Best Nashville, Tennessee Auto Insurance in 2025 (Check Out the Top 10 Companies)

The top providers for best Nashville, Tennessee auto insurance, are Nationwide, Farmers, and Geico, offering value for only $75 monthly. These insurers excel with competitive pricing, personalized service, and usage-based insurance (UBI) discounts, providing excellent value for coverage in Nashville, Tennessee.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Nashville

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Nashville

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Nashville

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe leading options for the best Nashville, Tennessee auto insurance are Nationwide, Farmers, and Geico, these companies stand out as the best choice for the Nashville, Tennessee auto insurance.

Nashville, Tennessee auto insurance requirements are 25/50/15 according to Tennessee auto insurance laws. Finding cheapest auto insurance companies in Nashville can seem like a difficult task, but all of the information you need is right here.

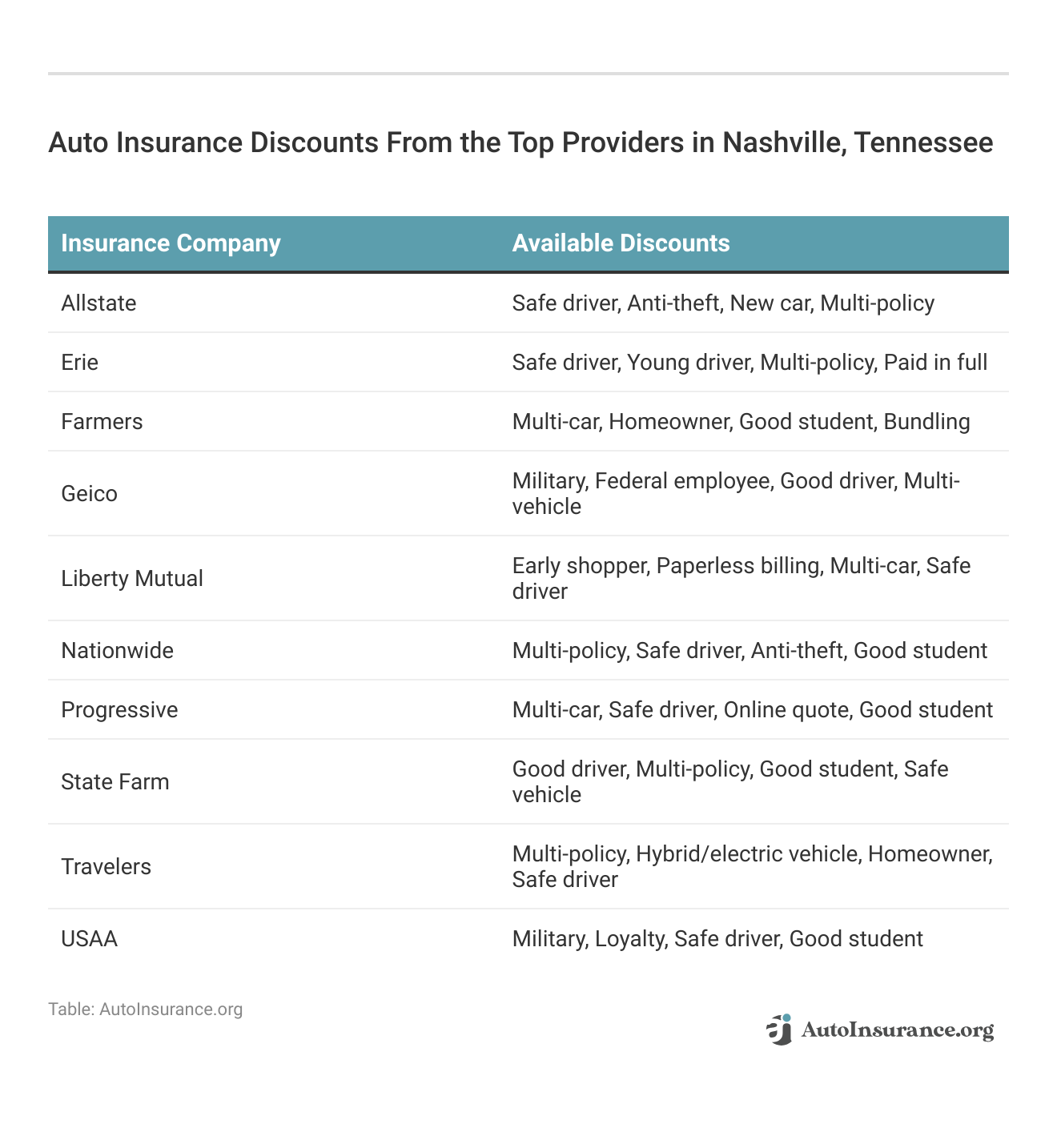

Our Top 10 Company Picks: Best Nashville, Tennessee Auto Insurance

| Company | Rank | Bundling discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | Broad Coverage | Nationwide |

| #2 | 25% | A | Flexible Plans | Farmers | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 25% | A | Custom Options | Liberty Mutual |

| #5 | 10% | A++ | Military Benefits | USAA | |

| #6 | 25% | A+ | Trusted Reputation | Allstate | |

| #7 | 20% | B | Local Agents | State Farm | |

| #8 | 8% | A++ | Comprehensive Policies | Travelers | |

| #9 | 12% | A+ | Online Tools | Progressive | |

| #10 | 10% | A+ | Customer Satisfaction | Erie |

Compare auto insurance in Nashville to other Tennessee cities, including Clarksville auto insurance rates, Jackson auto insurance rates, and Franklin auto insurance rates to see how Nashville, Tennessee auto insurance rates stack up. Enter your ZIP code above to get free Nashville, Tennessee auto insurance quotes.

- Liberty Mutual is the priciest auto insurer for teen drivers in Nashville

- The average commute length in Nashville is 25 minutes

- The minimum auto insurance required in Nashville, Tennessee is 25/50/15

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Overall Pick

Pros

- Comprehensive Coverage Options: Nationwide provides broad coverage options, including liability, collision, and comprehensive insurance. This extensive coverage ensures that Nashville, Tennessee drivers have access to robust protection, making it a strong choice for the best Nashville, Tennessee auto insurance.

- Multi-Vehicle Discounts: Nationwide offers up to 20% off for multi-vehicle policies, which is beneficial for families or households in Nashville with more than one car. This discount helps make their comprehensive coverage more affordable for Nashville, Tennessee auto insurance customers. Find out more in our Nationwide review.

- Strong Financial Stability: Nationwide’s A.M. Best rating of A+ (Superior) highlights its strong financial stability, ensuring reliable coverage for Nashville drivers. This rating is a key factor in providing peace of mind and security for those seeking the best Nashville, Tennessee auto insurance.

Cons

- Higher Premiums for Certain Drivers: Drivers with poor credit or a history of violations may face elevated premiums. This can make Nationwide less cost-effective for these individuals, potentially impacting their ability to secure the best Nashville, Tennessee auto insurance.

- Limited Discounts for New Drivers: Nationwide’s discounts for new or young drivers may be less competitive compared to other insurers, which could affect affordability for this group in Nashville, Tennessee, and limit their options for the best Nashville, Tennessee auto insurance.

#2 – Farmers: Best for Flexible Plans

Pros

- Customizable Coverage: Farmers offers highly customizable policies, allowing Nashville drivers to tailor coverage to their specific needs. This flexibility helps ensure that Nashville, Tennessee drivers can find the best Nashville, Tennessee auto insurance suited to their personal requirements.

- Flexible Payment Plans: With various payment options, including monthly installments, Farmers helps manage budgeting for Nashville drivers. This can make their policies more accessible and manageable, contributing to the best Nashville, Tennessee auto insurance experience.

- Strong Local Presence: Farmers’ extensive network of local agents provides personalized service, which is advantageous for Nashville drivers seeking tailored support. Their local presence enhances the accessibility and quality of the best Nashville, Tennessee auto insurance. Read more in our review of Farmers.

Cons

- Higher Average Rates: Farmers’ premiums may be higher on average, which could impact affordability for some Nashville drivers. This can make it challenging for these individuals to secure the best Nashville, Tennessee auto insurance at the lowest possible cost.

- Limited Online Tools: Farmers’ online resources and tools might not be as advanced or user-friendly as those of some competitors, potentially affecting convenience for tech-savvy Nashville drivers seeking the best Nashville, Tennessee auto insurance.

#3 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico is renowned for offering some of the lowest rates in the industry, which makes it a strong contender for those seeking cheap Nashville, Tennessee auto insurance. Their competitive pricing helps Nashville drivers access affordable coverage without compromising quality.

- Excellent Online Resources: Geico’s user-friendly website and mobile app offer a range of tools for managing policies and filing claims, which enhances convenience. This comprehensive online support contributes to an efficient experience for Nashville drivers looking for the best Nashville, Tennessee auto insurance.

- 25% Multi-Vehicle Discount: Geico provides up to a 25% discount for insuring multiple vehicles, which can significantly lower premiums for Nashville households with more than one car. This discount supports budget-friendly options for the best Nashville, Tennessee auto insurance. Find out more in our Geico auto insurance review.

Cons

- Limited Local Agent Access: Geico’s reliance on online and phone-based customer service may limit personal interaction with local agents, which some Nashville drivers might prefer for more personalized service. This can impact the overall experience for those seeking the best Nashville, Tennessee auto insurance with face-to-face support.

- Less Flexibility in Policy Customization: Geico’s policies may offer fewer customization options compared to some competitors, which could limit coverage tailoring for specific needs. This might affect the ability to find the best Nashville, Tennessee auto insurance that perfectly fits individual requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Custom Options

Pros

- Customizable Coverage Options: Liberty Mutual offers a range of customizable coverage options, allowing Nashville drivers to adjust their policies according to personal needs. This flexibility helps Nashville, Tennessee drivers find the best Nashville, Tennessee auto insurance tailored to their preferences.

- 25% Multi-Vehicle Discount: Liberty Mutual provides up to a 25% discount for multiple vehicles, making it an attractive option for families or households in Nashville with several cars. This discount supports budget-conscious drivers looking for the best Nashville, Tennessee auto insurance, which you can check out in our Liberty Mutual review.

- Unique Benefits: Liberty Mutual includes unique benefits such as accident forgiveness and new car replacement, which can enhance the value of their policies. These features contribute to the best Nashville, Tennessee auto insurance experience by offering additional protection and peace of mind.

Cons

- Higher Rates for Certain Drivers: Liberty Mutual may have higher premiums for drivers with less favorable risk profiles, impacting affordability for those with poor credit or driving violations in Nashville, Tennessee.

- Complex Policy Options: The range of customizable options can be overwhelming for some Nashville drivers, potentially making it more difficult to navigate and select the best Nashville, Tennessee auto insurance policy.

#5 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA offers specialized benefits for military personnel, including additional coverage options and discounts. This makes it an excellent choice for Nashville military families seeking the best Nashville, Tennessee auto insurance.

- 10% Multi-Vehicle Discount: USAA provides a 10% discount for insuring multiple vehicles, which helps military families in Nashville save on their premiums. This discount supports affordable coverage for those looking for the best Nashville, Tennessee auto insurance.

- A++ A.M. Best Rating: USAA’s A++ rating from A.M. Best reflects its strong financial stability and reliability, providing peace of mind for Nashville drivers. This top rating ensures that USAA is a dependable choice for the best Nashville, Tennessee auto insurance.

Cons

- Eligibility Restrictions: USAA insurance is only available to military personnel and their families, which limits its accessibility for other Nashville drivers. This restriction can affect those seeking the best Nashville, Tennessee auto insurance who do not qualify.

- Limited Coverage Options for Non-Military Drivers: Non-military drivers may find fewer options and discounts compared to those offered to military families, potentially impacting affordability and coverage variety in Nashville. Discover our USAA review for a full list.

#6 – Allstate: Best for Trusted Reputations

Pros

- Trusted Reputation: Allstate is well-known for its reliable service and long-standing reputation in the insurance industry, making it a trusted choice for Nashville drivers seeking the best Nashville, Tennessee auto insurance.

- 25% Multi-Vehicle Discount: Allstate offers up to a 25% discount for multi-vehicle policies, which can make coverage more affordable for Nashville households with more than one car.

- Innovative Tools: Allstate offers innovative tools like the Drivewise app, which can help lower premiums based on driving behavior. This tool contributes to finding the best Nashville, Tennessee auto insurance for those who prioritize safe driving, which you can learn about in our Allstate review.

Cons

- Higher Rates for Certain Profiles: Allstate’s rates can be higher for drivers with a less favorable risk profile, such as those with poor credit or a history of accidents, which might impact affordability in Nashville, Tennessee.

- Complex Policy Options: The variety of policy options and add-ons available might be overwhelming for some Nashville drivers, potentially complicating the process of finding the best Nashville, Tennessee auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – State Farms: Best for Local Agents

Pros

- Strong Local Agent Network: State Farm has a wide network of local agents, providing personalized service and support to Nashville drivers. This localized approach is beneficial for those seeking the best Nashville, Tennessee auto insurance with a personal touch.

- 20% Multi-Vehicle Discount: State Farm offers a 20% discount for multiple vehicles, which can help Nashville families save on their insurance premiums. This discount makes their coverage more affordable for those looking for the best Nashville, Tennessee auto insurance.

- Innovative Safety Features: State Farm offers innovative safety features like their Drive Safe & Save program, which can reduce premiums based on driving habits. This program is advantageous for those looking for the best Nashville, Tennessee auto insurance with a focus on safe driving.

Cons

- Higher Premiums for High-Risk Drivers: State Farm’s rates may be higher for drivers with a history of violations or poor credit, potentially impacting affordability for high-risk Nashville drivers. Learn more in our State Farm review.

- Limited Digital Tools: State Farm’s digital tools may not be as advanced as those of some competitors, which could affect convenience for tech-savvy Nashville drivers seeking the best Nashville, Tennessee auto insurance.

#8 – Travelers: Best for Comprehensive Policies

Pros

- Extensive Coverage Options: Travelers offers a wide range of coverage options, including comprehensive and collision coverage, which is beneficial for Nashville drivers seeking robust protection. This extensive coverage supports the search for the best Nashville, Tennessee auto insurance.

- Discounts for Multiple Policies: Travelers provides discounts for bundling auto insurance with other types of insurance, such as home insurance. This bundling discount can be advantageous for Nashville drivers looking to save on multiple policies. Read more through our Travelers auto insurance review.

- Innovative Tools: Travelers offers innovative tools and resources, such as their mobile app, which helps manage policies and file claims efficiently. These tools enhance convenience for Nashville drivers seeking the best Nashville, Tennessee auto insurance.

Cons

- Higher Premiums for Some Drivers: Travelers’ premiums can be higher for drivers with poor credit or a history of accidents, which may affect affordability for certain Nashville drivers.

- Limited Local Presence: Travelers may have fewer local agents compared to some competitors, potentially impacting the availability of personalized service for Nashville drivers.

#9 – Progressive: Best for Online Tools

Pros

- Unique Discounts: Progressive offers unique discounts, such as for bundling insurance policies or having multiple cars. These discounts can make coverage more affordable for Nashville drivers seeking the best Nashville, Tennessee auto insurance.

- Wide Range of Coverage Options: Progressive offers a broad range of coverage options, including specialty coverage for high-value vehicles and unique needs. This variety ensures that Nashville drivers can find the best Nashville, Tennessee auto insurance tailored to their specific requirements.

- Strong Digital Tools: Progressive’s website and app offer comprehensive tools for managing policies, filing claims, and accessing support, enhancing convenience for Nashville drivers seeking the best Nashville, Tennessee auto insurance. Read more through our Progressive auto insurance review.

Cons

- Higher Rates for High-Risk Drivers: Progressive’s rates may be higher for drivers with poor credit or a history of violations, which can impact affordability for certain Nashville drivers.

- Customer Service Variability: The quality of customer service can vary based on location and individual representatives, which might affect the overall experience for Nashville drivers seeking the best Nashville, Tennessee auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best for Customer Satisfaction

Pros

- Erie’s Rate Lock Feature: Erie Insurance offers a rate lock feature that prevents premium increases due to minor accidents or claims. This feature helps Nashville drivers maintain stable premiums and budget effectively for their auto insurance needs, contributing to the overall value of the best Nashville, Tennessee auto insurance.

- Discounts for Safe Driving: Erie provides various discounts for safe driving, including a Safe Driver discount for those with a clean driving record. This can help Nashville drivers save on premiums and incentivizes responsible driving behaviors, supporting their search for the best Nashville, Tennessee auto insurance.

- Comprehensive Coverage Options: Erie Insurance offers a range of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. This extensive range ensures that Nashville drivers can find the best Nashville, Tennessee auto insurance that suits their specific needs. Learn more in our Erie auto insurance review.

Cons

- Limited Availability: Erie Insurance is not available in all states, which can limit its accessibility for some Nashville drivers. This might affect those seeking the best Nashville, Tennessee auto insurance if Erie Insurance does not operate in their area.

- Higher Rates for Some Drivers: Erie’s rates might be higher for drivers with less favorable risk profiles, such as those with poor credit or multiple claims. This could impact affordability for certain Nashville drivers seeking the best Nashville, Tennessee auto insurance.

Minimum Auto Insurance in Nashville, Tennessee

We’ll cover factors that affect auto insurance rates in Nashville, Tennessee, including driving record, credit, commute time, and more.

Cheap Nashville, Tennessee Auto Insurance By Driving Record

Your driving record significantly influences your auto insurance premiums, as insurers view it as a key indicator of risk.

Understanding how to get a multi-vehicle auto insurance discount is crucial because, in Nashville, Tennessee, drivers with a bad record—such as those with accidents, speeding tickets, or DUIs—typically face much higher annual auto insurance rates compared to those with a clean record.

For instance, a driver with a clean record in Nashville might pay an average of $100 monthly for their auto insurance. However, the same driver with a history of violations could see their rates jump to $200 or more per month.

Cheap Nashville, Tennessee Auto Insurance Rates After a DUI

Finding cheap auto insurance after a DUI in Nashville, Tennessee is not easy.

Monthly Auto Insurance Rates After a DUI in Nashville, Tennessee

| Insurance Company | Monthly Auto Insurance Rates With a DUI |

|---|---|

| Allstate | $483 |

| Farmers | $291 |

| Geico | $418 |

| Liberty Mutual | $568 |

| Nationwide | $399 |

| Progressive | $304 |

| State Farm | $229 |

| Travelers | $273 |

| USAA | $278 |

Compare the moonthly rates for DUI auto insurance in Nashville, Tennessee to find the best deal. Enter your ZIP code below to get free Nashville, Tennessee auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Nashville, Tennessee Auto Insurance Rates By Commute

Commute length and mileage play significant roles in determining the cost of auto insurance in Nashville, Tennessee. Generally, insurance providers view drivers with longer commutes or higher annual mileage as higher risk, which can lead to increased premiums.

This is because more time spent on the road increases the likelihood of accidents. For those looking to find the cheapest auto insurance in Nashville, Tennessee, based on commute length, it’s important to compare quotes from different providers, as rates can vary widely.

Typically, drivers with shorter commutes and lower mileage can secure more affordable premiums.

Best By Category: Cheapest Auto Insurance in Nashville, Tennessee

Compare the cheapest auto insurance companies in Nashville, Tennessee in each category to find the company with the best rates for your personal needs.

Best Monthly Auto Insurance Rates by Company in Nashville, Tennessee

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | Geico |

By comparing quotes from different companies, you can get the ideal one for your car insirance. Enter your ZIP code below to get free Nashville, Tennessee auto insurance quotes.

The Cheapest Nashville, Tennessee Auto Insurance Companies

What are the best auto insurance companies in Nashville, Tennessee and what are the cheapest?

Average Monthly Auto Insurance Rates by Company in Nashville, Tennessee

| Insurance Company | Average Monthly Rates |

|---|---|

| Allstate | $400 |

| Farmers | $270 |

| Geico | $268 |

| Liberty Mutual | $522 |

| Nationwide | $306 |

| Progressive | $324 |

| State Farm | $229 |

| Travelers | $237 |

| USAA | $218 |

Compare the top Nashville, Tennessee auto insurance companies to find the best monthly rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Auto Insurance Rates in Nashville, Tennessee

Compare Nashville, Tennessee Auto Insurance Quotes

Before you buy Nashville, Tennessee auto insurance, make sure you have compared rates from multiple companies.

Understanding local factors like commute time and traffic congestion is key to managing auto insurance costs in Nashville, Tennessee.Eric Stauffer Licensed Insurance Agent

Enter your ZIP code below to get free Nashville, Tennessee auto insurance quotes.

Frequently Asked Questions

What are the minimum auto insurance requirements in Nashville, Tennessee?

The minimum auto insurance coverage required in Nashville, Tennessee is 25/50/15 as per the state’s auto insurance laws.

How does age, gender, and marital status affect auto insurance rates in Nashville, Tennessee?

Auto insurance rates in Nashville, Tennessee are influenced by factors such as age, gender, and marital status. These demographics can impact the annual cost of insurance. Enter your ZIP code below to get free auto insurance quotes.

What are the average auto insurance rates for teen drivers in Nashville, Tennessee?

Finding cheap auto insurance for teen drivers in Nashville, Tennessee can be challenging. The annual rates for teen auto insurance tend to be higher compared to other age groups.

How do driving records affect auto insurance rates in Nashville, Tennessee?

Your driving record has a significant impact on auto insurance rates in Nashville, Tennessee. Having a bad driving record can result in higher annual insurance rates compared to a clean record.

How does credit history affect auto insurance rates in Nashville, Tennessee?

Credit history can play a major role in determining the cost of auto insurance. In Nashville, Tennessee, your credit history can affect your annual auto insurance rates. Enter your ZIP code below to start comparing your quotes today.

How do Nashville’s specific auto insurance requirements compare to those of other cities in Tennessee, such as Clarksville or Franklin?

Nashville’s minimum auto insurance requirements of 25/50/15 are standard across Tennessee, including cities like Clarksville and Franklin. While the minimum coverage is consistent, actual rates and additional coverage needs can vary based on local traffic conditions and risk factors.

What factors most significantly impact auto insurance rates in Nashville, and how do these compare with the factors affecting rates in cities with similar traffic conditions and demographics?

Key factors influencing auto insurance rates in Nashville include traffic congestion, commute times, and vehicle theft rates. Cities with similar traffic conditions, like Atlanta or Dallas, may experience comparable rate influences due to these factors.

How does having a high credit score or a clean driving record affect auto insurance premiums in Nashville versus other cities with different average rates?

In Nashville, a high credit score and a clean driving record can lead to lower premiums, similar to other cities with competitive insurance markets.

However, cities with higher average rates may see a more significant impact from these factors compared to Nashville. Enter your ZIP code below to get free Nashville, Tennessee auto insurance quotes.

What are the most common reasons for increased auto insurance rates after a DUI in Nashville, and how do these reasons differ from those in other cities with high DUI rates?

Common reasons for increased rates after a DUI in Nashville include higher risk assessments and potential policy cancellations. In cities with higher DUI rates, such as Los Angeles, the impact may be more pronounced due to more stringent risk assessments and higher average premiums.

What additional coverage options beyond the state-mandated minimum are recommended for Nashville drivers, and how do these options compare in cost and benefits to those recommended in similar metropolitan areas?

Nashville drivers are often advised to consider uninsured/underinsured motorist coverage and comprehensive insurance for broader protection. These additional coverages typically have similar costs and benefits compared to recommendations in other major metropolitan areas with comparable risk factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.