Nevada Minimum Auto Insurance Requirements in 2025 (NV Coverage Explained)

Nevada minimum auto insurance requirements are 15/30/10: $15,000 for bodily injury per person, $30,000 per accident, and $10,000 for property damage. Proof of the minimum auto insurance in Nevada is necessary for vehicle registration and operation. Failure to meet Nevada minimum requirements can result in penalties.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Nevada minimum auto insurance requirements, set by Nevada insurance laws, require 15/30/10 liability coverage—$15,000 per person, $30,000 per accident for bodily injury, and $10,000 for property damage.

These auto insurance minimums protect the driver and other parties involved in an accident by helping cover expenses and reducing financial exposure in at-fault accidents. All drivers must meet these minimum coverage requirements to register and operate a vehicle in Nevada legally.

Failure to comply with Nevada’s insurance laws can result in significant penalties, including fines, license suspension, and even vehicle impoundment, which may affect a driver’s ability to stay on the road.

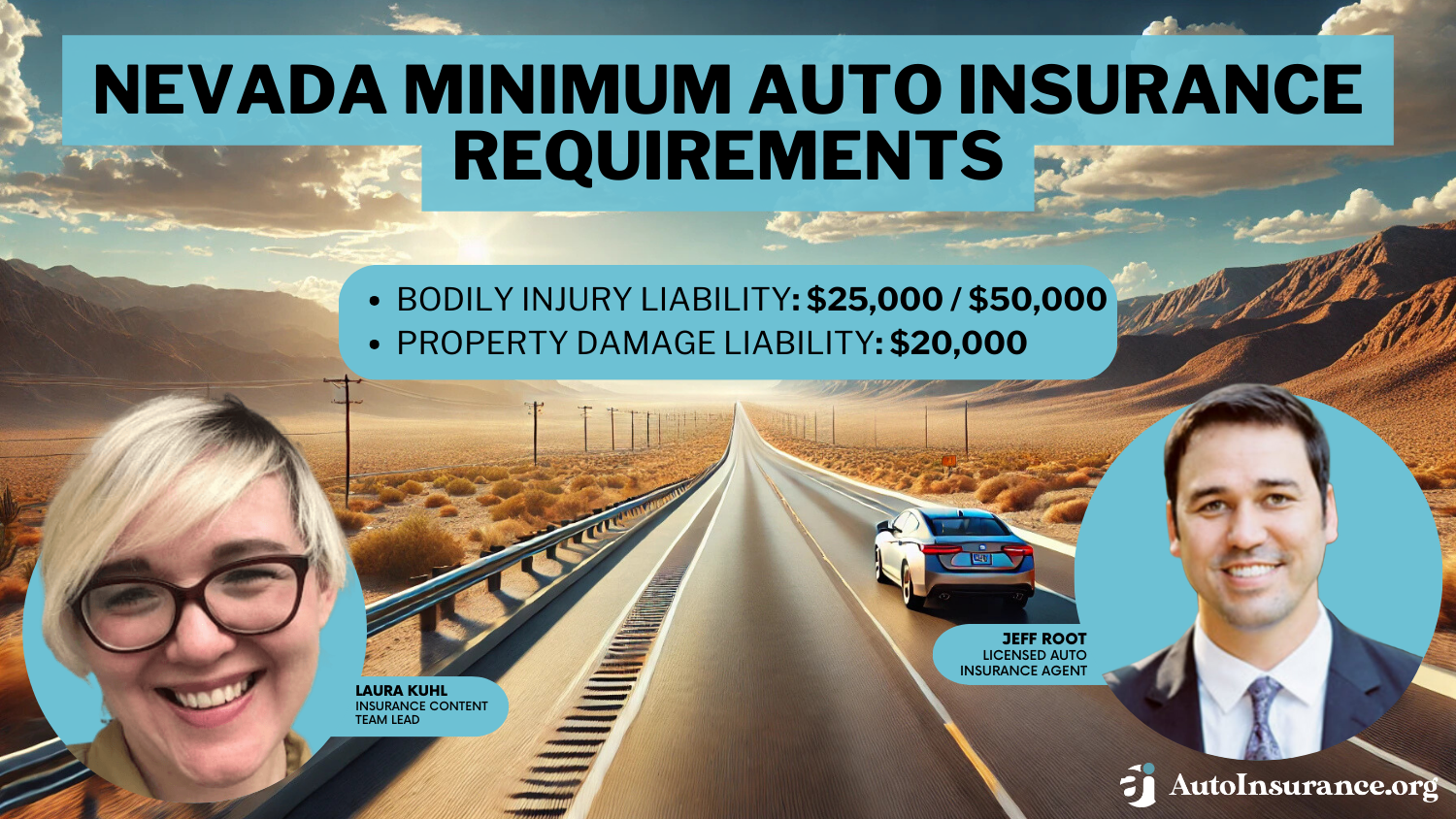

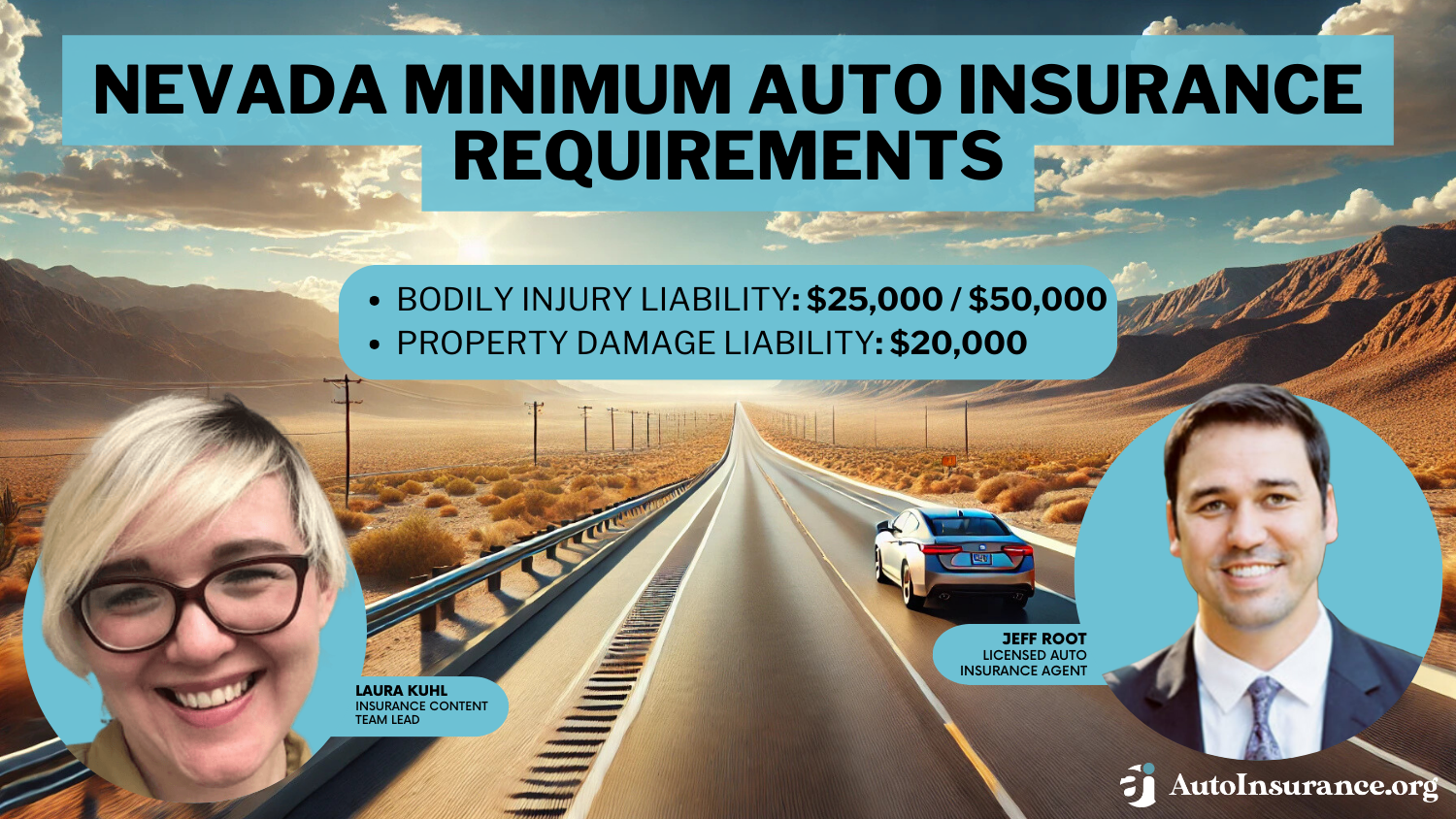

Nevada Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

The state’s electronic insurance verification system is directly connected to the DMV, so maintaining active coverage is essential to avoid penalties. Many drivers opt to exceed the minimums for extra protection. Enter your ZIP code above for more information on Nevada-compliant insurance options.

- Nevada requires 15/30/10 liability coverage for auto insurance compliance

- Proof of insurance must be provided for vehicle registration in Nevada

- Failure to meet insurance requirements can result in fines and license suspension

Nevada Minimum Coverage Requirements & What They Cover

There are minimum coverage requirements that you need to hold in the state of Nevada for auto insurance. These minums are required to register any vehicle and to drive legally. Minimum auto insurance requirements in Nevada are as follows:

- $15,000 for bodily injury or death of one person in any one accident.

- $30,000 for bodily injury or death of two or more persons in any one accident.

- $10,000 in coverage for injury to or destruction of property of others in any one accident.

The coverage requirements all exist for your safety and the security of those on the road. If someone were to cause an accident that you were involved in, you would be protected so that you could be indemnified for the losses. If you cause an accident for which you are liable, the minimum coverage is supposed to protect you from financial harm as a result of the loss caused.

Maintaining the minimum required auto insurance in Nevada not only ensures compliance with state laws but also provides critical financial protection in case of an accident. It’s a safeguard for both you and other drivers, giving everyone peace of mind on the road.

Read More: Minimum Auto Insurance Requirements by State

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Nevada

Finding affordable auto insurance in Nevada is essential for drivers looking to meet the state’s minimum requirements. Premiums vary depending on factors like age, driving history, and coverage levels. To ensure you’re getting the best rate, it’s important to compare different providers.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsUSAA offers competitive rates for drivers in Nevada, with a focus on providing value and reliable coverage. Find the best Nevada auto insurance including tips for saving on premiums.

Where to Buy Nevada Auto Insurance

You want to be sure that you are buying insurance from a company that is legally able to sell it to you. You could have an auto insurance policy that meets all of the minimum requirements, but if the provider is not licensed in the state, the coverage is void.

Nevada Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Boulder City | $78 |

| Carson City | $83 |

| Elko | $72 |

| Fallon | $70 |

| Henderson | $98 |

| Las Vegas | $120 |

| Mesquite | $74 |

| North Las Vegas | $115 |

| Reno | $87 |

| Sparks | $85 |

Coverage has to be validated by an insurance company that has been authorized to do business in the state of Nevada. If you do not meet this criterion, even if you have a policy that exceeds the minimum coverage limits, it does you no good.

Read More: What does an auto insurance policy look like?

Penalties for Driving Without Insurance in Nevada

Driving without insurance in Nevada is a serious offense. If caught operating a vehicle without proof of the required coverage, drivers can face significant penalties. These may include hefty fines, license suspension, and the possibility of having your vehicle impounded.

Consequences of Driving Uninsured in Nevada

| Consequence | Details |

|---|---|

| Fines and Penalties | $1,000 fine |

| Impact on Credit and Financial Stability | Financial hardship likely |

| Increased Insurance Rates | Higher future premiums |

| Legal Consequences | Possible misdemeanor charges |

| Liability for Damages | Full personal liability |

| License Suspension | License suspended until insured |

| Reinstatement Fees | $750 reinstatement fee |

| SR-22 Requirement | SR-22 filing required |

| Towing and Impound Fees | Towing and storage costs |

| Vehicle Registration Suspension | Registration suspension |

Nevada’s DMV uses an electronic system to verify insurance coverage, making it easier for authorities to track uninsured drivers. In addition to legal consequences, uninsured drivers may be financially liable for any accidents they cause, potentially leading to costly out-of-pocket expenses.

What Has to Be Reported to the Nevada DMV

There is also a reporting mechanism in place in the state of Nevada so that they can be made aware of insurance purchases. It is known as Nevada LIVE verification.

Liability insurance has to be reported to the DMV as well as losses and claims that have been reported.

You do not need to submit to the DMV what you have for coverage in regards to comprehensive, collision, and other types. All you have to prove through the LIVE verification system is that you have the adequate amount of liability insurance coverage.

Read More: How to Check if a Vehicle Has Auto Insurance Coverage

Other Coverage Options to Consider in Nevada

While meeting the minimum insurance requirements is necessary, many drivers choose to purchase additional coverage for better protection. Options such as collision auto insurance, comprehensive auto insurance, and uninsured motorist coverage can help cover damages that go beyond basic liability.

Nevada Minimum Liability Coverage vs. Recommended Coverage

| Coverage Type | Nevada Minimum Liability Coverage | Recommended Coverage |

|---|---|---|

| Bodily Injury Liability per Person | $25,000 | $100,000 |

| Bodily Injury Liability per Accident | $50,000 | $300,000 |

| Property Damage Liability | $20,000 | $100,000 |

| Uninsured/Underinsured Motorist | Not Required | $100,000 per person / $300,000 per accident |

| Medical Payments (MedPay) | Not Required | $10,000 |

| Comprehensive and Collision | Not Required | Equal to the car's actual cash value (recommended for newer vehicles) |

Collision coverage helps pay for repairs to your vehicle after an accident, while comprehensive coverage protects against non-collision incidents, such as theft or weather damage. Uninsured motorist coverage can also be vital in case you’re involved in an accident with a driver who lacks insurance. These additional coverages provide a higher level of financial security and peace of mind.

Registering a Vehicle in the State of Nevada

To be able to register a vehicle in the state of Nevada, you need to have with you the Nevada Evidence of Insurance card provided. The car insurance carrier which you purchase your policy from is going to be providing you with this card.

The vast majority of registration transactions will require this. When you are driving your vehicle, you also want to be sure that you have your evidence of insurance card handy, available for when you may need it.

Meeting Nevada’s minimum auto insurance requirements isn’t just about legal compliance—it’s your first line of defense against unexpected financial burdens on the road.Scott W. Johnson Licensed Insurance Agent

There is a lot of considerations that have to be made when you are registering a car in the state of Nevada. Meeting the minimum auto insurance requirements means that you have to shop the market and find the ideal policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Check Your Coverage and Seek Insurance Quotes in Nevada

Meeting Nevada’s minimum auto insurance requirements is essential for legal compliance and financial protection. Ensuring your coverage meets state standards can help you avoid penalties, protect your assets, and provide peace of mind on the road.

For added security, consider exploring additional coverage options tailored to your needs. There is ample opportunity to get free quotes online so that you can apply for new auto insurance today. Don’t forget to look for the best auto insurance discounts to maximize your savings while securing the coverage you need. Make the most of the tools available and shop the market.

Use our free insurance comparison tool below to compare rates and find the best policies for your situation.

Frequently Asked Questions

What is Nevada minimum auto insurance?

The minimum Nevada auto insurance is the minimum amount of coverage required by law for drivers in Nevada. It includes liability coverage for bodily injury and property damage. Explore the different types of auto insurance and see how they can protect you and your vehicle.

What are the minimum liability insurance requirements in Nevada?

What is the minimum Nevada liability insurance? In Nevada, the minimum liability insurance requirements are as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $20,000 property damage liability coverage per accident

What does bodily injury liability coverage mean?

Bodily injury liability coverage is insurance that helps cover medical expenses, lost wages, and other damages for injuries caused to others in an accident for which you are at fault. Minimum bodily injury liability coverage in Nevada provides up to $25,000 per person and up to $50,000 per accident. Enter your ZIP code below to explore affordable policies that meet Nevada’s coverage requirements while safeguarding your financial future.

What is property damage liability coverage?

Property damage liability coverage is insurance that helps cover the costs of repairing or replacing someone else’s property, such as their vehicle or other structures, if you are at fault in an accident. The minimum property damage liability coverage in Nevada is $20,000 per accident.

Are the minimum liability limits in Nevada sufficient?

While the minimum liability limits in Nevada meet the state’s legal requirements, they may not provide enough coverage in more severe accidents. In cases where the damages exceed the limits of your insurance, you would be responsible for paying the remaining costs out of pocket. It’s recommended to consider higher liability limits and additional coverages to protect yourself adequately.

What happens if I don’t have the minimum auto insurance in Nevada?

Failure to maintain the minimum auto insurance required by Nevada auto insurance laws can result in penalties and consequences. If caught driving without insurance, you may face fines, license suspension, and the possibility of impounding your vehicle. It’s essential to have the required insurance coverage to comply with Nevada auto insurance law.

What is considered full coverage auto insurance in Nevada?

What is full coverage auto insurance in Nevada? Full coverage auto insurance in Nevada generally includes liability, collision, and comprehensive coverage. While Nevada doesn’t legally define “full coverage,” adding collision and comprehensive insurance to your policy goes beyond the Nevada auto insurance minimums, offering more financial protection. For specific Nevada auto insurance requirements, consult your provider.

What is the minimum auto insurance coverage required in the state of Nevada?

The state minimum auto insurance Nevada requires includes liability coverage of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $20,000 for property damage. Meeting these requirements for auto insurance is essential to legally driving and legally registering your vehicle in Nevada.

What is the minimum amount of insurance required by law for automobiles?

Nevada law requires a minimum amount of liability insurance for all drivers. The Nevada state minimum auto insurance includes $25,000 per person for bodily injury, $50,000 per accident, and $20,000 for property damage. These requirements ensure essential financial protection for damages you may cause in an accident.

To learn about additional features that can protect your premiums after an at-fault accident, learn about accident forgiveness.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.