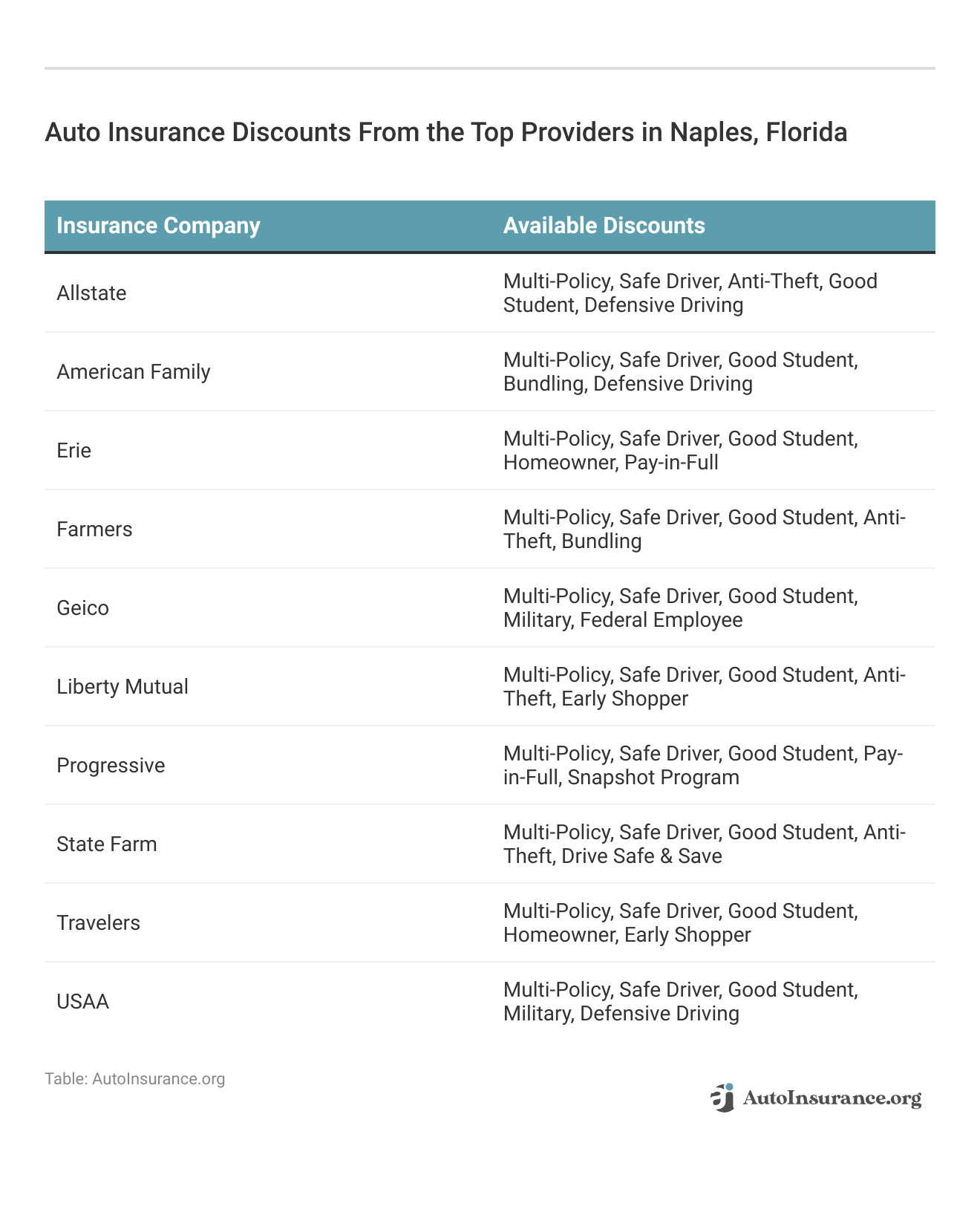

- Strong Discount Programs: American Family offers a variety of discounts, including those for safe driving and bundling policies. Naples, Florida drivers can benefit from significant savings, making American Family a competitive option for the best Naples, Florida auto insurance.

- Comprehensive Coverage Options: They provide a broad range of coverage options, including customizable add-ons for additional protection. This flexibility ensures that Naples, Florida car owners can tailor their policies to fit specific needs and preferences.

- Effective Mobile App: Their mobile app is well-rated for its ease of use, helping Naples, Florida drivers manage policies and file claims efficiently. The app’s functionality supports a seamless insurance experience, enhancing overall satisfaction. Find out more in our American Family insurance review.

Cons

- Potentially Higher Rates: Rates may be higher for drivers with a history of infractions or claims, which can make American Family less cost-effective for high-risk Naples, Florida drivers. This could result in increased premiums for those with more challenging insurance profiles.

- Discount Structure Complexity: The complexity of the discount structure may make it challenging for customers to fully understand and utilize available discounts. Naples, Florida car owners may find it difficult to maximize savings due to this complexity.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, including comprehensive and collision coverage. Naples, Florida drivers can benefit from extensive protection that meets their diverse needs, making Travelers a top contender for the best Naples, Florida auto insurance.

- Competitive Rates: With rates starting at $275 per month, Travelers provides affordable insurance options for Naples, Florida car owners. Their competitive pricing combined with robust coverage options makes them an appealing choice for budget-conscious drivers.

- Efficient Claims Processing: As outlined in our Travelers auto insurance review, Travelers is known for its efficient and transparent claims process, ensuring that Naples, Florida drivers receive timely compensation. This effectiveness in claims handling contributes to overall customer satisfaction.

Cons

- Customer Service Variability: While generally positive, customer service experiences can vary, with some customers reporting inconsistent support. This variability may affect Naples, Florida drivers’ overall experience with Travelers.

- Policy Complexity: The extensive range of coverage options and add-ons may be overwhelming for some customers. Naples, Florida car owners might find it challenging to navigate the complexities of Travelers’ policy offerings.

#8 – USAA: Best for Military Discounts

Pros

- Military Discounts: USAA offers significant discounts for military members and their families, making it an excellent choice for those eligible. Naples, Florida drivers who are military personnel or veterans can take advantage of these substantial savings, making USAA a leading option for the best Naples, Florida auto insurance.

- Excellent Customer Service: As outlined in USAA auto insurance review, USAA is highly rated for its exceptional customer service, providing top-notch support and handling claims efficiently. Naples, Florida car owners will benefit from the high level of care and responsiveness that USAA is known for.

- Competitive Rates: USAA offers competitive rates tailored to the needs of military families, ensuring affordability for eligible Naples, Florida drivers. Their pricing is designed to be attractive while providing best Naples, Florida auto insurance with comprehensive coverage.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members and their families, which limits access for non-military individuals. This restriction may prevent some Naples, Florida drivers from benefiting from USAA’s offerings.

- Higher Rates for Certain Coverage: Some types of coverage may be more expensive with USAA compared to other providers. This can impact overall affordability for Naples, Florida car owners seeking specific types of insurance coverage.

#9 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm is known for its reliable service and extensive agent network, providing consistent support for Naples, Florida drivers. Their network of agents ensures that policyholders receive reliable service and personalized assistance, making State Farm a strong candidate for the best Naples, Florida auto insurance.

- Competitive Rates: With pricing starting at $275 per month, State Farm offers competitive rates for Naples, Florida car owners. Their affordable premiums, combined with strong coverage options, make them an appealing choice for budget-conscious drivers. Read more in our review of State Farm.

- Wide Range of Coverage Options: State Farm provides various coverage options and add-ons, including roadside assistance and rental car coverage. This broad range of choices ensures that Naples, Florida drivers have access to protection that suits their specific needs.

Cons

- Higher Premiums for Some Drivers: Rates may be higher for drivers with a history of infractions or claims, which can make State Farm less cost-effective for high-risk Naples, Florida drivers. This could result in increased premiums for those with a more challenging insurance profile.

- Discounts May Be Limited: The range of discounts available may not be as extensive as those offered by some competitors. Naples, Florida car owners may find that the discount opportunities are less comprehensive, affecting potential savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico offers some of the most affordable rates in the industry, starting around $275 per month. This pricing is highly attractive for Naples, Florida drivers seeking budget-friendly auto insurance options while still benefiting from quality coverage, which you can learn about in our Geico review.

- User-Friendly Online Platform: Geico’s online platform and mobile app are well-regarded for their ease of use, making it simple for Naples, Florida drivers to manage their policies and file claims. This user-friendly technology supports efficient and convenient insurance management.

- Efficient Claims Handling: Known for its efficient claims processing, Geico ensures that claims are handled quickly and effectively. Naples, Florida car enthusiasts will appreciate the prompt resolution of their claims, contributing to overall satisfaction with their insurance provider.

Cons

- Less Personalized Service: Due to its large-scale operations, Geico’s customer service can be less personalized compared to smaller providers. Naples, Florida drivers may find the service less tailored to individual needs, impacting the overall experience.

- Limited Local Agent Availability: Geico has fewer local agents compared to some competitors, which can limit the availability of personalized service and support for Naples, Florida car owners. This may affect those who prefer face-to-face interactions with their insurance provider.

Minimum Auto Insurance in Naples, Florida

In Naples, Florida, auto insurance laws mandate that you must carry at least the state’s minimum coverage to be financially responsible after an accident.

Naples, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $95 | $290 |

| American Family | $88 | $275 |

| Erie | $85 | $270 |

| Farmers | $100 | $295 |

| Geico | $83 | $265 |

| Liberty Mutual | $85 | $275 |

| Progressive | $90 | $280 |

| State Farm | $87 | $275 |

| Travelers | $92 | $285 |

| USAA | $80 | $260 |

This minimum coverage includes $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL).

Minimum Required Auto Insurance Coverage in Naples, Florida

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $10,000 per person $20,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

For more details, review the specific insurance requirements for Naples, Florida.

Cheap Naples, Florida Auto Insurance by Age, Gender, and Marital Status

In Naples, Florida, auto insurance rates can vary based on factors like age, gender, and marital status.

Understanding how these demographics influence your annual insurance costs can help you make more informed decisions when shopping for coverage.

Best auto insurance for drivers under 25 and males typically face higher premiums due to higher risk profiles. Married individuals often benefit from lower rates.

Cheap Naples, Florida Auto Insurance for Teen Drivers

Securing affordable auto insurance for teenagers in Naples, Florida can be particularly challenging. Teen drivers add policy generally face higher premiums due to their higher risk profile and lack of driving experience.

Annual teen auto insurance rates in Naples reflect this increased risk, with many providers offering limited discounts for young drivers. Factors such as the teen’s driving record, the type of vehicle, and the level of coverage chosen also play a significant role in determining the overall cost.

To find the best rates, it’s crucial to compare quotes from various insurers and explore options like good student auto insurance discounts or usage-based insurance programs.

Additionally, understanding “How to Help Teen Drivers Get Their First License” can provide valuable insights into minimizing insurance costs and ensuring a smooth transition for young drivers.

To find out more, Just enter your ZIP code below to receive free trial of auto insurance quotes today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Naples, Florida Auto Insurance Rates By ZIP Code

Cheap Naples, Florida Auto Insurance Rates By Coverage Level

In Naples, Florida, the level of coverage you choose significantly affects your auto insurance cost. Higher coverage levels, like comprehensive or collision auto insurance, lead to higher premiums due to the increased protection they offer.

While basic coverage is more affordable, it provides limited protection. Comparing rates by coverage level helps balance the extent of coverage with your budget.

To start, just enter your ZIP code below to receive free auto insurance quotes.

Best By Category: Cheapest Auto Insurance in Naples, Florida

Compare the cheapest auto insurance companies in Naples, Florida in each category to find the company with the best rates for your personal needs.

Best Monthly Auto Insurance Rates by Company in Naples, Florida

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | USAA |

To start, just enter your ZIP code below to receive free auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Cheapest Naples, Florida Auto Insurance Companies

What are the cheapest auto insurance companies in Naples, Florida? Compare the top Naples, Florida auto insurance companies to find the best monthly rates.

Average Monthly Auto Insurance Rates by Company in Naples, Florida

| Insurance Company | Average Monthly Rates |

|---|---|

| Allstate | $504 |

| Geico | $256 |

| Liberty Mutual | $326 |

| Nationwide | $310 |

| Progressive | $406 |

| State Farm | $233 |

| USAA | $179 |

To start, just enter your ZIP code below to receive free auto insurance quotes.

Factors Affecting Auto Insurance Rates in Naples, Florida

Auto insurance rates in Naples, Florida, are influenced by several local factors, which can cause them to differ from rates in other cities. Traffic conditions are a major factor, as high traffic and frequent accidents in Naples lead to higher premiums.

Vehicle theft also plays a role; with 24 reported thefts according to FBI statistics, insurers increase rates to cover the higher risk auto insurance claims. Naples’ vulnerability to hurricanes and flooding further raises insurance costs due to the added risk of weather-related damage.

Additionally, Florida’s specific insurance regulations and the city’s average commute time of 22.4 minutes contribute to overall higher premiums.

Although Naples ranks 72nd globally for traffic congestion, indicating moderate issues, the city’s traffic delays and congestion during peak hours or tourist seasons still impact insurance rates. Understanding these factors provides insight into how Naples’ unique conditions affect auto insurance costs.

Compare Naples, Florida Auto Insurance Quotes

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum auto insurance requirements in Naples, Florida?

The minimum auto insurance coverage required in Naples, Florida is 10/20/10, as mandated by Florida auto insurance laws.

How does age, gender, and marital status affect auto insurance rates in Naples, Florida?

Auto insurance rates in Naples, Florida are influenced by factors like age, gender, and marital status. Demographics can impact the annual cost of insurance. Enter your ZIP code now to find out more.

Is it possible to find cheap auto insurance for teen drivers in Naples, Florida?

Finding cheap auto insurance for teen drivers in Naples, Florida can be challenging, but it’s not impossible. Teen auto insurance rates in Naples are typically higher.

What are the average auto insurance rates for seniors in Naples, Florida?

The annual average auto insurance rates for seniors in Naples, Florida can vary. It’s recommended to compare rates from different companies to find the best deal.

How does a driving record affect auto insurance rates in Naples, Florida?

Your driving record has a significant impact on your auto insurance rates in Naples, Florida. Having a clean driving record generally leads to lower insurance rates, while a bad record can result in higher rates. Enter your ZIP code to start.

How do various insurance providers handle customer service and claims processing for drivers who experience a significant life change, such as moving to a new state or getting a new car?

Most insurance providers offer flexible policy adjustments and streamlined processes for life changes, such as transferring coverage or updating vehicle information. Customer service quality can vary, with some insurers providing dedicated support teams to manage transitions smoothly.

What are the implications of different insurance providers’ coverage options on overall vehicle maintenance and repair costs for drivers in Naples, Florida?

Comprehensive and collision coverage options can reduce out-of-pocket expenses for repairs and maintenance by covering a broader range of damages. Providers offering higher deductibles or limited coverage may result in increased maintenance costs for Naples, Florida drivers if they face unexpected repairs.

How do insurance providers’ policies and discounts impact the financial planning of young or first-time drivers in Naples, Florida?

Policies with robust discount programs, such as good student discounts or safe driving incentives, can significantly lower premiums for young or first-time drivers. These discounts help manage the higher costs associated with insuring inexperienced drivers, making financial planning more manageable. Enter your ZIP code to compare your quote.

What additional benefits or features do insurance providers offer that specifically address the unique risks faced by Naples, Florida drivers, such as hurricane coverage or flood protection?

Some insurance providers offer specialized endorsements or riders for hurricane and flood damage, providing extra protection for drivers in flood-prone areas. These benefits are crucial for Naples, Florida drivers, given the region’s susceptibility to severe weather conditions.

How do insurance companies’ customer satisfaction ratings correlate with their handling of unconventional claims, such as those involving rare or high-value vehicles?

Higher customer satisfaction ratings often reflect insurers’ ability to effectively manage unconventional claims, including those for rare or high-value vehicles, with dedicated adjusters and specialized coverage. Conversely, lower satisfaction ratings can indicate challenges in handling such claims efficiently and equitably.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.